Abstract

This essay explores the complex and ongoing argument that has raged for over eight decades around the minimum wage in the US. Beyond superficial justifications, it thoroughly examines this approach’s economic advantages and disadvantages, offering a thorough analysis. The benefits include lowering poverty, raising living standards, stimulating local economies, and reducing income disparity. However, expenses are also considered for future job losses, inflationary pressures, and market efficiency issues. The intricacy of this strategy comes from the labor market’s volatility and its different effects across sectors and geographical areas. It is suggested to have a balanced approach that examines complementing strategies, considers regional variances, and accounts for inflation. The minimum wage discussion also calls for continuing study and adaptation as the nature of employment changes to meet new difficulties. In light of the complex nature of the minimum wage discussion concerning economic well-being and social equality, this article urges for educated discourse and evidence-based policy as its conclusion.

Keywords: Economic Benefits, Economic Costs, Poverty Reduction, Income Inequality, Job Loss, Inflationary Pressures, Labor Market Efficiency, Social Equity, Evidence-Based Policy, Complementary Policies, Regional Variations, Income Redistribution, Small Businesses, Policy Complexity.

Introduction

The Fair Labor Standards Act of 1938 created a federal minimum wage, even though the idea of a minimum wage in the United States stretches back to the early 20th century. This historical backdrop is crucial to comprehend the relevance of the minimum wage in the present. According to Kiger (2019), the minimum wage is fundamentally a political tool to guarantee the country’s lowest-paid employees a minimal standard of life. It is a reaction to the inherent disparities in the labor market, where certain workers may be at risk of being exploited because they cannot collectively bargain. To keep up with inflation and changing economic circumstances, the minimum wage has developed over time and has been raised gradually. Millions of employees across several sectors are impacted by it, which has solidified itself as a pillar of American labor policy. The argument over the minimum wage continues to influence economic and social policies, highlighted by the historical context. This essay’s goal is to thoroughly analyze the financial advantages and disadvantages of the minimum wage in the United States.

