Introduction

Apple is the leading American company in technology founded in the year 1976 by Steve Jobs and its specialization deals with consumer electronics, hardware, online services and computer software. It is the leading technology company in the world and by 2021 it had to total $284 billion in revenue being the most valuable company worldwide. Currently, it is the fourth- largest manufacture of smartphones and Pc vendors (Turakhia et al 2019). It is among the American Big Five companies in technology including Google, Facebook, Amazon, and Microsoft. Its headquarters is located in Cupertino California and today it operates 513 retail stores worldwide with 147,000 employees. This paper examines the strategy of Apple Company by looking into the nature of the company, environment analysis, and its capabilities.

Nature of the Company

Apple Inc. is a technological company manufacturing and producing personal computers, computer software, online services and consumer electronics. It is best in hardware products such as iPod, iPad, iPhone smartphone, and Mac. ITunes Store, iCloud, and App store are among the online services (Malfona, 2018. The purpose of the company is to maintain and continuing an excellent reputation as one of the successful electronic companies globally. It is a publicly owned company therefore the public can buy shares from Apple Inc. if they want. The ownership of the company is a limited liability and if there are debts the money invested in the business is lost however personal money cannot be forced for debts payment.

The objective and aim of the company is to maximize profit, to be a dominating brand in the world of high tech, to invent useful, sleek, and handy products appealing to all customers in the world especially focusing on Europe, the US, and Asia countries including Japan, China, South Korea and India and lastly to be number one company in the World (Paam et al 2019)

Vision: The vision states that “to make the best products on earth, and to leave the world better than we found it”

Mission: Apple mission states” to bring best personal computing products and support to the students, educators, designers, scientists, engineers, and consumers in all countries all over the world” (Gardere et al 2018)

Strategies

The multinational company differentiates its products on a simple basis but still, they are attractive. Apple has advanced capabilities and features of the services and products as competitive advantage basis. The innovations introduced by Apple have not limited to the iPad the first device with shuffle capabilities of storing thousands of songs through Macintosh development, the first computing device to use graphic user interface, and iMac launching that do way with dull beige boxes replacing them with shades of translucent machines which made aesthetic Apple which is best known for (Dolata, 2017). Apple has a first-mover advantage which is sustainable from a long-term perspective. Its competitive advantage may be compromised if the management fails to add capabilities and more features to the products. Apple’s generic strategy is earning a competitive advantage against Microsoft, Samsung, Amazon, Huawei, Google, and Walmart

Another pillar of Apple’s business strategy is the focus on customer experience (Lundaeva, 2018). The customers can record music on their own and upload it on YouTube because the company has succeeded in creation of customer experience that extends beyond the processes of purchasing the product. Using Apple products is simple as just opening the box plugging to electricity and turning the product. There are different Apple store in different regions and countries providing staff support which contribute to customer experience. Also, the company has advanced through vertical integration which has brought expertise advancement in software, services, and hardware. The vertical integration has set Apple Inc. apart from the competition and it has benefited immensely. Integration has created a competitive advantage relating to the ecosystem. Apple software and devices work well and sync easily together (Lundaeva,2018). Apple applications on the devices work multiple at the same time with no difference in the user interfaces. However, the same products failed to pair with other companies’ products thus closed ecosystem is closed. The ecosystem brings a switching cost with Apple customers and its competitors. Also, the ecosystem provides leveraging opportunities to customer relationships to offer other services and products.

Another Apple strategy is transitional of not relying on iPhones sales to prioritization of other divisions and services. The Company made high-profile changes which show it is focusing on services and other divisions as John Giannandrea received a promotion role to AI and machine learning retail, the chief left the company, and the head of Siri was removed (Zhang et al 2020). The apple division generated an increased revenue of about 16.6 % compared to relying on sales only.

Internal analysis

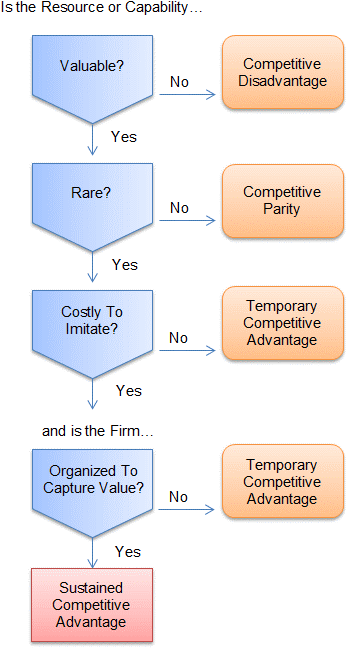

VRINE is used in analyzing the internal capabilities and resources of the company. It assesses the value, rarity, inimitability, non-substitutability, and exploitability (VRINE) of Apple Inc.’s internal resources (Zhang, 2017). It asses the organization’s standing of the organization based on its competitive products and future suggestion strategies that can be used to beat competitive advantage. The following explains Apple Inc. VRINE analysis giving the five dimensions with marvelous performance in finance.

