Introduction

Google Inc., which was established in Delaware in 1998, is the world’s most prominent search engine technology firm. Sergey Brin and Larry Page co-founded Google in 1996. Over the years, the company has become one of the most well-known and recognized globally. With the advancement of technology, the company’s services have expanded well beyond search engine technology. Increasing advertising in emerging countries like Russia and China is part of Google’s strategy to become the most popular Internet search engine. The company’s products have grown more varied due to the acquisition of Motorola Mobility Center and Keyhole. Google Inc. has achieved unparalleled levels of development and profitability due to a fantastic business strategy implemented by the corporation. The five forces analysis, SWOT analysis, and strategy road map of Google Inc. are all utilized in this article to highlight the company’s primary success aspects, which are then discussed further.

Executive summary

Two computer science student students, Sergey Brin and Larry Page of Stanford University, founded the first search engine in 1996 when they collaborated on a joint project. The Backrub was the company’s original name. In 1998, the name was changed to Google Inc., a play on the mathematics term “googol,” which refers to a single number followed by one hundred zeroes. In addition to its headquarters in Mountain View, California, Google also has offices in other parts of the globe. The company’s management is delegated to senior executives and members of the Board of Directors (BoD). This expansion has been fueled by a slew of developments that have made it possible for users to use the Internet search service without visiting a Google-affiliated web page, such as wireless search, search capabilities in more than 10 languages, and the Google Toolbar browser plugin. By the year’s conclusion, Google also offered Google News, Google Local, and the Google Scholar service, amongst other features. Aside from its nation domains reaching 150 by the end of 2004, Google’s web pages index grew to eight billion. After its initial public offering (IPO), Google Inc. had a record-breaking first day. The two co-founders made approximately $3.8 billion on the first day of trade as their company’s shares soared by 18%. The company’s employment had grown to more than 900 people, each earning over $1 million (Mogensen, 2018, p.723).

The Google Inc. Strategic Issue

Google Inc. has not confined its facilities to the Internet search expertise solely. Since 2005, the corporation has released various items with significant inventions and enormous financial reserves. It established new Internet apps through numerous strategic acquisitions to give advertising possibilities that underlie the giant’s immense success today. Notably, the purchase of Keyhole, a digital mapping business, permitted the introduction of Google earth in 2005. Motorola Mobility was also purchased by Google for $12.5 billion back in 2012. This purchase positioned the corporation in the hardware sector, bringing competition to Apple Inc. When Android was first released in 2008, it was considered as a step toward integrating the software into the hardware industry, as Apple Inc. has done.

In 2007, Google added street-view photos taken by Google camera vans as they drove around the globe to Google Maps. The technical method allows users to connect digital photos, webcam feeds, and videos to places presented by the Google mapping engine. Additionally, the business made it feasible to attach real estate listings and brief personal notes to the Google Maps locations. In 2010, the earth-view option was added to Google Maps, enabling users to see 3D views of various locations from the ground level (Gawade et al., 2020, p.41). Google’s goal was to become the world’s most popular search engine and dominate the Internet advertising market. Because of this approach, internet adverts are now available in more than 41 different languages all over the globe. Its 2012 revenue was split 50/50 between domestic and international sales. In 2013, the firm strategy concentrated on moving into new markets like Russia and China. However, approaching China, the world’s biggest developing market, was difficult. Local search companies like Baidu posed the most significant danger in China. To make things even more complex, the government mandated the censorship of search results. Google has just a 3% share of the Chinese market due to disagreements with the government (Mogensen, 2018, p.723).

Overview and Critique of Porter’s models of competition

A novel gaming scheme, such as a “Microsoft Xbox” or “Sony PlayStation,” may impact digital game sales, but Porter initially disregarded complements and replacements. Many management theories believe that to be a sixth factor [Wilkinson, 2013]. No matter whether an industry is expanding or established, high-tech or low-tech, managed or uncontrolled, according to Porter’s theory, “Industry structure impacts competitiveness and profitability.” Firm profitability may be affected by more than simply industry structure in certain cases, according to Porter (2008:32). The profitability of businesses may be adversely affected by government action and judicial action alike (Bruijl, 2018, p.95). As a result of this, Grundy (2006) argues that Porter oversimplifies industrial value chains. This is especially true in markets where the producer sells directly to consumers and via distributors, necessitating a distinction between channels, intermediary purchasers, and final consumers. Porter does not indicate which customers are of greater importance and therefore rank higher in terms of importance. Distributors may compete with producers in various industries by selling similar or even rival items.

