Executive Summary

Tesco Plc is a multinational company based in the UK that operates in retail. The organisation operates in other European markets, including Hungary, Germany, the Czech Republic, and Slovakia. It is seeking to venture into another country. Austria is an ideal investment destination for Tesco because it is located in central Europe and has a culture similar to Germany, a country in which Tesco has been successful. Macroeconomic analysis of Austria shows that the economy is recovering from the pandemic, it has low political and economic risks and energy costs are decreasing, meaning that disposable income will increase to increase aggregate demand. This report analyses the suitability of Austria as an investment destination for Tesco using PEST analysis and Hofstede cultural dimensions. It recommends entering the country using an international joint venture and hedging against foreign currency risk through diversification.

Key Words: Political risks, legal system, economic and trading blocs, foreign currency risk

Tesco PLC Profile

Tesco Plc is a company based in the UK that operates in retail. The multinational organisation is engaged in retailing business and associated activities (retail), as well as retail banking and insurance services. Significant segments of Tesco are the UK, ROI and Central Europe. The UK and ROI segment entails Tesco Plc’s operations in the UK and Republic of Ireland, while the Central Europe segment involves operations in the Czech Republic, Hungary, and Slovakia. Businesses comprise Tesco UK and ROI, Tesco Bank, Booker, Tesco Czech Republic, Tesco Hungary, and Tesco Slovakia (Reuters 2024). Product categories are fresh food, beverages, and frozen food, while services are telecommunications, gift cards, and financial/insurance services. The brands are Tesco, Tesco Express, and Jack’s. The organisation seeks to expand its multinational activities to other European countries. Austria is an ideal country for such a venture due to its location in Central Europe, where the company operates differently. Competitors include Carrefour SA, Edeka Zentrale AG, J Sainsbury, and Migros-Genossenschafts-Bund.

Country Profile: Austria

Austria is one of the members of the European Union since January 1995. As a result, the country uses the Euro to exchange goods and services. The official language spoken is German. The country has also been a member of the Schengen area since December 1997. The country has a federal parliamentary system where the Chancellor heads the government, and the president is the head of state. Austria has nine states where regional and federal governments exercise executive power (The World Factbook 2024). The Parliament consists of the Lower House, which is directly elected and the upper, which regional parliaments elect. The country’s most critical economic sectors are wholesale and retail trade, transport, accommodation and food and services (Global Data 2024). Others are public administration, defence, education, human health, and social work. Intra-trade accounted for 69% of Austria’s exports to Germany (30%), Italy (6%), and France (4%) in 2020, while trade outside the EU comprised exports to the U.S. (6%) and Switzerland (5%) (EHL 2024). Upper Austria, Lower Austria, and Vienna contributed about 58.4% to the country’s GDP in 2021, with the regions home to 57.2% of the country’s population in 2022 (Global Data 2024). As a member of the EU, Austria has contributed 18 members to the European Parliament, who also participate in many functions, including being members of European Committees. Austria had an estimated population of 8.9 million in 2023, with a population growth of 0.23% (The World Factbook 2024). Most of the population, 65.11%, are aged 15-64 (The World Factbook 2024).

Trends in Austria’s Retail Sector

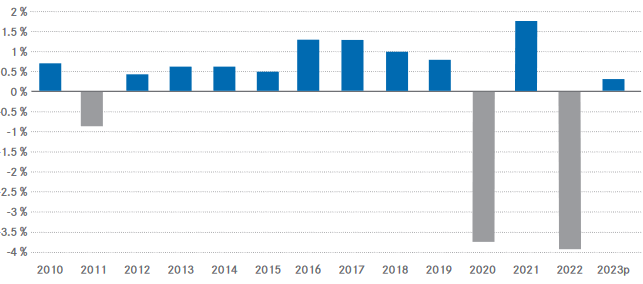

The first trend affecting the retail sector is the loss of purchasing power and insolvencies, which characterise a problematic year. The retail industry in Austria was the source of many headlines in 2022 and the first half of 2023 due to unfortunate events such as insolvencies and announcements of market existence. For instance, the sensational bankruptcy of the Kika/Leiner empire, the Forstinger automotive, and the insolvency of Delka/Salamander indicated a difficult textile segment. Overall, over 473 insolvencies were reported, making retail trade rank in KSV insolvency statistics during the year’s first half (EHL 2024). Together with other organisations that have indicated the possibility of quitting the Austrian market, it triggered commotion in the retail space sector. The departure of dominant companies such as Kika/Leiner enabled many potential companies to take the vacant space or allow the space to be used for an alternative use. The sharp increase in insolvencies is attributed to the effects of Covid-19 and shows the structural problem in the retail sector. According to EHL (2024), increasing inflation eroded the real purchasing power of many consumers in Austria, with increasing energy costs driving the operating costs of many retailers.