Figure I. VRINE diagram for Apple

Value

Apple’s operation is based on a highly rapid-paced and advanced industry thus capability, resource, or product is valuable if it enables the company to stand out from rivals in the market. iPhone is the most successful consumer electronic product in the world and it is the most multi-functional and innovative smartphone performing numerous functions with its high-processing speed and advanced technology (Zhang, 2017). iPhone plays a major role by making Apple the largest IT Corporation, most successful, competitive, and innovative company by revenue. Similarly, other products such as iTunes, iPod, Mac system, iPad, and Apple TV are successful because of the value that they offer to the company for investment and research and against the money of Apple customers.

Rarity

Apple products such as iTunes, iPod, Mac system, iPad, iPhone, and Apple TV are highly valuable and advanced but they cannot be called rare because of the presence of a large number of products competitive in the market. However, most of the time first-mover come ups in the industry. Its iTunes, iPod, Apple Store, iPad, and iPhone have remained in the past as the only services and products of their kind (Zhang, 2017). When other consumer electronics, smartphones, and computer manufacturers modernized and diversified their business and started competing with similar products with Apple, this when rarity ended.

Inimitability and non-substitutability

Due to continuous change and rapid growth in the field of information technology and computers, the products of Apple Company are no longer inimitable (Zhang, 2017). The major reason is the compatibility of Windows and android with products in which they are used have greater market share compared to Macintosh and IOS. Apple’s Macintosh and IOS do not provide technical support to other products apart from the Mac system and iPhone.

Exploitability

To the market, Apple products are highly exploitable. The product’s brand loyalty and level of appreciation help the company in exploiting manufacturing and resources capabilities so that attractive opportunities are availed from the market and at the same time the company to remain as one of the top innovative companies in technology globally (Zhang, 2017).

Porter 5 forces analysis

Figure 2 pestle analysis

The five forces model examines a given industry competition. Apple’s position in the five forces analysis in the technology industry shows the completion and bargaining power of the buyers as the strongest forces in the marketplace impacting the profitability of apple (Grebenshchikova, & Yakushev, 2017). The bargaining power of suppliers, the threat of new entrants in the market the threat of buyers opting for substitute products are the weaker elements in the industry forces. Apples in the industry have been largely challenged however the company needs to keep building and innovating the brand loyalty to keep a bay any challenger in the future.

Industry competition

The competition level among other competing companies with Apple Inc. in industry is high. Apple has direct competition with companies such as Amazon, Samsung, Google, and Microsoft. All of these companies spend a significant amount in marketing development and research like Apple thus creating a strong competitive force in the market. Relative low switching costs make the company highly competitive. Substantial investment from a consumer is not required for ditching IPad from Apple with tablet computers in Amazon (Giachetti, 2018). The marketplace competition threat is Apple’s key consideration and it is dealt with through the continuous development of unique and new products that contribute to strengthen and increased position in the global market.

Bargaining power of buyers

The low switching power as mentioned above strengthen the buyer’s bargaining power and it became a key for Apple to consider. There is further analysis of the force of bargaining power of the buyer: the collective and individual bargaining power. In Apple Company, individual bargaining power becomes a weak force because a single customer lost is representing a negligible revenue amount to Apple. In the other hand, customer’s collective bargaining power in the marketplace represents a strong competitive force to the possibility of defection with the mass customer (Kabeyi, 2018). Apple continues to make the substantial expenditure of capital in R&D so that it counters the strong force and enables to keep manufacturing unique and new products such as Apple Watch and Air pods which build the brand loyalty significantly. Through this area of competition, Apple has successfully established a large customer base because they cannot abandon iPhone favoring a different smartphone from competitors.

The threat of New Entrants to the marketplace

The threat of new entrants in the market threatening the Apples market share is relatively low. This is because there is an additional high cost to establish recognition of a brand name and a high cost of the company established within the industry. It means that any new entrant of smartphones or personal computers to the marketplace requires enough capital to spend on manufacturing, R&D, and developing and producing a portfolio of products before bringing of products to market and before the generation of revenue (Kabeyi, 2018). For such an entrant faces competition which is already in existence among Apple and other competitors, where all are well-established companies

Another challenge is establishing recognition for the brand name within an industry where several companies such as Google, Apple, and Amazon already have strong recognition of their brand. Nevertheless, it is possible to have new companies challenging Apple’s position however the likelihood of the challenge is remote. Additionally, it is important for Apple continues improving its competitive position through the development of new products and brand loyalty-building so that the new entrants in the market place at a larger competitive disadvantage.

