Introduction

Foreign direct investment (FDI) is a crucial driver of economic growth and development, as it can bring in new capital, create jobs, transfer technology, and stimulate local economies. Thailand, located in Southeast Asia, is one of the region’s most attractive destinations for FDI due to its strategic location, business-friendly policies, skilled workforce, and abundant natural resources (Wahyuni et al., 2013). This paper aims to discuss and analyze the FDI and attractiveness of Thailand, focusing on its economic and political environment, investment policies, and prospects for future growth.

Economic and Political Environment

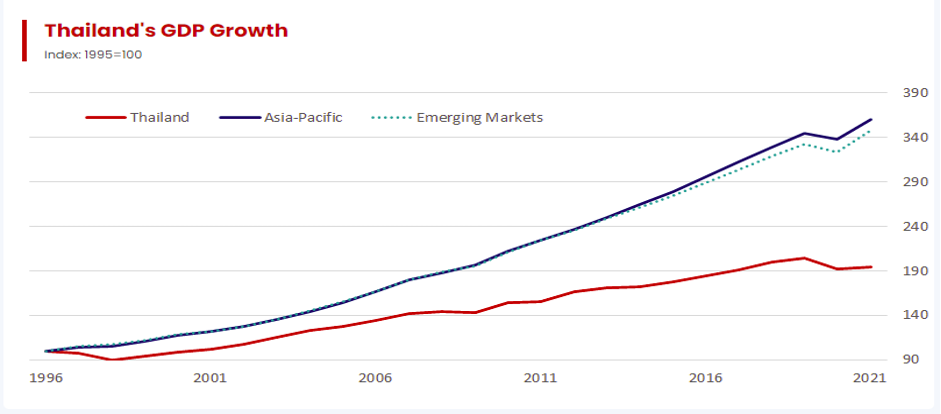

Thailand has a mixed economy that is heavily dependent on exports and tourism. Its GDP in 2020 was $505 billion, and it is the second-largest economy in Southeast Asia after Indonesia. The country’s economic growth has been hampered in recent years by political instability, social unrest, and the COVID-19 pandemic (Arnakim & Kibtiah, 2021 pg. 4). However, Thailand’s economy is expected to recover in the coming years, driven by the government stimulus measures, infrastructure projects, and the expansion of key industries, such as automotive, electronics, and food processing.

Thailand’s political environment has been volatile in recent years, with frequent changes in government and periods of social unrest. The military has played a prominent role in Thai politics and has experienced several coups. However, the current government has been in power since 2014 and has implemented several reforms to improve the business environment and attract foreign investment.

Investment Policies

Thailand has a business-friendly environment, and the government has implemented several policies to attract foreign investment. The Board of Investment (BOI) is the main agency responsible for promoting and facilitating FDI in Thailand. The BOI offers a range of incentives, such as tax exemptions, import duty exemptions, and permission to own land, to attract foreign investors (Wahyuni & Utari, 2013 pg. 3). The agency also offers a one-stop service for investment applications, streamlining the investment process and reducing bureaucracy.

Thailand’s policies aim to attract foreign investment in several key sectors, including manufacturing, agriculture, services, and technology. The country’s skilled workforce, high literacy rate, and strong education system make it an attractive destination for knowledge-based industries like IT and biotechnology. With a focus on these sectors, Thailand offers an environment conducive to foreign investment, enabling businesses to leverage the country’s resources and skilled workforce to drive growth and profitability.

Case study

Toyota has been operating in Thailand for over 50 years and has invested heavily in the country’s automotive industry. The company has established several production facilities in Thailand, including a factory that produces engines for export to other countries (Kaosa-Ard, 1993). The investment has created jobs for thousands of Thai workers and contributed to developing the country’s automotive industry.

Intel Corporation is another example of successful FDI in Thailand. The company has been operating in the country since 1995 and has invested over $5 billion. Intel’s investment has created jobs for thousands of Thai workers and contributed to developing the country’s high-tech industry. Thailand’s semiconductor manufacturing facilities supply computer processors to customers worldwide.

The attractiveness of Thailand for FDI

Thailand’s attractiveness for FDI stems from several factors. Firstly, its strategic location in Southeast Asia provides access to markets and supply chains in the region. Secondly, Thailand has business-friendly policies that support foreign investment, such as the Board of Investment’s incentives and streamlined investment application process (Wahyuni & Utari, 2013 pg. 3). Thirdly, investors can leverage the country’s skilled workforce and abundant natural resources.

