Introduction

Amazon (AMZN) has been a global powerhouse since its 1997 IPO. E-commerce, cloud computing, and digital streaming drive Amazon’s prosperity. Amazon investors must understand its volatility and market factors. This extensive analysis explores Amazon’s market dominance, innovation, and growth potential as investment grounds (Amazon.Com, 2023). This study analyzes portfolio variety and financial factors to assess Amazon as an investment.

Detailed overview of Amazon stock

Amazon (AMZN) has grown significantly since its 1997 IPO. Despite occasional turbulence, equity value has risen. Amazon is one of the world’s largest and most esteemed companies. Institutional and individual investors are interested in the company’s strong revenue growth and diversity. Recognizing Amazon’s stock’s inherent volatility and risks is crucial (Amazon.Com, 2023). The investment is sensitive to market, competitive, and global influences. Amazon’s stock is considered an excellent long-term investment due to its market domination, innovation, and potential digital economy growth.

Amazon investment rationale

Several variables encourage Amazon stock investment. First, Amazon dominates e-commerce, cloud computing (Amazon et al.), and digital streaming (Amazon Prime Video). This domination supports growth and revenue. Revenue also increased. Amazon’s success is due to its inventive strategy, deliberate growth into new industries, and unwavering customer satisfaction (Tou et al., 2019). Amazon’s strategic entry into cloud computing and digital content streaming has improved its prospects. Finally, Amazon’s ongoing innovation, investments in emerging technologies, and customer satisfaction position the company well for future development and competitiveness.

Portfolio diversification

Diversifying across asset classes and sectors reduces risk and maximizes profits. First, invest in equities, bonds, real estate, and commodities. Diversification balances risk and return. Amazon stock is equity. Second, sector allocation—investments in technology, healthcare, consumer products, finance, and others—is critical. Exposure to multiple industries reduces concentration risk (Ho & Huang, 2021). Geographical diversification spreads investments across regions and countries to mitigate local economic shocks and regulatory changes. Diversification requires risk management—stop-loss orders, portfolio reviews, and rebalancing preserve asset allocation and risk tolerance. Portfolio performance must be monitored and adjusted to match investment goals, market conditions, and risk tolerance.

Financial ratios analysis

The ratios can reveal Amazon Inc.’s liquidity, leverage, activity, and profitability during the past three years.

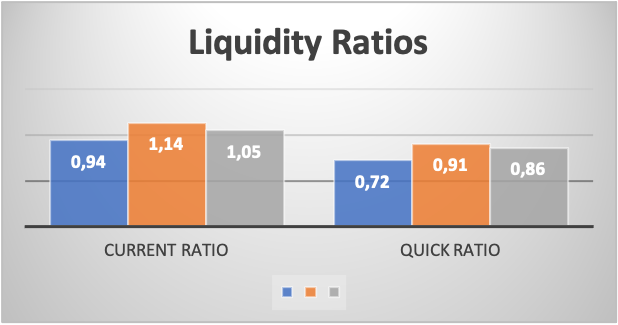

Liquidity

The current ratio indicates a company’s capacity to meet short-term obligations with current assets. Amazon’s current ratio dropped from 1.14 in 2021 to 0.94 in 2022. The company’s short-term liquidity may deteriorate (Amazon.Com, 2023). The quick ratio fell from 0.91 in 2021 to 0.72 in 2022. Amazon’s capacity to meet immediate obligations without inventories may shrink.

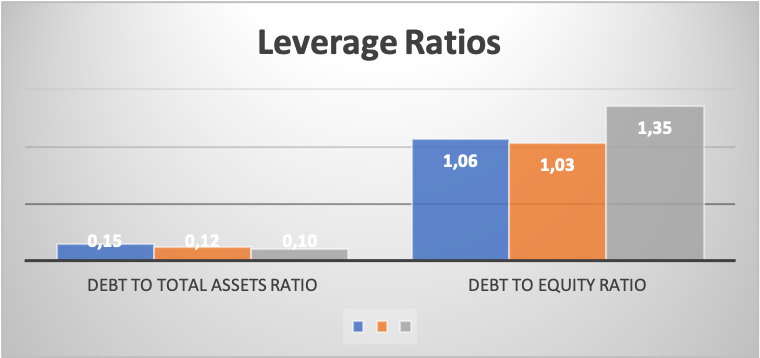

Leverage

The debt-to-total assets ratio shows the company’s leverage. Amazon’s debt-to-total assets ratio has grown over three years, indicating more debt financing. Compared to 2021’s 0.12 and 2020’s 0.10, 2022’s ratio is 0.15 (Amazon.Com, 2023). A company’s debt-to-equity ratio indicates financial leverage and risk. Amazon’s debt-to-equity ratio increased from 1.03 in 2021 to 1.06 in 2022.

