1. Introduction

1.1 Study Background and Context

Microfinancing in accordance with Islamic principles that prioritise economic and social equality is called Islamic Micro Finance (Mirakhor & Iqbal, 2022). Mutamimah et al. (2022) found this form of microfinance helpful in their research on the global effort to achieve the SDGs. Aiming to promote gender equality, eliminate extreme poverty, and ensure that everyone has access to high-quality education and the best available health care, the United Nations adopted the Sustainable Development Goals (SDGs).

Biancone et al. (2020) explain that the ethical values of the Quran and Hadith form the foundation of Islamic finance, which includes the IMF. Islamic money originates from the tradition of giving and receiving charity within Islamic civilisations. However, Islamic finance was formally established as an industry in its own right in the second half of the twentieth century (Mutamimah et al., 2022), complete with specialised financial institutions.

Islamic Micro Finance is a subset of Islamic finance that has received attention for its potential to help financially excluded people, especially in countries where Islam is the main religion. A good alternative for moral and inclusive finance (Tamanni & Haji Besar, 2019), it functions based on ethical principles that forbid interest (Riba) and promote profit-and-loss sharing, risk-sharing, and ethical investing.

Sustainable Development Goal 1: eliminate severe poverty global poverty by 2030. Goal 5 seeks to elevate women’s equality in society, and Goal 3 seeks to ensure that everyone can access health care. This research examines how the IMF might affect the SDGs, which aim to end extreme poverty, promote gender equality, and expand access to quality healthcare and education for all. This study seeks to bridge the gap in comprehension between the IMF and the SDGs by providing helpful information that can be used by governments, financial agencies, as well as development organisations to achieve the SDGs’ goals of promoting global socioeconomic improvement.

1.2 Problem Statement

The Sustainable Development Goals (SDGs) remain determinedly approached on a global scale due to persistent challenges such as poverty, gender inequality, disparities in healthcare and education, and gender inequality (United Nations, 2015). This study’s primary focus is on the underutilisation of Islamic Micro Finance as a tool to solve these urgent global issues and drive sustainable development. The study’s overarching goal is to discover how much of a role the IMF may play in helping to realise the SDGs. The report intends to help the IMF better promote financial inclusion, gender equality, and access to healthcare and education by offering insights and ideas to development practitioners and policymakers. This issue must be resolved if communities with fewer resources are to have the same chances for social and economic growth as those with more means.

1.3 Research Aims and Objectives

Aim:

This study aims to assess the effectiveness of Islamic Micro Finance in assisting in achieving SDGs.

Objectives:

- To introduce Islamic Micro Finance, including its basic ideas and relevant historical background.

- To analyse how Islamic microfinance contributes to the Sustainable Development Goals, focusing on eliminating poverty, promoting gender parity, improving health, and enhancing education.

- To identify knowledge gaps in the literature on IMF’s contribution to the SDGs.

1.4 The Significance of the Research

This research shows how Islamic Micro Finance might help solve pressing international problems. This study provides financial institutions, policymakers, and development groups with helpful information by assessing the IMF’s effect on the SDGs set out by the United Nations (Hussein Kakembo et al., 2021). Islamic Micro Finance is a powerful instrument for sustainable development because it can increase financial inclusion, advance gender equality, and broaden access to healthcare and education. Policymakers may use the research findings to make evidence-based choices and implement initiatives that align with the SDGs. In order to better respond to global issues, financial institutions might improve the products and services they offer. The Islamic Micro Finance can help development organisations multiply their positive social and economic effects. This research adds to the ongoing international endeavour to achieve sustainable and gender-balanced development in a society where such problems as poverty and inequality continue.

2. Literature Review

2.1 An Overview of Islamic Microfinance

2.1.1 Principles and concepts

Islamic Micro Finance is founded on Islamic finance’s fundamental principles, assuring ethical as well as inclusive financial behaviors that promote social welfare. Interest (Riba) is forbidden by the IMF since it is forbidden by the Quran (Mukhlisin et al., 2020). Instead, the IMF uses a risk and reward distribution system known as profit and loss sharing to encourage a more just and equitable financial system for all parties involved (Uddin et al., 2020).

Another fundamental idea contained within the IMF is the sharing of risk. This approach promotes a sense of cooperation and shared responsibility between investors and entrepreneurs by having them share in the rewards and losses of a project. Tok et al. (2022) note that IMF transactions are transparent and unmistakable when unnecessary uncertainty is avoided (Gharar). Islamic Micro Finance was founded on these principles in order to encourage honest banking practices that would help reduce poverty and strengthen the global economy.

2.1.2 Historical background

Islamic finance originates in the early days of Islam, namely in the generous and mutually helpful behaviours of Islamic civilisations. Such customs as “Qard al-Hasan” (charitable loans) and other forms of informal community-based monetary assistance may be traced back through history. Community members traditionally helped persons in need in these early systems (Uddin et al., 2021).

