Introduction/ Summary

In the last decades, global competitiveness and its role in the global value chain (GVC) emerged as a fundamental paradigm of worldwide organization and development of production. The vertical fragmentation of the goods and service production process across multiple countries and sequential assembly along supply chains interlinks the core necessity of GVC and the expansion of international trade. GVC has exhibited significant and lasting influence on global commerce, fundamentally affecting competitiveness in light of international trade interdependence. This aspect explains augmented south-south trade cooperation, increasing value for various countries. This report provides a comprehensive analysis of the drivers of global competitiveness and GVC from worldwide and national perspectives in the context of Nigeria. Theories such as Resource View and Institutional Theory are used to frame the report and arguments presented herein.

1.1 Drivers of Trade Competitiveness

Several factors have been shown to have a significant impact on competitiveness, ranging from innovation, institutions and constitutional policies, business environment, and business dynamism and cooperation, among other drivers, play key roles towards global trade competitiveness and, consequently, its value.

Technology

The dynamic advancement in technology and, consequently, innovation has fundamentally contributed to globalization, fragmentation, and enhanced competitiveness in the global economy (Bontempo, 2022; Mitra et al., 2021). Many research papers address such competitive edge based on the resource-based view (RBV) theory, which holds that nations and firms can develop and sustain competitiveness through the efficient allocation of resources (Tai, 2013; Hitt et al., 2016; Shibin et al., 2020). Generally, the integration of technology and its capacity to enhance globalization lays a framework focused on improving connectedness and, thus, the value chain (Chang et al., 2021). Under RBV, key drivers for competitiveness, such as integration, infrastructure, and technology, are largely interconnected. Technological innovations play a crucial role in expediting glocalization as the major facilitator and driving force. As noted by Naz and Ahma (2018), the augmented use of electronic business (E-Business) and electronic commerce (E-Commerce) has enhanced techno-globalism. Moreover, the emergence of technology has facilitated the fragmentation of products and services, increasing cooperation across countries and businesses. The cost of coordinating complicated operations within and between companies across great distances has significantly decreased because of information management software, more affordable and dependable telecommunications, and increasingly potent personal computers (OECDE, 2013). Information and communications technologies (ICT) have advanced quickly, making many commodities and services more tradable. Hazen and Byrd (2012) concluded that logistics IT has a significant impact on efficiency, effectiveness, and resiliency performance. Furthermore, containerized shipping, standardization, automation, and increased freight inter-modality have expedited the transportation of commodities in GVCs, resulting in reduced costs, agile supply chain, and enhanced coordination and management of resources (Naz and Ahma, 2018; Shibin et al. 2020).

Regulation

The role of national, regional, and international regulations on competitiveness and the global value chain must be supported. According to Naz and Ahma (2018), government and organizational policies designed to facilitate trade and foster globalization are instrumental in channelling the flow of finance, capital, resources, and competitiveness. For instance, the UK, the US, and France ranked among the best in the WEF Global Competitiveness Report due to a conducive regulatory framework for doing business (UK, 20212), even though the country outperforms in innovation, skills, and infrastructure. From institutional theory, which focuses on the regulations, laws, cultures, and norms in relation to the external economic environment, governments and international regulations significantly influence trade and the extent of GVC (Chacar et al., 2010). In a study, Bontempo (2022) investigated the role of institutional governance on competitiveness and determined that the quality of the business environment, including regulation, has a mediation impact towards competitiveness. Institutional governance is characterized by regulations facilitating economic activities between market players (Mustafa and Jamil, 2018). Despite the fact that rule is crucial to the logistics sector, Sadovaya and Thai (2012) emphasize that strictness in regulations results in avoiding redundant or superfluous laws.

Integration and Infrastructure

Integration or cooperation is seamlessly dependent on human capital, infrastructure, technology, and regulatory framework (Blyde, 2014; Mitra et al., 2021; Bontempo, 2022;). While building on the work of earlier researchers such as Jones and Kierzkowski (1990), economists across the globe have examined cooperation among world systems through the lens of fragmentation of services and goods to determine factors driving participation in the global value chain (Grossman and Rossi-Hansberg, 2008). Coordinating manufacturing, production, and distribution across space is a crucial requirement in a lean supply chain, which focuses on waste management, cost-saving, profitability, and, therefore, competitiveness – an aspect that demands technological and human resource innovation (Blyde, 2014). Generally, the key driving factors behind GVCs emphasise the contributions of technical advancement, lower transportation and communication costs, and the elimination of political and economic constraints (Amador & Cabral, 2014), which are fundamental facets of competitive edge.

