Introduction

Proper regulation and risk management strategies are the foundation of a vibrant banking sector. However, the current financial turmoil in the American banking system demonstrates poor regulations and supervision among regulators and poor risk management among failed banks. Although the Federal bank has adequate authority to regulate banks, the supervisors could have done better in their duties. The banks also focused on short-term profits rather than assessing their financial risks and developing strategies to curtail such threats. The paper focuses on interest rate structure, Federal Reserve, and business cycles and how they relate to the current turmoil in the American banking sector.

The Literature Review

The Regulatory System in the Banking System

Bank guidelines in the USA are fragmented compared to other G10 countries, as diverse nations have only financial institution regulators. Regulation acts as a transforming factor as the propensity on the manner to deregulation and gentle guidance has paved the way to more advanced and adequate guidelines and supervision. America has complicated regulatory procedures comprising diverse government regulatory institutions with overlapping responsibilities of banking guidelines (Wiley & Navickas, 2021). The reserve system in the central bank of the United States conducts the country’s financial plan. It also manages bank holding firms, financial holding institutions, and state-chartered financial institutions that are members of the reserve system. The down payment insurance coverage institutions are major regulators for state-hired financial institutions that are part of the Reserve System.

The National Bank Act of 1863 created the fundamental structure for the United States of America’s financial Sector and the national banks; chartering. The Federal Reserve Act, created in 1914, developed the Reserve System. The Banking Act of 1933 distinguished commercial banks from financial investment banks and created the structure of federal deposit insurance. The Federal Deposit Insurance Coverage Act merged past FDIC regulations into one Act and obligated the FDIC to act as the receiver of fallen-short financial institutions (Obadire & Obadire, 2023). The bank holding company act 1956 enables the Federal Reserve to authorize an institution to get a bank. It allows the BHCs to acquire past Federal Reserve approval to receive a rate of interest in other financial institutions and particular non-bank organizations. The Bank Secrecy Act of 1970 obligates all banks comprising financial institutions to create a threat-based procedure of internal controls to control cash laundering and terrorist financing. The Worldwide Banking Act of 1978 creates a structure for government regulation of foreign banks operating in America.

The Federal Reserve System is the core bank in America. It conducts five significant functions in promoting the effective operation of the American economy and public interest. The Federal Reserve performs the country’s monetary policy in promoting maximum employment and stable prices in the American economy. It also encouraged the financial system’s stability and aims to reduce and avert systematic risks via active monitoring and participation in America and abroad (Robe et al., 2010). The Reserve also promotes the safety and soundness of individual financial institutions. However, the Federal Reserve failed in its supervisory role leading to the current financial turmoil in the United States. The Fed Vice chair for supervision notes that SVB’s failure illustrates weaknesses in regulation and supervision. He further cited that the regulatory standards for Silicon Valley Bank needed to be higher, and the supervision of SVB operated slowly. The Federal Reserve also noted that the contagion from the bank’s failure posed systematic outcomes that the Reserve’s tailoring framework never contemplated (Siegel, 2023). The continuous high-interest rates shut the market for initial public offerings resulting in costly private fundraising.

Risk Management in the Banking Sector

Risk management is essential to banks in managing disasters. Proper financial risk management allows banks to manage the deluge of financial and other data they acquire, send or manage. It also enables them to streamline coordination and control over their business processes (Turgut, 2018). It enhances how banks measure performance and receive an improved understanding of their profit sources. The significant risks faced by banks include credit, operational, systematic, liquidity, reputational, business, and compliance risks.

By developing a clear, formalized risk management plan that exposes significant dependencies and control effectiveness, enhances performance, creates extra visibility and simplify the recognition of systemic issues that impact bank, banks can manage all the risks in the market. They can create a management program by developing a risk recognition procedure using a root-cause approach (Harle et al., 2021). Through this, they can determine the risks relevant to the institution and why particular events happen. Banks can also design risk mitigation strategies to neutralize those risks and prevent them from re-occurring.

Banks manage risks to avert losses, ensure survival, safeguard their reputation, protect stakeholders’ interests, comply with regulations and laws, and safeguard the bank’s credit ratings. Nonetheless, since banks and banking play a vital role within the national and international economy, the outcomes of poor risk management are extreme (Helmore, 2023). This is evident in the collapse of the Silicon Valley Bank and the Signature Bank in March this year. The regulator was also forced to bail out the US First Republic Bank through JP Morgan. The current occurrences in the American Banking sector indicate the importance of proper risk management strategies among financial institutions.

