Executive Summary

Seedcamp Venture capital firms have been investing in start-up businesses in the UK. The source of capital comes from contributions from its current owners and fundraising. That said, the organization stands a great chance to expand its regional operations, but the current issue is the need for more funds. The organization, values, and goals provide a better breed of services to a business needing expert support with hiring and engaging the latent they need. One of the ways to attain this objective is to identify individuals with specific talents and train them on how to perfection on their skills, thus making them productive. As one of the ways to secure financial stability and the future of the business, Seedcamp Venture capital strategies are much on investment (Cannon & McGee 2011, 115). Here, the organization plans to buy shares from Join Talent Company, thus gaining cooperate management of the business. From the joint venture, Join Talent can create a pool of funds by collecting the gains from different organizations they have shared. This has helped the organization to have financial stability and independence over the years. In this report, we will explore Join Talent Company as one of the potential start-up businesses in the UK in which Seedcamp Venture Capital will invest its funds. To thoroughly analyze the current financial status of Join Talent Company, I will highlight the reasons for identifying this Company as a promising start-up company. Here I will highlight its current ownership of the Company, the likelihood that the Company is for sale, its unique selling proposition, the business market characteristics, the competitive landscape, the venture personnel, the available fixed capital resources, the possible financing structure, and the price evaluation of the business (Magazine 2022, 12). Finally, I will evaluate the exit company strategy in terms of the potential gains based on its social-cultural objectives. This will cut across the business valuation, existing strategies, value creation, and capital structure.

1.1 Section of the Firm

Join Talent Company is a talent acquisition business founded to provide a new, better breed of services to businesses needing expertise by hiring and engaging the needed talents. This start-up company aims to help businesses improve their performance, thus enhancing the chances of growth Join (Join Talent 2022, 45). The organization connects businesses with its suppliers and customers in an easy way by establishing a networking platform. Due to the high rates of entrepreneurship development in the UK, this business stands a greater chance of development as they adopt strategic and unique ways to manage an organization. This starts with sourcing, consulting, implementing, and searching. This aids businesses with an easy time in decision making as already a pool of talents has been attracted based on each business need. This service ensures a sufficient labor force once innovation and creativity have been done. The business founders are Katrina O’Neill and Kelvin Blair (Join Talent 2022, 45). Additionally, over the years since the business was founded, the start-up has gone through seed funding as one of its ways of raising funds.

Current Directors & Secretaries

| Name | Role | Date Of Birth | Appointed |

| MS KATRINA HUTCHINSON-O’NEILL | Director | May 1978 | 18 Dec 2018 |

| MR GARETH GERARD O’NEILL | Director | Aug 1980 | 02 Sep 2019 |

| MR KEVIN BLAIR | Director | Sep 1977 | 15 Jan 2020 |

| MR KEVIN MATTHEW BLAIR | Director | Sep 1977 | 15 Jan 2020 |

Figure 1.0 Previous Directors & Secretaries

Since the organization has a single investor, the business will likely be for sale (Join Talent 2022, 45). By retaining a single investor, the organization has reduced its management structure, thus making decision-making easy. These elements of a single investor give more insight that the business might be for sale. However, the unique selling proposition of this business stands a greater chance for future development due to an increase in entrepreneurship growth, which pose a tremendous demand for Talent in the economy. However, due to the nature of the service provided by the Company, it stands a greater chance of attracting more customers.

1.2 Valuation

Valuation is a process of determining the economic value of a business. The value of a business aids it in cultivating the cultural practice of the business and creating public awareness. The organization’s nature and cultural practice of Join Talent Company is to provide professional service to other start-up companies by attracting new talents (Join Talent 2022, 45). Over the decades, the Company has created employment opportunities for over 200 employees. Moreover, the current chief product officer is Katrina O’Neill (Join Talent 2022, 45). The organization’s value is embanked in service prevention to other start-up companies. The organization aids real estate companies in the UK to value the Join Talent Company due to the skills and competencies of the employees acquired through the organization. That said, the organization’s annual revenue is estimated to be $44.7M annually.

