Executive Summary

The Australian economy reported significant growth of 3% in chain volume in the current financial year; labour productivity declined by 3.7%, and the household savings ratio dropped to 4.3% from 12.6%. At the same time, the country’s national net worth increased by $1.3 trillion to $19.0 trillion in the 2022/2023 financial year (Australian Government (2022). Policymakers combine fiscal and monetary policies to mitigate the negative effects of economic downturns and promote stability and growth of the country. The relationship between interest, inflation and exchange rates in the Australian economy is intricate, as the influence of one variable triggers a cascading impact on other variables, requiring policymakers to consistently and carefully evaluate the interaction of these variables while formulating economic and monetary policies (Bullen et al., 2014). Also, business entities and investors should assess these relationships to make informed business or investment decisions, particularly in the modern, highly dynamic economic environment.

Introduction

The analysis of the macroeconomic performance of Australia under the dynamic economic environments is evaluated based on economic indicators like real GDP, unemployment rates, inflation rates, interest rates (Cash rate target), exchange rates ($US/$A), and exports and imports. The economy impacts the Austrian performance as it influences the business cycle that drives the productivity and performance of any economy (Reserve Bank of Australia (2022). The Australian economy reported significant growth of 3% in chain volume in the current financial year; labour productivity declined by 3.7%, and the household savings ratio dropped to 4.3% from 12.6%. At the same time, the country’s national net worth increased by $1.3 trillion to $19.0 trillion in the 2022/2023 financial year (Australian Government (2022). The evaluation of the Australian economy entails the understanding of the nation’s real GDP, unemployment rates, inflation rates, interest rates (Cash rate target), exchange rates ($US/$A), and exports and imports through data analysis (World Bank, (2022). The report captures the data collection, analysis through charts or graphs, and statistical summary analysis like a business cycle in a real GDP growth, Inflation, unemployment, and Australian trade performance encompassing imports and exports.

Using the graphs and statistical summaries of the data collected

The data collected for the selected period 2001 to 2023 is captured in the Excel spreadsheet. The data analysis involves creating graphs and descriptive statistical summaries to evaluate and analyze the data as captured in the Excel spreadsheet.

Identify and discuss the impact of the business cycle on the following variables: Real GDP growth rate, inflation rate, unemployment rate, and Australia’s trade performance (exports & imports)

The business cycle describes the fluctuation and movement in economic activity that the Australian economy experiences over time, illustrated by features like expansion and contraction of real GDP periods. The economy can impact Australian businesses greatly, causing them to flow through the business cycle, which describes the overall trends of the economy and can show high or negative growth. The stages in a business cycle are expansion (the economy has high demands), peak (the turning point of the expansions before the economy falls), contraction (demand for goods and services is low), and trough (the opposite of a peak). In evaluating Australia’s current economic status, factors like unemployment, Inflation, interest, and exchange rates are.

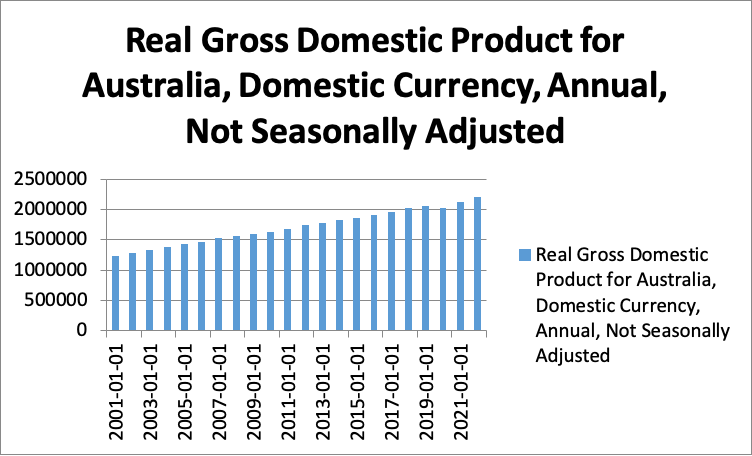

Real GDP Growth Rate

Australia’s real GDP increased from 2001 to 2023, as illustrated in the chart above. During the business expansion phase, the real GDP of Australia tends to accelerate because of an increase in consumer spending, business investment, and economic activity that accumulatively contributes to the country’s economic growth. For instance, the increase or decrease in exports could lead to higher production and economic output or a decline in economic growth.