As a result of this background, modern IMF organisations strive to promote financial inclusion and poverty reduction by creating a larger-scale version of the previous mutual assistance structures. Financial institutions like Islamic banks and microfinance organisations employ risk-sharing models and other ethical financial principles to extend small amounts of capital to underserved communities and individuals with low incomes. The importance of the IMF’s dedication to equitable society is highlighted within this context.

2.2 Sustainable Development Goals (SDGs)

The United Nations has set 17 goals that aim to improve the quality of life for all people across the world by the year 2030. These goals offer a methodical and coordinated framework (United Nations, 2015). These goals provide a path toward a more equitable and sustainable global society while also addressing a wide variety of interconnected issues.

Goal 1 of the SDGs seeks to eradicate extreme poverty throughout the world. Goal 5 promotes the empowerment of women. Goals 3 and 4 guarantee that everyone has access to quality healthcare and education. Goal 1 of the Sustainable Development Agenda focuses on eliminating extreme poverty, increasing prosperity, and decreasing disparities (Resolution, 2015). Recognising women’s critical role in development, SDG 5 emphasises the need to attain gender equality and empower women. Goals 3 and 4 of the Sustainable Development Agenda focus on improving people’s health and providing equal access to high-quality education.

These objectives highlight the need for coordinated international efforts in meeting the problems of our day. They demand morally and creatively addressing issues of poverty, equality, and improved access to basic amenities like healthcare and education. According to García-Pérez et al. (2020), Islamic Micro Finance provides a system of finance that is well situated to support equitable economic growth, social welfare, and financial inclusion in order to help achieve these SDGs. The IMF is an effective and promising tool for promoting global sustainable development because of its tight alignment with these SDGs.

2.3 Islamic Microfinance and the Sustainable Development Goals

2.3.1 Poverty alleviation and financial inclusion

Islamic Micro Finance is critical in reducing poverty and fostering financial inclusion, which aligns with Sustainable Development Goal 1 (No Poverty). Financial services are available through the IMF for underserved communities, especially in nations with a large Muslim population (Ali, 2020). In contrast to the exclusive nature of conventional financial institutions, this method opens the door to financial opportunities for those with lower incomes, micro-entrepreneurs, and marginalised populations. Income and wealth may be generated, and the cycle of poverty can be broken through the IMF’s provision of loans and investment opportunities that conform to Sharia-compliant principles such as profit-and-loss sharing and risk-sharing.

In addition, the IMF’s profit-and-loss sharing model promotes accountability and responsibility by dividing potential gains and losses equally between the financial institution and the business owner. This aligns with SDG 1’s goals of increasing prosperity, decreasing inequality, and providing access to economic opportunities for all (Santoso, 2020). The ethical financial policies of the IMF, which rigorously avoid interest (Riba), help reduce poverty by expanding people’s access to credit without the added stress of interest-based obligations, and they do it in a way that is both fair and long-lasting.

2.3.2 Gender equality and women’s empowerment

Islamic Micro Finance places a premium on women’s involvement in financial operations, a significant step toward achieving gender equality (SDG 5) and empowering women. The ethical principles of Islamic finance (Lanzara, 2021) support this priority since they emphasise the importance of economic justice and treating people fairly regardless of gender.

As a result of the IMF’s gender-inclusive strategy, women in many regions of the world, where they have historically been excluded and had restricted access to financial services, now stand to gain. IMF helps women achieve economic independence by empowering them to pursue jobs that generate revenue, become entrepreneurs, and grow their businesses. This not only helps accomplish SDG 5’s goal of gender equality, but it also encourages women to participate in economic and social growth, creating more stable and welcoming communities.

As part of their dedication to achieving gender parity, IMF institutions frequently create special initiatives aimed squarely at women. IMF helps create a more equal and empowered financial landscape by recognising and addressing the unique financial demands and obstacles women confront.

2.3.3 Healthcare and Education

In line with Sustainable Development Goals 3 and 4, Islamic Micro Finance may play a pivotal role in expanding people’s opportunities for quality medical treatment and academic training (Abduh, 2019). The Islamic Micro Finance ability to promote economic stability and provide funding for essential industries like healthcare and education is critical to reducing inequalities in these areas.

Islamic Micro Finance is dedicated to fair financial practices and equal access to healthcare and education (Ghoniyah & Hartono, 2020). Islamic Micro Finance allows local communities to invest in things like improved healthcare infrastructure, new clinics, and new schools (Mirakhor & Iqbal, 2022). The profit and loss (P&L) model promotes smart investments in these fields, leading to improved and affordable healthcare and education for all.

In addition, the IMF’s focus on risk-sharing and ethical investing guarantees that money goes toward programs that improve health and education. The extension and development of educational possibilities (SDG 4) are aided by this and the improvement of medical care (SDG 3).

The IMF’s ability to promote economic stability and provide money for essential sectors offers synergies with SDGs 3 and 4, providing a path for solving global healthcare and education access concerns.