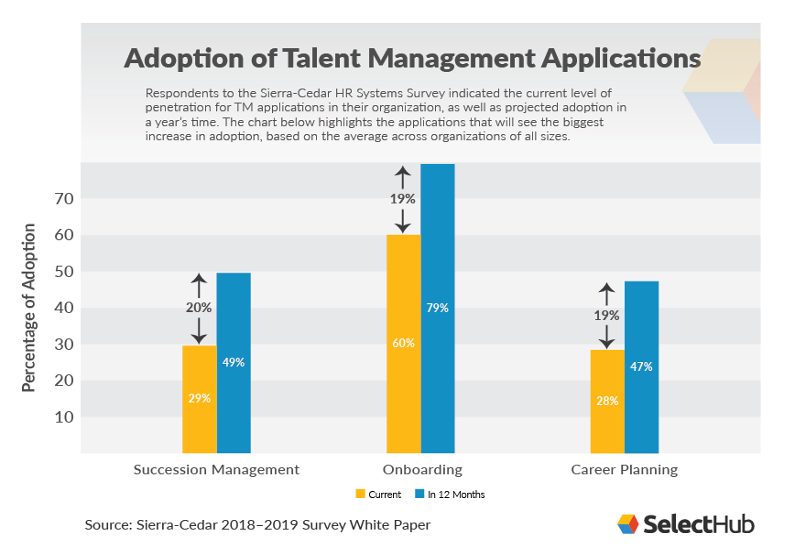

Figure 1.1 Adaption of talent management application

This value is attained through embracing technological tools which aid in service prevention. However, Join Talent has an estimated revenue per employee is $225.567. This means that the organization creates most of the job creation in the UK economy. The start-up grew by 16% yearly (Join Talent 2022, 45). In addition, based on the competitive market posed by other service providers, Join Talent Company tends to stand a greater chance due to its value and cultural practice.

1.3 Capital Structure

The organization’s capital structure defines the equity and debts used by the Company to finance its operations and acquire new assets.

