Abstract

This study examines the function of hedge funds in the current market, emphasizing their participation in acquisitions and mergers (M&A). Wealthy people and organizations can now invest in different alternative assets with the possibility of significant returns thanks to the development of hedge funds. With over three trillion dollars in assets under administration, they are now a key player in the current financial markets (Bowe, 2022). Hedge funds are increasingly taking up the role of activist shareholder investors in the M&A space, leveraging their sizable stakes in target firms to demand reforms like boosted share buybacks, management changes, and spin-offs. Hedge funds could participate in proxy battles to sway shareholder votes on crucial topics like mergers or executive administration compensation. The influence of the involvement of hedge funds in M&A, such as their return and performance, is examined in the article. The report also looks at a number of biblical verses that are relevant to the moral issues raised by the activism of hedge funds in M&A. Generally, the research points to the fact that funds of the hedge have a considerable role in how M&A deals turn out and that their participation can have both favorable and unfavorable consequences on stakeholders.

Keywords/ indexes: Hedge funds, alternative investments, alpha, merger and acquisition, hedge fund manager, leverage, long/short equity, performance fees, short selling

Introduction

The role of hedge funds in the global financial system is crucial and divisive. Hedge funds, first designed as investment vehicles for affluent people and organizations seeking high-level returns through aggressive and frequently dangerous trading tactics, have matured into a broad and complex business important to global financial markets (Sabirov, 2021). Financiers and Activist investors of leveraged buyouts and hedge funds are frequently identified with high-reward investments and high-risk, but they also play a significant role in acquisitions and mergers (M&A). This research study will examine hedge funds’ origins and subsequent growth, as well as their present market position and particular function in M&A deals. The article will look at how hedge funds can affect the results of M&A deals, such as through their investor shareholder agitation, their capacity to fund leveraged buyouts, and their involvement in proxy battles (Bowe, 2022). The research will also discuss the debates surrounding the utilization of aggressive trading tactics by hedge funds, their effects on financial stability, and their possible effects on the return and performance of transactions of M&A. In order to provide a thorough overview of the function of hedge funds in the transaction of M&A and to support the research, the research will reference a variety of peer-reviewed academic journal papers throughout this paper. Furthermore, the paper will include pertinent biblical passages to offer an ethical and moral perspective on the intricate financial procedures, debates surrounding hedge funds, and their function in the world economy.

Why were hedge funds created? What are they?

Investment funds that are privately managed, also known as hedge funds, employ a variety of trading techniques to produce high returns for their clients. Due to their feature of high minimums investment and stringent rules, they are often only accessible to rich investors and institutions. A group of investors who wanted to use various methods, such as leverage and short selling, to produce larger returns than standard investing created hedge funds in the 1940s (Hardie, 2007). Their name comes from the fact that they were first intended to “hedge” toward market risks.

Hedge funds’ function has changed, and institutional investors that want to diversify their various portfolios and increase returns are becoming increasingly interested in them. In order to produce alpha, hedge funds today invest in a broad range of assets, including fixed income, equities, derivatives, and commodities. Long-short equities, global macro, event-driven and quantitative strategies are examples of these tactics (Hardie, 2007). Due to their role as makers of the market and providers of liquidity, hedge funds are crucial to the functioning of the financial markets (Gaughan, 2017). They frequently engage in active trading, and the trades they make can have a big influence on the pricing of the assets they deal in. Hedge funds can also take on the role of activist investors, pressing for changes in management, corporate governance, and strategic direction by holding sizable stakes in the companies they invest in.

Hedge funds may have advantages, but in recent years, they have drawn criticism for their minimum lack of transparency, excessive fees, and possibility for risk-taking. Because they are not governed by the same rules as other investment vehicles, like mutual funds, investors may not be adequately protected. Biblical Integration; Ecclesiastes 11:2 emphasizes the significance of the diversification method in investing and the requirement need to be ready for unforeseen events, which is a key principle that hedge funds adhere to: “Invest in several ventures, indeed, in eight; you cannot know what disaster might come on the land (Hardie, 2007).” Hedge funds have grown to be a significant component of the finance landscape, giving investors access to various investment techniques and providing chances for excellent profits (Avazov, 2020). Before investing and taking part in hedge funds, investors and shareholders should carefully assess their investment goals and risk tolerance because they also carry major dangers.

What function do they currently serve in the market?

