Introduction

The purpose of this stock project is to research and analyze the financial health of one of the prevalent publicly-traded corporations in the world, Amazon.com. This stock analysis will include an analysis of the current and past financial performance of the company as well as a critical analysis of the company’s insider trading activity. This stock analysis will also include a profile of each member of the Board of Directors, stock analyst recommendations for the stock, a detailed product list of what the company makes (or provides if a service company), the stock split, and/or dividend history, a company profile, and any additional information that you find during your analysis. Part 2 of this stock analysis will also include a research report on the company.

Part 1

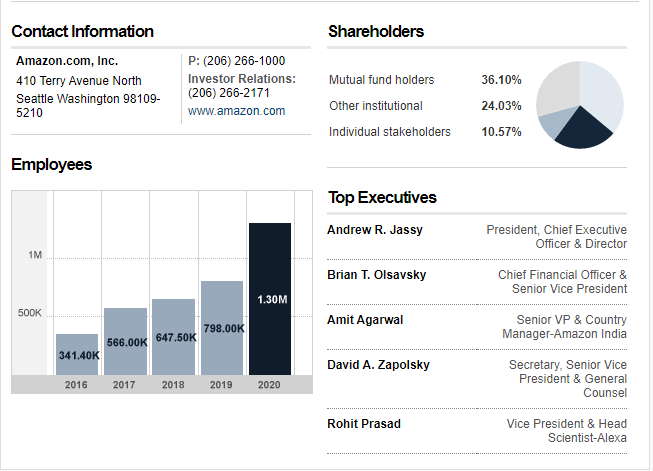

The company Amazon has been under increasing financial pressure for several years to be more transparent and accountable to its shareholders and has been criticized for being a “‘laggard” in this regard. The company’s shares are down about 50% from their high point in 2017, and its stock price is still well below its 52-week high.[1] However, insider trading activity and the profiles of each member of the board are up about 20% since 2016. The board members are: Mr. Larry K. Bowers, CEO; Mr. James R. Barksdale, Executive Vice President, General Counsel, and Secretary; Mr. Jeff Bezos, Executive Chairman and Founder; Mr. David J. Clark, Chief Financial Officer; Mr. Michael J.Kuo, Senior Vice President and Chief Accounting Officer; Mr. Thomas A.Peterson, Senior vice President and Chief Financial Officer; Mr.Jeffrey A.P.Parr, CEO of Jeff Bezos’s company Amazon said, “we are making a difference. This was in response to a question from a shareholder at the company’s annual meeting. The figure 1 below presents profiles of the board members who have been playing great deal to the growth of the company.

The Company Amazon is an American international corporation and expertise corporation established in Seattle, Washington. The establishment was established by Jeff Bezos on July 5, 1994, and became a subsidiary of Amazon.com, Inc. in July 1997. The company currently provides online shopping, cloud computing, and digital media services. In 2016, Amazon surpassed Walmart as the most valuable publicly traded company in the United States.[2]

Figure 1: Profile Summary. Retrieved from: CNN Business https://money.cnn.com/quote/financials/financials.html?symb=AMZN

Company profile

Amazon is an American company that provides online sales of millions of items to consumers throughout the world. The company was instituted in 1994 by Jeff Bezos and is head-quartered in Seattle. It is the second-largest online grounded e-commerce company in the world, the largest internet retailer, and since August 2008, the largest internet company in the U.S. It was the first corporation to sell books, music, and video with over 45, 000 full-time workers. This online retailing company is known for its cloud services, an online marketplace, its Kindle e-readers, and it’s Amazon Web Services.

Over the years, Amazon has expanded into several different industries and has acquired a number of smaller companies. As of December 31, 2018, the company had a market capitalization of $1.51 trillion.[3] The enterprise trades an extensive diversity of merchandises, comprising books, music, electronics, and apparel. Amazon also provides services, such as cloud computing and web hosting. The company is best known as a retailer, but it also offers a number of other services to help businesses improve their operations.

