Data analysts use time series analysis to examine trends, patterns, and other behaviors within data sequences. The method also makes predictions and derives insights about underlying processes and patterns. The technique allows analysts to use historical data to make predictions. It makes time series analysis indispensable in manufacturing, marketing, weather forecasting, economics, and finance. Such sectors rely on prediction, meaning that a statistical tool is as good as its ability to present insightful forecasts. Time series analysis trends can help draw insight into market sentiments and policy positions.

Time Series Analysis in Budget Analysis

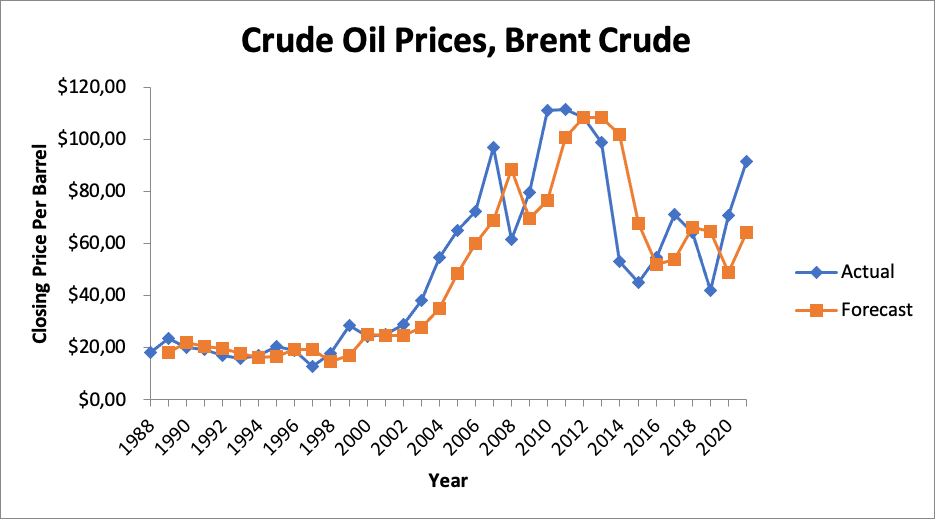

The report applies the core concepts of time series analysis to historical data. The chart reveals that the prices have changed annually over the three decades. The assets have been subjected to regular price fluctuations, critical when budgeting or making time series analysis predictions. The annual price is sorted chronologically to ensure the data is readable. Also, it is easy to spot errors, such as missing entries, as every year is associated with a single numerical factor. Some data types are easier to present than others in a time series test. Discrete figures fall in the former category and are easy to represent, while categorical data such as male/female cannot be captured in time series analysis.

The data set consists of yearly average closing prices of Brent Crude Oil between 1988 and 2022. It represents a continuous record with annual fluctuations. This format allows the data analysis model to manipulate the information and generate a time series graph. More importantly, the price trend can be used to understand the general market sentiments since crude oil is an international commodity. The trend can also be mapped against real-world social and economic patterns to draw conclusive inferences on the factors affecting oil prices. In this case, there is an upward trend for the average closing price. The implication is that crude oil has become more expensive over several decades. If current social, economic, and political trends continue, it is prudent for the company to expect higher prices.

Understanding Budget Planning and Forecasting

Budget planning is crucial for organizations and businesses since it is a roadmap for resource allocation, goal achievement, and financial management. Tools such as time series assessment streamline this function by highlighting errors in data entry, pointing out sharp changes, and revealing overall spending trends (Mishra et al., 2022). Organizations can enhance financial stability by exploring intuitive tools such as time series analysis in financial planning, decision-making, and project scheduling. One of the critical challenges facing businesses seeking to boost their financial and operational efficiency is the high costs associated with budgeting and planning accuracy. Budget forecasting analysis affects revenues, expenses, and the industry’s stability if the important players utilize similar tools and principles.

Tools such as time series analysis address the budgeting problem fairly comprehensively. The approach allows the analyst to quickly glimpse the most critical trends and outliers in a data range. For example, problems such as sudden spikes and drops are quickly revealed, allowing the analyst to probe such entries. Errors in data entry or sudden internal or external developments can explain most such cases. For example, many companies recorded losses in 2020 due to the Covid-19 pandemic. It was the first time recording negative growth for some of these organizations. Time series analysis leverages historical data to forecast future trends, exposes seasonality, and develops models that can be used to forecast future events.