Economic Benefits of the Minimum Wage

Increased Income for Low-Wage Workers

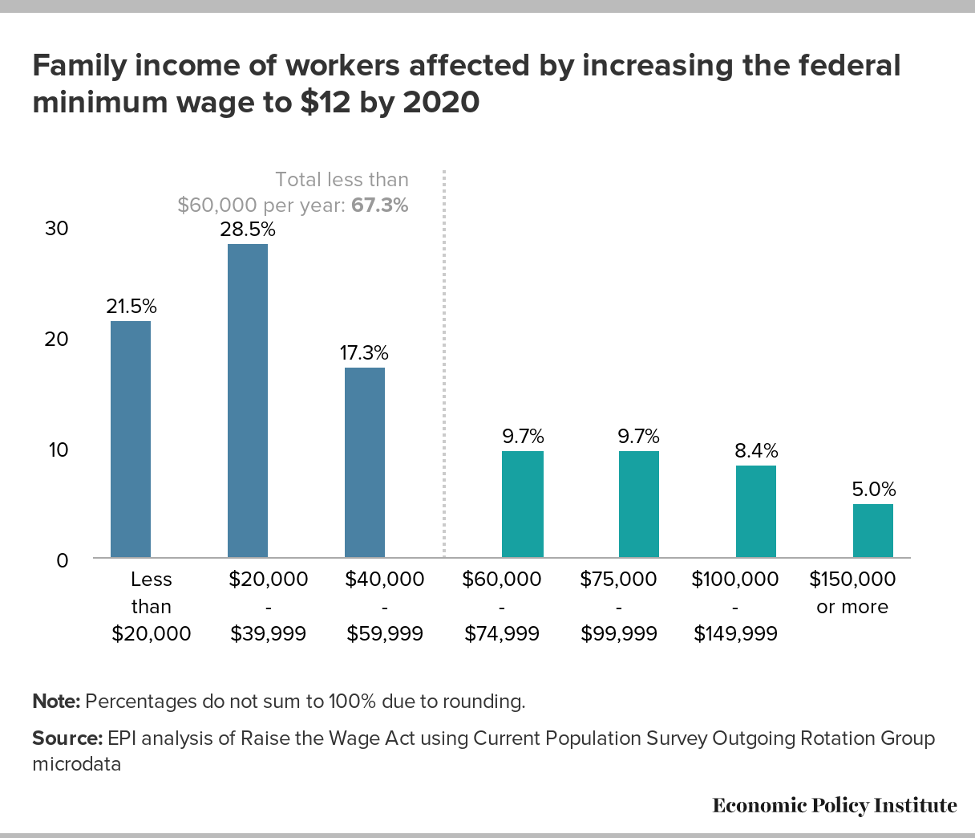

The minimum wage is an essential instrument for enhancing the financial security of low-income employees. In the first place, it is crucial for reducing poverty. The minimum wage prevents poverty by guaranteeing that employees are paid enough to cover their basic requirements by creating a salary floor (Roberts & Olinsky, 2021). This is crucial for vulnerable groups, such as single parents and those without a college degree or specialized training. Because it relieves pressure on social safety nets and lowers the total tax burden, poverty reduction positively impacts society. When low-wage employees can earn more, they depend less on government support programs, allowing governments to more effectively devote resources to other crucial sectors like infrastructure and healthcare. Second, by raising the minimum wage, low-income employees’ quality of life is enhanced. It allows people to improve themselves and their family’s access to housing, healthcare, and education.

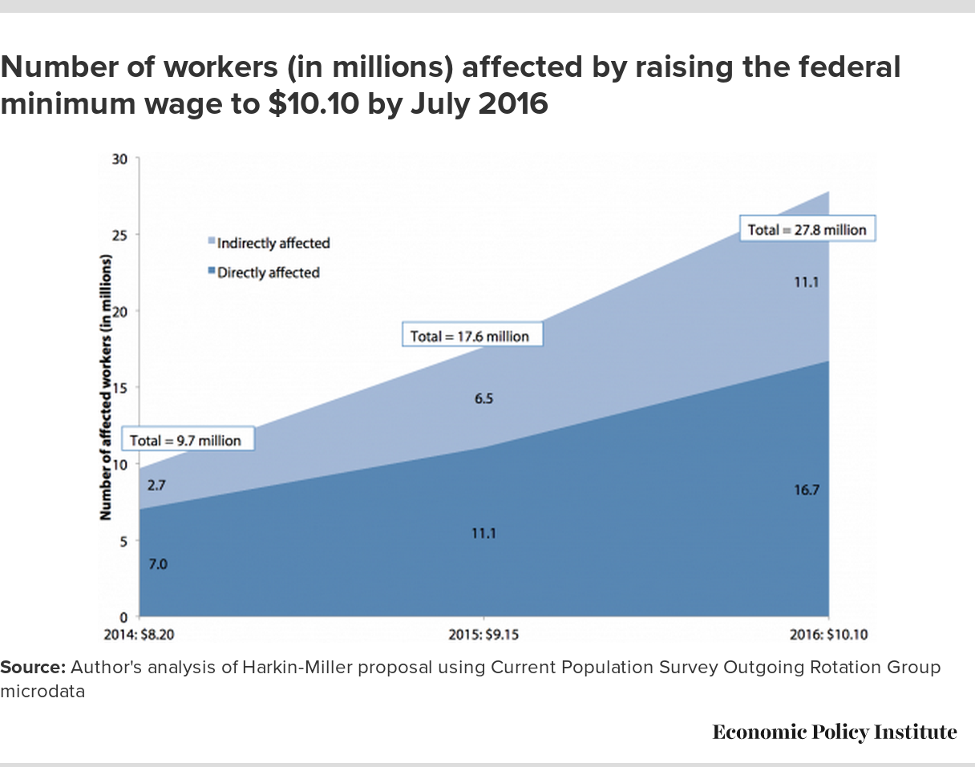

Stimulus to Local Economies

The ability of the minimum wage to boost local economies is another critical economic advantage. First of all, it causes a rise in consumer expenditure. Low-wage employees are more inclined to invest their extra money in their neighborhoods when their wages are increased. This increase in spending may have a snowball effect, increasing demand for products and services in a variety of industries, including retail and hospitality. Increased consumer spending benefits nearby companies and strengthens the whole economic system, with small firms profiting from this increased demand (“Monitoring the Effects of Minimum Wages,” 2020). Low-wage employees make up a significant percentage of the workforce at these businesses. They are more inclined to use local businesses for goods and services when they have more discretionary money. Due to their ability to develop and expand, small companies eventually contribute to creating jobs and the health of local economies.