| Item | Budget |

| Cash Flow | £150k |

| Net Worth | £9M |

| Total Liability | £130.2k |

| Net Assets | £9M |

Table 1.1 Joint talent budget

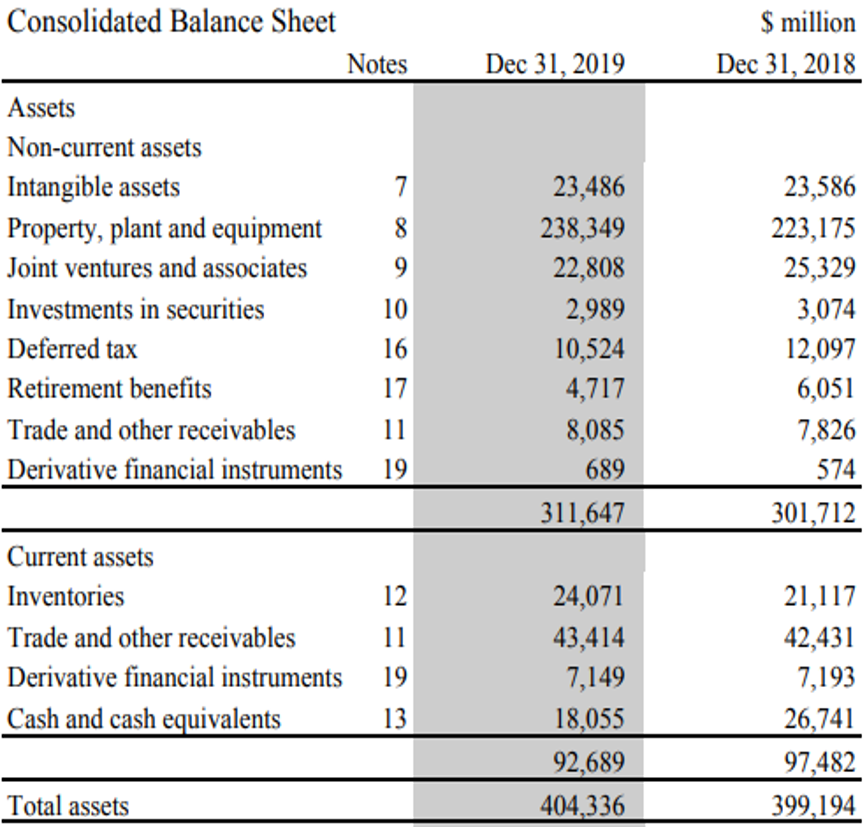

Figure 1.2 Graphical representation of net wort

Based on the above figure, the financial budget of Join Talent Company comes from contributions, funds, and loans. The Company has acquired its assets, which act as its long-term investments. However, based on the structure and liquidity of the assets, the Company needs help to meet its financial emerging. For instance, to ensure that this has ended, the organization management should accept investment proposals from Seedcamp Venture investors. The benefit of this investment proposal is that the Join Talent Company would be able to create a pool of funds that can be used to invest in other companies. Moreover, generating funds aids the Company with financial stability, thus reducing the chances of pre-seeding and seeding activities.

Pre-seeding rounds

| Date | Funding Stage | Money Raised |

| 16/04/2021 | Pre-seed | £300K |

| 23/06/2020 | Pre-seed | £150K |

| 01/09/2020 | Seed | £70K |

Table 1.2 Pre-seeding rounds

Based on the table above, we get more insights into the funding sources and the method used to raise funds. Here the business uses seeding and pre-seeding as significant ways of gathering funds. Due to the high rates of energy reduction demand in the UK, it is clear that the Company needs more sources of funds to aid and achieve its objectives (Kunigis 2018, 201).

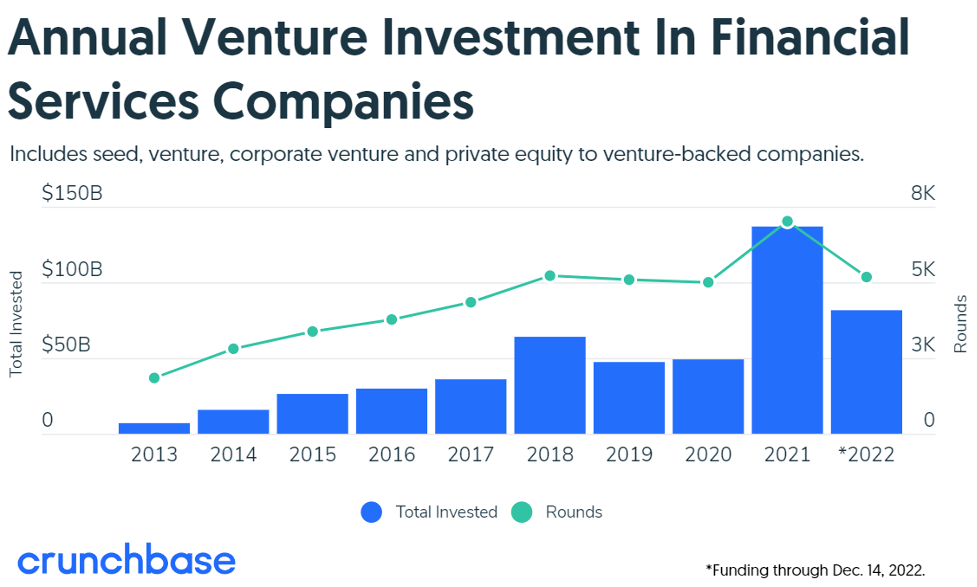

Figure 1.2 Venture capital financial edge

Moreover, with the majority of energy consumption in infrastructure and software development, it is clear that with the current technological development, real estate agencies will increase in the country (Kucherov & Zavyalova 2012, 104). This raises the alarm for innovations and creativity as the only ways to solve the energy reduction issue.

