1.0 Introduction

This project is about Albuquerque, New Mexico. It involves a process of revolution by our esteemed clientele—an entertainment organization known worldwide. In this case, the motivation behind that initiative was the urgent necessity to respond to the progressive demands of production ecosystems. The focus here is on holistic growth that includes modern sound stages, production lease spaces, and an efficient infrastructure organized to support the present and future construction of buildings.

1.0 1.1 Project Overview

$407,000,000 was given to this program, which is an attention-grabber. The AIA-Progressive Lump Sum approach was used in constructing the project, and it entailed pre-engineered metal building (PEMB) core and shell construction, site work, interior finishes, and mechanical, electrical, and plumbing (MEP) installations.

2.0 1.2 Involvement and Responsibilities

The cost management services’ custodianship role has been conferred on Gardiner and Theobald. Our commitment became spiderwebs once we attended design team meetings during design development. The job entails going beyond mere participation in these meetings to suggest value engineering options and review bid packages from general contractors for details.

After identifying waste on cost reporting failures and efficiencies, a detailed forensic audit was carried out. It recommends an improved independent cost report that contains all project cost analyses. All these commitments lead to detailed monthly progress reports about how healthy the project is financially. Every month, comprehensive risk assessments and exposures take place as if they were performances staged by an orchestra. At this point, it becomes more advisory, hence guiding clients through various strategies that can help them sail smoothly in managing them; however, what happens at every month’s peak is consultations and continued updating of the cost report in line with the procurement phase alone.

3.0 1.3 Key Stakeholders

Below are the primary stakeholders associated with this vast undertaking:

The Customer: Also known as the said investor, this person is responsible for all decisions. They offer money and cues at various points in time that enable a complex rendition of multiple actions to be carried out.

Local Government Agencies: These are represented by approval points, consents, and regulatory compliance. Our client works with metropolitan area authorities to ensure our project fits into the broader context of infrastructure development and contributes significantly to the local economy.

The Residents: This thing has become a big snag in the project. Anyway, their concerns regarding planning and designing were considered every step of the way. Indeed, job creation, infrastructure development, etc., were not random; ideas were carefully picked to correspond with local people.

Project Team: The entire community of subcontractors, general contractors, and engineers came together as one great force that aimed to control and direct the construction symphony. Only private discussions between them allowed them to convert hectares into concrete buildings such as a physical studio complex. The success of this project mainly depended on its complexity, whereas professionalism, quality consciousness, and the ability to meet deadlines were often questioned.

Local Workforce: Every realistic plan must have a labor team using their hands to do the work. This expansion program allowed residents to include sub-contractors, vendors, suppliers, and artists. We did not just throw away training programs but merged them as an added value metric to augment skill capacity and marketability within the region.

2. Approach to Key Issues

4.0 2.1 Key Issue One: CAPEX Funding Issues

Underfunding proved to be a significant obstacle in the initial stages. Thus, one of the world’s most famous media entertainment companies advised us to be frugal regarding budgetary allocations and limit available CAPEX funds to up to $307 million. The total project cost during the construction phase stood at $407 million. Hence, six months after commencing preconstruction activities, we needed thoughtful financial planning since corporate targets had been previously met so far.

As an associate director in cost management, I was embroiled in this problem concerning finances. At this point, the project was already going well, so this financial setback created a challenge on how to cut down $100 million from the budget without diluting the essence of the project, its timeline, or even the client’s vision generally. What made it more pressing was that significant resources had been invested primarily in the design and engineering phases, which were sunk costs. It ceased being about fiscal responsibility alone but came up with ideas not to fail due to late project delivery, violations of regulatory compliance issues, and potential litigation.

The project had to be concluded after several options were considered. The cash crunch led to this. It was one of the alternatives when we thought about how best to handle and complete such a predicament satisfactorily. The financial figures are crucial but not more than what keeps the project alive, e.g., its objectives should relate to customers’ strategic goals for it to go as planned. A series of discussions on alternative approaches followed this, facilitating strategic decisions concerning which direction the program should take through an optimum trade-off analysis of risks and benefits.

