Risk assessments are subjective and arbitrary, but they are essential to risk management. It is crucial to comprehend audit assertions when talking about audit procedures. These refer to management’s stated or implied claims regarding the accuracy and comprehensiveness of certain items in the financial records (HASpod, 2022). Parallel to this, fraud risks involve possible dangers or weaknesses within a company and result in monetary misconduct or other fraudulent acts. This statement guides our discussion of the risk assessment process, which identifies, analyzes, and manages organizational hazards.

Introduction to the risk assessment process

Every business choice and activity involves risks. Uncertainties can boost or hurt an organization’s goals. As protections, key controls reduce or manage these risks. Financial institutions may have credit checks or investment limitations to manage credit or market risk. Risks fall into numerous categories. Strategic Management decisions affect strategic goals, creating risks and, for example, entering a new market or launching a new product. Operational Risks are linked to the day-to-day operations, and these include risks from system failures, employee errors, or external events—compliance Risks stemming from the need to comply with laws and regulations (HASpod, 2022). Non-compliance can lead to legal penalties. Credit, liquidity, and market risks affect an organization’s finances. Negative publicity is a reputational risk for the organization.

Risk scoring quantifies and prioritizes hazards. Risks are scored by likelihood and impact. High-impact, high-probability risks score higher and require prompt response. Risk scoring relies on Audit Assertions and Fraud Risks. Audit assertions concern financial statement correctness. The transaction, account balance, and disclosure claims are included. Risks depend on how probable these claims are to be wrong. Identifying fraud threats is crucial to risk assessment. This includes assessing internal (employee theft) and external (cyber fraud) risks. Internal control testing is crucial to risk assessment. It assesses risk mitigation controls. Testing can involve tracking a transaction from start to finish, directly witnessing processes and controls, or reading relevant documentation to ensure controls are followed. The auditor independently tests the controls’ efficacy (HASpod, 2022).

When XYZ Business entered the European market in 2021, they were met with unforeseen operational difficulties brought on by differences in culture and laws. This unanticipated complexity highlighted how crucial it is to carry out thorough risk assessments before stepping foot in uncharted territory. These kinds of events highlight the real influence that careful risk evaluations can have on avoiding potential hazards and guaranteeing a more seamless company expansion.

Importance of risk assessments

Risk assessments help organizations learn, evaluate, and prioritize risks. They underpin every risk management plan, preventing catastrophes and ensuring company continuity. Risk assessment helps companies allocate resources, improve decision-making, and promote risk awareness. This need is exacerbated in today’s dynamic corporate environment, where rapid changes can introduce or change hazards. Risk perception and management affect any organization’s decision-making. Effective risk assessments help leaders make informed decisions by revealing potential risks and opportunities (HASpod, 2022). They help firms optimize risk-reward by balancing risk and caution. Risk assessments affect new businesses, expansions, investments, and daily operations. Organizations can organize to optimize good results and minimize negative impacts by recognizing decision risks.

Risk assessments analyze processes and controls as well as identify risks (Aven, 2016). This analysis shows how existing approaches increase or decrease risks. It helps firms detect system gaps and controls that are not working. Risk assessments help firms improve risk management. This could involve adding controls, enhancing risk management communication and training, or changing operational tactics to lower risk. Risk assessments aim to reduce risk, and this involves devising methods to reduce risk or mitigate its impact. Insurance, hedging, contingency planning, and investment diversification are mitigation techniques. Risk assessments and responses must be reviewed and updated due to their dynamic nature (HASpod, 2022). A good control or strategy today may work better than tomorrow. Agile organizations must constantly analyze risks and refine risk management strategies in response to internal and external developments.

Examining ABC Corp’s 2018 strategic move serves as an example of the transformational power of thorough risk assessments. The company prevented millions in prospective damages and preserved its reputation by actively implementing a cybersecurity risk evaluation and thwarting a possible major data breach. This real success story shows how doing risk assessments can improve decision-making and act as a preventative measure against unfavorable occurrences.

Examples of risk scoring matrix

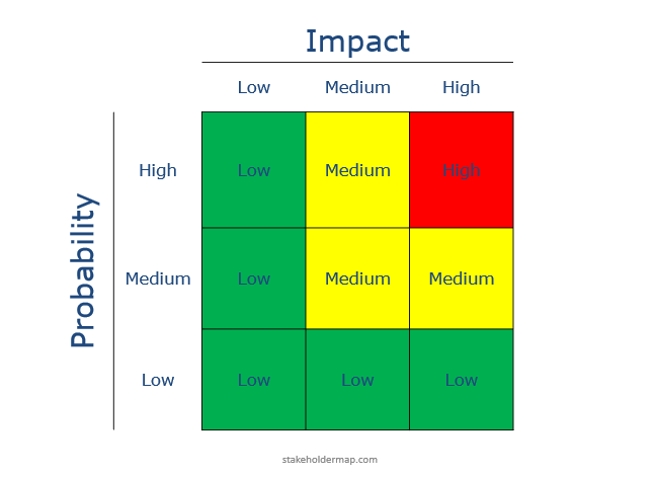

Risk management requires risk-scoring matrices to assess and rank risks by severity and likelihood (HASpod, 2022). They structure risk assessments for organizations.

Basic Risk Scoring Matrix

A basic risk matrix categorizes risk into levels such as low, medium, and high, based on two dimensions: likelihood (or probability) and impact (or severity). For instance, Low Risk (Low probability and low impact), Medium Risk (Medium probability and impact), and High Risk (High probability and high impact) (HASpod, 2022). In a manufacturing company, a risk such as “machine breakdown” might be rated as high risk if the probability of occurrence is high and the impact (in terms of production loss) is significant. Conversely, the risk of “minor delays in raw material supply” might be considered low if delays are infrequent and have minimal impact on operations.