| Accounts | 2019 | 2020 | 2021 |

| Cash | £83,662.00 | £189,891.00 | £1,718,998.00 |

| Net Worth | £101,041.00 | £121,146.00 | £842,411.00 |

| Total Current Assets | £131,284.00 | £309,226.00 | £2,393,989.00 |

| Total Current Liabilities | £33,977.00 | £141,713.00 | £1,502,943.00 |

Figure 1.3 Key Financials Analysis of seedcamp venture capital

The increase in capital structure will enhance Join Talent Limited with more reinforcement in the organization’s training and hiring process. The fixed capital of the organization comes from the assets that the Company utilizes to reduce energy (Kunigis 2018, 201). For instance, from the overview of the financial statements, much of the company assets are based on software development. Many funds are invested in training talents to enhance the labor market’s diversification methods. Additionally, 75% of the Company’s assets are based on real estate development.

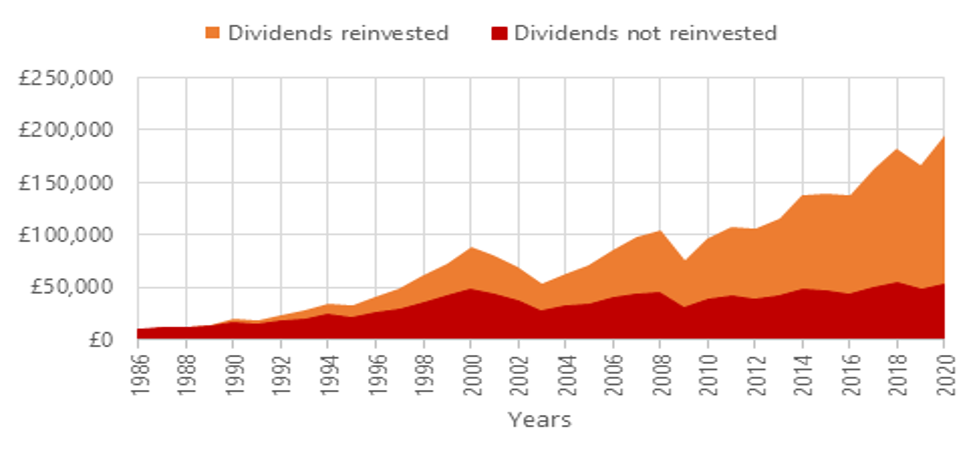

1.4 Valuation and Value Creation

The mechanism adopted by this organization to generate its funds has been fundraising through pre-seeding and seeding activities. The social-cultural activity of the organization has been promoting service awareness in the region for decays (Silzer & Dowell 2009, 145). However, the Company has been able to manage and create future value for its service in the market by creating customer relationships. This began with defining the value agenda of the products through quantifiable measures. Join Talent Company has been able to adopt management systems that have made it easier to source talent. This means that the organization can identify and pick competent employees from the list of interviews. Moreover, after identification of the talents, the organization then assess the skills and qualification of the individual in the labor market. At this point, the value of the individual is determined. Here the Company may decide to train the individual for specific fields based on the demand in the labor market (Kunigis 2018, 201). In addition, Joint Talents Company may opt to adopt use specialization as its line of specialization, but as for Join Talent Company, it sticks with service prevention. After accessing and training qualified individuals, the Company now hires. During the hiring process, individuals are given a proper orientation that highlights, in general, the organization’s performance. After the hiring, the Company now manages employees’ strengths and recognizes hardworking individuals. In monitoring, the Company can keep its employees motivated while hardworking employees are rewarded.