5.0 2.1.1 Options

Option 1: Shelve the project until more funding can be secured.

The first alternative was to postpone the entire project until more funding could be obtained. However, this option was not seen as viable for many reasons. Nevertheless, the need of the customer to expand the studio to raise their corporate income rendered it unreasonable to put off this. Furthermore, irreversible design and engineering costs are involved, especially at this level where a lot has been spent. It is also worsened when you realize there are Capital Expenditure (CAPEX) restrictions to move the budget from $307 million and doubts about further shareholders’ contributions, among others. Accordingly, there appeared to be an imminent 8% national escalation in 2022, while investigations showed that escalation risks were likely and added start-up costs during these periods. Considering all these facts, the client dismissed it with a wave, choosing other ways to help her accomplish it without diverting from its primary goals.

Option 2: Proceed at risk.

On the other hand, they could have gone ahead with the project, using part of the available $307 million and waiting for the remaining $100 million. However, that was also a wise decision, but it had some dangers that would be overlooked easily. In helping Bensons for Buildings Ltd.’s client decide, they drew up an all-inclusive risk register. The purpose of this document is to explain what can put change initiatives in danger, i.e., lack of funds for design changes, scope creep as a known risk material shortage, non-payment of contractors, regulatory compliance requirements, expected delays, and other forms of additional financial burdens like contract disputes; escalating inflation and recession.

However, it had certain advantages, e.g., if perpetual construction was allowed without resumption fees and sunk costs from scratch. However, collective agreement among those concerned about this project concluded that these were impossible risks. Nevertheless, in terms of integrity reasons, timing concerns, and financial viability, if they needed to be adequately addressed by top management, they ultimately declined this alternative.

Option 3: Phase the project into Phase 1 and Phase 2. (Best and chosen option)

The third alternative, the last one, was a three-phase plan that broke down this project into phases I and II. In such a case, the first phase would start construction with $307 million of money available, but the balance of $100 million had to wait until the second phase. This implies that some buildings may be constructed while others must wait until phase two. Finally, I identified those structures overdue for completion but whose delays would not result in severe losses in the company’s earnings, as well as his being the ultimate judge. My work also involved refined price or fee deferments, like examining delayed costs and transportation ticket fares since they are expensive.

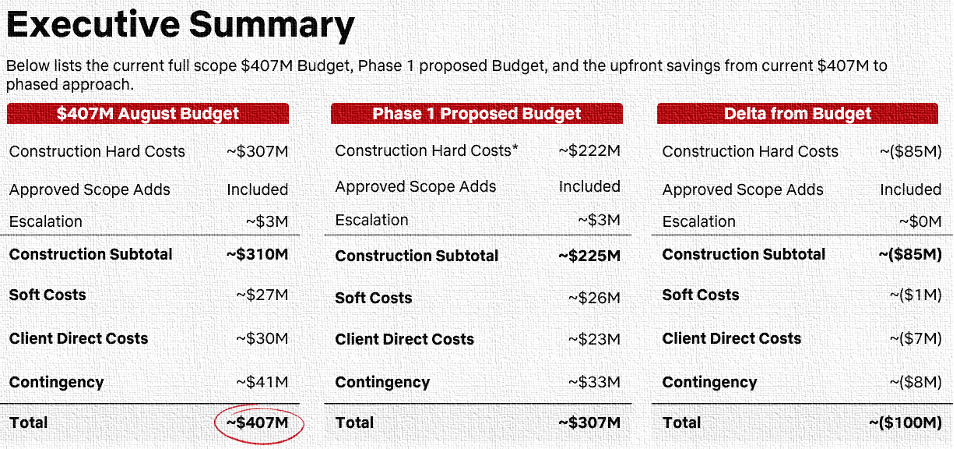

As seen in [Figure 1: see appendix], to maintain flexibility against unforeseen contingencies, there should be a minimum owners’ contingency of at least 10% above $307 million based on industry standards. With customer expectations preferring this method over many less viable alternatives, these risks are reduced when pursuing such ambitious projects by providing an error-free approach towards attaining all the goals stated in the plan at any cost. Therefore, these elements combined form a significant shift towards more practical programming of financial dynamics, based mainly on the insuperable obstacles surrounding every time funds are raised too high.