Financial Summary

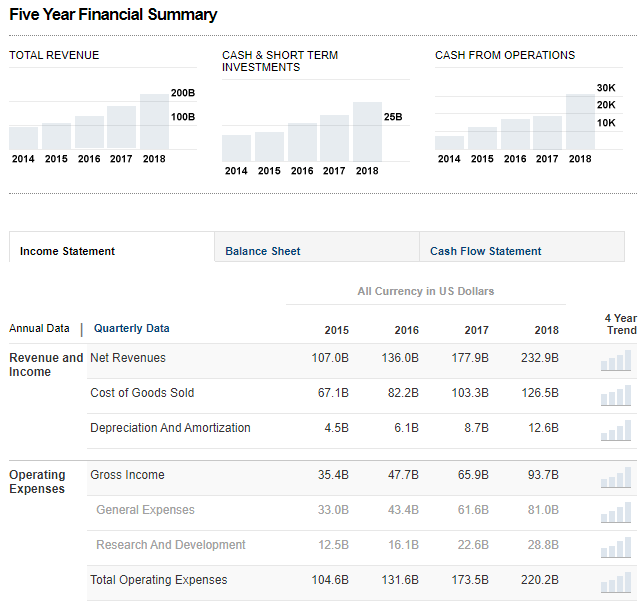

Amazon is a company that focuses on e-commerce and cloud services. Amazon has over a decade of experience in the e-commerce market and has been a mainstay as a pioneer in the e-commerce market. The financial information of this company are below, this is an annual report of Amazon. They list the following information: revenue, net income, profit, cash, debt, and share price in the last year.

Figure 2: Five years financial summary. Retrieved from: CNN Business https://money.cnn.com/quote/financials/financials.html?symb=AMZN

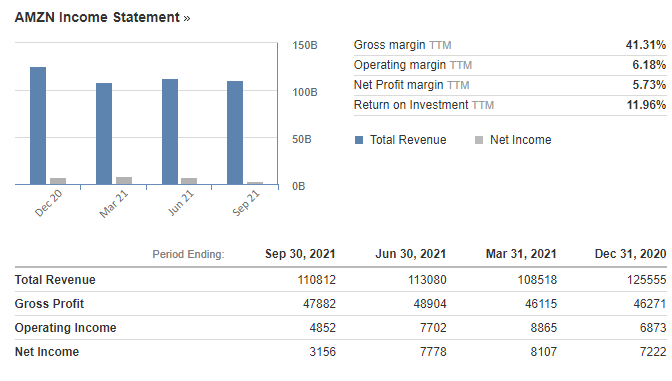

Figure 3: Amazon Income Statement [4]

Part 2:

The overall health of the company can be evaluated by looking at the performance of its financial results. The company is very popular with the public and has been making an impact among consumers. The latest figures from 2018 showed that the company makes a profit every year since its inception and it has been growing exponentially. But the company has a lot of challenges to overcome. The company Amazon addresses the overall financial health of the company (in terms of revenues, overweight revenue boundary, net return border, and reoccurrence on asset) is addressed in the company financial statement. The company Amazon addresses the overall financial health of the company is addressed in the company financial statement.

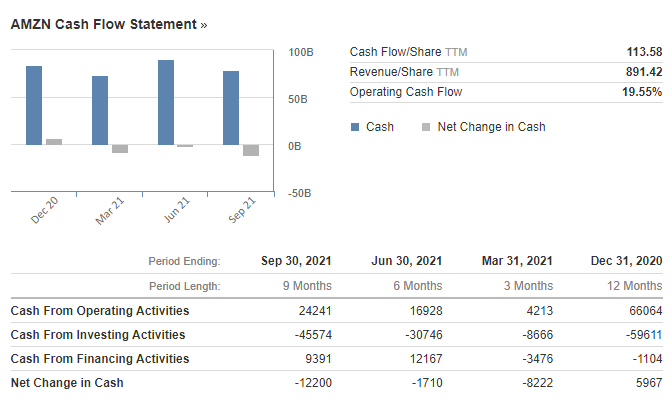

Figure 4: Amazon Cash Flow Statement[5]

The general monetary financial of the business determines how much money the company has available to invest in the future of the company. The company has grown revenues at a fast pace over the past five years. However, analysts expect growth to slow in the coming years. That being said, the company still has plenty of room to grow. The company’s most significant recent activity was acquiring Kiva Systems in 2013 for $775 million. The company also signed a deal with Amazon to supply its cloud servers. In addition to its success in the cloud, the company can be seen as a market leader for e-books and other devices to download and read digital content. Companies such as Barnes and Noble and Apple are also leaders in this area. Research shows that the company has a strong brand and consumer loyalty. This is good because it brings in customers when they need it most.