One of the model’s most glaring flaws is that it is a static one. In a sense, it’s a time capsule of the entire industry at one point in its history. However, the model has little added value in today’s world of continual change and rapid dynamism. While the PEST Framework and Porter’s Five Forces provide us a notion of assessing dynamism, much of this is regulated by and intimately related to the PEST framework, such as a SWOT analysis. The ‘800-pound gorillas’ of Porter’s five forces archetypal of competitive returns are referred to as ‘gazelles’ by Merchant [2012], citing another complaint. As the colonial era moves towards a “pull” strategy where customers desire the product before the companies offer it, he asserts that businesses must be “quick, flexible, and adaptive,” using social media and other “social era” factors to create a customer base via “pull” strategies (the gorilla). A company’s ability to adapt, rather than its position in the market, is given more importance here, as Porter did not.

A firm’s strategic positioning can be developed using a model provided by Dobbs, M.E. (2014), but Porter himself does not offer a model to follow. As Bruijl, 2018 have observed, “there is little use undertaking any effort on policy if employees aren’t able to verbalize it and, as a consequence, behave per it,” Porter prefers to concentrate on the five factors on their own rather than how a corporation may utilize these forces. For these reasons, Porter’s five forces model, which focuses on microeconomic theory rather than the practicalities of the business world (as well as being highly prescriptive and rigid), is rarely (if ever) used by practicing managers, according to Bruijl, 2018.

However, Porter’s model does not adhere to the sustainability of competitive advantage, which may be its most glaring flaw of them all. Many models of a modern strategic theory based on or even originate from the industry-based view, which includes the five forces archetypal, but the five forces model can only help a company gain competitive advantage, not sustain it. On the other hand, other Resource-Based-View models provide frameworks that address this shortcoming. Central Skills and knowledge by Prahalad and Hamel [1996] differs from the Dynamic Capabilities model, which concentrates on a company’s ability to respond to the changing challenging world (for example, Alphabet Inc.). Instead, it tries to build intangible core capabilities, such as organizational culture or patents, that can be maintained for a long period of time (for example, Google). Resource imitation, causal ambiguity, unique historical trajectory, and temporal compression diseconomies are also raised by Barney [1991]. (Bruijl, 2018, p.95).

Company analysis

Google’s SWOT Analysis

Swot analysis is an abbreviation for “strengths, weaknesses, opportunities, and threats. A company’s micro-and macro-environmental elements are the focus of this research. This section presents an in-depth SWOT analysis of Google Inc.’s business model) (Khan et al., 2019, p.995

Strengths

The internal environment of Google Inc. has several advantages. As a start, each product is imbued with the company’s objective (to reorganize the world’s knowledge to make it universally accessible and helpful). Many experts in open-source software development consider these goods and services to be of the highest quality. Allowing the company to grow in any way, its openness enables it to do so without being limited to a specific business area of competence. This also means clients are carefully taken care of. The company’s products are geared toward providing customers with a unique and memorable experience. The business assures its customers that the products it sells are up to their expectations in terms of quality and functionality. For example, Google Maps and digital pictures may keep track of photo opportunities at different events and places.

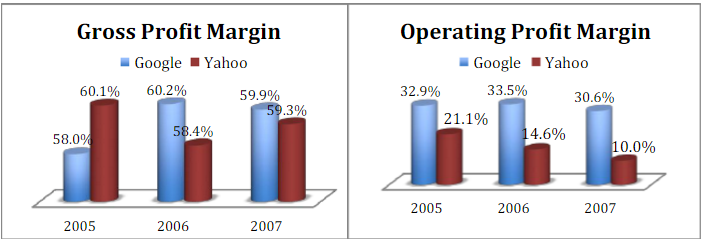

Google, Inc. is well-equipped to handle all its projects and endeavors in terms of finances. Between 2001 and 2006, the company’s financial statistics on profitability and liquidity (shown in figures 3, 4, and 5 respectively). Earnings of $ 49.99 billion and profits of more than $10.99 billion make the corporation one of the most lucrative globally (21.9 percent). Over $47 billion in liquid assets and debt of only $.6.9 billion make it one of the most liquid companies in the world (Khan et al., 2019, p.995. Because of its strong financial position, the corporation can afford to make significant investments in cutting-edge technology and the finest available human talent. It is the largest source of money for the vast search engine; thus, its online advertising is quite successful. Customers may see Google Ads on websites they visit because of the firm’s fascinating partnerships with them. As a result of viral advertising, Google can sustain its year-over-year profitability. According to the appendix, Google’s performance has grown far faster than its competitors (Figure 5). Figure 6 depicts the Google Inc. Financial Ration study.

