Introduction

Ultimately, the global financial markets, the gross domestic product of different countries, and overall investment opportunities depend on macroenvironmental aspects such as oil price volatility. To this effect, it has significant implications for the financial sector, specifically focusing on investors. A case in point is that oil price volatility impacts investor power in both the United States and Canadian markets; therefore, analyzing the current state of activities and future trends is integral in providing remedies on how investors can cope with global trends in oil price fluctuation. In this case, oil price volatility refers to the level at which oil. Prices fluctuate upwards or downward in the contemporary market. The susceptibility of investors to risks in oil prices has shown different future directions and trends, such as integrating ESG criteria in investment under the integration of other data analytics to guarantee investment viability. The aspects remain vital in engaging investments and identifying viable financial markets, depending on impact investments and strategic investments done by organizations in different sectors.

Key Issues Regarding Market Volatility And Oil Pricing

Investor Education

There has been a growing need to enhance investor education to understand aspects of oil prices and activity in the financial sector. The impact on organizations’ potential return on investment is integral because it helps understand the trajectory and future trends. Therefore, investors should understand the risk management strategies and other market dynamics linked to global oil price fluctuations or stability. Understanding sustainable practices such as green financing and bonds is vital to transforming investment practices. It also has an impact on the overall dynamics of global regulation. To the effect in the financial sector and navigating volatility, investor education remains essential in ensuring calculated and well-informed investments by investors. The need for investor education emanates from the knowledge needed to understand predictive models, market impacts, and alternatives such as ESG integration for long-term investments in contemporary markets.

Data Analytics

Conversely, contemporary activities in investor trends in the financial sector are linked to data analytics. A better understanding of the oil price volatility and how it is affected by different aspects globally requires predictive model Insights(Henriques & Sadorsky, 2011). Oil price movements understood based on big data analytics help investors in the financial sector make informed decisions. It also helps understand the agility of the changing global market and how it may impact different types of investments. Embedding big data analytics can also provide predictions regarding potential return on investment, adding to the informed decision-making capability in the domestic and global markets for investors.

Conversely, regulatory compliance is focused on. Despite the impact of oil price volatility at the global level, investors comply with diverse regulations depending on the jurisdiction of investment. The evolving financial regulations and predictability of the amendments at times enhance the need for extensive risk disclosure and optimal understanding of trading derivatives(Chen et al., 2024). They help in data-driven insights and regulatory compliance to mitigate future financial fund loads. Integration of regulatory compliance for investors in the financial sector may lead to losses and minimal return on investment. Subsequently, regulatory compliance is also impactful in oil-dependent markets and remains vital in providing A predictive model and other data-driven insights for investors to make informed decisions. The changes in regulatory dynamics in investment that are not aligned with oil price volatility is one of the critical issues in the current market.

Strategic Investment And Oil Price Volatility

The need for investors’ analysis of oil price volatility emanates from the shifts towards strategic investment. According to Zhu and Singh, managers in organizations make investments depending on the current value of the investment(Zhu & Singh, 2016). Therefore, investments are based on organization, which guides the interpretation of strategic investments. Nevertheless, a better understanding of global factors such as oil price volatility will help shift strategic investments derived from investor interest and data-driven predictive models. Strategic investment in organizations is mainly dealt with to increase the value of the shareholder interest. It may also limit optimal investor funding and capital or, in some cases, increase lending interest rates. The strategic investment options that are augmented with the fluctuations in oil price volatility may have a negative impact on subsequent return on investment for organizations. Therefore, companies must enhance investor and organization collaboration for better prioritization of capital investments and long-term along-terminate their shocks off fluctuations in oil prices emanating from the global markets. Based on the analysis, integrating the impact of price volatility on investors will help in extensive planning and data-driven decision-making.

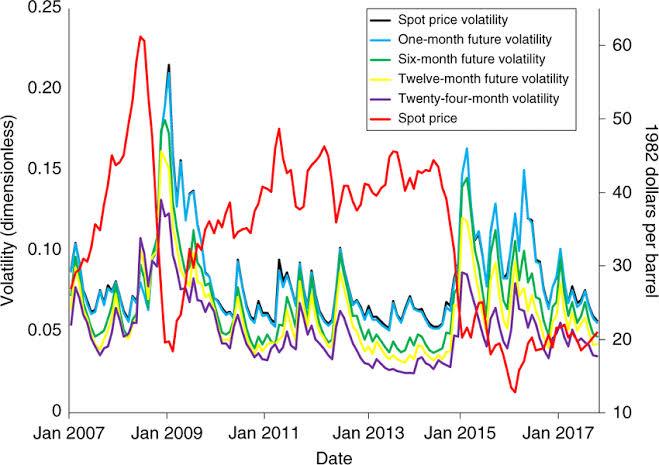

Figure showing rates of oil volatility using the GARCH model.(Ansari & Kaufmann, 2019).

