Introduction

The primary objective of this research is to expansively analyze and synthesize the numerous elements shaping global business opportunities in Lebanon. As a country located at the crossroads of the Mediterranean, Lebanon grips strategic importance for international trade and investment (Economics Insights, 2022). This short research aims to look into the major industries powering Lebanon’s foreign trade, evaluate their impact on the country’s GDP and economic growth, and consequently propose actionable recommendations for U.S. investors looking for new investment options. Lebanon’s exceptional geopolitical position, historical economic bonds and recent developments position it as a critical player in the global business sphere. Through a concentrated examination of Lebanon’s economic strengths and opportunities, the current research aims to provide valuable understanding to stakeholders interested in taking advantage of the economy’s possible communally beneficial global business ventures.

Major Industry Analysis

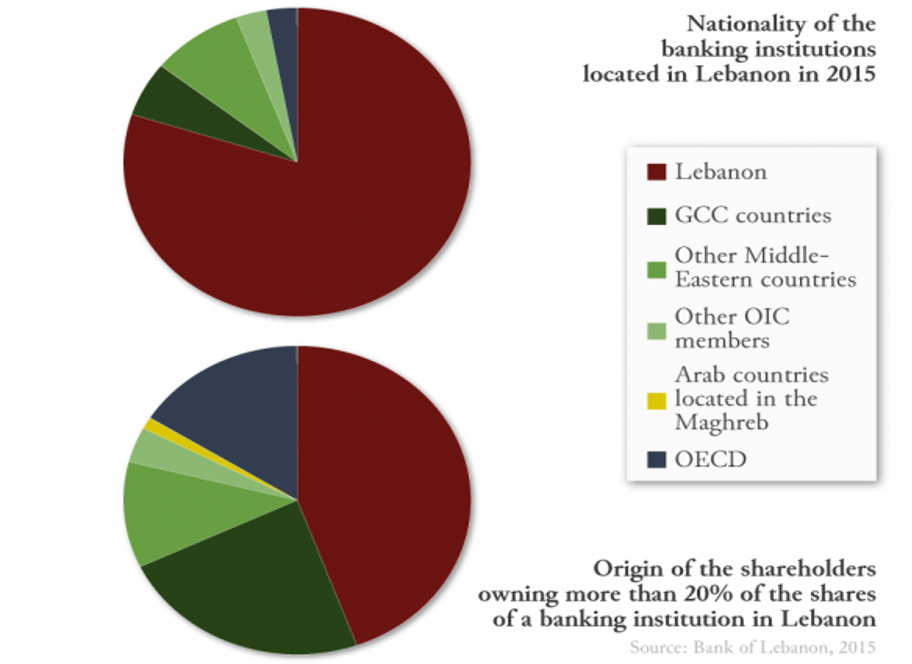

In Lebanon, the banking and financial services industry stands out as the main industry that meaningfully empowers the nation’s foreign trade. This section plays an essential role in Lebanon’s economy because of its substantial contribution to foreign exchange earnings, acting as a foundation for the economic stability of the country (Economics Insights, 2022). Lebanon’s exceptional financial sphere, categorized by a robust banking system and a historical legacy as a financial hub in the Middle East, has powered the success of this industry. Factors such as a deep-rooted tradition of banking clandestineness, a dynamic capital market, and strategic geographic positioning have fascinated global investors and empowered Lebanon to become a significant financial player in the region (Dewailly, 2019). Compared with the United States financial sector, Lebanon’s banking industry displays a distinct model, marked by a high concentration of banks and a concentration on cross-border financial services. The influence of this industry on Lebanon’s GDP and economic growth is considerable, as demonstrated by statistics and figures replicating its contribution to the national economy. Service-related activities compose 70% of Lebanon’s GDP. Old and famous, the banking and financial activities only accounted for 8% of the GDP (4.4 billion US$) in 2013, i.e., less than half of the number of trade activities and less than industrial production (Consult, 2017). A comparative analysis with the U.S. complement also discloses the exclusive dynamics and contests that distinguish Lebanon’s financial sector. It offers valuable understanding for assessing its international competitiveness and the possibility for further growth.

Figure 1: Banking and finance sector in Lebanon

III. Opportunities for U.S. Investors

Explore Opportunities in Lebanon for the U.S. Investors

With its strategic position and varied economic sphere, Lebanon offers promising opportunities for American investors seeking to expand their international presence. Recognizing specific markets or industries with substantial potential for investment is critical for informed decision-making (CeicData, 2023). Although Lebanese banking and financial services are American companies’ most formidable investment opportunities, other sectors are more feasible than the already established banking and financial services sector. The Lebanese technology and innovation sector, described by a mounting startup ecosystem and skilled workforce, stands out as a major area for American investors from a country with high technology and innovation prominence. Given the reputation of American companies in technology and innovation, investing in this area will be viable because it will easily attract consumers who want to associate with reputable brands (Ajaero, 2018).