6.0 2.1.2 Resolution

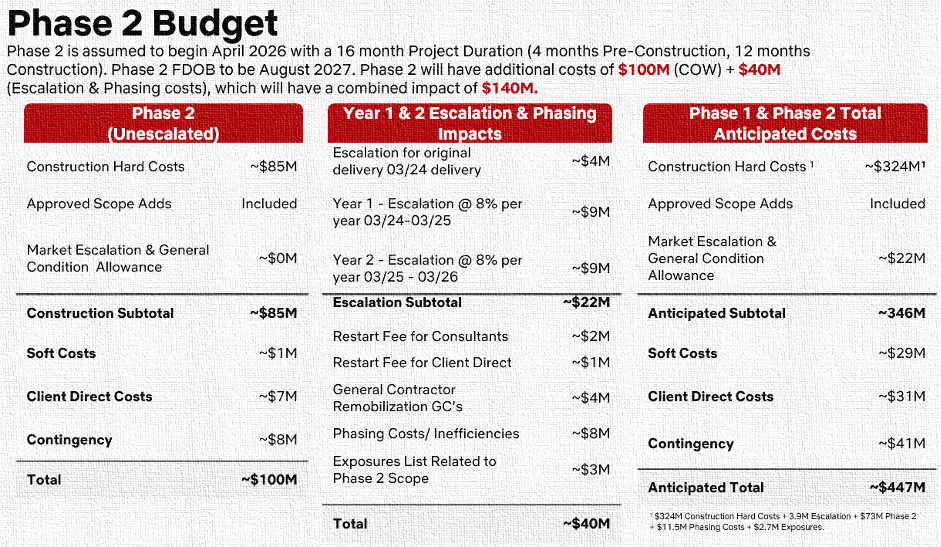

After much consideration, option three was selected to deal with the problem of funding CAPEX. In light of this phased approach, the client was informed about the non-escalating feature projected costs and told it should be cautious about cost increases associated with early completion of Phase II. Figure 2 highlighted potential escalation fees and showed a rise of 8% from the expected completion date for both years on page 2024, which means Phase II would resume in 2026.

However, the client decided on a stage-by-stage approach, notwithstanding the anticipated rise in price. Operating as many facilities as possible during phase one would mean high returns for the firm. However, though there were concerns about rising to about forty million dollars, it was juxtaposed with the expected income. For this reason, option three became the best choice since it allowed them to maximize profits through buildings that could be used within phase one. It was achieved through two integral achievements, including aligning the project with business objectives and ensuring its financial intricacies well enough.

7.0 2.2 Key Issue Two: Phased Option Budget Incorporation

In August 2022, the client decided to integrate the phased approach to Key Issue One into the general project structure, representing a significant turning point. Consequently, this decision necessitated a strategic review of the project budget and thus made it a complex matter that required careful management. It meant I was entrusted with spending $307 million to phase seamlessly within the $407 million budget.

