Introduction

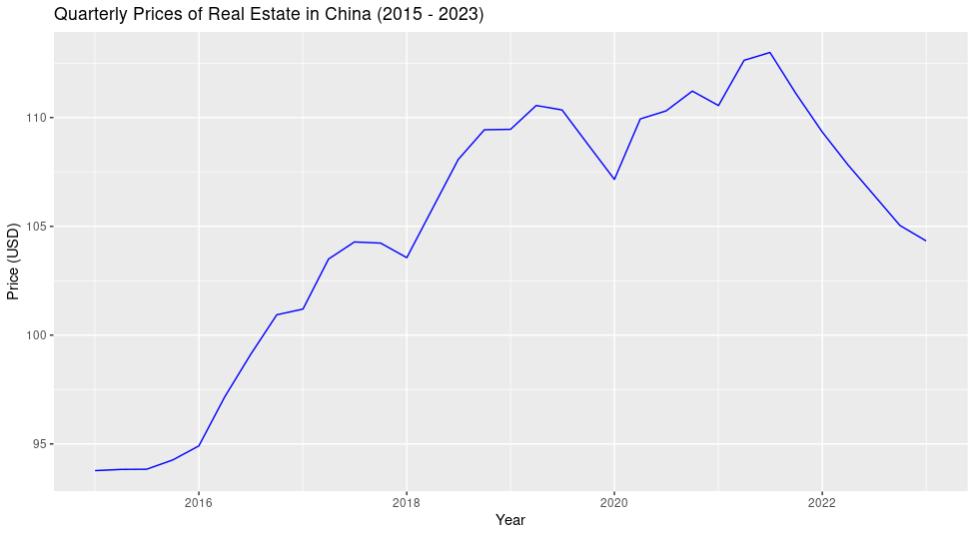

The graph below shows that the price of real estate in China has been increasing steadily over time. The average cost of real estate in China in 2022 was 9,991 yuan per square meter, less than the previous year. China’s real estate market has seen steady price increases since the housing reform 1998. Nowadays, housing in the nation is frequently out of reach, especially given Chinese households’ low per capita income. Some of the world’s most competitive real estate markets may be found in Beijing and Shanghai. Although the sharp rise in property costs has made homeowners wealthier, it has also encouraged speculative behavior among real estate developers and purchasers. Owners of homes expected annual price increases, treating their properties as investments.

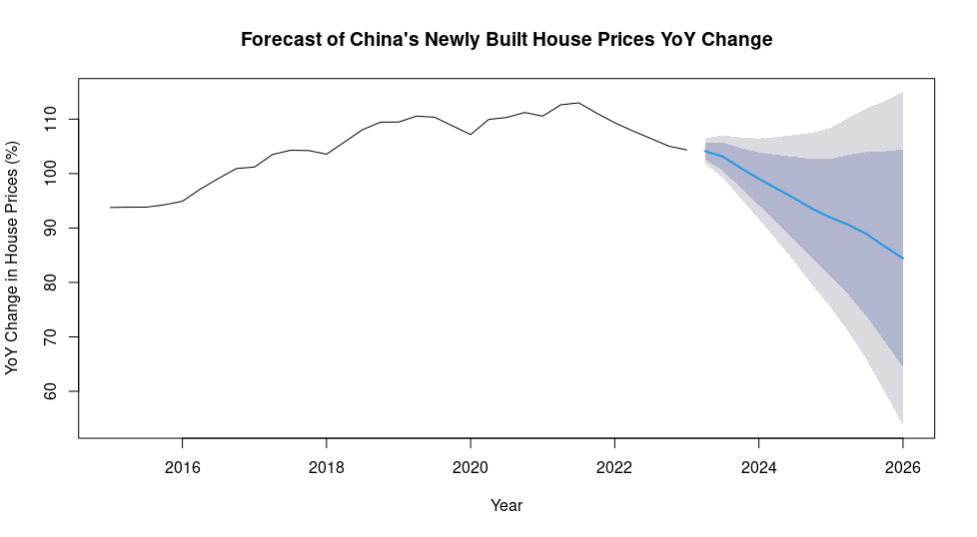

This study explores the influence of the recent economic turmoil in China’s real estate industry on building enterprises in a detailed manner. Using various interest rate scenarios and sophisticated smoothing techniques, the study aims to project a three-year projection of the Year-over-Year (YoY) Change in China’s Newly Built House Prices. Beyond simple forecasting, the research broadens its purview to include creative and specific policy suggestions meant to support and strengthen the real estate industry within the complex structure of China’s economy.

Objective of the study

The study aims to produce a reliable and accurate 3-year forecast of the Year-over-Year (YoY) Change in China’s Newly Built House Prices by utilizing advanced smoothing techniques. With the help of these goals, the study hopes to provide insightful analysis that will help shape focused policy suggestions that would strengthen the stability and prosperity of China’s real estate market.

