Executive Summary

This report provides a detailed analysis business strategy of Samsung, one of the biggest electronic companies. From the report, Samsung is among the most recognized electronic companies with massive revenue. However, since it operates in a highly competitive industry, it receives massive competition from other companies such as Apple Inc and LG. Apple and LG perform better in revenue generated and the home appliances sector than Samsung, respectively. Samsung’s growth has been based on Ansoff’s matrix strategies which involve market penetration, market development, diversification, and product development.

Having analyzed Samsung’s strategy, there are various recommendations on how the company can improve its strategy for future operations. The first recommendation is that Samsung needs to engage in sustainability activities as customers’ behaviors have changed radically, and they only want to be associated with sustainable activities. Another recommendation is that Samsung needs to increase its investment in the home appliances sector. Based on the above analysis, the company has been outsmarted in the home appliance sector by LG.

1. Introduction

Overview of Samsung Operations

Samsung is one of the best companies in electronics from South Korea that specializes in producing electronic gadgets. It has specialized in producing numerous varieties of industry and consumer electronics such as semiconductors, digital media devices, Integrated systems memory chips, and appliances (Bondarenko, 2021). Similar to other companies, it has a business strategy characterized by a high degree of flexibility, allowing it to adapt to the changes in its external environment (Dudovskiy, 2017). As such, its strategy has three pillars: effective leadership, scanning and utilizing market opportunities, and developing new products.

Financial Performance

Regarding Samsung’s financial performance, the company has been doing okay despite the macro environment challenges presented by the pandemic. According to the 2022 fourth-quarter financial results, the following critical information can be extracted. First and foremost, the company had a consolidated revenue of KRW 70.46 trillion and an operating profit of about KRW 4.31 trillion (Samsung, 2023). When critically examined, it is evident that the company’s fourth-quarter earnings decreased significantly, and part of the reason was the economic slowdown that was experienced globally due to weak demands.

However, during the entire 2022 financial year, the company had a total of KRW 302.23 trillion, the highest annual revenue it has ever recorded (Samsung, 2023). Moreover, during the same financial year, it recorded an operating profit of about KRW 43.38 trillion (Samsung, 2023). Hence based on the above, the financial performance of Samsung is expected to grow despite various challenges being experienced in the world.

Competitors

Samsung is one of many companies operating in electronics, and it faces stiff competition from other companies that manufacture electronic devices. Such as Apple Inc. LG, and Sony (Wcs, 2022). For quite some time, Apple has been Samsung’s biggest competitor, especially in the smartphone sector. The two companies have been going head to head with each other by constantly being innovative to stay ahead.

The two are currently the world’s largest tech companies and the biggest rivalries in the sector. The rivalry was intense in that in 2014, Samsung’s strategy document leaked, showing that Samsung’s aim was to surpass Apple (Wcs, 2022). Also another major competitor of Samsung is LG. LG, also a South Korean company, has been competing with Samsung for a long time, each suing the other for patent infringement (Wcs, 2022). Although Samsung has superior revenue and phone sales, LG is much better in the home appliances sector. Having had a glimpse of Samsung, this report aims at evaluating Samsung’s business strategy and providing a recommendation to the board of directors for future development.

Samsung’s Strategic Position in its Industry

Samsung is one of the world’s largest electronics companies, specializing in household appliances and consumer electronics. However, it faces stiff competition from companies such as Apple and LG, which also operate in the electronic sector. Therefore, to better comprehend Samsung’s strategic position, it is important to analyze its performance and that of the competitors using various Key performance indicators such as financial performance, market share, and brand value.

Key Performance Indicators (KPI)

Financial Performance

The first KPI that will be used is that of financial performance. Based on the data from the financial year that ended in 2022, this is Samsung seems to be doing fine financially. As such that during the entire 2022 financial year, the company’s total revenue was KRW 302.23 trillion, the highest annual revenue it has ever recorded in its operations (Samsung, 2023). Also, during the same year, it recorded an operating profit of about KRW 43.38 trillion.