Background of the current banking turmoil in the United States of America

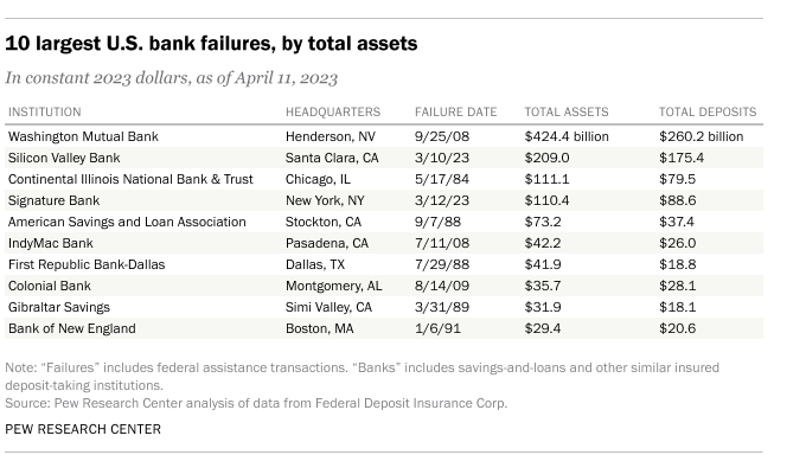

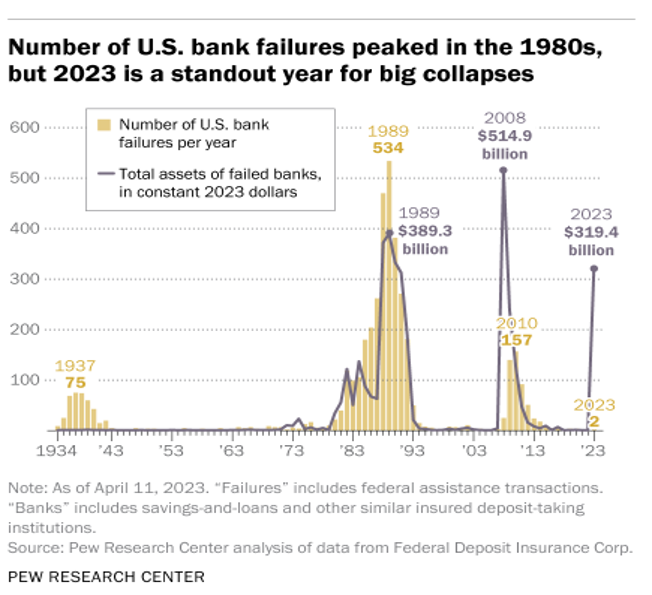

Since early March, challenges have brewed in the American banking sector with the collapse of Silicon Valley Bank (SVB) and Signature Bank with astonishing speed. The first months of 2023 witnessed the collapse of the three most significant bank failures in U.S. history. First Republic, SVB, and Signature Banks are currently the second, third, and fourth largest banks’ failures in U.S. history (Singh, 2023). The three failed banks held assets of approximately $532 billion, exceeding the $526 billion owned by the twenty-five banks that collapsed in 2008. The current banking turmoil resulted from various issues, such as hiked interest rates causing significant declines in the market value of treasury bonds and government-backed mortgages securities, large amounts of uninsured deposits, regulatory rollbacks, and poor supervision by the U.S. Federal Reserve (Hetler, 2023). All three failed banks had developed fast using short-term funding. They invested most of their assets in long-dated treasury bonds and mortgage-backed securities, a massive concentration of uninsured deposits and short-term liabilities that could only be withdrawn after a while.