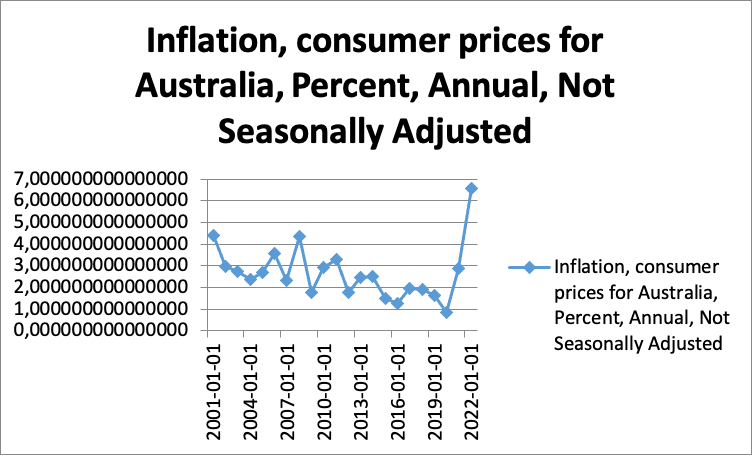

Inflation Rate

Based on the chart above, the inflation rate fluctuates from time to time through diverse business cycle movements. The expansion phase creates high demand, triggering an increase in product prices, which is further driven by an increase in export demand in Australia (Reserve Bank of Australia (2022). During periods of recession, product prices decrease because of demand reduction, consumer spending and business investment, and a contracting business cycle phase.

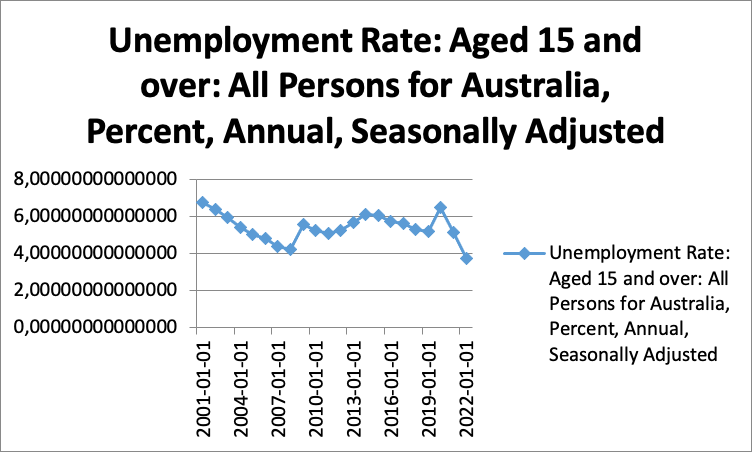

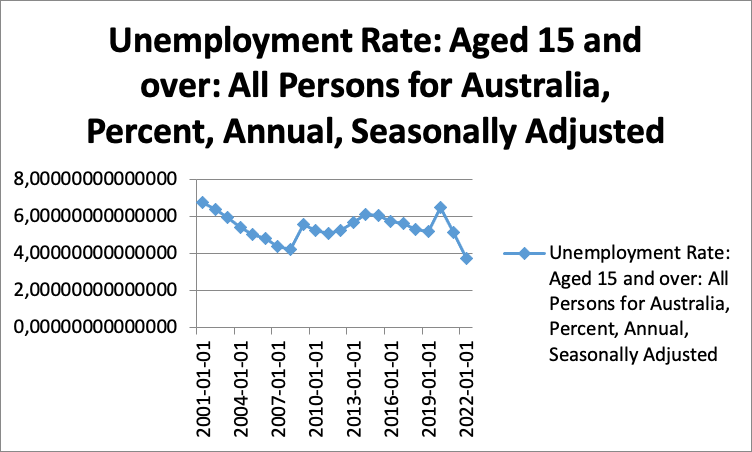

Unemployment Rate

The expansion phase of the business cycle illustrates a situation where the economy is experiencing growth, creating opportunities to hire more workforce to satisfy the increasing demand. Therefore, the unemployment rate tends to decline during the expansion phase of the business cycle because of increased job opportunities (chart above). During the recession, business organizations reduced production to align with prevailing demand, thus increasing unemployment as workers are laid off, deteriorating consumer spending, and exacerbating the economic downturn.