1.2 The drivers and Barriers to Nigeria’s trade Competitiveness

Nigeria remains one of the most identifiable economies in Africa in terms of GDP and, thus, a key player in South-South cooperation and, consequently, global trade (Duke et al., 2017). Just like global trade competitiveness, several factors have played significant roles in Nigeria’s trade competitiveness, including technology, infrastructure, cooperation, and trade environment as dictated by policies. The first most identifiable trade barrier and enabler is policies or regulations. While examining trade in West Africa, Torres and Van Seters (2016) argue that member countries in ECOWAS experience strict import and export regulations, with governments often supporting regional trade policies and standards deemed crucial to national interest. Nigeria is not an exception. Duke et al. (2017) argue that policymakers in the country are particularly concerned about competitiveness, given the country’s reliance on crude oil exports and substantial imports of products and services. The government has implemented extensive reforms aimed at diversifying the economy, moving trade away from a focus on crude oil to integrate other services and products, including exchange rate reforms (Omojimite and Godwin, 2010) aimed at facilitating external competitiveness. Despite this, research by De Melo and Ugarte (2013) identifies the limitations of policies affirming studies by Torres and Van Seters (2016). The research established poor trade and governance regulatory framework with a significant impact towards limiting trade, reducing participation in GVC, and thus slowing economic competitiveness.

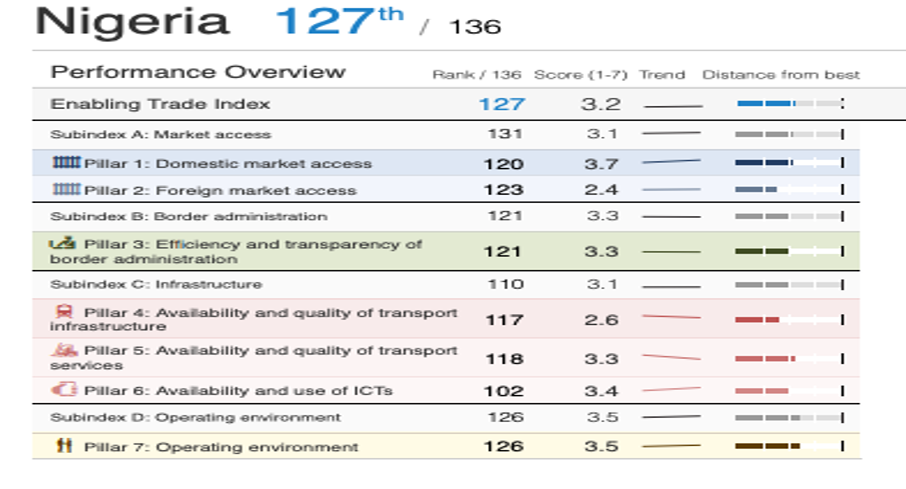

From the 2020 data published by the World Bank Trading Across Boarders, Nigeria ranked over 179 from 190 countries, indicating limited cross boarder access and economic ease (World Bank, 2023a). This aspect also explains data shown in Figure 1 (appendices) from The Enabling Trade Index report of 2016 published by Word Economic Forum (WEF), which indicates that Nigeria scores among the worst in regulatory transparency whilst ranking at least 127th out of 136 countries in terms of its ability to enable trade (WEF, 2016). Nonetheless, the country ranks between 125 and 127 out of 136 counties in terms of operating environment pillar, access to foreign and domestic markets, and efficiency and transparency of border administration. These regulatory shortcomings have a significant effect on competitiveness, as depicted in the institutional theory, which points to the role of governance in influencing other institutions, such as trade agencies, firms, and regulatory bodies (Chacar et al., 2010). While the country has made efforts to leverage regulations as enablers, there is a need to rethink the current regulatory framework from a global trade perspective.

