ABSTRACT

Financial crisis is the lead cause for alterations in the liquidity of the financial institutions of a nation. During the year 2007-2008, the European countries incurred a financial crisis that left majority of the members of European central bank financially crippled and at the mercy of borrowing funds for running the daily operations of the institutions. due to the crisis, the importance of managing liquidity was realized by majority of the countries. Initially, the asset markets of the various nations were positively performing and operating at readily available costs. The rapid change in the market situations opened up the consideration of how the liquidity of a financial institution can easily evaporate. Meanwhile, holding liquid assets such as cash and government securities imposes an opportunity cost due to their possession of low returns. With poor regulation in the banks, it is reasonable to anticipate holding the liquid assets until they can maximize the firm’s financial performance. Beyond all the occurrences, policymakers are entitled to the option of requiring more extensive holdings of liquid assets. The purpose of the study herein is to determine the impacts of liquidity risk management on the financial performance of financial institutions in Europe. Essentially, there exists a negative relationship between liquidity risk and the profitability of the financial institutions hence an increase in liquidity decreases the profitability of the institutions. Additionally, considering the regulatory requirements on the minimum capital needed by the banks, capital adequacy indicates the financial institution’s ability to undertake additional roles in the business fields. The size of the money is responsible for the provision of financial flexibility for the banks and financial institutions. Financial institutions equipped with higher capital ratios have an increased probability of earning more profits by translating the safety advantages into a profit.

1.0: INTRODUCTION

1.1 Background of the Problem

Liquidity is an primary aspect that has affected European numeral countries during the financial problems incurred during the Eurozone crisis. This is because the uncertainty of the economies led to the evaporation of the funding sources, thus causing a shortage of cash in many commercial banks. As a result, the majority of the banks were unable to offset their obligations as they came due. On the extreme edges of the crisis, some banks were forced to use amalgamation terms to improve their performance. Therefore, liquidity is the ability of a financial institution or a company to meet its collateral obligations without incurring any severe losses. To extend overall financial stability, numeral governments offered to provide substantial liquidity levels in the countries. During the Eurozone crisis, mainly due to a balance-of-payments crisis, many banks experienced financial difficulties failing to manage the liquidity levels properly.

Meanwhile, holding liquid assets imposes an opportunity cost due to their possession of low returns. With poor regulation in the banks, it is reasonable to anticipate holding the liquid assets until they can increase the firm’s financial performance (Boissay and Collard, 2016). Beyond all the occurrences, policymakers are entitled to the option of requiring more extensive holdings of liquid assets. For instance, it is perceived as a benefit to the stability of the firm’s overall financial performance. This study will aim at establishing the impacts of liquidity risk management on the performance of financial institutions in Europe.

1.1.1 Liquidity Risk Management

Liquidity is the funding capacity of a financial institution to increase the number of assets and meet the collateral obligations under reasonable costs. The risk of liquidity in the banks mainly occurs due to financing long-term investments through the short-term liabilities hence exposing the liabilities to the risk of refunding. Surprisingly, the liquidity risk is primarily in individual nature, but sometimes depending on the situation may compromise the liquidity ability of the financial system. In financial institutions, liquidity risk is management is defined as the risk resulting from the institution’s inability to meet their current obligations to the investors or focus on funding an increase in assets as they fall due with minimal and manageable losses. With an effective liquidity risk management program, firms can minimize adverse situations in the institutions.

Banks are obligated to ensure a flawless management of liquidity risk in the markets. Therefore, the banks should establish robust liquidity risk management frameworks that provide strict maintenance of sufficient liquidity. The frameworks can include a cushion of unconstraint, quality liquid assets and withstanding all the stressful events during an operation. Therefore, it is the responsibility of the supervisors in a bank to assess the adequacy of the liquidity risk management frameworks and the Bank’s liquidity position. Additionally, the supervisors should take immediate actions in the cases whereby the banks are deficient in any of the two areas to protect the depositors and investors and act as a limitation to the potentiality of a crisis occurring to the financial systems.

Banks are often faced with two dire issues concerning liquidity. Firstly, banks conduct the role of managing the creation of liquidity and the occurrence of liquidity risk. Liquidity creation aids the depositors, investors, and companies in maintaining liquid, especially when the other financial sources become difficult. The management of liquidity risk is essential in financial institutions because it ensures that the banks own liquidity and serve their function continually. During the prevalence of the European crisis, several states such as Portugal, Greece, Cyprus, Spain, and Ireland were unable to fully refinance the governmental debts or serve as the banks of the last resort for other financial institutions. This made the management of the liquidity risk harder due to the unavailable funds to finance the crisis hence driving home the importance of liquidity to a proper functioning of the banking sector and financial markets. Before the problem, asset markets were functioning and running positively, increasing funding at a low cost. Rapid reversing of the economic and market conditions in the European countries illustrated the possibility of liquidity quickly evaporating. That illiquidity can last for a more extended period than the expectation of the governments can last longer before a successful sorting of the financial crisis. The banking systems of the affected European countries were under severe stress, which triggered an action from the financial guarantees of the European countries. This was due to the immense fear of collapsing the euro and the financial contagions and the international monetary fund.