Figure 1. Trends in purchasing power per resident (EHL 2024)

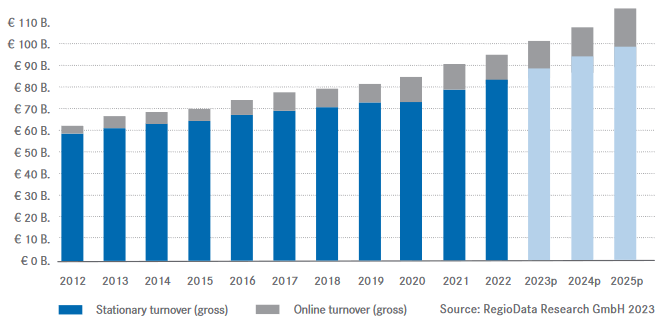

Figure 2. Retail sales in Austria (EHL 2024)

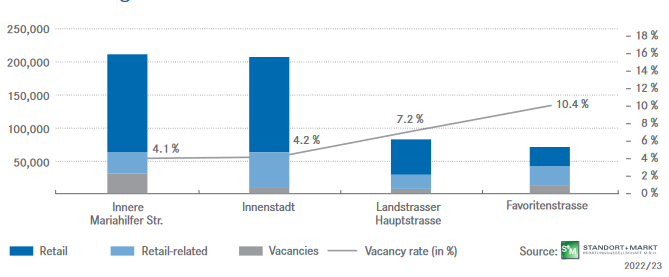

During the second half of 2023, the retail sector passed many difficult phases. Energy prices and inflation decreased, with tourism closing the summer season with solid results and robust private consumption (EHL 2024). Several positive developments characterised the rental side. First, discounters increased the demand for space, and food retailers showed gradual expansion despite posting weak growth. The luxury segment posted outstanding performance due to increased demand, with rent increasing in absolute top locations (EHL 2024). The rising demand increased rental space on Kohlmarkt to EUR 600/sqm and EUR 250 / sqm for smaller spaces and areas exceeding 400 sqm, respectively (EHL 2024).

Moreover, the steady decrease in total selling space shows another positive feature for the retail sector. The resistance against new retail areas enhances expectations that the small volume of new space entering the market will not offset the annual reduction. As a result, the sector is unlikely to expect a significant reduction in vacancies and a decrease in rents.

Figure 3. Retail space (sqm) and vacancy rates (%) in Vienna’s high streets (EHL 2024)

Austria’s Retail Sector Outlook

Weak Demand for Space

They started on a difficult path in the 2023/24 period because of various factors. The first is increasing disposable income due to increases in wages and pension, together with enhanced transfer of payments. High-interest rates, a weak economy, and inflation have increased uncertainty and reduced consumer expenditure. On the contrary, Austrian retailers are facing higher purchase prices and wages, leading to substantial reservations in demand for space in submarkets (EHL 2024).

More Conversions

Reduced space production in other real estate markets, such as office and residential areas, indirectly affects the retail space market. According to EHL (2024), many retail spaces have been converted into offices or apartments today, as it was historically done. Moreover, increased restrictions on AirBnB apartments in Vienna could increase the demand for space in low-cost hotels and hostels, creating alternatives for hard-to-rent shopping areas.

Limited Chances for Rent Increase

The weak demand for space has created rent pressure. It is challenging to achieve adjustments equivalent to the inflation rate on new rentals and contract extensions. As a result, the actual rental income and nominal rent decrease. However, the negotiation position of the landlords has improved due to reduced energy prices, which triggered a massive surge in operating expenses in 2022 and the first quarter of 2023 (EHL 2024). There is a continuing trend toward shorter leases (2-3 years), which are increasingly becoming famous relative to similar leases exceeding five years.

