1.0 Introduction

Mavericks is a company committed to accomplishing stability and sustainable development in the strongly comparable company landscape. With a powerful focus on tactical objectives, we are dedicated to operating revenue, growing market share, fostering development, optimizing productivity, preserving a motivated employee, and ensuring outstanding quality. Our company goals revolve around the core fundamentals of stability and viable annual advancement.

| Key performance measures | Round 1 | Round 2 | Round 3 | Round 4 |

| Total sales(€m) | 2318.37 | 3910.35 | 7024.51 | 7860.93 |

| Total Unsold stock (€m) | 0 | 83.75 | 642.98 | 2915.29 |

| Shareholder funds (€m) | 557.86 | 655.96 | 1726.35 | 2880.44 |

| Closing bank balance(€m) | 294.66 | 358.46 | 1470.11 | -105.97 |

| Outstanding loan (€m) | 0 | 0 | 0 | 0 |

Figure1: Summary of Maverick’s performance over four years of business

2.0 Company performance

2.0 Round 1

2.1.0 Decision

In Round 1, our group, Mavericks, thoroughly examined the accessible data and set our manufacturing and sales focuses accordingly. We determined to generate 63,127 units of Model M1 and 33,090 units of Model M2, striving to connect the marketplace demand while taking into account our employee capacity and potential efficiency figures. This decision was impacted by the target manufacturing and the potential productivity data offered as we looked to optimize output and maximize our assets. Additionally, we effectively sold all the generated units, accomplishing a sales income of £2,318.37 million. Our concentration on cost leadership and pricing methods paid off, as demonstrated by the gross margin of £709.79 million. This suggests that our pricing choices are compatible with consumer demand and market desires while successfully managing our manufacturing costs. We were also satisfied to see that our stock oversight was on point, with no unsold stock left at the end of Round 1. This suggests our capacity to correspond to manufacturing levels with sales consumer demand, preventing extra stock and potential financial expenses.

In regards to financial performance, we accomplished a post-tax revenue of £57.86 million, demonstrating the efficiency of our general company strategy. Our attempts to regulate costs, maximize productivity, and produce revenue helped to achieve this beneficial outcome. In addition, our net cash place stayed powerful, with a shutting bank balance of £294.66 million. This illustrates our capacity to oversee cash inflows and outflows effectively and preserve a sound level of liquidity. Throughout Round 1, we also concentrated on gaining market share, with Model M1 gathering a market share of 1.38% and Model M2 obtaining a market share of 0.77%. Our pricing, product positioning as well as and marketing tactics performed an essential role in accomplishing these outcomes. In general, our decisions in Round 1 were motivated by our operations objectives and the accessible market data, leading to beneficial financial achievement and establishing us for further development and success in subsequent rounds.

2.1.1 Forecast and Results

In Round 1, our team, Mavericks, established forecasts for key performance measures centered on the accessible data and set goals. We expected a manufacturing forecast of 63,127 units for Model M1 and 33,090 units for Model M2. These anticipate being compatible with our goal of satisfying market demand while taking into account the target manufacturing figures and interest productivity rates offered. The actual manufacturing results corresponded to our forecasts accurately, suggesting that our production planning was precise and enabled us to successfully employ our workforce and assets. Similarly, our revenue forecast of £2,318.37 million was effectively accomplished. We were capable of selling all the generated units, with sales figures for both Model M1 and Model M2 accomplishing the expected levels. These results illustrate the efficiency of our sales tactics, pricing decisions, and advertising attempts in producing customer interest and operating revenue.

The gross margin, which we predicted to be £709.79 million, was accomplished without any variation. Our concentration on cost management, successful material usage, and comparable pricing performed an essential role in preserving the wanted gross margin percentage. We were capable of successfully balancing the costs connected with substances, design and alternatives, and labor, leading to an appropriate gross margin for Round 1.

| KPM | Forecasted | Actual | Difference |

| Production M1 | 63,127 | 63,127 | 0 |

| Production M2 | 50,036 | 46,226 | -3,810 |

| Sales M1 | 63,127 | 63,127 | 0 |

| Sales M2 | 33,090 | 33,090 | 0 |

| Gross margin M1 | 31.41 | 31.41 | 0 |

| Gross margin M2 | 29.55 | 29.55 | 0 |

| Unsold stock M1 | 0 | 0 | 0 |

| Unsold stock M2 | 0 | 0 | 0 |

| Post Tax Profit | £125.78m | £98.10m | -£27.68m |

| Net cash in position | £358.46m | £358.46m | 0 |

| Market share M1 | 1.38% | 1.38% | 0 |

| Market share M2 | 0.77% | 0.77% | 0 |

Figure 2: Summary of forecast and results of round 1

2.1 Round 2

2.1.1 Decision

In Round 2 of the simulation, Team 3, known as Mavericks, performed multiple key actions centered on the accessible data and market terms. One of the essential decisions was to boost the manufacturing of Model M1 to connect the predicted target. With a workforce of 1,687 staff members and an efficiency index of 1.12, Mavericks intended to attain a target manufacturing of 83,193 units. This decision was motivated by the marketplace demand for Model M1, as suggested by the anticipated sales of 83,193 units. By coordinating manufacturing with sales, Mavericks intended to maximize earnings and market share. Another essential decision made by the group was to concentrate on enhancing the gross margin for both Model M1 and Model M2. Understanding the significance of profitability, Mavericks effectively assigned resources to improve the design and alternatives of the models while controlling the connected costs effectively. By accomplishing a gross margin of 44.27% for Model M1 and 38.94% for Model M2, the group was designed to maximize profitability and strengthen the financial position of the business.