Similarly, numeral rating agencies downgraded several of the European country’s debts, accelerating the ending of the crisis in the countries. As a result, the Realization of the importance of liquidity risk management in the countries was reached due to the implications of such risks to the banks and the general financial systems in the countries. Essentially, the crisis enabled the banks to quickly realize the importance of holding more liquid assets than in the past hence aiding in self-insurance against the potential funding difficulties. The rapid seriousness of liquidity risks in the various nations triggered the desire to devise strategies and measures globally that would aid in managing liquidity risk in the individual states.

1.1.2 Financial Performance of Financial Institutions

Realizing profits is the ultimate goal for all commercial and financial institutions globally. To determine the profitability of a financial institution, there are numeral ratios that can be utilized. The majors are the return on assets, net interest margins, and equity. Return on equity is the financial ratio that defines the profit levels of a company compared to the total level of shareholder equity found on the companies’ balance sheets. Return on equity is the central aspect that the investors seek in return to their investments.

On the other hand, return on asset is the income ratio to a company’s total assets and measures the ability of the banks to generate incomes through the utilization of the company’s assets at their disposal. Equally, net interest margins are the measure that determines the difference between the interest income levels generated by the banks and the level of interest given to their leaders, such as deposits, concerning the interest-earning on their assets. Meanwhile, NIM is expressed as a percentage of the earnings of the financial institutions on loans during a specific period and other assets subtracted from the interest paid on the debited funds divided by the average amount of the total assets that generated income in the particular period. The variable of net interest margins is defined as the division of the net interest income and the total asset earnings. In many cases, the investors of a bank such as Barclays are concerned with the ability of the firm to generate, maintain and increase incomes. Therefore, a financial institution’s profitability can be measured using numeral interrelated dimensions.

To begin with, the is the relationship between the firm’s profits and their revenues is the residual return on the firm per sales dollar. Secondly, return on investment correlates with a firm’s earnings to the assets required to generate the profits. The financial institutions’ income analysis is necessary to the stockholders since it is responsible for deriving revenues in the form of dividends in the financial institutions. Essentially, further increase in the profits levels of financial institutions can increase the market prices hence creating a capital gain for both the financial institutions and the individual economies.

1.1.3 Relationship between Liquidity Risk Management and the Financial Performance of the Financial Institutions

In studies previously conducted to establish the relationship between the liquidity risk management and financial performance of a financial institution, a negative relationship between the liquidity trends and the institutions’ profitability was based. The adaptation of the liquidity strategies in many countries is found to have less to no impact on the return on assets. Therefore, only an increase in the use of liquidity forecasting and the daily financing of financial institutions during the financial crisis can positively impact the return on assets. Additionally, it is established that the essentiality of the critical rations that are meant for monitoring the company’s liquidity remains the same hence creating a mix on the profitability of the financial institutions and the significance hence creating doubt on the conclusions of the impacts of liquidity in the financial institutions and the economies in general.

In developing countries, weak positive relationships between liquidity and a financial institution’s profitability are established. For instance, a study conducted on the Nigerian financial institutions concludes that the success of the operations and survival of the financial institutions in the countries should offer a minimal compromise to the efficiency and effectiveness of liquidity management. Lack of liquidity and excessive liquidity are identified as financial problems that attempt to efficiently eradicate the profit bases of the financial institutions since they directly affect the ability of the bans to attain a high profitability level. On the other hand, a study conducted on the American countries such as Canada indicates a nonlinear relationship that suggests the profitability is immensely improved for the financial institutions that hold liquid assets. However, there is a point that having excessive liquid assets diminishes financial institutions’ profitability. According to the estimation results, the relationship between the profitability of a financial institution and the liquid assets mainly depends on the institution’s business model and the risk of funding market difficulties in existence. Therefore, adopting a traditional business model in financial institutions enables the institutions to maximize their profits while incurring lower levels of liquid assets. Equally, in cases where the likelihood of funding the market difficulties is minimal due to a nation’s economic growth, the financial institutions are advised to hold less liquid assets to maximize their profit base.

1.1.4 Financial Institutions in Europe

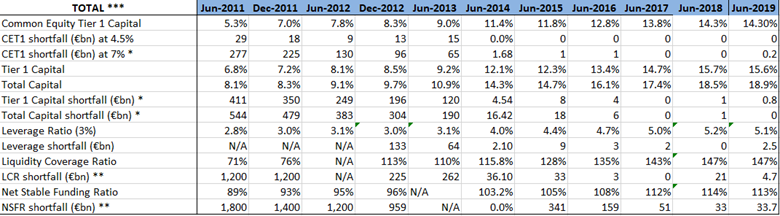

The European financial institutions have continually built solid and robust capital positions and focused on strengthening their balance sheets throughout the years. Recapitalization efforts of the European financial institutions that were made following the Eurozone crisis have gradually made the European banking sectors more robust and resilient. Capital with the primary equity tier ratio of the European financial institutions on a complete loaded basis that includes the only means of the highest level of quality was at 14,3% in June 2019 (Schildbach et al., 2017). The percentage was similar to the previous years while doubling the same ratio in December 2011.

After the reduction of the initial total capital shortfall by more than €500 billion as from the year 2011 and reaching a zero level in June 2017, this was mainly achieved through raising new capital earnings and retaining earnings; hence the banks in the European Union maintained a zero level of shortfall in 2019. Tier 1 and the sum of the capital earnings continually show a positive relationship trend that reaches 15.6% and 18.9% respectively in 2019, increasing from 6.80% and 8.10% respectively in 2011. In 2019, European banks scheduled a meeting that indicated the liquidity ratio above the minimum once again in the institutions. Meanwhile, the shortfall of all the categories of capital in the year 2019 maintained the lowest levels, as indicated below.