Times Series Chart

Fig 1.1 Time-Series Analysis

Analyzing the Time Series

The Brent Crude time series analysis reveals critical information about the closing prices over the past three decades. The data reveals a pattern in the general price changes over time. The curve has an upward trend which suggests that oil prices will likely continue to rise. Several key developments suggest abnormal price changes in the trend. For example, there was a sharp rise in the price of oil between 2005 and 2008. These developments can be attributed to growing demand for oil, geopolitical tensions, and supply constraints. Many Asian countries underwent significant economic transformations in the early 2000s (Zou & Chau, 2006). As these nations underwent rapid industrialization, their demand for cheap energy increased drastically. China emerged as one of the world’s top oil markets in the early 2000s. Geopolitical tensions in the Middle East caused major supply constraints, forcing the rest of the oil producers to raise their prices.

The time series analysis also shows a second sharp increase in oil prices between 2009 and 2012. This development can be attributed to the financial crisis 2008, which affected most countries worldwide. The 2008 economic recession was characterized by unemployment, low demand for non-essential products, people losing their homes, and low economic activity (Saurina et al., 2013). While the oil demand decreased temporarily due to the recession, many governments quickly took corrective measures to address the problem. Oil producers started to increase their prices as the demand rose. In addition, quantitative easing policies may explain the increased oil prices. The same era saw many central banks pump more money into the economy to stimulate activity (Shkodina et al., 2020). The financial liquidity forced oil producers to increase prices as it was the only way to control the value of the commodity in the international market.

The time series analysis shows a price decrease between 2013 and 2017. The change can be attributed to several key socioeconomic changes. Oil-producing countries embraced many technologies commonly associated with shale oil extraction (Reynolds & Umekwe, 2019). It caused a boom in the US and non-OPEC nations. This change meant the world no longer relied on OPEC nations for energy. In 2014, Saudi Arabia led OPEC in a strategy that maintained production despite falling prices. These nations aimed to defend their oil market share at every cost. The move played a major role in maintaining the low prices. It should be noted that measures to restore the necessary balance were later implemented.

Lastly, the time series chart reveals a price increase in 2020. The change can be attributed to several key elements, such as the COVID-19 pandemic, the Supply Cut Agreement, and the subsequent economic recovery. COVID-19 triggered global lockdowns, which caused a significant drop in oil demand. Many passengers and business movers no longer needed to travel regularly (Onyeaka et al., 2021). The drop in the oil demand caused the prices to fall. OPEC members ignited the Supply Cut Agreement to reduce production and restore balance. By the end of the year, governments and research institutions worldwide quickly developed measures to reopen the economy. As vaccines were distributed faster, various industries started to reopen, increasing the demand for traveling and general transportation. This forced the major oil producers to increase prices and balance the demand with the supply.

Conclusion

Time series analysis is useful for extracting patterns and trends from a data range. The case study presents Brent Crude Prices over 30 years. The time series analysis reveals that prices have continued upward since 1988. In addition, there have been multiple spikes and fluctuations in oil prices. These can be attributed to global economic conditions, policy decisions, and supply disruptions. The time series analysis is excellent in financial management and control as it facilitates predictive forecasting. Businesses can use time series analysis to make more insightful decisions and stabilize their financial operations.

References

Mishra, A. K., Singh, S., Gupta, S., Gupta, S., & Upadhyay, R. K. (2022, November). Forecasting future trends in crude oil production in India by using Box-Jenkins ARIMA. In AIP Conference Proceedings (Vol. 2481, No. 1). AIP Publishing. https://doi.org/10.1063/5.0103682

Onyeaka, H., Anumudu, C. K., Al-Sharify, Z. T., Egele-Godswill, E., & Mbaegbu, P. (2021). COVID-19 pandemic: A review of the global lockdown and its far-reaching effects. Science progress, 104(2), 00368504211019854. https://doi.org/10.1177/00368504211019854

Reynolds, D. B., & Umekwe, M. P. (2019). Shale-oil development prospects: The role of shale-gas in developing shale-oil. Energies, 12(17), 3331. https://doi.org/10.3390/en12173331

Saurina, C., Bragulat, B., Saez, M., & López-Casasnovas, G. (2013). A conditional model for estimating the increase in suicides associated with the 2008–2010 economic recession in England. J Epidemiol Community Health, 67(9), 779-787. http://dx.doi.org/10.1136/jech-2013-202645

Shkodina, I., Melnychenko, O., & Babenko, M. (2020). Quantitative easing policy and its impact on the global economy. Financial And Credit Activity-problems of theory and practice, 2, 513-521. https://doi.org/10.18371/fcaptp.v2i33.207223

Zou, G., & Chau, K. W. (2006). Short-and long-run effects between oil consumption and economic growth in China. Energy policy, 34(18), 3644-3655. https://doi.org/10.1016/j.enpol.2005.08.009

write

write