In addition, Google Inc. possesses a patent portfolio that is unrivaled in strength. On the global patents list in 2012, the firm ranked No. 21 with more than 1150 patents (Gamble, 2013). For Google Inc., intellectual property is the most critical lever for achieving a competitive advantage over competitors. Google’s purchase of Motorola gives it a significant competitive edge over its competitors. Furthermore, Google’s ability to seamlessly integrate its many products is unquestionably one of its greatest assets. There is a feasible ecosystem for outstanding customer experience when all its products are integrated. To buy one item, you have to buy another. Even among the world’s biggest I.T. corporations, this degree of integration is rare.

Weaknesses

Several internal issues constrain Google. First and foremost, it depends only on advertising to generate revenue. The company’s revenue climbed by double digits due to the company’s growth in internet advertising in 2013. Second, Google provides a single search bar. To become a producer instead of a finder is difficult because of this issue. The corporation has been attacked based on internet privacy. Critics allege that users may examine other users’ personal information in YouTube, Picasa, and Orkut accounts. Besides, the litigations affecting the corporation are expensive and resource-demanding. It is a source of diversion from its business duties (Khan et al., 2019, p.995.

Opportunities

The online business world is expanding at a rapid pace. The decline in smartphone sales has given Google Inc. a golden opportunity for growth and success. Due to the rapid rise of smartphones, people using the internet have skyrocketed. The growing use of smartphones has allowed the company to expand its online operations. Additional Google Inc. potentials include building an autonomous browser that speeds up Internet downloads and improving its systems to deliver greater real-time feedback to the almost infinite number of customers of Google Inc. Extended relationships with smartphone manufacturers are an opportunity for Google because of the increasing number of smartphone makers. Its autonomous database software can structure databases to allow clients to search for specific information more effectively. In addition, the corporation is taking advantage of the company’s ongoing growth of its network. In addition, as local news becomes more important to communities, Google News’ functionality is expected to grow. The expansion of the company’s services into new markets, such as China, offers significant growth potential.

Threats

Copyright disputes and concerns on music, movies, books, and legal issues impacting YouTube are just some dangers Google Inc. confronts. An additional issue is that customers are reluctant to use Google because of the company’s reputation for storing their personal information. Anti-spyware software and tools put Google cookies at risk because of their existence on the system. AdWords and AdSense growth may be affected by this situation.There is also a risk that Google’s servers could be hacked, resulting in catastrophic damage. Google Inc. faces a severe threat from a Microsoft-Yahoo! joint venture (Khan et al., 2019, p.995. The corporation is still burdened by its free offerings, which result in losses. If a company introduces unprofitable or low-value items, its earnings will soon decline.

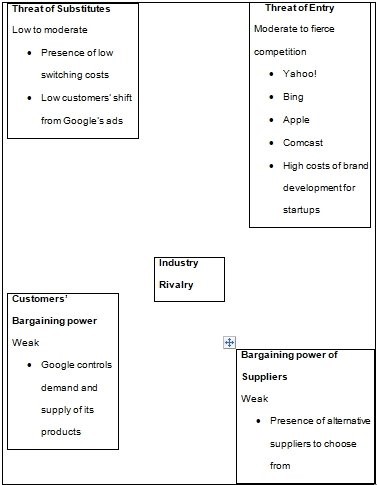

Porter’s Five Forces Analysis and HowPorter’s Five Forces Model Fit with Google Practitioner’s Experience

Organizations utilize the Porter’s Five Forces Model to understand their macro-environment better and better align their strategic goals. Businesses need to enhance their external surroundings in light of the ever-changing business world, unpredictability, and the trend of globalization. Analyzing the environment with this tool allows you to spot potential problems that could impact the company’s long-term growth. Michael E. Porter coined the term in 1979, and the tool considers the competition in the given industry. Several external factors, such as supplier power, barriers to market entry, competitive rivalry, the threat of substitutes, and the power of buyers, have a significant impact on Google’s external environment (Bruijl, 2018, p.95).

Google Inc. is facing stiff competition, which might restrict the company’s ability to expand. Other external factors, such as low switching costs and a large number and variety of competing businesses, must be considered by the company in light of the market competition. Numerous companies compete with Google daily. As a result, Google offers a wide range of services and products, including advertising, Glass, Fiber, Android O.S. for mobile devices, and the Chromecast. As a consequence of the wide range of products available, there has been an increase in competition. As a result of product innovation and differentiation, it has gained an unmatched competitive edge over its rivals.