EBF calculations with data from EBA’s Basel III report monitoring exercise

*LCR figures from EBA report on liquidity measures **Including G-SIB surcharge ***Overall shortfall group 1 and group 2 **** Assumption of weights: 80% G1; 20% G2

The number of deposit liabilities over the total assets in the European financial institutions remained at 54,2% in 2019, which was in line with the positive relationship trend of 47.3% initially started in 2007 (Iwasaki et al., 2022, pp.1261-1283.). This indicates the significant shift towards a higher reliance on deposits as the source of funding for the majority of the banks. Additionally, the increase in the share of the non-bank deposits in the region to the total assets decreased by 39% in the year 2018 to a percentage of 38,8 in 2019. The level of deposits in the countries equaled to less than half of the total assets in Denmark, Sweden, Ireland, the United Kingdom, Finland, and Luxembourg. The figures continually reflect the different banking models, for instance, the well-developed, fully covered bond markets in Scandinavia. Meanwhile, the European countries with vast shares of deposits financing the banking sector assets are Bulgaria, Estonia, Poland, Latvia, Italy, Lithuania, Romania, Slovakia, Croatia, Slovenia, and Portugal, with a total of 70% or more assets as the deposits.

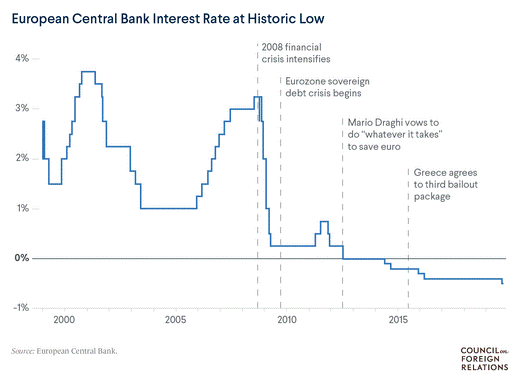

With the ECB’s interest in maintaining a low-interest rate throughout 2019, the financial institutions’ profitability remained the major challenge facing the majority of the institutions. Meanwhile, return on equity, which is the primary indicator of assessing the banking industry attractiveness to the investors, has slowed regained momentum and recovered in the countries. ROE of the European financial institutions was at 5.4% in 2019, which was a decrease from 6.1% in 2018 (Stehnei and Korol, 2020, pp.156-167). Despite the notable decline in the percentage remained at an equal level with the previous years though a bit far from the 10.6% registered initially before the onset of the financial crisis.

However, reflecting on the Eurozone crisis, all the nations possess a positive ROE, which significantly improved the previous performances. The numeral of the counties doubled in their ROE. For instance, Hungary recorded 16%, the Czech Republic 12.5%, and Romania 15.2%, with only Greece recording a low percentage of 0.73%. The difference between the highest and lowest country stood at 15.3% points in 2019, far from the initial recording of 101.6 in 2013. Overall, the European countries have focused on improving their general performance and gradually attaining commendable results.

1.1.5 Research Problem

Financial institutions play an essential role in economic resource allocation globally. This is because they ensure a continuous channeling of funds from the depositors to the investors. This is through generating the necessary income required to cover their operational costs incurred in due course of the institution’s operation. Therefore, for the sustainable intermediation function to keep on rolling, banks must make profits that will enable the continuation of their operations to both the investors and depositors. Beyond the intermediation role played by most financial institutions, primarily commercial banks, the performance of the financial institutions poses critical implications to the economic growth of the countries.

Meanwhile, sound financial performance is a crucial reward to the investors and other shareholders on their investments. As a result, investors are encouraged to engage additional assets with the financial performance, increasing economic growth. However, poor financial performance in the financial institutions can cause a banking failure in the economy and a potential financial crisis which radiate detrimental repercussions to the economic growth of any country. With a rise in liquidity risks in the financial institutions, the banks are adversely affected by their financial performance and the solvency aspects of the Bank. The European countries have continually registered an improvement in their liquidity risk, which has brought about a positive relationship between bank profits and liquidity. As a result, the banking sector of the European countries has been rated among the strongest globally with the use of capital adequacy, management quality, asset quality, liquidity, and earnings in the global rating systems. Referring to the previous studies that established a mixed relationship between liquidity and profitability in the financial institutions, a significant change in the various countries has been shown. Therefore, the study will seek to clearly define the relationship between liquidity and profitability in financial institutions.

1.1.6 Research Objective

To determine the impacts of liquidity risk management on the financial performance of the financial institutions in Europe.

1.1.7 Value of the Study

The Eurozone crisis that recently occurred to the European Countries has triggered learning the essence of sound bank liquidity management. In response to the situation, regulators in each European country have focused on devising new liquidity strategies to establish a more resilient and stable financial system in the countries. Similarly, liquidity problems are known to detrimentally affect the financial performance of the various financial institutions, influencing the bank solvency. Therefore, industry practitioners must comprehend the effects of liquidity management on the financial performance of financial institutions. The financial institution’s senior management teams will utilize the report herein to improve their asset liability management committees’ effectiveness levels and gauge the importance of managing the liquidity risk.