2.4 Research Gap

There is a considerable knowledge gap despite the fact that the current study on the role of Islamic Micro Finance in attaining Sustainable Development Goals (SDGs) gives valuable insights. While some research recognizes the IMF’s potential to contribute to SDGs, there needs to be a thorough review of the fund’s efficacy or the difficulties it faces when put into reality. Existing research often helps explain the connections between the IMF and the SDGs by providing a theoretical or conceptual context. They typically discuss how IMF principles align with broader goals like ending poverty, promoting gender equality, and enhancing healthcare and education (Resolution, 2015). However, there needs to be more thorough empirical research that evaluates the impact of IMF initiatives on accomplishing particular SDGs in various settings.

This study will fill the gap by assessing the IMF’s contribution to the SDGs more thoroughly and objectively. It will attempt to evaluate the impact of IMF initiatives to expand access to banking services, advance gender parity in the workplace, and improve health and education opportunities through case studies and statistical analysis. It will also examine the problems and obstacles that IMF initiatives face in various areas and situations. This research seeks to bridge the gap between theoretical considerations and real-world effects of IMF in the context of SDGs by providing a detailed understanding of these consequences. This study will help enlighten financial institutions, policymakers, and development organisations on best utilizing the IMF’s resources to promote long-term social and economic progress.

3. Methodology

3.1 Research design

This study employs secondary research methods, which constitute a systematic literature review. The goal of this method is to get a thorough comprehension of the connection between Islamic Micro Finance and the SDGs by reviewing and synthesising the relevant material. This approach was chosen because the literature supports it and is appropriate for the intricacy of the issue under investigation. The theoretical foundation for this technique is constructivism, which emphasises the significance of expertise and comprehension built via interpretation and analysis of available information (Braun & Clarke, 2022). This research aims to use the current body of knowledge to provide a comprehensive review of the linkages between the IMF and the SDGs.

A systematic literature review strategy was chosen because it is often regarded as the benchmark for synthesising previous studies (Huyler & McGill, 2019). It is suitable for thoroughly investigating the complex interrelationship between the IMF and the SDGs because it provides a systematic and open procedure for collecting, assessing, and synthesising the current literature on a particular issue.

The deductive approach entails comparing a theoretical framework to existing data (Kumar, 2018). This is in line with the study’s intention to assess the success and obstacles faced by the IMF in attaining selected SDGs. The methodology relies heavily on a literature search and synthesis to understand the connections between the IMF and the SDGs. The research will thoroughly review the present state of knowledge on this topic by methodically seeking, choosing, and critically assessing academic articles, reports, and pertinent materials. The approach offers a solid framework for understanding the interactions between the SDGs and the IMF, and it is well-suited to the study’s problem due to its capacity to give a thorough assessment of the data that is currently accessible. Decisions made by development organisations, governments, and financial institutions will be more informed.

3.2 Data Collection Methods

This study relies on data from reputable sources, including academic publications, newspapers, and reports. This study follows the systematic review method established by (Mutamimah et al., 2022) to guarantee the inclusion of relevant, recent research. A number of reputable scholarly journals covering microfinance, development studies, and Islamic finance are used as primary data sources. Academic journals such as “Islamic Economic Studies,” “World Development,” and “Journal of Economic Behavior & Organisation” have published studies on Islamic microfinance’s effects on global development (Braun & Clarke, 2022; Huyler & McGill, 2019).

Further research is conducted by consulting various sources, including studies and publications from the World Bank, the Islamic Development Bank, and the United Nations (United Nations, 2015; World Bank, 2019). Data gathered using the systematic review method is guaranteed to be current, pertinent, and highly scholarly. It makes it possible to draw together different strands of information about the subject and identify where more investigation is needed. This study aims to shed light on the connection between the IMF and the SDGs. Hence, the methodology chosen reflects that goal.

3.3 Data Analysis Techniques

The thematic analysis method was employed to extract significant findings and insights into the connections between Islamic Microfinance and the Sustainable Development Goals (SDGs) from the information collected. Literature was organised according to themes and connections using a predefined framework. Data from several sources may be synthesised, and shared patterns and trends can be identified using thematic analysis (Braun & Clarke, 2022). This study aimed to identify recurrent themes and concepts in the literature about the IMF’s effect on the SDGs through thematic analysis. This enabled the categorisation of data, which in turn allowed for a more systematic investigation of the links between the IMF and the realisation of SDGs.

The systematic and open nature of the study, enabled by the transparent classification scheme adopted, enhanced the rigour and dependability of the research findings. This methodology was suitable for the study since it allowed for a thorough evaluation of the prior information, which allowed for a more in-depth comprehension of how IMF is in line with and contributes to the SDGs.

3.4 Ethical Considerations

The ethical issues in this research focus primarily on the responsible management of material and the correct citation and credit of sources. There is no need to worry about privacy or security as this is a secondary research project. So, academic integrity should be prioritised while thinking about ethical issues. The APA (2020) outlines the need for proper citation and identification of sources as important ethical norms in academic research. The reviewers of the relevant literature have agreed to properly cite their references in an effort to protect intellectual property. The researchers have also adhered to ethical principles and procedures in their literature review processes to guarantee the highest levels of research integrity. Methods for locating, evaluating, and synthesising past research must be open and exhaustive. Following these moral guidelines ensures that the study remains scholarly and trustworthy while giving due credit to the work of experts in Islamic microfinance and the SDGs.