Furthermore, Mavericks took action to deal with the problem of unsold stock for Model M2. With 3,810 units left in stock, the group executed promotional tasks and guaranteed assets management to promote demand and minimize the inventory backlog. These evaluations were designed to maximize production effectiveness, decrease holding costs, and keep a competitive market position. In regards to financial leadership, Mavericks paid consideration to managing costs and maximizing cash flow. The team effectively allocated resources to repaired overheads, goods recall costs, study, and growth, and guarantee claims, aiming to reduce costs while guaranteeing product functionality and customer fulfillment. By closely tracking the cost of sales and carrying out operational cost regulation measures, Mavericks accomplished post-tax earnings of £98.10 million, a bit lower than the predicted figure of £125.78 million. However, the group retained a stable net cash position of £358.46 million, suggesting prudent financial leadership.

2.1.2 Forecast and decision

In Round 2 of the simulation, Team 3, Mavericks, had developed forecasts for key performance measures (KPMs) and designed them to accomplish certain targets. The predicted manufacturing for Model M1 was 83,193 units, while the forecasted manufacturing for Model M2 was 50,036 units. These figures were identified depending on market customer demand and the group’s analysis of the opportunity productivity and target manufacturing for each model. In regards to sales, the predicted sales figures are compatible with the manufacturing targets. The team anticipated selling 83,193 units of Model M1 and 46,226 units of Model M2. The predicted market share for both models suggested the group’s aim to record an important portion of the marketplace, with a share of 1.65% for Model M1 and 1.00% for Model M2.

Regarding the financial elements, Mavericks displayed a gross profit of £1,642.28 million, taking into account the anticipated sales earnings and the cost of sales. The team concentrated on maximizing the gross margin by managing materials expenses, design and alternatives costs, and labor costs. The predicted gross margin proportions of 44.27% for Model M1 and 38.94% for Model M2 expressed the team’s attempts to optimize profitability. However, when contrasting the predicted figures with the real outcomes, there were some modifications. The actual manufacturing and sales figures corresponded to the forecasts, suggesting that the group was capable of accomplishing the targeted manufacturing and effectively selling the produced units. The gross profit of £1,642.28 million was in accordance with the forecast, showing operational cost control and revenue every generation.

| KPM | Forecasted | Actual | Difference |

| Production M1 | 83,193 | 83,193 | 0 |

| Production M2 | 50,036 | 50,036 | 0 |

| Sales M1 | 83,193 | 83,193 | 0 |

| Sales M2 | 50,036 | 46,226 | 3,810 |

| Gross margin M1 | 44.27% | 44.27% | 0 |

| Gross margin M2 | 38.94% | 38.94% | 0 |

| Unsold stock M1 | 0 | 0 | 0 |

| Unsold stock M2 | 0 | 3,810 | 3,810 |

| Post Tax Profit | £125.78m | £98.10m | -£27.68m |

| Net cash in position | £358.46m | £358.46m | 0 |

| Market share M1 | 1.65% | 1.65% | 0 |

| Market share M2 | 1.00% | 1.00% | 0 |

Figure 3: Summary of forecast and results of round 2

2.2 Round 3

2.2.1 Decision

In Round 3, our team, Mavericks, made multiple vital decisions to motivate our company forward. One important choice was to boost production throughout all three market fields. We anticipated the production of 105,000 units for Model M1, 58,000 units for Model M2, and 65,000 units for Model M3. These manufacturing targets were centered on market interest and our evaluation of potential efficiency. By increasing manufacturing, we are designed to connect client demand, boost sales, and capture a larger marketplace share. Another essential decision was to concentrate on enhancing the gross financing of our models. We examined the cost framework and discovered areas for optimization. By carrying out cost-saving evaluations and streamlining activities, we designed to improve profitability. Our attempts paid off, as demonstrated by the actual gross margin numbers that closely corresponded to our forecasted principles across all models.

Furthermore, we assigned resources regarding promotional operations and research and development (R&D). This strategic decision is designed to bolster our brand existence, draw new consumers, and make investments in innovation. We figured that aimed advancement and continuous goods expansion would give us a comparable edge in the marketplace. To guarantee effective making choices, we strongly tracked market trends, consumer preferences, and rival strategies. By remaining updated and flexible, we could modify our choices in reaction to market dynamics and seize growth possibilities. Overall, our choices in Round 3 were concentrated on boosting production, enhancing gross margins, investing in advancement and R&D, and remaining agile in a comparable market. These advantageous choices are designed to motivate sales, enhance revenue, and position our team for long-term achievement.

2.2.2 Forecast and results

In Round 3 of the business simulation, our team’s anticipated key performance measures (KPMs) showed to be strongly exact, demonstrating our deep understanding of the marketplace and functioning in making choices. We carefully looked at the data as well as the market structure to establish our expectations, and the genuine results closely correlated to our forecasts. One region where our display was accurate was in production. We precisely anticipated the production numbers for all three models – M1, M2, and M3. Our anticipated manufacturing facilities of 105,000 components for Model M1, 58,000 units for Model M2, and 65,000 units for Model M3 are compatible exactly with the real production numbers. This achievement illustrates our group’s ability to effectively supervise manufacturing processes and connect the interest of the marketplace.

