Introduction

This report centers around the three significant members in public finance, in particular, private assets, public, and supporting organizations. In the light of the delicate monetary market execution, prudential administrative guidelines, including Worth In danger requirements, are forced broadly everywhere. The motivation behind these guidelines is to decrease the danger of benefits reserves and ensure annuity store members. There are various aspects in todays’ bookkeeping world that must be considered. These features range from accounting, consolidations and acquisitions, and charges to stock and benefits. One worry in this day and age that has everyone stressed is the prospect of retirement. With expansion and costs rising, arranging retirement has become much more basic regardless of turning out to be progressively troublesome. Annuities are one type of retirement arranging that is genuinely dependable and simple to set up. A benefit is an agreement for a decent measure of cash to be paid to somebody in customary portions normally following retirement. A benefit is a developed over numerous long stretches of administration for an organization and it is a blend of ventures and income all through the long stretches of administration

Nonetheless, the administrative skyline is generally a lot more limited than the institutional financial backers’ speculation skyline.

Section two researches the ideal speculation procedures of a public pension under such a misalignment. Characterized Advantage and Characterized Commitment are the two most normal kinds of benefits plans. People with Characterized Commitments pension plan get a single amount when they resign. They can then choose whether and when to annuitize the singular amount. The annuity pay relies upon the size of the benefits riches and the loan fee at the annuitization time.

The third section breaks down retirement timing choices of benefits plan members, considering the ideal annuitization timing choice. Organizations supporting underfunded plans are regularly legally necessary to make extra monetary commitments to close the subsidizing hole. Amidst a monetary emergency, obligatory commitments will seriously fix monetary requirements of supporting organizations. Section 4 fosters an ideal venture procedure for an organization supporting an under-subsidized benefits plan with a compulsory commitment necessity, meaning to lessen the effect of obligatory commitments on monetary limitations.

Purpose statement

This report focuses on the analysis of the data provided to us, to further interpret which organization was at the first line to contribute much as far as capital is of question. To analyze these factors on various assets such as private companies and public pensions.

Body

The coming of pandemic unannounced messed up with many economies because no economy was prepared to for it coming. As a result, many companies were forced to close for the purpose and to obey government regulation on the pandemic. The closing of hotels and companies forced some employers to release their workers for no money was being generated hence no money was them to pay the workers to.

The Coronavirus pandemic has been a twofold blow concerning annuity frameworks’ sufficiency. From one perspective, soaring joblessness rates lessened the portion of the workforce in proper business that is covered by annuity plans. Lower commitments to benefits plans, and the way that a few state run administrations permitted savers to take advantage of their retirement reserves, shrank the future annuity pots.

By freeing some from the tension on the state spending plan to fund state government assistance in the short run, the area could see three unfortunate results: higher benefits imbalance, a higher predominance of advanced age destitution, and a higher portion of the older who rely upon charge financed state government assistance in advanced age in the long haul. Therefore, the Coronavirus emergency cast a long shadow over America in a long time to come. Moreover, future declined simply transitory because of Coronavirus and will surely continue its vertical pattern. Joined with declining fruitfulness rates, this advancement prompted quickly expanding advanced age reliance proportions

The aftereffects of Dakota pension fund data, which surveys how pre-arranged worldwide benefits frameworks are for segment change, show that regardless of a few late changes, the supportability and ampleness of America’s annuity frameworks have barely changed inside the most recent two years. They actually range in the lower half of the positioning, with the general evaluations going somewhere in the range of 3.5 and 4.3 on a scale from one (best) to seven since the impacts of certain changes point in various headings regarding maintainability and sufficiency for instance, Texas’ choice to build the pension fund, for instance, or were too mindful to even consider making some difference, similar to the increment of the retirement age.

Pension facts

Pension; There are various aspects in todays’ bookkeeping world that must be considered. These features range from accounting, consolidations and acquisitions, and charges to stock and benefits. One worry in this day and age that has everyone stressed is the prospect of retirement. With expansion and costs rising, arranging retirement has become much more basic regardless of turning out to be progressively troublesome. Annuities are one type of retirement arranging that is genuinely dependable and simple to set up. A pension is an agreement for a decent measure of cash to be paid to somebody in customary portions normally following retirement. A pension is a developed over numerous long stretches of administration for an organization and it is a blend of ventures and income all through the long stretches of administration

According to a bookkeeping perspective, benefits are split as representing the business and representing the annuity store. There are two kinds of benefits plans. The first is a contributory asset. With this sort, the representatives have part of the weight as they make installments toward their asset all through their vocation. The second kind of asset us called a noncontributory reserve. With this the business bears every one of the expenses and pays for the whole asset. Which kind of annuity store is utilized relies upon how an organization needs to use government personal tax breaks? Plans that really do offer tax breaks are called qualified benefits plans. These plans offer assessment derivations from the business’ commitments and tax-exempt profit from annuity store resources.