Figure 1.4 Joint talent market share

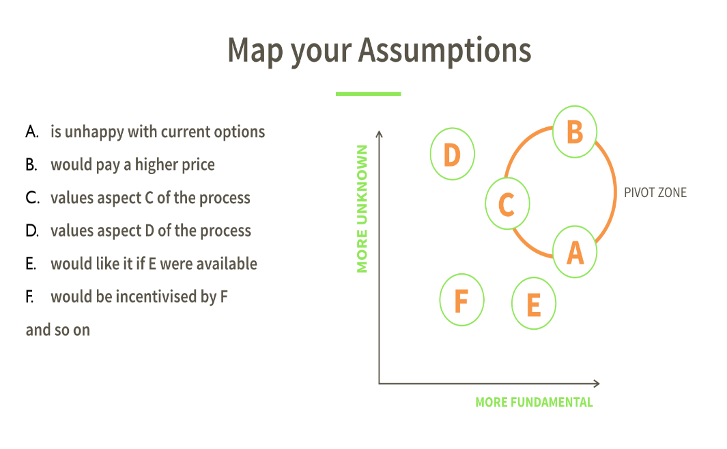

Based on the Company’s performance, it is quite clear that it needs investors. However, the join talent Company’s investment strategies need to be restructured with a few amendments that would create a conducive environment for investors (Kunigis 2018, 201). For instance, once Seedcamp venture capital has laid its investment in this organization, then it means that they will be partners in organization management. However, this can be done regarding share ownership, where the party with a huge share has more authority in the organization.

| Competitor Name | Revenue | Number of Employees | Employee Growth | Total Funding | Valuation |

| #1

Veran Performan… |

£17.1M | 82 | 4% | N/A | N/A |

| #2

Elements Talent… |

£65.9M | 287 | 63% | N/A | N/A |

| #3

activpayroll |

£52.6M | 229 | 9% | N/A | N/A |

| #4

XCD Limited |

£23.9M | 114 | -3% | N/A | N/A |

| #5

ECA Internation… |

£32.3M | 140 | -1% | N/A | N/A |

| #6

Momenta Operati… |

£128.4M | 491 | 7% | N/A | N/A |

| #7

Oradeo |

£13.2M | 70 | 4% | N/A | N/A |

| #8

BrightHR |

£81.2M | 311 | 18% | N/A | N/A |

| #9

Thomas Internat… |

£121.4M | 464 | 2% | N/A | N/A |

| #10

Adepto |

£0.4M | 4 | -20% | N/A | N/A |

Figure 1.5 Join Talent Competitors and Alternatives

The organization has been able to meet and service in the competitive market due to its continuous innovation and creativity. For decays, the organization’s management has offered training programs to its officials whereby they are trained on leadership and management skills (Leavitt et al. 2021, 750). For instance, over the past three years, the Company has been able to meet its operational cost and other financial issues through seeding. However, despite these limited resources, the Company needs to reward its employees adequately due to the limited resources. However, from the limited available resources, the Company cannot keep up with employees’ wages once they have gained experience. For instance, once an individual has been trained and worked with Join Talent Company for a will, they are legible for a salary increase. However, since there are insufficient resources, they are taken by other competing companies with higher payments. That said, Seedcamp venture capital investment in Join Talent Company brings more potential growth and enhances its financial operation efficiency.

1.5 Exits

Join Talent Company exists in the market due to its flexibility in amendments of the policies. The organization adopts social-cultural practices to create value for its services. Based on the debts and pre-seeding funds the Company has been having, only little of its liability has been catered for (Leavitt et al. 2021, 750).

| Strengths | Weaknesses |

| · Recruitment of diverse workforce

· The adaptability to change · Huge pool of employees |

· Poor work life balance

· Poor management · Financial crisis · Little resources · Damaged market reputation |

| Opportunities | Threats |

| · Carrier enhancement and planning programs

· Diverse workforce · Internal treats of the company |

· Employees are not engaged in management

· High turnover rates · Better equipment competitors |

Table 1.1 Joint talent company SWOT Analysis

Recent performance and Likelihood of Sale

Over the years, Join Talent Company has been struggling to meet their needs as their financial support from funding has little impact on the company liability. The Liability of £130.2 million with only a Cash flow of £150 million puts the business in a risky position where by it is unable to gain financial stability.

