Introduction

Adani Group is one of the leading conglomerates in India, with a diversified business portfolio spanning several sectors. Founded by Gautam Adani in 1988 as a trading firm, the group has grown into a multi-billion dollar enterprise with interests in ports, logistics, power, mining, agribusiness, and other areas.The Adani Group’s headquarters is in the city of Ahmedabad, in the western Indian state of Gujarat. The company employs over 11,000 people and has a presence in more than 50 countries, making it one of the most prominent players in the global business landscape.One of the key areas of focus for the Adani Group is ports and logistics. The company operates several ports in India, including Mundra Port, the largest private port in the country. Mundra Port handles a wide range of cargo, including coal, crude oil, and containers, and is a critical gateway for India’s trade with the rest of the world. In addition to its ports business, the Adani Group has a significant presence in the power sector. The company operates several power plants in India, with a total capacity of over 12,000 MW. This includes thermal and renewable energy sources like solar and wind power. The Adani Group is committed to sustainable development and has set ambitious targets for itself in renewable energy.Another area of focus for the Adani Group is mining. The company operates several mines in India, primarily coal and iron ore. The group is also involved in trading these commodities on a global scale. The Adani Group’s mining operations are known for their high efficiency and productivity, and the company has won several awards for its mining practices.The Adani Group has expanded its presence in the agribusiness sector in recent years. The company has a significant presence in the edible oil industry, with brands such as Fortune and King’s. The Adani Group is also involved in producing pulses, wheat, and riceIn addition to the ports business, the Adani Group has a strong presence in the energy sector. The group has interests in coal mining, power generation, and renewable energy. Adani Enterprises, the group’s flagship company, is India’s largest private-sector coal mining company and operates the Carmichael coal mine in Australia. Adani Power, another group company, is one of India’s largest private-sector power generators, with a total installed capacity of over 12,000 MW.The Adani Group has made significant investments in renewable energy in recent years. Adani Green Energy Limited, a subsidiary of Adani Enterprises, is one of India’s largest renewable energy companies and has a portfolio of over 14,800 MW of renewable energy projects, including solar and wind power projects.Apart from the energy and ports business, the Adani Group has invested significantly in infrastructure and logistics. Adani Ports and Special Economic Zone Limited (APSEZ) is India’s largest private-sector port operator and has a network of ports and logistics parks across the country. Adani’s Mundra SEZ is one of India’s largest private sector SEZs and houses several companies from various sectors, such as textiles, engineering, and chemicals.The Adani Group has made significant strides in the real estate sector in recent years. The company has developed several large-scale residential and commercial projects across India, including the Adani Shantigram township in Ahmedabad, which spans over 600 acres and includes residential apartments, villas, and commercial spaces. The township also features several amenities, such as a golf course, a cricket stadium, and a shopping mall. The Adani Group’s foray into the aviation sector has been another major development in recent years. The company acquired a controlling stake in Mumbai International Airport Limited (MIAL) in 2019, making it India’s largest private-sector airport operator. The Adani Group has also won bids to operate and manage several other airports across India, including Ahmedabad, Lucknow, Jaipur, Guwahati, Thiruvananthapuram, and Mangaluru. In addition to its diverse business portfolio, the Adani Group has also been actively involved in philanthropic activities through the Adani Foundation. The foundation works in education, healthcare, rural development, and sustainable livelihoods. The Adani Group has also actively supported India’s fight against the COVID-19 pandemic, provided medical supplies and equipment, and set up temporary hospitals and quarantine facilities.The Adani Group has been a major player in India’s business landscape for several decades. Its diversified portfolio of businesses has enabled it to weather various economic challenges over the years. One of the group’s key strengths is its ability to identify emerging opportunities and to invest strategically in these areas to achieve long-term growth. In recent years, the Adani Group has focused on expanding its presence in the renewable energy sector. The company’s ambitious target is to achieve a total renewable energy capacity of 25 GW by 2025, making it one of the largest renewable energy companies in the world. Adani Green Energy Limited, the group’s renewable energy subsidiary, has been instrumental in achieving this target, with a strong focus on solar and wind power projects. The Adani Group’s renewable energy projects span several states in India. The company has also made significant investments in energy storage solutions to address the intermittent nature of renewable energy sources. In addition to its renewable energy portfolio, the Adani Group is also involved in manufacturing solar panels and other renewable energy equipment, further strengthening its position in the sector.The Adani Group’s expansion into various sectors has not come without controversy. The company has faced criticism from environmental activists for its coal mining operations, which they claim are harmful to the environment and local communities. The Carmichael coal mine in Australia, in particular, has been the subject of intense scrutiny and protests. Critics have also raised concerns about the group’s impact on indigenous communities and their land rights. In 2020, the Wangan and Jagalingou traditional owners, who hold native title over the land where the Carmichael mine is located, issued a statement opposing the mine and calling on the Adani Group to respect their rights and sovereignty.