4. Results and Findings

4.1 Contribution of Islamic Micro Finance to the SDGs

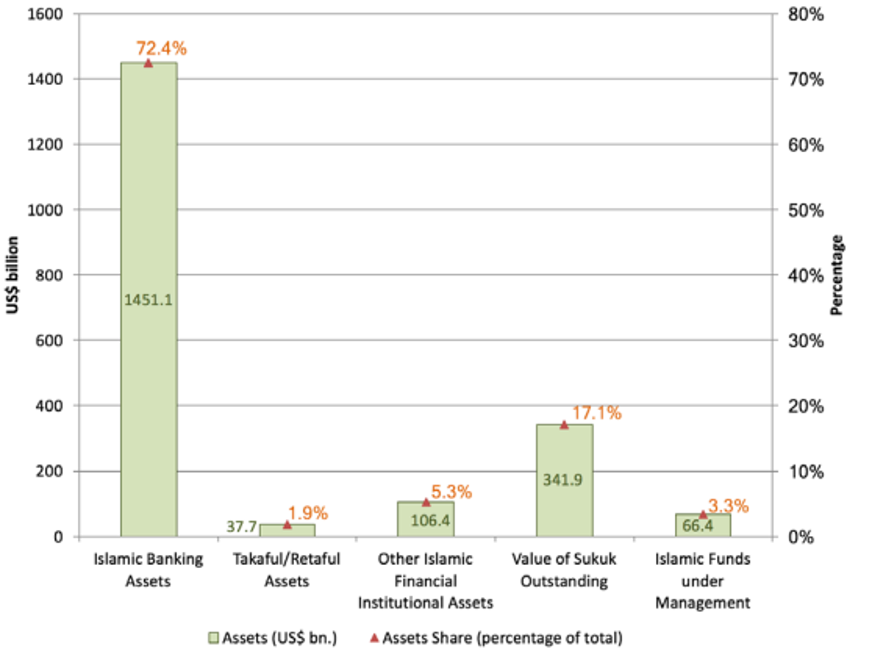

The Islamic financial industry has expanded significantly since its start in the 1970s and is now considered systemically crucial in many jurisdictions. The banking sector accounts for 72.4% of Islamic finance’s projected $2 trillion in 2016 total assets, with sukuk (or Islamic bonds) following at 17.1% (figure I) (Habib Ahmed, 2017).

Figure 1: Islamic financial industry Expansion ( Source: Habib Ahmed, 2017 )

Sustainable development goals (SDGs) are greatly aided by Islamic microfinance (IMF). Since the IMF follows SDGs-aligned concepts, including P&L parity, risk-sharing, and Riba prohibition (Haneef et al., 2015), it is an effective instrument for sustainable development.

Particularly important is the role played by the IMF in achieving SDG 1, which is to end all forms of poverty. IMF encourages economic inclusion by expanding access to financial services for underserved groups, which in turn helps to alleviate poverty. According to empirical research, the IMF has been shown to help individuals escape poverty, especially in areas with few employment prospects (Mirakhor & Iqbal, 2022).

IMF also prioritises gender equality, which is in line with SDG 5. Many IMF programs aim to improve women’s economic empowerment and gender equality by encouraging them to participate in financial activities (Pakkanna et al., 2020). The SDGs encourage gender equality, and several research back up the idea that IMF programs help women financially and socially (Östling Svensson, 2021).

Figure 2: Financial Inclusion in the SDGs (Source: Östling Svensson, 2021)

Finally, the literature shows that the IMF is highly related to the SDGs, underlining its potential as a driver of sustainable development. The SDGs aim to end poverty, expand economic opportunity, and promote gender equality worldwide, and the principles and practices of the Islamic Micro Finance (IMF) may help get us there.

4.2 Impact of Islamic Micro Finance on Poverty Reduction

The ethical financial practices and concepts at the foundation of Islamic microfinance (IMF) significantly influence alleviating poverty. The elimination of interest-based debt loads for borrowers is a key differentiator from more traditional financial systems. Therefore, the IMF enables people to escape the cycle of poverty by providing them with access to financial resources according to Islamic concepts of profit-and-loss sharing, including risk-sharing (Mohamed & Fauziyyah, 2020).