There are different sides to benefits plans and both will be taken a gander at inside this paper. The principal kind of annuity plan is a characterized commitment plan. This kind of benefits centers around what the business adds to an annuity in light of a recipe. This equation depends on elements like age, length of profession, benefits, and pay sum. These plans are typically alluded to as 401k plans. The business turns over the first sums added to an outsider. This outsider is then liable for the venture and appropriation of benefits store. For this situation the representative gets every one of the advantages or misfortunes from the asset and the business just contributes yearly the sum chose by a recipe. This implies that business should just make a benefits cost section consistently to record the sum that was paid to the annuity store. The benefits are recorded as an obligation provided that the business has not settled completely the concurred sum and it is recorded as a resource assuming they make the full installment. Alongside the section the business should incorporate notes that depict the arrangement, the determinants of commitment, and the gatherings covered. The second kind of annuity plan is a characterized benefit plan. This sort of plan centers around the advantages the representative will get upon retirement. The organization should meet the assigned advantage responsibilities upon retirement by deciding the amount they need to pay in the present to give enough later on.

Data and findings

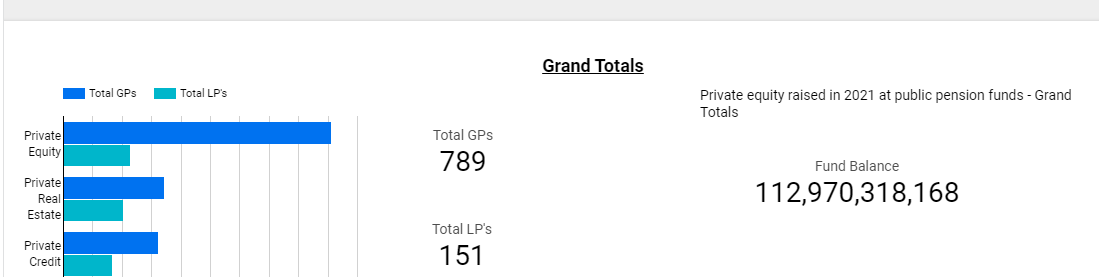

Figure 1 shows the grand total of every account with their graphs.

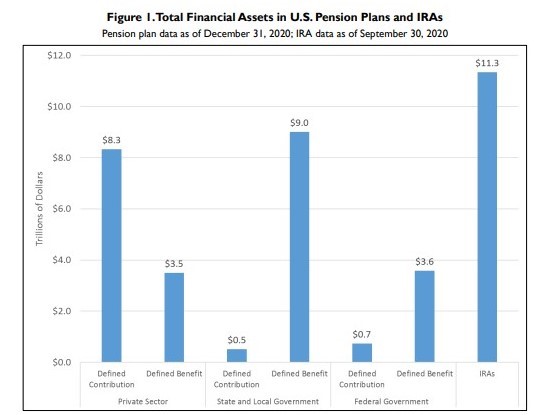

Figure 2. Total Financial Assets in U.S. Pension Plans. Dakota Data as of December 31, 2021

