Introduction

Foreign direct investment (FDI) determines economic growth in developing countries like Colombia. The country’s recent stable political climate, strong economic growth, positive institutional factors, and attractive investment prospects have recently attracted foreign investors. Despite these positive aspects, foreign direct investment (FDI) for the country’s inflow impact has been low compared to Latin American countries. Colombian policymakers seeking foreign funding face a major challenge. Therefore, studying Colombian foreign direct investment (FDI) factors is very important. This project collects and analyzes economic articles to find Colombia’s major foreign direct investment factors. The project will create a regression model to correctly assess how the political stability, macroeconomic conditions, government policy, and infrastructure affect Colombia’s foreign direct investment (FDI) inflows. This project aims to help policymakers and investors understand the factors that draw foreign investment to Colombia.

Hypothesis

The factors that play an important role in positively impacting Colombian foreign direct investment (FDI) inflow are Political stability, Macroeconomic stability, market size, government policy, and natural resources.

Literature review

Many studies have examined factors affecting foreign direct investment for Latin American countries in the past. Quazi (2007, 59 – 67) studied how trade and business agreements boosted Latin American FDI. The authors used a structural gravity model to examine foreign direct investment (FDI) flows and bilateral trade & investment agreements. These deals positively impact the Latin American regional foreign direct investment (FDI) in the short run. The study further found that the Latin American countries with trade agreements with developed countries had more significant foreign direct investment (FDI) inflows than those with developing nations.

Camacho, Freddy, and Yanina (2020, 247-257) investigated foreign direct investment (FDI) inflow and then made its connection and the economic growth in three South American counties of Ecuador, Peru, and Colombia. The authors explored various variables that affected foreign direct investment (FDI) inflows, therefore, determining the economic growth of the three nations. Thus the effect of FDI on economic growth using a comparative analysis approach was determined. It was concluded that FDI boosts economic growth in each of the three countries. According to the authors, FDI inflows help to increase local market size, transfer technology, and expertise, and produce job possibilities. This implies that FDI can contribute significantly to the growth and development of the economy of developing nations like Ecuador, Peru, and Colombia. The study looks at the variables that affect FDI inflows to these nations. The authors discover that economic policies, including trade liberalization and investment incentives, positively impact all three countries’ FDI inflows.

Furthermore, political stability and institutional quality are recognized as significant factors in determining FDI inflows, with nations with more stable political situations and robust institutions drawing more FDI. The analysis also sheds some light on how FDI is distributed by sector in these nations. The authors discover that FDI is mostly focused on sectors including mining, manufacturing, and services, frequently distinguished by the high capital intensity and technology levels. This means that policies that support technical advancement and innovation can increase foreign direct investment (FDI) into these nations and foster economic growth and development.

Cerquera-Losada, Hernán, and Libardo (2020, 9-26) examine the correlation between Colombia’s FDI and economic growth. The study examines FDI’s impact on economic growth and identifies the industries that have attracted the most FDI inflows. The Autoregressive Distributed Lag (ARDL) technique was used to examine the short- and long-term relationship between FDI and economic growth using 1980–2016 time-series data. The study found that FDI boosts Colombia’s economy over time. The survey also finds that mining and energy receive the most FDI, followed by manufacturing. The study also analyses Colombia’s FDI factors using the gravity model. Market size, infrastructural quality, and labor costs influence FDI inflows. According to the authors, officials can improve infrastructure and lower labor costs to increase FDI. This article adds to the literature on FDI and Colombian economic growth. The study’s findings show the importance of FDI for the country’s economic development. The sectors that receive the most FDI indicate where the government should spend its efforts to recruit more.

Economic theory

Many developing nations rely on several factors, including foreign direct investment (FDI), to determine economic growth. Due to rising FDI inflows, Colombia has recently become one of South America’s top investment destinations. This research examines the factors that affect FDI inflows to Colombia to add to the existing literature. The study hypothesizes that political stability, macroeconomic stability, market size, government policy, and natural resource richness boost FDI in Colombia.

Political stability

According to studies, political stability has been identified as one of the key elements in attracting foreign investors. Investors would prefer stable political environments with low levels of political risk. Political instability usually leads to a lack of confidence in the country’s investment climate, discouraging FDI inflows. Therefore, political stability is hypothesized to impact FDI inflows in Colombia positively.

Macroeconomic stability

Economic linkages, including domestic demand and output, the balance of payments, and fiscal revenues and expenditures, must be stable to attract FDI. Macroeconomic stability means no inflation, exchange rate fluctuation, or other economic issues.