The dynamic advancement in technology has significantly impacted local, national, and global trade, making it a key facet of competitiveness and GVC. Nigeria has done well in terms of information and communication technology, with the IT sector remaining a fundamental framework in supporting communication, e-commerce, and, consequently, the ability of the country to engage in the extensive market fragmentation process (De Melo and Ugarte, 2013). In theory research, Naz and Ahmad (2016) concluded that technology is seen as a key enabler and facilitator of globalization processes, with advancements in IT enabling businesses and countries to export their goods worldwide quickly. Thanks to the connection facilitated by technology, multinational food chains are able to replicate and standardize their goods around the world, including Nigeria. Data from WEF on the availability and use of internet and communication technology ranked Nigeria at 102 in 2014 and 108 in 2016, with increased scores between 2014 and 2016 from 2.7 to 3.5 out of 7 (WEF, 2016), which shows a positive trend in the last decade. From the RBV perspective, which promotes efficient allocation and utilization of resources to foster competitiveness (Chang et al., 2021), Nigeria has exhibited efforts to leverage existing and innovative strategies, including e-commerce, to obtain a competitive edge and foster its economic prowess. Generally, the augmented integration of technology, innovation, and technological readiness has enhanced human capital skills, competency, and the ability of the country to compete globally, especially in the South-South trade cooperation.

The concept of infrastructure and cooperation are primary factors when examining competitiveness. In their research, Arvis et al. (2007) demonstrated that the ability of logistics businesses and worldwide networks is greatly impacted by national infrastructure as well as the efficacy of regulations and institutions. From the Logistics Performance Index (LPI) that measures the performances of at least 160 countries in terms of efficiency and quality of international logistics, Nigeria has improved slightly from 2014 (score of 2.7) to 2022 score of 2.8 out of 5, indicating significant progress towards quality of trade and transport-related infrastructure and consequently ease of shipments, ability to trace and track, as well as competitiveness in pricing (World Bank, 2023b). The country is, however, ranked 88 out of the 160 countries, indicating significant improvements in logistics, infrastructure, and cooperation – key drivers of competitiveness in the global arena. Given that in 2017, it was ranked 75th, the country’s international competitiveness has declined sharply in the last decade, which points to the slowed integration of drivers of international competitiveness in regard to regulations, technology, and infrastructure. In the recent WEF report, the availability and access to transport infrastructure ranked 117 out of 136 and scored 2.6 out of 7 (see Figure 1 appendices). In their report, the OECD (2013) concludes that many developing economies often get excluded from GVC due to a lack of necessary infrastructure, which tends to create a limited business environment and consequently hinder cooperation at a global scale. This is affirmed by Naz and Ahmad (2016), who report that limited infrastructure impedes globalization by obstructing communication and transportation. This aspect tends to hinder air, sea, and land transportation, negatively influencing competitiveness.

1.3 Trade Opportunities Between Nigeria and India

India and Nigeria have enjoyed historical bilateral trade relations with significant opportunities that have shaped their roles in the South-South trade cooperation as well as the global trade arena (Wapmuk, 2012). Based on the data published by the Observatory of Economic Complexity (OEC), in 2021, India mainly exported refined petroleum, motorcycles and cycles, as well as packaged medicament, contributing to about 4.7 billion USD in revenue, while Nigeria exported 9 billion USD to India in terms of crude petroleum, petroleum gas, and agricultural;l products (OEC, 2021). In terms of rankings, India ranked 41 in the Economic Complexity Index (ECI) and 14 in total exports, while Nigeria ranked 126 in ECI and 52 in terms of total exports. This data is affirmed by data published by the Indian government, which points out that India established a diplomatic house in Lagos, Nigeria, in the 1950s and became Nigeria’s trading partner, with bilateral trade volume reaching up to 15 billion between 2021 – 2022 (Consolidate General of India, CGI, 2022). These aspects have been attributed to mutual agreements established through trade regulations – key drivers of competitiveness and GVCs, such as the Joint Trade Committee established in 2017, the Trade Agreement of 1983, and the Nigeria-India Business Council (NIBC) (CGI, 2022). Several opportunities in these bilateral trade associations explain the increased contribution of both countries in the South-South trade.

The major sector around the bilateral trade and a key area of opportunity is the Oil and Gas industry – the diversification in the Petroleum and Gas industry. While Nigeria largely relied on Crude petroleum exports (exports to India stand at 8.1 USD in 2021) as a major economic driver, recent policy reforms and advancements in technology have led to diversification of the sector to integrate refinery industries, which were initially imports from India and other countries (CGI, 2022). A report published by CGI, 2021) shows that, while Nigeria continues to face challenges when it comes to technology and ICT – an aspect that is evident in the WE F (2016) report, India has excelled in the sector. The technological and infrastructure sector and manufacturing industry are interlinked and create a trade opportunity between Nigeria and India, which is also a key driver in global competitiveness and GVC. Given that the oil and gas sector has exhibited over 12% year-on-year real growth in the second quarter of 2022, contributing at least 6% towards GDP, there is a need for diversification in the sector, especially given the continued decline in the manufacturing sector by over 12% in the same period (National Bureau of Statistics (NBS), 2022).

