Executive summary

This report aims to help us examine and understand the key accounting standards changes that have occurred within the Company and also examine the impacts of the Covid 19 pandemic on the Company’s operations and functioning. The report found that the key accounting standard changes that have occurred within the Company include state regulations, Income from Consumer Contracts, Receivables from Contractual Earnings from Sales to Customers, Allocation of Transaction Value to Existing Contracts, Prior Period Performance standards, Fair Value Measurements, Risk to the Counterparty and Offsetting and many others. The impacts of Covid-19 were the decline in global demands and disruption of financial positioning, among others. The report will then provide a conclusion at the end in summarising the key findings.

1.0 Introduction

Callon Petroleum Company is an independent petroleum and energy firm engaged in purchasing, exploiting, and producing premium properties in the most productive oil fields in South and West Texas. In 1951, John S. Callon established the business, which would now become Callon Oil Corporation (Rassenfoss, 2015). He produced oil in two of his reservoirs on June 15, 1953. Sim C. Callon, Sim’s brother, joined the firm, then named Callon Oil & Gas Corporation, in 1955. In 1962, Callon Oil & Gas changed its name to Callon Oil Company. Petroleum and natural gas are two examples of the actual and prospective energy product market divisions that the Commodities and Securities Trading Commission (the “CFTC”) has the ability to watch over. The Corporation is therefore obligated to adhere to anti-market modification and disruptive trade policies and associated laws imposed by FERC and the CFTC regarding physical buying and selling of energy resources and other energy products, as well as any associated hedging actions the Firm performs.

Significant regulatory power is also held by the CFTC, such as the power to impose civil fines. The over-the-counter futures contract and the organisations engaged in it are now subject to government scrutiny and regulations thanks to the financial planning reform law Congress enacted in 2010 (Mazur et al., 2021). The Global Accounting Standards Board created and maintained a common standard known as Global Accounting Standards (IFRS) to enable built, arising, and underdeveloped countries to apply those standards consistently across the globe. This will allow investors and other market participants to compare the income statements. The COVID-19 epidemic and numerous government responses have had a detrimental effect on the world economy, interrupted distribution networks around the world, and caused significant uncertainty and interruption in the finance and commodity market opportunities (Avram & Avram, 2020).

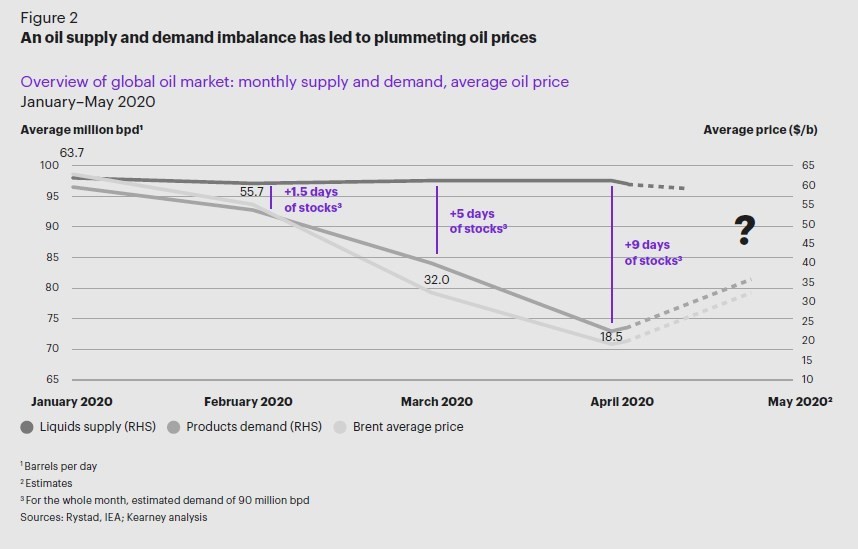

Additionally, it has led to an unprecedented decrease in demands for natural gas and petroleum in 2019-2020, which has had a substantively negative influence on the Company’s operations, financial condition, outcomes of operations and operating income. The COVID-related epidemic has also accelerated fluctuation and occasionally pressures the financial markets.

Consequently, in the long term, they may have trouble obtaining the financing required to support their operations, which have significant capital prerequisites, on favorable terms or at all. This would boost the liquidity management associated with a significant decrease in the company revenues and financial accounting changes. The significant accounting adjustments that have been made to the firm’s financial statements and the implications of COVID-19 on the firm will be examined and better understood with the aid of this paper. The study will begin with a short overview of the firm, discuss IFRS, and then offer a summary of the study’s conclusions at the end.