From the perspective of policymakers, the results realized in this study will be of great relevance. This is because as the policymakers devise the standards and measures for establishing an appropriate and adequate level of liquidity for the financial institutions, aiding in offering assurance in the adequacy of stability for the general economic systems, they should consider the trade-off between the resilience levels to the liquidity shocks and the expense of holding a low performing liquid assets. In as much as the holding of the liquid assets is expected to make the financial institutions more resilient to the possibility of liquidity shocks, hence minimizing the negative externalities that may be imposed on their economic agents, while holding too much of the liquid assets might pose a high cost concerning the reduction of profitability in the financial institutions. The study will impact additional knowledge that will further aid other scholars and academic enthusiasts who may need to assess the effects of liquidity management on the financial performance of the banks and other financial institutions.

2.0: LITERATURE REVIEW

2.1 Introduction

This chapter will focus on the literature review concerning the research on the impacts of liquidity risk management on the financial performance of financial institutions. It will focus on assessing the past studies conducted on this area of liquidity risk management. This chapter is devoted to presenting a review of the available theories that have guided the study, their meaning, and the essentiality of liquidity risk management to the financial performance of commercial institutions. The review also depends on theoretical literature such as past research papers, financial reports, books, and research from peer-reviewed articles.

2.2 Theoretical Review

2.2.1 Shift ability Theory

According to this theory, maintaining the liquidity levels of a financial institution is possible if it holds assets that can be quickly sold or shifted to other investors in exchange for cash. This perspective insinuates that a financial institution’s liquidity can be enhanced if it always holds assets that can be sold and provided for the European Central Bank and discount the market stands ready for purchasing the investment offered on discount. The theory recognizes and agrees to the marketability, shift ability, or transferability of the financial institution’s assets to ensure stable liquidity in the financial institutions.

The theory further recognizes that holding high security by the financial institutions is a good source of liquidity. Meanwhile, ensuring the convertibility of the assets without delays and noticeable losses, such assets are subjected to meeting the three requisites (Aiyar et al., 2015, pp.955-983). Other theories such as the liability management theory and liquidity theory consist of the activities involved in obtaining funds from the depositors and creditors and engage in the determination of the appropriate mix of funds that belong to a specific financial institution. According to this perspective, liability management is obligated to answer questions such as obtaining depositors’? How to receive funds from other creditors? What is the recommendable fund mix for any of the banks? It is the role of the management to conduct an assessment of the activities involved in supplementing the liquidity requirements of a bank through the use of the credited funds.

Liquidity management theory is inclined to the liability side of the financial institution’s balance sheet. According to this theory, additional liquidity can be realized from the liabilities of the Bank. Additionally, the thesis argues that since the financial institutions can buy any amount of funds needed for their operation from the central banks, there is minimal logic and need to store liquidity on the assets side of the institutions’ balance sheet. However, other scholars have subjected liquidity theory to scrutinization and critical reviews. Generally, during periods of crisis and distress in an economy, financial institutions may incur serious effects, and credit worthiness invariably lacks. However, in a healthy performing bank, the liabilities that include the deposits, markets, and creditors constitute an essential source of liquidity.

2.2.2 Liquidity Preference Theory

Liquidity preference theory is the notion that people hold money in high regard and value money for the transaction of the current business and its widespread use as a store of wealth. Thus individual members of an economy are willing to sacrifice their ability to earn interest on the money set aside for current expenditures. People only desire to harbor the cash on hand for the precautionary expense. On the other hand, during the phases of an increase in interest rates, people shift to becoming more willing to hold more negligible amounts of money for the transaction and precaution purposes to secure a profit from the capital.

People often need money due to the desire to fulfill their needs and expenditure plans directed at financing the various individual projects or are generally speculating on the future occurrences and the path of interest rates. Similarly, people may hold money due to the uncertainty of the possible events that might take underway in the future. Hence, it is advisable to set aside a fraction of the resources in the form of pure purchasing power. These purposes of money are identified as transactions, precautionary and speculative motives behind the demand of money in today’s societies. The liquidity preference theory suggests that banks pursue active balance sheet policy instead of the passive accommodation of demand for credit hence furthering the liquidity preference in the market.

2.2.3 Loanable Funds Theory

The ideology behind loanable funds theory is that people only express concern on the actual variables: output loss or gain and the purchasing power gain or loss. The marginal productivity of the capital assets is determined by the technical coefficient and characteristics of the productive assets. For this reason, the entrepreneurs are interested in maximizing their utility levels through arbitrating between the present consumption and the future consumption without savings from the individual perspectives.

Therefore, in the loanable fund’s markets, the supply of the loanable funds is emarginated from the individuals interested in saving their finances to realize dividends from the savings. For this reason, the individuals providing the loans are referred to as the lenders. Meanwhile, the demand for loans is mainly high in the entrepreneur’s sector that wants to increase the capital base of their businesses through capital assets. The entrepreneurs are regarded as the borrowers to the banks. The negotiations in the loan markets are initiated in terms of the actual rate of the interests that the lenders can lend, and the entrepreneurs are obligated to borrow and return the borrowed funds at the same interest (Minetti and Peng, 2013, pp.2397-2416). Therefore, when the entrepreneurs’ marginal gains are more significant than the interests, they invest more and invest less in cases where the marginal gains are minimal. Similarly, individuals with more significant marginal gains are a greater cost tend to save more and vice versa. An increase in the investment levels increases the interest rates automatically.