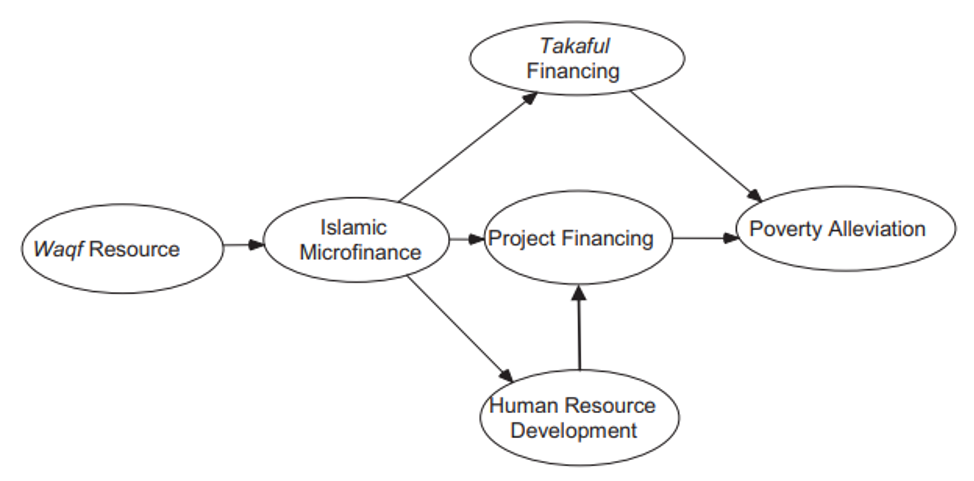

The elimination of poverty and the rise of living standards in areas where IMF initiatives are implemented are supported by empirical facts. Importantly, research has found that involvement with the IMF helps poor countries improve their economies. According to Mutamimah et al. (2022), the Model for Islamic Microfinance Integration through Waqf helps people attain economic security by facilitating access to microfinance solutions and encouraging entrepreneurship.

Figure 3: Model for Islamic Microfinance Integration through Waqf (Source: (Mutamimah et al., 2022)

The goals of SDG 1, which include increasing economic prosperity and decreasing economic inequality, are perfectly in sync with these SDGs represented in the IMF’s profit-and-loss sharing model since both seek to empower people economically, raise people’s living standards, and elevate them out of poverty. Given the IMF’s track record of success in alleviating poverty, it may be a helpful instrument in an effort for long-term prosperity.

4.3 Global Success Stories – Case Studies

Evidence from throughout the world shows that Islamic Micro Finance (IMF) has had a significant effect on a variety of progress. The transforming power of IMF is illuminated by these real-world examples, which are consistent with the research targets and literature evaluation.

The Bangladeshi organisation Grameen Bank, established by Muhammad Yunus, is a prime example of a group that has used microfinance to combat poverty effectively (Barua & Khaled, 2023). Grameen Bank’s approach is centred on providing modest loans to low-income persons, allowing many of them to become self-employed and improve their standard of living (Oikawa Cordeiro, 2020). Success at the bank demonstrates the IMF’s capacity to expand economic possibilities for the poor, which aligns with SDG 1’s goal of ending extreme poverty.

The instance of BMT Bina Ummah in Indonesia is an illuminating example of the IMF’s efforts to advance economic growth and gender parity (Buheji, 2019). The advancement of gender equality is critical to the success of SDG 5, and this IMF institution has proven particularly useful in increasing the economic independence of women business owners (Pakkanna et al., 2020).

These examples demonstrate how the IMF may affect beneficial change in several areas of development. They provide helpful guidance on how the IMF may best aid in achieving the SDGs, highlighting its potential as a resource for the international community.

4.4 Policy and Regulatory Considerations

In order to maximise Islamic Micro Finance’s (IMF) contribution to the SDGs, effective policy and regulatory issues must be considered (Kanyurhi et al., 2016). For the IMF to be in sync with larger sustainable development goals, such frameworks play a crucial role, as emphasised by the current literature and research aims.

The importance of regulatory frameworks that encourage ethical and sustainable financial behaviour in the context of the IMF is highlighted by a review of the relevant literature. These rules are essential for several reasons, including the security of financial transactions and the reliability of IMF programs (Barua & Khaled, 2023).

In addition, governments and international organisations play a pivotal role in shaping a policy framework that is friendly to and supportive of IMF initiatives. Among the steps needed to accomplish this goal are introducing monetary incentives, the elimination of bureaucratic roadblocks, and the formation of cooperative alliances with IMF institutions. The success of IMF programs has been linked repeatedly to government backing (Lanzara, 2021).

In conclusion, policy and regulatory factors are essential for optimising the IMF’s contribution to the SDGs. To guarantee that the IMF continues to be a helpful instrument in the worldwide quest for sustainable development, the literature highlights the significance of effective regulatory structures, government backing, and monitoring procedures.

4.5 Strategies for Enhancing the Contribution to the SDGs

According to study aims and literature, a diverse strategy is needed to improve Islamic Micro Finance (IMF) contributions to the SDGs. The Islamic Micro Finance (IMF) must improve its capability and reach. According to studies (Haneef et al., 2015), providing IMF to previously unreached populations is crucial. This includes increasing the IMF’s funds, personnel resources, and operational capacities to assist a broader range of people. Aligning with SDG 1, focusing on areas with the highest poverty rates and lowest economic development levels is critical.