Steady and robust demand for top locations

Another source of increasing rents is the exceptional boom in demand for top locations with luxury labels. Many global market leaders seek to settle in Vienna with aggressive pricing approaches, especially for infrequently vacated spaces.

Sustainability as a Challenge and Opportunity

There is a sustained political and social pressure towards enhanced sustainability. Calls for sustainability originating from the economic and political standpoint can be considered challenges or opportunities in the retail sector (EHL 2024). Energetic improvements associated with sustainable heating systems minimise operating costs, although they increase the cost of producing new spaces, making the process more difficult.

PEST Analysis of Austria’s Retail Sector

Political Factors/Risks

Austria is a parliamentary representative in which the people directly elect the president. The president heads the state, while the Chancellor heads the federal government. The country has nine federal provinces. Austria was a significant power in Central Europe until the First World War. Although many things have changed, the country is a member of the EU, the United Nations, and other regional and international blocs. The country remains politically stable, with democratic elections held regularly. Nonetheless, an article by Ebner (2019) reported that corruption and racism have been normalised in Austria, and the rise of far rights is a significant concern. A different article by BMI (2024) indicated that the significant political risk in Austria is the rising cost of living attributed to the increased price of energy and inflation. As a result, the short-term political risk index ranks the country at 79.3 per cent. The government has made significant efforts to develop and implement policies easing the cost of living. The re-election of President Van der Bellen enhances political stability. As a result, political risks in Austria remain extremely low.

Economic Factors/Risks and Trading Blocks

Various economic factors affect how companies operate in Austria. The economy performed well over the past decade up to 2019, just before the onset of the COVID-19 pandemic, when the economy grew by 446.31 billion dollars (European Commission 2023). However, the pandemic significantly affected the economy, with the growth rate decreasing by -6.7% in 2020 before a 4.4% rebound in 2021 (World Bank 2024). Nimble government policy responses helped the country mitigate major shocks, given that output quickly rose above the pre-pandemic levels. The authorities used the available fiscal room to cushion the effect of higher energy prices to conserve energy. Despite the efforts by authorities, higher energy prices and tighter financial conditions have reduced growth prospects in the Austrian economy. The country relies heavily on Russia for energy, and the Ukrainian war had a significant impact on oil prices. The 0.8% contraction of the Austrian economy in 2022 is attributed to the high cost of energy, which reduced output in energy-intensive sectors and elevated inflation (IMF 2024). In the future, the economy is expected to recover, though gradually. For instance, the economy is expected to expand by 0.5 per cent by mid-2024 due to rising real wages supporting higher aggregate consumption.

The labour market is expected to remain strong regardless of the weaker growth because the unemployment rate remains moderate after hitting a record high in mid-2023. Job vacancy rates remain above the pre-pandemic levels with a solid nominal wage growth. Moreover, inflation is expected to gradually fall to near the target by the middle of 2025 (IMF 2024). Despite the outlook, significant economic risks comprise a stronger-than-anticipated external demand. The short-term growth in external demand will drive prolonged production in all sectors, including retail, which is an opportunity for all entities, including new entrants like Tesco (IMF 2024). Downside risks comprise intensified Red Sea trade disruptions and shocks linked to commodity markets, particularly gas. Austria currently has ample gas storage, although continued dependence on Russian gas exposes the country and consumers to renewed supply disruptions. An abrupt domestic correction in the housing and commercial real estate sectors will adversely affect the financial industry and housing balance sheets, further dampening growth and posing a significant risk to all retail companies, among other players (European Commission 2023). Lastly, if inflation remains above the Eurozone average, Austria’s competitiveness in the international market as an investment destination will be affected.

Socio-Cultural Factors and Cultural Distance

Austria has a highly developed social environment with high living standards. Austrians are comfortable with a high level of household income. However, the high cost of living has affected disposable incomes and spending. Although Austria is a developed country, a small proportion of the population, including immigrants, is at risk of poverty (Strausz, 2023). The Hofstede cultural dimensions model is used to measure the cultural dimensions of Austria, including power distance. According to Strausz (2023), Austria and Germany score almost equally on individualism and uncertainty avoidance, meaning that the people focus on developing family relations, self-actualisation, rules, and laws. The country places more excellent value on an egalitarian social structure. According to Hofstede, Austria has a low score on the dimension of power distance (score of 11) and higher on indulgence relative to Germany, implying that the country emphasises participative communication and equality among members of society (Scroope 2018). As such, Austrians value personal relationships and networks with the social system, reflecting equality’s significance. The extensive welfare system supports the health, education, employment, and retirement needs of the population.