2.0 Accounting standard changes as per IFRS

2.1 State Regulations

Texas supervises the generation, collection, and marketing of petroleum and natural gas and mining of these resources. This regulation includes severance charges and procedures for acquiring drilling licenses. Texas presently charges a 4.6percentage severance taxation on the extraction of oil and a 7.5percentage severance tax on the extraction of natural gas. Governments also control how new fields are developed, how wells are spaced and operated, and how to avoid wasting petroleum and natural gas commodities (Cherian et al., 2018). The government has set maximum daily output limits from petroleum and natural gas reservoirs according to market demands, resource preservation, or a combination of the two. We cannot guarantee that states won’t restrict wellhead pricing or participate in other forms of direct price controls in the long term. These rules limit the quantity of petroleum and natural gas that can be generated from the company wells as well as the variety of wells or drilling sites that are permitted. The petroleum business must also follow additional federal and municipal rules and laws. Some of the laws deal with equal job opportunities and resource protection. However, they think that adhering to these regulations will negatively impact us in a significant way (Dietrich, 2011).

2.2 Income from Consumer Contracts

In accordance with the relevant contractual provisions, the firm realises income from the extraction of oil, natural gas, and NGLs when the administration of the commodity passes to the buyer. The representation of collection, shipping, and processing in the consolidated balance sheets of business is also influenced by the change in control (Mire, 2021).

2.3 Receivables from Contractual Earnings from Sales to Customers

The financial account of net accounting records, which is shown by the consolidated financial statements under “Accounts receivable, net,” on October 30, 2021, and October 31, 2020, was $167.1 million and $100.5 million, respectively. Net receivables encompass volumes billed and currently owing from earnings from agreements with oil and natural gas production clients.

2.4 Allocation of Transaction Value to Existing Contracts

The pragmatic expedient in Accounting Rules Convention 605-10-54-14, which also asserts the Corporation is not mandated to disclose the transaction prices allocated to remaining contracts with customers if the varying evaluation is assigned purely to a dissatisfied contractual obligation, has been applied to the Firm’s product sales that have contracts with terms longer beyond one year. Every item of goods is often treated as a unique performance obligation under certain contracts of sales; as a result, prospective quantities are dissatisfied and reporting the transaction price assigned to unfulfilled performance requirements is unnecessary (Hobbs, 2019).

2.5 Prior Period Performance standards

When the commodity is handed over to the client, the Company recognises income. The Firm must anticipate the quantity of goods provided to the buyer, and the cost which will be paid for selling the goods since settling statements for purchases could not be obtained for between 30 and 90 days just after the period production is distributed. When payments from the customer are generated, the firm keeps track of any discrepancies between projections and actual amounts earned for sales volume. Internal control systems for the firm’s cash estimating process and associated accrued expenses are in place, and any past discrepancies between the firm’s earnings estimates and actual revenues received have not been substantial (Bernauer & Slowey, 2020).

2.6 Fair Value Measurements

A three-level appraisal pyramid is established by accounting standards for assessing fair value to be disclosed. Based on the visibility of the data used in the assessment, the valuing hierarchy divides assets and liabilities valued at fair market value into one of three categories. These are the three tiers’ definitions: Level 1: Observed data, like stated prices for similar, unconstrained assets or liabilities at the reporting date in active marketplaces. Level 2: Additional data that are either directly or indirectly visible, such as stated prices in inactive marketplaces or data that are observed directly or indirectly for almost the entire duration of the asset or obligation. Level 3: Non – observable variables that the Company relies on estimates how market players might value the assets and obligations without sufficient market information (Bernauer & Slowey, 2020).

2.7 Goals and Approaches for Using Derived Instruments

The Corporation is vulnerable to price changing its extraction of natural gas, oil, and NGLs. As a result, the Company considers it reasonable to control the cash flow fluctuation in its production of crude oil, natural gas, and NGL. The Firm uses a combination of collars, swaps, putting and call options to control operating cash volatility brought on by shifts in commodities prices. The Corporation does not use such securities for speculation or marketing.

2.8 Risk to the Counterparty and Offsetting

The Firm usually has many commodity derivative contracts with counterparties that have been signed at different dates for different types of contracts, products, and time frames. This frequently leads to both liability and asset positions in commodities derivatives with that counterparties. Following International Swap Dealers Association Master Agreements ( referred to as “ISDA Contracts”), which call for net settling throughout the agreement as well as on the occasion of default or agreement cancellation, the Corporation earns its commodities futures instrument valuations implemented with the same creditor to a separate asset or liability. Generally, the opposing party has the power to request the placement of security, demand a cash payment transfer, or dissolve the contract if a party to a derivatives transaction experiences an incident of failure, as stated in the relevant agreement (Connolly et al., 2020). To reduce its credit risk to any counterparty, the firm has sixteen existing commodities derivative contracts as of October 30, 2019. The counterparty to all of the commodities financial derivatives of the Firm are also borrowers under the Loan Agreement of the Firm. So as long as the business is in a net liability status with the security protecting the agreement, each of the Firm’s creditors permits the Company to pay any margin requirements connected with commodities and financial derivatives, obviating the requirement for separate security postings (Ajami, 2020).

