Abstract

This paper provides a comprehensive analysis of the industry through a strategic marketing lens, focusing on evaluating PESTEL analysis, Porter’s Five Forces analysis, and the importance of Corporate Social Responsibility (CSR). The PESTEL study emphasizes how the industry is impacted by elements related to politics, economy, society, technology, environment, and the law. Political dynamics like Brexit and geopolitical conflicts have disrupted supply chains and increased supermarket costs. In contrast, Economic factors, such as inflation and exchange rates, have affected consumer spending and profit margins. Social shifts towards health consciousness and environmental awareness have reshaped consumer preferences, driving demand for sustainable products. Technological advancements like e-commerce and AI are transforming operations and customer experiences. Environmental concerns, particularly regarding climate change and plastic usage, have prompted sustainability initiatives within the industry. Legal regulations, including consumer protection laws and competition policies, shape business conduct and market dynamics.

Porter’s Five Forces analysis examines the competitiveness of the UK supermarket industry. While the bargaining power of buyers and suppliers is relatively weak, threats from new entrants and substitute products remain low due to market dominance by established players, and the intense competition among major supermarkets further reinforces market barriers against new companies. The essay further highlights the importance of Corporate Social Responsibility (CSR) in enhancing environmental sustainability and consumer loyalty within the supermarket industry. By integrating social concerns into operations and promoting sustainable practices, companies can drive profitability and consumer trust and improve market competitiveness.

1. Introduction

The growth of any economic niche depends not only on internal factors such as employee inputs and organizational cultures but also on external factors often out of the control of the market players. The supermarket industry is not an exception, as external forces could dictate growth, especially considering the consumers and the businesses. In the UK, the supermarket industry is extensive, offering the highest employment rates within the private sector. According to Bedford (2023), Tesco, Asda, Sainsbury’s, and Morrison are the four grocery businesses that control the industry. They had witnessed a rise of 1.5% in revenue, representing £212 Billion in 2023 (Lang, 2023), and the industry is estimated to hit £241.3 billion by 2028 (Mintel, 2023). Despite the growth in recent years, there have been significant changes caused by macro-environmental factors within the UK and across Europe. This paper aims to provide a strategic marketing report by evaluating a PESTEL analysis of the supermarket industry, Porter’s five forces analysis, and the importance of corporate social responsibility to organizations in the industry.

2. PESTEL Analysis of the UK Supermarket Industry

A PESTEL analysis for the supermarket industry in the UK includes an evaluation of the political dynamics of the country and how they affect the supermarkets, the economic policies that are beyond the abilities of the supermarket industry, social consideration, environmental approaches in the industry, and the legal provision which affect the growth of the sector.

2.1. Political Factors

Brexit, the withdrawal of the UK from the European Union, offered significant changes to the supermarket industry. The reliance on European help in trade and financial aid is forcing the supermarket industry to incur additional costs as the UK heavily depends on EU labour, financial aid subsidies, and regulations (Benton & Thompson, 2019). The Russian-Ukrainian war also affects the supply chain, causing food shortages and high prices of supplies to supermarkets. According to Bloom (2023), the supply chain dilemma has forced supermarkets to assess what they need to sell to mitigate the risks of empty shelves. Recent political developments involve the government’s proposal of price caps for essential goods (Reuters, 2023). The move is set to mitigate rising inflation and high living costs. However, this will limit the supermarkets’ profit margins and influence competition within the industry.