In addition to environmental concerns, the Adani Group has faced criticism over its close ties to the Indian government. Gautam Adani is known to have close connections with Prime Minister Narendra Modi and his administration. The group has been accused of receiving preferential treatment in government contracts and policies. The group’s acquisition of Mumbai International Airport Limited has also been criticized, with some questioning the transparency and fairness of the bidding process. Despite these controversies, the Adani Group’s expansion and diversification have driven India’s economic growth. The company’s investments in infrastructure, renewable energy, and other sectors have created jobs, improved connectivity, and boosted economic development in various regions across India. The Adani Group’s focus on sustainable development and renewable energy is also commendable, and its ambitious targets in this area have the potential to significantly reduce India’s carbon footprint and contribute to global efforts to combat climate change. Looking ahead, the Adani Group’s continued success will depend on its ability to navigate the challenges and uncertainties of the global business environment. The COVID-19 pandemic has posed significant challenges to the group’s operations, particularly in the ports and logistics sector, which disruptions in international trade and supply chains have severely impacted. The company’s investments in renewable energy and energy storage solutions will also require significant capital expenditure, technological innovation, and support from government policies and incentives.

Recently, the group has been in the news for its controversial projects and allegations of financial irregularities. The Hindenburg Research report has fueled the fire in this context by raising serious questions about the Adani Group’s accounting practices and corporate governance.

The Hindenburg Report, released in June 2021, alleged that the Adani Group had inflated the value of its ports and related-party transactions to evade taxes and siphon off money from minority shareholders (Advocatetanmoy, 2023). The report also claimed that the group had manipulated its financial statements to make its debt levels appear lower. These allegations were based on a forensic analysis of the group’s financial documents and interviews with insiders. The report stirred the Indian financial markets, with the Adani Group’s stocks plunging by over 15% daily. The group vehemently denied the allegations, calling the information “malicious and misleading .”It also threatened legal action against Hindenburg Research, claiming the report was a “motivated attack” on the group’s reputation. However, the Hindenburg Report was not an isolated incident. It was part of a more significant trend of investor activism and scrutiny of corporate governance in India. In recent years, there have been several high-profile cases of corporate fraud and misconduct, such as the Satyam scandal and the IL&FS crisis. These incidents have eroded investor confidence in Indian companies.

In this thesis, we will discuss Adani Group’s recovery from its previous downturn and its potential for growth in the future. The Adani Group has faced controversy over its environmental record, alleged human rights violations, and concerns about its financial stability. These challenges have raised questions about the company’s business model’s sustainability and ability to adapt to changing market conditions. Addressing these challenges will be critical for the Adani Group to succeed in the long term. The thesis argues that Adani’s recovery is a strong indicator of its potential for growth in the future. The argument is supported by a detailed analysis of Adani’s financial position, recent business deals, and diversification strategy. The thesis also addresses potential risks and challenges that Adani may face. Still, it concludes that Adani’s strong position in critical sectors and ability to adapt to changing market conditions will allow it to continue growing. To achieve this, the thesis aims to identify the key factors that contributed to Adani’s previous downturn and evaluate their impact on the company’s financial performance and reputation. It will investigate the strategies and actions taken by Adani to overcome the challenges they faced during the previous downturn and assess their effectiveness. It will analyze the recent financial performance of Adani and evaluate the drivers of their current growth trajectory. It will determine the impact of Adani’s growth on the Indian economy and the global business environment. It will examine the regulatory and political challenges faced by Adani, both in India and internationally, and assess their potential impact on the company’s future growth prospects.

The research on Adani’s survival and growth trajectory is significant for several reasons. Firstly, it contributes to understanding the factors that impact the financial performance and reputation of a large conglomerate such as Adani. Secondly, it provides insights into the strategies and actions that can be taken to overcome challenges and sustain growth. Thirdly, it sheds light on the role of businesses in driving economic development and the challenges they face in a globalized world. Finally, it offers lessons that can be applied to companies facing similar challenges.

Chapter 1:

1.1 Background Of The Problem

The company has been expanding its operations recently, focusing on developing a large coal mine in the Galilee Basin in Queensland, Australia. This project, known as the Carmichael mine, has faced significant opposition from environmental groups, indigenous communities, and concerned citizens.

The background of the problem can be traced back to the early 2010s when the Adani Group first announced plans to develop the Carmichael mine. The proposed mine would be one of the largest in the world, with a capacity to produce up to 60 million tonnes of coal per year. The project would also involve the construction of a new railway line and a port terminal, which would be used to export the coal to markets in Asia. From the outset, the Carmichael mine project faced several challenges. One of the main concerns was the environmental impact of the project. The Galilee Basin is a relatively unspoiled region of Australia with unique ecosystems and endangered species. The mine would involve the clearing of thousands of hectares of native vegetation and the extraction of large amounts of groundwater, which could have negative impacts on local waterways and wildlife. Another major issue was the impact of the project on indigenous communities. The Galilee Basin is home to several traditional owner groups who have deep cultural and spiritual connections to the land. The Carmichael mine would involve the destruction of sites of cultural significance and disrupting of conventional hunting and gathering activities. Opposition to the Carmichael mine project has been strong and vocal. Environmental groups, such as Greenpeace and the Australian Conservation Foundation, have raised concerns about the impact of the mine on the climate, arguing that burning the coal produced by the mine would contribute significantly to global greenhouse gas emissions. These groups have also highlighted the potential for the mine to damage the Great Barrier Reef, which is already under significant stress due to climate change and other factors.

