CHAPTER 1: LITERETURE REVIEW

Foreign Direct Investments (FDI) refers to substantial, lasting investment made by a company or government of another country to another one for the purpose of establishing a long-term interest in a business in the foreign country (Venugopal, 2022). The definition of FDI is based on long-term relationship that reflects a lasting interest and control of a resident entity in another economy as a way of differentiating FDI from portfolio management, which involves short-term investment. FDI may result from purchasing physical assets in foreign country, establishing business operations in a foreign country, acquisition, or ownership and control of interests belonging to the parent company (Szarzec et al., 2021).

Advantages of FDI to the Company

FDI has been proven to be beneficial to organizations in ways such as access to large markets, access to resources, diversification of market, and access to low labor costs. Beginning with access to large markets, companies investing in a foreign country expand the market to accommodate other target customers from different countries (Paul, 2019). This helps the investing company to reduce their reliance on domestic market and diversify its revenue channels. Investing in a foreign country enables a company to reach new customers and expand its customer base. This can be beneficial for companies looking to increase their sales and revenue.

Another advantage of FDI is low labor costs. In developing countries, the labor cost is lower, hence, it reduces it reduces the production cost (Nguyen, 2021). Many companies invest in foreign countries to take advantage of lower production costs. This can be due to cheaper labor, raw materials, or energy costs. By investing in a country with lower production costs, a company can manufacture its products at a lower cost, which can help it to stay competitive and increase its profits.

FDI can allows the investing company to access resources. Investing in a foreign country can give a company access to new technologies, research and development facilities, efficient infrastructure, and skilled workers (Bajrami, 2019). This can benefit companies looking to innovate and stay ahead of the competition. For example, a company may invest in a foreign country to access cutting-edge technologies or research facilities unavailable in its home country.

Disadvantages of FDI

While foreign direct investment (FDI) has many advantages, it is not without its drawbacks. This section explores some of the disadvantages of FDI and its potential negative impacts on investing companies include regulatory barriers, cultural differences, and costly.

First, it can be expensive. Investing in a foreign country requires significant financial resources, including capital investment, operational expenses, and legal and regulatory compliance costs (Tang and Buckley, 2022). This can be a significant barrier for small or medium-sized companies needing more financial resources to invest in a foreign country.

Secondly, legal and regulatory barriers. Investing in a foreign country requires compliance with local laws and regulations, which can be complex and time-consuming (Mistura and Roulet, 2019). These regulations may be designed to protect local industries or limit foreign ownership, which can restrict the investing company’s operations.

Lastly, cultural differences. Investing in a foreign country requires a company to interact with different cultures, languages, and business practices (Tang and Buckley, 2022). These differences can create communication and operational challenges, which can impact the effectiveness of the investing company’s operations.

Impact of Market Stability of MNE’s FDI

Market stability has influence on the FDI of an investing company. A stable market provides a predictable environment to allow the business to carry on (Sabir et al., 2019). Market stability reduces the level of risk incurred in operating in a foreign country as well encourage other investors to enter the market (Sabir et al., 2019). The major impact of market stability is to reduce the volatility and uncertainty in the business environment. Market stability can be promoted through political stability, low inflation rate, stable exchange rate, and favorable monetary/fiscal policy (Haudi et al., 2020). Other factors that affect market stability include unemployment rate, interest rate, and income inequality.

CHAPTER 2: FDI ANALYSIS OF THE CHOSEN COUNTRY

This section comprises of three subsections: country overview, country strategic actions, and market stability analysis. Each of these sections will be further divided into several subsections as presented in the subsequent parts.

2.1 Country Overview

China has a population of 1,425,900,000 people (OECD, 2023). The total population is calculated by adding all the people with Chinese citizenship. The official language of China is Mandarin, and it was adopted as early as in the 1930s (Meredith, 2022). With the rise of Covid-19 pandemic foreign direct investments as well as GDP reduced (OECD, 2022).

However, China still managed to be among the top ten major FDI investors in the first half of 2022. Nevertheless, it dropped from position 2 in the last quarter of 2021 (OECD, 2022). The People Republic of China was rated A (high) in 2022 by DBRS, A+ by Fitch, A and S& P, and A1 by Moody’s (World Government Bonds, 2023). This credit rating is medium, it is below the rating of some countries but way better than most countries. This implies that the country is able to sell bonds to population and access loans as well when need be. Hence, the ‘sovereign risk’ is low because the likeliness of the government defaulting is quite low because the country has resources that could be used to settle sovereign debts. Additionally, sovereign risk is contained as public debt is mainly domestic and denominated in local currency (Santander Trade, 2023).