2.2. Economic Factors

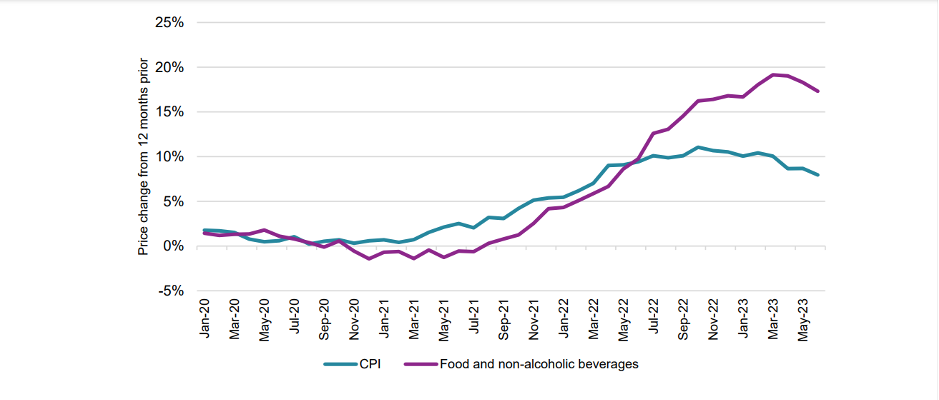

The economic environment within the UK affecting the supermarket industry is highly connected to the rate of inflation experienced. According to the Bank of England (2024), the inflation rate by the end of year 2023 was 4%, higher than the anticipated 2%. The increase in inflation rates has especially affected the food and beverages industries and consequently influenced decisions within the supermarket industry. A report by the Competition and Markets Authority (CMA)(2023) indicates that the inflation was at 17.3% by June of 2023, while the Consumer Price Inflation (CPI) was at 8% (see Appendix I). The Report highlights that the goods inflation began later than the CPI rate. The reasons noted for the increase in inflation across the industry are attributed to the COVID-19 pandemic of 2020 and the onset of the Russian-Ukrainian war, which have contributed to higher fuel prices in the country (Bedford, 2024). Unfavourable exchange rates have also contributed to the high inflation, with the Sterling Pound trading at $1.07 in 2022 (CMA, 2023). According to the OAG (2023), the resulting inflation will introduce lower profits for supermarkets through unwarranted discounts. Consumers also reduce their supermarket spending, especially if wages are not increased during inflation (OAG, 2023). These factors affect the operations of the supermarket industry in terms of performance within the markets.

2.3. Social Factors

The shifting demographics in the UK dictate the trajectory that supermarkets must follow in order to adjust to consumer preferences. The consumer expectancy rate has increased in the last two decades, with 6.7% for men and 4.4% for women (Deloitte, 2020). The assessment illustrates the continuous existence of supermarket clientele. Although there is an increase in the population willing to spend within supermarkets, other social dynamics come into play and dictate the industry’s behaviour. Deloitte (2023) observes that health matters drive consumers to spend more on healthier foods, forcing supermarkets to be selective in their services. As more people are educated and shift towards more tech- and freelance-oriented careers, consumers become aware of the products they purchase and how they affect their health. Environmental and sustainability issues also influence consumer decisions. Khan et al. (2020) observe that consumer green behaviours align purchasing behaviours with consumers’ attitudes toward the environment. These social factors combined drive the UK consumer to spend only on essentials, cutting back on discretionary items.

2.4. Technological Factors

E-commerce and online purchases have increased among the UK Supermarkets, especially after the COVID-19 pandemic. The lockdowns initiated a huge migration into online purchases, which most supermarkets have continued to embrace. Not only is the adoption of technology for the consumer, but the industry itself is adopting technology in its routine operations. Sabanoglu (2023) illustrates that most Supermarkets in the UK will have to adapt to “the Internet of Things (IoT), Augmented Reality (AR), and Artificial Intelligence (AI)” within their operations, as seen through ASDA, which has rolled out the application of AI analytics in 250,000 products and experiencing a profit increase of 32% due to waste reduction and automated pricing (Ross, 2023). However, technology use will reduce the employment rate in the country’s largest private sector employer.

2.5. Environmental Factors

Climate change has the biggest environmental impact on the supermarket industry. Emissions and non-biodegradable materials still challenge supermarkets in their efforts to control climate change. Khan et al. (2020) observe that the UK government implores supermarkets to increase the prices of plastic packaging in order to dissuade consumers from using it (p. 2). Environmental awareness also affects the attitudes of the consumer as they will often align their purchasing decisions with their convictions on climate change and hence opt to purchase from brands and vendors who show care towards the environment (Deloitte, 2023)—consumer attitude sides with the sustainability efforts that all industry stakeholders require. In light of this, there has been a rise in social supermarkets around the UK.

Social supermarkets focus on sustainability rather than the business’s profitability (Alexander, 2023). The rise of social supermarkets can be attributed to the consideration of food waste, water conservation, sustainable agricultural practices, and food insecurity (Berri & Toma, 2023). Social supermarkets offer competition to traditional retailers through the consideration of environmental impact. Although supermarkets adapt to the expected ecological requirements, Lysaght (2023) notices a rise in greenwashing within the supermarket industry. That means there is a rise in misinformation regarding the sustainability of products sold by supermarkets, which could negatively impact their sales.

