Introduction

Amazon Inc. is an American international technology company mainly based on e-commerce, digital streaming, and cloud computing. It is an online retailer, manufactures e-book readers, and provides web services. Over the years it has been in operation, the company has become an iconic example of electronic commerce. Among the commodities offered by the company are industrial items, health and beauty products, books, games, groceries, kid’s products, jewelry, sports products, music, movies, toys, and electronics.

Corporate Governance Analysis:

Amazon Inc. Corporation is a legal entity independent of its owners. In the corporation, it is the responsibility of shareholders to appoint directors, who in turn elect managers. Also, the director’s role is to represent shareholders’ interests and establish the organizational policies that the managers ought to implement. The CEO of Amazon is called Jeff Bezos. His leadership is mainly oriented toward customer focus. According to Bezos, the business should not be concerned about its competitors, generating income for its shareholders, or even the short-term business flow (Mooers, 2020). He is guided by the principle of customer focus, which implies that if the corporation caters to the needs and interests of its customers, then every other thing will fall into place. With such a management perspective, there is a potential risk of neglecting the organization’s internal structures. This could further lead to the exploitation of staff members, especially the casual non-permanent workers.

Other potential conflicts of interest could arise in the corporation. One is nepotism, which involves extending favors to close family and friends, especially by hiring them into the company. In most cases, organizational stakeholders who practice nepotism may even employ relatives that may not be the best for the job. Another potential conflict of interest is self-dealing. This is a situation in which an individual in management portrays external interests and acts in a way that benefits themselves and not the organization. This mainly occurs when someone has been trusted with high-rank organizational operations and violates the trust.

There are conflicts of interest that arise in the workplace. It is common for a staff member to have another business that competes with the employer (Amazon.com). Such an employee could have divided attention between their side business and the corporation leading to lower productivity on the employer’s side. This could result in firing or premature resignation (Aromataris, 2022). Also, a person in the management position may have a romantic relationship or even get married to another employee. Such an occurrence could result in a confidentiality breach since such workers could discuss sensitive organizational matters. Also, a former employee at Amazon.com could start their own business and compete directly using the former employer’s client list. An employee could also develop friendships with an Amazon.com supplier and allow the supplier to go around bidding or even give the supplier the bid.

Conflicts of interest could also arise amongst the boards of directors. In Amazon, board members sign a conflict of the interest policy statement. If any conflict arises from any of them, such a member could be expelled or even get sued. For instance, any director who tries taking the business away from the corporation and giving it to others could be sued. Another common conflict of interest that may arise amongst the board of directors is insider trading (Effron and Raj, 2021). This is an occurrence whereby one board member identifies a potential deal that might affect the selling price of the organizational stock and tries to benefit from it.

Amazon Inc. Corporation manages its image in society in different ways. The organization has established significant financial pillars across payment, cash deposits, and loan advancements. The corporation has evolved, including a digital wallet for its customers and a payment network for merchants. Over time, Amazon.com has continued to build financial services products that support its primary strategic goal. Consequently, the company has been able to develop and launch tools to increase the number of clients on Amazon and even enable them to make purchases quickly and spend more. The company is also able to reduce trading friction. Amazon also employs different marketing channels that direct its clients to its websites. The tracks include sponsored search, email marketing campaigns, and the Associated program.

The corporation acknowledges its social obligation by conducting corporate social responsibility in the community. The company understands that the community significantly influences consumer perception of the organizational goods and services. For this reason, Amazon supports different community interests such as healthcare, education, development support, and environmental conservation.

