Introduction/Background

When it comes to helping those who do not have access to regular banking services, Cashco Financial, a Canadian financial services company, is the best. Since its founding in 1985 in Edmonton, Alberta, the firm has opened more than 70 locations around the country (Craft, 2023). Payday loans, installment loans, credit lines, and prepaid credit cards are just some of the financial options offered by Cashco Financial. Consumers with low credit scores, limited banking options, or no access to conventional forms of finance are the focus of the company’s marketing efforts. This research will analyze the strategy choice cascades for Cashco Financial. In this research, we will look at the many strategic paths open to the business and assess the results we may expect from each. The study will be based on a careful review of the present state of affairs at the firm and an assessment of the external variables that may affect its future prosperity. The final product of this research will be a set of suggestions for the company’s long-term strategy.

Industry Research

The financial services industry is very competitive, with numerous firms vying for a slice. Mobile banking, internet lending, and fintech firms have all contributed to the fast development of the financial services industry (Kronick & Omran, 2021). Cashco Financial may set itself apart from the competition by catering to underserved populations, including low-income people and those with bad credit ratings. As shown by the study, a significant obstacle for Cashco Financial is maintaining regulatory compliance in the financial services sector. In order to prevent fines and damage to the company’s image, management must ensure that all applicable rules and regulations are followed.

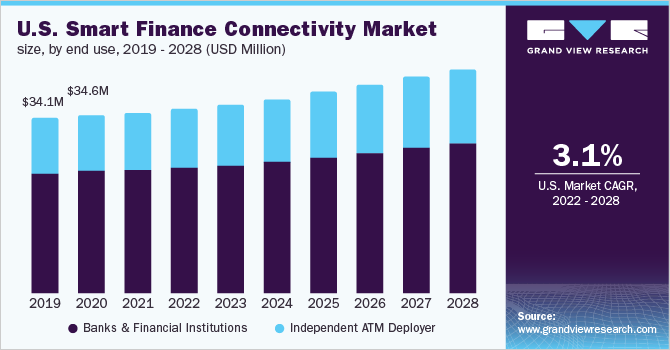

The statistical data presented offers supplementary perspectives on the financial services industry. The statistical data in Figure 1 suggests that the worldwide financial services market is projected to expand at a Compound Annual Growth Rate (CAGR) of 3.1% throughout the estimated period, implying a possibility for advancement in this industry (Business Wire, 2021). The data also suggest a rising trend in the adoption of mobile banking, thereby strengthening the inclination towards digitalization within this industry. The statistical data indicates that a considerable proportion of the American populace lacks a credit score or possesses a limited credit history, thereby highlighting the necessity for financial products and services tailored to address the requirements of these underserved segments of the community.

Competitive Landscape

Cashco Financial participates in the financial services industry, a sector characterized by intense competition. Within the current competitive environment, Cashco Financial has several businesses that may be classified as direct competitors. These competitors provide similar commodities and amenities, aim for identical consumer segments, and contend for equivalent market portions.

Some of Cashco Financial’s direct competitors include:

- Money Mart: Money Mart is a financial institution that provides payday loans, check cashing services, and other financial products on a short-term basis. Cashco Financial faces significant competition from a company with a robust brand reputation and a substantial customer base.

- Fairstone Financial: Fairstone Financial is a financial services firm headquartered in Canada that provides a range of financial products, including personal loans, mortgages, and other offerings (6sense, 2022). The company exhibits a robust presence within the Canadian market and is renowned for its competitive pricing and customized client support.

- Easy Financial: Easy Financial is a lending institution that provides loans to individuals with a low credit score or who needs a credit history. The organization offers diverse loan offerings and adaptable payment alternatives, making it an appealing choice for those seeking credit accessibility.

- Credit Canada: Credit Canada is a non-profit organization that offers credit counseling services and financial education on debt management. Although not a direct competitor of Cashco Financial in terms of its range of products and services, this entity provides comparable solutions to individuals encountering financial challenges.

Money Mart can be considered a formidable competitor of Cashco Financial, primarily due to its well-established brand reputation and extensive customer base, which indicate its relative strengths. Fairstone Financial emerges as a noteworthy competitor in the market owing to its competitive interest rates and customized customer support (6sense, 2022). While Easy Financial and Credit Canada may possess a different brand recognition than Money Mart and Fairstone Financial, they provide distinctive products and services catering to a particular customer demographic. In order to maintain competitiveness within the financial services industry, Cashco Financial must maintain a vigilant awareness of its competitors and consistently engage in innovative practices.

