Introduction

After the industrial revolution, international trade, which was a vital part of the world economic system for decades, became significantly important. The state of the financial system before the industrial revolution was autonomous. Thus, it affected a particular portion of the trade activities. Therefore, the emergence of systematized states resulted in the emergence of current international finance; matters such as taxation, global lending, foreign direct investments, and economic protectionism became more critical, especially in business and policy formulations. International finance significantly affects multinational organizations’ operations since it is the key administrative element. Furthermore, it also has an impact on financial management, access to raw materials, and the hiring process. Notably, the global financial system has since moved from a self-governing system to an extensive unified physical and virtual system connected through various aspects such as banking, exchange of currency, lending insurance, and commercialization of securities or shares in market exchange. This article thoroughly supports the potential acquisition of Malaysia Airlines by Etihad Airways. The report critically analyses the two companies based on structural organization, the possible synergies from the acquisition, financial factors like evaluation, and the impact of the acquisition of Malaysia Airlines by Etihad on the Malaysia Company.

Background Information of the Two Firms

Etihad Airways has grown to be the largest carrier in the Middle East since its establishment in 2003. Etihad Airways has over 100 passenger planes that serve 90 terminuses across the world. The company’s headquarters is in Abu Dhabi International Airport, which has expanded the airline business’s revenue streams to include a shipment division. The freight delivery is within the same destination network, attended by the firm’s passenger carriers. Dadson & Marguet (2016) explain that for the company to expand its operation, they formed a collaboration with other airlines such as Air Seychelles, Jet Airways, and Air Serbia. Furthermore, the corporation has enabled the firm to upsurge its existence in the Middle East, African, and Asia markets.

Malaysian Airlines was established in 1972 after the parting of possessions between the Airline and Singapore Airlines. After the country attained self-rule in 1966, the process of separation started, leading to the formation of the two national airlines. Despite having an extensive experience of operation that goes back to the 1930s, the company experienced financial challenges recently due to the influx of budget airlines across Asia. Furthermore, the mysterious vanishing of company’s plane in 2014 resulted in increased public negativity; this further caused financial struggle for the company (Calder, 2014).

A Review of the Companies’ Business and Operational Models

Due to high expenses and overheads in the airline industry, companies should develop appropriate sustainable routes that can help minimize operating expenses. These operation models include the hub, the point-to-point model, and the spoke model. The deregulated aviation industry allows operators to choose the best operational plan (Cook & Goodwin, 2008). Due to the oil crisis, the deregulation process was made necessary by the concerns of the increased fuel prices over the sustainability of the aviation industries. The high cost caused the failure of most inaugural budget carriers in the operation of point-to-point flights. Consequently, those that survived were prompted to adopt the hub and spoke model. Most Airlines use long direct flights between major cities and maintain the point-to-point operation to target high-end markets.

Etihad Airways adopted the pivot and spoke model. The company’s headquarters served as the international airport operating as the main hub for the company. The company’s success was attributed to the diversification of the United Arab Emirates economy as the state sought to develop other vital areas of the economy, such as tourism and business. Therefore, the emergence of Abu Dhabi and Dubai as tourism a center significantly enhanced the Airline’s success. Also, the strategic partnership of Etihad Airways led to an increased flow of customers since it receives connecting passengers to various destinations such as the United States, Europe, Africa, Asia, and Australia.

Similarly, Malaysia Airlines also adopted the hub and spoke model. However, the company never attained the level of success as Etihad Airways in the model. This was attributed to the usage of the three hubs that caused the firm to sustain high overhead and direct managerial costs. The key hub is situated in the Kuala Lumpur International Airport, which is the City’s capital. The second hub is located in Kota and Kuching. The hub and spoke model enhances the efficient operational cost for most airlines due to the centralization of most administrative functions (Cook & Goodwin, 2008). The main aim of Malaysia Airlines was to realize management in providing premium services to its customers. However, adopting the hub and spoke model proved less efficient since the company’s premium carriers only succeeded in the point-to-point model. The use of several hubs refuted the profits of the hub and spoke model by adopting the multiple administrative functions across several hubs, resulting in a high cost of operation.

Despite the two firms having similar operation models, numerous underlying differences come from their strategic management. Firstly, the formulation and implementation of the goals and objectives of the company. Etihad Airways is keenly focusing on being the largest airline company globally. This is attributed to the company’s progress in increasing the fleet size, growing the number of destinations, and refining the quality of services and products. Furthermore, the company is striving to reduce the cost of operation and support the best business model that supports expenditure optimization. On the other hand, there is an apparent lack of business strategy in Malaysian Airlines company. For instance, a conflict exists between the company’s operational structure and corporate strategy since cost-effectiveness is needed. Yet, the company is operating 3 different hubs in the same state.