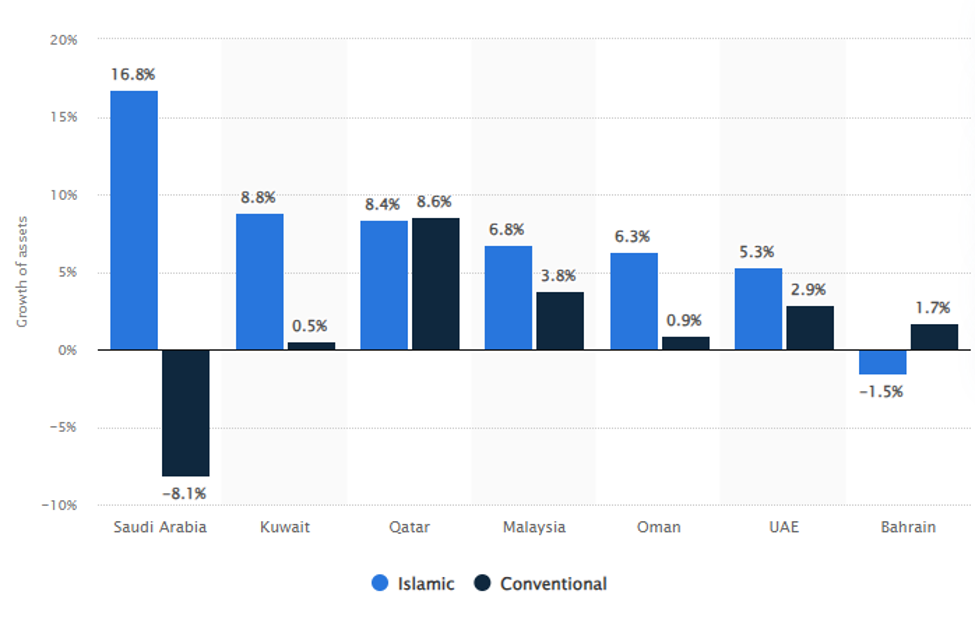

Second, it’s crucial to raise the level of financial education among those who benefit from IMF programs. The importance of financial literacy and individual agency in promoting sustainable development has been emphasised by researchers (Ghoniyah & Hartono, 2020). The overall asset value of the worldwide Islamic financial markets was around 2.88 trillion US dollars (Puri-Mirza, 2022). Financial inclusion and economic prosperity are two of the Sustainable Development Goals (SDGs) that may be aided by the Islamic Micro Finance (IMF) by helping its beneficiaries acquire the knowledge and skills necessary to manage their money and assets.

Figure 4: Global Islamic banking asset growth (Source: Puri-Mirza, 2022)

Encouraging collaboration between IMF bodies and other development players is also crucial. The impact of IMF programs may be magnified by partnerships with government agencies, NGOs, and international groups (Mohamed & Fauziyyah, 2020). These collaborations make it easier to pool resources, share information, and target specific Sustainable Development Goals.

Finally, the current literature and research goals suggest that an integrated approach that includes capacity building, financial literacy, collaborations, and research-based methods may considerably increase the IMF’s contribution to the SDGs.

5. Conclusion

5.1. Summary of key findings:

This study provides conclusive evidence of Islamic Micro Finance’s (IMF) strong congruence with the Sustainable Development Goals (SDGs) requirements, especially in poverty alleviation and gender equality. It demonstrates that the IMF has the potential to make significant contributions that are crucial to achieving these primary SDG goals. Haneef et al. (2015) and Barua & Khaled (023) provide extensive empirical data and convincing case studies that support the central role of IMF in reaching global sustainable development milestones, providing more support to the argument.

5.2. Practical implications and recommendations:

This research highlights the importance of strategic steps to strengthen Islamic Micro Finance (IMF) organisations. Actions that strengthen these institutions, increase beneficiaries’ financial literacy, foster collaborations, and execute policies informed by research can increase the IMF’s impact on attaining the SDGs. Mirakhor & Iqbal (2022) and Mutamimah et al. (2022) support this claim academically. These recommendations will help the IMF have the most significant effect on the global sustainable development agenda.

5.3. The study’s limitations

This study has numerous significant limitations that must be considered. Since they are secondary, their information is more likely to include inaccuracies and information gaps. Furthermore, case studies may be influenced by reporting bias. Ghoniyah & Hartono (2020) and Lanzara (2021) point out that the contextual diversity of IMF programs may alter their generalisability to different countries and people. These limitations highlight the importance of cautious interpretation and the possibility of variances in implementing IMF in different contexts.

5.4. Future research directions:

Various elements affect the performance of Islamic microfinance (IMF) programs worldwide and among different demographic groups; these aspects should be investigated in further research. It is essential to study the effects of the IMF in various economic and social contexts so that assistance may be customised to specific needs. Research on the regulatory structures guiding IMF practices and how well they align with SDGs is also an urgent requirement. Research along these lines has the potential to inform policymakers, financial institutions, and practitioners working in the field of IMF and sustainable development, helping them to develop more focused and efficient strategies to further the global community’s pursuit of SDGs and socioeconomic progress.