2.3 Determinants of Financial Performance in Commercial Banks

2.3.1 Macroeconomic Factors

Macroeconomic factors such as the macroeconomic factor stability, inflation, political instability, the GDP, and other macroeconomic variables affect the performance of the financial institutions. For instance, the gross domestic product of a nation vastly affects the demand for assets in the banks. In the cases of declining GDP growth in a country, the need for credit services gradually decreases, leading to negative profitability for financial institutions (Altavilla, 2018, pp.531-586). On the other hand, a growing economy that expresses a growing GDP experiences a greater demand for credit services due to the unique nature of the business cycle. During a financial boom, the need for credit services skyrockets compared to a recession phase. Referring to the Greece situation, the relationship between the inflation levels and the profitability of the financial institutions remains debatable. However, the money supply is identified to affect a financial institution’s profitability positively. The other external variables and macroeconomic factors, such as the growth rate and inflation rate, barely significantly affect the various countries’ numeral economies.

2.3.2 Capital Adequacy

Capital adequacy is defined as measuring the financial institution’s financial capabilities and strengths. This is in terms of the financial institution’s ability to withstand the operational and abnormal losses that might arise in due course of operation. Additionally, considering the regulatory requirements on the minimum capital needed by the banks, capital adequacy indicates the financial institution’s ability to undertake additional roles in the business fields. The size of the money is responsible for the provision of financial flexibility for the banks and financial institutions. Financial institutions equipped with higher capital ratios have an increased probability of earning more profits by translating the safety advantages into a profit. Through capital adequacy ratios, a financial institution’s internal capabilities and strengths to withstand the occurrence of any losses during a financial crisis are defined. Capital adequacy ratios are directly proportional to the solvency and resilience of th banks during an emergency. Similarly, capital adequacy also directly affects the financial institution’s profitability by determining the expansion to the risky but profitable ventures.

2.2.3 Asset Quality

Banks are often the primary generators of the assets for regenerating the central portions of the Bank’s incomes. Meanwhile, loans are identified as the main asset for any financial institution from which they generate their incomes from the borrowers. Therefore, the quality of the loan portfolio mainly determines the level of the profits for the banks, and the loan portfolio quality directly bares the profitability of the financial institutions. The highest risk that a bank can face is generating losses that are derived from delinquent loans, and the ratio is a loan loss reserves to the overall net interest revenues is the estimate of the financial institution’s asset on the quality that indicates the level of the total portfolio that has been provided for but not charged off. The poorer quality’s more excellent ratio realizes a higher risk for the loan portfolio.

2.3.4 Management Efficiency

Management efficiency is the primary internal factor that determines the profitability of financial institutions. Management efficiency is widely represented by the different financial ratios such as asset growth, loan growth rate, and earnings growth rate. Meanwhile, it is one of the complex subjects that vastly capture the financial ratios of the institutions. Additionally, the operational efficiency applied in managing the operating costs is one of the dimensions for quality management. The administration’s performance is mainly expressed qualitatively throughout the evaluation of the management systems and the organizational disciplines that control the designs, quality of staff, and other financial institutions. The ability of the management to involve its resources efficiently, maximize the incomes, and reduce the operational costs are mainly measured through the financial ratios.

2.4 Banks and Liquidity Risk

Modern financial theories have recognized that financial institutions exist due to two critical roles in the economies. First, financial institutions perform the roles of creating liquidity and the risk of transformation. Therefore, the banks are given the unique position of intermediaries to transform liquid liabilities into loans. A small portion of the financial institution’s resources is referred to as the equity for granting the loans to the customers; hence majorly, most of the funds are availed to the third parties as liabilities incl, When the finance providers deposit money, the creation of liability is undertaken in the Bank’s balance sheets, and the assets formed to provide the borrowers with available funds. Therefore, banks are obligated to manage their liability and asset sides to meet the possible additions withdrawals from the accounts. Thus, banks are exposed to the risk of insufficient liquid assets that can efficiently meet the ransom demands from the depositors. Similarly, the banks’ liabilities possess shorter maturity than the assets; hence, financial institutions must effectively control the balance sheet structures depending on the maturity transformation. As a result, the banks’ endless refunding cycles repeatedly affect them by exposing them to liquidity risk.

3.0: RESEARCH METHODOLOGY

3.1 Introduction

This chapter provides an outline of the research methodology applied in the study. The chapter discusses the research design, the population portion involved in the research, data collection, and the data analysis techniques utilized in the study.

3.2 Research Design

The study utilizes descriptive research. Descriptive research is the inclusion of surveys and fact-finding inquiries of different types. The primary purpose of the descriptive research is to describe the state of affairs in the current today as they exist. The main aspects of the descriptive research method are that the researcher has zero control of the variables and, therefore, only reports the happenings that have previously occurred or the current situations in the economy. This method will also involve collecting quantitative information previously presented online and can be tabulated along a continuum numerically.

Often, descriptive research applies visual aids such as graphs and charts essential for easy understanding of the subject under investigation. Similarly, they help the reader understand the distribution of the data hence drawing a closer relationship to the issue under research. In many cases, quantitative analysis is divided into the studies that describe specific events and the studies directed at discovering inferences or drawing casual relationships of the data provided. In the descriptive analysis, the study will aim to define and answer what is; therefore, observation and survey methods will be frequently applied to bring forth concepts and collect the descriptive data.