The Impact of Regulations on the Banking Sector

The Dodd-Frank Act required banks to have more capital at hand. This implied that most of the bank’s money is exposed to risk while leading. It also restricted particular lending operations, particularly the nontransparent chopping and dicing of loans into other securities. Besides, this Act forced the too-big-fail banks to develop living wills, making it easier for regulators to unwind or shut down a struggling financial institution when a crisis arises. The Act is also subject to the most extensive banking institutions’ stress tests. Stress tests entailed a particular form of simulation created by the Federal Reserve and other central banks to enable them to examine how severely a particular bank’s portfolio would persevere if a broad sell-off across various asset classes or a specific shock occurred compared to the 2008 crisis. This is the most vital tool for central banks to force banks to disclose to the supervisors the risks the banks face. Banks with assets above fifty billion were subject to an aggressive and open-ended discretionary supervisory regime. It entailed the stress test developed by the Act and the ones the Fed had been doing before.

These requirements under the Act have made banks careful about how they are investing their finances. They are also reluctant to lend money to lower-grade borrowers. It has also made bank regulators’ supervisors and executive arm more intrusive and tough on banks and financial institutions. Particular forms of assets have also been avoided by banks based on the implementation of the Dodd-Frank Act. Therefore, this Act comprises about seventeen diverse regulations supporting the financial system after the 2008 crisis. It has reduced the likelihood of a financial crisis occurring again. However, repealing the law in 2018 has partly contributed to the current crisis being experienced in the American Banking system.

In the context of interest rate structure, SVB invested massive bank deposits in long-term U.S. treasuries and agency mortgage-backed securities. Treasury and bond values decrease when interest rates increase (Eisinger, 2023). When the Federal Reserve increased interest rates to curtail inflation in 2022, SVB’s bond portfolio began dropping. The bank could have recovered its capital if it had held the bonds until maturity.

The impact of Risk management on the Banking Sector

The current banking environment has unique demands for risk management. Increased uncertainty and volatility in business, regulatory, and geopolitical settings force organizational leaders to decide whether to retain the traditional banking system structures or reconsider their risk management approach. They often develop risk management programs by creating a risk identification process based on the root-cause approach. Risk management allows banks to determine risks relevant to their institutions and why they occur (Inscribe). They also design risk mitigation techniques to neutralize those risks and prevent them from re-occurring. For instance, risk management allows banks to leverage proper analytics and machine learning data to assess their activities routinely and repeatedly. The insights from this continuous surveillance assist the bank in creating and adopting vital risk indicators to warn its risk management experts early of any potential challenges. Poor risk management among the failed banks resulted in investment in one Sector, particularly the technological Sector, for SVB, exposing it to various risks.

The Current failures of regulators/regulations and risk management in the Sector

The change of the Dodd-Frank Law in 2018 eliminated the requirement of a living will for all banking institutions. This requirement could have assisted in identifying other forms of loss-absorbing capital and liquidity in Silicon Valley Bank. Before 2018, the stress tests could have been operational annually, which could have identified the concentration of risks (Chotiner, 2023). However, the report indicates that Silicon Valley Bank mismanaged its risks using the safest, plain-vanilla assets. This implies that a stress-test system could have exposed their activities if it had been operational. The new law changed the banks’ subject to enhanced stress testing and the rest from fifty billion dollars to two hundred and fifty billion. This implied that banks below the 250 billion mark never underwent strict scrutiny.

Although the innovations of Dodd-Frank occurred in 2018, the regulators and supervisors retained all techniques needed to pursue any concerns on risk concentrations or risk management to the extent of forcing a bank into liquidation. The regulators and supervisors identified red flags but failed to act on them. According to the Federal report about the recent failures, the regulator noted that Silicon Valley Bank’s failures illustrate various weaknesses in regulation and supervision. The regulator notes that the regulatory standards for SVB were low, and the bank’s supervision failed to operate with adequate urgency and force (Barr, 2023). This implies that the supervisors were slow to understand the problems at SVB and failed to operate aggressively to ensure the challenges were fixed (Horsley, 2023). The report also blamed the change adopted in 2019 that exempted all banks except the most significant banks from strict scrutiny as well as the cultural shift towards less-assertive policing of banks as enabled the SVB’s challenges.

Furthermore, while the SVB was rapidly growing in size and complexity, the Federal Reserve changed its regulatory and supervisory policies based on various external statutory alterations, particularly the passage of the Economic Growth, Regulatory Relief, and Consumer Protection Act (EGRRCPA) in 2019 and internal policy choices (Barr, 2023). This Act forced the Federal Reserve to revise its framework for regulation and supervision, retaining the strict prudential standards for only eight banks but reducing the requirements for other large banks. For SVB, this caused lower supervisory and regulatory standards, notably lower capital and liquidity requirements. The higher regulatory and supervisory requirements could have reinforced the resilience of SVB.

