Introduction

Tesla Inc. is an American multinational leading in the manufacturing and distribution of electric vehicles, energy storage devices, and solar systems in local and international markets. Markets and economists ranked Tesla Inc. as the most valuable automotive brand and one of the most valuable brands across industries in June 2023 (Carlier, 2024). Over the years, the company has made significant efforts to widen its customer base and increase the sale of all Tesla models. Technology integration and continuous improvement of Tesla models, such as sedans and crossover vehicles, have notably been some of Tesla’s strategies to attract and maintain customers (Carlier, 2024). Consequentially, its market shares in the major and minor global markets have improved significantly. According to Statista research, Tesla led the battery-electric market in sales in 2022 (Carlier, 2024). Its vehicle deliveries across the US, China and international markets reached a record of 1.3 million units despite the global automotive conductor shortage witnessed in the same year (Carlier, 2024).

Description & History of Tesla Inc.

Tesla Inc. is an American automotive and clean energy company headquartered in Austin, Texas. It has major manufacturing facilities in the United States, China and Germany. Its major operational activities include designing, manufacturing and selling passenger cars, sedans, cybertruck and crossover vehicles (Farley, 2023). Its prominent and bestselling models include the Tesla Model Y, Model 3, Model S, Model X, and Tesla Cybertruck. The company has also ventured into the solar electricity business. They manufacture, install and maintain clean energy generators/storage systems in client homesteads (Farley, 2023). Most importantly, the company’s relentless engagement in the production of clean energy products and electric vehicles. Additionally, its modern and unique models integrated with 21st-century technology make it stand out as one of the most valuable brands worldwide. Tesla Inc.’s mission statement argues that the company is objectively aiming to accelerate the introduction of sustainable transport by bringing compelling market electric cars into worldwide markets as soon as possible (Musk, 2013).

Martin Eberhard and Mark Tapenning founded Tesla Company in 2003 (Wu, 2023). The two Silicon Valley engineers wanted to prove that electric vehicles could be safer, better, quicker and fun to drive than gasoline-powered vehicles. Eberhard and Tapenning met at Wyse Technology as engineers. They became good friends, and both had a passion for developing companies. They launched NuvuMedia Company, which released the Rocket eBook in 1998 (Wu, 2023). Soon later, in 2001, Eberhard and Tapenning met Elon Musk after they heard his speech at Stanford University. Musk had initially made significant fortunes from the sale of his online payment system, PayPal (Wu, 2023). He made $165 million from the sale. In 2003, Musk incorporated Tesla and led the initial rounds of funding (Wu, 2023). Friends, family members and firms were his initial investors. Since then, Musk has been leading in designing and manufacturing various Tesla models. Above all, the company has made immeasurable gains and profits despite the unforeseen market challenges.