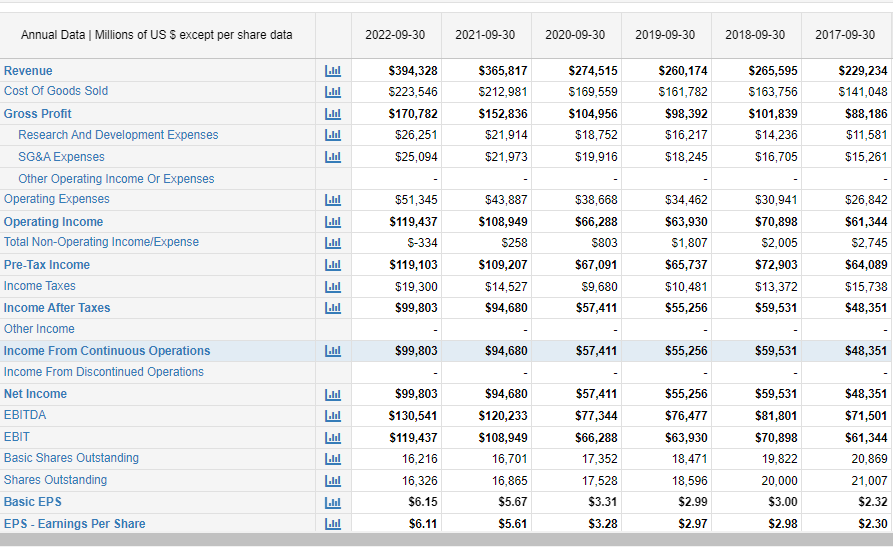

However, according to Macrotrends (2023), Samsung competitor Apple Inc. has also been doing good in terms of soft revenue and net profit (Appendix 2). As such, its 2022 financial year had an annual revenue of about $ 394.3 billion, an increase of 8% (Apple.com, 2022). Besides just Samsung and Apple, LG has also been progressing well regarding its financial performance. This is such that in the 2022 financial year, LG generated revenue of KRW 80 trillion, which was the highest revenue the company has ever recorded as the revenue increased by 12.9% compared to 2021 (Lg.com, 2023). Mostly LG’s growth can be attributed to the increase in demand for its services and products, especially in the home appliances sector. Therefore as seen above, although Samsung is doing fine financially, Apple surpasses it in terms of financial performance.

