Executive Summary

This report study is to convey the concern about the substantial expenses of the company Clark Casc Logistics PLC, to the Chief Executive Officer, as the company’s expenses are expanding beyond the fund resulting in a huge loss to the company. The report analyzes the calculations of past year budget expenditures and existing year 6 months budgeted figures to formulate the strategies for the upcoming year to reduce the expenditures and increase the profit. In this report, several budgeting approaches will be discussed that can help in selecting a single or a mixture of budgeting approaches for planning a proper budget. The relevant calculations and appropriate evaluation is done to calculate the individual services and items expenses according to which reductions are made in services while keeping the quality the same, and recommendations have been stated to achieve the targeted budgeting figures.

Introduction

I’m the manager of the organization’s Loading Bay. This article is sent to the CEO of Clark Casc Logistics PLC, as the CEO (Chief Executive Officer) is worried about the overall real costs that exceed the authorization, resulting in a € 3.2 million loss for the business. It is about the organization’s proposed budget. Last year’s budget for the loading bay was € 918000, which was exceeded by € 10000. The existing year fund was set at € 469000, and the costs for the first six months were set at € 478000, indicating that the expenses did not understand the account and that overspending was present, which has to be controlled. As a result of the prime management’s concern over expenditures, which resulted in corporate losses, the meeting is held with the firm’s various department managers. The main discussion topic in this meeting will not be about the current year because management recognises that there isn’t much that can be done about it because six months have already passed; instead, the meeting will be about the budget for next year with a vision of overspending control by all department managers. The total budget of € 882000 for next year will be discussed. As the company’s loading bay manager, I must report on the entire projected budget, as well as the savings that may be made to halt or limit overspending and also to save the organisation from incurring damages, during the budget debate (Uyar, 2009).

With this document, I’ll be providing an absolute approach to loading bay budget division, and the computation and analysis based on last year’s budget and the substantial amounts will be delivered utilizing a relevant approach, demonstrating these the budget of next year will be expected and formulated to the CEO of the organization in the upcoming meeting using this report on the appropriation (Egbunike&Nkiru, 2017). The proposed budget will be followed by the overall report conclusion and suggestions on every potential method for achieving the intended budget and saving money. In this report, two tables are shown below; one shows the previous year’s budget figures and the significant costs, indicating that the real spending far outnumber the budgeted numbers. The other depicts the current year’s budget as well as the significant costs for the first six months of the current fiscal year. It also shows that the total costs are more than the planned amounts.

In these two tables, one research is comparable in that the significant costs for employee wages, national insurance and pension contributions, insurance payments, and administrative payments exceed the planned values. The corporation must create a fair budget while considering the dangerous conditions and disasters so that the company’s management and other marketing departments may develop their selling plans and strategies to cover all ongoing expenditures (Silva, Fortunato, & Bastos, 2016).

Research Methodology

Budgeted Approach

The budget is defined as a financial strategy for a specific time period, and it is created using historical data, future estimates, past experiences, and uncertainties. Each of these are appropriately considered when developing the budget, which is beneficial in strategizing and regulating various business activities, allowing excessive spending to be measured and controlled, as well as information on various expenses chiefs for the coming year and recommended expenses to be sustained on several business actions. In addition, the budget will help with assessment, coordination, motivation, delegation, and authorisation. Clark Casc Logistics PLC is using the funds to achieve these goals. The organisation incorporates managers to determine the entire budget, which helps in creating more responsible personnel and increasing motivation levels. Budgeting may be approached in a variety of ways, including:

- Incremental Budgeting: It considers the previous year’s budget and makes certain modifications for the budgeted figures of prior years depending on business demands and market conditions. This budgeting method is simple to understand and might be used in the future with less challenges and efforts (Lidia, 2014).

Activity-based budgeting is a type of top-down budgeting that takes market goals into account when creating a budget. It evaluates numerous activities that must be carried out in order to achieve the organization’s aims and targets, and then the prices probabilities in carrying out these actions are examined. It is more acceptable when the aims and objectives are clearly defined and accepted by the management team; so, this strategy is not used for the loading bay department.