3.3 Population

The population target for the research was the European Central Bank, which is the central Bank for nineteen European union countries that utile the euro as the medium of exchange. The ECB is mandated to ensure the conduction of the monetary policies for the euro area since the year 1999 is fully achieved. Similarly, the Bank is responsible for maintaining the purchasing power of a euro and ensures price stability in the area. Additionally, ECB maintains a list of the groups of the institutions in the Euro region based on the regularly provided information by the members of the European system of central Bank. These include monetary financial institutions, investment funds, financial vehicle corporations, payment statistics relevant institutions, insurance corporations, and pension funds.

To establish a comprehensive image of the monetary developments, the European Central Bank comprises the following sectors: central banks, money market funds, and deposit-taking corporations, which are credit institutions, financial intermediaries, and electronic money institutions. The other commercial banks in the member countries are licensed and regulated by the ECB through various banking acts and prudential guidelines. The conduction of the study utilized the census approach whereby the individual data on the population of the different sectors of the Bank was used.

3.4 Data Collection

Secondary data, collected by a different individual other than the researcher, was applied as the data collection tool for the study herein. Secondary data sources are chosen since obtaining the primary data would be difficult. The publication of the financial performance of the financial institutions under the euro region is readily available and accessible due to the requirements imposed on the various institutions to publish their financial statements every financial year. This research focused on attaining data from the posted accounts of the European Central Bank that include the financial positions of the various member countries and their position in as much as liquidity is concerned.

3.5 Data Analysis

Numeral regressions are applied to examine the effect of liquidity management as determined through the liquidity ratios on the financial performance of the financial institutions in Europe.

3.5.1 Analytical Model

The financial performance of the financial institutions was calculated as follows.

The model specifications of the ECB taken in the precious years took the following form;

Y = b0 + b1X1 + b2X2 + b3X3 + b4X4 + e

Whereby;

Y is the measure of financial performance throughout the ROA, i.e., ROA=Average assets

b0, b1, b2, b3X3 are the parameters

X1, X2, and X3 are the independent variables: liquid assets to the total assets, liquid assets to the total deposits, balances, and asset quality, respectively.

Liquid assets mainly consist of the cash in hand, the balances in the ECB, bonds, and the treasury bills that belong to the banks; similarly, short-term funding is constituted of the balances owed to the other banks.

3.5.2 Statistical Test of Significance

To approximate the significance of the correlation between the dependent and the independent variables, the value of F and the test statistic is compared, taking the degrees of freedom to be k and n-k-1. Therefore, if the absolute value of the F distribution statistic appears to be less than the total value of the critical F, the hypothesis that liquidity risk management does not affect the performance of the financial institutions is accepted and vice versa. The statistical test of significance analysis utilized the statistical package of social sciences in data analysis.

4.0: DATA ANALYSIS, RESULTS, AND DISCUSSION

4.1 Introduction

This chapter focuses on the presentation of the results of the study. The results are based on the information provided by the ECB on the various articles. The multiple linear regressions were estimated through the ordinary least squares to establish the effect of liquidity risk management on the financial performance of commercial banks. This chapter presents the descriptive results and the regression analysis results.

4.2 Response Rate

The annual financial statement applied in this research emerges from the nineteen member countries of the European Central Bank. The data presented represents an availability rate of 100%, which is considered reasonably high for an effective and valid derivation of the conclusions.

Table 1 Descriptive Statistics

| ROA | TA | TD | BTB | Asset Quality | |

| Mean | 0.0224 | 0.3314 | 0.4457 | 0.0612 | 0.0808 |

| Median | 0.0238 | 0.3090 | 0.4274 | 0.0347 | 0.0547 |

| Std. deviation | 0.0261 | 0.1478 | 0.4020 | 0.9956 | 0.0720 |

| Minimum | -0.09 | -0.46 | -4.06 | 0.00 | 0.001 |

| Maximum | 0.072 | 0.71 | 1.32 | 0.78 | 0.40 |

The descriptive analysis in the table above indicates the mean on the Return on Assets as 0.0224 for a specific period of study with the standard deviation at 0.0261, which implies that the variability of the ROA values was deteriorating across time. Similarly, the other parts of the financial institutions were in a progressive movement either as an increase or as a decrease in the general performance of the economy.

Using the Kolmogorov-Smirnov test of normality, the null hypothesis of the study under the assessment is the variables indicated on the table are not significantly different from the statistical aspects of normal distribution.

Table 2: Coefficients

| Coefficients t Sig. | ||||

| Β Std. Error | ||||

| Constant | 0.054 | 0.07 | 8.283 | 0.00 |

| TA | -0.010 | 0.018 | -0.592 | 0.555 |

| TD | -0.022 | 0.007 | -3.294 | 0.001 |

| BTB | -0.142 | 0.029 | -4.868 | 0.000 |

| Asset Quality | -0.124 | 0.031 | -3.995 | 0.000 |

Following the coefficients, the regression equation Y= 0.054- 0.010X1- 0.022X2 – 0.142X3 – 0.124X4 is formed.

4.3 Discussion and Research Findings

From the findings realized from the research above, there is a variation between the values of the return on assets due to the emerging changes on the liquid assets to the ratio of the total assets. Liquid assets are determined through the total deposits ratio, balances to other banks, and asset qualities. The resulting equation proves a negative relationship and impact between the financial institution’s performance and liquidity risk management.