Strategy Choice Cascades Analyses

The Strategy Choice Cascades (SCC) framework is a widely employed analytical tool for examining the strategic decision-making processes of organizations, which are influenced by a range of internal and external factors. According to the SCC framework, firms should initially establish their desired level of achievement, followed by selecting a specific market in which to compete, formulating a successful strategy to attain victory in that market, cultivating the essential competencies to achieve success, and ultimately, implementing management systems to realize competitive success (Chiang, 2023).

Cashco Financial’s Apparent Winning Aspiration

The analysis of their recent actions suggests that their main aim is to augment their customer base and broaden their product offerings. Cashco Financial has disclosed its intentions to broaden its scope by inaugurating fresh branches and introducing a novel digital platform to enhance customer service efficiency, as shown in its pathway in Figure 2. To broaden its customer base and augment its revenue streams, Cashco Financial has recently introduced novel financial products such as credit cards, insurance, and personal loans (Cision, 2022). The statement implies that the company aims to establish itself as a prominent provider of alternative financial services in Canada by providing a diverse selection of reasonably priced and easily accessible financial offerings to underserved consumers.

Cashco Financial’s Playground

Cashco Financial’s target demographic comprises the underserved population in Canada, encompassing individuals who encounter financial limitations that impede their ability to avail of conventional banking and financial services. Individuals belonging to this demographic are commonly characterized by suboptimal credit ratings, restricted financial resources, or inadequate avenues for credit acquisition, thereby rendering the process of loan procurement or credit card issuance from conventional financial institutions a formidable task.

The market segment identified by Cashco Financial presents an opportunity to offer financial services to a population frequently overlooked by conventional financial institutions. Cashco Financial has identified an untapped demographic and has strategically positioned itself to stand out from conventional financial institutions such as banks and credit card companies.

Targeting underserved populations can be advantageous due to their heightened demand for financial services compared to other population segments. Individuals with limited financial resources or unfavorable credit histories may require short-term loans to address unforeseen expenditures or to manage the interval between salary disbursements (Cision, 2022). Cashco Financial can access a market with substantial growth potential by providing this population with loans and other financial services.

Cashco Financial’s Winning Strategy

Cashco Financial’s winning strategy is focused on its dedication to furnishing reasonably priced and easily accessible financial services to the underserved people of Canada. The organization acknowledges that many individuals in Canada encounter notable impediments in obtaining conventional banking commodities and amenities owing to factors such as inadequate credit ratings, restricted earnings, and the absence of collateral. Cashco Financial has recognized the potential to distinguish itself by offering customized financial services to cater to the requirements of the underserved population.

Cashco Financial’s ability to offer financial services that are both affordable and accessible is largely attributed to its utilization of technology and innovation. The organization has made significant investments in data analytics and machine learning algorithms, enabling it to evaluate creditworthiness and underwrite loans efficiently and precisely (6sense, 2022). Cashco Financial employs a data-driven methodology to provide loans and credit cards to individuals who may be excluded from conventional banking services while upholding a rigorous risk management framework.

Cashco Financial prioritizes exceptional customer service alongside its dedication to technology and innovation. The company acknowledges that establishing enduring associations with customers is crucial to its prosperity and endeavors to offer customized assistance that is customized to the distinct requirements of each customer (Cashco, 2023). Cashco Financial boasts a proficient and well-informed customer service team and provides a range of support channels for its clientele, encompassing face-to-face, telephonic, and online modes of communication.

Cashco Financial’s successful approach also encompasses a dedication to upholding responsible lending protocols. The corporation acknowledges the weighty obligation of extending loans and credit cards to an underserved population. It has instituted several protective measures to guarantee that it dispenses financial services conscientiously and enduringly. Cashco Financial provides financial literacy programs and additional resources to support its clients in enhancing their financial management skills. The organization is dedicated to collaborating with customers who may encounter difficulties in loan repayment to identify mutually beneficial solutions.

Cashco Financial Apparent Capabilities

Cashco Financial possesses several essential competencies that facilitate its ability to effectively compete in the financial services market that caters to the underserved population. The company’s technology-based underwriting process is considered one of its fundamental abilities, enabling it to evaluate creditworthiness and handle risk more efficiently than traditional banks and credit card firms.