Quantitative Risk Scoring Matrix

More complex matrices use a numerical scale (e.g., 1-5 or 1-10) to rate the likelihood and impact, providing a more nuanced assessment (HASpod, 2022). The overall risk score is often calculated by multiplying these two factors. In healthcare, the risk of a “patient data breach” might be scored as 4 (out of 5) for likelihood, considering the increasing cyber threats, and 5 for impact due to potential legal, financial, and reputational damages. This gives a total risk score of 20 (4×5), indicating a very high risk that demands immediate attention.

Industry-Specific Risk Scoring Matrices

Different industries tailor their risk-scoring matrices to reflect unique risks pertinent to their sector (HASpod, 2022). This customization allows for a more accurate assessment of the risks most likely to impact that particular industry. In the IT industry, a specialized risk matrix often emphasizes cybersecurity threats due to their prevalence and potential for significant damage. For instance, the risk of “ransomware attacks” is a critical concern. Ransomware attacks involve malicious software that encrypts a user’s data, with the attacker demanding a ransom to restore access. Given the increasing sophistication and frequency of these attacks, they are often rated high in both likelihood and impact. The scoring for likelihood might consider factors such as the level of existing cybersecurity measures, employee awareness of phishing scams (a common entry point for ransomware), and the general prevalence of such attacks in the industry. The impact is substantial owing to business disruptions, data recovery or ransom costs, and long-term reputational harm from a client or customer data breach.

Project Risk Scoring Matrix

Using risk-scoring matrices, project managers evaluate potential threats to project completion. These matrices examine project-specific elements like deadlines, resources, and scope. Construction schedule and resource allocation issues are common. Possible “delays due to weather conditions.” Weather can drastically delay construction. This danger may be medium, depending on the local climate and season. Construction in a season with heavy rains or storms may increase the likelihood score. Weather delays usually have a big influence. Delays can raise labor and equipment expenses, penalties for missing deadlines, and conflict with other projects. Delays are worse when the construction project has a deadline, such as a school building that must be finished before the new school year.

Challenges with Risk Assessment

Risk assessment is crucial in auditing and any organization. It faces various obstacles that could impair its accuracy and dependability. Effective risk management requires understanding and mitigating these obstacles (Aven, 2016).

Developing strategic solutions is necessary to navigate the obstacles in risk assessment. For example, XYZ Company effectively applied an established scoring framework to address the natural variability in risk scoring. This method, used in every department, reduced subjectivity and guaranteed uniformity in risk assessment. In addition, frequent training sessions were implemented to ensure that the workforce was knowledgeable about the latest developments in risk assessment techniques. This example shows how businesses can take proactive measures to resolve issues and create an environment that is more conducive to thorough risk assessment.

Varying Understanding of the Entity’s Nature

The heterogeneity in entity nature makes risk assessment difficult, especially for auditors. Auditor risk scoring is difficult without a thorough understanding of the organizational structure and operational operations (Aven, 2016). In the financial sector, an external audit team may need help understanding a bank’s derivative trading operations. This oversight can understate the danger of these activities, resulting in severe financial losses when market conditions change suddenly. Auditors need to undergo extensive onboarding and training to learn the company’s business strategy, industry hazards, and operational processes to solve this difficulty. Key individuals from diverse departments can also better comprehend the entity’s nature through regular encounters.

Understanding Risk-Scoring Criteria

Auditors must understand risk scoring criteria. Misinterpreting risk severity or likelihood might lead to successful risk management tactics with this understanding (Aven, 2016). In healthcare, an auditing team may misjudge a hospital’s IT system’s data breach risk. Because they need to comprehend cybersecurity risk-scoring standards, they may underestimate the likelihood and impact. This mistake can lead to insufficient protection and a major data breach. Regular risk assessment methodology and criteria training and seminars might be advantageous. Additionally, a standardized risk-scoring matrix across the company may provide risk assessment consistency and clarity.

Conclusion

A significant challenge in the auditing process is the tendency to fall into a cycle of repetition. The same issues are commonly found when auditors audit the same organizations using the same methods. Repeated audits reduce their usefulness and frustrate management, especially when they fail to address audit report findings and recommendations. The absence of effective follow-through and implementation of suggested improvements is a major risk assessment gap. Research is needed to build dynamic and adaptive audit methods. Data analytics, artificial intelligence, and machine learning can be used to uncover new hazards instead of traditional audit methods. Future studies should examine ways to increase management engagement and accountability in audit results. This could involve improving auditor-management communication to turn audit findings into actionable improvements. Continuous auditing and real-time risk monitoring can detect and control issues early. It would be useful to study how these systems fit into risk management. Risk assessments are crucial to organizational risk management, but their current status typically fails to improve internal controls and risk management processes.

The field of risk assessment is positioned for revolutionary developments in terms of direction-setting. Artificial intelligence (AI) and innovative analytics are particularly noteworthy as a future-oriented approach. The business’s ability to recognize, assess, and handle possible threats could be drastically changed by these technologies, which have the potential to provide a more fluid and comprehensive understanding of risks. The combination of human experience and technological prowess is poised to reshape risk assessment procedures as we enter the digital age, bringing with it an increased level of flexibility and adaptability.

References

Aven, T. (2016). Risk assessment and risk management: Review of recent advances on their foundation. European Journal of Operational Research, 253(1), 1–13. https://doi.org/10.1016/j.ejor.2015.12.023

HASpod. (2022). The 5 Types of Risk Assessment And When To Use Them. https://www.haspod.com/blog/paperwork/types-of-risk-assessment

write

write