Market size

The market is also an important determinant of FDI inflows. A larger market implies a more significant potential demand for products and services, which is attractive to foreign investors seeking new markets. Therefore, market size is hypothesized to positively impact FDI inflows in Colombia.

Government policy

Government policy impacts FDI. Tax benefits, investment protection, and simplified business setup attract investors. Thus, government policy may boost FDI in Colombia.

Hypothesis test

To test these hypotheses, this study will use regression analysis on a panel data set that covers the period from 1980 to 2016. Political stability, macroeconomic stability, market size, government policy, and natural resource richness will determine FDI inflows. The model will also include currency rates, inflation, and interest rates. Regression analysis will reveal Colombia’s FDI drivers. If the hypothesis is supported, it will imply that policymakers could focus on improving political stability, macroeconomic stability, market size, government policy, and natural resource abundance to attract more FDI to the country.

Empirical investigation

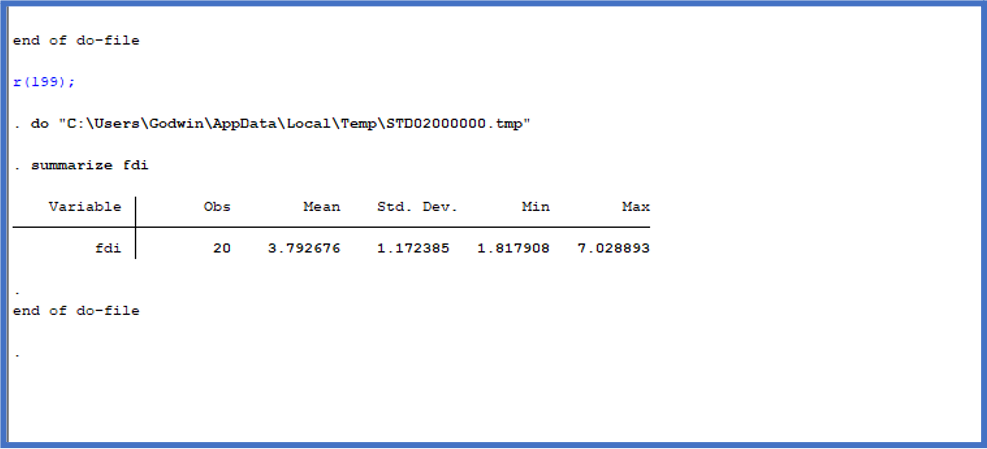

The variables used in the empirical model were Foreign direct investment (FDI), political stability, macroeconomic stability, market size, and government policies. The actual data was obtained from the word bank index report.[1] and BTI 2022 Colombia Country Report[2]. As seen in figure 1, the range of the Foreign direct investment for the years 2002 to 2022 is from 1.8179083 to 7.028893. Colombia’s foreign direct investment (FDI) values range by 1.17 units on average, according to the variable’s mean value of 3.79268 and standard deviation of 1.17238. The median (50th percentile) FDI percentile is 4.11582. The 10th percentile of Foreign direct investment (FDI) values is 2.21095, while the 90th percentile is 4.64639, indicating that 90% are below this amount.