2.6. Legal Factors

Consumer laws are regularly enforced and should be followed to protect consumers from unethical business by supermarkets (CMA, 2023). For the consumers, products must be labelled, especially regarding food items, ingredients, country of origin, nutritional information, and others. Import and export laws in the UK also influence the dynamics of the supermarket industry. Restrictions may be placed through taxes and levies or geographic countries, such as the case of Polish meat exporter SuperDrop, which violated UK trade laws (Khan et al.,2023). Legal restrictions are also in place to protect the competition within the industry. The CMA has taken action to intervene between Morrison’s and M&S for the violation of land rights and unfair competition (CMA, 2023). Legal factors within the supermarket industry protect both the consumer and the supermarkets, and they dictate the ethical conduct of businesses.

3. Porter’s Five Forces Analysis

In order to assess the competitiveness and appeal of the UK supermarket market, we need to look at the industry’s suppliers’ bargaining power, the threats of alternative goods and services, as well as new competitors and the competition between companies.

3.1. Bargaining Powers of the Buyers.

The organization of powerful buyers in small quantities usually dictates the reduction of prices in the markets (HBS, 2023). Within the UK supermarket industry, the bargaining powers of the buyers are weak, consequently making the industry favourable for the companies within it. There is, however, a change in trends as consumers can easily access online stores and discount facilities since the differentiation between the goods is minimal in traditional supermarkets. However, they can access a range of products cheaply in alternative stores.

3.2. Bargaining Powers of the Suppliers.

The fewer suppliers in an industry, the more power they can control in the markets (HBS, 2023). The supplier bargaining powers are limited in the UK as the legal and economic environments in the country allow for thousands of suppliers, both local and international, who can meet the needs of both the market and the consumer. The existence of multiple supplier choices allows the supermarkets to have better bargaining power to negotiate better deals and maximize profitability in the market.

3.3. Threats of New Entry

Industry barriers determine the difficulty for new entrants to access the UK market. The supermarket industry is dominated by few supermarkets that wield the power to control major dynamics, and it was only in 2022 when a foreign supermarket, the German discounter Aldi, entered the top four retailers, surpassing Morrison’s (Bedford, 2023). The domination by the giant supermarkets discourages other companies from joining. Access to suppliers and changing consumer loyalty to the big brands dissuades the entry of new players, making the industry ideal for the existing companies.

3.4. Threats of Substitute Products and Services

The commodities sold within the supermarkets are usually similar, and especially considering the foodstuffs, the threat of substitute products is considerably low. The main threats would appear from convenience other shops which can compete with the dominance of the giant supermarkets in the UK. That makes the environment within the industry quite favourable for the existing companies while reducing the chances of new businesses introducing newer products in the industry.