- Zero-based Budgeting: In this budgeting approach, the budget starts from zero and isn’t based on previous data. The four previous records aren’t needed in this budgeting approach, which formulates the budget of every year as a new budget without using earlier year data, making it more appropriate and optimising resource allocation. Nonetheless, this is an expensive procedure because it needs substantial training. The loading Bay department may utilise this budgeting strategy since various expenses are recognised; however, because the company’s other departments’ costs are not measurable owing to their intangible nature, such as marketing costs and development and research, this budget method will not be employed.

- Value Proportion Budgeting: It recognises all components of the budget from the perspective of the company’s stakeholders, and every product and part of the budget must be rationalised by the management department, and these activities must have meaning for the workers, stakeholders, or consumers. In the absence of an explanation, the specific activity or item is deemed worthless and will be removed from the company’s budget (Santosh, Indumathi, & Kumar, 2019).

The organisation will plan its budget for the coming year using a combination of value proportion and incremental budgeting. The divisions do not accept activity-based and zero-based budgeting approaches because they have various limits, such as a lack of obvious sales objective data and a high training price participation when using these budgeting kinds. In addition, incremental budgeting has various limits, such as the possibility of overspending if the right reason for all the increase in costs is not provided. Furthermore, in the accounts judgments need to be then after complete market analysis, which requires extra effort and time, thus to remove all of these constraints the value proposition budgeting approach is used along with incremental budgeting for explaining every single budget item and action, this will enable to constraint the unnecessary activities and overspending which aren’t going to amplify any business value and stakeholders. The approach of incremental budgeting is preferable for the loading bay budget because substantial spending exceeds budgeted numbers as observed for equipment maintenance, wages, insurance costs, and administrative costs that can be inferred if appropriately observed and analysed in market situations. Furthermore, it is straightforward and easy to use, and it does not need exceptional training for staff members to grasp, so it may be used indefinitely. As a result, the value proportion and incremental budgeting approaches will be used in tandem to develop the finest possible plans and actions (Msi, Saputra, &Muda, 2017).

Relevant Calculations

Budget statistics from past and current years are used to calculate the budget for the coming year. The current year’s budget numbers have depicted the budget for a total of six months. The budget figures for the current year will be computed using the data table below. The rise and decrease in the budget are computed by comparing the previous year’s budgeted figures to the current year’s planned numbers. It can be noticed that certain data do not show any difference while others indicate development (Roestel, 2016). Profit in the current year was not as high as in the previous year, according to budgeted data. However, no activity has resulted in a decrease in expenditures.