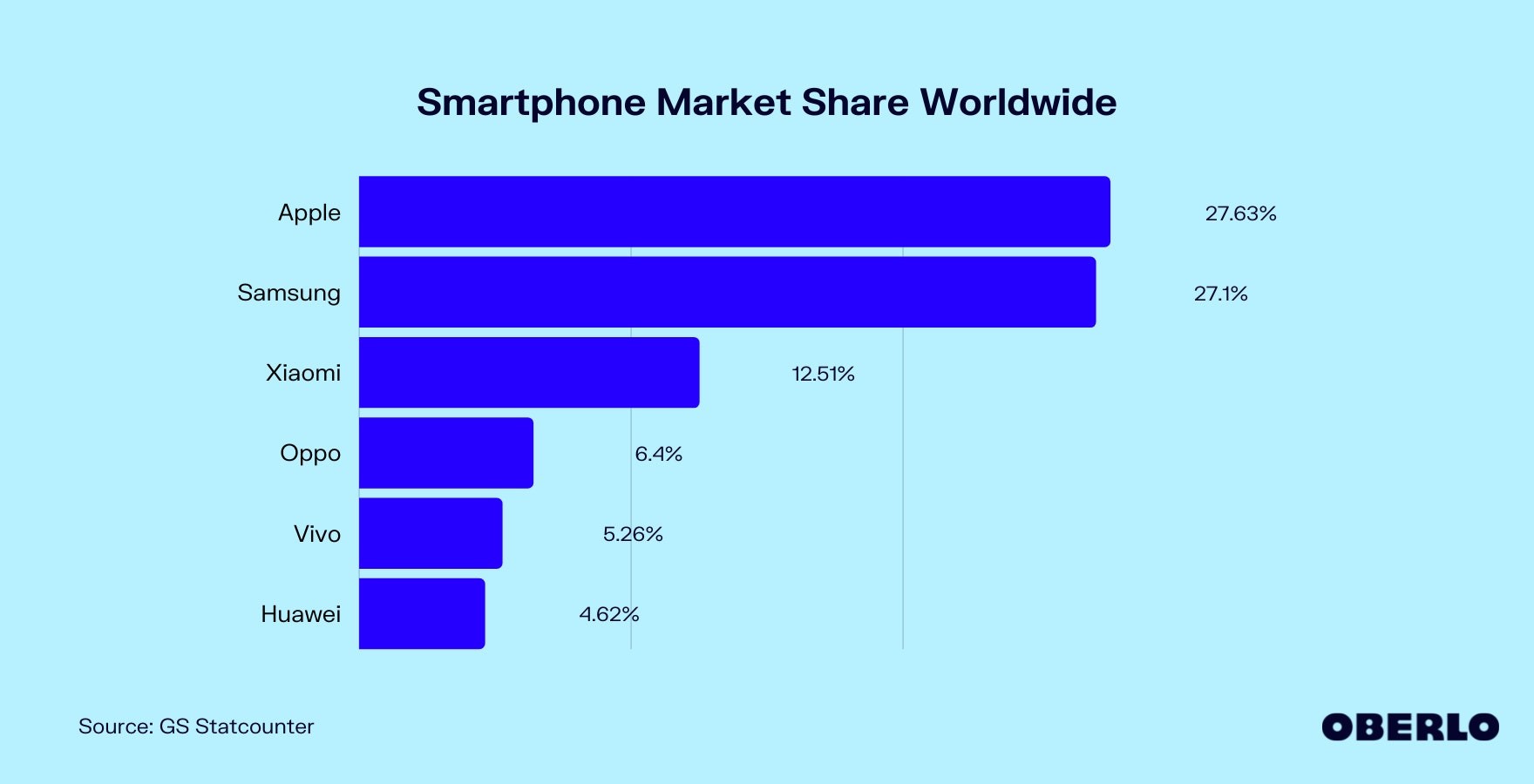

Market Share

Another primary KPI that will be used to look at Samsung’s performance concerns its market share. This is such that Samsung has a substantial market share in the sectors of the global smartphone, as Samsung has a market share of 27.1% (Oberlo, 2023). On the other hand, Apple has been doing great also in the smartphone market share in that it surpassed Samsung as it had a market share of 27.63%, surpassing Samsung by a small margin of 0.53% (Oberlo, 2023). Moreover, a close competitor in the smartphone market share is Xiaomi as it has a market share of 12.51% which appears to be behind Samsung and Apple by a wider margin (Oberlo, 2023). Hence from the above analysis, it is evident that the biggest threat to Samsung is Apple as LG exited the smartphone sector, and the only company that comes close to the two companies is Xiaomi.

Figure 1. Smartphone market share (Oberlo, 2023)