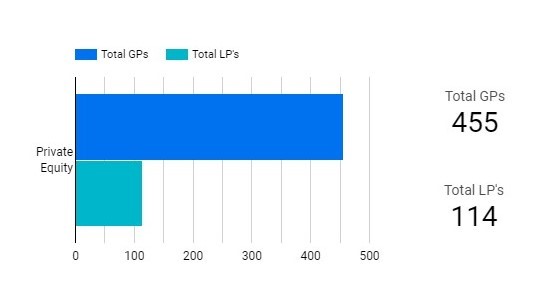

Figure 3. USA Private Equity December 2021

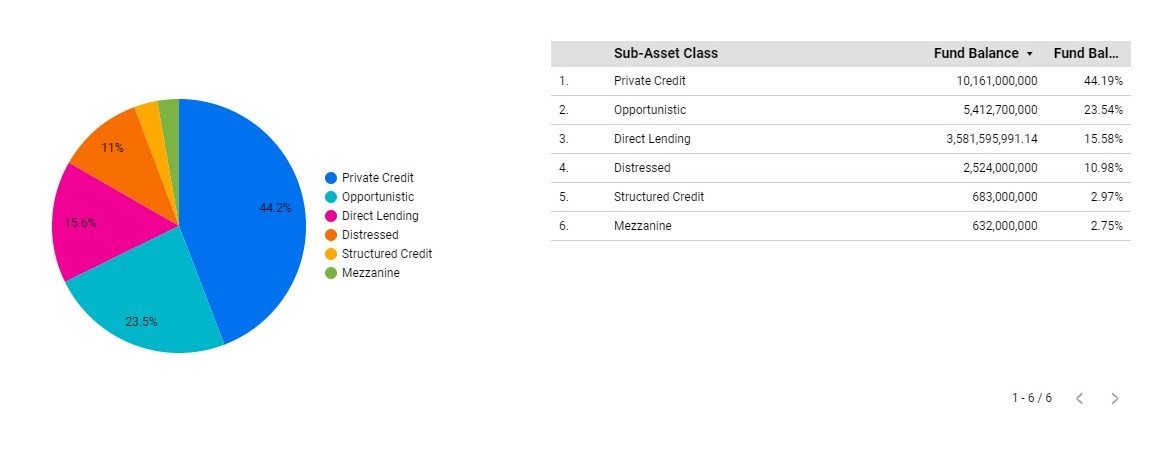

Figure 4. Public Pension Fund Assets

Data Analysis according to Dakota Data

The information tracks promoting moves in element, making it the fourth consecutive quarter that employing action has outperformed 400 maneuvers. This carries the all out for the year to 1,749, up by around half from the 1,164 actions in all of 2019. The greatest influential people for Q4 incorporate Private Value firms (108 maneuvers), Abundance The executives’ firms (87 actions), multi-Resource firms (67 actions), Speculative stock investments (53 actions) and Credit firms (43 actions). These are additionally the five areas that produced the most recruiting action in 2020 generally speaking, albeit in a marginally unique request with multi-Resource firms (350 actions) driving the way, trailed by Abundance The executives’ firms (305 actions), Private Value firms (285 maneuvers), Mutual funds (237 actions) and Credit firms (200 actions).

The areas that bounced the most in 2020 when contrasted with 2019 incorporate Foundation (+42 actions, or +1005%), Abundance The board (+171 maneuvers, or +127.6%), Credit (+85 actions, or +73.9%) and Private Value (+85 actions, or +42.5%). No area encountered a drop in recruiting action, as indicated by our information.

The information likewise tracks employing action in the more specialty areas of the elective speculation space (see ‘New Classes’ table), with generally equivalent quantities of gets across Secondaries (35 maneuvers), Asset of Assets (33 actions), FinTech/Investment (33 actions) and ESG (26 actions). Of these, the one with the most potential to break out in 2021 is possible Secondaries, which has partaken in a shelter as of late as financial backers’ racket to adjust their portfolios.

The topographical information uncovers not many astonishments other than that Brexit doesn’t seem to have essentially impacted the interest for USA-based advertising experts. Truth be told, recruiting in the USA went up in 2020 (315 maneuvers versus 274 actions in 2019), albeit not exactly as much as in the remainder of the EU (154 actions in 2020 versus 104 maneuvers in 2019). North America (NORAM) keeps on ruling employing action with around 66% (65.3%) of the multitude of moves in 2020, which is really an increment on the 59.1% proportion in 2019.

There are no significant inconsistencies in variety employing across techniques, with guys and Caucasians addressing the majority of the fresh recruits. The areas with the most non-Caucasian moves in Q4 included Private Value (24), multi-Resource (13), Multifaceted investments (12) and Abundance The board (10), not shocking given these are the areas with the most employing action by and large.

This information recommends that elective trading companies might be in briefly of retribution in 2021 as variety requests increase. Many firms made huge strides in 2020 to set up variety centered enlistment and preparing drives, yet these drives presently can’t seem to deliver profits as more different recruiting. We completely anticipate that institutional financial backers should start pulling their capital from firms that don’t gain more headway that is unmistakable a powerful inspiration to speed up changes in employing rehearses.

Generally significant, we are living in the Overlaid Period of Value Venture. Both the number and size of private value bargains have set new records every year since the Incomparable Downturn. After a short break in 2020 for Coronavirus, bargain volume in 2021 set one more record-breaking yearly record-before the finish of November. What might be compared to 10% of absolute resources universally. Everything unquestionably revolves around financing costs or rather the deficiency in that department. “To meet their future liabilities, institutional financial backers, for example, benefits assets and guarantors should accomplish yearly returns of 6% to 7%.” “With rates at absolute bottom levels they have kept on climbing into private resources where, it is contended, returns are more alluring.”

More than $3 trillion in uncalled capital-another unsurpassed record-is simply sitting in PE firms’ money vaults ready to be conveyed. All that inactive cash has powered rivalry for acquisitions, which has pushed products to one more unequaled record high. Thusly, that has constrained PE firms to look past their beloved objective areas for deals. Lodging is on the radar screen since we need more of it. LBM is targeted on the grounds that it is an intelligent contiguousness. The end result for LBM sellers is that getting a leave procedure is simpler today than it at any point has been-and perhaps more straightforward than it at any point will be once the gold rush peters out.