Tesla exports and market shares in China and worldwide markets

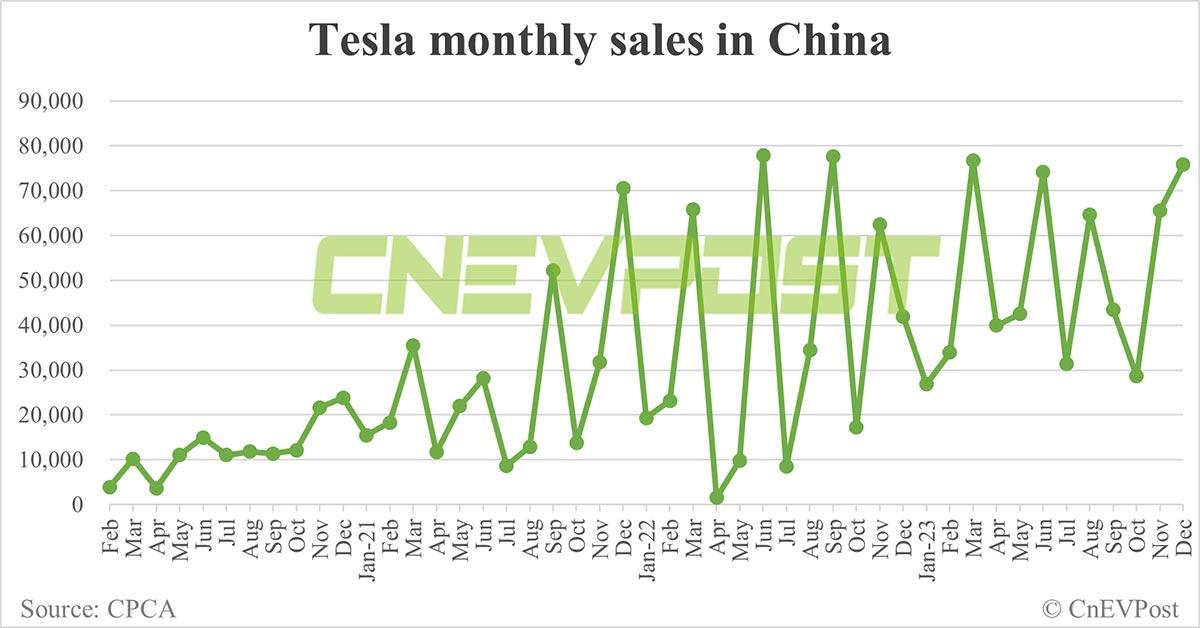

With the increased demand for Tesla vehicles in China, Kang (2024) assures that Tesla made incredible sales in December 2023, amounting to 75,805, 15.73% higher than sales made in November 2023. Tesla’s Shanghai plant contributed 18, 334 sales in the same month, higher than November’s percentage contribution by 8.31% (Kang, 2024). Figures 1 and 2 below indicate the changes in Tesla Exports across quarters and months from February 2020 to December 2023. We can also see the size of the company’s market share in China’s economy. Kang mentions that the Shanghai plant is the leading producer of Model 3 and Model Y for the local and international markets.

Figure 1: Tesla Monthly Sales since February 2021

Source: Kang, L. (2024, January 9). Tesla sells 75,805 cars in China in DEC, exports 18,334 from Shanghai Plant. CnEVPost. https://cnevpost.com/2024/01/09/tesla-sells-75805-cars-china-dec/#:~:text=For%20the%20full%20year%202023,data%20compiled%20by%20CnEVPost%20

The figure above shows the trend in sales between February 2020 and December 2023. It is notable that the company is witnessing a significant increase in sales across quarters. For example, in the first quarter of 2020, the average sales were approximately 10,000 units, while the average sales in the first quarter of 2022 were approximately 50,000 units and approximately 75,000 units in the first quarter of 2023. Similarly, an increase in sales translates to an increase in market shares. Figure 2 below shows the total Shanghai plant exports across quarters in the same period.