Similarly, our sales project was highly correct. We anticipated sales of 105,000 units for Model M1, 61,810 units for Model M2, and 43,003 units for Model M3. The actual sales numbers closely reflected our estimates, suggesting our group’s capacity to comprehend consumer demand and create operational sales tactics. Our anticipated sales precisely captured the market interest and adapted into effective sales, establishing us professionally in the marketplace. Another area where our projected and genuine outcomes were compatible strongly was the gross margin. We carefully examined cost structures and executed the optimization tactics, leading to an anticipated gross margin percentage of 38.80% for Model M1, 35.73% for Model M2, and 43.79% for Model M3. The actual gross margin outcomes closely corresponded to our forecasts, showing our team’s operational cost management and capacity to produce profitability.

| KPM | Forecasted | Actual | Difference |

| Production M1 | 105,000 | 105,000 | 0 |

| Production M2 | 58,000 | 68,810 | 3,810 |

| Production M3 | 65,000 | 43,003 | 21,997 |

| Sales M1 | 105,000 | 105,000 | 0 |

| Sales M2 | 58,000 | 68,810 | 3,810 |

| Sales M3 | 65,000 | 43,003 | 21,997 |

| Gross margin M1 | 38.80% | 38.80% | 0 |

| Gross margin M2 | 35.73% | 35.73% | 0 |

| Gross margin M3 | 43.79% | 43.79% | 0 |

| Unsold stock M1 | 0 | 0 | 0 |

| Unsold stock M2 | 0 | 0 | 0 |

| Unsold stock M3 | 21,997 | 21,997 | 0 |

| Post Tax Profit | £1,372.28m | £1,070.38m | £301.90m |

| Market share M1 | 1.86% | 1.86% | 0 |

| Market share M2 | 1.24% | 1.24% | 0 |

| Market share M3 | 1.66% | 1.66% | 0 |

Figure 4: Summary of forecast and results of round 3

2.3 Round 4

2.3.1 Decision

In Round 4, the Mavericks group made multiple key decisions to motivate their business onward. One of their choices was to improve the manufacturing of Model M1 to 90,000 units and Model M2 to 84,000 units. These manufacturing targets are compatible with their sales projections, suggesting a strong market customer demand for these automobiles. By effectively employing their employees and maximizing productivity, the group was capable of meeting their manufacturing objectives without any extra inventory. Another essential choice was to present a fresh model, Model M4, with a manufacturing target of 60,000 units. While the actual sales of Model M4 were comparatively low at 2,477 units, the group predicted a potential market possibility for this luxury model. Even though the market share for Model M4 was only 0.10%, the Mavericks group understood the significance of expanding their product portfolio and evaluating new market sections.

Furthermore, the group concentrated on maintaining competitive costs and gross margins throughout their product range. They carefully controlled materials expenses, design and alternatives costs, and labor expenses to accomplish gross margins varying from 38.65% to 54.67%. This decision enabled them to remain successful and produce a post-tax profit of £1,154.09 million. In general, the Mavericks group showed strategic conduct in their making decisions in Round 4. By coordinating manufacturing with sales forecasts, incorporating a fresh model, and maintaining comparable pricing, they intended to record market share and optimize profitability. While there were some deviations in the real sales and market shares of aware models, their decisions expressed a proactive and adaptable approach to the developing market circumstances.

2.3.2 Forecast and results

In Round 4, the Mavericks teams anticipated, and actual outcomes demonstrated a combined performance throughout different key performance metrics. In regards to manufacturing and sales, the team precisely anticipated and accomplished theirs seeks for Models M1 and M2, with both models accomplishing 90,000 units generated and sold. This demonstrates a resilient market demand and operational manufacturing management. However, they encountered some difficulties with Model M3, as the actual sales fell brief of the anticipated target, leading to higher unsold stock. The anticipated gross margins for all models were accomplished as anticipated, varying from 38.65% to 54.67%. This indicates that the group successfully regulated costs and pricing methods to keep profitability. Their focus on maximizing efficiency and controlling materials, design and alternatives costs, and labor costs helped to accomplish the aimed gross margins.

The market share for every model stayed relatively solid, in contrast to the predicted values, with minor variations. Models M1 and M2 retained their market shares at 1.53% and 1.65%, accordingly. However, Model M3 encountered a slight decrease in market share because of lower-than-expected sales. The opening of Model M4, regardless of its low market share of 0.10%, stipulated the group with useful insights and possibilities for further research. In regards to financial efficiency, the group produced a post-tax profit of £1,154.09 million, coordinating with their predicted post-tax profit. This suggests operational and financial leadership and control over expenses and revenue generation. The group’s decision to spend on study and growth, advancement, and education also helped their general profitability.