References

Abduh, M. (2019) The role of Islamic social finance in achieving SDG number 2: end hunger, achieve food security and improved nutrition, and promote sustainable agriculture. Al-Shajarah: Journal of the International Institute of Islamic Thought and Civilization (ISTAC). https://journals.iium.edu.my/shajarah/index.php/shaj/article/view/902

Ali, S. N. (2020) Big data, Islamic finance, and sustainable development goals. JKAU: Islamic Econ, 33(1), 83-90. http://ibir-api.hbku.edu.qa/sites/default/files/2020-03/BIg%20Data%2C%20IF%2C%20SDG.pdf

APA. (2020) American Psychological Association. – Concise guide to APA style: the official APA style guide for students. (No Title). https://cir.nii.ac.jp/crid/1130566853535378048

Barua, U., & Khaled, A. F. M. (2023) The Grameen Bank Microfinance Model in the Global North: Processes, Transfer Intermediaries and Adoption. Journal of Comparative Policy Analysis: Research and Practice, 25(5), 546-563. https://www.tandfonline.com/doi/abs/10.1080/13876988.2023.2223542

Biancone, P. P., Saiti, B., Petricean, D., & Chmet, F. (2020) The bibliometric analysis of Islamic banking and finance. Journal of Islamic Accounting and Business Research, 11(9), 2069-2086. https://www.emerald.com/insight/content/doi/10.1108/JIABR-08-2020-0235/full/html

Braun, V., & Clarke, V. (2022) Conceptual and design thinking for thematic analysis. Qualitative Psychology, 9(1), 3. https://psycnet.apa.org/journals/qua/9/1/3/

Buheji, M. (2019) Reviewing Implications “Poverty and Entrepreneurship in Developed and Developing Economies”. American Journal of Economics, 9(5), 268-271. https://www.researchgate.net/profile/Mohamed-Buheji/publication/336022403_Reviewing_Implications_Poverty_and_Entrepreneurship_in_Developed_and_Developing_Economies/links/5d8b57ff92851c33e939100c/Reviewing-Implications-Poverty-and-Entrepreneurship-in-Developed-and-Developing-Economies.pdf

García-Pérez, I., Fernández-Izquierdo, M. Á., & Muñoz-Torres, M. J. (2020) Microfinance institutions fostering sustainable development by region. Sustainability, 12(7), 2682. https://www.mdpi.com/2071-1050/12/7/2682

Ghoniyah, N., & Hartono, S. (2020) How Islamic and conventional banks in Indonesia contribute to sustainable development goals achievement. Cogent Economics & Finance, 8(1), 1856458. https://www.tandfonline.com/doi/abs/10.1080/23322039.2020.1856458

Habib Ahmed., (2017) Contribution of Islamic Finance to the 2030 Agenda for Sustainable Development. Available at: https://www.un.org/esa/ffd/high-level-conference-on-ffd-and-2030-agenda/wp-content/uploads/sites/4/2017/11/Background-Paper_Islamic-Finance.pdf.

Haneef, M. A., Pramanik, A. H., Mohammed, M. O., Amin, M. F. B., & Muhammad, A. D. (2015) Integration of waqf-Islamic microfinance model for poverty reduction: The case of Bangladesh. International Journal of Islamic and Middle Eastern Finance and Management, 8(2), 246-270. https://www.emerald.com/insight/content/doi/10.1108/IMEFM-03-2014-0029

Hussein Kakembo, S., Abduh, M., & Pg Hj Md Salleh, P. M. H. A. (2021) Adopting Islamic microfinance as a mechanism of financing small and medium enterprises in Uganda. Journal of Small Business and Enterprise Development, 28(4), 537-552. https://www.emerald.com/insight/content/doi/10.1108/JSBED-04-2019-0126/full/html

Huyler, D., & McGill, C. M. (2019) Research Design: Qualitative, Quantitative, and Mixed Methods Approaches, by John Creswell and J. David Creswell. Thousand Oaks, CA: Sage Publication, Inc. 275 pages, $67.00 (Paperback). https://onlinelibrary.wiley.com/doi/abs/10.1002/nha3.20258

Kanyurhi, E. B., & Bugandwa Mungu Akonkwa, D. (2016) Internal marketing, employee job satisfaction, and perceived organizational performance in microfinance institutions. International Journal of Bank Marketing, 34(5), 773-796. https://www.emerald.com/insight/content/doi/10.1108/IJBM-06-2015-0083/full/html

Kumar, R. (2018) Research methodology: A step-by-step guide for beginners. Research methodology, 1-528. https://www.torrossa.com/gs/resourceProxy?an=5018508&publisher=FZ7200

Lanzara, F. (2021) Islamic finance and Sustainable Development Goals. A bibliometric analysis from 2000 to 2021. European Journal of Islamic Finance. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3857617

