Introduction

Asymmetric information is a scenario where one of the parties in an economic transaction or business agreement (usually the seller) possesses superior knowledge than the other party (usually the buyer) (Asymmetric information problem, n.d). In capital markets, it refers to a situation where one economic agent (typically the seller) of financial securities possesses more privileged information than the other agent (usually the buyer). Asymmetric information can significantly impact the agent’s investment decision-making process.

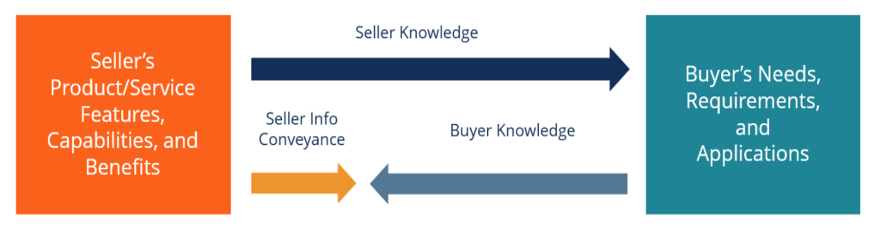

Figure 1: Asymmetric information

How Information Asymmetry Impacts Decision-Making

Source: Corporate Finance Institute

Types of Asymmetric information

Asymmetric information can be classified into adverse selection and moral hazard. The effects of asymmetric information on decision-making for capital market economic agents can range from higher costs and market inefficiencies to reduced financial liquidity (Asymmetric Information, n.d). Mitigation strategies include disclosure regulation, anti-insider trading laws, and due-diligence research. Secrets and Agents; Information Asymmetry (2016) affirms the need for agent signaling, stating that “The capital market is known for the existence of information asymmetry between sellers and potential buyers.” (p.10). This assertion suggests that capital markets perpetually exist in a state of information asymmetry.

Asymmetric Information vs. Adverse Selection

Adverse selection is a scenario that arises when one of the parties in an economic transaction possesses better information regarding the features of a financial asset than the other party. Adverse selection is a scenario where one economic agent can access accurate but different information than another (Mailath & Sandroni, 2003). Still, information asymmetry triggers market pricing inefficiency. A case example is when one party (seller) possesses insider information regarding the poor financial health of a company and leverages this information to offload their stocks to an unsuspecting party (buyer) oblivious of the company’s financial state. The result is information asymmetry that can trigger market imbalance and suboptimal outcomes for the disadvantaged party.

Asymmetric Information vs. Moral Hazard

The moral hazard occurs when one agent in an economic transaction willfully provides misleading information or alters behavior by leveraging their asymmetry information, believing they cannot face the consequences of the outcome. In the financial markets, moral hazard may occur when the company’s management engages in insider trading. According to Secrets and Agents; Information Asymmetry (2016), corporate executives have an information advantage and have access to classified corporate secrets. Subsequently, there are high chances of their involvement in insider trading, thereby disadvantaging agents who lack privileged access to company information.

Asymmetric information vs. Market Efficacy:

Asymmetric information can partly be blamed for inefficiencies witnessed in the financial markets, such as market price distortions. Market prices ought to reflect publicly accessible information. Inefficacy arises when some traders possess privileged insider information not indicative of the company’s share prices (Asymmetric information problem, n.d). Consequently, the resulting situation causes mispricing, share price misrepresentation, and market inefficiencies. Privileged economic agents leverage asymmetric information to exploit the other party, causing market inefficiency.

Incidence of Asymmetric Information in Decision-Making

Financial Markets

The problem of asymmetric information can manifest in the financial markets during lending and borrowing. A case example is where the borrower possesses better knowledge and information concerning his financial state than the lender. In such a case, the borrower can exploit the asymmetric information to the lender’s disadvantage. Given the scenario, the lender will be incapable of accurately deciding the borrower’s creditworthiness, thus increasing the risk of a loan default. Kalou et al. (2013) concur that the problem of asymmetric information distorts financial markets, making it difficult for lenders to access accurate consumer information. Nevertheless, he affirms that the problem of information symmetry can be solved through information sharing and exchange. Given the limited information, lenders usually charge high-interest rates to compensate for the asymmetric information risk.