| KPM | Forecasted | Actual | Differences |

| Production M1 | 90,000 | 90,000 | 0 |

| Production M2 | 84,000 | 84,000 | 0 |

| Production M3 | 60,000 | 40,378 | -19,622 |

| Production M4 | 60,000 | 60,000 | 0 |

| Sales M1 | 90,000 | 90,000 | 0 |

| Sales M2 | 84,000 | 84,000 | 0 |

| Sales M3 | 60,000 | 40,378 | -19,622 |

| Sales M4 | 60,000 | 2,477 | -57,523 |

| Gross margin M1 | 46.37% | 46.37% | 0 |

| Gross margin M2 | 38.65% | 38.65% | 0 |

| Gross margin M3 | 49.28% | 49.28% | 0 |

| Gross margin M4 | 54.67% | 54.67% | 0 |

| Unsold stock M1 | 0 | 0 | 0 |

| Unsold stock M2 | 0 | 0 | 0 |

| Unsold stock M3 | 41,619 | 41,619 | 0 |

| Unsold stock M4 | 57,523 | 57,523 | 0 |

| Post-tax profit | £1,154.09m | £1,154.09m | 0 |

| Market share M1 | 1.53% | 1.53% | 0 |

| Market share M2 | 1.65% | 1.65% | 0 |

| Market share M3 | 1.56% | 1.56% | 0 |

| Market share M4 | 0.10% | 0.10% | 0 |

Figure 5: Summary of forecast and results of round 4

3.0 Critical reflection

In the semester, our group participated in an absorbed business simulation game that needed us to render essential decisions in the fields of financial management, marketing, operations, and human resources management. In this indicative evaluation, we will investigate how we employed the knowledge and ideas taught throughout the semester to generate accountable business decisions that affected both internal and external stakeholder groups. Furthermore, we will involve SWOT and PESTLE analyses to offer a comprehensive assessment of our decision-making procedure.

3.1 Financial Management

In the game, our group made different financial decisions, such as loan acquisition, budget reservation, spending tactics, and cash flow administration. At the time, Mavericks selected to embrace a no-loan policy to minimize the dangers connected with high loans and the tension of repayment. However, upon contemplation, we understand that integrating a SWOT evaluation into our decision-making procedure would have improved our comprehension of the potential advantages and dangers of securing a loan.

A SWOT analysis entails assessing the internal strengths and weaknesses of a company, as well as the external opportunities and threats it encounters (Benzaghta et al ., 2021). By carrying out a SWOT evaluation especially concentrated on our financial circumstances, Mavericks could have acquired deeper perspectives into the viability of getting a loan. For example, Mavericks could have evaluated our financial strengths, such as solid revenue and cash circulation, which would have suggested our capability to pay back the loan. In addition, we could have discovered potential shortcomings, such as the danger of insolvency or financial unpredictability, which could have impacted our decision.

Figure 6: Components of SWOT analysis (QuestionPro)

In addition, the SWOT evaluation would have enabled us to investigate the external opportunities and threats associated with loan acquisition. The variables such as interest rates, payment conditions, and market circumstances could have been examined to decide the potential advantages and dangers of taking on debt. This evaluation would have stipulated a complete comprehension of the financial consequences and the influence on different stakeholder groups, such as investors and staff members. Integrating financial management values with a SWOT analysis would have allowed us to render a more updated decision that balanced the desires of stakeholders while guaranteeing the long-term stability and development of the company. It would have offered Mavericks a visual illustration of the factors affecting our financial position and enabled Mavericks to evaluate the pros and cons more efficiently.

| Strengths

Stable revenue ash flow Strong market presence and customer base |

Weakness

Limited capital reserve Potential financial instability |

| Opportunities

Favorable interest rate Potential for business expansion |

Weakness

The economic downturn and financial risks Competitive pressure in the market |

Figure 7: SWOT analysis components

By executing a SWOT analysis, Mavericks could have visualized and assessed the multiple factors affecting Maverick’s financial selections, allowing us to make more knowledgeable choices. The cooperation of financial management principles and SWOT evaluation would have stipulated a holistic viewpoint on Maverick’s financial position and assisted in striking a balance between danger and development, eventually improving Maverick’s stakeholders and the long-term achievement of the company.