With a huge influence on the financial and economic markets, hedge funds have grown to be a prominent player in the current financial markets. Giving investors access to alternative investment choices typically not offered by more conventional investment vehicles like mutual investment funds is one of the main functions of hedge funds (Bulău, 2022). To produce returns for their investors, hedge funds employ various investing techniques, such as event-driven, long-short, and global macro.

The provision of liquidity factor is another significant function that hedge funds take part in the current market. They make investments challenging to trade in the asset market, like distressed debt or private equity (Sabirov, 2021). This enables them to simplify transactions and supply liquidity to the market, which contributes to preserving the general stability of the system of finance. Hedge funds are renowned for their active participation in corporate administration governance, which involves keeping an eye on the operations of the businesses where they have investments. They advocate for push and transformation for reforms of corporate governance using their power (Avazov, 2020). They have become significant players in shareholder proxy and activism battles. As a result, they frequently adopt an activist attitude to pressure management into making strategic adjustments.

Hedge funds have been increasingly crucial in acquisitions and mergers in recent years. They frequently invest in a business considered for acquisition and merger and utilize their clout to demand a greater price. They have become key participants as a result, and occasionally their presence has caused the deal’s structure to change significantly. Hedge funds, which offer alternative investment alternatives, liquidity, and active involvement in M&A transactions and corporate governance, have generally become an essential part of the finance market. They significantly impact the financial and economic markets, and they will probably play an even bigger role in the future (Bulău, 2022).

Proverbs 11:14, which emphasizes the value of seeking advice and information from multiple and numerous sources, is quoted as saying that “a nation-state falls due to lack of guidance, but good victory is won and achieved through numerous advisers.” This verse is analogous to hedge funds’ role in offering investors financial guidance and advice. Hedge funds are also criticized for their perceived situation risk to financial stability, excessive fees, and lack of transparency (Avazov, 2020). There are worries about their propensity to engage in dangerous or fraudulent activities because they are not subjected to the same regulatory monitoring as other finance institutions. Despite these complaints, hedge funds have continued to play a significant role in the financial industry, and in the years to come, their impact on the current markets is predicted to increase.

What role do they play in mergers and acquisitions (M&A)?

In the realm of acquisitions and mergers, hedge funds are pretty important. They have frequently been sought after as possible investors or acquirers in transactions of M&A and have grown in favor in recent years because of their capacity to produce alpha returns (Gaughan, 2017). The numerous roles played by hedge funds in M&A, including their duty as investors activists, their roles duty in leveraged buyouts, their duty roles in proxy battles, and their effects on performance and returns, will be covered in this section.

As activist investors, hedge funds

In M&A deals, hedge funds frequently play the role duty of activist investors, utilizing their clout as sizeable shareholders and investors to push for the transformation they believe will improve shareholder value. Hedge funds that advocate for change often target undervalued or failing companies to force management changes, spin-offs, restructuring, outright sales, or divestitures (Gaughan, 2017). They might also push for adjustments to corporate governance, executive pay, and other laws. As investors look for higher returns and more corporate transparency, hedge fund activism has become popular recently. According to the firm Activist research Insight statistics, hedge funds launched the most activist campaigns ever in 2020 (Stensås, 2019). Pershing Square, Third Point and Elliott Management are a few well-known hedge funds activists.

From a biblical perspective, activism can be viewed as stewardship in which investors assume a duty to actively manage their resources to benefit all investors, including clients, employees, and the larger community. In the Parable section of the Talents (Matthew 25:14–30), the master gives his servants talents (a type of currency) with the expectation that they will make prudent investments and earn a profit (Burkhanov, 2020). In a similar method, managers of hedge funds can be viewed as stewards of the money invested by their investors, attempting to maximize returns while simultaneously advancing the interests of the organizations they invest in.

Their role in Leveraged buyouts

In leveraged buyouts (LBOs), a transaction of M&A where an organization is acquired utilizing a sizable amount of mortgage debt, hedge funds also act and play a significant duty. Hedge funds frequently provide the capital or equity for LBO transactions. To finance LBOs, hedge funds may collaborate with private equity companies (Stensås, 2019). Following the LBO, hedge funds could also actively participate in the management point of the firm by holding a board seat or being involved in the day-to-day operations. This involvement can take many forms, from pushing for transformation in the organization’s management or direction to implementing cost-cutting strategies to increase profitability (Burkhanov, 2020).