Reduced Income Inequality

An instrument for social fairness and wealth redistribution is the minimum wage. It directly tackles income inequality by guaranteeing that the lowest-paid employees have a fairer portion of the economic pie. Policies like the minimum wage aid in bridging the income gap since income inequality remains a significant problem worldwide. The equitable distribution of wealth is not only an issue of economic need but also of social fairness. Societies demonstrate their commitment to equal pay for all employees, regardless of their profession or background, by setting a minimum wage that supports a respectable quality of life. As a result, people feel like they have a stake in the economy and are less likely to feel excluded or disadvantaged. This promotes social fairness and inclusion.

Additionally, lessening economic disparity may promote better social stability and togetherness. Societies may experience heightened social unrest and political polarization when wealth inequalities are severe. By reducing economic disparities, the minimum wage helps create a more peaceful and fair society.

Economic Costs of the Minimum Wage

Potential Job Losses

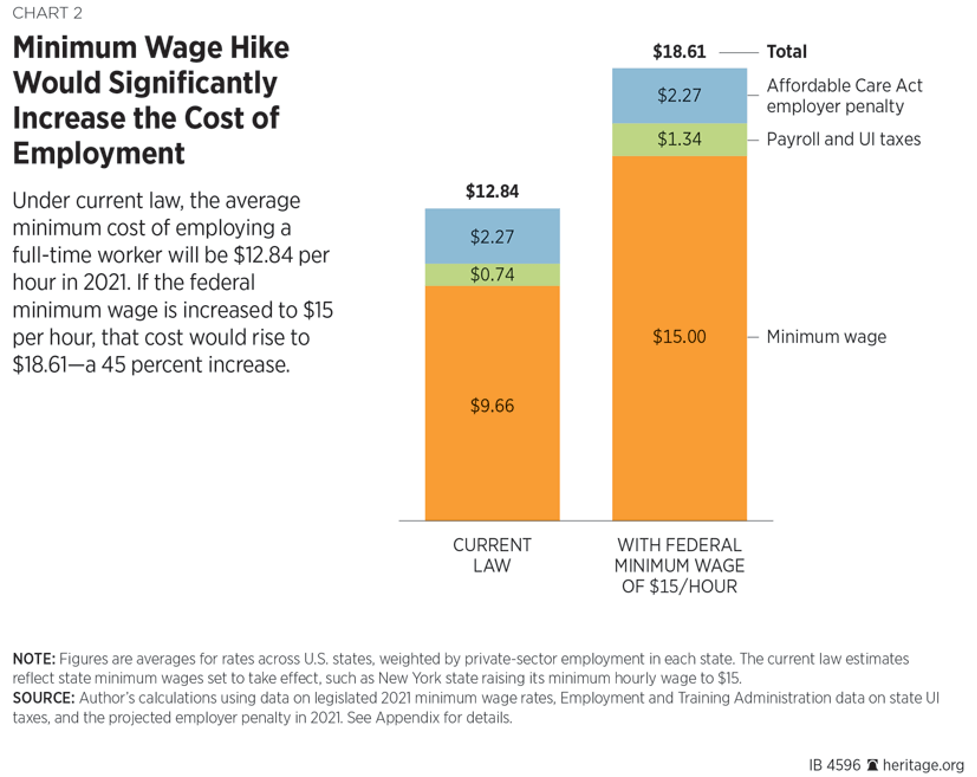

The possibility of job losses is one of the main issues brought up in the minimum wage discussion. Critics contend that when the minimum wage is raised, companies may retaliate by cutting down on employment, especially among low-skilled employees likelier to make the minimum wage. This worry arises from the assumption that increasing labor costs may make certain occupations unprofitable for firms, forcing them to reduce hiring or possibly implement layoffs. Low-skilled individuals are the most at risk since they often depend on minimum-wage jobs for employment. Although advocates claim that low-paid employees gain from pay rises, job losses may disproportionately affect this group (Campos Vázquez et al., 2017). For some people, quitting their work might cause more financial difficulty than the salary boost would alleviate. According to critics, young persons looking for their first jobs and entry-level employees should be especially concerned about this effect. Additionally, transitioning to rising minimum salaries presents difficulties for small enterprises. Small businesses could have slimmer profit margins and less financial flexibility than significant firms.