Brand Value

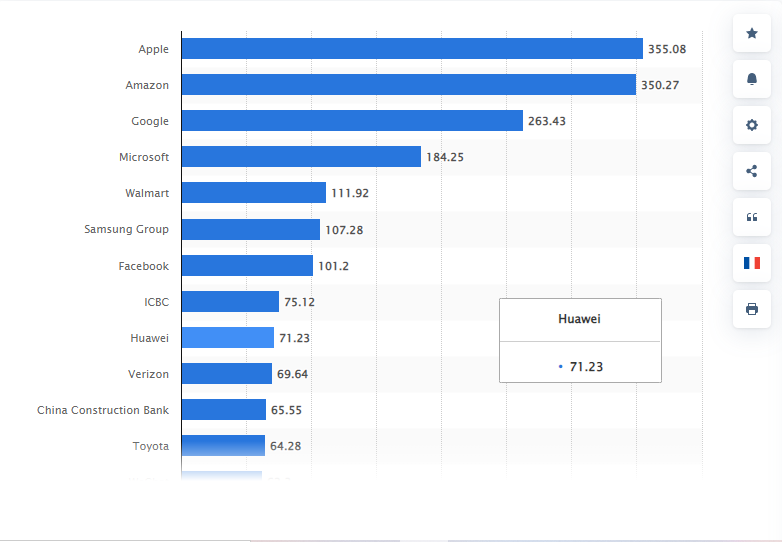

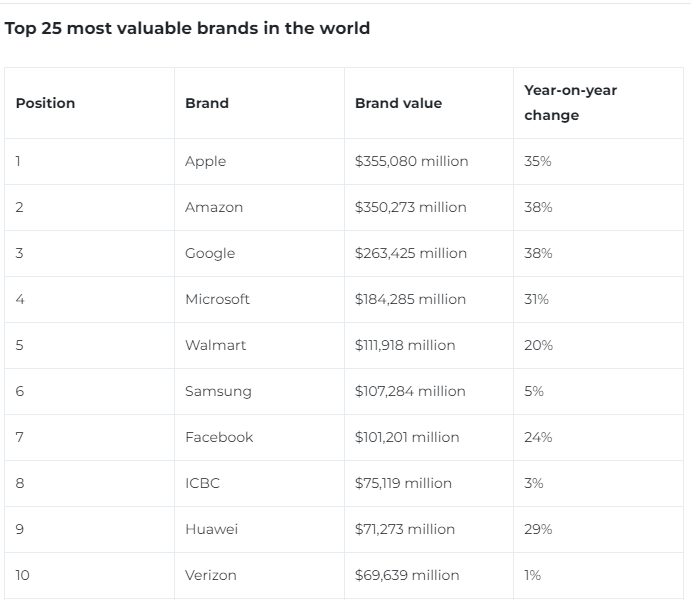

Another KPI that can be used to evaluate Samsung relates to brand value. Brand value implies that a brand with a well-recognized name will generate more income than a less-known company whenever it sells its products. In this case, Samsung has a brand value of $ 107.28 billion, while its primary competitor Apple has a brand value of $ 355.08 billion (Faria, 2023). This means that in terms of brand value, Samsung is way below Apple Inc, which has the best brand value globally (Appendix 1). According to Little (2022), Apple’s substantial brand value means it has the upper hand in differentiating itself from the competitors such as Samsung.

Figure 2. Most Valuable brands in USD as of 2022

From the above, it is evident that Samsung has a strong strategic position as it faces intense competition from other companies such as Apple, LG, and Xiaomi in different sectors. Although the company generates less revenue when compared to Apple, its revenues are still massive. Additionally, the company has a substantial market share as it is close to that of Apple. Also, Samsung has a strong brand value though nowhere near that of Apple Inc, and this means Samsung must continue being innovative as it will help it gain some form of competitive advantage.

Samsung Strategic Direction

Samsung as a company operates in a highly competitive industry which requires any company to have a strategic direction. Therefore, to have a detailed understanding of Samsung’s strategic position, an analysis of the various methods it has used to pursue strategy must be analyzed. The two methods critical in analyzing the company are the Ansoff matrix and the Boston Consulting Group (BCG) Matrix.

Ansoff Matrix

Ansoff matrix is a commonly used tool by companies and organizations to evaluate their growth. It has four strategies for evaluating growth: market penetration, product development, market development, and diversification (Huang & Lin, 2017). Samsung has developed into a worldwide company, and the key to its success is appropriately utilizing the Ansoff matrix.

Market Penetration

Market penetration revolves around introducing a new product in an already existing market. Therefore, to gain market penetration, Samsung uses various strategies, such as providing discounts or charging a lower price for a new product for a few months before launching the product in the existing market (Adamkhankasi, 2020). Market penetration has been helping to increase its market share and sales while also helping it eradicate the product’s inventory before it launches it (Adamkhankasi, 2020). It can be said that Samsung has mastered the art of market penetration as it usually launches new products in simultaneous markets while also heavily promoting them, which helps elevate the entry barriers for its competitors.

Market Development

Market development is another strategy that Samsung has also perfected concerns. Market development revolves around a company launching existing products in a new market (Huang & Lin, 2017). Samsung does it severally, and one of the main ways that Samsung does this is by geographically expanding into new markets, including the counties it has yet to tap into (Adamkhankasi, 2020). In launching a product in a new market, Samsung usually ensures that it uses attractive packaging for its goods. It also partners with local sportspeople and celebrities in those new markets to create brand loyalty and a reputation for the company (Adamkhankasi, 2020). Furthermore, while launching products, it usually ensures that it prices all its product in local currency as it is usually a big deal to customers in different nations.

Product Development

Another strategy that Samsung has perfected and utilized is product development. Ideally, product development revolves around launching a new product in an existing marketplace using a line extension strategy (Huang & Lin, 2017). Samsung has heavily invested in product development. Samsung has several models, unlike Apple, which specializes in single smartphone models (Adamkhankasi, 2020). Samsung has deals in developing various models of smartphones and frequently launches improved models and versions of all its products (Adamkhankasi, 2020). Also, regarding this section, the company is known for investing heavily in research and development to develop durable and better functionality devices.

Diversification

The fourth strategy of the Ansoff matrix that Samsung engages in is diversification. Samsung’s broad portfolio has not restricted itself to horizontal diversification (Adamkhankasi, 2020). While engaging in diversification, Samsung is known for venturing into unrelated sectors and succeeding (Adamkhankasi, 2020). The secret behind its diversification is that the company does extensive research and identifies sectors with great potential allowing it to offer different products and services in a greater market.