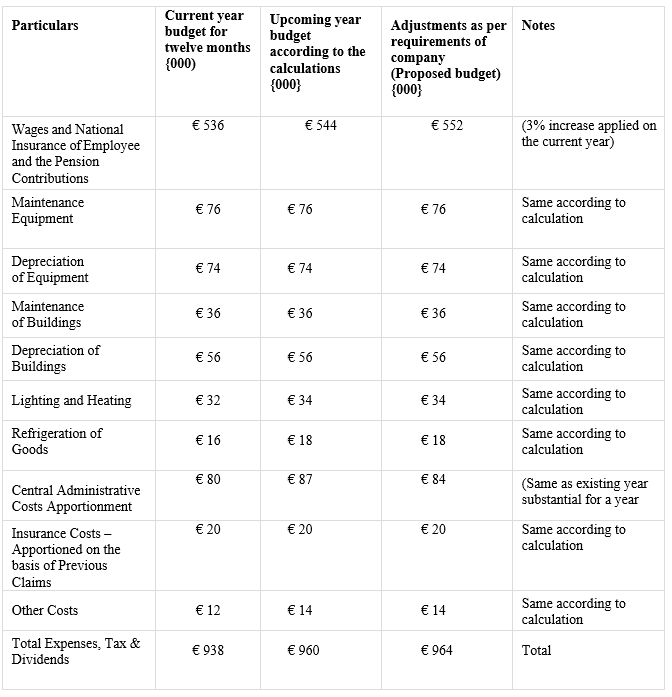

Table no. 3: computation of upcoming year’s budget

Evaluation of Proposals

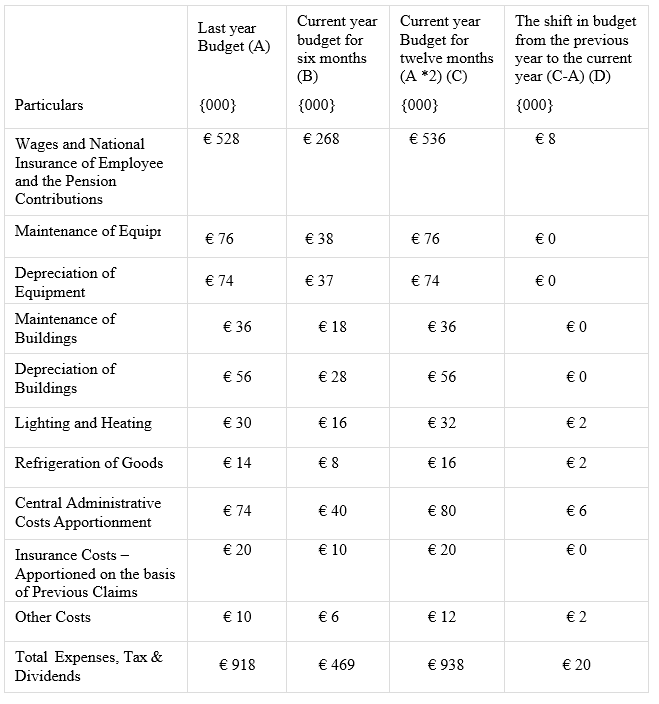

The table above shows the budget calculations for the coming year, which are based on a basic study and review of current and prior year data. The chief executive officer has provided more information through email concerning the Central Administrative expenses apportionment and salary increases that must be changed before developing the final budget for the next fiscal year. The Central Administrative expenditures must be considered in accordance to the organization’s current large costs for the € 80000 loading bay budget. Salaries have risen by 3% as a result of trade alliances, and this figure is anticipated to be altered in the future year’s proposal (Carvalho&Jonker, 2015). According to the primary formula, the increase in pay is 1.52 percent, which has to be amended by 3 percent. Furthermore, the overall budget for the next year based on the aforementioned calculation shows € 960,000, although the top management has sought to maintain the budget within € 882,000, which is lower than the budget for the previous year. This indicates that a careful examination is required, as well as the elimination of a few expenditures. The revised data is shown in the table below: –

Table no. 4: The proposed budget based on adjustments and calculations.

Conclusion

The complete proposed budget, using applicable calculations based on incremental and value budgeting approaches, demonstrates that every action shown in the allotment is significant for the organization’s unloading and loading divisions. The business organisation desires to establish a budget of € 882000 for the loading bay, which is not feasible because prices are growing and the pay increase is also 3%, which is higher than the predicted value. The previous year’s loading bay budget was set at € 918000, while the significant costs were € 928000, both of which were higher than the planned figures (Lawal, 2017). The current year study demonstrates an increase in spending when compared to the previous year’s expenses, making it hard to set a budget lower than the previous year without sacrificing quality. If the organization sets the budget for loading and unloading operations at € 882000, the disparity between substantial costs and projected numbers will be bigger than in the current and prior years since the set budget is not fair. Regardless, the company’s status and senior management worries are clear, and pricing and money may be more tightly controlled up to the planned funding level of € 964000.

Recommendations:

Rotation of additional staff members on duty: The performance of loading bay employees may be assessed by HRM (Human Resource Manager), and we can have a thorough talk about it with me. I’ve seen that multiple members are allocated to the region in excess of what is required, resulting in excessive free time being squandered by all of them on non-productive activities. I will not advocate eliminating these additional staff members, but a duty rotation can be formed and they can be reassigned to other essential departments, since termination can cause disruption from the union trade side, which can impede business. It will benefit the firm by lowering the loading bay wage costs, as this is the branch’s most significant expense (Himme, 2012).

