Executive Summary

The case study focused on this paper will examine the logistics dilemma experienced by Arun Kumar, the customer relationship manager at JSW Steel Ltd in India. Kumar must decide how to transport 7,000 tons of steel coils to client Jindal SAW Ltd. (JSAW) within 12 hours; the manager wants to determine whether to ship the locks through rail or barge transport. Based on a case study of JSW Steel Ltd, it was evident that rail transport was the faster means than the barge. However, barge transportation was determined to save an overall cost savings of 22%; despite this massive cost-efficient saving advantage offered by barge, it was decided to pose a risk in the transit process, specifically due to its unclean storage and late delivery of packages. With this available data and insightful information from JSW Steel Ltd case studies, we aim to provide a detailed analysis of factors relating to the costs of transportation, time taken during the delivery of packages, and the associated probability calculation on delays experienced for both modes of transport, with this analysis we intent to develop a data-driven recommendation on the costs, risks, and benefits of each using each option; this recommendation will help Arun Kumar to make an impactful decision that will lower the cost of operation and optimize on the profits. To determine these analytical results and make a statistically viable recommendation, we will construct a decision tree model to quantify and visualize the expected profit of rail shipment in (₹).

Analysis of the Logistics Dilemma at JSW Steel Ltd.

JSW Steel Ltd. is one of India’s leading steel manufacturers. As Kumar, a customer relationship manager, evaluates how to transport steel coils to client Jindal SAW Ltd. (JSAW), he faces a complex logistics dilemma. The steel is needed urgently, but Kumar must choose between faster but costlier rail transport or slower but cheaper barge transport. This analysis draws on academic research in supply chain risk management and decision analysis to assess Kumar’s alternatives and recommend the optimal approach.

Challenges Facing Kumar

The key challenges that Kumar faces in making his decision include the tight deadline set at 12 hours. With this, Kumar’s decision on the mode of transport to use is affected negatively (Lorentz, Wong, & Hilmola, 2007). The logistic team also exerts pressure on him to use rail transport as it will lead to faster delivery of the packages when compared to the barge; in addition, there should be an on-time delivery of packages as it is critical for meeting the needs of the important client for Jindal SAW Ltd (JSAW). Furthermore, there is uncertainty around rail rake availability until Monday morning, which also poses a challenge to the delivery process; Kumar is tied between deciding on using cost savings associated with the slow mode of barge transportation and the higher transportation associated with the faster rail transportation, he knows that his decision will significantly impact the ability of JSW to meet the quarterly financial targets, his decision comes with a higher is risk of negatively affecting the relationship of the company and its major client. The study determined that these challenges faced by Kunar reflect the common issues examined in the academic literature on supply chain risk management; according to Shockley and Henry (2011), Ellis, Shockley, and Henry (2011), managers often face difficulties in balancing the cost savings against supply chain risks such as late deliveries that can disrupt organization’s operations. Lorentz, Wong, and Hilmola (2007) found that tight deadlines and uncertainty in the supply chain process are the most common risks associated with the logistical decision; this literature provided the foundation for the techniques used to apply to address the supply mentioned above chain issues experienced by Kumar in the quest for decision between cost reduction and maintaining speed and reliability of supply chain processes.

Alternatives Available to Kumar

Based on the case study, Kumar had two clear alternatives: ship coils via rail with an option of using either Jumbo or BoXN rakes or ship coils barge method through the ports in Goa and Mundra. According to a study by Gurnani, Mehrotra, and Ray (2012), a discrete option to simplify analysis and avoid dilemma lies in weighing the risks associated with the availability and the time taken for meeting the supply chain processes for every mode available against bottom line cost associated with the supply process.