According to Fed Report, SVB grew from 71 billion dollars in 2019 to over 211 billion in assets in 2021. The bank was not subject to strict supervisory or regulatory standards. The Federal Reserve should have appreciated the seriousness of vital deficiencies in the bank’s governance, liquidity, and interest risk management . This judgement implies that SVB remained well-rated, even as situations worsened and a significant risk to the bank’s safety and soundness emerged (Barr, 2023). The regulator also rated the bank as satisfactory in management, irrespective of continuously identifying weaknesses in risk management. It also rated the strong on liquidity irrespective of robust asset growth and idiosyncratic business model.

The report further accuses the SVB’s board of directors and management of failing to manage the bank’s risks. It states that SVB was a highly vulnerable organization that directors and management never appreciated. These vulnerabilities, prevalent managerial weaknesses, an intense business model, and dependence on uninsured deposits made the bank severely vulnerable to escalating interest rates and reduced operation in the technology industry between 2022 and 2023 (Barr, 2023). The board never received enough details on risks at SVB and never confronted the management for effectively managing the bank’s risks. The Fed noted that SVB failed its internal liquidity stress tests and lacked effective plans for accessing liquidity in a crisis (Barr, 2023). The bank managed its interest rate risks based on short-run profits and safety from probable rate decreases. It eliminated interest rate hedges instead of managing long-run risks and the threat of rising rates. This implies that the bank altered its risk-management moulds to minimize how it measured the risks instead of comprehensively tackling the fundamental risks.

Existing Resolutions to prevent these failures

It is challenging to control the banking crisis as central banks continue to tighter the monetary policy. Banking failures or crises are challenging to prevent in all contingencies, particularly in a fractional federal system where deposits must not fully back loans. The current bank crisis demonstrates the vital instability of banks’ business models. Irrespective of all these gaps, the regulators have proper crisis management frameworks to avert generalized contagion when a bank fails. Central Bank interventions, such as liquidity providers, are proper for controlling or preventing liquidity crises (Henriquez, 2023). Secondly, in the principle of central banking, the regulators have tools or techniques to tackle the insolvency of a single bank. For example, if a bank fails, the Federal Reserve or the central banks can resolve the crisis through a bail-in or a bailout. A bail-in entails banks using the money from depositors and unsecured creditors to assist them in avoiding failure. In a bailout, the regulators inject money back into the struggling bank, and large corporations assist them in avoiding bankruptcy. A bail-in is a good alternative theoretically to safeguard the taxpayers, but a bailout is the best in some cases. This is because a bail-in might cause financial instability, while a bailout creates a moral hazard and act as a hidden grant to the banking industry (FDIC, 2023). Furthermore, national regulators can tackle the crisis of one bank by facilitating mergers with national banks through moral suasion, subsidy, or both. Regulators in America currently use these strategies to limit bank failures.

Recommendations to strengthen the current global financial system.

The SVB crisis resulted from risk management, supervision, and regulation failure. In this context, the Federal Reserve should enhance supervision’s speed, force, and agility. They should introduce additional continuity between the portfolios, allowing a bank to comply with strict scrutiny as it grows. They should also be keen on the risks resulting from organizations with rapid growth and fixed business models. They should also empower supervisors to act during crises and guard against complacency. Based on regulation, the Federal Reserve should hike the baseline for resilience. They should enhance regulations on banks’ management of interest rate risk. They should also re-assess the stability of uninsured deposits and the management of held-to-maturity securities in the standardized liquidity regulations. They should also enhance regulations on capital requirements to align a bank’s capital requirements with the financial position and risk.

Furthermore, regulators should learn that all deposits are unstable and that partial deposit insurance is incredible. In the context of SVB, the regulators bailed out all depositors. However, banks should be required to insure all deposits ex-ante. If full deposit insurance is costly, the regulators should reform the banking system towards central bank digital currency or narrow banking to limit the bank’s activities to low-risk short-term investments. Secondly, the Federal Reserve should review the regulations to ensure proper regulations for all banks, irrespective of size. This is because not only large banks but also midsize banks cause contagion. When a crisis occurs, public authorities; intervention should stop it. The difference between systemic and non-systemic banks where the post-crisis regulatory framework is based is useless. All failures have systemic impacts and thus need proper regulations.