The 2013 purchase of Dell Inc. is one instance of a hedge fund participating in an LBO. The initial takeover offer from private equity company Lake Silver Partners and Dell founder Dell Michael was challenged by hedge fund management Carl Icahn, who said the deal undervalued the business (Greece, 2022). Icahn put up a different strategy that called for a recapitalization leveraged of the business. Ultimately, Silver Lake Partners and Michael dell purchased Dell after Icahn’s attempt to take over the company failed. In using biblical verses to explain how hedge funds work in leveraged buyouts. This verse emphasizes the possible dangers of employing leverage transactions in finance, as the borrower may wind up being obliged to the lender; according to Proverbs 22:7, “The rich leads over the poor individuals, and the borrower individual is the slave person of the lender.” Using debt to finance an acquisition in an LBO increases the risk factor for the acquirer. It may negatively affect the acquired organization if the debt cannot be serviced (Burkhanov, 2020).

Proxy Battles:

Proxy fights, also referred to as proxy battles, happen when a group of shareholders or a shareholder launch an effort to take over the company’s board of directors by enlisting the support of different shareholders to make a vote for their proposed amendments or proposed board nominees to the company’s policies of corporate governance (Greece, 2022). Hedge funds and institutional investors with sizable organizational stakes can start proxy fights.

Proxy battles are a common strategy hedge funds use to affect how an M&A deal turns out. A hedge fund, for instance, can start a proxy battle to demand a better price in an acquisition or merger or to thwart a deal they feel is not in the better interests of shareholders (Moriarty, 2019). They might also utilize a proxy battle to push for company leadership adjustments, board makeup, or corporate governance principles.

Proxy battles can be expensive and consuming of time, but they also have the potential to be successful in attaining the desired result. In some circumstances, the mere possibility of a proxy conflict may be sufficient to persuade a corporation to negotiate with other activist investors or a hedge fund to avert a visible struggle for control. Proxy battles can pose concerns about moral conduct and the appropriate use of authority and influence from a biblical perspective. This verse emphasizes the significance of seeking intelligent counsel and guidance while making significant decisions, including those pertaining to finance and business: “Where indeed there is no guidance, an individual falls, but in much abundance of counselors there exist safety.” Furthermore, Proverbs 16:8 cautions against accumulating wealth through unethical means, saying, “Better is a minimal with righteousness than bigger revenues with injustice approach (Moriarty, 2019).” This verse serves as a reminder of the significance of acting honorably and honestly in all our dealings, even those involving money.

Performance, Impact, and Returns:

Hedge funds’ effects on M&A transactions have been thoroughly researched, especially in relation to activism, leveraged buyouts, and proxy battles. Analysis has been done on the returns and effectiveness of these invested funds in M&A activity. According to certain studies, the participation of hedge funds in M&A deals might enhance the long-term success of the target companies. For example, a 2013 research study by Ganache noted that over three years after the introduction of the campaign activist, firms targeted by hedge fund activists generated sizable positive anomalous returns (Yan, 2019). The survey also discovered that these businesses’ operational efficiency, financial health, and long-term expansion prospects improved.

Regarding the effect of hedge funds on the returns and outcomes of M&A, various research has produced conflicting or ambiguous results. Hedge fund activity in M&A deals, for instance, was linked to larger bid offer premiums and a broader higher probability of deal completion, according to a study by Yan and Chemmanur (2019) (Chemmanur, 2019). However, the study discovered that these transactions were linked to poorer long-term post-operating merger performance.

Overall, the influence of hedge funds investment on M&A deals relies on the context and may change based on the nature of the transactions, the hedge fund’s objectives, and the traits of the target company (Ahluwalia, 2022). According to the research, the activism of Hedge funds in M&A deals may occasionally result in target companies performing better over the long run.

Hedge funds participating in M&A transactions have typically outperformed the overall market regarding returns and performance in recent periods. Hedge funds that focus on mergers and acquisitions and event-investing drove have outperformed the overall hedge fund industry lately, according to a report by Hedge Research Fund, Inc., producing annualized returns of nearly 8% from the year of 2014 to 2019.

Hedge funds are crucial players in M&A deals as activist investors, contributors to leveraged buyouts, and leaders in proxy battles. The currently available research implies that activism of hedge funds can occasionally result in greater long-term success and performance for target companies, even though their effect on M&A returns and outcomes might fluctuate depending on the environment. Additionally, in recent periods, M&A-focused hedge funds have outperformed the industry.