2.9 Presenting and Settlement of Financial Statements

The discrepancy between the contract value or rates indicated in the derivative instruments and a reference price, such as the NYMEX value, is used to resolve the Firm’s commodities derivatives. The Firm utilises present value methodologies that incorporate product pricing statements based on those seen in underpinning marketplaces to ascertain the fair market value of the Firm’s financial derivatives.

2.10. Warrants

The firm issued warrants for 10.5 million shares of the common stock (the “September 2021 Warrants”) that may only be exercised on a net sharing settlements basis on October 30, 2021, for a total principal value of $400.0 million. The Firm concluded that the October 2020 Warrants must be treated as a derivatives contract for accounting purposes. Profits and losses resulting from changes in the fair value of the October 2021 Warrants are documented as “(Profit) loss on financial derivatives” in the consolidated balance sheets of processes for the time frame in which the changes take place (Bourghelle et al., 2021). The Industry registered the October 2020 Warrants as an obligation on its consolidated statements of financial position measured at fair value as a constituent of “Fair market value of derivative products.”

2.11. Measuring at Fair Market value for Nonrecurring Basis for assets and liabilities.

The Firm utilises a discounted cash flows framework with data that are not market evident and are thus classified as Level 3 in the pricing ranking to determine the market price of projected benefit liabilities as of the date a well started excavating or when manufacturing equipment and facilities are implemented (Shehzad et al., 2021). Forecasts of the expenses of plugging and disowning oil and gas wells, attempting to remove processing equipment and facilities, and rebuilding the surface of the land, as well as forecasts of the financial statements of the petroleum and natural gas wells and future inflation expectations, are substantial components to the fair value estimation of accrual accounting responsibilities.

3.0 Effects of Covid 19 to the Company

3.1 Influence on the financial position

Any future invasion of other highly transmissible or dangerous diseases may negatively impact our firm’s financial position, outcomes of operations, and future revenues. The COVID-19 epidemic and numerous government measures to reduce its impact substantively adversely affected these variables (Gharib et al., 2021). The COVID-19 epidemic and various government responses to it have had a negative impact on the world’s economy, interrupted distribution networks worldwide, and caused considerable fluctuation and interruption in the finance and commodity markets. Additionally, it has led to an unprecedented drop in demands for petroleum and natural gas, especially in 2020, which has had a substantively negative effect on our Company’s operations, financial condition, outcomes of operations and future revenues (Lin & Zhang, 2020). The COVID-related epidemic has also elevated fluctuation and occasionally pressures the financial markets. Consequently, in the long term, the Company may have trouble obtaining the financing required to fund company processes, which have large capital demands, on favorable terms or at all. This would raise liquidity problems related to a major decrease in revenues and future revenues.

3.2 Unexpected restrictions

Shelter-in-place directives and other comparable adjustments to the workplace are relevant to our 28 workers and business associates, among many others. The difficulties in working brought on by the COVID-19 epidemic and associated limitations affected the well-being of corporate staff, affecting staff retention, production, and company culture. Additionally, they can encounter staff turnover, as is the case for businesses across the U.S. economy (Thorbecke, 2020). The COVID-19 epidemic’s final effects are very unclear and prone to change since there are no similar previous occurrences that can be used as a precedent for what influence they could have.

3.3 Worldwide recession

Moreover, the magnitude of the COVID-19 epidemic’s impact on Callon company, operational and financial performances, such as the capacity to carry out our corporate goals and objectives in the anticipated timespan, was uncertain and depended on a variety of unpredictable factors, such as the: the severity and length of the disease outbreak; the reaction of the authorities, Company, and other sectors to the disease outbreak; the influence of the disease outbreak on business growth among many others (Mhalla, 2020).