Confidential interest to save money: I assure you that I will get the job done in the limited number of staff members and will provide extra assistance to HRM in duty changing by personally communicating with individual staff members on their department choices without jeopardizing the quality of services and products. I’ll look at the equipment and building maintenance expenditures because they’re the next one after wagering that leads to rising prices. I’ll urge staff members to work more effectively and productively with my supervision and active engagement (Oparanma & Nwaeke, 2015).

References

Carvalho, J., &Jonker, J. (2015). Creating a Balanced Value Proposition: Exploring the Advanced Business Creation Model. The Journal of Applied Management & Entrepreneurship, 20(2), 49- 64.

https://www.researchgate.net/publication/282893934_Creating_a_Balanced_Value_Proposition_ Exploring_the_Advanced_Business_Creation_Model

Covaleski, M., Evans, J., &Luft, J. (2006). Budgeting Research: Three Theoretical Perspectives and Criteria for Selective Integration. Journal of Management Accounting Research, 15(1), 587- 624.

https://www.researchgate.net/publication/223658927_Budgeting_Research_Three_Theoretical_P erspectives_and_Criteria_for_Selective_Integration

Egbunike, A., &Nkiru, U. (2017). Budgeting, budgetary control and performance evaluation: Evidence from Hospitality Firms in Nigeria. https://www.researchgate.net/publication/322430905_BUDGETING_BUDGETARY_CONTRO L_AND_PERFORMANCE_EVALUATION_Evidence_from_Hospitality_Firms_in_Nigeria

Himme, A. (2012). Critical success factors of strategic cost reduction. Journal of Management Control, 23(3).

https://www.researchgate.net/publication/257338845_Critical_success_factors_of_strategic_cost_reduction

Lawal, B. (2017). Effect of Cost Control and Cost Reduction Techniques in Organizational Performance. https://www.researchgate.net/publication/341314249_Effect_of_Cost_Control_and_Cost_Reduct ion_Techniques_in_Organizational_Performance

Lidia, T. (2014). Difficulties of the Budgeting Process and Factors Leading to the Decision to Implement this Management Tool. 15, 466-473.

https://www.sciencedirect.com/science/article/pii/S2212567114004845

Msi, E., Saputra, A., &Muda, I. (2017). The Analysis of the Influencing Factors of Budget Absorption. International Journal of Economic Research, 14(12). https://www.researchgate.net/publication/320335376_The_Analysis_of_the_Influencing_Factors_of_Budget_Absorption

Oparanma, A., &Nwaeke, L. (2015). Impact of Job Rotation on Organizational Performance. British Journal of Economics Management & Trade, 7(3), 183-187. https://www.researchgate.net/publication/276122146_Impact_of_Job_Rotation_on_Organization al_Performance

Roestel, M. (2016). A Collaborative Approach to Budgeting and the Impact on the Budgeting Process: A Case Study. 35-85. https://scholarworks.waldenu.edu/cgi/viewcontent.cgi? article=3440&context=dissertations

Santhosh, R., Indumathi, C., & Kumar, P. (2019). Research on Budgeting. International Journal of Engineering and Advanced Technology (IJEAT), 8(3), 1-6. https://www.ijeat.org/wp- content/uploads/papers/v8i3S/C11550283S19.pdf

Silva, J., Fortunato, G., & Bastos, S. (2016). Operating cost budgeting methods: quantitative methods to improve the process.https://www.researchgate.net/publication/307526465_Operating_cost_budgeting_metho ds_quantitative_methods_to_improve_the_process

Uyar, A. (2009). An Evaluation of Budgeting Approaches: Traditional Budgeting, Better Budgeting, and Beyond Budgeting. https://www.researchgate.net/publication/303911248_An_Evaluation_of_Budgeting_Approaches_Traditional_Budgeting_Better_Budgeting_and_Beyond_Budgeting

write

write