Methodology

The dataset for Chinese house prices utilized in this study was from FRED (Federal et al.). From the first quarter of 2015 to January 2023, the data was originally acquired in Excel format and subsequently imported into the Posit Cloud platform for analysis. An initial data cleaning process was conducted to ensure the absence of any null values, enhancing the dataset’s reliability and integrity. To visualize the temporal trends and patterns, two essential graphs were created using smoothing: the first graph portrayed the historical data, offering insights into the past dynamics of Chinese house prices. In contrast, the second graph depicted the forecasting results derived from advanced smoothing techniques. These graphical representations served as crucial tools for extracting meaningful insights and patterns. In the subsequent Results and Discussion section, the generated graphs were thoroughly analyzed, providing a foundation for a comprehensive understanding of the dataset and facilitating the formulation of key insights and findings.

Results and Discussion

Recent shifts in the nation’s real estate sector have been reflected in the dangers connected to Chinese enterprises’ high capitalization levels. The long-term correlation between high debt accumulation and high investment levels is causing risks to rise. Beyond the traditional banking industry, non-bank financial companies are becoming the source of debt, offering less reliable funding and more vulnerable to erratic swings in investor mood. Furthermore, there are other ways in which conflicts in major corporate sectors could spread to the rest of the economy. These channels include households whose wealth is heavily exposed to the housing sector. They are becoming more and more leveraged (Dieppe, 2018). The economic shock has impacted building companies in several ways. Tighter laws have prevented borrowing sprees, and speculative construction projects have declined.

The economic shock has had a variety of effects on construction enterprises. Stricter rules have stopped people from taking on excessive debt, and speculative construction projects have declined. Dealing with the debt overhang in some enterprises has been more difficult, particularly since it became known that China Evergrande, one of the biggest developers, owed $300 billion (Apostolou et al., 2022).

The graph below shows that in the next three years, the prices of the newly built house will decrease. Analysts claim that a housing boom fueled by urbanization and population growth has historically been the primary driver of China’s remarkable economic growth, among major nations’ fastest and longest-lasting expansions. Still, more than two years ago, the government-led crackdown on developers’ financing caused a crisis in the property sector, which is vital and accounts for up to 30% of the economy. The property crisis is anticipated to continue, presenting a serious danger to China’s economic prospects for the next three to five years. Last year witnessed the first decrease in real estate investment in a decade, and Beijing will likely take longer to provide a quick fix. According to Alicia Garcia-Herrero, Chief Economist for Asia Pacific at Natixis, absorbing excess capacity is predicted to slow China’s economic growth, with an estimated yearly loss of roughly 1.5 percentage points until 2026 (He, 2023).

Policy Recommendations

China’s government should implement measures like a national “de-stocking” policy to lessen the excess supply of houses in China.

China has to make a gradual but difficult adjustment to meet this dilemma by matching the housing supply with the declining demand brought on by an aging population.

The Chinese government may consider laws promoting real estate investment through subsidies or tax exemptions. Furthermore, the government might think about loosening rules to facilitate developers’ access to funding.

Conclusion

In summary, the historical and projected house price data indicate a marked change in the direction of China’s real estate market, one that should be carefully examined. The research has explored the complexities of the current economic unrest affecting the real estate industry and how it has rippled down to construction companies. Using a dataset obtained from FRED and subjected to sophisticated smoothing techniques, the study reveals the difficulties that businesses encounter in the face of more stringent laws and a decrease in speculative construction projects. According to Alicia Garcia-Herrero, China’s economic growth is seriously threatened by the projected decline in the price of newly constructed homes over the next three years, in addition to the current property crisis.

The report emphasizes the need for deliberate governmental interventions to reduce the surplus supply, adjust housing supply to shifting demand dynamics, and promote real estate investment through focused initiatives. A deliberate and flexible strategy is necessary as China makes its way through this complicated economic landscape to manage the many problems and maintain the stability and growth of its real estate industry.

References

Apostolou, A., Al-Haschimi, A., & Ricci, M. (2022). Financial risks in China’s corporate sector: real estate and beyond. Www.ecb.europa.eu. https://www.ecb.europa.eu/pub/economic-bulletin/articles/2022/html/ecb.ebart202202_01~48041a563f.en.html

Dieppe, A., Gilhooly, R., Han, J., Korhonen, I., & Lodge, D. (2018). The transition of China to sustainable growth–implications for the global economy and the euro area. ECB Occasional Paper, (206).

He, L. (2023, October 6). The real estate crisis | CNN Business will hobble China’s economy for years. CNN. https://edition.cnn.com/2023/10/06/economy/china-economy-real-estate-crisis-intl-hnk/index.html

write

write