Introduction

The economics of the renewable energy sector are being closely examined as part of the global shift toward green energy. This study aims to investigate the economic intricacies, particularly those concerning solar and wind power systems. By analyzing consumer preferences, production trends, and market conditions, this article seeks to further knowledge of the economic dynamics of the clean energy industry. The significance of renewable energy in the world’s energy mix and the quick advancements in solar and wind technologies make this a vital topic to look into. Therefore, enterprises, governments, and power users must comprehend the economic implications of these advancements. First, the report offers comprehensive information on the market overview, including key facts about the renewable energy industry, its participants, and the regulatory landscape. Second, it focuses on theoretical and empirical study, deconstructing market phenomena using some economic theories and their ideas. Finally, the summary will emphasize the significant findings and discuss the study’s shortcomings, highlighting areas that may need further investigation.

Market Overview

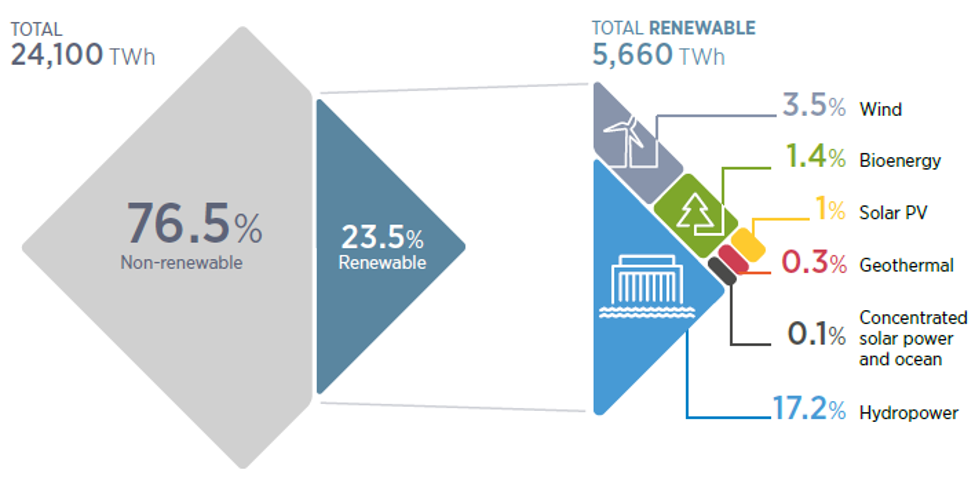

The renewable energy industry focuses on producing and distributing energy that is recycled following natural regeneration. The solar and wind energy sectors comprise two of this enormous business segment’s key energy sources. These technologies have gained much traction since they lessen reliance on nonrenewable energy sources and greenhouse gas emissions. There are many different kinds of participants in the renewable energy industry. Some key players are manufacturers of wind and solar technologies, project developers, energy utilities, and end users. Major international corporations, such as Siemens Gamesa and Tesla, are crucial players in this space. Additionally, there is no shortage of companies that are innovators in various cutting-edge technologies that stimulate the sector.

The two sides to the renewable energy market scope, local and global, provide targeted activities, such as constructing onshore wind farms or community solar programs, to meet the local communities’ energy needs. Simultaneously, large-scale solar and wind power projects that can supply electricity across international borders are approved through international collaborations and funding. The market offers many products, and connections between them extend beyond regional boundaries. Industry reports state that in 2021, the installed capacity worldwide, including solar and wind energy contributions, was 2,799 GW. The market’s size fluctuates, which reflects factors including advancements in technology and helpful regulations. Thirdly, and perhaps most significantly, consumer selection is influenced by public knowledge of sustainability and energy saving.

The market competition landscape for renewable energy is inherent because of breakthroughs, remarkable efficiency, and reduced prices. Solar and wind technologies are constantly improving, giving them a competitive edge in the market. Additionally, there is competition between countries and businesses to see who can promote green energy first. As a result, creativity and sustainability are naturally encouraged in the company environment. Furthermore, regulatory frameworks are essential to the growth of the market for renewable energy. Feed-in tariff programs, tax credits, and renewable portfolio requirements are among the most widely used policy tools that governments worldwide have chosen to promote renewable energy sources. These laws foster investments and technological advancements by creating a conducive environment for market growth. Different tax regimes in various regions may also impact the economics of creating renewable energy projects.

Although the renewable energy industry is expanding, it has challenges. These include intermittent power outages, challenges related to energy storage, and initially higher costs. On the other hand, these challenges provide fresh chances for innovation and learning. These obstacles are removed and advancements in energy storage, smart grids, and cooperative international activities create new market opportunities.