Conclusion

Hedge funds have developed over time and now represent a substantial presence in the finance market. Hedge funds were initially created to protect investors from market risks. However, they have since broadened their investing techniques and increased their involvement in corporate governance, particularly in acquisitions and mergers (Moriarty, 2019). Hedge funds use their positions as sizeable shareholders to try to sway the strategy of the corporate companies in their portfolios. To increase their profits, they participate in proxy battles and use buyouts.

Hedge funds have demonstrated outstanding returns and performance, while their influence on M&A operations has been debated. Regarding returns, hedge funds have significantly outperformed other investment tools, including index funds and mutual funds (Avazov, 2020). However, hedge funds’ investment and leverage concentration also expose them to increased dangers. As a result, before choosing to be a shareholder in a hedge fund, shareholders must conduct more research.

Overall, given the rising demand for shareholder activism and corporate governance, the involvement of M&A in hedge funds operations is anticipated to remain substantial. However, regulatory monitoring and the greater scrutiny of their operations by institutional investors are likely to limit their power. Hedge funds will ultimately continue to be crucial to the market of finance, but in order to succeed, they will require to adapt to shifting market and regulatory conditions.

References

Avazov, N., & Maxmudov, N. (2020). Investment as a source of financing. Архив научных исследований, (24).

Ahluwalia, S., & Kassicieh, S. (2022). Effect of Financial Clusters on Startup Mergers and Acquisitions. International Journal of Financial Studies, 10(1), 1.

Bowe, M., Kolokolova, O., & Yu, L. (2022). Advisor-hedge fund connections and their role in M&A.

Bulău, V. (2022). RELIABLE ENTERPRISE VALUATION METHODS: A CASE STUDY ON ROMANIA’S INVESTMENT FUNDS. European Journal of Economic and Financial Research, 6(2).

Burkhanov, A. (2020). The practice of investment funds development in developed countries. Архив научных исследований, (23).

Chemmanur, T. J., & Yan, A. (2019). Advertising, attention, and stock returns. Quarterly Journal of Finance, 9(03), 1950009.

Gaughan, P.A. (2017) Hedge funds as activist investors – mergers, acquisitions, and …, Chapter Seven Hedge Funds as Activist Investors. Available at: https://onlinelibrary.wiley.com/doi/10.1002/9781119380771.ch7 (Accessed: March 30, 2023).

Greece, D., & Stefanakis, M. (2022). Greece gains investment activity from foreign private equity funds. International Tax Review.

Hardie, I., & MacKenzie, D. (2007). Assembling an economic actor: the advancement of a Hedge Fund. The Sociological Review, 55(1), 57-80.

Moriarty, R., Ly, H., Lan, E., & McIntosh, S. K. (2019, December). Deal or no deal: Predicting mergers and acquisitions at scale. In 2019 IEEE International Conference on Big Data (Big Data) (pp. 5552–5558). IEEE.

Stensås, A., Nygaard, M. F., Kyaw, K., & Treepongkaruna, S. (2019). Can Bitcoin be a diversifier, hedge, or safe haven tool? Cogent Economics & Finance, 7(1), 1593072.

Sabirov, O. S., Berdiyarov, B. T., Yusupov, A. S., Absalamov, A. T., & Berdibekov, A. I. U. (2021). Improving Ways to Increase the Attitude of the Investment Environment. Revista Geintec-Gestao Inovacao E Tecnologias, 11(2), 1961-1975.

Yan, S., Ferraro, F., & Almandoz, J. (2019). The rise of socially responsible investment funds: The paradoxical role of the financial logic. Administrative Science Quarterly, 64(2), 466-501.