Thailand’s diverse economy is another aspect that makes it an attractive destination for foreign investors. The country has a range of industries, from automotive and electronics to textiles and food processing, that offer opportunities for investment and growth. Additionally, Thailand is known for its tourism industry, which contributes to the country’s economy and provides opportunities for investment in related sectors such as hospitality and leisure.

Thailand’s infrastructure and logistics industry are also key factors that make it an attractive destination for foreign investors. The country has well-developed airports, seaports, highways facilitating trade and commerce, and a well-established logistics industry that can efficiently transport goods across the region. These factors make it easier for businesses to operate in Thailand and regional access markets, contributing to the country’s attractiveness for FDI.

Prospects for Future Growth

Thailand’s prospects for future growth are positive, as the country is expected to recover from the COVID-19 pandemic and continue to attract foreign investment (Ren & Jiang, 2021 pg. 3). The government has implemented several stimulus measures, such as tax cuts and infrastructure projects, to support the economy. The country is also promoting the development of key industries, such as electric vehicles, digital technology, and medical tourism.

However, there are some challenges that Thailand needs to address to maintain its attractiveness to foreign investors. These include political stability, corruption, and the availability of skilled workers. The country also needs to address environmental issues, such as air pollution and deforestation, which can affect the quality of life and impact the tourism industry.

Recommendation

Based on the analysis of Thailand’s economic and political environment, investment policies, and prospects for future growth, it is recommended that foreign investors consider Thailand as an attractive destination for FDI (Krongkaew, 2004, pg. 236). The country’s business-friendly policies, skilled workforce, and well-developed infrastructure make it a desirable location for foreign investors looking to expand their operations in Southeast Asia.

The Thai government has demonstrated its commitment to attracting FDI by offering incentives, streamlining the investment process, and promoting investment in key sectors, such as manufacturing, agriculture, services, and technology. The success stories of Toyota and Intel Corporation serve as examples of the potential benefits of investing in Thailand.

Despite some challenges, such as political instability, corruption, and environmental issues, Thailand’s prospects for future growth are positive. The government has implemented measures to support the economy and promote the development of key industries. Thailand is well-positioned to continue attracting FDI in the coming years.

Conclusion

In conclusion, Thailand’s attractiveness for FDI is supported by various factors, including its strategic location, business-friendly policies, skilled workforce, and diverse economy. The government’s investment policies, such as the BOI’s incentives and streamlined investment process, have also contributed to the country’s attractiveness to foreign investors. Despite some challenges, such as political instability and environmental issues, Thailand’s prospects for future growth are positive, driven by government stimulus measures and the development of key industries. Thailand remains a top destination for foreign investors in Southeast Asia, with its economic growth and development potential.

References

Arnakim, L. Y., & Kibtiah, T. M. (2021). Response of ASEAN member states to the spread of COVID-19 in Southeast Asia. IOP Conference Series: Earth and Environmental Science, 729(1), 012100. https://doi.org/10.1088/1755-1315/729/1/012100

Krongkaew, M. (2004). The development of the Greater Mekong Subregion (GMS): real promise or false hope? Journal of Asian Economics, 15(5), 977–998. https://doi.org/10.1016/j.asieco.2004.09.006

Wahyuni, S., Astuti, E., & Utari, K. (2013). CRITICAL OUTLOOK AT SPECIAL ECONOMIC ZONE IN ASIA: A COMPARISON BETWEEN INDONESIA, MALAYSIA, THAILAND AND CHINA 1. Journal of Indonesian Economy and Business, 28(3), 336–346.

Wahyuni, S., & Utari, K. (2013, September 19). Attracting Investors into Thailand: The Strategy Implementation and Affectivity. Papers.ssrn.com. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2328224

Ren, Z., & Jiang, T. (2021, August 4). Thailand’s Epidemic Prevention and Control and Economic Recovery Policies. Www.atlantis-Press.com; Atlantis Press. https://doi.org/10.2991/aebmr.k.210803.008

Kaosa-Ard, M. S. (1993). TNC involvement in the Thai auto industry. TDRI Quarterly Review, 8(1), 9-16.

write

write