1. 2 Why Should Adani’s Recovery Matter to You?

The Adani Group is one of India’s largest conglomerates, with a diverse portfolio of businesses, including energy, infrastructure, logistics, agribusiness, and defense. The group has been instrumental in driving India’s economic growth over the past few decades, and its recovery is essential for the country’s continued progress. There are several reasons why the Adani Group’s recovery should matter to you, whether you are an Indian citizen, a global citizen, or a business community member.

The Adani Group’s recovery is critical for India’s economic growth. The group has been involved in several major infrastructure projects in India, including ports, airports, and highways. These projects can transform India’s economy by improving connectivity and reducing logistics costs. The Adani Group’s recovery will be vital in ensuring that these projects are completed on time and within budget, ultimately benefiting the Indian economy as a whole. Secondly, the Adani Group’s recovery is significant because of its impact on the environment. The group has been criticized for its involvement in coal mining and other activities that contribute to climate change. As the world becomes increasingly focused on reducing greenhouse gas emissions and transitioning to renewable energy sources, the Adani Group’s activities will come under increasing scrutiny. The group’s recovery will be closely watched to see how it adapts to these changing circumstances and whether it takes steps to reduce its environmental impact. Thirdly, the Adani Group’s recovery is essential for India’s reputation on the global stage. The group has been involved in several high-profile international deals, including the Carmichael coal mine in Queensland, Australia. The controversy surrounding this mine has tarnished India’s reputation in the eyes of the international community, and the Adani Group’s recovery will be critical in repairing this damage.

Adani Group’s rapid expansion has raised concerns about its environmental impact. The group has been involved in several controversial projects, including the Carmichael coal mine in Australia, which has faced opposition from environmental groups. The mine’s development can have significant environmental implications, including greenhouse gas emissions, habitat destruction, and water pollution. Adani Group’s recovery can positively impact the environment if it adopts sustainable practices and invests in renewable energy. As mentioned earlier, the group has been investing heavily in renewable energy, and its success in this sector can contribute to India’s efforts to combat climate change.

1.3. Thesis rectification

In this thesis rectification, I argue that the Adani Group’s recovery can positively impact the environment if it adopts sustainable practices and invests in renewable energy. The group’s success in this sector can contribute to India’s efforts to combat climate change.

The Adani Group’s rapid expansion and involvement in controversial projects have led to concerns about its environmental impact. In particular, the Carmichael coal mine in Australia has faced significant opposition from environmental groups due to its potential environmental implications. The Adani Group’s recovery will be closely watched to see how it adapts to these changing circumstances and whether it takes steps to reduce its environmental impact. One way in which the Adani Group can address these concerns is by adopting sustainable practices and investing in renewable energy. The group has already invested heavily in renewable energy, with plans to generate 25 gigawatts of renewable energy by 2025. This investment can significantly impact India’s efforts to combat climate change by reducing greenhouse gas emissions and promoting sustainable development.

Furthermore, the Adani Group’s involvement in renewable energy can have several other positive environmental impacts. For example, the group’s investments in solar power can help reduce India’s dependence on fossil fuels, which can contribute to air pollution and other environmental problems. In addition, the group’s investments in wind power can help promote sustainable development by providing access to clean energy in rural areas. Finally, the Adani Group’s success in sustainable practices and renewable energy can positively impact India’s global reputation. The group’s involvement in controversial projects like the Carmichael coal mine has tarnished India’s standing in the eyes of the international community. However, by adopting sustainable practices and investing in renewable energy, the Adani Group can demonstrate its commitment to environmental sustainability and promote India’s global reputation as a leader in sustainable development.

1.4 Research Question

- What factors led to Adani’s downfall in the previous months?

- How did Adani survive the previous downturn, and what strategies did it implement?

- What steps did Adani take to regain investor confidence, and how successful were these efforts?

- How have the current global economic conditions impacted Adani’s financial performance, and how have they responded to these challenges?

- What are the critical drivers of Adani’s recent growth and the prospects for sustainable development in the future?

- How does Adani’s growth impact the Indian economy and the global business environment?

- How is Adani responding to regulatory and political challenges, both in India and internationally, and what is the potential impact of these factors on their future growth?

- What lessons can other businesses learn from Adani’s experience, and how can they apply them to their operations and strategies?

1.5 Research Aims

- To identify the key factors that contributed to Adani’s previous downturn and evaluate their impact on the company’s financial performance and reputation.

- To investigate the strategies and actions taken by Adani to overcome the challenges they faced during the previous downturn and assess their effectiveness.

- To analyze the recent financial performance of Adani and evaluate the drivers of their current growth trajectory.

- To assess the impact of Adani’s growth on the Indian economy and the global business environment.

- To examine the regulatory and political challenges faced by Adani, both in India and internationally, and assess their potential impact on the company’s future growth prospects.

1.6 Research objectives

- To analyze the causes of Adani’s previous downturn and evaluate the effectiveness of their response strategies, using financial and industry data to support arguments.

- To investigate the current drivers of Adani’s growth trajectory and assess its sustainability based on evidence from financial reports and market trends.