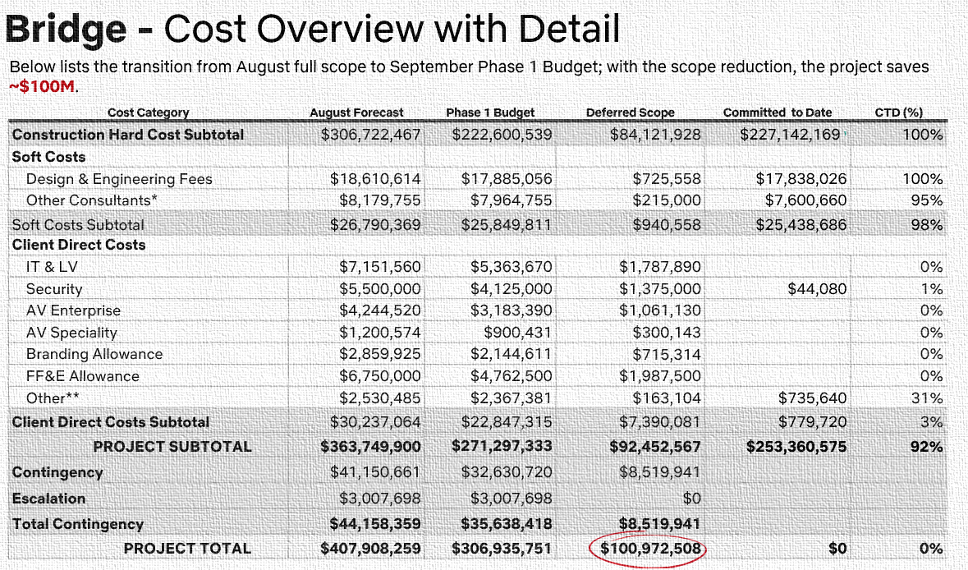

As such, this problem invites us to cut $100 million from our budget to do it first. Thus, deductive change orders were utilized with the deference of scope to achieve this goal. Reasoned change orders helped deal with contract funds already incorporating deferred scope changes. In contrast, straightforward deferment without the application of reasoned change orders would do where money has yet to be awarded. Therefore, clients have introduced incentives such as goodwill from subcontractors, and lost work on deferred scope could foster collaboration and good relationships among parties involved in projects under different terms or conditions.

Next, the client gave me an assignment to develop the bridge document, which is a picture presentation of this project’s financial aspects. It is supposed to demonstrate how the August 2022 project forecast in full becomes a September 2022 Phase 1 budget that now includes phasing. This fact can be evidenced by [Figure 3: see appendix], which gives insight into how much money has been expended through deductive change orders and deferred scope elements deleted from the budget.

The project requires that the project leader be financially savvy and be able to communicate effectively with stakeholders to ensure they comprehend any amendments made to the project budget. In this process, the bridge document is an important artifact that acted as a transparent communicator that illustrated the financial journey of the project and connected stakeholders to the strategic choices that guided a smooth, phased approach.

8.0 2.2.1 Solutions

Solution 1: Hard Costs

Several options were examined before the job had to be completed. This resulted from the cash shortage. When considering the best course of action to take in order to resolve this situation successfully, this was one of the options that we considered. Financial data is essential, but it’s not more important than what keeps the project going; for example, for the project to succeed, its goals must align with the strategic objectives of its clients. Following this, several talks on different strategies were held, which helped with strategic judgments on the program’s course through an ideal trade-off analysis of benefits and hazards. To this end, a general contractor was deducted for change orders made, leading to a credit back. The overall Phase 1 budget of $222 million had already been committed to the awarded scope and exceeded $227 million. I began my far-reaching analysis with input from the project management team that touched on each EA trade package. Thus, it enabled the identification of deferred scopes in these packages, ensuring accurate and targeted cost adjustments.

Solution 2: Soft Costs

Soft costs underwent an elaborate examination under items like design and engineering fees. It brought into play more refined aspects through internal reviews of company fees and direct engagements with architects and engineers. Thus, the forecasted deferred fees due to reduced scope was $940,000. Therefore, based on the agreed-upon deferred amount, we prepared deductive change orders directed toward all vendors, including internal companies. The remaining suppliers knew they would be paid off soon because there was no other choice but to reduce their scope after this deduction for reduced scope.

Solution 3: Client Direct Costs

This made it very difficult because the customer had to pay individual costs, so I had to talk to each of them in person and bargain over fees. The deductive adjustment requests were made for anticipated client direct costs, which required the client’s prior approval. This was because the way this project was approached represented transparency and adherence to the client’s objectives.