Theoretical and Empirical Analysis

A cost analysis is conducted in this study based on particular renewable technology data. These include wind power and solar photovoltaics, focusing on the cost of producing electricity. The data shows a striking annual decline in solar PV of 58% between 2010 and 2015. The fact that module costs have decreased by about 80% since 2009 due to growing technology is noteworthy. The cost of produced power decreased to three-quarters of its starting price in 2017; an additional 57% of this trend is predicted to occur by 2025. Likewise, the data details the costs of wind power and indicates that it has been the cheapest renewal energy compared with fossil fuels since 2015. This meant a 50% price cut from 2010 to 2017, with wind costs onshore down about 25% from 2010. Wind turbines’ prices have been stable within the last ten years, and more technological advancement is expected to lead to further cost reductions. Of significance is the average increase in capacity factor and more efficient turbines, an aspect of the rapid penetration phenomena and ongoing technological advancements.

Theoretical Models and Concepts:

Supply and Demand Framework:

Using the Supply and Demand framework, one can analyze the market dynamics for renewable technologies. The falling costs of solar-powered PV systems coupled with the marked decrease in the wind-powered costs points towards a change in the supply-demand balance. This pushes down costs as global sustainability objectives drive up demand for green power. Understanding how supply and demand changes affect the renewable energy market is important. The “Supply and Demand” framework interprets the driving forces of costs, giving an economic perspective on the renewables landscape.

Cost-Benefit Analysis:

Cost-benefit analysis can be applied to assess the economic efficiency of renewable energy investments. Cost and benefits analysis involves calculating the cost of developing and installing technology and the long-termits long-term savings in comparison to reduced environmental impact. While these findings paint a picture of an ongoing reduction in solar PV cost advantage, they reveal an encouraging result for the two technologies. Cost-benefit analysis makes it possible to consider the practicality of investment in renewable sources. It takes into account financial and non-financial components that determine the actual value of switching to renewables.

Game Theory:

Application of game theory to study the strategic relations among various players of the renewables markets is crucial. Private ventures, international bodies, and states also come under this category. The location where the investment is noted as being more scattered across geography might imply that there exists a country diversification strategy within those countries. This is necessary to understand the game-like interactions in the renewable energy market. Game Theory informs on potential situations where cooperation or rivalries can occur among players involved in international investments in renewable energy.

Main Findings and Implications:

Empirical findings show an impressive surge in the solar and wind deployment due to enhanced efficiency, declining costs, and favourable government regulations. This implies a causal link between technological progress and market expansion. The impacts may be directed towards renewable leading instead of relying on standard fossil fuel.

Consumer and Demand Characteristics

The data analysis suggests that the prices for solar PV and wind power technologies have rapidly dropped, with an elastic response from the demand side for renewable energy. The costs of these technologies decline as time passes, making them attractive to consumers, particularly those prioritising ecological concerns. However, the relative price comparison of wind power and fossil fuel technologies started in 2015 emphasizes wind energy as a viable competitor. In addition, it accentuates the compatibility of technical innovations, as evident in the constant reduction of cost associated with solar PV and wind power systems. Elastic demand represents that the product has an encouraging outcome in terms of pricing, and therefore, it is widely consumed. Renewable technologies are a web of “substitutes” and “complements” that call for inclusive approaches in search of sustainable energy options.

Producer and Supply Characteristics:

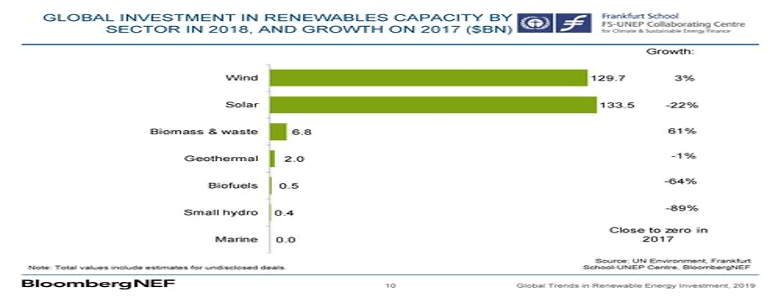

The ongoing solar PV and wind power technology improvement points to an elastic supply. Such flexibility will assist producers in accommodating market changes while allowing them to meet increased demand effectively. This illustrates the robustness of the renewable energy suppliers’ side. The data shows that advancements in technology and manufacturing processes make for better and faster productions. The reduction of the cost of PV modules, and the cost associated with wind power technology, indicates economies of scale with fixed costs spread over more enormous capacities that have apositively influence general industry profitability. This is evidenced by increasing global investments (especially in emerging economies) and varied industry makeup. This shows a vigorous and expanding industry that is both technological and far-reaching regarding geographical spread. The elasticity of supply supports an effective expansion in the renewable energy industry. These lead to sustaining high profits by minimizing costs and efficient production processes. Thus, it points towards chances of collaboration and innovation in an international scope.

