Executive Summary

Levi Strauss & Co’s goals include growing its market share, sales revenue, and profits. Identifying and capitalizing on opportunities in the external environment is critical to achieving these goals. One business opportunity in the industry is the growing demand for gender-fluid fashion among young consumers.

This market for gender-fluid fashion is projected to grow at a rate of 4.5% to reach $3.2 billion by 2028. Market research indicates that 36% of Americans say they have purchased fashion outside their gender identity, and 73% are considering buying more gender-neutral fashion. Levi Strauss & Co. should capitalize on this market opportunity by launching a new line of loose-fitting, vintage-style, and comfortable gender-fluid denim jeans under Levi’s brand.

The primary target market for this new product is young people 18 to 39 years old with middle to high incomes. The company can create more value for this segment and grow its direct-to-customer (DTC) channel by launching an on-demand service allowing customers to customize their jeans. The core marketing objectives are to grow market share and sales revenue by 10% and 20%, respectively, in the next five years.

The market for gender-fluid fashion is still less competitive. Major players in this market comprise small startups. Levi Strauss & Co. enjoys a competitive advantage from the iconic Levi’s brand that is recognized globally. The company’s established distribution network also reduces the cost of launching a new line of denim jeans.

Situation Overview

Levi Strauss & Co. is an American company founded in 1853 in San Francisco, where it is currently headquartered. The company is known for its Levi’s branded denim jeans. It remains the world’s largest maker of denim jeans. In addition to Levi’s brand, the company owns Signature, Denizen, and Dockers. Levi’s is the company’s top brand, accounting for 87% of its sales 2022 sales, which totalled $6.2 billion (Levi Strauss & Co, 2023). The company has set a target of $10 billion in sales by 2027. The company is actively exploring market opportunities beyond denim jeans to achieve its sales target. For instance, it recently entered the activewear market for women by acquiring Beyond Yoga. However, this market remains under-penetrated, with Beyond Yoga accounting for just 2% of total sales (Levi Strauss & Co, 2023). In addition to denim jeans, Levi Strauss & Co’s products include tops, leggings, yoga pants, footwear, and accessories such as belts.

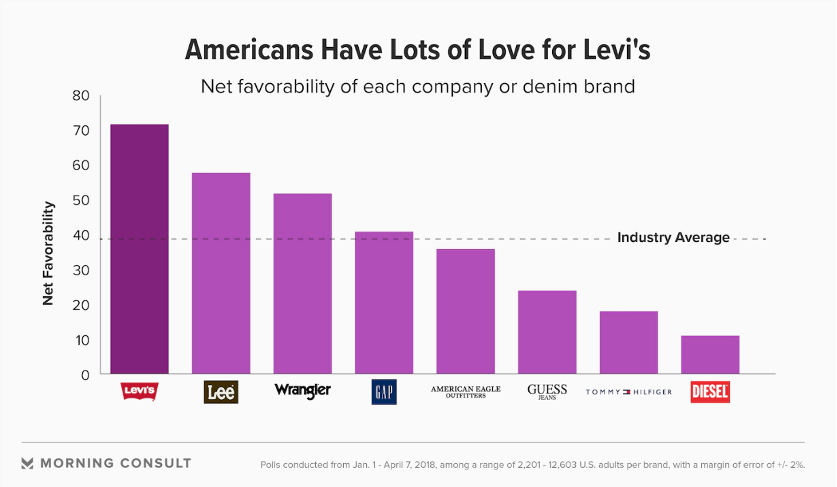

The global denim market continues to record positive growth. This market is projected to grow at an estimated annual rate of 6% to reach 95 billion US dollars by 2030, up from 64.5 billion US dollars in 2022 (Statista, 2023). Consumers in this market value high-quality products, comfort, and style. The market is highly dynamic, and players must stay updated with changing consumer tastes and fashion trends. Levi Strauss & Co’s sources of competitive advantage in the denim jeans market include its iconic and popular Levi’s brand, global presence, high-quality products, and continuous innovation. Its key competitors include VF Corp’s Lee and Wrangler brands, GAP, and American Eagle (Figure 1). Overall, the denim market continues to record positive growth, and Levi Strauss & Co. enjoys a competitive position.

Social trends will continue to shape the denim jeans market. One key trend is a growing demand for gender-fluid fashion among younger consumers. Genderless fits are expected to drive the new denim cycle among younger consumers, including Gen-Z and millennials (Young, 2023). Industry projections suggest that the market for unisex or gender-neutral fashion will grow at an annual rate of 4.5% to reach $3.2 billion by 2028 (James, 2023). One market research involving over 12,000 consumers from 11 countries found that the US leads the way with gender-neutral fashion. According to the study, 36% of Americans say they have purchased fashion outside their gender identity, and 73% are considering buying more gender-neutral fashion (Klarna Insights, 2022). Levi Strauss & Co. should capitalize on this market opportunity by launching a new line of loose-fitting gender-fluid denim jeans sold under Levi’s brand. This new product will be explicitly marketed as gender-fluid.

