Introduction

Saving for retirement is the most fulfilling approach for many individuals and families during their retirement. Excellent and successful retirement packages enable individuals and families to meet their needs as before. Individuals can undertake various retirement saving plans to maintain or secure their lifestyle during retirement. For instance, personal retirement plans are managed or developed by individuals if they believe that other sources of retirement income, such as pensions, will not be sufficient to cover their expenditures during retirement. It is, therefore, critical for individuals to seek the input of retirement planners to ensure that they have an excellent saving retirement plan to secure and guarantee a decent and good lifestyle during retirement. This paper presents the personal retirement plan of a family of four people in light of this information. The retirement plan has delved into the critical essential factors often considered in developing individual retirement plans. More importantly, this personal retirement plan will identify the appropriate monthly and annual savings and withdrawals that will support the proposed retirement plan for the client.

Description of the Family for Retirement Plan

This personal retirement plan is for a family of four, a couple with two children. The husband in this family is a general manager in an HR consulting firm, and he is currently aged 35 years. In comparison, the wife is aged 31 years and is an office administrator in one of the most reputable law firms in the United States. The couple has been blessed with two children, a boy and a girl aged 5 and 9 years, respectively. Based on the information provided by this client, the husband earns a basic salary of $ 56,000 annually while the wife earns, on average, a basic salary of $ 45,000 a year. Due to the number of dependents in this family and their children’s future educational and medication needs, the couple requires an excellent personal retirement plan that will guarantee them a better lifestyle during retirement. The couple has further provided information about their preferred retirement age and the planned retirement income. According to their plans, they will choose to retire at the age of 66 years and thus require an annual retirement income of $ 50,000 to meet their needs. The life expectancy of this couple is 86years, according to the statistics they did after visiting the websites such as “Living to 100”, which helps individuals to estimate their life expectancy after answering several questions on the website. The client informed me that this life expectancy was pegged on their general health conditions, which, according to their family doctor, were stable as the family had no history of chronic lifestyle infections. To ensure that this couple’s retirement needs are met and that they better understand how their retirement plan will work and benefit them, they must understand the most critical factors that are considered when developing a personal retirement plan.

Factors that Influence a Retirement Plan

Retirement plans are often driven or influenced by several factors which must be clearly understood by the client when choosing a retirement plan. These factors form the basis of retirement planning and guide the experts in recommending an effective retirement package for the client. Financial and personal planning are factors to consider in recommending a retirement plan for the client. The financial planning includes the current income, savings and other sources of income such as pension and social security funds. On the other hand, personal factors entail marital status, age, number of dependents, health conditions, and life expectancy.

When formulating a strategy for retirement, age is a crucial component to take into account because it directly affects the amount of cash saved and the pension payments earned. For instance, the minimum age requirement in the United States of America varies depending on the type of retirement package being sought. Your age substantially impacts the amount of money you can expect to receive from Social Security and the actions you must take to ensure that your retirement savings are not subject to any penalties. For instance, retiring at 62, a person will only receive a 75percent of the whole amount; however, this will be compensated for by the fact that the individual will continue to receive benefits for a much extended period (Lin et al., 2021). The help provided to your spouse will also be reduced since they will only accept a 35percent of your whole retirement amount as opposed to 50 per cent if an individual waits until he attains at least 66 years old before taking the retirement benefits.

The retirement age also influences retirement planning, such as social security funds. Retiring at an early age means the individual will need a sizable emergency fund to complement the funds you receive from Social Security. The individuals will not be eligible for Medicare until they turn 65; if they have to get health insurance on their own, they will almost surely have to pay high out-of-pocket fees (Marchand & Tremblay, 2021). Therefore, considering the retirement age’s impact on social security funds and medical expenses will help avoid unpleasant surprises.