The Insurance

The information asymmetry problem also plays a vital role in insurance purchase decision-making. For instance, when insuring a car, the insurer needs more information on whether or not the customer will take good care of the car. In this case, if the insurer has advance information that the customer is careless with locking the car or that the tracking device will frequently malfunction, the insurer would not insure it. Subsequently, this scenario can lead to the problem of adverse selection and also presents a moral hazard (Nikolaou et al., 2013). The person insuring his car knows that his actions can lead to theft and ignores the risks involved, e.g., parking in risky places or leaving the car unlocked.

Similarly, someone buying health insurance possesses more information regarding their health than the insurer. Notwithstanding the multiple screening tests, the insurer cannot accurately identify all health problems. As a result, there is information asymmetry between the insurance buyer and the insurer. To deal with this problem, insurers raise health insurance premiums to compensate for the risk of information asymmetry (Barbaroux, 2014).

Stock market

The problem of asymmetric information can also adversely affect stock market investment decision-making. For instance, managers of Company A could have insider information about the company’s financial health. For instance, they may know the company’s share price is over-valued or under-valued (Asymmetric Information, n.d). Leveraging this knowledge, the managers may engage in insider trading, given their information asymmetry.

Asymmetric Information Analysis

According to Sloman (2006), asymmetric information is central to the principle-agent relationship. Principles can employ agents to transact on their behalf. He opines, “The crucial advantage agents have over their principles is specialist knowledge and information.” (p.11). However, considering information asymmetry, it is hard to determine in whose best interest the agent is acting.

In competitive asset markets, economic agents with accurate information typically drive agents with inaccurate information from the market. This long-standing belief is supported by market selection theory stating that agents possess exogenous knowledge. According to Mailath & Sandroni (2003), economic agents can use information asymmetry to alter commodity prices. Nevertheless, the privileged information that agents possess may not necessarily be accurate. Nevertheless, information accuracy is crucial in investment decision-making. Superior information grants an agent information advantage, helping them increase wealth. According to Kalou et al. (2013), information asymmetry would cease if economic agents shunned opportunistic behavior. He states, “Financial markets need more complete and accurate information about the financial structure and the daily operation of the firms….” (Nikolaou et al., 2013; p. 617).

Lack of information permits unscrupulous traders to operate—the more the information asymmetry between the agents, the higher the scope of deception. Sloman (2006) concurs that adverse selection can cause buyers to select poor suppliers. Still, a lack of information for insurance companies can cause higher risk consumers buying health insurance. He asserts that moral hazards permit rogue traders to exploit a gap in the contract to their advantage. Still, the moral hazard problem arises when a person who ensures a house takes significant risks knowing that the property is insured (Sloman, 2006).

Conclusion

Information asymmetry can significantly impact investment decision-making for market economic agents. Besides, it can lead to adverse selection or moral hazards responsible for market failure, inefficiency, and a high cost of economic transactions. Therefore, markets must eliminate information asymmetry to provide sellers and buyers with a level playing field to enable them to make sound economic investment decisions.

References

Asymmetric Information. (n.d.). Corporate Finance Institute. https://corporatefinanceinstitute.com/resources/wealth-management/asymmetric- information/

Asymmetric information problem – Economics Help. (n.d.). Economics Help. https://www.economicshelp.org/blog/glossary/asymmetric-information/

Barbaroux, P. (2014). “From market failures to market opportunities: managing innovation under asymmetric information,” Journal of Innovation and Entrepreneurship, 3 (1), pp. 1-15. https://doi.org/10.1186/2192-5372-3-5

Mailath, G. J., & Sandroni, A. (2003). Market selection and asymmetric information. The Review of Economic Studies, 70(243), 343-368. Retrieved from https://www.proquest.com/scholarly-journals/market-selection-asymmetric- information/docview/204333407/se-2

Nikolaou, I. E., Chymis, A., & Evangelinos, K. (2013). Environmental information, asymmetric information, and financial markets: A game-theoretic approach. Environmental Modeling & Assessment, 18(6), 615-628. doi:https://doi.org/10.1007/s10666-013-9371-5

Secrets and agents; Information asymmetry. (2016). The Economist, 420, 55-56. https://www.proquest.com/magazines/secrets-agents-information- asymmetry/docview/1806159028/se-2

Sloman, J. (2006). Asymmetric information and market failure. Teaching Business & Economics, 10(3), 11-12. Retrieved from https://www.proquest.com/scholarly- journals/asymmetric-information-market-failure/docview/231304782/se-2

write

write