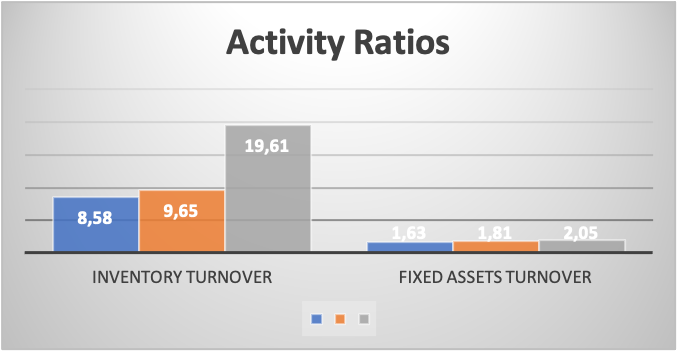

Activity

The inventory turnover ratio reflects a company’s inventory management efficiency. Amazon’s 2021 inventory turnover was 9.65; 2022’s was 8.58. A lower turnover ratio means the company holds goods longer, which could impair liquidity and profitability. A company’s fixed assets turnover ratio shows how well it generates revenue (Amazon.Com, 2023). Amazon’s fixed assets turnover declined from 2.05 in 2020 to 1.63 in 2022, indicating decreased fixed asset sales efficiency.

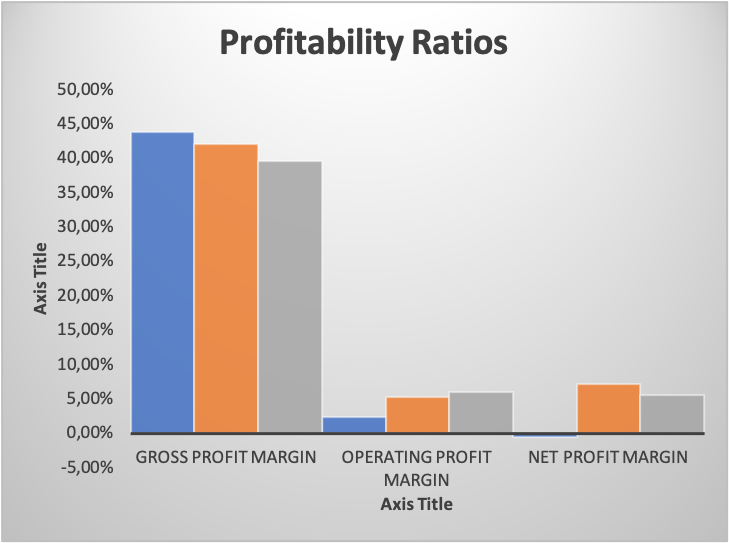

Profitability

Gross profit margin is the percentage of revenue left after subtracting the cost of goods sold. Amazon’s gross profit margin increased from 39.57% in 2020 to 43.81% in 2022. The operating profit margin reflects core operating performance. Amazon’s operating profit margin dropped from 5.93% in 2020 to 2.38% in 2022, indicating a profit reduction. After taxes, the net profit margin shows the company’s profitability (Amazon.Com, 2023). Amazon’s net profit margin fluctuated from -0.53% in 2022 to 7.10% in 2021. Profitability dropped in 2022 due to the negative margin. Amazon’s three-year financial review indicates uneven results across ratios.

Analysis of the investment price to stock market beta for the past five years.