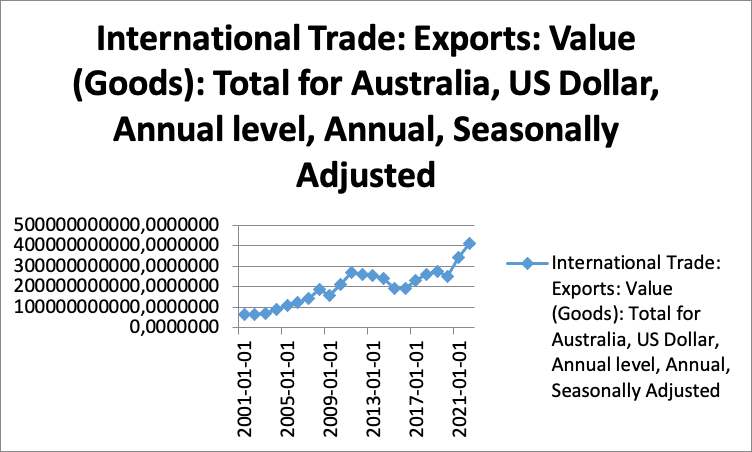

Trade Performance (Exports & Imports)

The expansion phase of the business cycle in the Australian economy contributes to an increase in both domestic and international demand for products and services. For instance, demand for Austrian exports is high due to expansion in the global economy, contributing to a progressive trade balance. The contraction business cycle phase emerges during a recession characterized by weakened global demand and deteriorating demand for Australian exports, although weaker domestic currency tends to make exports more competitive (Bruno, Dunphy, and Georgiakakis, 2023).

In summary, the business cycle has a multifaceted impact on various economic variables, and these effects can be observed in the context of real GDP growth rate, Inflation, unemployment, and trade performance. Policymakers combine fiscal and monetary policies to mitigate the negative effects of economic downturns and promote stability and growth of the country.

Discuss the relationship between the movements of Inflation, interest, and exchange rates.

The relationship between Inflation, interest, and exchange rates is complex and interconnected. Changes in one of these variables can influence the others, and understanding these relationships is crucial for policymakers, businesses, and investors. Let’s discuss the dynamics among inflation rate, interest rate, and exchange rate in the context of the Australian economy.

Inflation Rate

The inflation rate describes the rate that captures the price change in products and services in an economy, contributing to a reduction in the purchasing power of the country’s currency. When the level of Inflation in Australia is high, the value of its currency or money declines, adversely affecting consumer purchasing power and confidence. For instance, the economy’s international competitiveness is affected when Inflation is high and domestic prices of the firm increase at a fast rate compared to the economy’s trading partners.

Interest Rate

The Reserve Bank of Australia (RBA) utilizes interest rates as a strategic tool to control Inflation and attain economic stability by fluctuating the interest rate to cool down or stimulate economic activities respectively (Huynh, Mallik, and Hettihewa, 2006). An increase in interest rate escalates borrowing costs while lowering interest rate makes borrowing appealing, minimizing and increasing consumer and business spending appetite, respectively.

Exchange Rate

Describes the value of Australian currency in terms of another currency like the USD. The variation in interest rates between the US and Australia impacts the exchange rate. For instance, the high-interest rate in Australia relative to the US attracts foreign capital searching for higher returns, causing the value of AUD to appreciate; the reverse is also true.

Relationship Dynamics

The country’s policy utilizes the relationship between interest rates and Inflation to regulate market prices. For instance, the Australian Government strategically increases interest rates to combat Inflation by increasing the cost of borrowing to minimize consumer spending and business investment ability. The approach is instrumental in cooling down the overheated economy and managing inflationary pressures in the market. Equally, the link between interest rate and exchange rate manages the supply and demand for the Australian currency in the market. For example, when the interest rate in the Australian economy is high, it attracts foreign investment/capital, escalating the demand for the Australian dollar and triggering depreciation in the competitive market’s value (Huynh, Mallik, and Hettihewa, 2006). It creates beneficial and adverse implications for the economy as a strong domestic currency makes the importation of goods affordable, but it curtails export competitiveness.

The inflation exchange rate relates to the fact that higher inflation rates in Australia compared to trading partners cause the Australian dollar to decline in value. It makes exporting domestic products and services attractive and competitive but increases the cost of importing needed products and services into the country (Dada, 2023). Further, external variables like geopolitical activities and global economic conditions significantly influence the exchange rate independent of Inflation and interest rates. The relationship between interest, inflation and exchange rates in the Australian economy is intricate, as the influence of one variable triggers a cascading impact on other variables, requiring policymakers to consistently and carefully evaluate the interaction of these variables while formulating economic and monetary policies (Bullen et al., 2014). Also, business entities and investors should assess these relationships to make informed business or investment decisions, particularly in the modern, highly dynamic economic environment.