There should be debated efforts to analyze market volatility constantly because of the constant fluctuations in contemporary markets. The macroeconomic impacts constantly shift depending on aspects such as geopolitical dynamics. Therefore, there is a need to analyze the impacts on financial markets and the designated organizations.

The Impact of Oil Price Volatility On Investors

Risk Management

Global volatility has a significant impact on uncertainty in investment that also adds to dynamics in risk management. It also impacts risk in the investment portfolios of different investors in the financial sector. Investors exposed to oil-dependent markets or investing in organizations whose supply chains and return on investment depend on oil pricing must endure extensive risk exposure(Bashir, 2022). Good services and commodities or energy stocks are extensively impacted by oil price volatility, which makes it vital for organizations to research and invest extensively in strategic investments in the long term. In times of high volatility, investors are more likely to lose capital because of the opportunities in the market and, in some cases, at most acceptable to the unpredictability of different investment markets. The data-driven decision-making capabilities should be vital in not only predicting volatility but also in the provision of contingency plans or in ensuring that other organizations and investors collaborate to mitigate risk and ensure the implementation of strategies that are more likely to gain a return on investment.

Portfolio Diversification

Contemporary investors may also reduce the levels of risk by increasing portfolio diversification(Ozdurak, 2016). A case in point is that investors can diversify their portfolios, including organizations in multiple markets. It, therefore, encourages investment through stocks and bonds or direct organizational investment and funding in companies that are less likely to be impacted by the shocks of oil price volatility. Listening to the impact of oil price fluctuations will positively impact performance and the level and type of risks involved. Subsequently, portfolio diversification can also be integrated into ESG criteria. Focusing on sustainability and long-term investing will help investors in the financial sector mitigate long-term short-terms that may lead to less return or investment and profitability emanating from volatility.

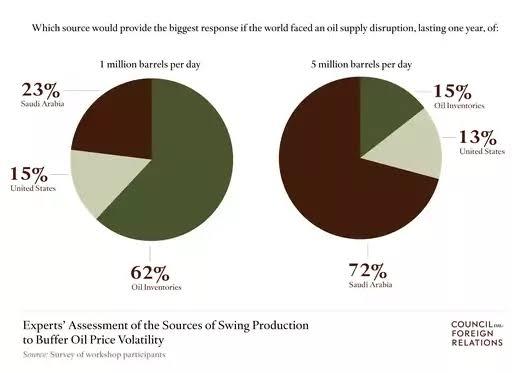

Figure 1 shows the state of oil supply and oil price volatility globally.

Investor Confidence

Additionally, oil price volatility has an impact on investor confidence globally. The unpredictable spikes and drops in oil prices in the global markets may lead to uncertainty in investment and, therefore, negatively affect organizations and other companies. The uncertainty in investor confidence has different shifts in terms of asset allocation and also impacts the investment strategies depending on each sector. In Canada, there is a significant correlation between investor confidence and fluctuations in oil prices. The reluctance to invest emanates from the uncertainties in the potential return on investment and the differences in interest rates in the capital given to the organization.

Conversely, the volatility of oil prices impacts overall interest rates. The macroeconomic impact may influence economic stability, investor confidence, and willingness to disseminate capital. It also impacts organizations and their ability to maintain a return on investment. The global economic relationships should also be analyzed to determine how market uncertainty linked to price volatility can impact investment options and opportunities. It is an aspect that calls for extensive research by investors to guarantee consistency in potential investment options and alternatives to enable lesser shocks emanating from the macro environment impact on financial investment in capital.

Market Sentiment

The different levels of informal decision-making should also incorporate market sentiment analysis. A case in point is that being a practitioner in global oil prices and any other subsequent volatility may indicate shifts in geopolitical or economic trends. It can also be vital to ensure that the investment analysis based on market sentiment can show investors’ risk appetite in different regions. It is a critical pointer in determining the viability of investments in their specific markets, especially in terms of market volatility linked to oil and price volatility and fluctuations. It is one of the aspects that leads to informed decision-making for investors and ensures invested capital is based on a data matrix and analysis of the impacts of investor sentiment. It is also one aspect that informs portfolio diversification levels depending on market sentiment. The diversity of portfolios mitigates risks associated with global oil price volatility and fluctuations. Alternative investments can be mitigating factors to eliminate extensive exposure and protect investor interests depending on the international markets. Therefore, market analysis should be a significant determinant of investments and how they are integrated into extensive investor research to ensure consistency in data-driven decision-making capabilities and return on investment irrespective of market and industry.

Future Trends and Recommendations

Green Energy Transition

The first future trend for investors is the integration of green energy transition. Global investment opportunities are shifting towards renewable energy sources, and extensive monitoring of its impact on organization return on investment. The transition means that investors move away from their traditional oil-dependent industries. Contemporary non-oil-dependent industries are less bound to be affected by oil price volatility, which emanates from a global prosecution and is difficult to control. Investors should, therefore, extensively monitor the transition to green energy solutions because of their positive impacts on contemporary organization investment options.