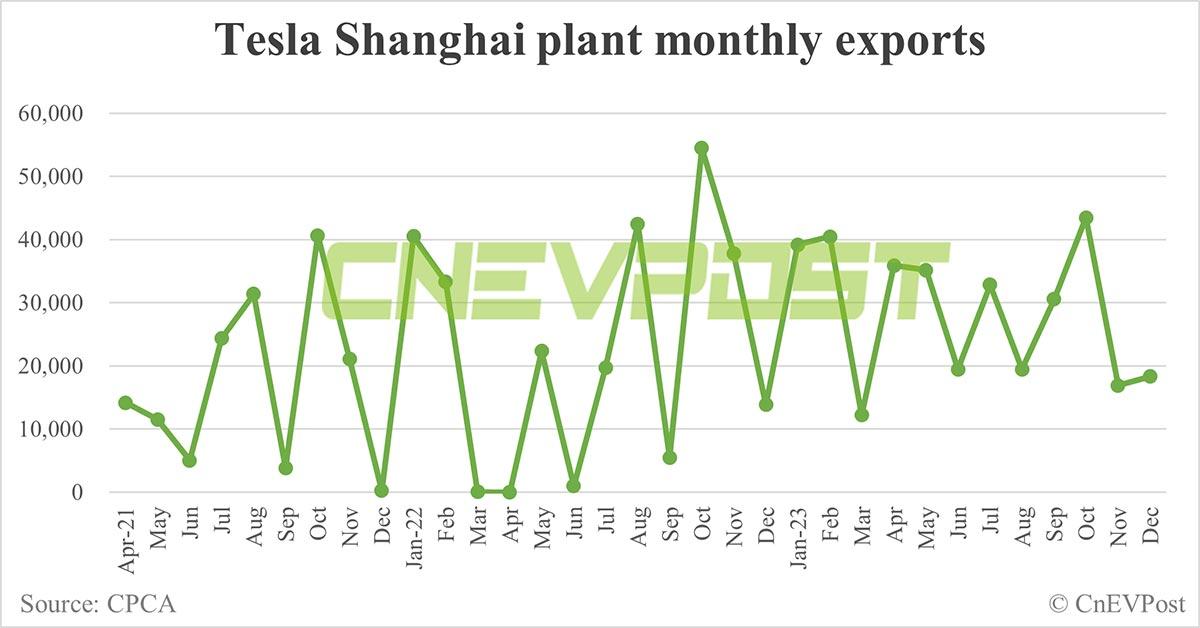

Figure 2: Tesla’s Shanghai monthly exports

Source: Kang, L. (2024, January 9). Tesla sells 75,805 cars in China in DEC, exports 18,334 from Shanghai Plant. CnEVPost. https://cnevpost.com/2024/01/09/tesla-sells-75805-cars-china-dec/#:~:text=For%20the%20full%20year%202023,data%20compiled%20by%20CnEVPost%20

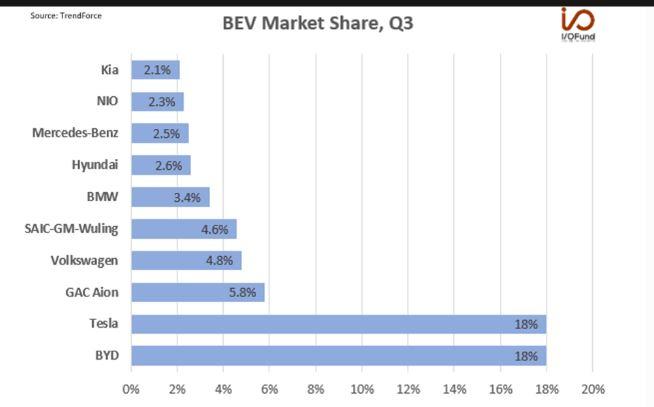

In Comparison with BYD BEV market shares, Forbes research shows that Tesla held approximately 20.1% share of China’s BEV market on a YTD basis up to Q3. BYD held a 15.9% market share of China’s BEV market. However, the final analysis shows that both companies matched in quarter 3, each holding 18% of China’s BEV market shares regardless of the differences in sales between the two companies in China’s market.

Figure 3: BEV market shares of companies in the Chinese market (Q3, 2023)

Source Kindig, B. (2023, December 11). Tesla’s China Market Share continues to slide. Forbes. https://www.forbes.com/sites/bethkindig/2023/12/07/teslas-china-market-share-continues-to-slide/?sh=56d867d6659f

Figure 3 above shows the volume of BEV market shares held by different companies in the China market. Tesla and BYD are two prominent companies with competing BEV market shares. Nevertheless, Tesla appears to be gaining a competitive edge since it thrives in a foreign land.

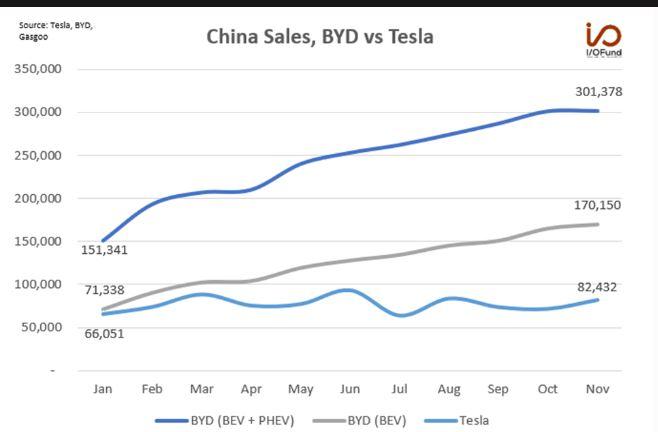

Figure 4: Differences in Tesla and BYD sales between December 2022 and November 2023