The Synergic Benefits Obtained by Etihad Airline from Acquisition

Many firms pursue mergers and acquisitions since they help companies benefit from several synergies created by those decisions, such as financial, cost, and revenue synergies (Weston & Weaver, 2001).

Firstly, undertakings will allow the Etihad company to venture into a new market through consistent growth in tourism and trade (DePamphilis, 2014). Acquiring the whole part of the Malaysian Airline helps achieve the Etihad company’s expansion goal. Notably, this is vital since the undertaking for the company comes at the period when the government of Malaysia is keen on establishing the country’s profile as a foremost destination center for tourists. Therefore, the decision will ultimately increase the volume of customers visiting the country; this will ultimately cause the company to realize high revenue through its acquisitions.

Etihad company will be able to eliminate competition, and it will increase its negotiating power with purchasers and suppliers (Moeller & Brady, 2014). Notably, the Airline will be able to remove obstacles such as rivalry to create a unified ticketing option model. Furthermore, the routes will be optimized, thus removing industry redundancy, saving operational costs, and taking advantage of the economies of scale.

Additionally, Etihad can expand its operation by generating more revenue sources. Oil producers, the external stakeholders, significantly influence producing good quality products and prices. Therefore, the acquisition of the Malaysia airline will increase the bargaining power of Etihad Airways with suppliers (Dutordoir, 2014).

Barriers to Cross-border Merger and Acquisition and Impact of these Barriers

Valuation

One of the most critical and challenging parts of a merger and acquisition is the valuation aspect, especially for the firms that do not trade their shares on the stock exchange. Acquisition majorly involves consolidating and creating the majority of ownership of the public traded company through ownership of the company’s shares. Malaysian Airlines does not trade its shares, and it is challenging for the company seeking merger and acquisition to reach an agreement with the company. The most applicable and practical method in finance is valuation using the net assets (Association of Chartered Certified Accountants, 2012). Valuation involves adding up all liabilities owed by the firm and carrying out a total net of assets owned. However, this can not be applied in current practice because of the value attached to intangible resources such as brand names, patents, and goodwill in the business. Furthermore, some firms have substantial trade inventories for commercial purposes. Therefore, this item will alter the true valuation of the enterprise. The best alternative way of valuation is using income found to calculate the present value of the business. The income-based valuation is suitable because it uses the firm’s net present value and the company’s cash flows for years.

Cash Flow Analysis

The key objective of an analysis of the cash in a firm is to enhance the prediction of the number of financial resources the firm will have at a specific point in the future. Furthermore, according to Bodea et al. (2016), the pro forma cash statements should be provided to give deeper insightful information into most indicators of the anticipated finances thereafter based on the presumptions established. Based on these assumptions, the pro forma cash flow statements describe the incoming and outgoing cash generation. The cash flow statements are established by the daily cash inflows and outflows the company expects during its operation in the following years. The inflows are the income the firm generates in its operations, while the outflows are primarily the expenses the company is likely to incur.

Business mostly profits from asset analysis as it provides an excellent way to know your business’s future. One will know any outcomes and ensure the required measures are in place. Financial analysis is beneficial in establishing how the tactical transformation will impact the company’s income and cash flow if the firm plans to implement (Dadson & Marquet, 2016). By making judgments from the analysis, a company can predict what its future looks like, and they can forecast how they have been performing before and compare and put strategy and plans how what they would like to accomplish in coming times.

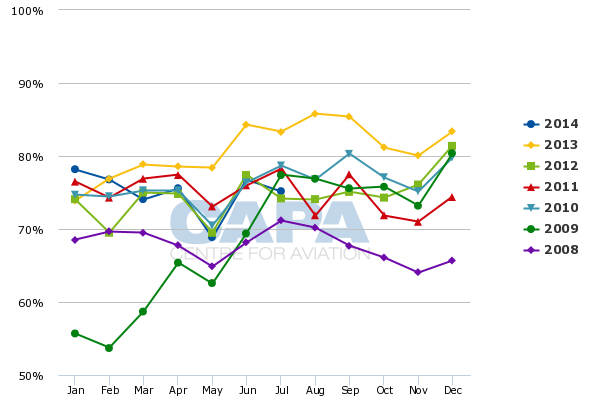

The revenue generated by Malaysia Airlines was 14.6 billion in 2017, and in 2008, they realized 15 billion, as per the case provided. According to the report, this represented a 2.7 % increase in the revenues realized by the firm in the 2 years. However, the company generated 11.3 billion in revenues in the subsequent years. This was a dismal performance. This represented a 25 % drop in revenue over the previous years. In the years 2010, 2011, 2012, 2013, and 2014, the company provided a projection of 12.9 billion MYR, 14 billion MYR, 15.1 billion MYR, 16.4 billion MYR, and 17.7 billion MYR, respectively (Jacque & Wiley, 2020). These figures show increased rates of 14.69 %, 8.22 %,8.22 %,8.21 % and 8.2 % respectively (Jacque &Wiley, 2020). These revenue figures are very reassuring for any investor. However, there are no signs of growth over the 5 years after the 2009 loss in revenue generation. According to the, CAPA – Centre for Aviation. (n.d.), the projected revenue is unrealistic for 2011, 2012, 2013, and 2014. Although the travel by air business is volatile, maintaining such a growth rate is not impossible.

