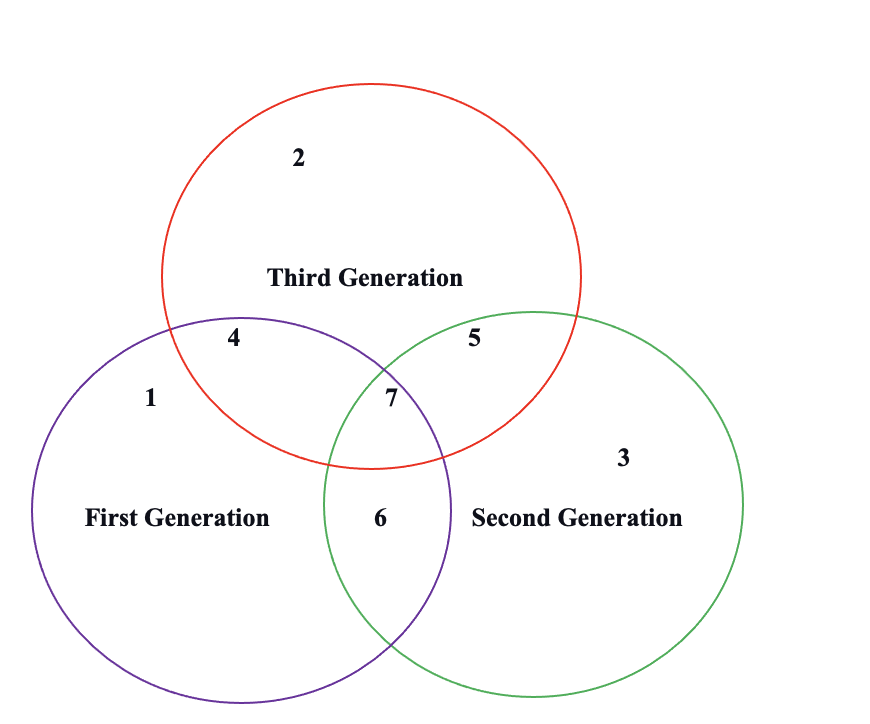

Part A

- The first Generation’s family members, namely Don Miguel and his wife-Carolina Carrasco, who started the family business. Don Miguel started the Bazán Family Business and has thrived in the agro-business industry for the last 60 years. For the Bazán Family Business’ continuation, Don Miguel used a merit-inheritance system to share business property rights among his children.

- The second Generation’s family members to whom his father transferred ownership rights. Don Miguel had seven children: Pablo, Diana, Daniela, Antonia, Alejandra, Roberto, and Patricia, second-generation family business owners. Of the seven children, Don Miguel gave his youngest son, Pablo, the highest ownership rights since he was much more responsible than his siblings.

- The third Generation’s family members inherited their parents’ ownership rights. Roberto’s sons, Carlos and Luisa, are the Bazán Family Business third generation owners. Roberto explicitly transferred his property ownership rights to his sons to lower the tax burden.

- A team comprised of the first and third generations owning the family business. Don Miguel and his grandchildren, Carlos and Luisa, are Bazán Family Business’s first and third-generation team with ownership rights.

- The third and second generations team owns the family business. Carlos, Luisa, and Don Miguel’s seven children are the third and second-generation owners of the Bazán Family Business.

- A team comprises members from the first and second generations who are active family business owners. Don Miguel and his seven children are first- and second-generation family business owners.

- The family members from all three generations own the family business. Don Miguel, his seven children, and his grandchildren, Carlos and Luisa, are, respectively, the family business’s first, second, and third generations.

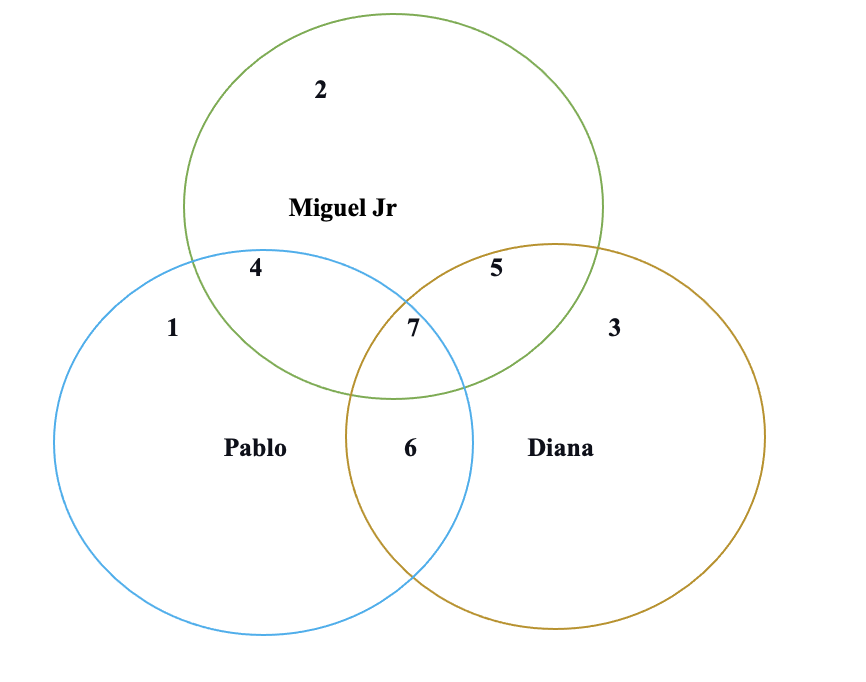

Part B

The First Consultant

- Pablo’s Family Members who are legal owners of the family business

- Don Miguel’s five other children, Daniela, Antonia, Alejandra, Roberto, and Patricia, and their children and future family members with the family business’s property rights.