Bargaining power of suppliers

For Apple products, the bargaining power of supplier become a weak force. The amble amount of supply and several potential suppliers to Apple weaken the position of bargaining suppliers. Apple is free from choosing among several suppliers for the products components parts. The industry of suppliers such as computer processors manufacturers are themselves highly competitive (Kabeyi, 2018). Apple switching cost in exchange of one supplier to another is low therefore it is not a significant obstacle. Additionally. Apple is a major customer to its product parts suppliers, so they are afraid of losing a loyal customer. The advantage strengthens the negotiating position of Apple and weakens the supplier’s position so it is neither a major consideration to Apple and its competitors.

The threat of buyers opting for substitute products

Substitute products do include a product that directly competes with Apple products but these are a possible substitute for them. In the case of Apple Company, an example of a substitute product is the iPhone substitute to landline telephone (Kabeyi, 2018). The threat of buyers opting for a substitute product force is relatively low for Apple because the potential product substitute has capabilities that are limited compared to Apple products. Landline phones with iPhones are incomparable because it just used in making calls.

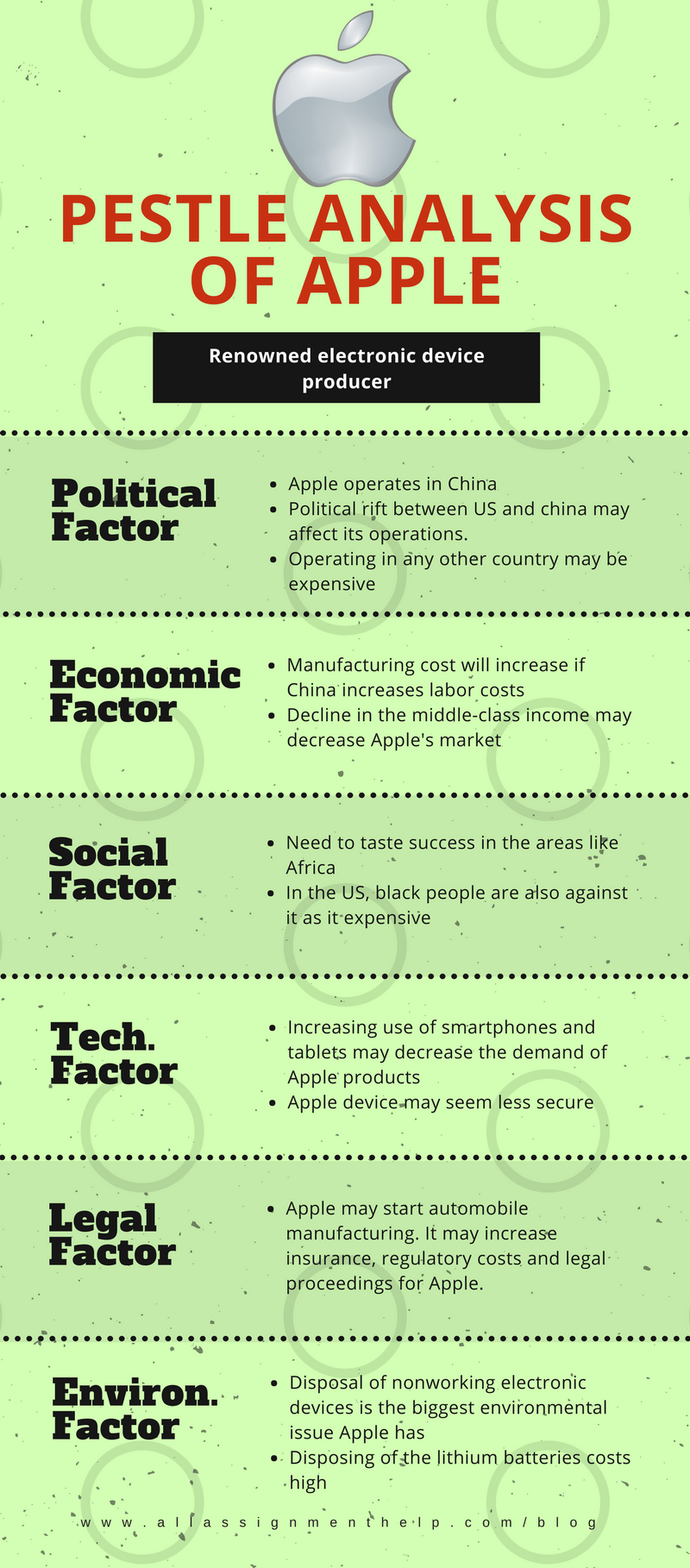

PESTEL analysis

Figure 3 Apple pestle analysis

Political factors

In Apple pestle, the political factors are explained as Apple is an American Company that has contributed to revenue generation growth with a large amount of money accumulation (Van De Vliert, 2021). More of the sale made by Apple have been reported from other countries where China is the leading product manufacture of Apple because of low cost A political issue is alarming a war trade between China and the US and it may impact the sales revenue of the company thus the great risk is created to the growth. Increasing the US tariffs will result in heavy taxes on Apple products by the Chinese government. Apple being an overall taxpayer globally, thus political issues influence its performance.