According to the analysis, operating expenses, between 2007 and 2008, the cost of goods sold to the company increased by 6 percent. Notably, the company also realized an increase in revenues by 3 % despite increased prices of goods. Also, the company’s operating expenses rapidly dropped in the same period. Therefore, this indicates that the company’s capability to convert its products into revenue is declining at an alarming rate. It is impossible, therefore, to predict that 2010 revenue will rise by 15 % while the operating expenses will increase by 5 %. According to 2011 projections, despite an increase of 8% in revenue, there will be an increase of 1% operational cost (Jacque &Wiley, 2020).

Unless there are concrete factors that can explain the rapid increase in incomes in 2010 and the subsequent constant growth for the next 4 years, the expected revenues do not depict the actual position of the firm performance. If the firm’s prior results are not considered, the less than proportionate increase in operational cost should also be established.

Figure 1

Malaysia Airline widening loss

(CAPA – Centre for Aviation. (n.d.)

Factors to Consider when Bidding

During the acquisition of Malaysia Airlines, examining the financial performance is essential. As a result, Etihad should consider the following factors before investing in Malaysia Airlines.

Long Term Strategy

Etihad Airlines should consider the acquisition of the Malaysia airline company if it aligns with the long-term strategy and objectives of the organization. The business level of Etihad should be maintained at the current level, grow the business and facility expansion of the new geographical markets. Therefore, the Etihad company should focus on projects that fit with the company’s goals, regardless of the long-term strategy.

Economic Environment

The Etihad should consider the economic environment of Malaysia. According to Choueiri (2018), Malaysia has had rapid growth and is on track to joining high-income earning states in the future. Furthermore, in 2017, the country realized an increase of 5.8 % GDP with a population of 32 million people. Also, the country’s status as the central tourism hub in the Middle East will likely enhance the aviation business as tourists visit for recreational activities and vacations (Ministry of tourism and culture Malaysia, 2018). This will benefit the Etihad’s decision on acquisitions.

Differences in the Tax regime

Taxation is critical in enhancing decision-making, since it can negatively impact company revenue. It is vital to factor in the tax regime when a company wants to invest in a different country. According to PricewaterhouseCoopers (2017), Malaysia had a fixed 24 % resident corporation. Notably, a corporation is considered to operate within Malaysia if the management and control are carried out within the country. The country does not charge capital gains for foreign investors, thus making it a more compelling investment decision. According to Deloitte (2016), the country has an agreement with other countries regarding tax relief. This agreement protects foreign investors from double taxation.

Estimated Bid Price by the Etihad Airline

Analysis of the presented case shows several bidding prices hinged on the evaluation method. According to the report, the updated share price for Malaysia Airlines is $0.64. Therefore, this makes the company worth 1.3 billion. The price worth of the company ranges from $ 1092 billion to $ 2.072 billion. According to the banking report, the best bidding price for the Etihad company is estimated to be $1.3 billion.

Additionally, the correct valuation technique is essential in helping the firm acquire the ownership at a lower price, thus reducing the incompetent offer that could result in a costly purchase. Therefore, the valuation based on shock twelve months should be employed since it gives a diverse view, with the most incredible value being the company’s minimum value.

Etihad should bid a much lower offer after evaluation based on the Malaysia airline’s neighbors. Therefore, the company should place itself in a better negotiation position when it compares several parameters using value and market share.

Conclusion

Mergers and Acquisitions have proved to be the best techniques in market entry for many corporations worldwide (Straub, 2006). However, they also face many obstacles such as political rivalry between states, trade-in export and import imbalances, regulated foreign direct investments, and firm valuation. After an exhaustive analysis of the Etihad’s acquisitions of Malaysia Airlines, if the Etihad company obtains the majority interest, it will how the company to make necessary changes to streamline the Malaysia airline structural operation. However, if the company accepts minority interests, the company will face substantial teething challenges.

Additionally, after analysis of the cash flow, it shows slight differences in the Malaysian airline value; therefore, the assessment forecast should be re-evaluated. Furthermore, the analysis points out that the country’s economic environment has a greater impact on its success in post-acquisition. Consumer demand and growth are good indicators of Malaysia’s economy. Furthermore, the government is striving hard to make Malaysia a global tourist attraction, increasing market demand and revenue generation.