Technological Factors/Risks

Online retail is a significant feature that characterises the retail business in Austria. The central feature of online retail business is its gradually becoming symbiotic. Mid-year research by RegioData reported that the online share of retail-relevant turnover in Austria decreased by 1.5% to 15% in 2023 (EHL 2024). The trend is attributed to the end of the pandemic, although other underlying reasons also exist. These comprise a strong performance posted by discounters, luxury segments, and food retail segments whose online share of retail business is meagre. As such, e-commerce is no longer a fear factor for brick-and-mortar retail, given that Internet shopping is a daily occurrence and now complements, but in no way replaces, branch-based retail trade (EHL 2024). Qualitative trends and the growing number of successful entities illustrate this trend, indicating the transition from competition for customers to synergetic cooperation whereby online and offline business elements complement each other to create client benefits and add value for retailers.

‘Click and Collect’ enhances efficiency with the increasing number of stores with showroom characters to provide haptic and visual impressions for online consumers. They also offer chances for personal advising. Another factor is the Ropo Effect, which is researched online and purchases offline and has become a critical factor influencing e-commerce in Austria’s retail sector (EHL 2024). These factors have changed online shopping from a threat to retailers to a successful expansion strategy capable of increasing market shares.

Forex and Currency Risks

Foreign currency risk is the chance of losing whenever Tesco Plc exchanges one currency (GBP) to another (Euro) when operating in Austria because one or both currencies fluctuate. The volatility of the currencies can result in a decline in the value of Tesco’s investment in Austria. For instance, Tesco can use the British Pound to investors. If the GBP appreciates relative to the Euro, the investment will be worth more in Euros and vice versa. Alternatively, the company can incur costs when changing profits from Euro to GBP. As a result, the company can lose or gain through foreign currency risk.

Recommendations

Entry Mode

The macroeconomic outlook of Austria identifies the country as an investment destination for Tesco Plc. The company can venture into the country using one of the many entry modes. According to Ali et al. (2021), market entry mode is an institutional arrangement that makes it possible for an organisation such as Tesco to venture into a market to sell its products, technology, human skills, management, or other sources. Although it can use franchising and M&A, an international joint venture is the most suitable entry mode for Tesco in Austria. An international joint venture entails the creation of a new business by two or more companies for a common goal (Gunnarsson 2011). Both companies will participate actively in strategic management decisions. According to Griffin and Pustay (2015), international joint ventures are often motivated by at least one partner wanting to expand into a challenging market. The joint venture could involve Tesco Plc, a UK-based company, and another retail corporation in Austria. The entry mode will enable Tesco to access resources and the Austrian market, transfer technology, limit political risks, and improve Tesco’s competitive position in Austria. The strategy also provides economies of scale and helps the company avoid interfirm contracting, transactions, and negotiation costs (Piaskowska, Nadolska, & Barkema 2019). The method is cheaper than acquisition, minimises risks because of partnership with local firms, and profits and returns can be greater than other investments. If the company finds the venture successful after several years, it can establish other stores in Austria to diversify its income.

Response to Cultural Dimensions

In response to Hofstede’s cultural dimensions, Tesco should consider Austrian values when doing business in the country by paying attention to academic titles. Although younger people might view this differently, many consider titles part of an individual’s necessary sign of respect and distinction from the rest. In response to the lower power distance measure, Tesco should avoid using campaigns with one-size-fits-all approaches (Strausz, 2023). For instance, an email campaign should minimise a top-down communication style or one-size-fits-all and focus on identifying and addressing individual needs. Moreover, Austrians emphasise leisure and enjoyment of life, meaning Tesco’s products should fit into this niche.

Mitigating Foreign Currency Risk

Tesco Plc can mitigate foreign currency risk using several strategies. The first approach is diversification of investment in other countries with strong currencies. Most company operations are in different European countries, where the Euro is the currency used for trade. It should consider investing in countries outside the Eurozone. Secondly, the company can hedge currency risk using exchange-traded funds when it buys foreign stocks and currencies from one or more countries and hedges the risk on its behalf. Lastly, Tesco can choose to invest in other companies operating in different countries outside the European Union to reduce the risks associated with foreign currency risks.