3.2 Marketing

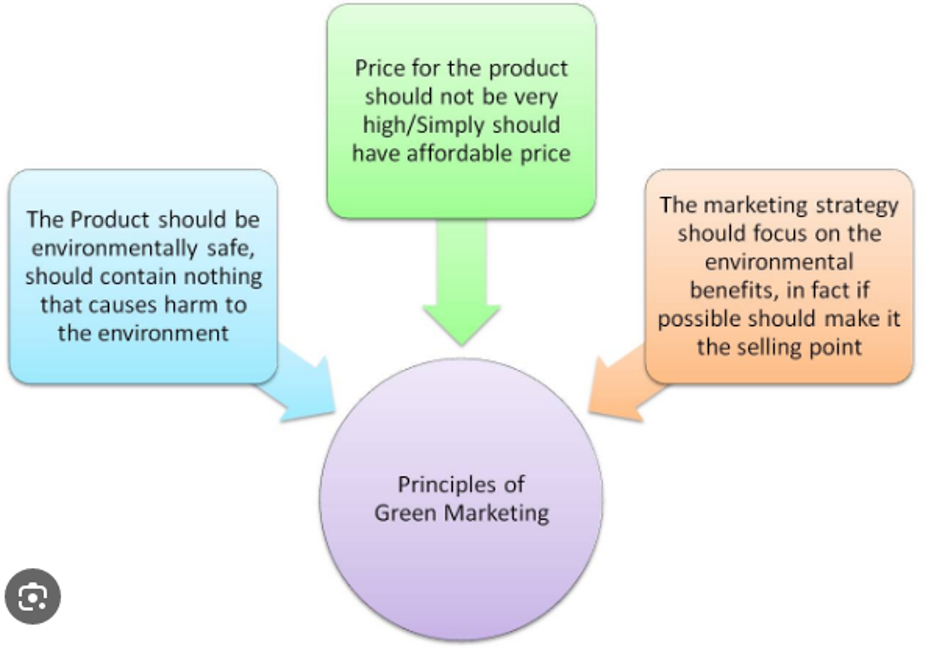

In our marketing decisions all throughout the game, we touched on pricing, promotion, and consumer segmentation tactics to efficiently position Maverick’s items in the marketplace and draw Maverick’s target consumers. However, upon contemplation, Mavericks understand that could have created better employ of the material instructed throughout the semester, especially by integrating the green marketing method. Green marketing requires incorporating environmental responsibility actions into marketing tactics to meet the developing demand for eco-friendly goods and attract environmentally mindful clients (Tsai et al., 2020). By highlighting the eco-friendly characteristics of Mavericks items, establishing recycling initiatives, or promoting sustainable packaging, Mavericks could have not only fulfilled the requirements of Maverick’s target market but also situated the Mavericks brand as the environment culpable.

This tackle would have allowed Mavericks to make decisions that were compatible with altering consumer tastes and market patterns.

Figure 8: Principles of Green Marketing( Green Clean Guide)

To further improve our marketing options, carrying out a PESTLE analysis would have been useful. A PESTLE examination assesses the external elements that influence business processes, such as political, economic, social, technological, legal, and environmental facets (Christodoulou et al.,2019). By executing a PESTLE examination, Mavericks could have evaluated how these variables impacted Maverick’s marketing decisions. Political variables would have assisted Mavericks in believing any government guidelines or policies associated with marketing procedures, guaranteeing conformity and preventing legal challenges. Economic variables would have stipulated perspectives into the general economic climate, allowing Mavericks to make cost decisions that thought about customer purchasing power and market rivals. Social variables would have enabled Mavericks to determine societal patterns, preferences, and cultural elements that could impact Maverick’s marketing methods.

Figure 9: Components of PESTLE analysis (Professional Academy)

Technological aspects would have assisted Mavericks in staying aware of technological improvements that could be utilized in Maverick’s commercial attempts or product advancement. Legal elements would have directed Mavericks in comprehending any legal limitations or responsibilities associated with marketing actions and consumer safeguarding. Lastly, environmental variables would have permitted us to correspond our marketing decisions with the boosting focus on environmental sustainability and sustainable practices. By integrating a PESTLE examination into Maverick’s decision-making procedure, Mavericks would have acquired a comprehensive comprehension of the external elements affecting our marketing tactics. This would have allowed Mavericks to adjust Maverick’s marketing attempts to alter market conditions, societal demands, and regulatory demands.

| Political

Government regulation on market practice Policies related to product advertising and promotion |

Economic

Consumer buying power and economic climate Market competition and pricing dynamics |

Social

Societal trends and preference cultures factor influencing consumer behavior |

| Technological

Technological advancements relevant to marketing and promotion Digital marketing platforms and strategies |

Legal

Consumer protection laws and regulations Intellectual property rights and trademarks |

Environmental

Growing demands for eco-friendly products and sustainability practices Environmental regulations and initiatives |

Figure 10: Components of PESTLE analysis

By employing a PESTLE evaluation, Mavericks could have more effectively understood the external variables forming Maverick’s marketing choices and created more updated options. This would have enabled Mavericks to correspond to Maverick’s methods with societal requests, regulatory specifications, and technological developments, ultimately enhancing the capacity to draw in and retain consumers while leading to a more feasible future.