The trade around petroleum and gas is a key bilateral trade between the two countries, and diversification in the sector could help influence their place in global business. As noted by OEC (2021), Nigeria exports Crude Oil to India, which exports refined petroleum products back into the country. Over 30% of the economy has long relied on oil, which makes diversification a key necessity towards the future of Nigeria’s economy. In a report, the International Monetary Fund concludes that India has experienced extensive difficulty or challenges in trying to leverage global trends in diversification due to high reliance on Oil and oil products, yet emphasizes that the country could learn and benefit from peer countries, including India and Malaysia (Yao and Liu, 2020. This aspect includes leveraging success data from India on its move from reliance on natural resources to integrating technological advancement, including e-commerce and the business-to-business market (Bughin et al., 2016). The dependence on e-commerce, B2B, and the move towards agricultural production and refinery of petroleum products creates a framework to facilitate cooperation at a global scale. As noted by OECD (2013), GVC and global competitiveness are driven by a conducive business environment, innovation, technology, and diversification aimed at establishing a competitive edge.

Conclusion

Overall, the key drivers of global and national competitiveness, as well as GVC, include technology, infrastructure, regulations, and cooperation. Countries such as Nigeria have exhibited efforts towards implementing these drivers, although they face challenges which have limited capacity to leverage GVC. This report shows that cooperation between countries, from a systems theory, RBV, and institutional theory perspective, is crucial to remain competitive and enhance economic growth.

Reference List

Amador, J. L., and Cabral, S. (2014) Global value chains: Surveying drivers and measures.

Arvis, J. F., M. A. Mustra, J. Panzer, L. Ojala, and T. Naula. (2007) Connecting to Compete-Trade Logistics in the Global Economy. Washington: The World Bank.

Bontempo, P. C. (2022) Countries’ governance and competitiveness: business environment mediating effect. RAUSP Management Journal, 57, 49-64.

Blyde, JS, (2014) The Drivers of Global Value Chain Participation: Cross-Country Analyses. Synchronized Factories: Latin America and the Caribbean in the Era of Global Value Chains, pp.29-73.

Business Innovation & Skills (BIS) (2012) Benchmarking UK competitiveness in the global economy – GOV. UK, publishing.service.gov.uk. Available at: https://assets.publishing.service.gov.uk/media/5a7899e1e5274a277e68dfed/12-1207-benchmarking-uk-competitiveness-in-the-global-economy.pdf (Accessed: 21 November 2023).

Consulate General of India Lagos (CGI) (2022) Brief on India-Nigeria Bilateral Economic & Commercial Relations, Consulate of India, Lagos. Available at: https://cgilagos.gov.in/India-Nigeria-Bilateral-Trade-and-Economic-Relations.php (Accessed: 21 November 2023).

Chacar, A. S., W. Newbury, and B. Vissa (2010) “Bringing Institutions Into Performance Persistence Research: Exploring the Impact of Product, Financial, and Labour Market Institutions.” Journal of International Business Studies 41: 1119–1140.

Chacar, A. S., W. Newbury, and B. Vissa (2010) Bringing Institutions Into Performance Persistence Research: Exploring the Impact of Product, Financial, and Labour Market Institutions. Journal of International Business Studies 41: 1119–1140.

Chang, C. H., Lu, C. S., and Lai, P. L. (2022) Examining the drivers of competitive advantage of the international logistics industry. International Journal of Logistics Research and Applications, 25(12), 1523-1541.

Duke, O., Yakub, M., Nakorji, M., Gaiya, B., Isma’il, F., Sani, Z., Zimboh, S., Obiezue, T., Asuzu, O. and Aliyu, V., (2017) Determinants of Nigeria’s External Sector Competitiveness. Economic and Financial Review, 55(2), p.4.

De Melo, J., and Ugarte, C. (2013) Nigeria: Time to Take the Lead on Regional and Global Trade Integration in West Africa (No. P66). FERDI Working paper.

Gugler, P. and Chaisse, J. eds., (2010) Competitiveness of the ASEAN countries: corporate and regulatory drivers. Edward Elgar Publishing.

Hazen, B. T., and T. A. Byrd. (2012) Toward Creating Competitive Advantage with Logistics Information Technology.” International Journal of Physical Distribution & Logistics Management 42 (1): 8–35.