Google’s consumers’ bargaining power is weak; thus, the business has a chance to control both the demand and supply of its goods. Google’s weakened negotiation position is due to a variety of issues. At first, the giant search engine has little impact on the small size of individual buyers, who represent a weak force. The company’s income is mainly derived from corporate customers. Second, individual consumers have minimal influence over Google Inc. due to the significant demand for online items from the corporation and its competitors. Because Google offers so many different goods, suppliers have little leverage in negotiations. Suppliers’ lack of negotiating strength may be attributed to various issues, including the abundance of suppliers in the sector. The two elements reduce negotiating strength since Google may choose from a broad pool at a regulated cost. As a result of this predicament, the corporation can change suppliers. Due to Google’s wide range of goods, the suppliers are diversified (Bruijl, 2018, p.95).

Google Inc. has a low to moderate risk of product substitution. Alternatives to online advertising include traditional media such as television, radio, and print. As replacements are readily available and switching costs are minimal, substitutes offer only a mild danger. No matter how many people click on Google’s advertising, it has little effect on the corporation. The possibility of new entrants has a modest impact on Google’s company in various ways. Firstly, the low cost of starting a new firm means that Google is vulnerable to growing competition. It is challenging for new enterprises to join the internet advertising and other sectors because of the high cost of brand creation.

Conclusion

Google Inc. is the most popular online advertising corporation in the world today. These two Stanford undergrads started a startup that’s changed everything in the ad industry. Globally, it has maintained its dominance in the industry via general and broad initiatives. Google Inc. says that it has complete command over the supply and demand for its goods.

To determine the direction of the strategic policy, the company employs Porter’s Five Forces analysis approach based on a shared norm of the strategic policy. Since the quality of information that customers have access to is decreasing, they have less bargaining power when it comes to pricing, and suppliers have less negotiating power when it comes to a wide range of products like Google Glass; Google has a strong and leading market share as a strategic management position in the area of cost leadership. In other words, there are a variety of market forces that Google is dealing with, and each one requires a specific strategic management application.

The Nexus smartphone and the most frequently used iteration of the Android operating system have recently been added to the company’s product portfolio, which now includes virtual desktops and mobile applications. This strategic study used Porter’s Five Model and SWOT analysis to address Google’s micro-and macro-environments. Internet searches are predicted to skyrocket as the knowledge-based economy grows in popularity. In light of the company’s business strategy, the company’s activities are largely unaffected by economic, political, legal, and cultural variables. Investing in creating mobile apps may help Google Inc. become more competitive. Google’s innovation skills may fill this market vacuum in other industries where mobile applications are in high demand, such as banking, healthcare, and insurance.

Recommendations

Google’s Generic Strategy

An industry-wide perspective informs Google’s strategic decisions. The general strategy strongly influences the company’s actions. Google’s generic strategy has impacted the highly competitive business. Innovating new products and expanding markets are the pillars of this strategy. Differentiation is the firm’s general strategy, according to Porter’s model. An innovative business strategy bolsters Google’s competitive edge. Firms differentiate themselves from one another by offering distinctive products. A vital advantage of the organization is its creativity. Google Inc. has innovated with products like Google Fiber and Google Glass. Google’s algorithm evolves to maintain competition and growth. According to experts, Google’s algorithm surpasses Yahoo! and Bing in search. The continual innovation of Google Inc. sets it apart from its competitors. Goals for product development and differentiation strategy are intimately linked. The company also ensures that its present products are regularly improved for its market position and profitability. The company’s general differentiation strategy keeps it competitive with other industry participants.

References List

Bruijl, G.H.T., 2018. The relevance of Porter’s five forces in today’s innovative and changing business environment. Available at SSRN 3192207 pp.95-96.

Gawade, P., Kumari, L. and Dagur, P., An Analysis of the Impact of Human Resource Planning and Development as a Mean for Accelerating and Improving the Organisational Performance. JournalNX, pp.41-46.

Khan, U.A., Alam, M.N. and Alam, S., 2019. A critical analysis of internal and external environment of Apple Inc. International Journal of Economics, Commerce and Management, 3(6), pp.955-961.

Mogensen, B.G., 2018. Managing Corporate Legitimacy Through CSR Reporting: A Qualitative Case Study of Google Inc.’s Supplier Responsibility Reports (Master’s thesis) pp.723-781.

Appendices

Porter’s five forces model

write

write