2.2 Country Strategic Actions

The attitude of Chinese government regarding Foreign Direct Investment can be evaluated by the efforts the country has shown towards FDI. China is one of the highest ranking countries when it comes to foreign outflows (OECD, 2022). This can also be denoted by the progressive increase in FDI from 2019 to 2020 then 2021 and 2022 despite the Covid-19 pandemic.

The Chinese government imposes restrictions while encouraging FDIs. FDI is prohibited in some industries, including those that protect “national flagships” and state-owned enterprises by discriminatory methods and the enforcement of legislation only when necessary (Santander trade, 2023). Additionally, the nation restricts foreign investment in crucial industries where it intends to turn homegrown firms into MNCs that can compete globally (UNCTAD, 2022). Yet, the Chinese government promotes investments in high technology, equipment manufacturing, the service industry, recycling, renewable energy, and environmental protection. A new Foreign Investment Law has been passed that makes it illegal for the government and its representatives to force technology transfer and protect foreign investors’ and foreign-funded businesses’ intellectual property rights (NDRC, 2021). The country has introduced measures to improve the delivery of significant foreign investment projects such as streamline customs clearance (Santander Trade, 2023).

2.3 Marketing Stability Analysis

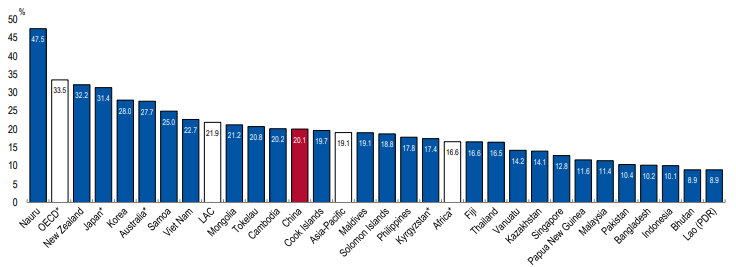

Fig 1: Revenue Statistics in Asia and the Pacific 2022-China (OECD, 2022)

From the diagram above. The tax-GDP ratio of China is 20.1% in 2020, which is above the Asian and Pacific average of 19.1% but below the OECD, which is 33.5%. This makes China a good investment destination when from OECD country, because the tax rate will be lower.

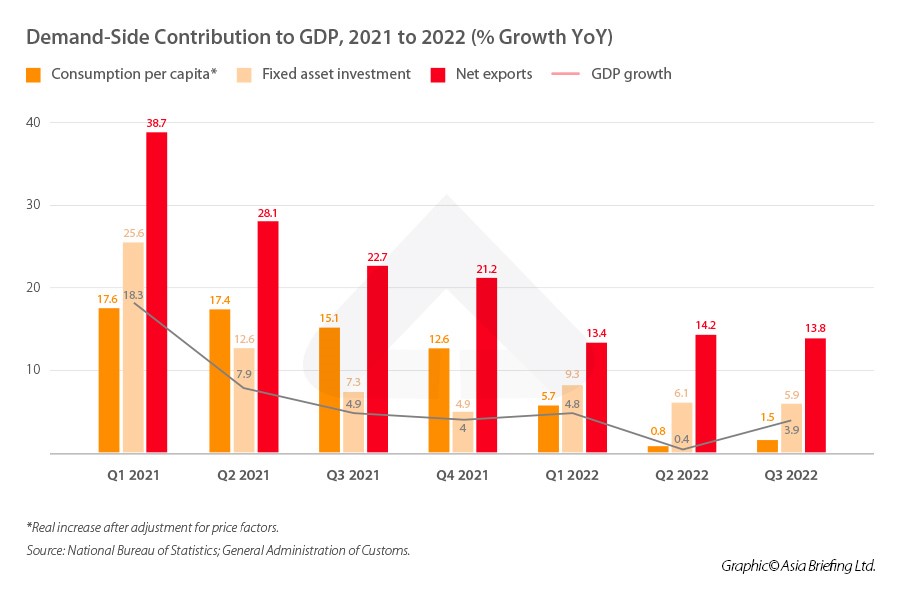

Fig 2: GDP Growth (China Briefing, 2022).