Loaning from the banks, the X3 in the equation, poses the highest effect on the liquidity of 14.25%, which is mainly equal to the X4, the asset controlling variable with an impact of 12.4%. The relation implies that borrowing from the financial institutions bounces back a negative repercussion on the performance of the institutions by 14.2%. In comparison, the asset quality is similarly affected by the negative performance by 12.4%. An increase in the financial institutions’ borrowing levels results in a 14.2% decrease in the return on assets. Similarly, an increase in the non-performing loan level results in a 12.4% reduction in the return on investments. This is consistent with the finding that the loan portfolio quality directly impacts the profitability level of the financial institution. Financial institutions possessing higher non-performing had higher loan loss ratios with a lower return and vice versa for the financial institutions holding lower non-performing ratios.

5.0: SUMMARY, CONCLUSION, AND RECOMMENDATIONS

5.1 Introduction

This chapter focuses on presenting the research findings, conclusions, and recommendations on the possible precautions that can be taken on liquidity risk management.

5.2 Summary of the Findings

The study’s primary objective herein was to determine the impacts of liquidity risk management on the performance of the financial institutions in the European region. The study utilized the conciseness of the descriptive research method. The study population emerged from the listed countries under the European Central Bank, which has over 19 countries as members of the union. Additionally, the data analysis is widely conducted using the various aspects of regression that are essential in determining the coefficient ratio.

The regression ratio arrived in the study is

Y= 0.054- 0.010X1- 0.022X2 – 0.142X3 – 0.124X4

According to the established regression equation in the study, there exists a significant negative relationship between the financial performance of the financial institutions and liquidity risk management. The research results indicate that an increase in the total assets ratios leads to a decrease in the return on assets by 1%. Additionally, adding the liquid assets to the total deposits reduces the return on investment by 2.2%. Lastly, the control variable, the asset quality, leads to an increase in the non-performing loans as the proportion of the overall loans, leading to a rise of 12.4% on the decreases in assets.

5.3 Conclusion

This study reaches a significant conclusion that there is a negative relationship between the financial performance of financial institutions and liquidity risk management. This is so in that an increase in one of the factors leads to a substantial decrease on the other and vice versa. Essentially, the borrowing done from the banks by other financial institutions to fully meet the collateral obligations of the institutions poses a greater liquidity risk in the institutions. This indicates that the banks often utilize the inter-bank relationships for funding purposes during which they repay at a higher cost for the borrowed funds, thus impacting the general financial performance in the banks.

The research has also concluded that holding more assets than the total deposits creates lower returns to the financial institutions. Therefore, the financial institutions are encouraged to maintain the necessary level of liquidity directed at meeting the customers’ needs but not to the excessive levels that diminish the returns due to the association with liquid assets. Essentially, all the financial performances of the financial institutions in the European region should be considered and not only focus on achieving isolation of the liquidity risk management. Similarly, Liquidity management theory is inclined to the liability side of the financial institution’s balance sheet. According to this theory, additional liquidity can be realized from the liabilities of the Bank.

Additionally, the theory argues that since the financial institutions can buy any amount of funds needed for their operation from the central banks, there is minimal logic and need to store liquidity on the assets side of the institutions’ balance sheet. However, other scholars have subjected liquidity theory to scrutinization and critical reviews. Generally, during periods of crisis and distress in an economy, financial institutions may incur serious effects, and credit worthiness invariably lacks. However, in a healthy performing bank, the liabilities that include the deposits, markets, and creditors constitute an essential source of liquidity.

Liquidity is the funding capacity of a financial institution to increase the number of assets and meet the collateral obligations under reasonable costs. The risk of liquidity in the banks mainly occurs due to financing long-term investments through the short-term liabilities, exposing the liabilities to the risk of refunding. Surprisingly, the liquidity risk is primarily in individual nature, but sometimes depending on the situation may compromise the liquidity ability of the financial system. In financial institutions, liquidity risk is management is defined as the risk resulting from the institution’s inability to meet their current obligations to the investors or focus on funding an increase in assets as they fall due with minimal and manageable losses. With an effective liquidity risk management program, firms can minimize adverse situations in the institutions.

On the other hand, Management efficiency is the primary internal factor that determines the profitability of financial institutions. Management efficiency is widely represented by the different financial ratios such as asset growth, loan growth rate, and earnings growth rate. Meanwhile, it is one of the complex subjects that vastly capture the financial ratios of the institutions. Additionally, the operational efficiency applied in managing the operating costs is one of the dimensions for quality management. The administration’s performance is mainly expressed qualitatively throughout the evaluation of the management systems and the organizational disciplines that control the designs, quality of staff, and other financial institutions. The ability of the management to involve its resources efficiently, maximize the incomes, and reduce the operational costs are mainly measured through the financial ratios.

Essentially, the Realization of profits is the ultimate goal for all commercial and financial institutions globally. To determine a financial institution’s profitability, numeral ratios can be utilized. The majors are the return on asset, net interest margins, and equity. Return on equity is the financial ratio that defines a company’s profit levels compared to the total level of shareholder equity found on the companies’ balance sheets. Return on equity is the central aspect that the investors seek in return to their investments. On the other hand, return on asset is the income ratio to a company’s total assets and measures the ability of the banks to generate incomes through the utilization of the company’s assets at their disposal. Equally, net interest margins are the measure that determines the difference between the interest income levels generated by the banks and the level of interest given to their leaders, such as deposits, concerning the interest-earning on their assets.

