Financial statements indicate all the business operations, progress, and projections. They are normally audited by government institutes and accounting firms so as to guarantee accuracy and for purposes connected to financing, investing, and taxes. Throughout this assignment, we will be looking at two different companies which are Netflix and Disney+, analyzing their balance sheets and income statements, and making a projection on what will be happening with a movie streaming business. Disney+ and Netflix are the biggest competitors within the movie streaming industry, and each one of them operates differently and has different sizes of subscribers, which translates to different incomes. The financial performances of these two different companies reveal a business’s profitability and the capacity to achieve both temporary and permanent financial requirements.

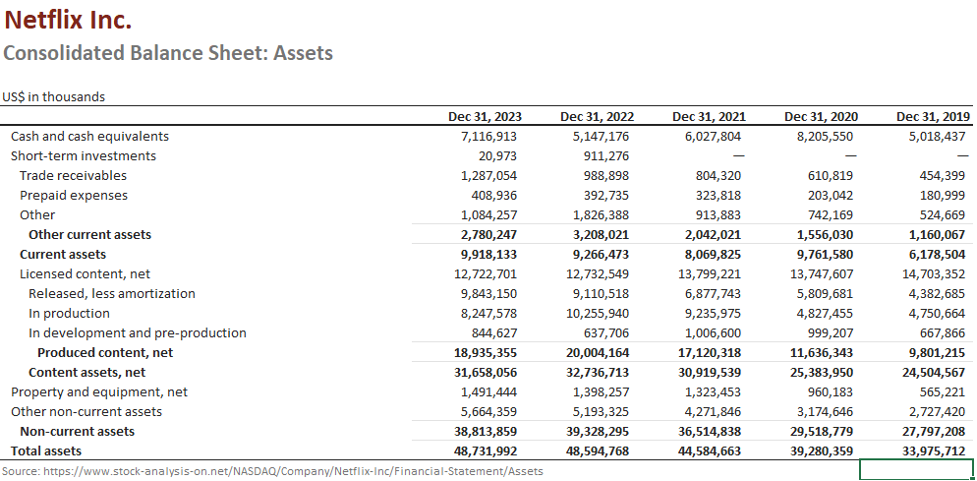

Figure 1: Netflix Balance Sheet

Figure 1 shows a summary of the company’s balance sheet for different financial years from 31st Dec 2019 to 31st Dec 2023. This balance sheet offers essential data on the firm’s equity, liabilities, and assets (Sen, 2023). Looking at the positive progressive nature of the balance sheet, we can all agree that Netflix company is in a healthy financial position, and it can adequately care for its financial obligation without strain. Looking at this balance sheet, the company had total assets worth $48,731,992 on 31st Dec 2023, which was an increase from the financial year 2022, which was valued at $48,594,768. The increase in total assets is because of a growth in cash, investment, property, and equipment.

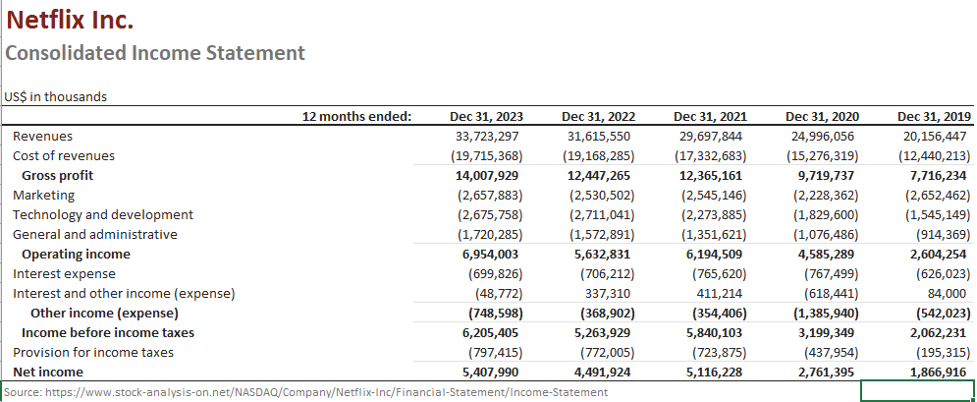

Figure 2: Income Statement for Netflix company

The income statement for this company indicates important financial information on revenue, profit, and cost. When we compare the financial year 2023 and 2022, it is clear that Netflix generated around $33,732,297 worth of revenues in 2023 and a net income of $5,407,990, which was an increase from the previous year when the company created about $31,615,550 worth of revenues and a net income of $4,491,924. The high gross margin can be attributed to the fact that Netflix experiences a high demand for streams with a low cost of content production (Sen, 2023). All the way from 2019 to 2023, the company has been growing its revenues and net income, and this is clear in the income statement above.