The economic look of China in 2022 was optimistic compared to the one for 2021. The economy was catching up from the Covid-19 pandemic.

Conclusion

In conclusion, this study has been about the potential advantages and disadvantages for a company to conduct foreign direct investments in China. Despite China being one of the countries that was majorly affected by Covid-19 pandemic, it still remains one of the top countries with priorities in FDI. The country has put in place measures to regulate FDI in some sectors as well motivate FDI in other industries. Since China is the highest populated country in the world (OECD, 2023), it can be one of best FDI destination due to its readily available market. It is advisable for MNCs to conduct a thorough evaluation of the market before deciding to enter it to ensure that the market is stable and operation will not be hindered.

References

Bajrami, H., (2019) Theories of Foreign Direct Investment (FDI) and the Significance of Human Capital. In Theories of Foreign Direct Investment (FDI) and the Significance of Human Capital: Bajrami, Hykmete.

Haudi, H., Wijoyo, H. and Cahyono, Y., (2020) Analysis of Most Influential Factors to Attract Foreign Direct Investment. Journal of Critical Reviews, 7(13).

Huld, A. (2022 Dec) China’s Economy in 2022: A Tumultuous Year Ending with an Optimistic Outlook. China Briefing. Available at: https://www.china-briefing.com/news/chinas-economy-in-2022-a-tumultuous-year-ending-with-an-optimistic-outlook/ (Accessed: 30th March 2023).

Meredith, A. (2022Feb) What Languages are Spoken in China? Available at: https://studycli.org/learn-chinese/languages-in-china/ (Accessed: 30th March 2023).

Mistura, F. and Roulet, C., (2019) The Determinants of Foreign Direct Investment: Do statutory Restrictions Matter?.

NDRC. (2021 Feb) Foreign Investment Law of the People’s Republic of China. Available at: https://en.ndrc.gov.cn/policies/202105/t20210527_1281403.html (Accessed: 30th March 2023).

Nguyen, C.H., (2021) Labor Force and Foreign Direct Investment: Empirical Evidence from Vietnam. The Journal of Asian Finance, Economics and Business, 8(1), pp.103-112.

OECD. (2022) Revenue Statistics in Asia and the Pacific 2022-China. Available at: https://www.oecd.org/tax/tax-policy/revenue-statistics-asia-and-pacific-china.pdf (Accessed: 30th March 2030).

OECD. (2023) Population (indicator). doi: 10.1787/d434f82b-en (Accessed: 30th March 2023).

Paul, J., (2019) Marketing in Emerging Markets: A Review, Theoretical Synthesis and Extension. International Journal of Emerging Markets, 15(3), pp.446-468.

Research FDI. (2021 March) Advantages and Disadvantages of Foreign Direct Investments. Available at: https://researchfdi.com/resources/articles/foreign-direct-investment-advantages-disadvantages/ (Accessed: 30th March 2023).

Sabir, S., Rafique, A. and Abbas, K., (2019) Institutions and FDI: Evidence from Developed and Developing Countries. Financial Innovation, 5(1), pp.1-20.

Santander Trade. (2023) China: Foreign Investment. Available at: https://santandertrade.com/en/portal/establish-overseas/china/foreign-investment (Accessed: 30th March 2023).

Szarzec, K., Nowara, W. and Totleben, B., (2021) State-owned Enterprises as Foreign Direct Investors: Insights from EU Countries. Post-Communist Economies, 33(5), pp.517-540.

Tang, R.W. and Buckley, P.J., (2022) Outward Foreign Direct Investment by Emerging Market Multinationals: The Directionality of Institutional Distance. Journal of Business Research, 149, pp.314-326.

UNCTAD. (2022) World Investment Report. Available at: https://unctad.org/system/files/official-document/wir2022_en.pdf (Accessed: 30th March 2023).

World Government Bonds. (2023) World Credit Ratings/China. Available at http://www.worldgovernmentbonds.com/credit-rating/china/ (Accessed: 30th March 2023).

Venugopal, R. (2022) Foreign Direct Investment and the Environment in India (Doctoral dissertation, Politecnico di Torino).

write

write