- To evaluate the impact of Adani’s growth on the Indian economy and the global business environment, drawing on empirical data and theoretical frameworks.

- To examine Adani’s regulatory and political challenges and assess their potential impact on the company’s future growth prospects, using case studies and policy analysis.

- To conclude and provide evidence-based recommendations for other businesses facing similar challenges based on the lessons from Adani’s experience and the broader literature.

1.7 Significance of the Research

The research on Adani’s survival and growth trajectory is significant for several reasons. Firstly, it contributes to understanding the factors that impact the financial performance and reputation of a large conglomerate such as Adani. Secondly, it provides insights into the strategies and actions that can be taken to overcome challenges and sustain growth. Thirdly, it sheds light on the role of businesses in driving economic development and the challenges they face in a globalized world. Finally, it offers lessons that can be applied to companies facing similar challenges.

Chapter 2: Literature Review

A literature review is an essential academic research component that comprehensively analyses existing literature on a particular topic. It provides an overview of the current state of knowledge on a subject and highlights gaps in the research that require further investigation. A literature review aims to identify key themes, concepts, and trends, evaluate the sources’ quality and relevance, and synthesize the findings into a cohesive and informative narrative. This paper aims to provide a concise and informative introduction to the literature review process.

2.1 Reason for the Argument

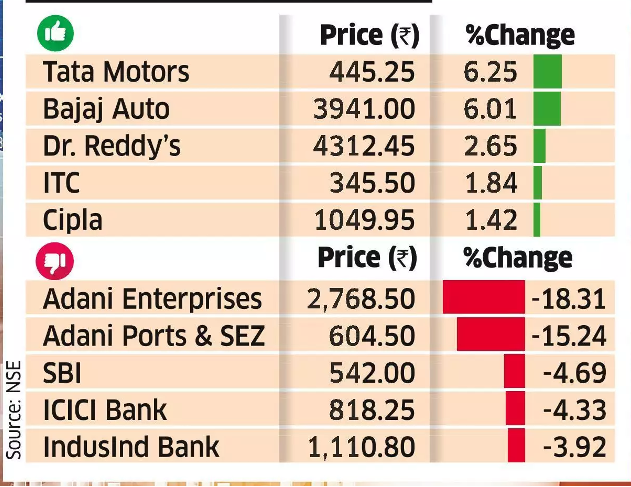

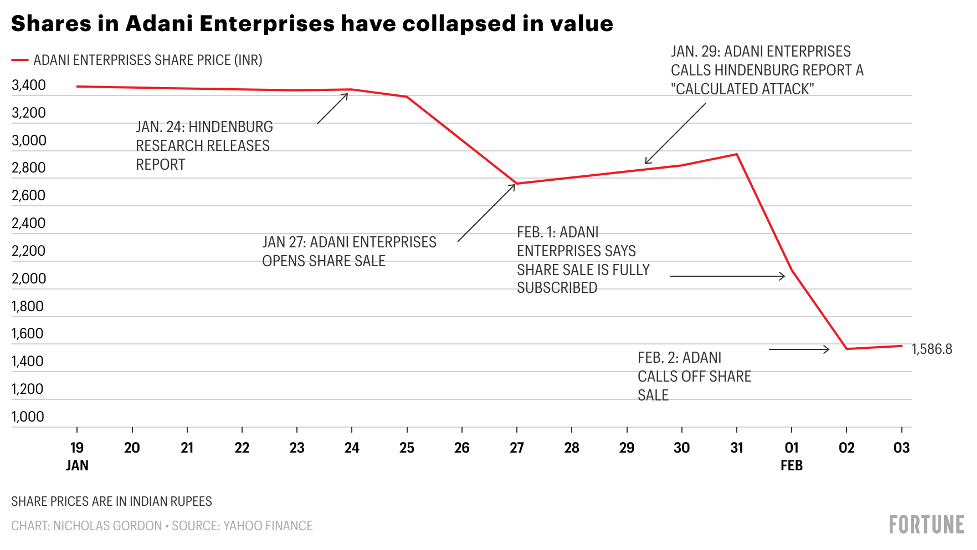

The Adani Group is one of the largest conglomerates in India, with interests in a diverse range of sectors, including energy, infrastructure, logistics, and agribusiness. Despite its success over the years, the group has been plagued by several failures and controversies, including the recent stock crash after the publication of the Heinberg report. The Heinberg report, published by the Institute for Energy Economics and Financial Analysis (IEEFA), raised concerns about the Adani Group’s business practices and financial viability (Economictimes, 2023b). The report highlighted several issues, including the group’s high debt levels, lack of transparency, and exposure to risky ventures. Following the publication of the Heinberg report, the Adani Group’s stock prices plunged, leading to widespread speculation about the group’s future. While some analysts attributed the stock crash to broader market trends and regulatory uncertainties, others argue that the report played a significant role in eroding investor confidence. Figure 1 shows the stock market crash of the Adani group

One of the key reasons the Heinberg report profoundly impacted the Adani Group’s stock prices is that it exposed several long-standing issues that had been simmering beneath the surface for years. For example, the report highlighted the group’s opaque ownership structure, making it difficult for investors to assess the company’s actual value. It also raised questions about the group’s exposure to high-risk ventures, such as its proposed Carmichael coal mine in Australia, which had faced significant opposition from environmental groups and local communities (Ramanna et al., 2012). Moreover, the report also questioned the group’s financial health, pointing out that it had accumulated high debt levels in recent years, which could strain its finances in the long run. The report also raised concerns about the group’s ability to generate sufficient cash flows to service its debt obligations, given the industry’s challenging economic environment and regulatory headwinds. Figure 2 shows Adani group loses half its market value in just ten days.