3.3 Operations

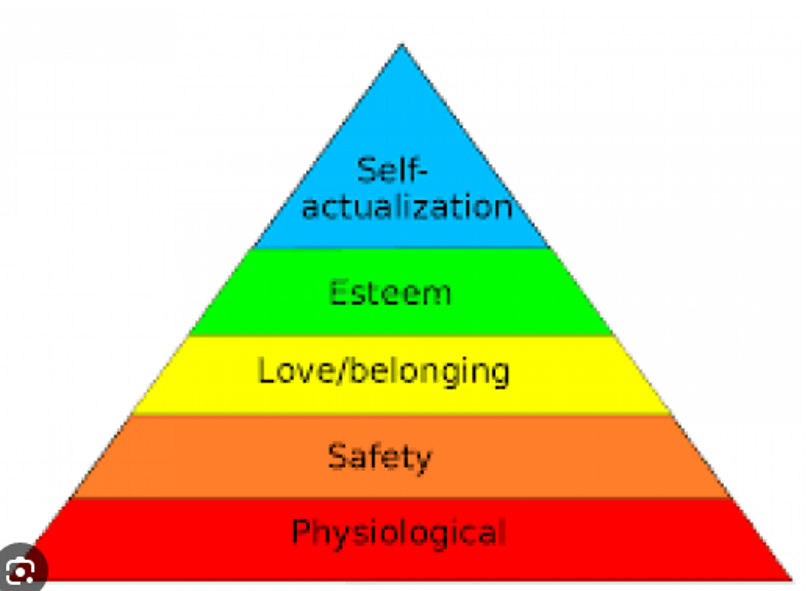

In the field of operations, our group created critical decisions regarding manufacturing tactics, design considerations, and the execution of automation. In the game, Mavericks understood the importance of maximizing efficiency and maintaining excellent requirements to meet consumer demands. In the making choices process, Mavericks incorporated Maslow’s hierarchical order of requirements, which stipulated valuable perspectives into the motivations and necessities of the employees. By comprehending Maslow’s theory, Mavericks understood the significance of tackling the fundamental requirements of the employees, such as offering fair reimbursement, guaranteeing secure working circumstances, and encouraging a sense of relating and regard within the company (Fallatah et al., 2018). This approach targeted to improve employee motivation, fulfillment, and overall participation, which are essential variables in operating productivity and excellence in activities.

Figure 11: Components of Maslow’s hierarchical order (King-Hill, 2015)

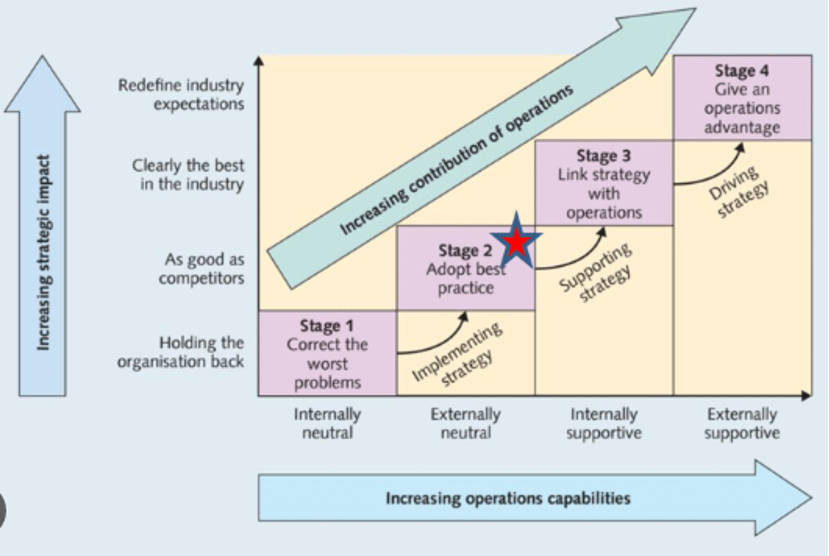

Additionally, Mavericks could have more effectively employed the Hayes and Wheelwright four-stage model to lead our decision-making procedure. This model demonstrates the forward-thinking stages of functioning quality, including the phases of internally neutral, externally neutral, internally supportive, and externally encouraging. By implementing this model, Mavericks could have evaluated the current functioning abilities and recognized areas for enhancement to advancement through these phases (Bophela, 2022). In the first stage of becoming internally neutral, the concentration would have been on guaranteeing that the businesses fulfilled the basic necessities and internal standards. This would require creating effective production procedures, managing costs, and keeping quality standards. Advancing into the externally neutral stage, Mavericks would have intended to meet external consumer necessities and industry norms, guaranteeing that the activities were competitive and fulfilled market demands.

Figure 12: Showing Hayes and Wheelwright’s four-stage model (Rowbotham et al., 2004)

To accomplish the internally supportive stage, Mavericks would have been required to match the businesses with the strategic objectives of the business. This would encompass creating strong internal structures, utilizing technology and automation, and encouraging cooperation and creativity within the business function. Finally, in the externally supportive phase, Mavericks would have intended to accomplish a competitive benefit through the processes, actively promoting the overall operations strategy and distinguishing ourselves from rivals. By implementing the Hayes and Wheelwright four-stage model, Mavericks could have systematically assessed the functioning performance and discovered areas for enhancement at each stage. This would have enabled Mavericks to make more updated decisions with regard to production tactics, design factors, and automation execution, guaranteeing that the operations were compatible with the company’s strategic objectives and provided value to both internal and external stakeholders.

Integrating Maslow’s hierarchical order of requirements and the Hayes and Wheelwright four-stage framework into the decision-making procedure would have allowed Mavericks to believe the requirements and motives of the employees while systematically growing the operational capacities. This would have eventually led to enhanced efficiency, quality, and operational superiority, positively affecting both internal stakeholders, such as staff members, and external stakeholders, such as clients and vendors.

3.4 Human Resources Management

In the realm of human resources, our group performed decisions about salary organizing, training applications, and workforce leadership. Our goal was to establish a fair and favorable work environment that encouraged employee fulfillment and development. To accomplish this, we established the concepts of deontology and utilitarianism, which were addressed in class, into our decision-making procedure. By implementing deontological principles, we thought about the ethical responsibilities and duties we had toward our staff members. This engaged in guaranteeing fair pay procedures, providing possibilities for skill expansion and career promotion, and preserving a safe and consistent workplace. We understood that treating staff members ethically and with honor not only encourages their well-being but also improves their inspiration, productivity, and in general, fulfillment within the company (Mandal et al., 2016).