Solution 4: Contingency

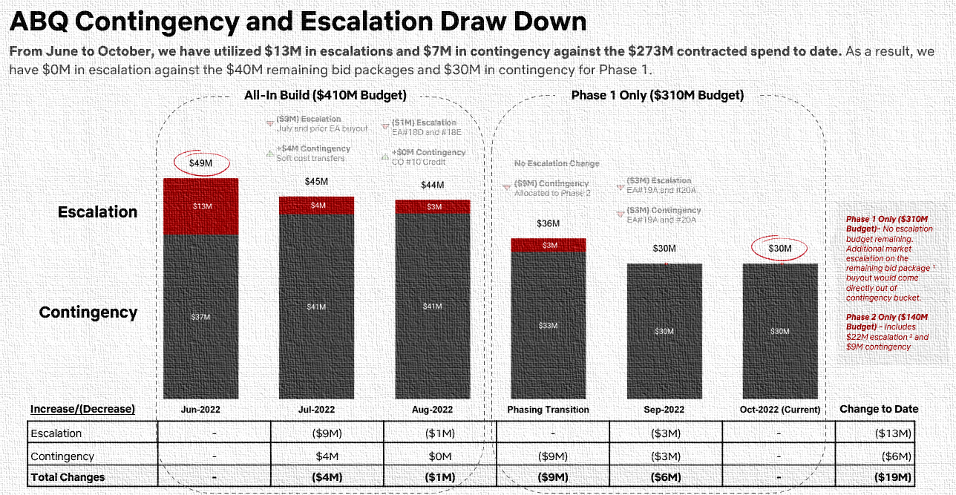

The suggestion was made with a robust explanation for a minimum of 10% of the owner’s contingency during the phase. Between June 2022 and October 2022, a $13 million escalation contingency fee and $7 million owner’s contingencies have been drawn down about the total committed cost of $273 million expended. On this account, all escalation contingencies were spent while reserving other owners’ contingencies at an amount equal to $30 million for Phase 1 only by October 2022. In [Figure 4: see appendix] is a waterfall chart that illustrates why this reserve is being carried and visually represents this reasoning, helping to communicate intricate issues surrounding such proposed contingency provisions.

9.0 2.2.2 Resolution

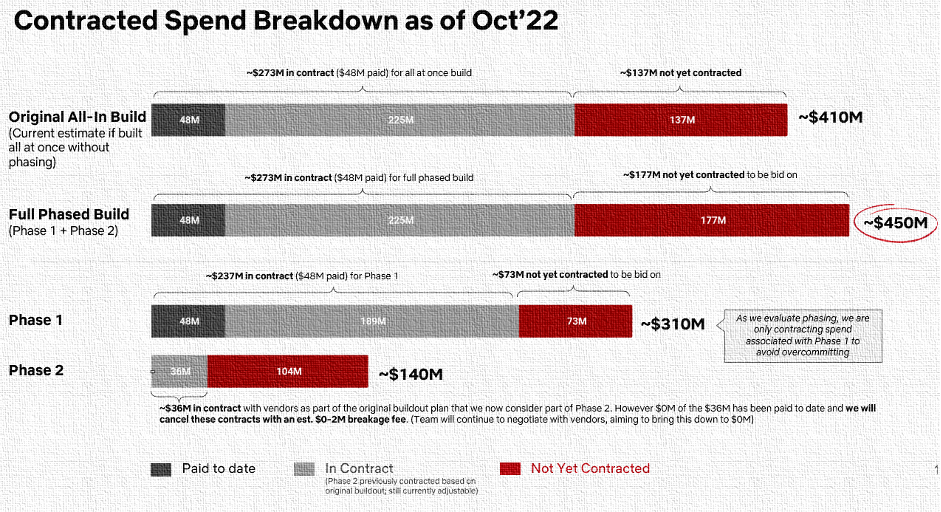

[Figure 5: see appendix] presents a detailed explanation of step-by-step phase construction and an initial “all-in build.” It was a great picture that revealed the financial part of the project and helped interested parties understand how changes were accommodated to allow some growth. Therefore, it highlighted the amounts spent on all activities by October 2022.