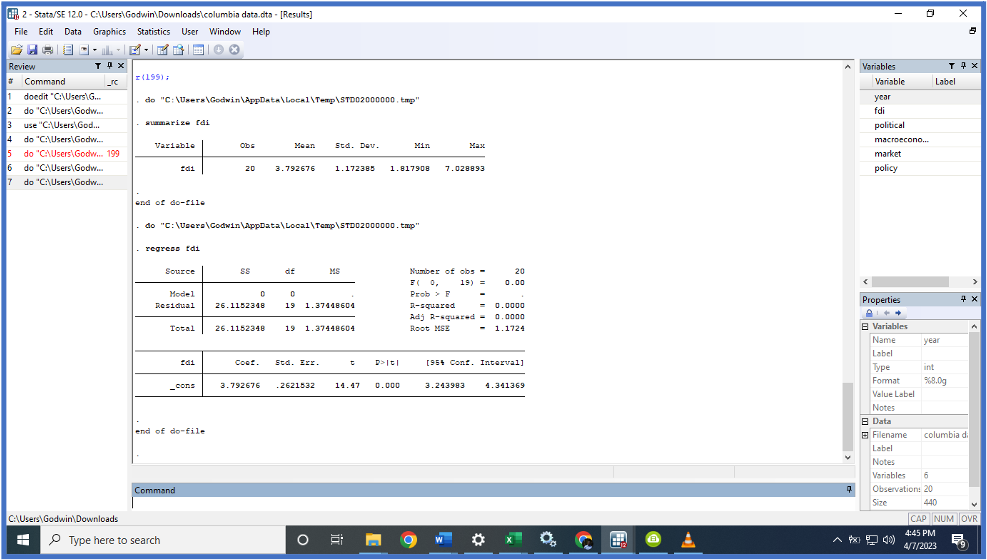

The low R-squared and adjusted R-squared values show that foreign direct investment (FDI) statistically performs poorly in this investigation. The models R-squared is 0.0000, meaning none of the independent variables explain FDI’s fluctuation. The model fits the data poorly since the adjusted R-squared value is 0.0000. The model’s F-statistic and p-value are both insignificant. The model fits worse than the intercept-only model since the F-statistic is 0.00 and the p-value is more than 0.05. Only the intercept, or constant term, has a statistically significant coefficient. The intercept coefficient is 3.792676, and its p-value is less than 0.05, suggesting a significant difference from zero. This value indicates the low impact on how the independent variables (political, macroeconomic, market, and policy) affect the dependent variable (FDI), suggesting that more factors play into determining the Colombian FDI inflow.

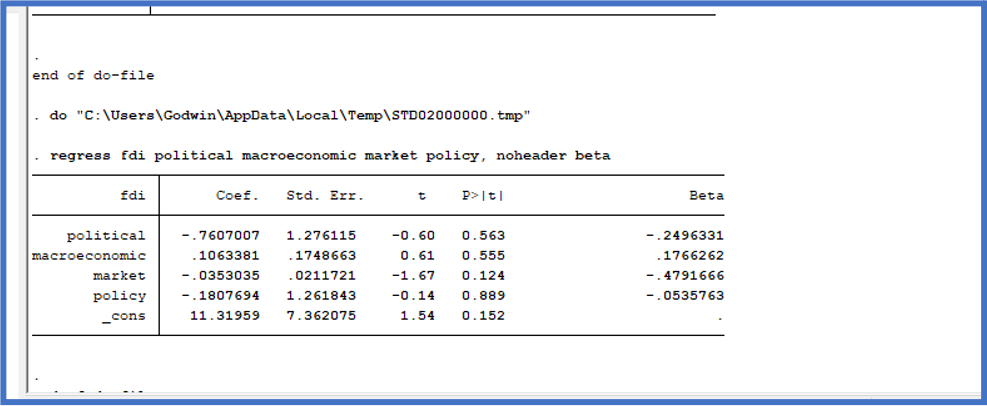

The model’s independent variables—political, macroeconomic, market, and policy—have no statistically significant coefficients in the output. Only the intercept term is statistically significant. Thus, it is impossible to economically discuss the significant independent variables, predict the dependent variable using the whole model specification, or make policy recommendations based on the econometric estimations. The current model definition may not adequately explain Colombian FDI factors. The model may miss crucial FDI variables. FDI and its determinants may be too complex for the sample size. To enhance estimates, further study is needed to discover and add key variables and increase the sample size. Policymakers must understand Colombia’s FDI drivers to create pro-FDI policies. Policies that reduce corruption and bureaucracy and stimulate investment in certain sectors like infrastructure or human capital development are examples. However, the current model’s lack of statistically significant coefficients shows that more research is needed to find Colombia’s most effective FDI policies.

Conclusion

Despite the lack of major returns, Colombian officials must continue to pursue FDI to support economic growth and development. Policymakers could consider adding factors to the model to explain FDI trends in Colombia, as well as the investment climate and priorities. Bigger sample size may increase estimate reliability.

References

Quazi, Rahim M. “Foreign direct investment in Latin America: a panel regression study.” The International Journal of Business and Finance Research 1, no. 1 (2007): 59-67.

Camacho, Freddy R., and Yanina S. Bajaña. “Impact of foreign direct investment on economic growth: Comparative analysis in ecuador, Peru and Colombia 1996-2016.” International Journal of Economics and Financial Issues 10, no. 4 (2020): 247-257.

Cerquera-Losada, Óscar Hernán, and Libardo Rojas-Velásquez. “Foreign Direct Investment and Economic Growth in Colombia.” Revista Facultad de Ciencias Económicas: Investigación y Reflexión 28, no. 2 (2020): 9-26.

“Colombia .” Data. Accessed April 7, 2023. https://data.worldbank.org/country/colombia.

“BTI 2022 Colombia Country Report.” BTI 2022. Accessed April 7, 2023. https://bti-project.org/en/reports/country-report/COL.

[1] “Colombia .” Data. Accessed April 7, 2023. https://data.worldbank.org/country/colombia.

[2] “BTI 2022 Colombia Country Report.” BTI 2022. Accessed April 7, 2023. https://bti-project.org/en/reports/country-report/COL.

write

write