Source Kindig, B. (2023, December 11). Tesla’s China Market Share continues to slide. Forbes. https://www.forbes.com/sites/bethkindig/2023/12/07/teslas-china-market-share-continues-to-slide/?sh=56d867d6659f

Figure 4 above shows the differences in Tesla and BYD sales. The chart is very important to this study because it signals how Tesla is becoming competitive in China despite the constant rise in BYD BEV sales across months. Tesla should intensify manufacturing to upscale its competitiveness and improve its market position. They have the potential to increase their China BEV sales from 82,432 units to more than 120,000 units to match up BYD BEV sales.

Worldwide market sales

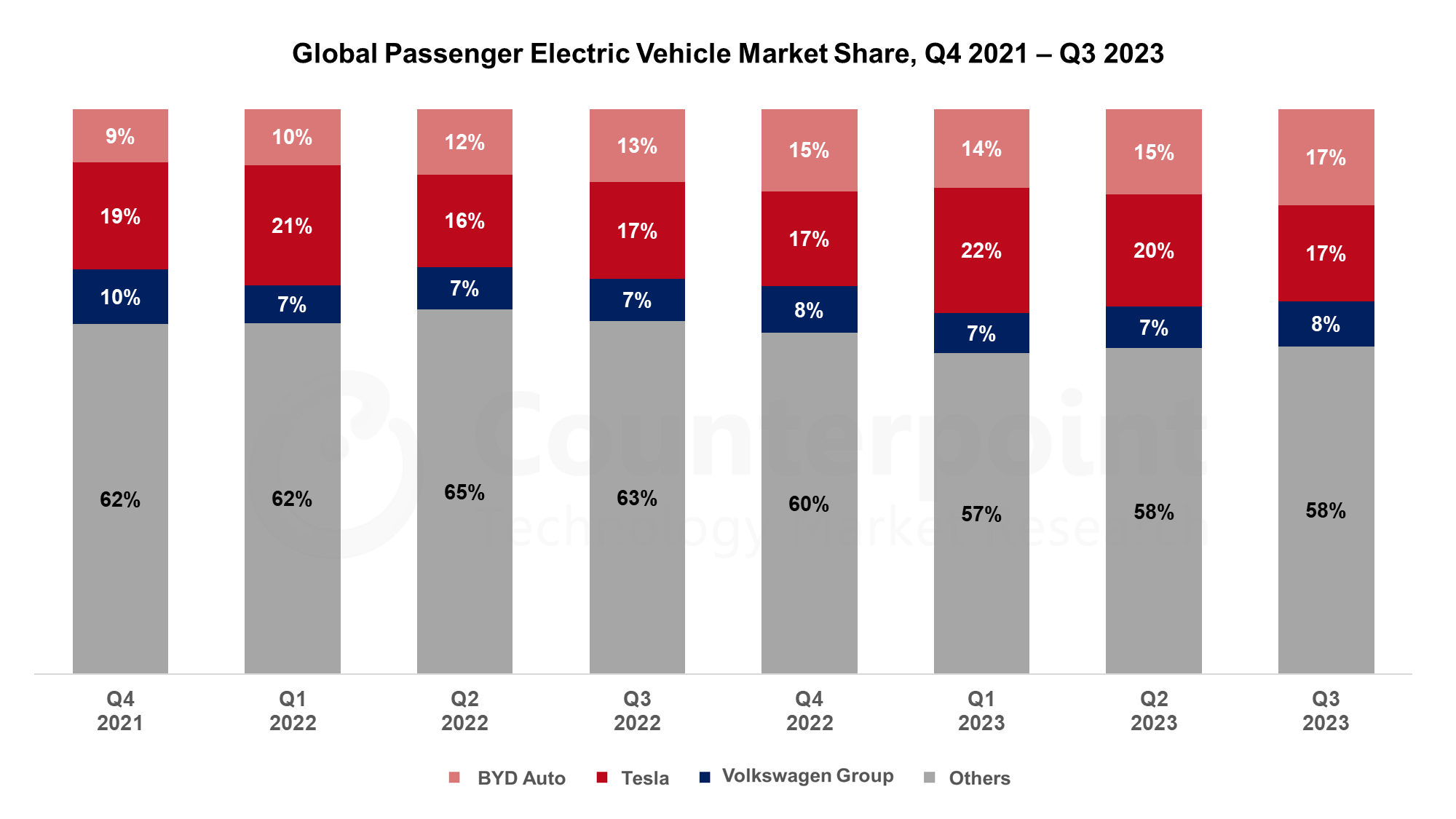

Figure 5 below shows the total market shares of Tesla, BYD, and other companies manufacturing electric automobiles.

Figure 5: Global Market Shares for Tesla, BYD and other companies

Source: CounterPoint. (2023). Global Passenger Electric Vehicle Market Share, Q4 2021 – Q3 2023. Counterpoint. https://www.counterpointresearch.com/insights/global-electric-vehicle-market-share/

From Figure 1 above, Tesla’s global market shares in quarters 1, 2, 3, and 4 were slightly higher than BYD’s global market shares in the same quarters. Additionally, Tesla’s market shares were high in quarters 1 and 2 of 2023 and equivalent in quarter 3. The matching up of shares may be due to an increase in BYD Auto manufacturing volume. Nevertheless, Tesla is better positioned to overcome the BYD competition, especially in the US and China BEV markets.

Conclusion

China, Germany, and the United States markets remain competitive zones for Tesla Motors and BYD Auto businesses. Both companies must adopt competent manufacturing and marketing strategies to widen their customer base and increase sales. In Figure 1, Tesla appears to be gaining more customers due to tremendous increases