A portfolio is a pool of assets that generates revenue. These market instruments comprise money and capital markets, and derivative markets. The risk diversification principles allow for numerous investment portfolios. The primary objective of an investor is to maximize revenue depending on the risk involved. Thus investor concentrates on obtaining all information concerning market prices. Therefore, this project aims to analyze historical investment data, identify trends and patterns, application of statistical models to forecast future performance. The project will also examine diversification strategies and risk management methods.

Analyzing historical investment data

Analysis of historical data examines market behaviour over a certain period. Market data may comprise volatility, volume and prices that can be measured and analyzed over a specific period. A historical return for a stock index of company X is 500, typically measured from the start of January 1 to December 31 when the market closes (Kenton, 2021). A company compiles returns every year to depict historical returns over numerous years. Investors and businesses can measure historical returns for all investments comprising real estate value, exchange-traded funds, home value, and mutual funds. Historical returns can also be used to calculate price [performance for products such as silver, wheat, gold, and corn (Kenton, 2021).

Calculating historical returns entails subtracting the most recent price from the oldest prices in a data set and dividing the result by the oldest price. For instance, let us calculate the retune of Company X for 2020.

- 4850 = Company X closing price on December 31 2021

- 5900 = Company X closing price on December 31 2022

- 5900 – 4850 = 1050

- 1050/4850 = 0.22 0r 22%

An Investor can repeat this process to calculate monthly returns or any other period. Investors can compile the computed data set and determine similarities and trends between one time and the other.

Trends and patterns

Investors can discover short, medium and long-term trends. Typically, investors take a position in profitable assets as long as the present trend continues. Analysts use trend lines and channels that price fluctuation boundaries, intending to spot and determine trends. Upward trends depict asset prices reaching higher highs and higher lows, while downward trends show lower highs and lower lows (CATALANO, 2019). Many investors trade in the trend direction. Patterns are the different formations generated by security movements on a chart. A pattern is recognized by a line that joins common price points comprising closing prices during particular periods (CATALANO, 2019)

Statistical Model

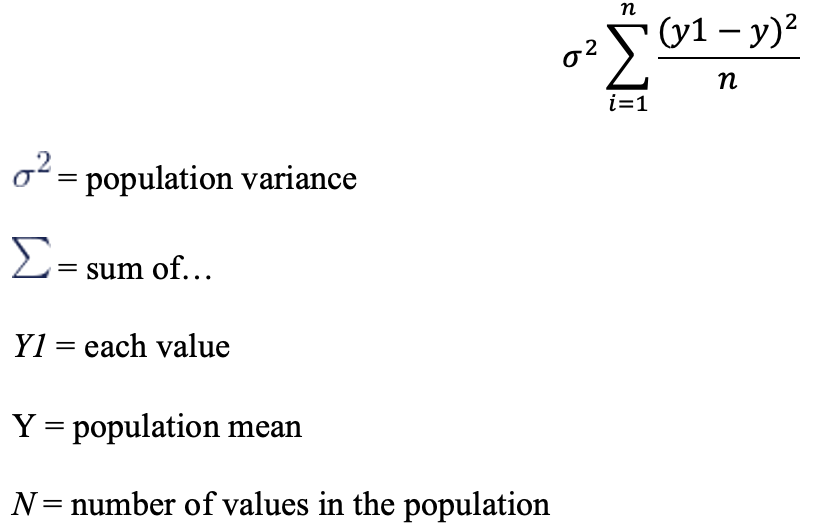

Standard Deviation and Variation

The method is an essential criterion for investment securities management. The standard deviation and variation display the degree probable returns deviate from expected returns. Variation measures price changes; the standard deviation is the fundamental risk approach. Investors must calculate price change volatilities in financial instruments (Hacioglu et al., 2013). The formula is as follows:

Recommendations on financial risk management

-

Diversification strategies

Modern and traditional portfolio techniques are the two primary approaches to portfolio diversification. Traditional techniques affirm that a portfolio is less risky than a single instrument. A portfolio’s outcomes are the total profit shares of financial assets, periodical increase, and coupon payment yields (Hacioglu et al., 2013). The technique states that an investor should increase the number of securities to minimize risks. Risks reduce. Once securities are integrated into the portfolio. The primary reason for a portfolio is to spread risk. Since securities, in a portfolio all have different outcomes, portfolio risk is less severe than a single security. Traditional methods emphasize increasing the portfolio.

The modern theory emphasizes every portfolio security’s expected yields and prospects. A portfolio’s return ratio and risk define investment performance instead of the risk and outcome ratio of a single financial instrument (Hacioglu et al., 2013). In this approach, the investor makes decisions depending on the ‘superiority principle’ and the level of risk returns among portfolios. Thus investors should select portfolios with more negligible risks among the ones with similar return levels and portfolios with higher expected returns among those with similar risks (Hacioglu et al., 2013).

-

Risk management techniques

- Avoidance – investors can avoid financial risks associated with investment portfolios. After assessing the level of risk associated with different portfolios, investors can decide not to purchase the investments.

- Retention- depending on the probable frequency and severity of the presented risk, retaining or part of the risk may be inexpensive despite other available techniques (Human Resources, n.d.). For instance, colleges maintain the risk of damages to gates, fences and poles due to the difficulty of tallying and assessing all these structure types.

- Spreading – investors can apply the risks of loss to people and property. For example, making duplicates of documents and records and storing the copies in distinct locations can help spread threats such as fire outbreaks in a facility (Human Resources, n.d.).

- Reduction and loss prevention – when investors cannot avoid risks, that can reduce the risk severity and frequency (Human Resources, n.d.)

- Transfer – in some instances, investors can transfer risk to others, generally by signing contracts. For example, insurance purchase transfers financial risks to the insurance company in case of injuries or property damage.

- Contracts – investors can use contracts to free themselves from all liability for their actions associated with the contract.

References

Catalano, T. J. (2019). Patterns vs Trends: What’s the Difference? Investopedia. https://www.investopedia.com/ask/answers/010715/what-are-differences-between-patterns-and-trends.asp

Hacioglu, Ü., Dincer, H., & Çelik, I. E. (2013). The Evaluation of Financial Risk and Portfolio Selection. Managerial Issues in Finance and Banking, 111–120. https://doi.org/10.1007/978-3-319-01387-9_8

Human Resources. (n.d.). What are the Essential Techniques of Risk Management – Human Resources, Diversity and Inclusion | CSUF. Hr.fullerton.edu. https://hr.fullerton.edu/risk-management/information-and-document-requests/information-management/essential-techniques-of-risk-management.php

Kenton, W. (2021, June 7). Historical Returns. Investopedia. https://www.investopedia.com/terms/h/historical-returns.asp

write

write