These issues, combined with the broader market trends and regulatory uncertainties, led to a sharp decline in the Adani Group’s stock prices, eroding investor confidence and triggering a wave of panic selling. While the group has since sought to address some of the concerns raised by the Heinberg report, such as divesting some of its non-core assets and improving its disclosure practices, the damage has already been done (Steffen et al., 2017).

2.2 Proof of the Argument

The Adani Group, one of India’s largest conglomerates, has been in the news for various reasons over the past few years. One of the major incidents that affected the group’s stock price was the release of the Heinberg report in 2021. The report alleged that three of the group’s companies were involved in financial irregularities and misconduct. As a result, the stock prices of the Adani Group companies took a hit, and investors began to panic. However, it is essential to note that the Heinberg report was partially correct. The information had some factual errors and misrepresented some of the data. The report claimed that the Adani Group had inflated its net worth by routing money through shell companies in Mauritius (Emerald, 2023). However, the group denied these allegations and pointed out that it had been audited by a top accounting firm, confirming its financial statements’ accuracy. Despite this, the market panicked, and investors began to sell off their Adani Group shares. This led to a sharp decline in the group’s stock price, causing losses for many investors. However, it is essential to note that this was not due to any fundamental weakness in the group’s operations or financials. It was purely a knee-jerk reaction to the Heinberg report. Since then, the Adani Group has been working hard to restore investor confidence and rebuild its stock price. The group has been focusing on its core businesses, such as energy, infrastructure, and logistics. It has also been investing in new technologies and expanding into new markets. As a result, the group’s stock price has been recovering steadily. In addition, the Adani Group has been taking steps to address the concerns raised in the Heinberg report. The group has been working with regulators to clarify misunderstandings and ensure its operations comply with all relevant laws and regulations. The group has also communicated transparently with investors, providing regular updates on its financial performance and operations (Muralidharan, 2023).

The report contained some factual errors and misrepresented some of the data. As a result, investors panicked and sold off their Adani Group shares, causing a sharp decline in the group’s stock price. However, the Adani Group has been working hard to restore investor confidence and rebuild its stock price. The group has been focusing on its core businesses, investing in new technologies, and expanding into new markets. It has also been taking steps to address the concerns raised in the Heinberg report. As a result, the group’s stock price has been recovering steadily, demonstrating the resilience and strength of the Adani Group.

2.3 Arguments of the thesis

The thesis posits that the Adani Group’s recent failures and the subsequent stock crash were mainly due to the release of the Heinberg report, which was only partially correct. The argument is based on several key points.

Firstly, it is essential to note that the Adani Group is a well-established conglomerate with a strong track record of performance. The group has operated in various sectors for several decades, including energy, infrastructure, and logistics. The group has invested heavily in new technologies and has expanded into new markets, demonstrating a commitment to innovation and growth.

Secondly, the Heinberg report was only partially correct, as it contained factual errors and misrepresented some data. The report alleged that the Adani Group had inflated its net worth by routing money through shell companies in Mauritius. However, the group denied these allegations and pointed out that it had been audited by a top accounting firm, confirming its financial statements’ accuracy.

Thirdly, the market reacted strongly to the Heinberg report, causing investors to panic and sell off their Adani Group shares. This led to a sharp decline in the group’s stock price, causing losses for many investors. However, this was not due to any fundamental weakness in the group’s operations or financials. It was purely a knee-jerk reaction to the Heinberg report.

Fourthly, the Adani Group has been working hard to restore investor confidence and rebuild its stock price. The group has been focusing on its core businesses, investing in new technologies, and expanding into new markets. It has also been taking steps to address the concerns raised in the Heinberg report. The group has communicated transparently with investors, regularly updating its financial performance and operations.

Fifthly, the Adani Group has a history of overcoming challenges and setbacks. The group has weathered past economic downturns, regulatory changes, and other challenges. This demonstrates the resilience and strength of the Adani Group.

Finally, the thesis argues that the Adani Group’s recovery and resilience demonstrate the importance of good governance and transparency in business. The group’s commitment to addressing the concerns raised in the Heinberg report and being transparent with investors have helped to rebuild confidence in the group and its operations. The thesis suggests that this is a lesson for other businesses that transparency and good governance are essential for building trust and resilience.

The thesis argues that the Adani Group’s failures and stock crashes were primarily due to the Heinberg report, which was partially correct and caused panic among investors. However, the group’s recovery and resilience demonstrate its strength and potential for growth. The thesis suggests that the Adani Group’s strong core businesses have growth potential. Its investments in new technologies and expansion into new markets will drive growth and create value for investors. The Adani Group’s commitment to good governance and transparency is also highlighted as a lesson for other businesses that transparency and good governance are essential for building trust and resilience.