Moreover, the renewable energy industry in Lebanon, motivated by government initiatives, incentives and a sustainability pledge, presents an attractive opportunity for U.S. investors looking for long-term growth forecasts. In securitizing investment opportunities, looking into the economic and regulatory environment that foreign investors will meet in Lebanon is vital. The Lebanese government has been aggressively working to attract foreign investment, executing reforms to streamline bureaucratic processes and increase the general ease of doing business. However, obstacles related to political unpredictability and a budding regulatory landscape persist (Consult, 2017). Consequently, thoroughly comprehending these economic and regulatory dynamics is indispensable for U.S. investors to circumnavigate successfully and capitalize on the identified opportunities.

Propose Recommendations for U.S. Investors in Lebanon

Building upon the analysis of specific sectors and the economic environment, proposing recommendations for U.S. investors involves a nuanced assessment of existing multinational organizations with initiatives in Lebanon. Collaborating with established players in the market can provide U.S. investors with valuable insights, mitigate risks, and enhance the overall success of their ventures (Ajaero, 2018). Multinational organizations, whether insiders with local expertise or outsiders with a global perspective, can serve as strategic partners, facilitating market entry and offering crucial support. Furthermore, evaluating possible new trade opportunities is pivotal in creating robust recommendations. U.S. investors should consider aligning their interests with the ongoing development projects in Lebanon, such as infrastructure initiatives and technological advancements. By taking advantage of the strengths of existing multinational organizations and aligning investments with emerging trends, U.S. investors can not only navigate the challenges but also thrive in the dynamic and evolving Lebanese market (Consult, 2017). This strategic approach ensures a comprehensive and well-informed set of recommendations tailored to Lebanon’s economic landscape’s unique opportunities and challenges.

Existing Multinational Organizations Analysis

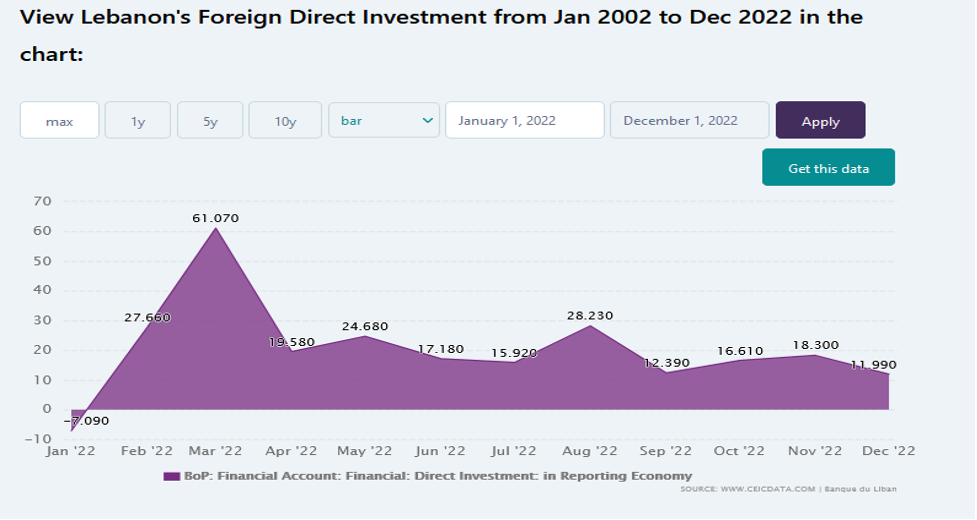

Multinational organizations are essential in shaping global business sceneries; Lebanon is no exception. Measuring these entities involves examining both insider and outsider perspectives. An insider perspective looks into the operations and strategies of multinational organizations that originated within Lebanon. These organizations, intensely entrenched in the local market, bring an understanding of the nuanced cultural and economic factors that influence business in the country (Economics Insights, 2022). On the other hand, outsider perceptions consider multinational organizations entering Lebanon from abroad. Analyzing their initiatives provides insights into how foreign entities navigate the unique challenges and opportunities present in Lebanon’s business environment. Turning attention to potential trade opportunities facilitated by these multinational organizations, a complete analysis is essential. These entities, like banks, financial service institutions, and moneylenders, often act as key facilitators in cross-border trade, leveraging their global networks to bridge gaps between Lebanon and international markets (CeicData, 2023). They may engage in joint ventures and strategic partnerships or invest in local enterprises, creating avenues for increased foreign direct investment. Identifying the sectors or industries where these organizations are active sheds light on the areas with significant growth potential, providing valuable information for U.S. investors looking to capitalize on emerging opportunities in Lebanon.