Financial Analysis of Rail Transport

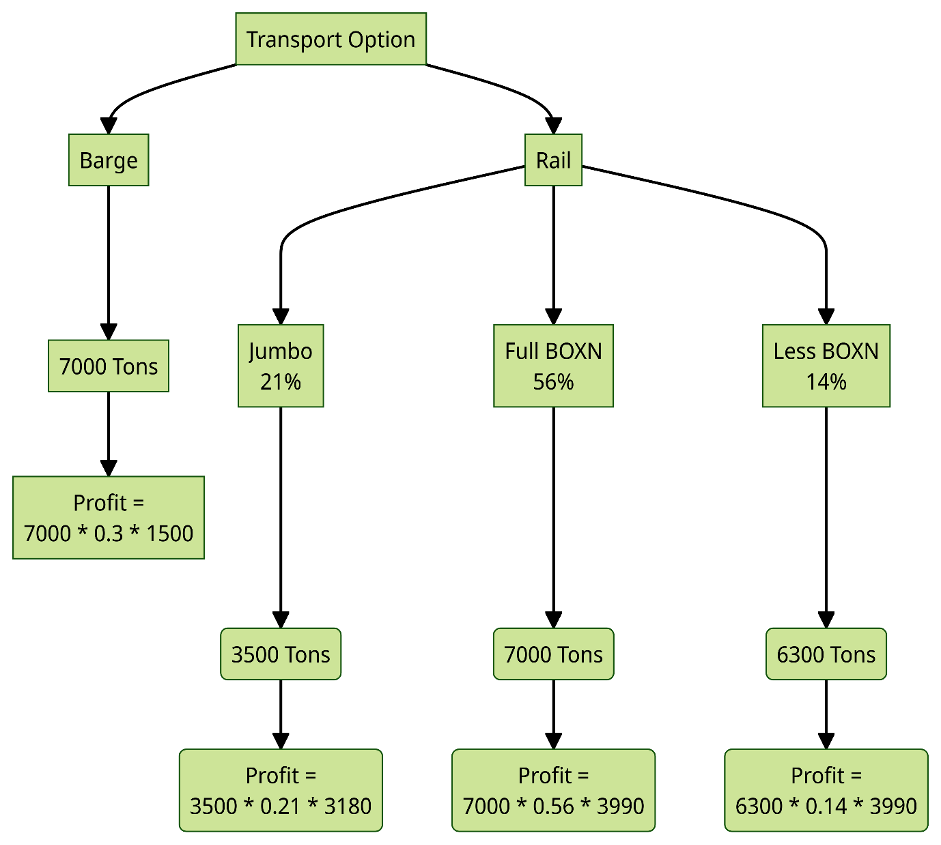

To quantify the key financial tradeoff, a decision tree model can calculate the expected profit from selecting the rail option:

Figure 1 Decision tree diagram

This decision tree aligns with frameworks from Camm, Chorman, Dill, Evans, Sweeney, and Wegryn (2020) and accounts for the different probabilities and costs provided for Jumbo vs. BoXN rakes:

First, there is a 30% chance of getting a Jumbo rake, which would carry the 7,000 tons at a rate of ₹3,180 per ton. Second, there is a 70% chance of getting BoXN rakes instead. Within that 70% chance, there is an 80% probability of receiving the full requested number of BoXN rakes, transporting the 7,000 tons at ₹3,990 per ton. Alternatively, there is a 20% chance that the allocation would be one less BoXN rake than requested, meaning only 6,300 tons could be shipped at the ₹3,990 BoXN rate. Adding the expected values at each end node yields an overall expected profit of ₹277,044,000 if Kumar chooses the rail option. While rail has higher costs, this quantifies the profit impact if rail delivers on time.

Risk Assessment of Barge vs. Rail Transport Mode

While rail has a clear cost disadvantage, its speed could outweigh that if the barge cannot meet the urgent deadline. As Manuj and Mentzer (2008) discuss, managers must balance cost savings against risk impacts like late deliveries; to assess the risks, past shipment data provides key insight:

The barge transit from Goa to Mundra port takes 50-60 hours, compared to 96-120 hours for the rail transit from Bellary. Second, Class I barge vendors have a historical 80% on-time delivery rate versus 70% for rail shipments. Third, selecting Class I barge storage reduces the risk of damage to the steel coils. Though slower, barge transit times suggest the reasonable ability to meet the deadline. The higher on-time rate also indicates lower delay risks relative to rail. While rail is faster, variability means delays could still occur. Obtaining Class I barge storage further mitigates barge risks.

Recommendation and Justification

Considering the above analysis, barge is the optimal mode for Kumar. Given the pressing financial targets, the 22% transport cost savings are highly valuable. The transit times and risk profile suggest that the barge can reasonably meet the urgent deadline. As Luo, Wang, and Zhang (2016) discuss, cost reduction is vital but should not compromise customer service. Here, the barge appears capable of timely delivery despite the slower speed. Securing Class I barge storage reduces the risk of coil damage. Finally, maintaining strong relations with key clients, JSAW should take priority over internal logistics team pressures. Failing to meet the deadline could severely damage this relationship. With barge appearing to meet the deadline at lower cost and risk, it becomes the recommended option.

Conclusion

This analysis illustrates key insights for supply chain managers facing logistics decisions under tight deadlines and uncertainty; quantifying modeling tradeoffs provides a structure on how to identify lower-risk, cost-saving options, collecting and analyzing the data associated with every option data enable risk-informed choices that are balanced against customer and marked demands however it is important to note that some uncertainties may not be completely solved through the process of quantitative analysis only, a combination of statistical and financial methodologies backed with relevant data in requires for justified recommendations to be developed.

References

Camm, J. D., Chorman, T. E., Dill, F. A., Evans, J. R., Sweeney, D. J., & Wegryn, G. W. (2020). Business analytics: Data analysis & decision making (8th ed.). Cengage Learning.

Ellis, S. C., Shockley, J., & Henry, R. M. (2011). Making sense of supply disruption risk research: A conceptual framework grounded in enactment theory. Journal of Supply Chain Management, 47(2), 65-96. https://doi.org/10.1111/j.1745-493X.2011.03217.x

Gurnani, H., Mehrotra, A., & Ray, S. (2012). Supply chain disruptions: Theory and practice of managing risk. Springer-Verlag.

Lorentz, H., Wong, C. Y., & Hilmola, O. P. (2007). Emerging distribution systems in central and eastern Europe: Implications from two case studies. International Journal of Physical Distribution & Logistics Management, 37(8), 670-697. https://doi.org/10.1108/09600030710825694

Luo, W., Wang, K. J., & Zhang, Q. (2016). An integrated optimization model for supply chain cost reduction under demand uncertainty. Journal of Industrial and Production Engineering, 33(5), 325-335. https://doi.org/10.1080/21681015.2016.1172204

Manuj, I., & Mentzer, J. T. (2008). Global supply chain risk management strategies. International Journal of Physical Distribution & Logistics Management, 38(3), 192-223. https://doi.org/10.1108/09600030810866986

write

write