Discuss the supply side effects on Australia’s inflation rate and real GDP and, hence, government monetary policies in Australia.

The macroeconomic landscape of the economy is influenced by supply-side variables like regulatory policies, technological advancement, production efficiency and labour productivity of goods and services (Bruno, Dunphy, and Georgiakakis, 2023). The focus is to evaluate the impact of supply-side variables on the nation’s real GDP rate, inflation rate, and implications for government monetary policies.

Inflation Rate

The changes in productivity lower business operation costs as goods and services prices are low, contributing to low inflationary pressure. In comparison, disruptions in supply-side variables trigger geopolitical and natural calamities that escalate production expenses that imply an increase in product and service prices. The conditions also influence Inflation in the labour market, such as an increase in wages due to skill shortages, and alteration in labour market conditions escalates the inflation rate; the opposite is also true.

Real GDP rate

Technology and Innovation lead to increased production efficiency and real GDP rate due to automation, digitization, and improvements in production operations and processes. Supply-side constraints, like resource shortages and production bottlenecks, limit real GDP growth (Read, 2022). It occurs because of challenges in accessing raw materials, and infrastructure limitations hinder economic production capacity.

Government Monetary Policies

The Reserve Bank of Australia (RBA) use Inflation targeting as a key objective of monetary policy where improvement in the supply side lowers the economy’s inflationary pressures, empowering the RBA to enjoy flexibility in implementing accommodative monetary policies to support economic growth (Australian Bureau of Statistics (2022). Also, the supply side influences the output gap (difference between actual and estimated GDP) as an increase in potential GDP drives monetary policy decisions. The RBA adopts expansionary policies to close the output gap when the economy is operating below its potential. The RBA adjust interest rates to realize inflation targets and support sustainable economic growth. For example, improvement in supply-side forces leads to lower Inflation; the RBA has an opportunity to sustain a lower interest rate for a certain extended period to stimulate economic activity.

Conduct a simple regression analysis to investigate how real GDP growth and Inflation have influenced the interest rates in Australia. Discuss the estimated effects.

The regression analysis evaluates the linear relationship between variables such as real GDP growth rate, inflation rate and the interest rate in Australia.

| SUMMARY OUTPUT | ||||||||

| Regression Statistics | ||||||||

| Multiple R | 0.312122 | |||||||

| R Square | 0.09742 | |||||||

| Adjusted R Square | 0.052291 | |||||||

| Standard Error | 1.227603 | |||||||

| Observations | 22 | |||||||

| ANOVA | ||||||||

| Df | SS | MS | F | Significance F | ||||

| Regression | 1 | 3.253182 | 3.253182 | 2.1587 | 0.15732 | |||

| Residual | 20 | 30.1402 | 1.50701 | |||||

| Total | 21 | 33.39338 | ||||||

| Coefficients | Standard Error | t Stat | P-value | Lower 95% | Upper 95% | Lower 95.0% | Upper 95.0% | |

| Intercept | 1.973042 | 0.539193 | 3.659252 | 0.001558 | 0.848306 | 3.097777 | 0.848306 | 3.097777 |

| Interest Rates: 3-Month or 90-Day Rates and Yields: Interbank Rates: Total for Australia, Percent, Annual, Not Seasonally Adjusted | 0.193767 | 0.131881 | 1.469252 | 0.15732 | -0.08133 | 0.468866 | -0.08133 | 0.468866 |

The evaluation of the relationship between the various variables shows that there is a positive relationship between the real GDP rate and Inflation within the integration of the Australian economy, as captured in the above regression model summary table. The assessment of how real GDP growth and Inflation influence interest rates indicates that high real GDP tends to cause an increase in interest rates as the central bank uses the integrated rate to prevent inflationary pressure on the Australian economy. The r-squired value rate of 9.42% shows the variables’ variance rate as reflected in the Excel spreadsheet of data analysis (Ville and Merrett, 2006).

Briefly Discuss the Likely Macroeconomic Policies The Australian Government Is Expected to Implement in The Next 24 Months.

Monetary policies are instrumental in streamlining the operation and economic performance of the country in a significant way. Economic conditions are valuable to policymakers as they assess the prevailing economic forces in the market, such as the real GDP growth rate, employment and unemployment rates, interest rates, and inflation rates (Liu and McKibbin, 2022). The Australian economy is experiencing positive economic growth, and policymakers want to adopt contractionary measures to slow down Inflation. In cases where the Australian economy experiences an economic slowdown, the Government adopts expansionary monetary policies in the next 24 months to stimulate economic growth and activities.