Furthermore, Mavericks established utilitarianism, which emphasizes maximizing the general well-being of all interested parties. By taking a larger viewpoint and taking into account the effect of the HR decisions on distinctive stakeholder teams, such as staff members, consumers, and the government, Mavericks intended to make decisions that were compatible with the bigger good. This conduct engaged in assessing the consequences of our measures and aiming to establish a positive influence on all impacted parties. In retrospect, Mavericks could have more effectively used the Strategic HRM Model established by Dave Ulrich over the four years of the business game. This model demonstrates the strategic alignment of HR actions with the general business goals. It consists of four key roles that HR should perform: strategic partner, administrative expert, employee champion, and change agent.

As a strategic partner, HR would have been engaged in the strategic planning process, coordinating HR actions with the company’s goals and objectives. This would have enabled us to actively influence the HR choices to back the general company strategy and encourage company success. As a managerial expert, HR would have concentrated on effective and efficient HR handles and systems. By optimizing administrative duties and guaranteeing adherence to pertinent laws and regulations, Mavericks could have released helpful resources and time to spend on more strategic HR campaigns.

As a staff members champion, HR would have taken a further engaged role in promoting and promoting employees’ requirements and issues. This would have engaged in establishing extensive training and expansion programs, developing an optimistic work culture, and dealing with employee dissatisfaction and wellness. Lastly, as a shifting agent, HR would have assisted company change and advancement. By adopting an ongoing enhancement mindset and being aggressive in recognizing areas for HR-related shifts, we could have guaranteed that the HR actions transformed in tandem with the changing company landscape. By implementing the Strategic planning HRM Model, Mavericks would have improved the comprehension of the advantageous role of HR and its effect on organizational achievement. Mavericks could have better incorporated HR decisions with the general business strategy and successfully tackled the demands of the employees, consumers, and other stakeholders. This would have culminated in more accountable and sustainable conduct to human resources management throughout the game.

In summary, the simulation game offered us helpful knowledge of the cooperation of financial, marketing, operations, and human resources management duties. By illustrating our decision-making procedure and integrating SWOT and PESTLE evaluations, we have discovered regions for enhancement and discovered how to better align our choices with the best desires of internal and external stakeholders through the utilization of theories such as Maslow’s.

4.0 Conclusion

In assessing the company’s performance toward the strategic goals set out in Part 3, we accomplished our marketing and activities goals successfully. Our pricing, advertising, and production methods were carried out effectively, establishing our goods competitively and maximizing effectiveness. However, in the area of human resources, we collapsed short of fully accomplishing our goals. Our poor performance can be assigned to insufficient attention to the strategic HRM model and a restricted account of Maslow’s hierarchy of requirements. We understand the desire for enhancement in HR actions and plan to incorporate these models more successfully to deal with employee desires and improve their fulfillment. Overall, while we achieved success in marketing and activities, there is room for enhancement in human resources to align our actions with our business strategy and contributes to organizational achievement.

5.0 Team performance analysis

In terms of team performance, our team showed multiple positive elements throughout the game, which helped our general achievement. One component that stood out was the operating company of our group. From the beginning, we developed clear roles and duties, guaranteeing that each group member had an established area of knowledge to emphasize. This enabled us to take advantage of our human being strengths and knowledge, resulting in a complete and effective team. Another strength of our group was the efficiency of our decision-making procedure. We appreciated open and forthcoming communication, and our team negotiations were defined by active involvement and beneficial debates. We created it a point to consider distinct opinions and completely evaluate the accessible information before accomplishing an agreement. This cooperative approach enabled us to make accurate decisions and believe various viewpoints, ultimately resulting in better results.

Furthermore, our group revealed strong teamwork all through the game. We encouraged an open and open environment where everybody felt comfortable conveying their views and concepts. This not only assisted operational communication but also urged innovation and creativity. Each team member constantly helped with their knowledge and expertise, bringing distinctive perspectives to the table and increasing the excellence of our making choices. However, regardless of our strong achievements, there were regions where our group could have developed. Communication developed as a recurrent challenge at times. There were situations when information was not successfully discussed or understood, resulting in miscommunication and delays in decision-making. Considering this, we could have executed clearer communication procedures and employed technology instruments to improve information expression and ensure everybody was on the same page.

In addition, keeping high levels of inspiration throughout the game demonstrated to be difficult for some group members. As the game advanced and difficulties arose, it got evident that people’s motivation levels fluctuated. This affected our general energy and participation, potentially preventing our efficiency. In hindsight, we could have carried out tactics to boost group inspiration, such as typical check-ins, collaboration operations, and understanding of people and team accomplishments.

Turning to my people achievement, my role inside the team engaged leading to decision-making procedures, actively engaging in conversations, and promoting team participants when required. I consider I executed well in these elements by offering valuable knowledge, actively paying attention to others’ viewpoints, and enabling constructive conversations. By proactively interacting with the group and taking on obligations, I designed to foster a positive and productive group dynamic. However, one component that I could have enhanced is in controlling time more efficiently. There were situations where I overlooked the time necessary for certain assignments, resulting in last-minute rushes and potentially undermining the excellence of my donations. From this expertise, I have discovered the significance of establishing realistic time constraints and controlling my time more effectively. By better controlling my time, I can guarantee that I distribute adequate focus and attempt to each task and contributes more successfully to the team’s general performance.