Mirakhor, A., & Iqbal, Z. (2022) An Introduction to Islamic Finance. John Wiley & Sons. https://repository.bungabangsacirebon.ac.id/xmlui/handle/123456789/2594

Mohamed, E. F., & Fauziyyah, N. E. (2020) Islamic microfinance for poverty alleviation: a systematic literature review. International Journal of Economics, Management and Accounting, 28(1), 141-163. https://journals.iium.edu.my/enmjournal/index.php/enmj/article/view/774

Mukhlisin, M., Tamanni, L., Azid, T., & Mustafida, R. (2020) Contribution of Islamic microfinance studies in achieving sustainable development goals. Enhancing Financial Inclusion through Islamic Finance, Volume I, 51-79. https://link.springer.com/chapter/10.1007/978-3-030-39935-1_4

Mutamimah, M., Zaenudin, Z., & Bin Mislan Cokrohadisumarto, W. (2022) Risk management practices of Islamic microfinance institutions to improve their financial performance and sustainability: a study on Baitut Tamwil Muhammadiyah, Indonesia. Qualitative Research in Financial Markets, 14(5), 679-696. https://www.emerald.com/insight/content/doi/10.1108/QRFM-06-2021-0099/full/html

Oikawa Cordeiro, B. (2020) Global mobility of microfinance policies. Policy and Society, 39(1), 19-35. https://www.tandfonline.com/doi/abs/10.1080/14494035.2019.1659472

Östling Svensson, K. (2021) The Impact of a Supply Side Educational Program on Women’s Empowerment: Evidence from Indonesia. https://lup.lub.lu.se/student-papers/record/9050556/file/9050557.pdf

Pakkanna, M., Rasulong, I., & Akhmad, S. I. W. (2020) Microfinance institutions and women empowerment: evidence in the rural areas of Tangerang, Indonesia. International Journal of Scientific and Technology Research, 9(2), 3994-3999. https://library.unismuh.ac.id/uploaded_files/temporary/DigitalCollection/YWVmNzA5NWJmYTMwMDRmNTYyMjYzODUyZWY3MGZjZGFjNDlhNzAzZQ==.pdf

Puri-Mirza, A. (2022) Worldwide: growth of Islamic banking assets by country 2020, Statista. Available at: https://www.statista.com/statistics/1249543/worldwide-growth-of-islamic-banking-assets-by-country/.

Resolution, G. A. (2015) Transforming our world: the 2030 Agenda for Sustainable Development. UN Doc. A/RES/70/1 (September 25, 2015). https://www.un.org/en/development/desa/population/migration/generalassembly/docs/globalcompact/A_RES_70_1_E.pdf

Santoso, B. (2020) The Role of Micro, Small, and Medium Enterprises Toward Sustainable Development Goals Through Islamic Financial Institutions. In 2nd Social and Humaniora Research Symposium (SoRes 2019) (pp. 585-595). Atlantis Press. https://www.atlantis-press.com/proceedings/sores-19/125935286

Tamanni, L., & Haji Besar, M. H. A. (2019) Profitability vs Poverty alleviation: has banking logic influences Islamic microfinance institutions? Asian Journal of Accounting Research, 4(2), 260-279. https://www.emerald.com/insight/content/doi/10.1108/AJAR-05-2019-0039/full/html

Tok, E., Yesuf, A. J., & Mohamed, A. (2022) Sustainable development goals and Islamic social finance: from policy divide to policy coherence and convergence. Sustainability, 14(11), 6875. https://www.mdpi.com/2071-1050/14/11/6875

Uddin, M. N., Hamdan, H., Kassim, S., Embi, N. A. C. E., & Saad, N. B. M. (2020) Role of Islamic microfinance institutions for sustainable development goals in Bangladesh. Journal of International Business and Management, 3(1), 01-12. https://www.researchgate.net/profile/Md-Uddin-6/publication/338493359_Role_of_Islamic_Microfinance_Institutions_for_Sustainable_Development_Goals_in_Bangladesh/links/5e18372f92851c8364c0387c/Role-of-Islamic-Microfinance-Institutions-for-Sustainable-Development-Goals-in-Bangladesh.pdf

Uddin, M. N., Kassim, S., Hamdan, H., Saad, N. B. M., & Embi, N. A. C. (2021) Green microfinance promoting sustainable development goals (sdgs) in Bangladesh. Journal of Islamic Finance, 10, 011-018. https://journals.iium.edu.my/iiibf-journal/index.php/jif/article/view/523

United Nations. (2015) “Transforming Our World: The 2030 Agenda for Sustainable Development. Sustainable Development Knowledge Platform.” 2023. United Nations. United Nations. Accessed October 13. https://sustainabledevelopment.un.org/post2015/transformingourworld/publication https://sustainabledevelopment.un.org/post2015/transformingourworld/publication

World Bank. (2019) World development report 2019: The changing nature of work. The World Bank. https://www.worldbank.org/en/publication/wdr2019

write

write