Stockholder Analysis and Dividend Policy

The stockholder’s breakdown in Amazon.com Inc. is as follows; Institutional investors own 59.96% of the outstanding shares they control, whereby Mutual fund holds 33.37%, and 26.60% is under other institutional stakeholders (AMZN – Amazon.com Inc Shareholders – CNNMoney.com, 2022). Individual stakeholders own 11.47% of the outstanding shares. Insider stockholders own the remaining 28.56% of the shares. The following table shows the top ten owners of Amazon and the stake they hold.

| Stockholder | Stake |

| The Vanguard Group, Inc. | 6.42% |

| BlackRock Fund Advisors | 3.66% |

| SSgA Funds Management, Inc. | 3.21% |

| T. Rowe Price Associates, Inc. | 3.07% |

| Fidelity Management & Research Co. | 2.60% |

| Geode Capital Management LLC | 1.49% |

| Capital Research & Management Co. | 0.99% |

| Northern Trust Investments, Inc | 0.93% |

| Norges Bank Investment Management | 0.83% |

| Capital Research & Management Co | 0.73% |

The topmost individual insider stockholders of Amazon Inc. are Jeff Bezos, Andrew Jassy, and Jeffrey Blackburn (AMZN – Amazon.com Inc Shareholders – CNNMoney.com, 2022).

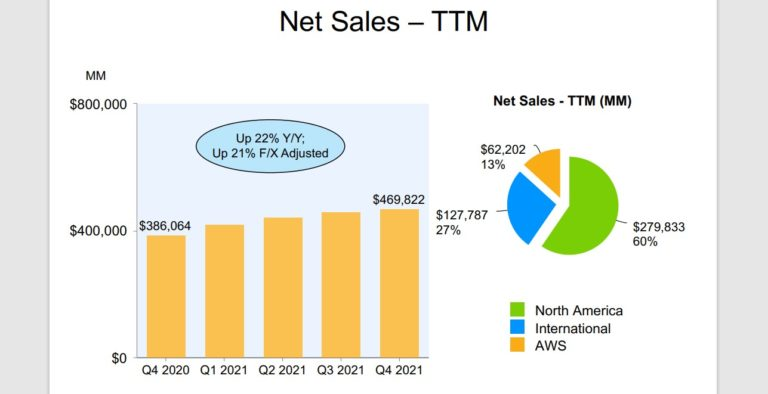

Amazon has not paid dividends to its investors and does not plan to pay them dividends. While the company has had increased income consecutively over the past ten years, Amazon plows back its cash flow into the business instead of returning cash to the shareholders. Amazon Inc. has a market cap higher than 1.4M US dollars (Ciura, 2022). The company operates in North America and internationally and offers web services. International and North American sectors include the global retail platform for consumer goods through the organizational web. The web facilities sector provides subscriptions of cloud computing and storage facilities to start-ups, consumers, administration agencies, enterprises, and educational institutions. The e-commerce sector has generated high organizational income over the past decade. However, it is essential to note that the company spent a lot of money to build its retail operations. Consequently, the company’s profit margin was significantly low for many years of its growth phase. However, it is essential to note that the company made profits every year in the past 10 years except in 2014.

By the end of 2021, Amazon.com had increased its revenue by 9% to 137.4B USD from 125.6 USD in 2020. The company also had a higher rate of earnings per share of $64.81 compared to $41.83 in 2020. The continuous revenue growth over the years in the company is an indication of likely dividend payments in the future.

Given that the company is significantly profitable, it can pay dividends to its stockholders if it chooses to. However, Amazon could take a while before beginning to pay dividends. The reason is that the profits could be used in other areas such as reinvestment in prospective growth projects, debt payments, payment of dividends, or even buying back shares. If the organization chooses to pay dividends to its shareholders, the payout is likely to be small as far as the dividend yield is concerned. An example of a 50% payout ratio, the dividend of 32.40 USB per share equates to a 1.1% yield. Also, there is significantly high pressure on the organizational revenue and cash flow caused by the increasing costs. Therefore, Amazon is unlikely to declare dividends for its shareholders in the near term.