Figure 1.6 Annual Financial Report

This means that the Company needs other investors to finance its operation, thus giving it financial stability. Access liquidity aids with ease in transforming assets into cash.

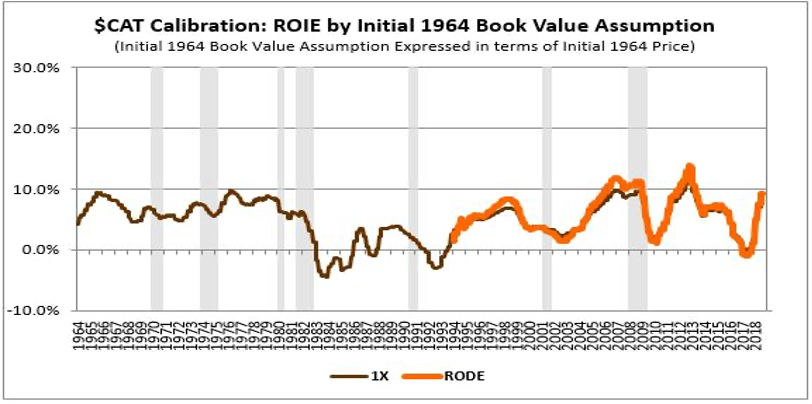

Figure 1.7 Average return of the Investment

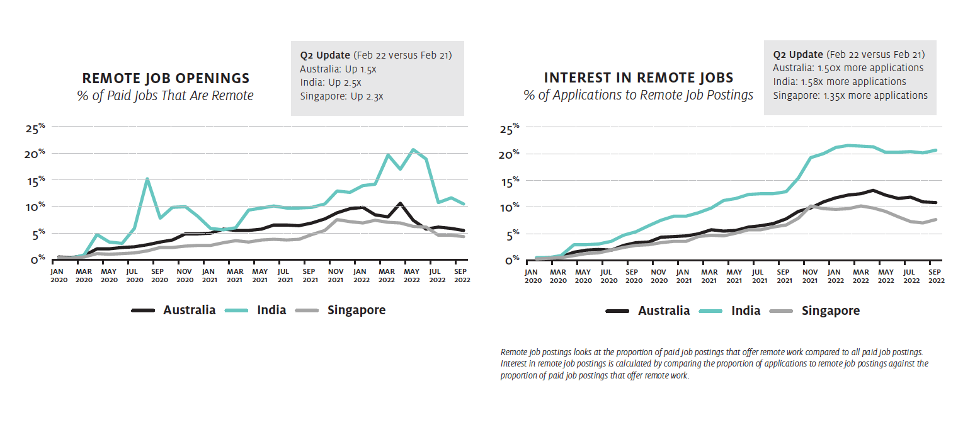

Based on the above diagrams, Join Talent Company is likely to sell much of its shares to Seedcamp venture capital as one of its strategies to reduce its financial risk. Using the development of remote jobs in other states as well as in UK, the company require huge investment to renew its talents skills and training programs to ensure its workers are competent. For instance, in the years 2022, the compared merely raised $50K after several rounds of pre-seeding which means they need investor.

Deal Description

Based on the company financial performance, the estimated valuation of £9M is below the company full capability. The management team are more geared to restructure the management structure to attract more investors. Teaming up with SeedCamp Company would increase the changes of gaining financial stability by 80% of its current performance.

SeedCamp venture capital credit score is 70 of the market share. According to Fame (2019) the venture capital transforms the assets into liquid money that is readily available. SeedCamp Company is willing to invest 80% of its funds to the organization unlike other banks which are unwilling to offer such financial support. This means that there will be 8-year repayment starting from December 2023 which it’s reasonable to Join Talent Company.