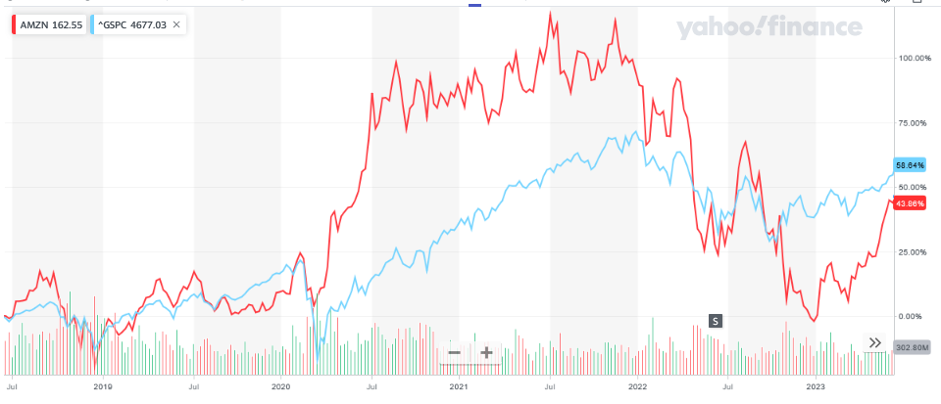

Over the analyzed period from January to May 2023, the average daily closing prices for Amazon stock and the S&P 500 index exhibited different trends. Amazon’s stock displayed fluctuations, with notable increases in April and May, while the S&P 500 showed more stability overall. However, the average daily volumes for both Amazon and the S&P 500 remained relatively similar throughout the months, indicating a comparable level of trading activity (Umer et al., 2019). These comparisons provide insights into Amazon’s performance and trading patterns and the broader market index during the given timeframe (Yahoo Finance, 2023).

A trend line that depicts the price movement for the investment against the market index movement (Yahoo Finance, 2023)

The type of investor who would be the best candidate for the chosen investment and a rationale for why this investment is a solid choice.

Amazon stock investors should be aggressive. Amazon is known for its innovative and profitable business model. Due to commercial, competitive, and global influences, investing in Amazon is risky. Aggressive investors take more risks for better profits. Long-term investors are more risk-tolerant and comfortable with market volatility. Amazon stock appeals to daring investors for several reasons (Zhang & Yang, 2019). Amazon dominates e-commerce, cloud computing, and digital streaming with Amazon Prime Video. Market domination supports revenue growth and market reach. Amazon’s success is also due to its strategic entry into new markets. Cloud computing and digital content streaming have increased the company’s possibilities and income channels (Gupta &Chen, 2020). Amazon’s continued innovation, intelligent investments in emerging technologies, and unrelenting devotion to customer happiness have positioned the company for growth and competitiveness. Amazon is an attractive investment option for bold investors seeking high growth.

Conclusion

Amazon stock is a promising investment with the potential for tremendous growth and long-term financial reward. Amazon’s market dominance, innovative strategies, and diverse revenue streams position it well for digital economy expansion. Investors must analyze their risk appetite, strategically distribute their assets across asset classes and industries, and monitor their portfolio performance. Investors can unlock significant value and achieve their financial goals by strategically combining a deep understanding of Amazon’s complex dynamics, a diversified portfolio, and intelligent risk management.

References

Amazon.Com. (2023). Amazon.com, Inc. – Overview. Amazon.com, Inc. – Overview. Retrieved June 18, 2023, from https://ir.aboutamazon.com/overview/default.aspx

Gupta, R., & Chen, M. (2020, August). Sentiment analysis for stock price prediction. In 2020 IEEE conference on multimedia information processing and retrieval (MIPR) (pp. 213–218). IEEE.

Ho, T. T., & Huang, Y. (2021). Stock price movement prediction using sentiment analysis and CandleStick chart representation. Sensors, 21(23), 7957.

Tou, Y., Watanabe, C., Moriya, K., Naveed, N., Vurpillat, V., & Neittaanmäki, P. (2019). The transformation of R&D into a neo-open innovation-a new concept in R&D endeavor triggered by Amazon. Technology in Society, 58, 101141.

Umer, M., Awais, M., & Muzammul, M. (2019). Stock market prediction using machine learning (ML) algorithms. ADCAIJ: Advances in Distributed Computing and Artificial Intelligence Journal, 8(4), 97–116.

Yahoo Finance. (2023). Amazon.com, Inc. (AMZN). Yahoo Finance – Stock Market Live, Quotes, Business & Finance News. Retrieved June 18, 2023, from https://finance.yahoo.com/quote/AMZN/chart?p=AMZN#eyJpbnRlcnZhbCI6ImRheSIsInBlcmlvZGljaXR5IjoxLCJ0aW1lVW5pdCI6bnVsbCwiY2FuZGxlV2lkdGgiOjgsImZsaXBwZWQiOmZhbHNlLCJ2b2x1

Zhang, Y., & Yang, S. (2019, October). Prediction on the highest price of the stock based on PSO-LSTM neural network. In 2019 3rd International Conference on Electronic Information Technology and Computer Engineering (EITCE) (pp. 1565–1569). IEEE.

write

write