3.5. Competitor Rivalry

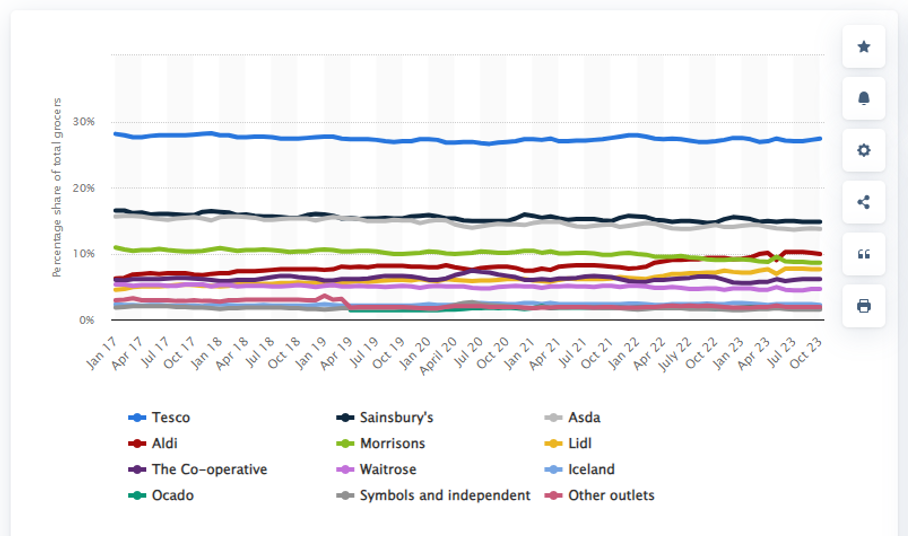

Competition within the UK supermarket industry is intense, especially considering the large companies within it. Tesco is the largest supermarket in the UK, having a 27% market share, while Sainsbury’s is second at 15% (see Appendix II). As an oligopoly market, the price wars between Aldi and Lidl are introducing new forms of competition from discount stores towards supermarkets, increasing their share within the market. The fierce competition of the major players discourages the entry of new companies within the UK supermarket industry.

4. Importance of Corporate Social Responsibility

A company’s ability to consider social issues and incorporate them into its operations and stakeholder interactions is known as corporate social responsibility or CSR. The importance of CSR within the UK supermarket industry includes the improvement of environmental sustainability. Companies within the supermarket industry should aim to reduce their carbon emissions, conserve the natural environment, and consider sustainable water and waste management (Lee & Hammant, 2022). Through innovation, companies can increase their profitability through energy conservation and developing and selling products.

Improved sustainability efforts resonate with the consumer. Godefroit-Winkel et al. (2021) observe that the consideration of CSR efforts through the participation of companies in consumer cultures and attitudes improves consumer loyalty. Buyers increasingly adopt safer and more environmentally friendly products, and brands or companies that align with their interests gain consumer advantages as consumers embrace ethical and sustainability efforts from the supermarkets, resulting in increased sales, which helps the supermarket industry. Asiamah and Ghulam (2020) prove that there is a correlation between effective CSR practices and an increase in sales. The markets respond favourably through philanthropy and community-oriented initiatives, determining the revenue the companies generate.

5. Conclusion

In conclusion, the UK supermarket industry has few Supermarkets that wield immense power and control over the markets and supply chains. The revenues from the sector are estimated to hit £241.3 billion by 2028. The market evaluation demands a look into the PESTEL analysis and Porter’s five forces analysis. Though PESTEL, the industry is highly affected by geopolitics, such as Brexit and the Russian-Ukrainian war, affecting supply and contributing to the inflation witnessed in the economy. Sustainability efforts are at the core of social and environmental issues in the market driven by the demographic changes in the UK. Legal provisions and regulations control and protect the consumer and companies within the markets. The market, however, has little bargaining power for both the buyers and the suppliers, making it favourable for the existing companies. There is little threat from new entries and products; hence, existing companies can dictate the market dynamics. He could maximize environmental sustainability efforts while CSR reads consumer loyalty and improves revenue streams.

6. References

Alexander, L. (2023, August 11). What is the “Social supermarket”, and how is it tackling poverty? The Borgen Project. https://borgenproject.org/social-supermarket/

Bank of England. (2024, February 2). When will we get back to low inflation? https://www.bankofengland.co.uk/explainers/will-inflation-in-the-uk-keep-rising

Bedford, E. (2023, November 3). Topic: Supermarkets in the United Kingdom (UK). Statista. https://www.statista.com/topics/1983/supermarkets-in-the-united-kingdom-uk/#topicOverview

Bedford, E. (2024, February 2). Topic: Food price inflation in the United Kingdom (UK). Statista. https://www.statista.com/topics/10116/food-price-inflation-in-the-united-kingdom-uk/#topicOverview

Benton, T. G., & Thompson, C. (2019). Food Politics and Policies in Post-Brexit Britain. Technical Report, pp. 1–33.

Berri, A., & Toma, L. (2023). Factors influencing consumer use of social supermarkets in the UK: A redistribution model providing low-cost surplus food. Cleaner and Responsible Consumption, p. 10, 100133. https://doi.org/10.1016/j.clrc.2023.100133

Bloom, J. (2023, November 7). There needs to be more trouble in store for post-Brexit Britain. The New European. https://www.theneweuropean.co.uk/theres-trouble-in-store-for-post-brexit-britain/

CMA. (2023). Competition, choice and rising prices in groceries. Competition and Markets Authority. https://assets.publishing.service.gov.uk/media/64b80adaef5371000d7aeefb/Competition__choice_and_rising_prices_in_groceries.pdf