Many people believe that reaching the mid- 60s is the ideal age to retire since you have amassed an excellent financial cushion at this point in life, yet you are still strong enough to use your retirement fully. At this retirement age, the person receives the total amount of the Social Security payout, which can make a tremendous difference, mainly if the retiree is in relatively good health and more likely to have a life expectancy that is either typical or longer than expected. Waiting provides an individual with the opportunity to add to enjoy tax-advantaged investment accounts over a few additional years. Clients who are at least 50 years old are eligible to make what is known as a “catch-up” contribution to their retirement account or 401(k) each year (Bernstein, 2021). For instance, in the USA, individuals aged over 50 years can make a contribution of $ 7,000 to the traditional individual retirement account. Still, if the individual is using 401(k) as their retirement savings plan, they can defer close to $ 27,000 of their salary after reaching the age of 50 years. In light of this analysis, it is also critical to understand the client’s risk tolerance before recommending an effective saving plan which will influence retirement planning.

Client’s Risk Tolerance

Risk tolerance has a significant bearing on the retirement saving plan as it dictates the choice of investment vehicles that will increase the income for retirees. The risk-return analysis influences individuals’ risk bearing and demands honest self-assessment (Shou & Olney, 2022). Therefore conscious of the risk-return tradeoff, my client’s risk tolerance is high. According to our conversation, my client believes that the higher the risk, the more the expected returns. Additionally, the increased risk bearing of my client has also been built by his career, which often involves giving consultancy services to various investors on how to invest in human capital. Besides, my clients also expressed optimism about portfolio diversification as one way to increase income streams in the future during retirement.

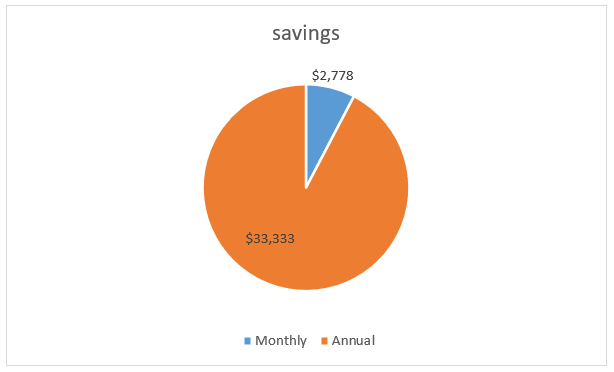

Client’s Retirement Saving Plan before Retirement

Based on my client’s personal information, they will work for 31years and 35 years for the husband and the wife, respectively. This means they make savings for over 30 years to be in active employment. They have also agreed that the husband with make savings in the individual retirement accounts (IRA) while the wife will make retirement savings through the 401(k) saving plan. Considering the life expectancy of this couple and their preferred retirement age of 66 years, they are expected to live for 20 years after their retirement, and their proposed annual post-retirement income is $ 50,000. This means they will require $1,000,000 or above to achieve their income requirements during retirement. They will collectively be required to save $ 33,333 annually and $ 2,778 monthly.

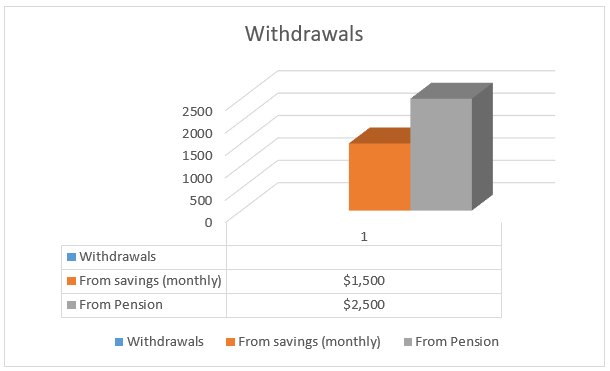

Client’s Withdrawals after Retirement

The withdrawals to be made by this client during retirement will be influenced by their personal needs such as food, payment for physical exercise, insurance, travelling and clothing, among others. Therefore the clients will require a monthly retirement withdrawal of $ 1500 from their savings, and they will also be getting monthly collectively monthly pension of $ 2500 from their employers’ pension savings plan.