On the other hand, apart from integrating ESG criteria, long-term planning should be focused. Financial sector investors should mitigate these shocks or fluctuations in oil prices globally by integrating long-term strategic planning and investments. The long-term trends will help in the evolution of energy uses within the different sectors and meet sustainability goals while navigating contemporary issues of global oil price spikes and drops. Therefore, focusing on sustainability is critical to guarantee consistency in return on investment and provide long-term returns and transformation of different industries to reduce dependency on oil markets.

Technological Innovations

Conversely, financial investors extensively focus on technological innovations in the contemporary Marke. A case in point is integrating blockchain-based solutions or additional intelligence-based investment analysis. It has transformed how investors navigate through fluctuations in global oil prices. Here, ensuring the investor understands the impact of the capital in this specific center in which organizations operate is also integral. In turn, it can help in strategic risk management options and the development of contingency plans to ensure better data-driven, should I think, ability. It will also help in the transformation impact of strategic investments only. Intern for the organization managers’ interest in landrace perspectives and investor practices in the organization and its evolution. Nevertheless, it is vital to note that the technological integration should also be backed up by extensive relevant data on financial market trends and the analysis of the fluctuations in the market to ensure informed decision-making on alternative impact investments and strategic investments in different markets and sectors.

ESG Integration

Mitigating the constant fluctuations in global oil prices can also be based on implementing ESG criteria. The ESD criteria are increasingly important for contemporary investors. The considerations enhance long-term performance and sustainability in investment opportunities, moving away from dependence on oil-driven markets and green financing to avoid extensive shocks experienced in oil price volatility. Therefore, investors equip organizations with internal capabilities toward sustainability, listen to the overall susceptibility to market fluctuations, and increase resilience amid oil price volatility. The ESG criteria and integration in investment are also part of the long-term planning initiatives to guarantee sustainability in different sectors for investors and mitigate the shocks. Nevertheless, investors have to understand that the ESG random implementation is a long-term option to help cushion the companies on the electricians in oil prices globally.

Conversely, investors should also extensively integrate market research on regulatory compliance and changes in global policies. The geopolitical opponents and regulatory changes ensure that investors understand how the triggers may affect the financial markets, therefore informing decision-making. Some aspects extensively influence oil prices globally and impact the level of investment incorporated within organizations. Nevertheless, extra investment in alternative markets provides shocks against consistent oil price collections, although organizations consistently rely on interpolations used by oil price fluctuations. Moving away from investment options dependent on oil markets can also guarantee consistency in return on investment in the long term while also implementing sustainability initiatives. Augmentation of market analysis and ESG finance and trends also inform alignment with available regulations depending on the different industries.

Conclusion

In conclusion, oil price volatility is a global phenomenon, and fluctuations negatively or positively impact the return on investment. Organizations should know the strategies to mitigate oil price or activity shocks and create informed investment decision-making. Extensive risk management and contingency plans should be integrated into organizations and investors. Subsequently, there are future trends in investments, such as the use of ESG criteria, which aids in mitigating the shocks of oil price volatility by focusing on strategic investments impact investments and other green financing options. Research should also be embedded to enhance big data analytics and other predictive models to understand the macro environment that may affect oil price fluctuations. On the other hand, it is determined that apart from the diversification of the market portfolio, there can also be the integration of market sentiment analysis to analyze the risks of exposure and its impact on the investment of capital in different industries.

References

Ansari, E., & Kaufmann, Robert. K. (2019). The effect of oil and gas price and price volatility on rig activity in tight formations and OPEC strategy. Nature Energy, 4(4), 321–328. https://doi.org/10.1038/s41560-019-0350-1

Bashir, M. F. (2022). Oil price shocks, stock market returns, and volatility spillovers: A Bibliometric analysis and implications. Environmental Science and Pollution Research, 29(16), 22809–22828. https://doi.org/10.1007/s11356-021-18314-4

Chen, Y., Dong, S., Qian, S., & Chung, K. (2024). Impact of oil price volatility and economic policy uncertainty on business investment – insights from the energy sector. Heliyon, 10(5). https://doi.org/10.1016/j.heliyon.2024.e26533

Henriques, I., & Sadorsky, P. (2011). The effect of oil price volatility on Strategic Investment. Energy Economics, 33(1), 79–87. https://doi.org/10.1016/j.eneco.2010.09.001

Ozdurak, C. (2016). Volatility spillovers between crude oil price, exchange rate, and stock market of other emerging economies. Dynamic Linkages and Volatility Spillover, pp. 163–181. https://doi.org/10.1108/978-1-78635-554-620161008

Zhu, Q., & Singh, G. (2016). The impacts of oil price volatility on strategic investment of oil companies in North America, Asia, and Europe. Pesquisa Operacional, 36(1), 1–21. https://doi.org/10.1590/0101-7438.2016.036.01.0001

write

write