3.4 Restrictions on foreign exports

The federal restrictions from other countries hampered the exportation of oil products to their territories, reducing the market segment and leading to financial decline. The transportation rate to other potential countries was low compared to previous trading processes. For instance, china was severely affected by this pandemic. As a result, they could not access such regions due to state and federal restrictions (Corbet et al., 2010). The Company was forced to wait until the pandemic cools down to proceed with its distribution of natural gas and petroleum products. As a result, the Company could not secure financial credits from lending agencies. The existing debts continued to appreciate since the Company had made agreements before the pandemic was diagnosed; hence they had to continue paying, or the interests could have accrued. This, in return, affected the annual financial revenues recorded by the firm.

4.0 Conclusion

In conclusion, as per the findings, Callon petroleum company has had various accounting standard changes, which has contributed to its current marketing position. Some of the accounting standards changes that the Company has adopted include; state regulations, Income from Consumer Contracts, Receivables from Contractual Earnings from Sales to Customers, Allocation of Transaction Value to Existing Contracts, Prior Period Performance standards, Fair Value Measurements, Risk to the Counterparty and Offsetting and many others. These changes have brought a significant impact on their financial accounts and their financial revenues. The Company was also severely impacted by the Covid 19 pandemic. Some challenges observed include influence on the Company’s financial position, employee retentions, worldwide recession, and restrictions on foreign exports, among many others. Therefore, the Company needs to keep the focus on changing accounting standards as per the IFRS to keep abreast as other companies on the same line

5.0 References

Gatto Jr, J. C., & Nelson, W. B. Callon Petroleum Company.

Rassenfoss, S. (2015). Search for Elusive Sweet Spots Is Changing Reservoir Evaluation. Journal of Petroleum Technology, 67(09), 52-57.

Mazur, M., Dang, M., & Vega, M. (2021). COVID-19 and the march 2020 stock market crash. Evidence from S&P1500. Finance research letters, 38, 101690.

NO, A., & WEATHERLY, J. S. AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON NOVEMBER 21, 1997, REGISTRATION NO. 333-39401.

Avram, R. L., & Avram, C. D. (2020). ECONOMIC RECOVERY MEASURES TAKEN IN US IN THE CONTEXT OF THE COVID 19 PANDEMIC. Anale. Seria Stiinte Economice. Timisoara, 25, 5-12.

Cherian, B., Shoemaker, M., Nwoko, S., Narasimhan, S., Olaoye, O., Iqbal, J., … & Zakhour, N. (2018, September). Understanding development drivers in horizontal wellbores in the Midland Basin. In SPE Liquids-Rich Basins Conference-North America. OnePetro.

Dietrich, C. R. (2011). “Arab oil belongs to the Arabs”: Raw material sovereignty, Cold War boundaries, and the nationalisation of the Iraq Petroleum Company, 1967–1973. Diplomacy & Statecraft, 22(3), 450-479.

Mire, K. (2021). The Eagle Ford Shale Play of Texas Thirteen Years of Development December 2020.

Hobbs, G. (2019). British Imperialism and Oil: A History of British Petroleum, 1901-2016 (Doctoral dissertation, SOAS University of London).

Bernauer, W., & Slowey, G. (2020). COVID-19, extractive industries, and indigenous communities in Canada: Notes towards a political economy research agenda. The Extractive Industries and Society, 7(3), 844-846.

Connolly, R., Hanson, P., & Bradshaw, M. (2020). It’s déjà vu all over again: COVID-19, the global energy market, and the Russian economy. Eurasian Geography and Economics, 61(4-5), 511-531.

Ajami, R. (2020). Globalisation, the challenge of COVID-19 and oil price uncertainty. Journal of Asia-Pacific Business, 21(2), 77-79.

Bourghelle, D., Jawadi, F., & Rozin, P. (2021). Oil price volatility in the context of Covid-19. International Economics, 167, 39-49.

Shehzad, K., Zaman, U., Liu, X., Górecki, J., & Pugnetti, C. (2021). We are examining the asymmetric impact of the COVID-19 pandemic and global financial crisis on Dow Jones and the oil price shock. Sustainability, 13(9), 4688.

Lin, B. X., & Zhang, Y. Y. (2020). Impact of the COVID-19 pandemic on agricultural exports. Journal of Integrative Agriculture, 19(12), 2937-2945.

Thorbecke, W. (2020). The impact of the COVID-19 pandemic on the U.S. economy: Evidence from the stock market. Journal of Risk and Financial Management, 13(10), 233.

Corbet, S., Goodell, J. W., & Günay, S. (2020). Co-movements and spillovers of oil and renewable firms under extreme conditions: New evidence from negative WTI prices during COVID-19. Energy economics, 92, 104978.

Mhalla, M. (2020). The impact of novel coronavirus (COVID-19) on the global oil and aviation markets. Journal of Asian Scientific Research, 10(2), 96-104.

write

write