Valuation metrics

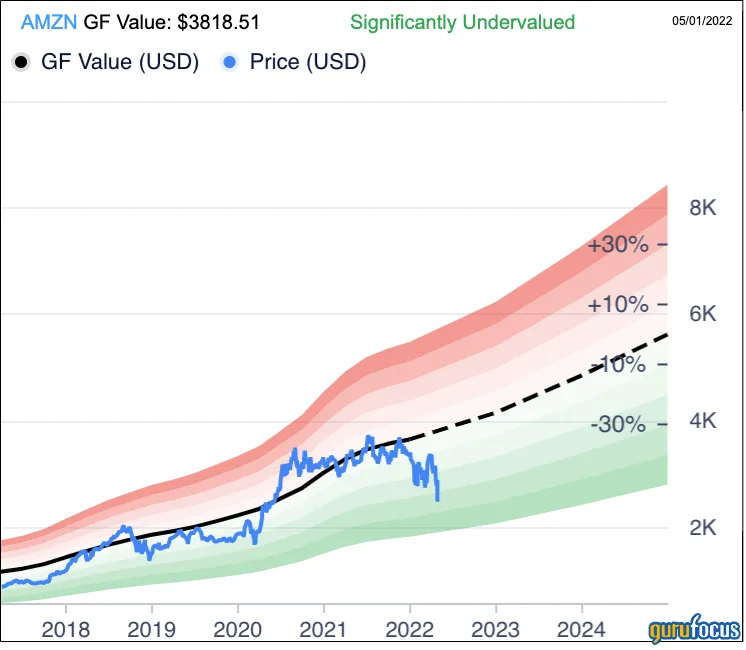

Over the years it has been in operation, Amazon Inc. Corporation has dominated the e-commerce market. However, the company’s stock price has recently declined by 14%. This decreased the stock price by 32% from its all-time high (Yahoo is part of the Yahoo family of brands, 2022). The price-sales ratio is currently 2.73, which marks the lowest proportion since the last drop in 2006. According to the graph below, the stock in the corporation is undervalued.

The main competitor of Amazon Inc. Corporation is Alibaba. In terms of the gross merchandise value, Alibaba generated 1.2 trillion USD in 2020, compared to Amazon, which generated $575B. However, it is essential to note that even with the lower GMV, Amazon generated more revenue than Alibaba bringing its revenue to 469.8B USD in 2021, while Alibaba achieved an income of $127.9B in 2021. The two companies maximize their profitability through different channels. Amazon generates most of its profits from cloud computing services (Alibaba vs. Amazon, 7 Differences & Similarities, 2022). On the other hand, Alibaba generates profits only from e-commerce business but loses money in non-retail companies such as web services.

Similar to Amazon.com, Alibaba is also undervalued. Currently, Alibaba’s price-to-earnings ratio is 33, which is significantly low. The P/E percentage in Amazon is higher than that of Alibaba, which implies that Alibaba is more undervalued compared to Amazon. This risks both organizations since a favorable EV/EBIT should be below 10. The EV/EBIT for Alibaba totals 14 while that of Amazon is 44, which is more than three times higher (Alibaba Shares Are Undervalued But Are Not A Buy Just Yet (NYSE: BABA), 2022). The P/B for Alibaba is quite impressive compared to Amazon’s since they have 1.9 and 8.3, respectively. An ideal P/B is one close to 3. Amazon Inc is based in America and makes most of its sales in the US, UK, Germany, and Japan. On the other hand, Alibaba is based in China and generates most of its revenue from China. Amazon imposes a sales commission on merchants, who also pay advertisement fees and logistic services fees. On the other hand, Alibaba does not charge transaction fees on Taobao listings.

Capital structure:

Amazon gets its funds through different channels, such as loans from Fintech organizations and other alternative lenders. There is a range of fintech companies such as Payability, Sellers Funding, and AccrueMe. AccrueMe offers funds upto 1M USD to businesses with more than 6 months’ track record. The loans have no interest, monthly payments, or loss of ownership to the service provider. Business term loans have financed the corporation for quite a long time. One significant advantage of business term loans is that they are suitable for progressive organizations later in their lifecycle. However, it is hard for early-stage businesses to secure such loans since they mainly consider a company’s credit history.