Meanwhile, NIM is expressed as a percentage of the earnings of the financial institutions on loans during a specific period and other assets subtracted from the interest paid on the debited funds divided by the average amount of the total assets that generated income within the particular period. The variable of net interest margins is defined as the division of the net interest income and the total asset earnings. In many cases, the investors of a bank such as Barclays are concerned with the ability of the firm to generate, maintain and increase incomes.

Banks are often faced with two dire issues concerning liquidity. Firstly, banks conduct the role of managing the creation of liquidity and the occurrence of liquidity risk. Liquidity creation aids the depositors, investors, and companies in maintaining liquid, especially when the other financial sources become difficult. The management of liquidity risk is essential in financial institutions because it ensures that the banks own liquidity and serve their function continually. During the prevalence of the European crisis, several states such as Portugal, Greece, Cyprus, Spain, and Ireland were unable to fully refinance the governmental debts or serve as the banks of the last resort for other financial institutions. This made the management of the liquidity risk harder due to the unavailable funds to finance the crisis hence driving home the importance of liquidity to a proper functioning of the banking sector and financial markets. Before the problem, asset markets functioned and ran positively, increasing funding at a low cost. Rapid reversing of the economic and market conditions in the European countries illustrated the possibility of liquidity quickly evaporating. That illiquidity can last for a more extended period than the expectation of the governments can last longer before a successful sorting of the financial crisis. The banking systems of the affected European countries were under severe stress, which triggered an action from the financial guarantees of the European countries’

5.4 Recommendation

Since the study has established a negative relationship between the financial performance of the financial institutions and liquidity risk management in the institutions, it, therefore, implies that managements of the various financial institutions should consider keenly the measures to be taken to maximize the return on the shareholders which the primary objective of the existence of the banks. The relationship has also established a close relationship between borrowing from other financial institutions and the return on assets for the same. This indicates that the inter-borrowing between the banks is more expensive than seeking the different sources of finances; hence the banks that were engaging in the inter-bank borrowing market were faced with direly detrimental effects on their financial performance. Therefore, financial institutions management should avoid borrowing from the other bank’s instances to establish a firm base for their growth in performance. This can be achieved through engaging in prior planning of their liquidity requirements, thus avoiding the last-minute borrowing instances. The committee responsible for the assets and liabilities in the institutions should be actively involved in the endeavor to ensure that a proper cash flow in the institution is always maintained.

The other finding realized from this research is that the total assets and the liquid assets to the overall deposits of the banks have a negative relationship due to the adverse effects posed on the financial performance of the financial institutions. Therefore, the banks should always ensure that maintaining the optimal levels of the liquid assets that possess lower returns and can efficiently meet the customers’ demands. Similarly, financial institutions are encouraged to establish creative and innovative ways through which the minimization of withdrawals by the customers is achieved. Additionally, the financial institutions should establish a complete chain that the majority of the payments and receipts can be done within the institution’s confines. As a result, the need to maintain a high amount of liquid assets is minimized, and eventually, a controlling level of the liquidity situation is achieved.

5.5 Limitation of the Study

The study focused on financial institutions such as the Barclays Banks based in the European countries. Therefore, the study was limited to the financial institutions within the European region. Similarly, the study results were limited to the financial institutions within the European area, thus limiting the possibility of extending the results to other countries.

The research heavily depended on the financial institutions; therefore, the results are inclined to the impacts of the liquidity risk management on the financial performance of the financial institutions in the European region. Similarly, the report focused on the different financial years in the area and heavily referred to the 2007-2008 crises that occurred due to an imbalance of payments.

5.6 Suggestions for Further Research

Conduction of further studies on the future can be done during the future periods of the economic shocks. The study can be under the ways through which the financial institutions perform their operation on impacts of liquidity management in the situations whereby it is no longer business as usual. For instance, in the cases whereby the economy is experiencing depreciation on the exchange rates of the country or in the cases whereby the interest’s rates turn to a decrease or an increase and the instances of economic recessions and booms.

Further studies can also be conducted on the impact of liquidity risk management particularly focusing on the the mix sources of funds and investment in the economy. Additionally, the studies can be conducted on the impacts of the heavy endowment risk on the financial performance of the financial institutions an how the liquidity risk management can affect the decision-making process in a financial institution.

References

Aiyar, S., Calomiris, C.W. and Wieladek, T., 2015. Bank capital regulation: Theory, empirics, and policy. IMF Economic Review, 63(4), pp.955-983.

Altavilla, C., Boucinha, M. and Peydró, J.L., 2018. Monetary policy and bank profitability in a low interest rate environment. Economic Policy, 33(96), pp.531-586.

Boissay, F. and Collard, F., 2016. Macroeconomics of bank capital and liquidity regulations.

Iwasaki, I., Kočenda, E. and Shida, Y., 2022. Institutions, financial development, and small business survival: Evidence from European emerging markets. Small Business Economics, 58(3), pp.1261-1283.

Minetti, R. and Peng, T., 2013. Lending constraints, real estate prices and business cycles in emerging economies. Journal of Economic Dynamics and Control, 37(12), pp.2397-2416.

Schildbach, J., Schneider, S. and AG, D.B., 2017. Where do European banks stand. Deutsche Bank Res.

Stehnei, M. and Korol, M., 2020. Analysis Of The Dynamics Of The European Banking System. Baltic Journal of Economic Studies, 6(4), pp.156-167.

write

write