in sales by 15.73%. Figure 5 also shows the constant increases in BYD BEV sales volume across all quarters in 2023. Therefore, it is upon Tesla to upscale its manufacturing efforts to match up with BYD’s market shares in China. Nevertheless, it is evident in Figure 5 that Tesla has been holding the largest market shares from quarter 4 of 2021 to quarter 2 of 2023, despite matching up in Q3 of 2023. Above all, Tesla is responsible for overcoming BYD’s competitiveness to gain higher global market shares because the above statistics prove that BYD Company will gain more global market shares if Tesla fails to meet market demands in the first, second, third and fourth quarters of 2024.

References

Carlier, M. (2024). Topic: Tesla. Statista. https://www.statista.com/topics/2086/tesla/#topicOverview

CounterPoint. (2023). Global Passenger Electric Vehicle Market Share, Q4 2021 – Q3 2023. Counterpoint. https://www.counterpointresearch.com/insights/global-electric-vehicle-market-share/

Kang, L. (2024, January 9). Tesla sells 75,805 cars in China in DEC, exports 18,334 from Shanghai Plant. CnEVPost. https://cnevpost.com/2024/01/09/tesla-sells-75805-cars-china-dec/#:~:text=For%20the%20full%20year%202023,data%20compiled%20by%20CnEVPost%20showed.

Kindig, B. (2023, December 11). Tesla’s China Market Share continues to slide. Forbes. https://www.forbes.com/sites/bethkindig/2023/12/07/teslas-china-market-share-continues-to-slide/?sh=56d867d6659f

Musk, E. (2013). The mission of Tesla. Tesla. https://www.tesla.com/blog/mission-tesla

Wu, A. (2023a). Tesla’s got the keys: A history of its success. Investopedia. https://www.investopedia.com/articles/personal-finance/061915/story-behind-teslas-success.asp

Wu, A. (2023b). Tesla’s got the keys: A history of its success. Investopedia. https://www.investopedia.com/articles/personal-finance/061915/story-behind-teslas-success.asp

write

write