Figure 1: Net favorability of denim brands among Americans

Source: Piacenza (2018)

Marketing Goals

Goals guide marketing activities and help firms evaluate the impact of their strategies. Marketers identify the focus of their company’s marketing activities, such as increasing sales, and define the specific benchmarks that should be achieved. The goals of the marketing strategy are to:

- Grow Levi Strauss & Co’s market share by 10% in the next five years

- Grow total sales revenue by 20% in the next five years

The goal focus is increasing market share and revenue by launching a new line of gender-fluid denim jeans. The quantitative benchmark is market share and sales growth by 10% and 20%, respectively. The temporal benchmark is five years from the launch of the new product line.

Strategy

Target Market

Target market analysis considers customers whose needs the company aims to fulfil with the new offering, collaborators, the company managing the offering, competitors, and the context. The primary consumer target for the new line of gender-fluid denim jeans is young adults 18-39 years old with middle to high incomes. The secondary consumer target is middle-aged adults 39-55 years old who want gender-fluid fashion. Levi Strauss & Co. will manage the new offering through its internal marketing team. Collaborators who will work with Levi Strauss & Co. on this offering include third-party retailers, consumers, and influencers. The company will engage target customers in the design and development process to ensure the new product appeals to the target audience. Retailers are key collaborators as they provide valuable data on consumer preferences and demand. Competition in this market is growing as traditional fashion brands like Wrangler and new entrants, such as Unspan, are already launching lines of gender-fluid denim jeans.

The context in which a company operates provides information about demand and profitability in the target markets. Social trends significantly drive demand in the seasonal fashion markets. Generation Z are known to openly embrace fashion that does not define traditional gender lines and value environmental sustainability. In one US survey, 85% of Gen Z consumers expressed that they are likely to purchase gender-fluid fashion (James, 2023). Interest in gender-fluid fashion is not limited to Gen Z consumers. The same survey found that about 60% of Gen X consumers expressed interest in gender-fluid fashion, suggesting Gen Z buyers significantly influence older generations’ attitudes and preferences (James, 2023). This social trend suggests that the market for gender-fluid fashion will continue to record positive growth as Gen Z become the largest cohort of consumers globally. The expanding middle class in global markets is also expected to drive demand for Levi’s products, including the new gender-fluid denim jeans.

Value Proposition

The new product aims to create value for the target customers and the company. The new offering aims to help consumers express themselves through fashion and feel comfortable. The new product will be positioned as flexible, comfortable, loose-fitting denim jeans that can be worn by every person regardless of their gender identity or body type. This new product differentiates itself from the skinny fits that dominate the jeans market. The new product offers consumers vintage style, relaxed, loose-fitting, and comfortable denim jeans for every body type.

Collaborator value for retailers includes increased traffic and profits. The new offering will help Levi Strauss & Co.’s retailers grow customer traffic and profits by expanding their product lines and helping them meet the needs of the modern fashion consumer. The primary company value is increased profits. The new product is expected to grow Levi’s market share and sales. The gender-fluid denim jeans are also expected to position the Levi’s brand as progressive, modern, and stylish.

Market Tactics

Product

The product is gender-fluid denim jeans. This new product will not be marketed to a specific gender. Instead, the new product line will be marketed as gender-fluid Levi’s jeans that persons of any gender and body type can wear. The key product features are loose-fitting, vintage style, flexibility, and comfort. The product will be made from sustainably sourced denim and sold under Levi’s brand. Customers will have the option to choose from stretch and non-stretch options. The product, packaging, and marketing campaigns will display Levi’s brand and logo.

Service

Retailers selling Levi’s products offer after-sales services such as convenient returns. Levi Strauss & Co. also offers convenient direct-to-consumer (DTC) services for select products. A service that Levi Strauss & Co. should consider adding is on-demand production where customers can customize and order their jeans. This can be achieved by launching an artificial intelligence (AI)-based app that customers can use to design their own jeans. The on-demand service would reduce costs through DTC delivery and prevent overproduction by preventing unreliable demand forecasting.

Brand

The new gender-fluid denim jeans will be offered under the Levi’s brand. Using the existing Levi’s brand is a good strategic decision because the new product is an extension of existing Levi’s jeans. Levi’s is an iconic brand that is recognized globally. Its most distinguishable brand element is the bright red Levi’s logo taking the shape of a bat wing. Levi’s remains the most popular denim jeans brand in the US. The company will leverage Levi’s strong brand equity to launch the new product line.

Price

The gender-fluid Levi’s jeans will retail at a price of between $150 to $230. The prices reflect the goals of attracting retail partners and customers, maximizing profits, and positioning the new offering as a high-quality product. The company will adapt prices based on consumer demand and competition.

Incentives

Marketers may use price-adjustment strategies such as discounting and promotions to attract customers and drive sales. The company will offer discount prices to customers who will place orders through its e-commerce website.

Communication

The company will communicate the new offering through mass media commercials, social media marketing, partnerships with influencers and celebrities, and fashion shows. Marketing communications will reinforce the Levi’s brand name and emphasize the main points of parity for the new gender-fluid denim jeans product line. Marketing communications will encourage purchases through the company’s e-commerce channels by providing information about available discounts and convenience. Most Levi’s sales are still completed in-store. The company will engage retail partners through personal selling and sales promotions.