Economic factors

Economic factors affecting the performance of Apple’s business include inflation, unemployment, and economic growth, deflation, and wage policies. Some of the Apple expansion opportunities include developed countries’ economic stability, developing countries’ rapid economic growth, and increased earning disposal among target consumers. The main Apple target is high-consumer because their prices are premium (Van De Vliert, 2021). Due to premium prices the company is facing a challenge of penetrating through the Asian market which has high opportunities for Apple as a tech brand and a high rate of growth in the market.

Social factors

Consumer expectations and behaviors are affected by social factors. The rising use of smartphones and personal devices is a great opportunity that increases the sales and revenue for Apple Company. The world cannot be imagined without these devices thus creating market ubiquity. Another social-cultural opportunity is the digital system progressing necessity thus increasing sales base on demand (Van De Vliert, 2021). The common man purchasing potential has risen increasing the global sale of Apple luxury products. The Apple products have a status symbol that has to change the mindset of the society. A threat arising for Apple is the rising of Anti- apple sentiment due to business challenges.

Technological factors

Increasing technological integration is presenting a growth opportunity to apple through the extension of technological services to the customers. However, technology has a short lifespan therefore Apple is required to be updating often are products so that it can beat its competitors. High–value technological products are offered by Apple competitors thus affecting the financial performance of the company(Van De Vliert, 2021). Another Apple opportunity is an expansion of cloud computing demand by building a clod framework extension that benefits the business in offering cloud services.

Legal factors

This analysis shows the legal influence to the company and can cause company threat if not followed. The government is putting pressure on the company to adhere to the privacy regulations. It is a threat if it requires a costly supervisor for private information. Apple relies on many products covered by intellectual property laws like music and software for its revenue thus leaving the company vulnerable for both suit and privacy(Van De Vliert, 2021).

Environmental factors

Apple makes most of its products manufacturing in China whose environmental side effects are a great concern and can influence regulation and cost on manufacturing. Apple has started working on new environmental technological solutions such as the production of products will less heat emission like batteries and processors (Van De Vliert, 2021). Business sustainability has contributed to the corporate image of the company. Apple is taking a thorough approach by finding a way of reducing carbon footprint and dispose of its electronic equipment responsibly after the end of useful life.

References

Dolata, U. (2017). Apple, Amazon, Google, Facebook, Microsoft: Market concentration-competition-innovation strategies (No. 2017-01). SOI Discussion Paper.

Gardere, J., Sharir, D., & Maman, Y. (2018). Consulting and Executive Coaching on Future Trends: The Need for a Long Term Vision with Apple and Samsung. International Journal of Business and Social Science, 9(3).

Grebenshchikova, L. S., & Yakushev, N. M. (2017). Definition of Competitiveness of the Enterprise Using the Five Forces of M. Porter. Vestnik IzhGTU imeni MT Kalashnikova, 20(3), 51-53.

Giachetti, C. (2018). Explaining Apple’s iPhone success in the mobile phone industry: The creation of new market space. In Smartphone Start-ups (pp. 9-48). Palgrave Macmillan, Cham.

Kabeyi, M. J. B. (2018). Michael porter’s five competitive forces and generic strategies, market segmentation strategy, and case study of competition in the global smartphone manufacturing industry. AJAR, 4(10), 39-45.

Lundaeva, E. (2018). Customer Experience Management: an essential factor in building customer loyalty

Malfona, L. (2018). The Apple Case. Architecture, Global Market, and Information Technology in the Digital Age. Ardeth. A magazine on the power of the project, (3), 52-72.

Paam, P., Berretta, R., Heydar, M., & García-Flores, R. (2019). The impact of inventory management on economic and environmental sustainability in the apple industry. Computers and Electronics in Agriculture, 163, 104848.

Van De Vliert, D. (2021). Apple iPhone: A Market Case Study. MacEwan University Student eJournal, 5(1).

Turakhia, M. P., Desai, M., Hedlin, H., Ramjan, A., Talati, N., Ferris, T., … & Perez, M. V. (2019). Rationale and design of a large-scale, app-based study to identify cardiac arrhythmias using a smartwatch: The Apple Heart Study. American heart journal, 207, 66-75.

Zhang, Q. (2017). Research on Apple Inc’s Current Developing Conditions. Open Journal of Business and Management, 6(01), 39.

Zhang, J. Z., Watson IV, G. F., & Palmatier, R. W. (2018). Customer relationships evolve-so must your CRM strategy. MIT Sloan Management Review, 59(3), 1-7.

write

write