Deal Structure and Possible Financing Structure

Based on the assumptions laid down, the outstanding investments of £3.5M will be covered by SeedCamp Venture Capital. Since the company funds require about 65% of the total investments pa, this will provide with financial equity for the year 2023. This means 0.15m of 17% would remain as its preference shares owned by the organization thus making it the reading share holder.

Merits

- The ability of the business to convert its assets into cash aids in creating capital for future investment.

- Due to the liquidity of its assets, the business can quickly convert its assent into cash (Williams 2000, 130).

- Enable staff members to calm the payment of redundancy

- Existence of skilled and competent labors

Demerits

- There are limited financial resources (Williams 2000, 130).

- A shareholder may be forced to pay illegal dividends that reduce their profits.

The possibility of Joint Talent Company selling some of its shares to secure its financial stability is the only hope for survival for this Company. If they do not secure funds by enabling more investors, the Company will be ineffective in its goals and objective due to lack of funds.

Recommendations

- Seedcamp venture capital to fund the Company as one of its major joint ventures

- The Company should understand its capitalization to improve its service value.

- Join Talent Company should strategize on building a target list for marketing.

- The Company should restructure its partnership policy to attract more investors.

References

Cannon, J.A. and McGee, R., 2011. Talent management and succession planning (Vol. 151). London: Chartered Institute of Personnel and Development.

EM, Magazine (2022) Editor, EM Magazine. Available at: https://www.energymanagermagazine.co.uk/reduce-energy-consumption-with-artificial-intelligence-to-increase-energy-security/

Join Talent (2022) – Crunchbase Company Profile & Funding, Crunchbase. Available at: https://www.crunchbase.com/organization/join-talent p. 45

Kucherov, D. and Zavyalova, E., 2012. HRD practices and talent management in the companies with the employer brand. European Journal of Training and Development, 36(1), pp.86-104.

Kunigis, A., 2018. Advantages vs. disadvantages of venture capital.201-235.

Leavitt, K., Schramm, K., Hariharan, P. and Barnes, C.M., 2021. Ghost in the machine: On organizational theory in the age of machine learning. Academy of Management Review, 46(4), pp.750-777.

Michaels, E., Handfield-Jones, H. and Axelrod, B., 2001. The War for Talent. Harvard Business Press. P. 50

Silzer, R. and Dowell, B.E. eds., 2009. Strategy-driven talent management: A leadership imperative (Vol. 28). John Wiley & Sons.

Williams, M.R., 2000. The War for Talent: Getting the Best from the Best. CIPD Publishing. p 130-150.

Appendix

Secretary-General’s bulletin

Staff Regulations and Rules

Under the Charter of the United Nations, the General Assembly provides staff regulations which set out the broad principles of human resources policy for the staffing and administration of the Secretariat and the separately administered funds and programmes. The Secretary-General is required by the staff regulations to provide and enforce such staff rules, consistent with these principles, as he considers necessary.

The Secretary-General promulgates the following with respect to the Staff Regulations and Rules of the United Nations, established by the General Assembly in accordance with Article 101 of the Charter:

Section 1

Revised edition of the Staff Regulations and Rules

1.1 By its resolution 72/254, the General Assembly approved the following amendments to the Staff Regulations and annexes thereto:

(a) Regulation 3.2 (a) is amended to revise the criteria covering post‑secondary education to make the education grant payable up to the end of the school year in which the child completes four years of post-secondary studies or attains a first post-secondary degree, whichever comes first, subject to the upper age limit of 25 years, as approved by the General Assembly in section III, paragraph 26, of its resolution 70/244. In accordance with section III, paragraphs 27 and 28, of the same resolution, the reference to the amount of the grant based on 75 per cent of admissible expenses is replaced by the sliding scale of reimbursement of admissible expenses consisting of tuition, including tuition in the mother tongue, and enrolment-related fees actually incurred. The reference to additional education grant travel at designated duty stations is deleted;