Impact of Changes in the Market:

The data indicates an increasing number of projects across different parts of the developing world. Decentralization signifies an increasingly worldwide distributed and inclusive renewable energy market. Progressive technologies are also expected to positively influence future decreases in prices of solar PV and wind power. Not only does it promote affordable use of renewable energy, but it also enhances efficiency and effectiveness in the market. The fact that the power sector has seen few investments over the past years poses a question concerning the policy’s influence while other developing countries have received more investment. Another way of improving market outcomes would be by developing potential policies to motivate investment in the power sector. Market interventions, technological changes, and policymaking shape the renewable energy market. Understanding their effects is fundamental for stakeholders to take necessary action for sustained growth and improved efficiencies in the industry as well.

Although the analysis is quite helpful, it should be noted that it suffers certain limitations. Primary data collection from further researchers would be advantageous as this is mainly an existing data-based study. Furthermore, the analysis does not look into the political elements of the renewable energy sector and offers another area to investigate as well. Another area for further research is the socio-economic effects of widespread renewable energy use, including job creation and community development.

Conclusion

The primary purpose of this report was to provide an elaborate assessment of the economic implications brought about by innovation and technological development in renewables, especially solar and wind energies. This study aimed to analyze theoretically and empirically the complex market dynamics and their impact on economic development, employment and environment in urban areas. It was noted that there has been an increase in investments, especially in developing nations, which implies that the world is committed to renewable energy. Although there has been a short-term slowdown in power sector investment, the continued commissioning of new renewable capacities implies a robustness based on lower technology costs. In addition, it shows that the investment is made across different geographical regions,. Most especially, the dominance of the developing countries emphasizes the growth process in this maturing industry. Accepting limitations, including using past data, will provide insight for more in-depth future studies on changing trends and local complexities. This research adds relevant perspectives as the global economies are transforming towards renewable energy sources, highlighting relevant policies required to sustain a new world of energy.

References

Abdelilah, Y., Bahar, H., Criswell, T., Bojek, P., Briens, F., & Feuvre, P. L. (2020). Renewables 2020: Analysis and Forecast to 2025. IEA: Paris, France.

Asad, M., Mahmood, F. I., Baffo, I., Mauro, A., & Petrillo, A. (2022). The Cost Benefit Analysis of Commercial 100 MW Solar PV: The Plant Quaid-e-Azam Solar Power Pvt Ltd. Sustainability, 14(5), 2895.

Henbest, S. M. K., Callens, J., Vasdev, A., Brandily, T., Berryman, I., Danial, J., & Vickers, B. (2021). New Energy Outlook 2021. BloombergNEF.

Khan, I., Hou, F., Zakari, A., & Tawiah, V. K. (2021). The dynamic links among energy transitions, energy consumption, and sustainable economic growth: A novel framework for IEA countries. Energy, 222, 119935.

Li, X., Raorane, C. J., Xia, C., Wu, Y., Tran, T. K. N., & Khademi, T. (2023). Latest approaches on green hydrogen as a potential source of renewable energy towards sustainable energy: Spotlighting of recent innovations, challenges, and future insights. Fuel, 334, 126684.

Mazo, C. M. G., Olaya, Y., & Botero, S. B. (2020). Investment in renewable energy considering game theory and wind-hydro diversification. Energy Strategy Reviews, 28, 100447.

Watson, J., Thoring, K., & Pek, A. (2018). Global growth trends and the future of solar power: leading countries, segments, and their prospects. In A Comprehensive Guide to Solar Energy Systems (pp. 469-484). Academic Press.

Xu, Y., Yang, Z., & Yuan, J. (2021). The economics of renewable energy power in China. Clean Technologies and Environmental Policy, 23, 1341-1351.

Zhang, D., Zhu, H., Zhang, H., Goh, H. H., Liu, H., & Wu, T. (2021). Multi-objective optimization for smart integrated energy system considering demand responses and dynamic prices. IEEE Transactions on Smart Grid, 13(2), 1100-1112.

write

write