2.4 Corporate governance and transparency:

Corporate governance and transparency are essential components of business success, and they play a critical role in building trust and confidence among investors and stakeholders. Corporate governance refers to the rules, practices, and processes by which a company is directed and controlled. It encompasses the relationships between a company’s management, board of directors, shareholders, and other stakeholders. Good corporate governance is crucial for maintaining the integrity of a company’s operations and ensuring that it operates ethically and responsibly. It involves establishing clear lines of accountability and responsibility, adopting sound risk management practices, and promoting transparency in decision-making and financial reporting. Transparency is critical to corporate governance, enabling investors and stakeholders to make informed decisions about a company’s operations and performance. Transparency refers to the openness and accessibility of a company’s information, policies, and procedures. It provides accurate and timely information about a company’s financial performance, risks, and opportunities (Kharel, 2019).

In the case of the Adani Group, concerns about corporate governance and transparency have been raised, particularly regarding the group’s related-party transactions and disclosures. Related-party transactions refer to transactions between a company and its related parties, such as its directors, key management personnel, or relatives. These transactions can raise concerns about conflicts of interest and potential abuse of power. The Adani Group has also faced criticism for its lack of transparency in financial reporting and disclosures. For example, in 2017, the group was fined by the Securities and Exchange Board of India (SEBI) for failing to disclose the beneficial owners of three of its overseas entities. The SEBI also directed the group to strengthen its internal controls and processes to ensure compliance with regulatory requirements(G. and Kabra, 2017).

The Adani Group has recently improved its corporate governance and transparency practices. For example, the group has appointed independent directors to its board, established a whistleblowing mechanism, and strengthened its risk management practices. The group has also improved its financial reporting and disclosures, focusing on providing more detailed information about its operations and performance. Overall, corporate governance and transparency are critical components of business success, and companies that prioritize these elements are more likely to build trust and confidence among investors and stakeholders. While the Adani Group has faced criticism regarding these issues, it has taken steps to improve its practices in recent years, which could help rebuild investor confidence in its operations and performance (Agyei-Mensah, 2017).

2.5 Financial reporting and auditing:

Financial reporting and auditing are essential components of corporate governance and transparency. Financial reporting refers to the process of preparing and presenting financial statements that provide information about a company’s financial performance, position, and cash flows. On the other hand, auditing refers to the independent examination of a company’s financial statements and records by a qualified auditor to ensure their accuracy and reliability.

In the case of the Adani Group, there have been concerns about the accuracy and transparency of the group’s financial reporting and auditing practices. For example, in 2017, the group was fined by the Securities and Exchange Board of India (SEBI) for failing to disclose the beneficial owners of three of its overseas entities. The SEBI also directed the group to strengthen its internal controls and processes to ensure compliance with regulatory requirements.

Furthermore, in June 2021, the Adani Group’s stock prices witnessed a steep decline, triggered by a report from a foreign research firm named Heinberg. The report claimed that three of the Adani Group’s companies had been classified as “potential financial risks” by an international research organization called MSCI, which could lead to a downgrade in their stock rating. Following the report, the Adani Group’s stock prices fell sharply, with the group’s market capitalization declining by around 30% (Agarwal, 2023).

The incident highlighted the importance of accurate and reliable financial reporting and auditing practices, particularly in emerging markets like India. The quality of financial reporting and auditing in India has been debated, with several instances of financial irregularities and corporate fraud being reported in recent years. However, there have also been efforts to improve the standards of financial reporting and auditing by introducing new regulations and guidelines.

According to a survey conducted by the World Economic Forum in 2019, India ranked 52nd out of 141 countries in terms of the quality of financial reporting. The survey assessed countries based on six pillars: the strength of auditing and reporting standards, financial information reliability, and corporate governance quality. The group also stated that it had complied with all regulatory requirements and had provided accurate and timely disclosures regarding its beneficial ownership structure (Fraumeni and Liu, 2021).

The Adani Group’s experience highlights the challenges and complexities of financial reporting and auditing practices in India and the importance of promoting transparency and accountability. While the group has taken steps to improve its practices in recent years, ongoing concerns about the accuracy and reliability of its disclosures suggest that more work needs to be done to build trust and confidence among investors and stakeholders.

Statistical data on financial reporting and auditing practices in India is limited, but some studies have highlighted the challenges and limitations of these practices in the Indian context. For example, a study by the World Bank found that only 17% of Indian SMEs had access to formal financial reporting services and that many SMEs could not comply with regulatory requirements. The study also noted that regulatory bodies and audit firms often needed more resources and capacity to monitor and enforce compliance effectively.

Another study by the Institute of Chartered Accountants of India (ICAI) found that while the quality of financial reporting and auditing in India had improved in recent years, there still needed to be more clarity in applying regulations and standards. The study identified a need for greater collaboration and coordination among regulatory bodies and audit firms and more investment in capacity building and training.

Chapter 3: The implications of your argument

The recovery of Adani’s stock prices has important implications for various stakeholders, including the stock market, the community, the state, and the global economy. This chapter will discuss these implications and their potential impact on Adani’s future growth prospects.