Hitt, M. A., K. Xu, and C. M. Carnes (2016) Resource Based Theory in Operations Management Research. Journal of Operations Management 41: 77–94.

Jones, R. W. and Kierzkowski, H. (1990), The role of services in production and international trade: A theoretical framework, in R. W. Jones and A. Krueger, eds, ‘The Political Economy of International Trade’, Oxford, Basil Blackwell, chapter 3, pp. 31–48.

Mitra, S., Gupta, A.S. and Sanganeria, A., (2020) Drivers and benefits of enhancing participation in global value chains: Lessons for India.

Mustafa, G., and Jamil, M. (2018) Testing the Governance-Productivity nexus for emerging Asian countries. The Lahore Journal of Economics, 23(1), 143–169. doi: 10.35536/lje.2018.v23.i1.A6.

National Bureau of Statistics (NBS) (2022) Reports | National Bureau of Statistics, Nigerian state. Available at: https://nigerianstat.gov.ng/elibrary/read/1241175 (Accessed: 21 November 2023).

Naz, A. and Ahmad, E. (2018) Driving Factors of Globalization: An empirical analysis of the developed and developing countries. Business and Economic Review, 10(1), pp.133-157.

OECD (2013) Interconnected economies: Benefiting from Global Value Chains – OECD. Available at: https://www.oecd.org/sti/ind/interconnected-economies-GVCs-synthesis.pdf (Accessed: 21 November 2023).

Omojimite, B. U. and Godwin, A. (2010) The Impact of Exchange Rate Reforms on Trade Performance in Nigeria. Journal of Social Sciences, 23(1): 53-62.

Observation of Economic Complexity (OEC) (2021) The observatory of economic complexity, The Observatory of Economic Complexity. Available at: https://oec.world/en/profile/bilateral-country/ind/partner/nga (Accessed: 21 November 2023).

Roy, S., (2018) Impact of competitiveness drivers on global competitiveness index. Pacific Business Review International, 11(2), pp.17-29.

Sadovaya, E., and V. V. Thai. (2012) “Maritime Security Requirements for Shipping Companies and Ports: Implementation, Importance and Effectiveness.” Paper presented at International Forum on Shipping, Ports and Airports (IFSPA) 2012, Hong Kong, May 27–30.

Simionescu, M., Pelinescu, E., Khouri, S. and Bilan, S., (2021) The Main Drivers of Competitiveness in the EU-28 Countries. Journal of Competitiveness, (1).

Shibin, K. T., R. Dubey, A. Gunasekaran, B. Hazen, D. Roubaud, S. Gupta, and C. Foropon. (2020) “Examining Sustainable Supply Chain Management of SMEs Using Resource-Based View and Institutional Theory. Annals of Operations Research 290 (1): 301–326.

Tai, Y. M (2013) “Competitive Advantage Impacts of Direct Procurement Management Capabilities and Web-Based Direct Procurement System.” International Journal of Logistics Research and Applications 16 (3): 193–208.

Torres, C. and van Seters, J., (2016) Overview of trade and barriers to trade in West Africa. European Centre for Development Policy Management Discussion Paper, 195, pp.1-75.

Wapmuk, S., (2012) Bilateral Trade and Investment Relations between Nigeria and India. Africa Review, 4(2), p.122.

World Economic Forum (WEF) (2016) The Global Enabling Trade Report 2016, weforum.org. Available at: https://www3.weforum.org/docs/WEF_GETR_2016_report.pdf (Accessed: 21 November 2023).

World Bank (2023a) Logistics performance index: Overall (1=low to 5=high) – Nigeria, World Bank Open Data. Available at: https://data.worldbank.org/indicator/LP.LPI.OVRL.XQ?contextual=min&end=2022&locations=NG&name_desc=true&start=2022&view=bar (Accessed: 21 November 2023).

World Bank (2023b) Trading Across Borders; World Bank Report, DataBank. Available at: https://databank.worldbank.org/reports.aspx?source=3001&series=TRD.ACRS.BRDR.RK.DB19 (Accessed: 21 November 2023).

Yao, J. and Liu, Y. (2020) Diversification of the Nigerian economy8. Available at: https://www.elibrary.imf.org/downloadpdf/journals/002/2021/034/article-A002-en.pdf (Accessed: 21 November 2023).

Appendices 1: Enabling Trade details of Nigeria.

Figure 1. Enabling Trade details of Nigeria. Source WEF, 2016.

write

write