International Supply Chain Management

It is recommended that Tesco undertakes international supply chain management because of its international ventures in Austria and other countries. Tesco Plc will be venturing into Austria, making international/global supply chain management essential. The global supply chain is critical because it enables the coordination of all sourcing, procurement, conversion, and logistics management activities, making up a company’s network. It is the process of planning, implementing, and controlling a company’s global supply chain operations. The objectives are to improve integration, sourcing conversion, and logistics to deliver goods to consumers.

Conclusion

Tesco Plc is a UK-based retailer operating in other countries and seeking to diversify revenue by venturing into Austria. Austria is an essential member of the European Union and an ideal investment destination for Tesco based on the macroeconomic analysis using PEST and Hofstede cultural dimensions frameworks. Tesco can venture into the country using an international joint venture with a local retailer. The mode of entry is cheaper compared to an acquisition or direct entry. Political and economic risks are low, although foreign currency risk is high. The company can mitigate the risk by hedging and diversifying investments outside Europe.

Reference List

Ali, T., Khalid, S., Shahzad, K., & Larimo, J. (2021) ‘Managing international joint ventures to improve performance: The role of structural and social mechanisms’, International Business Review, 30(3), 101791.

BMI. (2024) ‘Cost of living crisis remains main political risk in Austria’, available from: https://www.fitchsolutions.com/bmi/country-risk/cost-living-crisis-remains-main-political-risk-austria-30-11-2022. [Accessed Mar. 24, 2024].

Ebner, J. (2019) ‘Austria’s crisis is a lesson for Europe: far-right parties are unfit to govern’, available at: https://www.theguardian.com/commentisfree/2019/may/23/austria-crisis-europe-far-right-freedom-ibiza-scandal (accessed 01 January 2021)

EHL. (2024) ‘Retail market report: Austria 2023/24’, available from: https://publikationen.ehl.at/view/447904877/. [Accessed Mar. 24, 2024].

European Commission. (2023) ‘2023 Country Report: Austria’, available from: https://economy-finance.ec.europa.eu/system/files/2023-06/ip244_en.pdf. [Accessed 24, Mar. 2024].

Global Data. (2024) ‘Austria Pestle Insights – A macroeconomic outlook’, available from: https://www.globaldata.com/store/report/austria-pestle-macroeconomic-analysis/. [Accessed Mar. 24, 2024].

Griffin, R.W. & Pustay, M.W. (2015) International Business. A Managerial Perspective, 8th edition, England, Essex: Pearson Education Limited.

Gunnarsson, A. (2011) ‘The selection of entry mode when penetrating a foreign market’, available from: https://www.diva-portal.org/smash/get/diva2:421070/FULLTEXT01.pdf. [Accessed Mar. 24, 2024].

IMF. (2024) ‘Austria: Concluding statement of the 2024 article IV Mission’, International Monetary Fund (IMF), available from: https://www.imf.org/en/News/Articles/2024/02/29/mcs030124-austria-concluding-statement-of-the-2024-article-iv-mission. [Accessed Mar. 24, 2024].

Piaskowska, D., Nadolska, A., & Barkema, H. G. (2019) ‘Embracing complexity: Learning from minority, 50-50, and majority joint venture experience’, Long Range Planning, vol. 52, no. 1, pp. 134-153.

Reuters. (2024) ‘About Tesco PLC (TSCO.L)’, available from: https://www.reuters.com/markets/companies/TSCO.L/ [Accessed Mar. 24, 2024].

Scroope, C. (2018) ‘Austrian Culture: Core concepts’, available from: https://culturalatlas.sbs.com.au/austrian-culture/austrian-culture-core-concepts

Strausz L. (2023) ‘Localising into German? Here’s why you shouldn’t forget about Austria’, available from: https://www.teamajt.com/localising-into-german-heres-why-you-shouldnt-forget-about-austria/. [Accessed Mar. 24, 2024].

The World Factbook. (2024) “Austria”, available from: https://www.cia.gov/the-world-factbook/countries/austria/. [Accessed Mar. 24, 2024].

World Bank. (2024) ‘GDP growth (annual %) – Austria’, available from: https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?locations=AT

write

write