The company also uses merchant cash advances (MCAs) and peer-to-peer lending. MCAs suit businesses with relatively low credit scores and lack a decent cash flow. One advantage is that it has a quick approval, requires minimal documentation, and rarely any credit checks or no collaterals are necessary. The disadvantage of these loans is that they have a higher interest rate than the others. On the other hand, peer-to-peer lending is more flexible because the lender uses more than the credit score to assess the business. However, its approvals take longer, and the interest rate is also significantly high. In the case of peer-to-peer lending, more documentation is needed regarding financial records of the business, credit checks, and comprehensive business plans.

Currently, the value of the total assets for Amazon is USD 321.195M, and the total liabilities value is 227.791M. The total equity is USD 93.404M (Biswas, 2022). Given the figures, the debt to equity ratio is acquired by dividing total liabilities by total equity, which gives 2.44. On the other hand, Alibaba has a debt-to-equity ratio of 30.29%. This implies that Amazon is better positioned to handle its debts, given that it generates way more income than its debts. On the other hand, Alibaba seems to be financially unstable, given that it has a high debt-to-equity ratio.

Reference List

Aromatic, E., 2022. Compounding conflicts of interest: including an author’s own work in a systematic review. JBI Evidence Synthesis, 20(8), pp.1869-1870.

Biswas, A., 2022. Sources of Finance – Debt, Equity & Hybrid. [online] Blog.learnsignal.com. Available at: <https://blog.learnsignal.com/blog/sources-of-finance-debt-equity-hybrid> [Accessed 22 August 2022].

Ciura, B., 2022. Will Amazon Ever Pay A Dividend?. [online] Sure Dividend. Available at: <https://www.suredividend.com/amazon-dividend/#:~:text=Amazon%27s%20lack%20of%20a%20dividend,lack%20of%20a%20dividend%20payment.> [Accessed 22 August 2022].

Effron, DA and Raj, M., 2021. Disclosing interpersonal conflicts of interest: Revealing whom we like, but not whom we dislike. Organizational Behavior and Human Decision Processes, 164, pp.68-85.

Finance.yahoo.com. 2022. Yahoo is part of the Yahoo family of brands. [online] Available at: <https://finance.yahoo.com/news/amazon-plummets-14-stock-undervalued-171834124.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAMCMdHL0YUEEKFganmvZmX2JLTHQNu31tzsbVV5fpwJASdz_N6KAPzHPJNhRNlX9FFrtu2x24OcL0RGYYpaYjjsAkVIwfcWmutxiSJOWdkG-9OUNybCXjbV_vBxW3EPW0G_VrZYvdtE_xsPwSipBxfioT65-iufvjUJqIPLwUAr-#:~:text=According%20to%20the%20GF%20value,the%20stock%20is%20significantly%20undervalued.> [Accessed 22 August 2022].

Indigo9 Digital Inc. 2022. Alibaba vs. Amazon, 7 Differences & Similarities. [online] Available at: <https://www.indigo9digital.com/blog/alibabaamazonsimilaritiesdifferences#:~:text=Alibaba%20is%20the%20largest%20eCommerce,while%20Amazon%20generated%20%24575%20billion.> [Accessed 22 August 2022].

Money.cnn.com. 2022. AMZN – Amazon.com Inc Shareholders – CNNMoney.com. [online] Available at: <https://money.cnn.com/quote/shareholders/shareholders.html?symb=AMZN&subView=institutional> [Accessed 22 August 2022].

Mooers, J., 2020. Review and Analysis of All Shareholder Letters from Warren Buffett and Jeff Bezos. SSRN Electronic Journal,.

SeekingAlpha. 2022. Alibaba Shares Are Undervalued But Are Not A Buy Just Yet (NYSE:BABA). [online] Available at: <https://seekingalpha.com/article/4519909-alibaba-shares-are-undervalued-but-are-not-a-buy-just-yet> [Accessed 22 August 2022].

write

write