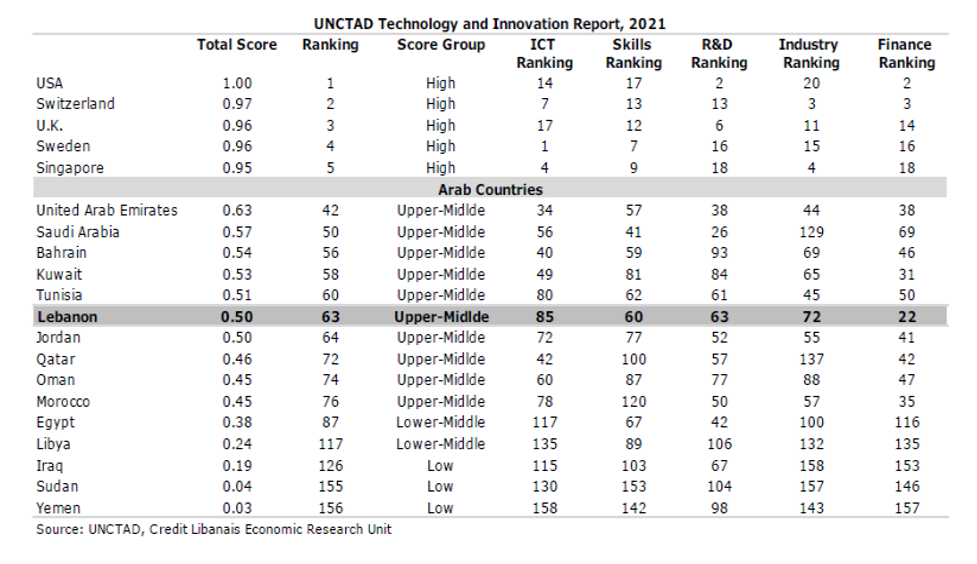

Recommendations and Defense

Based on country analysis, American investors seeking to invest in Lebanon should invest in the technology and innovation industry. The recommendation is based on an analysis of the strengths and weaknesses presented by the company.Lebanon’s technology and innovation industry displays strengths in a burgeoning talent pool, with a growing number of skilled professionals in STEM fields. Moreover, the country’s strategic location and historical bonds to various markets can be leveraged for global expansion (CeicData, 2023). However, areas for improvement may include infrastructure gaps, regulatory complexities, and limited access to funding for startups. The United States investors considering Lebanon’s technology and innovation sector should be conscious of risks such as political instability, cybersecurity threats, and regulatory indecisions. On the positive side, doles include access to a comparatively untapped market with mounting demand for technological solutions, possible cost advantages, and the opportunity to donate to the development of the local tech ecosystem. Data from the technology and innovation presented in this section shows the growth trajectory of the technology industry in Lebanon (Economics Insights, 2022). It is apparent from the comparison between the American and Lebanese sectors that the American sector is mature while the Lebanese sector is growing. Graphs displaying the increase in the number of tech startups, investment trends, and the adoption of digital technologies in Lebanon prove the potential profitability and growth of the sector.

UNCTAD Technology and Innovation Report 2021 showing U.S. and Lebanon index

Conclusion

This comprehensive research endeavor has aimed to unravel the multifaceted dimensions of international business opportunities in Lebanon, with a particular focus on the technology and innovation industry. As a nation positioned at the junction of the Mediterranean, Lebanon emerges as a pivotal player in the global business arena, wielding strategic importance for trade and investment. The major industry analysis spotlighted the dominance of Lebanon’s banking and financial services sector, underscoring its significant contribution to the nation’s foreign trade and economic stability. However, distinguishing the need for diversification, the research has fervently recommended the technology and innovation industry for U.S. investors. Leveraging the strengths of Lebanon’s growing talent pool and strategic location, coupled with a reasonable evaluation of risks and benefits, positions this sector as a prime avenue for international investment.

References

Ajaero, T. M. (2018, February 8). Ten Best Business Investment Opportunities in Lebanon. ProfitableVenture. https://www.profitableventure.com/lebanon/

CeicData. (2023). Lebanon Foreign Direct Investment, 2002 – 2021 | CEIC Data. Www.ceicdata.com. https://www.ceicdata.com/en/indicator/lebanon/foreign-direct-investment

Consult, S. (2017, June 27). Lebanon investment opportunities and incentives. Shanda Consult. https://shandaconsult.com/lebanon-investment-opportunities-incentives/

Dewailly, B. (2019, October 3). A Predominant Banking and Financial Sector (G. Faour, E. Verdeil, & M. Hamzé, Eds.). OpenEdition Books; Presses de l’Ifpo. https://books.openedition.org/ifpo/13238

Economics Insights. (2022). Lebanon Ranks 63rd in the 2021 Technology and Innovation Index. Economics.creditlibanais.com. https://economics.creditlibanais.com/Article/210278#en

write

write