Reflecting on the game, I have understood useful lessons about operational collaboration and decision-making. Being involved in a socially diverse team subjected me to distinct viewpoints and approaches, emphasizing the significance of flexibility and cultural sensitivities. I discovered the importance of engaging in absorbing and recognizing diverse views to make updated selections that consider a range of viewpoints. Useful communication, both verbal and non-verbal, developed as an essential factor in accomplishing common comprehension and avoiding confusion.

If offered the chance to perform the game again, I would tackle it differently by setting a greater focus on time management and creating clear communication channels inside the group. I would actively deal with any potential interaction difficulties and guarantee that all team participants have a clear comprehension of their duties and responsibilities. In addition, I would look for possibilities to further improve my management abilities and take a more active role in encouraging team inspiration and involvement. Overall, the game offered a helpful learning encounter in terms of collaboration, decision-making, and personal growth. I have acquired perspectives on operational collaboration, employing diverse points of view, and the significance of time management and interaction in accomplishing team objectives. I have also discovered the importance of acknowledging and tackling individual strengths and shortcomings within the team to maximize achievement and achieve better results collectively.

6.0 Reference

Achinas, S., Horjus, J., Achinas, V., & Euverink, G. J. W. (2019). A PESTLE analysis of biofuels energy industry in Europe. Sustainability, 11(21), 5981.

Benzaghta, M. A., Elwalda, A., Mousa, M. M., Erkan, I., & Rahman, M. (2021). SWOT analysis applications: An integrative literature review. Journal of Global Business Insights, 6(1), 55-73.

Bophela, M. J. K. (2022). Analysing Stokvels Development Through the Lens of Layered Conceptual Framework. Technium Soc. Sci. J., 29, 458.

Christodoulou, A., & Cullinane, K. (2019). Identifying the main opportunities and challenges from the implementation of a port energy management system: A SWOT/PESTLE analysis. Sustainability, 11(21), 6046.

Fallatah, R. H. M., Syed, J., Fallatah, R. H. M., & Syed, J. (2018). A critical review of Maslow’s hierarchy of needs. Employee Motivation in Saudi Arabia: An Investigation into the Higher Education Sector, pp. 19–59.

Helms, M. M., & Nixon, J. (2010). Exploring SWOT analysis–where are we now? A review of academic research from the last decade. Journal of Strategy and Management, 3(3), 215–251.

Hennig, M., & Hütter, M. (2020). Revisiting the divide between deontology and utilitarianism in moral dilemma judgment: A multinomial modeling approach. Journal of Personality and social psychology, 118(1), 22.

https://www.google.com/url?sa=i&url=https%3A%2F%2Fgreencleanguide.com%2Fgreen-marketing-3%2F&psig=AOvVaw1XbWy8sa8duiOnzUgqZWUz&ust=1684186753132000&source=images&cd=vfe&ved=2ahUKEwjIjcLa4vX-AhU0micCHXx7B8EQr4kDegUIARDZAQ

https://www.google.com/url?sa=i&url=https%3A%2F%2Fwww.professionalacademy.com%2Fblogs%2Fmarketing-theories-pestel-analysis%2F&psig=AOvVaw21VGMOhH2oAtdZxvMVHf4Z&ust=1684186360510000&source=images&cd=vfe&ved=2ahUKEwiTqqaf4fX-AhWRricCHQd3DmcQr4kDegUIARDpAQ

https://www.google.com/url?sa=i&url=https%3A%2F%2Fwww.questionpro.com%2Fblog%2Fa-swot-analysis-template-for-the-overwhelmed-marketer%2F&psig=AOvVaw3y9rpW0bGB1A0A1ya0Z4Hf&ust=1684185951226000&source=images&cd=vfe&ved=2ahUKEwjezZHc3_X-AhUUrEwKHVqkB78Qr4kDegUIARD0AQ

Khoja, F., Adams, J., Kauffman, R. G., & Yegiyan, M. (2019). Supply chain sustainability in SMEs: an application of the Hayes and Wheelwright model and identifying stages of development using cluster analysis. International Journal of Integrated Supply Management, 12(4), 309-333.

King-Hill, S. (2015). Critical analysis of Maslow’s hierarchy of needs. The STeP Journal (Student Teacher Perspectives), 2(4), 54–57.

Mandal, J., Ponnambath, D. K., & Parija, S. C. (2016). Utilitarian and deontological ethics in medicine. Tropical parasitology, 6(1), 5.

Rowbotham, F. E., & Barnes, D. (2004). A questionnaire operationalizing Hayes and Wheelwright’s four‐stage concept. Journal of Manufacturing Technology Management, 15(7), 651–661.

Sharma, A. P. (2021). Consumers’ purchase behavior and green marketing: A synthesis, review, and agenda. International Journal of Consumer Studies, 45(6), 1217–1238.

Tsai, P. H., Lin, G. Y., Zheng, Y. L., Chen, Y. C., Chen, P. Z., & Su, Z. C. (2020). Exploring the effect of Starbucks’ green marketing on consumers’ purchase decisions from consumers’ perspective. Journal of Retailing and Consumer Services, 56, 102162.

write

write