Distribution

Distribution decisions determine order fulfillment speed, sales volume, and customer satisfaction. The company will use two distribution channels: wholesale and DTC. Wholesale channels include department stores and third-party e-commerce sites such as Amazon. DTC channels include company-owned stores and e-commerce websites. DTC sales through the company’s owned stores and e-commerce channels accounted for about 31% and 8% of total sales in 2022, respectively (Waldow, 2023). The rest of the sales were made through wholesale channels, primarily department stores across the world. The company’s goal is to expand its DTC business to account for 55% of total sales by 2027 (Levi Strauss & Co, 2023). DTC will give the company better control over the brand and its customers. It will improve customer engagement and inventory management by increasing access to unified market data. DTC sales through e-commerce channels further reduce costs and increase speed.

Implementation

Implementation activities include product development and launch or deployment. Being an established company, Levi Strauss & Co. already has the business infrastructure, resources, and teams needed to develop and launch the new offering. The company has a formal product development process that includes several steps including idea screening and approval, concept design, testing, and launch. The new-product manager leads a team comprising designers, engineers, and marketers., which is responsible for new product development. In addition, the company has adequate financial resources needed to fund new product ideas. The company values innovation and encourages product ideas that align with its business goal.

Once the idea is screened for quality and approved, the new product development team will design the concept product. The concept development process will incorporate customer needs and preferences from the market research, the value proposition, and insights from competitor analysis. Engineers will develop a prototype that will be presented to a sample of target customers for testing. Companies in the fashion industry leverage models, influencers, and exhibitions for prototype testing. The goal of concept testing will be to collect feedback from consumers after interacting with the prototype. To increase reliability of the concept testing process, the new-product development team will ensure that the prototype resembles the final offering. The new product development team will then revise the design based on consumer feedback. The concept development process and testing will take about 3 months.

Detailed engineering will begin once the management reviews the product concept and marketing strategy and determines the proposal’s business attractiveness. The review process will take about a month and will entail projecting sales revenue, costs, and profits. The production phase will last about 3-4 months once materials sourcing is complete. The company will use its existing manufactures to lower transaction and production costs. Volume decisions will be made based on past sales and adjusted based on new information after launch. The company will launch the new product through commercials in mass media, social media marketing, and partnerships with influencers and models. The sales force will introduce the new product line to retail stores using samples and personal marketing. The company will leverage its owned stores to introduce the new offering to the market and create demand. The merchandising team will continuously optimize the product line for profitability after launch by replacing styles with low orders.

The new product development process will be customer-driven. The company will use market research to gain in-depth insights into target customers’ tastes and preferences. The identified customer tastes and preferences will be incorporated into the final product design and revisions. This design approach maximizes chances of product success by ensuring that new products reflect customer needs, preferences, and expectations. Customer engagement is particularly important in the fashion industry where social trends are key determinants of demands.

Controls

Performance towards the stated goals will be evaluated using the specified benchmarks. Sales and marketing teams will track monthly unit sales, revenue, and market share. Increases in sales revenue and market share towards the desired performance benchmarks will indicate effectiveness of the marketing activities. Management will also use process measures, such as consumer satisfaction, to evaluate performance. Consumer satisfaction with product and service quality is a key predictor of demand and sales. Data on this metric will be collected using customer satisfaction surveys. Marketing and sales teams will use the survey findings to optimize the new product line and put the company back on track toward achieving the marketing goals. Additionally, the marketing and sales teams will continuously scan the external environment for opportunities and threats, including changes in product demand, consumer preferences, and competition. This information will be used to optimize the marketing mix for success. For instance, low orders for a particular style will prompt management replace it with high-performing alternatives. Additionally, entry of new competitors may indicate the need for Levi Strauss & Co to adjust prices.

References

James, H. (2023, October 3). Fashion brands need to be prepared for a gender-fluid future. Marketing Week. https://www.marketingweek.com/helen-james-fashion-brands-gender-fluid-future/

Klarna Insights. (2022). A deep dive into fashion trends. https://insights.klarna.com/fashion-trends/

Levi Strauss & Co (2023). 2022 annual report: https://s23.q4cdn.com/172692177/files/doc_financials/2022/ar/LS-Co-2022-annual-report-final.pdf

Piacenza, J. (2018). Rebuilding the Levi’s brand. Morning Consult Pro. https://pro.morningconsult.com/articles/rebuilding-levis-brand

Statista. (2023, February). Value of the denim jeans market worldwide from 2022 to 2030. https://www.statista.com/statistics/734419/global-denim-jeans-market-retail-sales-value/

Waldow, J. (2023, January 26). Levi Strauss posts record Q4 DTC sales in the US Modern Retail. https://www.modernretail.co/operations/levi-strauss-posts-record-q4-dtc-sales-in-the-u-s/

Young, V. M. (2023, September 29). Analyst sees levi’s well positioned for “favorable denim cycle.” Sourcing Journal. https://sourcingjournal.com/denim/denim-business/levi-strauss-denim-global-lifestyle-brand-womens-levis-jeans-growth-oliver-chen-457590/

write

write