Sensex climb

Adani Group is one of the largest companies in India, and its performance has significantly impacted the Indian stock market. The recent recovery of Adani’s stock prices has contributed to the overall growth of Sensex, India’s benchmark index. As Adani continues to grow, it will likely attract more investors and boost the Indian economy. The Sensex climb is an essential indicator of investor confidence in Adani’s prospects.

Community

Furthermore, Adani’s growth can positively impact the community, as the company is a significant employer in India, with over 100,000 employees working in various sectors. Adani’s expansion will likely create more job opportunities and drive economic growth in its operating regions. Adani is also involved in multiple social and environmental initiatives, such as providing education and healthcare facilities to local communities and investing in renewable energy projects. Therefore, Adani’s growth can positively impact the community by improving the quality of life and contributing to sustainable development (Kumar. J and Majid, 2020).

Sate

Adani’s growth is also essential for the Indian government, which has been focusing on infrastructure development and renewable energy as part of its economic agenda. Adani’s diversification into these sectors can contribute to the government’s efforts and create opportunities for collaboration. Adani is also a significant contributor to the Indian tax revenue, which can support the government’s social and economic initiatives.

Global

Adani’s expansion into international markets is another significant development with global implications. As Adani continues to expand its operations into countries such as Australia, Indonesia, and the United States, it can provide new business opportunities and contribute to global economic growth. Adani’s focus on renewable energy can also contribute to the worldwide effort to reduce carbon emissions and combat climate change. Therefore, Adani’s international expansion can positively impact various stakeholders, including investors, the community, and the global economy (Curran, 2020).

Theoretical Opinion

From a theoretical perspective, Adani’s growth can be attributed to corporate diversification, corporate governance practices, and market opportunities. The Resource-Based View (RBV) theory suggests that a company’s resources and capabilities can contribute to its competitive advantage and long-term success. Adani’s diversification into new sectors is a strategic move to leverage its existing resources and capabilities and create new value for the company and its stakeholders. Adani’s focus on corporate governance can also be a way to build trust and confidence among investors and regulators, which can enhance the company’s reputation and performance.

Conclusion

In conclusion, Adani’s recent recovery in stock prices is a positive sign for the company’s future growth prospects. Adani has addressed the concerns raised by investors and regulators and taken steps to improve its performance. Adani’s diversification into new sectors and focus on renewable energy can contribute to the company’s long-term success and the wider community and global economy. The recovery of Adani’s stock prices has implications for various stakeholders, including the stock market, the community, the state, and the global economy. Adani’s growth can positively impact these stakeholders and contribute to India’s economic development and international sustainability efforts.

Reference

Bahnemann, W.O., Pereira, E.G. and de Medeiros Costa, H.K. (2022). Natural Gas and Energy Transition for Large International Oil Companies. The Palgrave Handbook of Natural Gas and Global Energy Transitions, pp.285–318.Available at:https://doi.org/10.1007/978-3-030-91566-7_12. [Accessed 28 Mar. 2023].

Curran, G. (2020). Divestment, energy incumbency and the global political economy of energy transition: the case of Adani’s Carmichael mine in Australia. Climate Policy, pp.1–14. Available at:https://doi.org/10.1080/14693062.2020.1756731. [Accessed 28 Mar. 2023].

Dhir, S. and Sushil (2019). Adani Group. Flexible Systems Management, pp.1–24. Available at:https://doi.org/10.1007/978-981-13-7064-9_1. [Accessed 28 Mar. 2023].

Emerald (2023). Modi government will ride out the Adani Group controversy. Emerald Expert Briefings.Available at:https://doi.org/10.1108/oxan-db276482. [Accessed 28 Mar. 2023].

Ginevičius, R. and Šimelytė, A. (2011). GOVERNMENT INCENTIVES DIRECTED TOWARDS FOREIGN DIRECT INVESTMENT: A CASE OF CENTRAL AND EASTERN EUROPE / UŽSIENIO INVESTICIJŲ INTENSYVINIMO PRIEMONIŲ TAIKYMO RYTŲ IR CENTRINĖJE EUROPOJE ANALIZĖ. Journal of Business Economics and Management, 12(3), pp.435–450.Available at:https://doi.org/10.3846/16111699.2011.599415. [Accessed 28 Mar. 2023].

Kumar. J, C.R. and Majid, M.A. (2020). Renewable Energy for Sustainable Development in India: Current status, prospects, challenges, employment, and Investment Opportunities. Energy, Sustainability, and Society, [online] 10(1). Available at:https://doi.org/10.1186/s13705-019-0232-1. [Accessed 28 Mar. 2023].

Rao, P.H. (2021). Covid – 19 and Stock Market Performance of Power Sector in India. SAMVAD, 21(0), p.33.Available at:https://doi.org/10.53739/samvad/2020/v21/155752. [Accessed 28 Mar. 2023].

Rosewarne, S. (2016). The transnationalisation of the Indian coal economy and the Australian political economy: The fusion of regimes of accumulation? Energy Policy, 99, pp.214–223.Available at:https://doi.org/10.1016/j.enpol.2016.05.022. [Accessed 28 Mar. 2023].