Etihad should focus on capitalizing on the strength of the Malaysia company, such as a strong marketing strategy to achieve its chief success. They should be able to strategize their techniques to overcome their inherent weakness by using their strength. Etihad Airways believed in the goal of low structural cost. These allowed them to maintain their current successful methods and expansion of the market t to enhance and improve the experiences in new ways that originated from increased need for air travel from both the normal and the new customers (Schosser &Wittmer, 2015).

Furthermore, from the report, additional flights to the most popular and demanding routes enable Etihad airways to provide convenience and unique features that distinguish it from other low-cost carriers. The company is likely to be the best in airway travel since it focuses mainly on consumer preference and the absence of better ticket options (Brito, 2019).

Etihad’s marketing strategies are mainly meant for both business and leisure. This has been realized by creating unique and pioneering programs that enhance demand for air travels, good customer relations, and outstanding products. Also, another central approach is to enhance revenue generation to reduce the cost of operation per available seat per mile.

Lastly, through the One World Alliance, the 3rd largest company by customers count, the company will be able to access new geographical markets. However, based on the analyzed report, the following recommendation should be made:

- The stakeholders in executive positions, such as directors in the Etihad firm, should independently examine the predictable cash flow provided by the firm. This is because of the lack of rationality that supports the anticipated income increase. For the 5 years, there has been an inconsistent drop in operational costs of the company.

- Purchase the regulating stake of the company. Through evaluation, various challenges arose regarding acquisition, given the differences in the 2 firm’s operational cost structures. The assessment reports several challenging issues that can occur during the acquisition. The company should obtain the majority ownership to enable the company to make proper management decisions and good strategic decisions that could propel the goals of the company to a better level.

Bibliography

Association of Chartered Certified Accountants, 2012. Business valuation. London: ACCA.

Brito. 2019. Are Larger Merger Synergies Bad News for Consumers? Endogenous Post‐Merger Internal Organization’, The Scandinavian journal of economics, 2019-10, Vol.121 (4), p.1728-1756.

Calder, S. (2014). Malaysian government to take full control of tragedy-hit Malaysia. [online] The Independent. Available at: https://www.independent.co.uk/travel/news-and-advice/malaysian-government-to-take-full-control-of-tragedyhit-malaysia-airlines-9657885.html [Accessed 9 Jul. 2022].

CAPA – Centre for Aviation. (n.d.). Malaysia Airlines 2Q loss widens. Restructuring is imminent but outlook remains bleak. [online] Available at: https://centreforaviation.com/analysis/reports/malaysia-airlines-2q-loss-widens-restructuring-is-imminent-but-outlook-remains-bleak-184380.

Choueiri, N. 2018. Malaysia’s economy: getting closer to high income status. [online] IMF. Available at: https://www.imf.org/en/News/Articles/2018/03/07/NA030718-MalaysiasEconomy-Getting-Closer-to-High-Income-Status

Cook, G. and Goodwin, J., 2008. Airline networks: a comparison of hub-and-spoke and pointto-point systems.Journal of Aviation/Aerospace Education & Research, 17(2), pp.51-60.

Dadson, K., and Marquet, J., 2016. Etihad airways: partnering for success. Southlake: Sabre Airline Solutions.

Deloitte. 2016. Taxation and investment in Malaysia 2016: reach, relevance, and reliability. New York: Deloitte Touche Tohmatsu Limited.

DePamphilis, D. M. 2014. Mergers, acquisitions, and other restructuring activities. New York:E Elisevier.

Dutordoir, 2014. Synergy disclosures in mergers and acquisitions’, international review of financial analysis, 2014-01, Vol.31, p.88-100

Jacque, L.L., Wiley. 2020. International corporate finance: Value creation with currency derivatives in global capital markets. John Wiley & Sons.

Ministry of tourism and culture Malaysia, 2018. Tourism Malaysia. [online] Tourism.gov.my. Available at: https://www.tourism.gov.my/media/view/increased-connectivity-set-to-bring-in-more-tourists-from-australia-to-malaysia [Accessed 9 Jul. 2022].

Moeller, S., & Brady, C. 2014. Intelligent M&A: navigating the mergers and acquisitions minefield. London: John Wiley & Sons, Inc.

PricewaterhouseCoopers. 2017. 2016/2017 Malaysian tax booklet: a quick reference guide outlining malaysian tax information. Kuala Lumpur: PricewaterhouseCoopers Taxation Services.

Schosser, M., and Wittmer, A., 2015. Cost and revenue synergies in airline mergers – examining geographical differences. Journal of Air Transport Management, 47, pp.142-153.

Straub, T. 2006. Reasons for frequent failure in mergers and acquisitions. Germany: Gabler Edition Wissenschaft.

Weston, J., & C.Weaver, S. 2001. Mergers and Acquisitions. New York: McGraw-Hill

write

write