Conclusion

The banking sector is very volatile, and every player should operate with utmost care since all activities within the Sector are interconnected. Banks and regulators should develop strategies to ensure sound financial activity and proper safety of taxpayers’ money. For example, the Federal government should not only focus on inflation while determining the interest rate structure but also consider the impacts of high-interest rates on banks’ operations. Banks should also develop proper risk management strategies to define their investment choices and identify future risks early. Therefore, Banks and regulators are responsible for a sound financial sector free of continuous turmoil and pressure that might result in a financial crisis.

References

Barr, M. (2023). Re: Review of the Federal Reserve’s Supervision and Regulation of Silicon

Valley Bank.

https://www.federalreserve.gov/publications/files/svb-review-20230428.pdf

Chotiner, I. (2023). The Regulatory Breakdown Behind the Collapse of Silicon Valley Bank.

https://www.newyorker.com/news/q-and-a/the-regulatory-breakdown-behind-the-collapse-of-silicon-valley-bank

Farrell, M. (2023). Inside the Collapse of Silicon Valley Bank.

FDIC. (2023). Recent Bank Failures and the Federal Regulatory Response.

https://www.fdic.gov/news/speeches/2023/spmar2723.pdf

Eisinger, J. (2023). Regulatory Failure 101: What the Collapse of Silicon Valley Bank Reveals.

https://www.govexec.com/oversight/2023/03/regulatory-failure-101-what-collapse-silicon-valley-bank-reveals/384124/

Harle, P et al. (2021). The future of bank risk management.

https://www.mckinsey.com/~/media/mckinsey/dotcom/client_service/risk/pdfs/the_future_of_bank_risk_management.pdf

Henriquez, M. (2023). Early Lessons from the Recent Banking Turmoil.

https://www.imf.org/en/Publications/fandd/issues/Series/Analytical-Series/cafe-econ-early-lessons-from-the-recent-banking-turmoil

Hetler, A. (2023). Silicon Valley Bank collapse explained: What you need to know.

https://www.techtarget.com/whatis/feature/Silicon-Valley-Bank-collapse-explained-What-you-need-to-know#:~:text=Why%20did%20it%20collapse%3F,SVB’s%20depositors%20were%20startup%20companies.

Helmore, E. (2023). Why did the $212bn tech-lender Silicon Valley bank abruptly collapse?

https://www.theguardian.com/business/2023/mar/17/why-silicon-valley-bank-collapsed-svb-fail

Horsley, S. (2023). The Fed admits some of the blame for Silicon Valley Bank’s failure in

a scathing report.

https://www.npr.org/2023/04/28/1172715215/silicon-valley-bank-postmortem-federal-reserve-fdic-signature-bank

Inscribe. How Banks Manage Risk: Everything You Need to Know.

https://www.inscribe.ai/financial-risk-management/how-banks-manage-risks#:~:text=Banks%20develop%20risk%20management%20programs,prevent%20them%20from%20re%2Demerging

Obadire, A. & Obadire, K. (2023). The Impact of Bank Regulation on Bank Performance: A

Novel Analysis of the Pre-Covid Era with Cross-Country Evidence. American Journal of Industrial and Business Management, 13, 118-139.

Robe, I et al. (2010). Impact of Regulatory Reforms on Large and Complex Financial

Institutions.

https://www.imf.org/external/pubs/ft/spn/2010/spn1016.pdf

Siegel, R. (2023). Fed says it must strengthen banking rules after SVB’s collapse.

https://www.washingtonpost.com/business/2023/04/28/silicon-valley-bank-collapse-investigation/

Singh, J. (2023). The 2023 U.S. Regional Banking Crisis Is Far From

Over.https://thewire.in/banking/us-regional-banking-crisis-far-from-over

Turgut, T. (2018). Risk management process in the banking industry.

https://mpra.ub.uni-muenchen.de/86427/1/MPRA_paper_86427.pdf

Wiley, B., J., & Navickas, J. (2021). Effect of Financial Regulation on the Banking System in the

United States of America. Journal of Finance and Accounting, 5(3), 11-21

write

write