Boston Consulting Group (BCG) Matrix

Another method that is vital in analyzing Samsung’s performance is the Boston Consulting Group (BCG) matrix. The BCG is a method that is usually used in analyzing the portfolio of a company or an organization. As such, it is applied in identifying the company’s strategic position and the probability of development (Rynca, 2016). Usually, the BCG has four quadrants: stars, cash cows, pets, and question marks.

Stars

The first quadrant is known as the stars, and the products in this quadrant have a high market share and huge growth potential. Hence, based on the BCG, the Samsung smartphone sector is in the star section as it has a massive market share of 27.1%, and there is enormous potential for growth (Oberlo, 2023). Also, despite Apple’s success, it only defeats Samsung by a small margin in this sector, insinuating that it is a start for Samsung.

Cash Cows

The next quadrant in the BCG is known as cash cows, and the products in this quadrant tend to have a high market share but limited growth potential. Since the products in this sector have low growth, they are usually unattractive to most investors (Rynca, 2016). However, when equated to Samsung, the cash cows can be the home appliances sector as Samsung has not heavily invested in it, making LG the best in this sector.

Pets/Dogs

Another group of products is known as pets, and the products in this quadrant have low market share and little growth potential. As such, the products in this sector rarely generate substantial income, and their low market share makes them unattractive to investors (Rynca, 2016). Nonetheless, when related to Samsung, the product that can fall in this section is the Samsung smartwatch. The company launched the smartwatch but failed to perform as expected due to competition from the apple smart watch.

Question Marks

The fourth quadrant is what is known as the question marks, and the products in this sector usually have a low market share, but their growth potential is high. In most cases, the products in this section do not generate profit and must be financed from other sources (Rynca, 2016). Regarding Samsung, the dog section is similar to the company’s decision to acquire Harman International, an automotive company, a new sector with tremendous growth potential (Kim et al., 2019). The huge potential of the automotive industry is what made Samsung acquire the company.

Critical Evaluation of Samsung’s Strategy

Suitability Acceptability and Feasibility (SAF) Framework)

Samsung does not have a simple strategy like most companies do. Instead, it has a complicated and multifaceted strategy. This strategy has enabled it to be one of the most excellent electronic companies on the continent, as shown by its brand value. However, to comprehend Samsung’s strategy, it is important to use the Suitability, Acceptability, and Feasibility (SAF) framework, which describes whether the company’s strategy is suitable, acceptable, and feasible.

Suitability

Suitability refers to the company’s strategy being able to align with the company’s goals and missions. For a long time, Samsung has been aiming to be known as the best electronic company globally. This desire aligns with the company’s market penetration, diversification, product development, and market development, as it has allowed Samsung to launch new products in existing and new markets and diversify its portfolio (Adamkhankasi, 2020). The above activities are vital if a company wants to be in the leading position in its operating sector. Since Samsung has already done it, it means that its actions align with its aim of being the best company in the electronics sector.

Acceptability

Another vital concept of the framework concerns its acceptability: the amount of support the company receives from critical stakeholders such as shareholders, customers, and employees. Samsung’s strategy has been quite good, and its crucial stakeholder has accepted it. This is true when one looks at the market shares that Samsung occupies in the smartphone sector, as it currently has a market share of 27.1%, meaning more clients prefer Samsung products to other android users (Orbelo, 2023). Moreover, the employees accept Samsung’s strategy as the workers seem inspired and are constantly innovating new products, such as the foldable smartphone, which has become common for smartphone companies.

Feasibility

The last concept of the framework is feasibility, which is the company’s resources and ability to implement its strategy. Currently, Samsung has enough resources and capability to engage in any project. For instance, when one looks at the company’s financial performance, as discussed above, it is evident that it has been generating massive revenues (Samsung, 2023). Strong financial performance means that Samsung has sufficient resources to engage in market and product development, which are essential for any electronic company. More so, Samsung, an international company, has a strong brand image, so it can quickly get the required resources to engage in any vital activities that benefit the company.