Inflationary Pressures

The possibility of inflationary pressures is another consequence of raising the minimum wage from its current level. Businesses may raise the prices they charge customers for products and services when their labor expenses rise due to rising salaries. The overall price level may rise as a consequence, decreasing the buying power of customers’ income. Rising costs for necessary products and services may indicate inflationary pressures, which can impact all members of society, even those who gain from a raise in the minimum wage. Critics contend that the overall impact may be negligible or even harmful if the price rises exceed the salary increases.

Furthermore, such inflation may reduce the value of investments, making it more difficult for people to accomplish long-term financial objectives and financial stability. The minimum wage’s inflationary effect may harm people who depend on saving and investing to create wealth. The actual value of money is diminished by inflation, which may make investing in education, preparing for retirement, or buying assets like houses more challenging.

Market Efficiency Concerns

The effect of the minimum wage on the market’s effectiveness is another issue critics brought up. They contend that governmental interference in wage determination might upset the labor markets’ natural equilibrium and result in unforeseen effects. A possible effect of minimum wage regulations is decreased company rivalry. When a set minimum wage is mandated for all employers, it might lessen the motivation for companies to compete on labor expenses (Campos Vázquez et al., 2017). Due to the absence of competition, the labor market may be less innovative and efficient, resulting in fewer employment possibilities and less economic dynamism. Laws requiring a minimum wage may also cause labor market inefficiencies. For instance, they could oppose employing people who might be less productive but are prepared to labor for reduced pay because of a disability or other particular need.

Personal Perspective

It is critical to understand that the minimum wage is not a one-size-fits-all answer when weighing its economic advantages and disadvantages. On the one hand, the advantages—such as lowered rates of poverty and higher levels of consumer spending—are indisputable and have a positive impact on low-wage employees’ lives as well as the general economic health of communities. The policy’s intended beneficiaries—low-skilled employees and small businesses—may be harmed by the possible job losses and inflationary pressures; thus, they cannot be overlooked. It is important to note that the effect of the minimum wage varies according to the particular conditions of the location and sector. What matters is how the minimum wage is administered and modified to consider these differences, not whether it is generally good or bad. It is also critical to consider any unforeseen policy implications, such as less competition or labor market distortions, which might have detrimental long-term impacts.

Flexibility and evidence-based decision-making should be the main components of fair minimum wage legislation. First, to account for regional cost of living and inflation disparities, officials should regularly examine and change the minimum wage. This guarantees that the policy will continue to successfully enhance the lives of low-wage people without unjustifiably harming companies. Complementary policies should also be taken into account. For instance, increasing the Earned Income Tax Credit (EITC) may help low-income people and families precisely without affecting labor market dynamics. Salary subsidies for firms that recruit low-paid employees may be investigated to encourage employment creation. Additionally, initiatives should be taken to aid small enterprises in adjusting to rising labor expenses.

Conclusion

The minimum wage is a potent tool for achieving economic and social fairness, but it must be used carefully and precisely. We can fight to build a fairer, more prosperous society that benefits all its members, from low-wage employees to small business owners and beyond, by acknowledging its strengths and limits and staying dedicated to evidence-based policies. A balanced strategy that considers regional disparities, accounts for inflation, and examines complementing policies is necessary to maximize the benefits of the minimum wage while minimizing any possible negatives.

Appendix

References

Campos Vázquez, R., Esquivel, G., & Santillán Hernández, A. (2017). The impact of the minimum wage on income and employment in Mexico The impact of the minimum wage on income and employment in Mexico. CEPAL Review N°, 122. https://repositorio.cepal.org/server/api/core/bitstreams/308e7edf-2569-45ad-908c-6f51e924423c/content

Chapter 7 -Monitoring the effects of minimum wages. (2020). https://www.ilo.org/wcmsp5/groups/public/—ed_protect/—protrav/—travail/documents/genericdocument/wcms_508532.pdf

Kiger, P. (2019, October 18). Minimum Wage in America: A Timeline. HISTORY. https://www.history.com/news/minimum-wage-america-timeline

Roberts, L., & Olinsky, B. (2021, January 27). Raising the Minimum Wage Would Boost an Economic Recovery—and Reduce Taxpayer Subsidization of Low-Wage Work. Center for American Progress. https://www.americanprogress.org/article/raising-minimum-wage-boost-economic-recovery-reduce-taxpayer-subsidization-low-wage-work/

write

write