Australia may formulate Inflation Targeting through the RBA (central bank) as the primary policy objective to fix economic performance in the next 24 months. The Central Bank of Australia strategically adjusts the interest rates to mitigate the deferential and deviation of inflation rates from the target range (Dada, 2023). Adjusting the interest rate systematically restores the economy inflation rate to a desired range within two years.

Further, Australian policymakers can mitigate and stimulate economic performance through employment and unemployment policy decisions over 24 24-month periods (Reserve Bank of Australia (2022). The Government adopts policies that influence job creation and support workers as a manoeuvre to mitigate the high rate of unemployment and weak employment growth in the Austrian economy.

The employment and unemployment rate and global economic conditions impact the Australian economy significantly. The monetary policymakers evaluate the dynamics of trade, global trends, and external risks to come up with policies that stimulate or sustain the Australian economy over the 24-month period. Environmental and Climatic Change Sustainability objectives must be reflected in the monetary policy decisions as the Australian Government must explore mechanisms to ensure it aligns its economic policies to prevailing environmental variables and objectives (Bullen et al., 2014).

Financial Stability and exchange rates are valuable in formulating monetary policies for economic performance measures. Australian policymakers aim to sustain financial stability by monitoring the banking sector and implementing monetary policy measures to address risks and prevent systemic issues. The exchange rate affects Australia’s international competitiveness. Therefore, policymakers should integrate measures to influence the exchange rate, particularly when concerns about export competitiveness and external imbalances arise.

Conclusion

The Australian Government can coordinate fiscal and monetary policies to effectively realize the country’s economic objectives. For instance, balancing fiscal and monetary policies is instrumental in salvaging the economy during economic uncertainty (Debelle, 2018). It is worth noting that future policy decisions are influenced and align with prevailing economic and geopolitical environments and conditions as governments purely respond and adjust policies to harmonize with conditions in the global market. The relationship between interest, inflation and exchange rates in the Australian economy is intricate, as the influence of one variable triggers a cascading impact on other variables, requiring policymakers to consistently and carefully evaluate the interaction of these variables while formulating economic and monetary policies (Bullen et al., 2014). Also, business entities and investors should assess these relationships to make informed business or investment decisions, particularly in the modern, highly dynamic economic environment.

References

Australian Bureau of Statistics (2022). Australian Bureau of Statistics. [online] Available at: http://www.abs.gov.au/ [Accessed 12 January 2023].

Australian Government (2022). Budget Documents. [online] Available at: https://www.budget.gov.au/2022-23/content/documents.html [Accessed 12 January 2023].

Bruno, A., Dunphy, J. and Georgiakakis, F., 2023. Recent Trends in Australian Productivity| Bulletin–September 2023.

Bullen, J., Greenwell, J., Kouparitsas, M., Muller, D., O’Leary, J. and Wilcox, R., 2014. Treasury’s medium-term economic projection methodology (No. 2014-02). Treasury Working Paper.

Dada, S.A., 2023. The impact of real effective exchange rate and its volatility on economic growth in the OECD (Master’s thesis, Işık Üniversitesi).

Debelle, G., 2018. Twenty-five Years of Inflation Targeting in Australia| Conference–2018.

Goodwin, N., Harris, J.M., Nelson, J.A., Rajkarnikar, P.J., Roach, B. and Torras, M., 2022. Macroeconomics in context. Routledge.

Huynh, W., Mallik, G. and Hettihewa, S., 2006. The impact of macroeconomic variables, demographic structure and compulsory superannuation on share prices: the case of Australia. Journal of International Business Studies, 37, pp.687-698.

Liu, W. and McKibbin, W., 2022. Global macroeconomic impacts of demographic change. The World Economy, 45(3), pp.914-942.

Read, M., 2022. RDP 2022-09: Estimating the Effects of Monetary Policy in Australia Using Sign-restricted Structural Vector Autoregressions. Reserve Bank of Australia Research Discussion Papers, (December).

Reserve Bank of Australia (2022). Statistical Tables. [online] Available at: https://www.rba.gov.au/publications/smp/ [Accessed 12 January 2023].

Ville, S. and Merrett, D., 2006. A New Macroeconomic Time Series: Business Profitability in Twentieth-Century Australia.

World Bank, (2022). World Development Indicators. [online] Available at: http://datatopics.worldbank.org/world-development-indicators/ [Accessed 12 January 2023].

write

write