- Diana Family Members own the Bazán Family Business.

- Pablo’s and Miguel Jr.’s family members will transit in owning the family business.

- Miguel Jr’s and Pablo’s family members will become family business owners later.

- Pablo’s and Diana’s family members will become Bazán Family Business’s new business owners.

- Pablo, Diana, and Miguel Jr. are new owners of the Bazán Family Business.

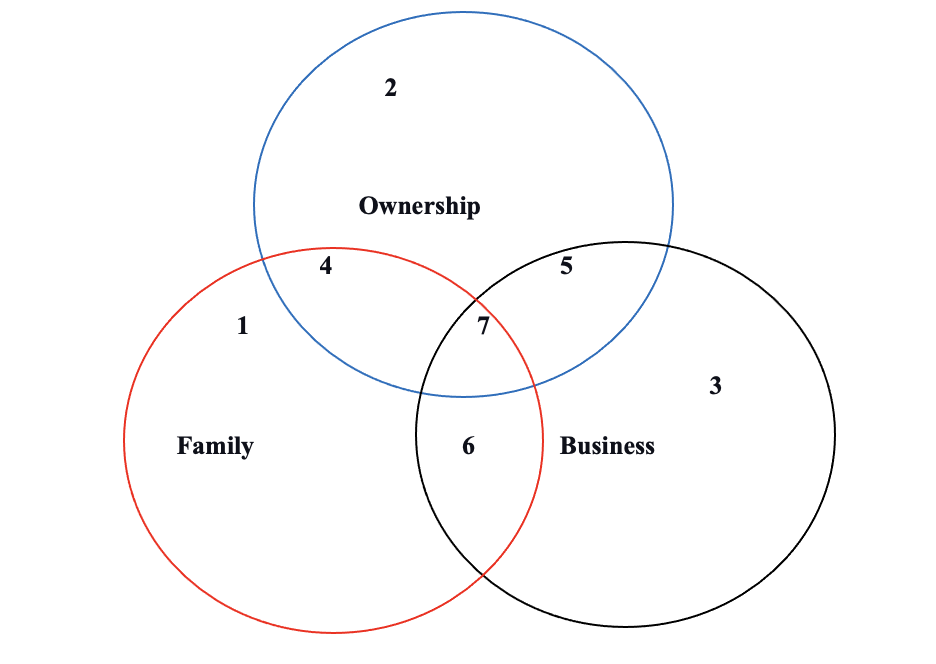

The Second Consultant

- The Family members who neither work nor own shares in the family business.

- Non-family owners who do work at the family business.

- The family members work in the family business but do not own shares.

- The family members with shareholding rights but do not work at the company.

- Non-family members who own shares and work at the family business.

- The family members working at the business but do not own shares

- The family and non-family members work at the business and own shares.

Discussion

The second consultancy’s three circles model is more rational. It makes sense that it allows family and non-family members or investors to become family business shareholders (Poza & Daugherty, 2013). Also, it facilitates the inclusion of two lucrative tools, namely corporate government and open-empathic communications, thus making the family business run for an infinite time (Poza & Daugherty, 2013). Via corporate governance, the family business will remain competitive since the family members will be forced to explicitly design effective strategies, like product expansion and internationalization, to maximize the investors’ returns (Poza & Daugherty, 2013). On the other hand, open empathic communications will make the family members’ core owners, Pablo and Diana, involve other family members and investors in decision-making processes (Poza & Daugherty, 2013). Compared to the second consultancy’s three circles model, the first needs to be more rational since denying other family members and the public’s shareholding rights will reduce the family business’s competitive advantage, ultimately leading to its insolvency.

Part C

The model I have created in part B, the second consultancy’s three circles model, can satisfy Diana’s concerns about commitment. A sense of commitment will be restored among the third and future generations since the corporate government system will ensure every Don Miguel family member is involved in running the family business (Von Schlippe & Groth, 2023). Therefore, the most significant percentage of Don Miguel’s family members not working or owning shares in the family business will often get contacted before the new management makes lucrative decisions. As a result, many of these family members will look forward to working or owning shares in their family business. Also, fewer members of Don Miguel’s family, like Pablo and his future successor, will aggressively try recruiting newer family members who will continue protecting the Bazán Family Business’s legacy.

References

Poza, E. J. & Daugherty, M.S. (2013). Family business. Cengage Learning. https://books.google.co.ke/books?hl=en&lr=&id=7dQWAAAAQBAJ&oi=fnd&pg=PP1&dq=Ernesto+J.+Poza+and+Mary+S.+Daugherty+family+business+5th+Edition&ots=fvNFSXOH5r&sig=2XoxJka0uZs_iy_z8QsvXEQIjPE&redir_esc=y#v=onepage&q&f=false

Von Schlippe, A., & Groth, T. (2023). Company, Family, Business Family: Systems-Theoretical Perspectives on the Extension of Three-Circle Thinking. In Sociology of the Business Family (pp. 259-269). Springer, Wiesbaden. https://link.springer.com/chapter/10.1007/978-3-658-42216-5_12

write

write