>

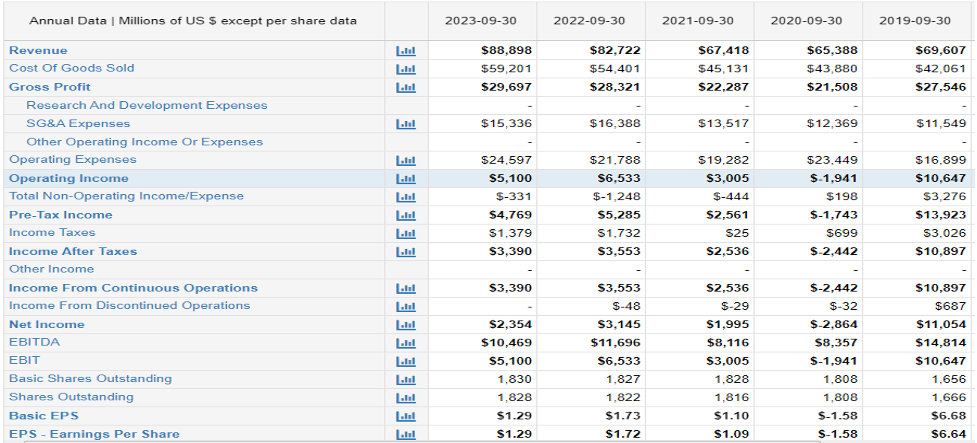

Figure 3: Disney+ Income Statement

Figure 3: represents an annual income statement for Disney+ company from 2019 to 2023. The company has been recording positive revenues from 2019 to date, with the current revenue standing at $88.9 billion as per the report on 31st Dec 2023. The net income for the same year is $2.4 billion. The positive growth in the company operations is because of the low manufacturing expenses and higher selling prices (Kaur & Poojari, 2021).

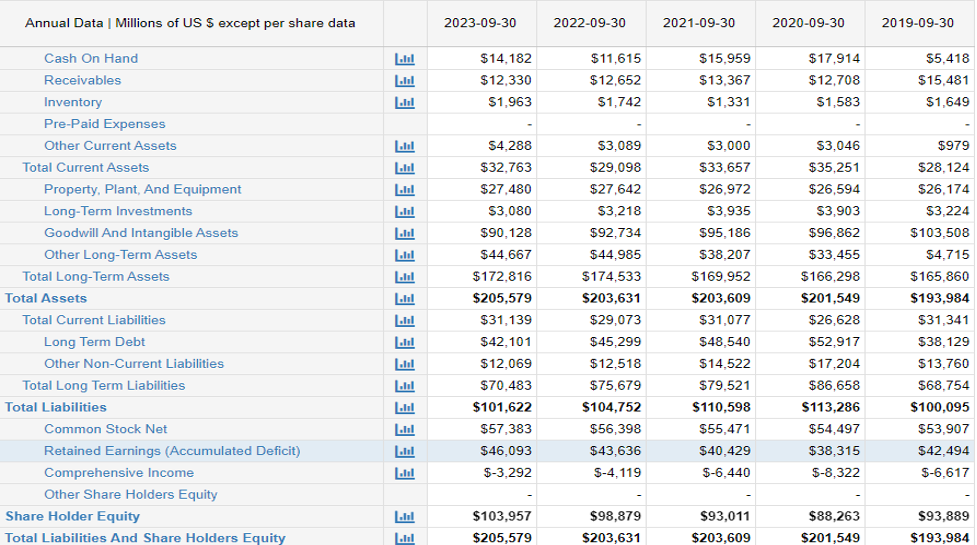

Disney+ Balance Sheet

The balance sheet of the Disney+ firm presents an important insight into this sector of video streaming. For example, the company had an equivalent of $205.6 billion in total assets in 2023 and $101.6 in total liabilities resulting in a total shareholder equity of $101.6 billion. This shows that the firm has a strong and healthy financial position and that it can attain its financial obligations.

Conclusion

Financial data from these two companies offers comprehensive analysis into understanding how the movie streaming industry is operating and gives an insight into the current trends, the strategies used by rival companies, and the potential business openings in the sector. By looking at this data, we have an idea of how these companies conduct their business, their marketing approach, and operational practices. We can, therefore, use the financial data of these companies to analyze the movie streaming industry trends and recognize the most outstanding niches within a specific segment. With this information, we can also tailor our content and products to suit the needs of the target market and generate realistic revenue goals. In addition, we can use the financial data for these two companies for benchmarking purposes. Ideally, Netflix and Disney+ will always stand out as the key players in the movie streaming industry; therefore, their financial data can be used with any startup company to asses their progress as they move from one step to another. It is also important to use this information to identify areas of improvement and establish policies to compete more favorably.

References

Kaur, R., & Poojari, K. (2021). A Study of Disney + Hotstar OTT Combination Via Acquisition of 21st Century Fox By the Walt Disney Company. Journal of Development Research, 14(2), 21. https://doi.org/10.54366/jdr.14.2.2021.21-32

Sen, S. 1. (2023). Netflix’s Blue Ocean Strategy: An Empirical Study on Its Shareholder Returns. IUP Journal of Business Strategy; 37-78. Retrieved from https://www.proquest.com/scholarly-journals/netflix-s-blue-ocean-strategy-empirical-study-on/docview/2865584688/se-2?accountid=151051

write

write