(b) Regulation 3.2 (b) relating to additional assistance with boarding costs at designated duty stations is deleted. A new paragraph (b) is added to reflect the decision of the General Assembly to limit assistance with boarding-related expenses to staff serving in field duty stations whose children are boarding to attend school outside the duty station and to provide flexibility for the Secretary-General to establish conditions under which boarding assistance would exceptionally be granted to staff members serving at headquarters duty stations (resolution 70/244, sect. III, para. 29);

(c) Regulation 3.2 (e) is deleted; as stepchildren and adopted children are already covered by the definition of “child” in staff rule 3.6 (a) (ii), that provision is not needed;

(d) Regulation 9.2 is amended to reflect the increase in the mandatory age of separation to 65 years for all staff members, including those appointed prior to 1 January 2014, as endorsed by the General Assembly in section I of its resolution 70/244.

1.2 The General Assembly noted the amendments to staff rules 3.9, 4.14, 4.16, 7.2, 9.6, 10.4 and 11.5, the new staff rule 13.13 and the amendments to appendices B and D to the Staff Rules, subject to the provisions of the same resolution.

1.3 The revised text of the Staff Regulations and Rules incorporating the amendments referred to above is attached to the present bulletin.

1.4 Articles 8, 97, 100, 101 and 105 of the Charter of the United Nations, which relate to the service of the staff, are included in the introductory part of the present edition of the Staff Regulations and Rules, on page 6.

1.5 In the present edition, each article of the Staff Regulations of the United Nations precedes each chapter of the related Staff Rules.

Section 2

Final provisions

2.1 In accordance with staff regulations 12.1, 12.2, 12.3 and 12.4, the revised Staff Regulations and Rules are effective as from 1 January 2018.

2.2 The present bulletin abolishes Secretary-General’s bulletin ST/SGB/2017/1 and ST/SGB/2017/1/Corr.1.

(Signed) António Guterres

Secretary-General

Domestic and Overseas Sales FY2017 1,114.7 1,114.3 1,100.0 1,071.3 1,149.3 FY2018 FY2019 FY2020 FY2021 Billions of yen Japan Overseas 0 200 400 600 800 1000 1200 Operating Income/Business Profit & Operating Income/Business Profit Margin FY2017 95.6 93.2 99.2 113.1 120.9 8.6 8.4 9.0 10.6 10.5 FY2018 FY2019 FY2020 FY2021 Billions of yen % 0 30 60 90 120 150 Operating income/Business profit (Billions of yen) Operating income/Business profit margin (%) 0.0 2.0 4.0 6.0 8.0 10.0 Interest Coverage Ratio FY2017 FY2018 FY2019 FY2020 FY2021 Times 43.3 38.1 32.6 49.2 45.0 0 20 40 60 80 Costs, Expenses, and Profit as Percentages of Sales Years ended March 31 FY2021 FY2020 Percentage Change Percentage Cost of sales 62.9% 0.8 62.1% Gross profit 37.1 (0.8) 37.9 Selling, R&D, and G&A expenses 26.6 (0.9) 27.5 Business profit 10.5 (0.1) 10.6 Profit before income taxes 10.7 1.5 9.2 Profit attributable to owners of the parent company 6.6 1.1 5.5 Management’s Discussion and Analysis Ajinomoto Group 04 Financial Report 2022 Segment Information (Billions of yen) Sales FY2021 FY2020 Difference YoY change Seasonings and Foods 664.2 620.5 43.7 7.0% Frozen Foods 221.7 198.2 23.4 11.8% Healthcare and Others 251.2 239.5 11.7 4.9% Other 12.1 13.1 (1.0) (7.6%) Total 1,149.3 1,071.4 77.9 7.3% Business Profit FY2021 FY2020 Difference YoY change Seasonings and Foods 81.2 86.7 (5.5) (6.4%) Frozen Foods (0.6) 2.3 (2.9) — Healthcare and Others 43.3 26.2 17.0 65.1% Other (3.0) (2.2) (0.7) — Total 120.9 113.1 7.7 6.9%

write

write