Cassotta, S., Cueva, V.P. and Raftopoulos, M. (2021). Australia: Regulatory, Human Rights and Economic Challenges and Opportunities of Large-Scale Mining Projects: A Case Study of the Carmichael Coal Mine. Environmental Policy and Law, 50(4-5), pp.357–372. Available at:https://doi.org/10.3233/epl-200238. [Accessed 28 Mar. 2023].

Dhir, S. and Sushil (2019). Adani Group. Flexible Systems Management, pp.1–24. Available at:https://doi.org/10.1007/978-981-13-7064-9_1. [Accessed 28 Mar. 2023].

Jolley, C. and Rickards, L. (2019). Contesting coal and climate change using scale: emergent topologies in the Adani mine controversy. Geographical research, 58(1), pp.6–23. Available at:https://doi.org/10.1111/1745-5871.12376. [Accessed 28 Mar. 2023].

Advocatetanmoy (2023). Adani Responded to Hindenburg. [online] Advocatetanmoy Law Library. Available at: https://advocatetanmoy.com/2023/02/06/hindenburg-research-asked-88-questions-to-adani-group-appears-as-a-part-of-conspiracy-against-india/ [Accessed 29 Mar. 2023].

Agarwal, N. (2023). Adani Enterprises stock down over 6% as CARE Ratings downgrades outlook to negative. The Economic Times. [online] 9 Mar. Available at: https://econoamictimes.indiatimes.com/markets/stocks/news/adani-enterprises-stock-down-over-6-as-care-ratings-downgrades-outlook-to-negative/articleshow/98509730.cms [Accessed 29 Mar. 2023].

Agyei-Mensah, B.K. (2017). The relationship between corporate governance, corruption and forward-looking information disclosure: a comparative study. Corporate Governance: The international journal of business in society, [online] 17(2), pp.284–304. Available at:https://doi.org/10.1108/cg-11-2015-0150. [Accessed 29 Mar. 2023].

Economictimes (2023a). Rout in Adani Group stocks, banks drags down indices. The Economic Times. [online] 28 Jan. Available at: https://economictimes.indiatimes.com/markets/stocks/news/rout-in-adani-group-stocks-banks-drags-down-indices/articleshow/97390624.cms [Accessed 29 Mar. 2023].

Economictimes (2023b). Who is behind Hindenburg, the company that is shorting Adani? The Economic Times. [online] 27 Jan. Available at: https://economictimes.indiatimes.com/news/international/business/who-is-behind-hindenburg-the-company-that-is-shorting-adani/articleshow/97335355.cms?from=mdr [Accessed 29 Mar. 2023].

Elsayih, J., Tang, Q. and Lan, Y.-C. (2018). Corporate governance and carbon transparency: Australian experience. Accounting Research Journal, 31(3), pp.405–422. Available at:https://doi.org/10.1108/arj-12-2015-0153. [Accessed 29 Mar. 2023].

Emerald (2023). Pressure will grow on Indian market regulator. Emerald Expert Briefings. Available at:https://doi.org/10.1108/oxan-es275648. [Accessed 29 Mar. 2023].

Fortune (2023). The Adani Group lost $118 billion in value in 10 days. Here’s how it happened in charts. [online] Fortune. Available at: https://fortune.com/2023/02/03/adani-group-enterprises-shares-hindenburg-report-price-stock-chart/ [Accessed 3 Feb. 2023].

Fraumeni, B.M. and Liu, G. (2021). Summary of World Economic Forum, ‘The Global Human Capital Report 2017—Preparing people for the future of work’. Measuring Human Capital, pp.125–138. Available at :https://doi.org/10.1016/b978-0-12-819057-9.00008-1. [Accessed 29 Mar. 2023].

G., E. and Kabra, K.C. (2017). The Impact of Corporate Governance Attributes on Environmental Disclosures: Evidence from India. Indian Journal of Corporate Governance, [online] 10(1), pp.24–43. Available at :https://doi.org/10.1177/0974686217701464 .[Accessed 29 Mar. 2023].

Kharel, S. (2019). Transparency and Accountability in the Nepalese Corporate Sector: A Critical Assessment. [online] papers.ssrn.com. Available at: https://ssrn.com/abstract=3649000 [Accessed 29 Mar. 2023].

Muralidharan, S. (2023). End of a roll: The curious rise and fall of Adani stocks. [online] Frontline. Available at: https://pure.jgu.edu.in/id/eprint/5623 [Accessed 29 Mar. 2023].

Ramanna, V., Dhanuka, A., Vasu, D. and Valluri, H. (2012). Adani Power Initial Public Offering. SSRN Electronic Journal. [online] Available at :https://doi.org/10.2139/ssrn.2003329. [Accessed 29 Mar. 2023].

Steffen, W., Bambrick, H., Alexander, D. and Rice, M. (2017). Risky business: Health, climate and economic risks of the Carmichael coalmine. [online] eprints.qut.edu.au. Australia: Climate Council of Australia Limited. Available at: https://eprints.qut.edu.au/110038/ [Accessed 29 Mar. 2023].

write

write