Conclusion

From the above analysis, it is evident that Samsung is among the most recognized electronic companies. The company generates massive revenue, which has enabled it to be outstanding for an extended period. Despite its good performance, it faces stiff competition from companies such as Apple and LG, which surpass it in various sectors, such as revenue and home appliances, respectively. Samsung’s growth has been based on Ansoff’s matrix strategies which involve various strategies such as market penetration, market development, diversification, and product development. Furthermore, when critically examined, various products of Samsung in the BCG quadrants, such as cash cows, question marks, and stars, tend to have the potential to succeed. However, the only failure was from the dog’s sections, where its smartwatch failed to perform as expected. More so, based on the SAF framework, Samsung’s strategy seems suitable, acceptable, and feasible, and hence, Samsung needs to continue being innovative to gain a competitive advantage against its competitors, such as Apple and LG.

Recommendations

Having analyzed Samsung’s strategy, there are various recommendations on how the company can improve its strategy for future operations. The first recommendation is that Samsung needs to engage in sustainability activities as customers’ behaviors have changed radically, and they only want to be associated with sustainable companies. Hence, Samsung needs to ensure it engages in environmentally friendly and community development activities. By being sustainable, the company can avoid losing environmentally conscious customers, which might have an impact on its revenues as well as its reputation. Therefore, Samsung needs to invest heavily in renewable energy and develop eco-friendly products.

Another recommendation is that Samsung needs to increase its appliance investment. Based on the above analysis, the company has been outsmarted in the home appliance sector by its rival, LG. Hence, since the home appliances segment is experiencing significant growth, it is high time that the company gives the sector the required attention. Although Samsung has invested in appliances, they have yet to invest in the sectors as they have done with a smartphone.

References

Adamkhankasi. (2020). Ansoff matrix of Samsung. Retrieved February 10, 2023, from https://ansoffs.com/ansoff-matrix-of-samsung/

Apple.com. (2022). Apple reports fourth-quarter results. Retrieved February 10, 2023, from https://www.apple.com/ke/newsroom/2022/10/apple-reports-fourth-quarter-results/

Bondarenko, P. (2021). Samsung as a global company. Retrieved February 11, 2023, from https://www.britannica.com/topic/Samsung-Electronics/Samsung-as-a-global-company

Dudovskiy, J. (2017). Samsung Business Strategy and competitive advantage: Effective exploitation of market readership – research-methodology. Retrieved February 11, 2023, from https://research-methodology.net/samsung-business-strategy-competitive-advantage-effective-exploitation-market-readership/

Faria, J. (2023). Most Valuable Brands Worldwide 2022. Retrieved February 10, 2023, from https://www.statista.com/statistics/264875/brand-value-of-the-25-most-valuable-brands/

Huang, K. C., & Lin, Y. C. (2017). The Battlefield of IoT: Competitive and Cooperative Relationship Among Smart Home Vendors.

Kim, J. H., Chun, M. Y. S., Nhung, D. T. H., & Lee, J. (2019). The transition of Samsung electronics through its M&A with Harman International. Journal of Open Innovation: Technology, Market, and Complexity, 5(3), 51.

Lg.com. (2023). LG announces 2022 financial results. Retrieved February 10, 2023, from https://www.lg.com/my/about-lg/press-and-media/lg-announces-2022-financial-results#:~:text=In%202022%2C%20LG%20achieved%20its,trillion%20for%20the%20first%20time.

Little, T. (2022). Apple retains the most-valuable brand, Crown, as the tech boom continues and TikTok soars. Retrieved February 10, 2023, from https://www.worldtrademarkreview.com/article/apple-retains-most-valuable-brand-crown-tech-boom-continues-and-tiktok-soars

Macrotrends. (2023). Apple Financial statements 2009-2022: AAPL. Retrieved February 10, 2023, from https://www.macrotrends.net/stocks/charts/AAPL/apple/financial-statements

Oberlo. (2023). Smartphone market share worldwide [Feb 2023 update]. Retrieved February 10, 2023, from https://www.oberlo.com/statistics/smartphone-market-share

Ryńca, R. (2016). Using the idea of the Boston Consulting Group matrix in managing a university. Journal of Positive Management, 7(1), 70–86.

Samsung. (2023). Samsung Electronics announces Fourth Quarter and FY 2022 results. Retrieved February 10, 2023, from https://news.samsung.com/global/samsung-electronics-announces-fourth-quarter-and-fy-2022-results#:~:text=The%20Company%20posted%20KRW%2070.46,43.38%20trillion%20in%20operating%20profit.

Wcs. (2022, June 08). Top 10 Samsung competitors in 2023. Retrieved February 10, 2023, from https://whatcompetitors.com/samsung/

Appendices

Appendix 1: Top Ten Most valuable brands as of 2022

Appendix 2: Apple Annual Report

write

write