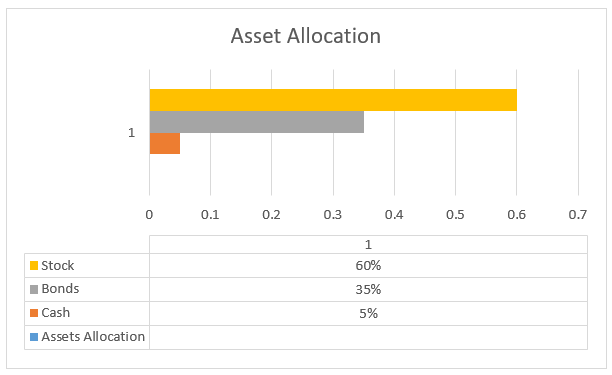

Recommended Asset allocation For the Client

The most critical factors to consider in recommending asset allocation for retirees are life expectancy and lifestyle. The life expectancy of my client is 86 years, meaning they are expected to live longer after retirement. Besides, their post-retirement monthly demand will require that they have enough nest eggs to secure their retirement and complement their savings. According to the investment analyst, retirees should gravitate more towards more conservative asset allocation because they might not have the more active income to cover expenditures (Ryan & Cude, 2020). In this regard, my client’s investment objective is to grow revenue over time. I recommend an asset allocation of 5% cash, 35% bonds and 60% stock. This asset allocation will guarantee stable cash streams for the client since bonds provide fixed interest income while stockholders can benefit from dividend payments and capital gain. The 5 per cent in the asset allocation equation covers emergence funds before the other investment instruments mature and provides returns to the client.

Conclusion

Having an effective retirement plan is essential in safeguarding the life of retirees. However, this plan is built on the financial and personal factors of the individual. The retirement age significantly affects retirement planning, but the decision depends on individual goals. Enlisting the assistance of retirement planning experts helps to build a better retirement plan. Based on this retirement plan of my client, a couple with two children, retiring at the age of 66 will provide more benefits to the family considering my proposed asset allocation, which will augment their savings and secure decent retirement life.

References

Bernstein, D. (2021). Pre-retirement use of 401 (k) funds. Business Economics, 56(2), 81-86.

https://link.springer.com/article/10.1057/s11369-021-00214-7

Lin, H. C., Tanaka, A., & Wu, P. S. (2021). Shifting from pay-as-you-go to individual retirement accounts: A path to a sustainable pension system. Journal of Macroeconomics, 69, 103329.

https://www.sciencedirect.com/science/article/pii/S0164070421000355

Marchand, I., & Tremblay, D. G. (2021). Choosing to Retire? A Study of Women’s Patterns for Retiring or Continuing to Work. Revue Interventions économiques. Papers in Political Economy, (66).

https://journals.openedition.org/interventionseconomiques/14065

Taulli, T. (2022). Asset Allocation. The Personal Finance Guide for Tech Professionals (pp. 157-167). Apress, Berkeley, CA.

https://link.springer.com/chapter/10.1007/978-1-4842-8242-7_8

Ryan, M. P., & Cude, B. J. (2020). Financial advice, plan choice, and retirement plan satisfaction. Journal of Financial Counseling and Planning.

https://connect.springerpub.com/content/sgrjfcp/early/2020/07/03/jfcp-18-00050.abstract

Shou, Y., & Olney, J. (2022). Measuring risk tolerance across domains: Scale development and validation. Journal of personality assessment, 104(4), 484-495.

https://www.tandfonline.com/doi/abs/10.1080/00223891.2021.1966019?casa_token=6-UmllBZBVUAAAAA:avZPfVNEonlCOPIbwONt98huPSDkuW5qXoSKRNxkAwI0zlB35XPoYjJU3fVzaaZrG8NWCSkYQRh1TnscpA

Appendices

write

write