CMA. (2023, December 6). CMA cracks down on more supermarket land agreements to protect shoppers. GOV.UK. https://www.gov.uk/government/news/cmacracks-down-on-more-supermarket-land-agreements-to-protect-shoppers

Deloitte. (2023). Consumer green behaviour: An approach towards environmental sustainability. http://www.deloitte.co.uk/changingconsumer

Godefroit-Winkel, D., Schill, M., & Diop-Sall, F. (2021). Does environmental corporate social responsibility increase consumer loyalty? International Journal of Retail & Distribution Management, 50(4), 417-436. https://doi.org/10.1108/ijrdm-08-2020-0292

HBS. (2023). The five forces. Institute For Strategy And Competitiveness – Harvard Business School. https://www.isc.hbs.edu/strategy/business-strategy/Pages/the-five-forces.aspx

Hussain, S., Nguyen, V. C., Nguyen, Q. M., Nguyen, H. T., & Nguyen, T. T. (2021). Macroeconomic factors, working capital management, and firm performance—A static and dynamic panel analysis. Humanities and Social Sciences Communications, 8(1). https://doi.org/10.1057/s41599-021-00778-x

Khan, M. S., Saengon, P., Alganad, A. M., Chongcharoen, D., & Farrukh, M. (2020). Consumer green behaviour: An approach towards environmental sustainability. Sustainable Development, 28(5), 1168-1180. https://doi.org/10.1002/sd.2066

Khan, M., Wasley, A., & Skrzypczyk, A. (2023, June 20). Polish meat giant supplied superbug-infected chicken to UK shelves. The Bureau of Investigative Journalism (en-GB). https://www.thebureauinvestigates.com/stories/2023-06-20/polish-meat-giant-supplied-superbug-infected-chicken-to-uk-shelves

Lang, J. (2023). Supermarkets in the UK – Market size, industry analysis, trends and forecasts (2024-2029)| IBISWorld. IBISWorld – Industry Market Research, Reports, & Statistics. https://www.ibisworld.com/united-kingdom/market-research-reports/supermarkets-industry/#KeyStatistics

Lee, C., & Hammant, C. (2022). Corporate social and community-oriented support by UK food retailers: A documentary review and typology of actions towards community wellbeing. Perspectives in Public Health, 143(4), 211-219. https://doi.org/10.1177/17579139221095326

Lysaght, L. (2023, August 29). Greenwashing ‘rife’ across the UK supermarket sector. Open Access Government. https://www.openaccessgovernment.org/greenwashing-rife-across-the-uk-supermarket-sector/165656/

Mintel. (2023, January 3). UK supermarkets market report – Market size & forecast. Mintel Store. https://store.mintel.com/report/uk-supermarkets-market-report

Nyame-Asiamah, F., & Ghulam, S. (2019). The relationship between CSR activity and sales growth in the UK retailing sector. Social Responsibility Journal, 16(3), 387-401. https://doi.org/10.1108/srj-09-2018-0245

OAG. (2023, September 1). Increasing food inflation and the impact on supermarkets. Open Access Government. https://www.openaccessgovernment.org/increasing-food-inflation-and-the-impact-on-supermarkets/165830/

Reuters. (2023, May 28). Reuters.com. reuters.com. https://www.reuters.com/world/uk/uk-govt-ask-supermarkets-cap-prices-basic-food-items-telegraph-2023-05-28/

Ross, M. (2023, December 29). AI sparks a revolution in how much supermarkets charge you for food. The Telegraph. https://www.telegraph.co.uk/money/consumer-affairs/food-cheaper-near-expiry-supermarkets-test-ai/

Sabanoglu, T. (2022, March 28). Topic: Retail technology in the UK. Statista. https://www.statista.com/topics/5425/retail-technology-in-the-uk/#topicOverview

7. Appendices

7.1. Appendix I: CPI and Food and Non-Alcoholic Beverages 12-month inflation rate, Jan ‘20– Jun ‘23

Source: Competition and Market Authority

https://assets.publishing.service.gov.uk/media/64b80adaef5371000d7aeefb/Competition__choice_and_rising_prices_in_groceries.pdf

7.2. Appendix II: Market share of grocery stores in Great Britain from January 2017 to October 2023

Source: https://www.statista.com/topics/1983/supermarkets-in-the-united-kingdom-uk/#topicOverview

write

write