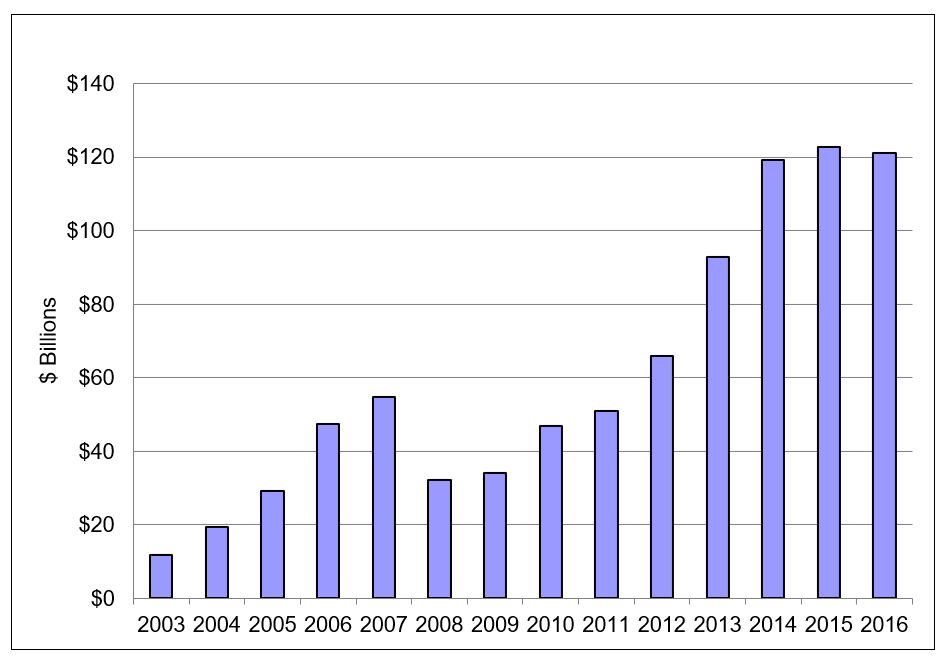

Appendix 1.

Assets of Activists Under Management (AUM)

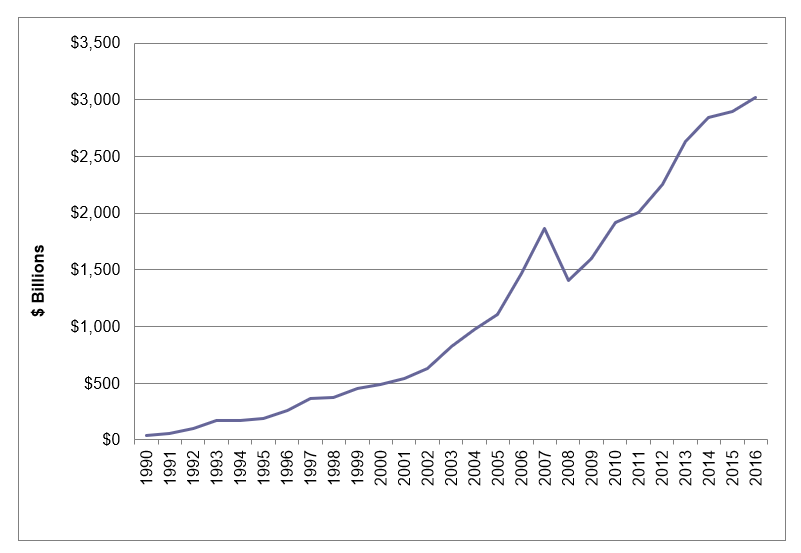

Appendix 2

($ Billions) Hedge Fund Assets

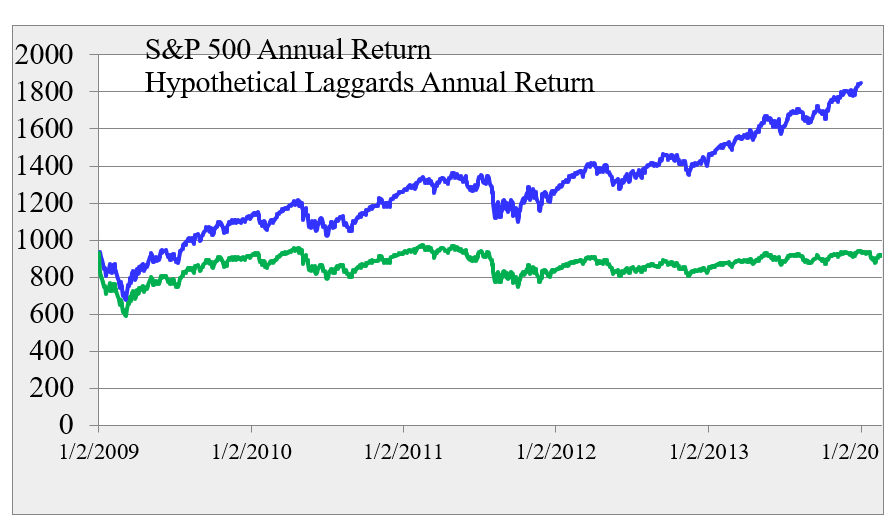

Appendix 3

Total Annual Return of S&P vs. S&P Laggards Annual Return.

write

write