3. Personal Achievements

10.0 3.1 Key Issue One: CAPEX Funding Issues

Efficiency is achieved by optimizing time, cost, quality, and risk arguments. The customer could judge the outcomes of different opposing perspectives using unbiased decision proof from continuous research. It impacted significant improvements in client care capacity, risk containment, designing economics, cost planning, and project developability within that area. However, this did not just mean he was concerned about handling sensitive monetary issues and how his customers’ ultimate objectives determined strategic decisions.

11.0 3.2 Key Issue Two: Phased Option Budget Incorporation

There must be no significant procurement, additions, or deferrals to the scope to achieve phase budget integration success. Thus, much thought had to be devoted to this issue since recast budgets would never have any gaps if critically examined by their customers. Additionally, relevant authorities could have participated in more talks over changes in scope so far that would have given them a practical understanding of numbers, like reliance upon numerical estimation methods or project financing control from their perspective alone. For example, doing something similar meant achieving business goals only but displaying deep understanding, thereby making it easier for clients to identify many perspectives emerging due to changing hands, leading to diverse outcomes throughout their companies.

4. Conclusion

12.0 4.1 Key Issue One: CAPEX Funding Issues

Raising capital for investment in my career is a difficult task, and this is very important. It has also conferred some confidence on many other similar occasions when I had to consult clients about these issues. Therefore, the possibility that this predicament will be effectively tackled would create mutual trust among most of my clients concerning me. It shows flexibility if there are any favorable changes in the project budget. It develops different skills for use in many fields and emphasizes the importance of belonging to the Royal Institute of Chartered Surveyors (RICS). Thus, there appears to be an image related to systematic thinking over troubles and ensuring that competent professionals would manage every difficulty consumers face. In other words, such experience may serve as an underpinning for future progress or development and better customer relations.

Recommendation: Ongoing professional development should include areas like risk management, design economics, and project feasibility analysis, among others, to enable professionals to sharpen their skills while devising mechanisms for responding efficiently to customers if this accomplishment continues improving (Shamim 67).

13.0 4.2 Key Issue Two: Phased Option Budget Incorporation

The resolution of this matter closed the decision to phase in budgeting. The resolution highlighted the importance of knowledge and understanding in project management, quantification, and costing. Additionally, successfully integrating correct numbers for two phases further revealed that project skills must be firmly grounded. I now understand how important it is to tell my clients what they need to hear and present factual information with valuable insights into meeting clients’ needs. For instance, a realization like this about contingency planning for such a problem has given us more confidence than ever before. We will find these new insights helpful in resolving future issues or aligning with customer needs.

Recommendation: Any modifications to industry regulations must be implemented expeditiously to align our services with evolving client demands (Shamim 67).

14.0 Works Cited

Shamim, Mahfuzul Islam. “Exploring the success factors of project management.” American Journal of Economics and Business Management 5.7 (2022): 64-72.

Appendix

Figure 1: Analysis of All costs for Phase One and Phase 2

Figure 2: Displays 8% escalation for 2025 and 2026, relevant for Phase 2 costs.

Figure 3: Illustrates budget shift from complete to phased scope (Aug to Sep 2022).

Figure 4: The waterfall graph shows contingency use in financial decisions.

Figure 5: Breakdown of spending as of Oct 2022, comparing phased and “all in” builds.

Table 1: Competencies demonstrated in this case study

| Mandatory | Core | Optional |

| Client Care | Design Economics and Cost Planning | Risk Management |

| Ethics, Rules of Conduct and Professionalism | Due Diligence | |

| Communication & Negotiation | Project Feasibility Analysis | |

| Quantification & Costing |

write

write