Cashco Financial possesses a significant competitive edge in the market due to its capacity to provide a diverse array of financial products and services tailored to underserved people’s requirements (6sense, 2022). The company acknowledges that conventional banking offerings may not adequately cater to the requirements of numerous Canadian citizens. Consequently, it has devised a selection of comparatively more attainable and reasonably priced products.

Cashco Financial’s Apparent Management Systems

Cashco Financial’s Apparent Management Systems are a major factor in the firm’s ability to compete in the underserved financial services industry. The company has fostered a culture encouraging creativity, customer satisfaction, and staff participation (Cashco, 2023). All sorts of programs and efforts are in place to instill this culture of open communication and individual responsibility among workers.

Cashco Financial is a company that is committed to innovation, as seen by its “Innovation Hub,” a group of people that work together to create innovative products and services that meet the specific needs of underserved Canadians. The Innovation Hub is where all workers are encouraged to submit and discuss new ideas, and the corporation backs up these suggestions with funding and assistance.

Cashco Financial values innovation, but it also prioritizes its customers and its workers. Employees are the company’s most precious resource; thus, several programs and initiatives have been established to aid in their professional growth and create a happy atmosphere in the workplace.

Cashco Financial, for instance, provides all recruits with a thorough training program and all current workers with the opportunity for continued training and development. The organization provides its employees with several advantages and incentives, such as possibilities for professional growth, health and wellness programs, and adaptable work schedules.

A robust compliance and risk management framework is also a part of Cashco Financial’s management systems to keep the firm compliant with all applicable regulations and allow for efficient risk management (Cashco, 2023). The corporation has a compliance department whose job is to keep an eye on the regulatory landscape and update the company’s policies and processes as needed to align with the law.

In addition, Cashco Financial has a risk management structure to detect and deal with threats to the whole business. This framework aims to reduce the likelihood of unfavorable outcomes through routine risk assessments, continuous monitoring of key risk indicators, and various controls and mitigation techniques.

Further Exploration

I want to elaborate further on the technological and data-oriented methodology that Cashco Financial employs in loan underwriting and creditworthiness evaluation.

- What measures does Cashco Financial undertake to sustain a robust corporate culture centered on innovation, customer service, and employee engagement?

- Please provide further details regarding Cashco Financial’s risk management strategies and adherence to regulatory standards.

- What methods are used by Cashco Financial to assess and monitor customer satisfaction, and what measures are implemented by the organization to enhance its customer service consistently?

- What strategies does Cashco Financial intend to employ to maintain competitiveness in the dynamic realm of fintech and digital financial services?

Figure 1.

Image retrieved from https://www.grandviewresearch.com/static/img/research/us-smart-finance-connectivity-market-size.png

Figure 2; Cashco Pathway;

Image retrieved from https://mma.prnewswire.com/media/1836696/Cashco_Financial_Cashco_Financial_Announces_Pathway_for_the_Futu.jpg?w=600

References

Business Wire. (2021, March 10). Global financial services market outlook 2021-2030; Expected to reach $28.52 trillion by 2025 – ResearchAndMarkets.com. https://www.businesswire.com/news/home/20210310005386/en/Global-Financial-Services-Market-Outlook-2021-2030-Expected-to-Reach-28.52-Trillion-by-2025—ResearchAndMarkets.com

Cashco. (2023). Cashco. Cashco Financial. https://www.cashcofinancial.com

Cashco. (2023), https://cashcofinancial.com/privacy

Cision. (2022, June 14). Cashco Financial announces pathway for the future 2.0. Newswire: Press Release Distribution, Targeting, Monitoring & Marketing – Canada. https://www.newswire.ca/news-releases/cashco-financial-announces-pathway-for-the-future-2-0-831686427.html

Chiang, K. (2023, April 23). Systems in the strategic choice Cascade – Tools and applications used to across the value cycle. Ibbaka. https://www.ibbaka.com/ibbaka-market-blog/systems-in-the-strategic-choice-cascade-tools-and-applications-used-to-across-the-value-cycle

Craft. (2023). Cashco Financial. https://craft.co/cashco-financial

Kronick, J., & Omran, F. (2021). Upping our Game: How Canada’s Financial Sector Can Spur Economic Performance. CD Howe Institute e-Brief, 314.

6sense. (2022, July 18). Cashco financial services company insights, tech stack, and competitors. 6sense – The Only ABM Platform Powered by Revenue AI™. https://6sense.com/company/cashco-financial-services/5d9e01f0a7537b35bb5e3eda

write

write