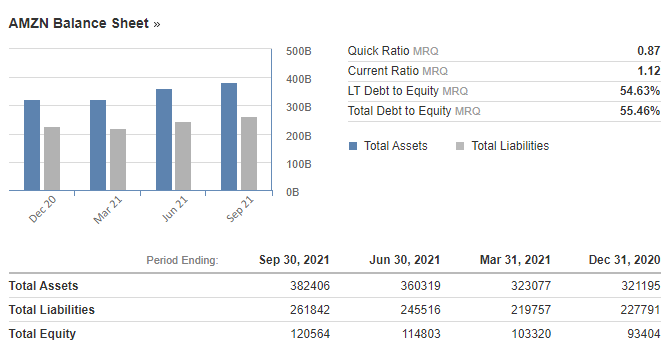

Figure 5: Amazon Balance Sheet[6]

Recommendations

The stock market is a very volatile place, but it has also become the most important place to invest in for the future. By staying current with the news and by using a good financial advisor, you can make sure that your money is growing rather than shrinking. And like any other investment, it can generate a profit or a loss, so you need to know how the stock market works. Investing time in learning about stocks and market trends will pay off over time for you. It’s best to make sure that you know what you’re doing before you get into the market. Most people don’t have the experience or expertise to invest in the stock market. You need to know about all aspects of your investment before you make a decision. The first thing you have to do is to figure out which types of investments are appropriate for your circumstances. For example, you may not want to put your money into stocks that are just starting to gain in popularity. Instead, you may want to allocate your money into a mutual fund or a pension fund that will be there when you need it. This is because it takes years for companies to build up profits before they can begin to give regular dividends to shareholders. Your money gets locked up in a mutual fund until you need it, and you have the peace of mind that the fund will always be there. These funds are considered stable because they have a fixed percentage of your money invested in stocks and are managed by professionals.

Conclusion

The first thing one can learn about investing in stocks is that it’s a long-term strategy. It takes years to build a fortune, and the returns are significantly lower than what you can achieve with a long-term asset in the standard marketplace. However, the long-term returns are much higher than what you can achieve with a bank account or savings account. On the other hand, you can achieve significant returns in a short period of time by investing in the stock market, but the long-term returns are much lower than what you can achieve with a long-term investment. In recommendation, one can choose variety of funds like Amazon that invest in different areas, such as large companies, small companies, foreign stocks, bonds, and even options. Some companies actually specialize in certain areas such as the stock market in the United States or stocks and bonds in other countries. For example, if you are interested in investing in the United States, you can choose from funds that specialize in U.S. stocks, or U.S. businesses, or U.S. funds that invest in U.S. stock.

References

Amazon.com Inc. (2020). Five years financial summary. Retrieved from: CNN Business https://money.cnn.com/quote/financials/financials.html?symb=AMZN

Franek. K. (2019). Amazon Annual Report: Financial Overview & Analysis 2019. Retrieved from: https://www.kamilfranek.com/amazon-annual-report-financial-overview-and- analysis/

Investing.com. (2020). Amazon.com Inc. Retrieved from: https://www.investing.com/equities/amazon-com-inc-financial-summary

[1] Amazon.com Inc. (2020). Five years financial summary. Retrieved from: CNN Business https://money.cnn.com/quote/financials/financials.html?symb=AMZN

[2] Ibid 1 Amazon.com Inc. (2020)

[3] Franek. K. (2019). Amazon Annual Report: Financial Overview & Analysis 2019.

[4] Investing.com. (2020). Amazon.com Inc. Retrieved from: https://www.investing.com/equities/amazon-com-inc-financial-summary

[5] Investing.com. (2020). Amazon.com Inc. Retrieved from: https://www.investing.com/equities/amazon-com-inc-financial-summary

[6] Investing.com. (2020). Amazon.com Inc. Retrieved from: https://www.investing.com/equities/amazon-com-inc-financial-summary

write

write