An excessive amount of centralization is a risk around here. Building regulations, materials, development practices, and purchaser inclinations all fluctuate by district and market. One size never fits all, which limits economies of scale. Subsequently, achievement in some random market depends intensely on the viability of neighborhood administrators. Those administrators should be leaders to have the option to react to the idiosyncrasies of their market. That is a difficult one for most private value firms. PE firms are remodelers. They purchase organizations to set them up and flip them for a benefit. Very much like houses, a few need underlying fixes while others just need a layer of paint to support their control offer. Be that as it may, each house needs something. In the event that it doesn’t, it does not merit purchasing.

The makeover almost consistently incorporates a brought together brand in addition to centralization to amplify economies of scale and collaborations. An obtaining need to squeeze into an essential rationale that accepts the entire is worth more than the amount of its parts. That rationale drives US LBM nowadays. Its divisions are coordinated into six areas, each with a VP manager (Barro, 2020). Everybody has relocated to a solitary ERP framework. Many on the off chance that not most administrative center capacities are combined, and the main special case buying is being rearranged.

Conclusion

Time has it that the annuity store was upheld by pension, which settled the whole framework. Nonetheless, with financial exchange speculations and other worthwhile yet unstable procedures being utilized to pay out benefits throughout the previous few decades, numerous organizations are experiencing difficulty tracking down the essential money. To stay aware of the enormous number of retired folks, most importantly organizations and policymakers should have an arrangement, particularly in an unpredictable circumstance like a pandemic. “Effective state benefits frameworks, like those in Wisconsin, South Dakota, and Tennessee, have kept up with high subsidized proportions throughout recent years partially on the grounds that they have systems including arrangements that target obligation decrease and offer additions and misfortunes with laborers and retired folks to alleviate cost increments during financial slumps.”

There are a few hints of something better over the horizon. However, the securities exchange declined by 34% before monetary years over 2020, and the normal state benefits store procured just 3% for the financial year finishing off with June, 2020, the market has since energized in a fantastic manner, with venture returns of more than 25% for 2021.

The eventual fate of benefits returns is dinky, best-case scenario. Albeit the economy is by all accounts recuperating from the pandemic at a decent speed, behind the memorable $5 trillion in government upgrade and the blossoming securities exchange, the steadiness of the big picture approach is impossible to say. “The Legislative Financial plan Office expects normal genuine monetary development of 1.6% somewhere in the range of 2026 and 2031 and ostensible development of 3.7% over a similar time span essentially below the authentic normal. Furthermore, with loan fees right now lower than pre-pandemic levels, they likewise project securities to yield only 2% over the course of the following ten years prior to getting back to the pre-pandemic expected yield of around 4%.” It is irrational, however when the financial exchange and stock valuations are high, it is the most awful time to settle in

References

Anna, K., & Nikolay, K. (2015). Survey on big data analytics in public sector of russian federation. Procedia Computer Science, 55, 905-911.

Barrowclough, D. (2022). Sovereign Wealth Funds and the South: Under-used potential for development and defense. In South—South Regional Financial Arrangements (pp. 231-263). Palgrave Macmillan, Cham.

Berger, P. G., & Lee, H. Did the Dodd‐Frank Whistleblower Provision Deter Accounting Fraud?. Journal of Accounting Research.

Clayton, W. W. (2022). How Public Pension Plans Have Shaped Private Equity. Maryland Law Review, Forthcoming.

Egli, F., Schärer, D., & Steffen, B. (2022). Determinants of fossil fuel divestment in European pension funds. Ecological Economics, 191, 107237.

Fabián, I. D., & Turner, J. A. (2022). Spain: The evolution of the Spanish private pension system-1994-2019. In The Evolution of Supplementary Pensions. Edward Elgar Publishing.

Hopwood, A., & Unerman, J. (Eds.). (2010). Accounting for sustainability: Practical insights. Earthscan.

Koedijk, K. C., Slager, A., & Bauer, R. (2010). Investment beliefs that matter: New insights into the value drivers of pension funds. Available at SSRN 1603262.

Kumar, S., Sharma, D., Rao, S., Lim, W. M., & Mangla, S. K. (2022). Past, present, and future of sustainable finance: insights from big data analytics through machine learning of scholarly research. Annals of Operations Research, 1-44.

Nolte, K., Chamberlain, W., & Giger, M. (2016). International land deals for agriculture: Fresh insights from the land matrix: analytical report II (p. 68). Bern Open Publ.

write

write