Introduction

John Maynard Keynes is a 20th-century British economist who developed his economic thoughts and is the father of modern macroeconomics. Keynesian economic theories have significantly contributed to the economic theories and impacted the global economic policies of governments (Chen). His basic economic principle is that an investment level should exceed the saving rate to enhance business and economic growth. According to Keynes, when a country saves more than it spends, there will be a slowdown of the economy which will eventually cause a recession. Chen states that he believed increased spending would solve the problem of unemployment and recover the economy. Also, the Keynesian economic theory argued that demand drives supply and production, which is contrary to the conventional economist who held that supply drives demand (Chen). A healthy output combined with adequate economic expenditures boost the economy and decreased spending reduces demand, leading to a high unemployment rate. Considering the existing substantial external debt and defaults history, Argentina needs to cut spending to stabilize the economy and attract investors before benefiting from Keynesian economic principles.

Macroeconomic crises are situations where the economy deteriorates and is characterized by a declining GDP, plummeting of stock market and shares, and drying up liquidity. During a financial crisis, investors panic and sell their assets or withdraw from their savings (Kenton). They panic and rush to recover their finances because they fear their assets will lose value during the financial crisis. Also, a currency crisis, stock market crash, and sovereign default are considered economic crises. As Kenton maintains, financial crises are limited to banks, a single state, region, and worldwide, such as the Great Depression. Factors contributing to the financial crisis are systems failure, too much risk, regulatory absence, and contagious failures that spread among institutions like a wildfire. Even when measures are in place to avert an economic crisis, they still can occur.

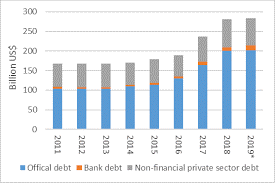

A long time ago, Argentina was one of the wealthiest countries globally; however, in recent decades, it possesses a long history of a financial crisis, huge foreign debts, and has defaulted nine times since independence. Despite changing the currency five times, Argentina still suffers annual inflation of 105%. Current economic troubles result from long-existing issues and recent developments (Congressional Research Service 1). President Macri introduced a series of reforms to avert the effect of unsuccessful economic policies in the previous government. He cut export taxes, lifted currency controls, and resolved the 15- year dispute holding the Argentinian bonds restoring the country in the international capital market (Congressional Research Service 2). The interest rates were also increased by 25% to curb inflation. Congressional Research Service explains that although the economy shrank by 1.8% in 2016, in 2017, it recorded a growth of 2.9% (2). This government did not, however, address the 4.3% budget deficit of 2014. There was increased borrowing from the international market (Congressional Research Service 2). For instance, in 2016, the Macri government recorded an external debt of $56 billion, and with interest, the budget deficit was at 6.4% of GDP. Capital inflow to finance the deficit overvalued Argentinian Peso by 10-25%, exacerbating the currency account deficit.

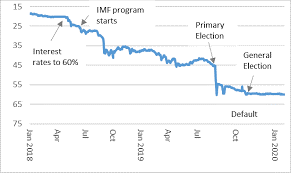

In addition to over-reliance on external financing, decreased interest and value in Argentine bonds due to increased interest rates by the US further hurt their economy. Moreover, a severe drought affected commodity yields decreasing agricultural export revenue. Following Congressional Research Service, the investors sold their assets, putting more pressure on the Peso, and in 2018 Macri government borrowed $ 50 billion within three years (1). Despite the IMF program, the Peso continued to depreciate, which made it harder to tame inflation. After the term of President Macri term ended, President Fernandez tried to revive the economy by freezing utility tariff prices, increasing working wages, reducing medicine prices, tax rebates to a vulnerable population, and adding severance pay (Congressional Research Service 2). To offset the cost, the government increased taxes. He also addressed the public debt by talks with the IMF and other creditors. The Covid- 19 pandemic hurt the Argentinian economy by 5.7% in 2020 due to early lockdowns even though it slowed the transmission rate (Congressional Research Service 2). By printing money to finance the government, the country is at risk of another further inflation.

Figure 1: Argentina Foreign Debt (Congressional Research Service, 2)

Figure 2: Current Value of Peso (Congressional Research Service 1)

By missing the $ 503 million interest payment in 2020, Argentina defaulted on debt payment for the ninth time. There are ongoing talks to swap the old bonds with new bonds to offer some debt relief by reducing principal, interest rates, and emergency extension (Congressional Research Service 2). The IMF also acknowledges that restructuring the offer to bondholders can stabilize the external debt. Keynesian principles advocate for more government spending than saving (Chen). In this increased spending, decreased taxes in periods of recession boost the consumer purchasing power by creating more jobs. The total spending power of a government determines the production and employment rate (Chen). John Maynard Keynes argues that even in times of crisis, the government maintains the economy by increasing investment and spending power even at the cost of incurring external debt.

Over the years, the Argentinian governments have overly relied on external funding and spent most of it solving short-term issues such as improving the quality of life. Increasing taxation to curb inflation, however, works at their disadvantage. Incorporating Keynesian economic principles will not be of much help to the Argentina financial crisis. The country has a long history of debts defaults due to significant external debts. Although Keynesian principles work in some economies and recommend external borrowing, the Argentinian economy already has a substantial financial debt (Chen). Therefore, I doubt that Keynes would recommend more foreign debt to a volatile economy. According to the Wharton University of Pennsylvania, the country needs to cut spending to recover economically. Once the economy is in better shape, it will attract foreign and domestic investments, which will further help stabilize the economy. Although there will be a short period of unemployment and poverty, in the long run, this will benefit the country (Wharton University of Pennsylvania). Additionally, when the economy is better, the country can then apply Keynesian economic principles. To summarize, for the Argentinian economy to recover, .they need both political stability and political-economic discipline.

Argentina is burdened by large financial debts and a long history of defaulting; to benefit from Keynesian economic thoughts, they need first to cut spending to stabilize the economy and attract domestic and foreign investments. Historically, the country largely depended on external loans accumulating large debts which they were unable to pay. In short, stable economies attract foreign and local investments; therefore, the Argentina government should stabilize the economy.

Work Cited

Chen, James. “John Maynard Keynes.” Investopedia, 2021, https://www.investopedia.com/terms/j/john_maynard_keynes.asp.

Congressional Research Service. 2020, https://sgp.fas.org/crs/row/IF10991.pdf.

Kenton, Will. “Financial Crisis”. Investopedia, 2021, https://www.investopedia.com/terms/f/financial-crisis.asp.

The Wharton University of Pennsylvania. “What Will It Take To Rescue Argentina’s Economy?”. Knowledge@Wharton, 2019, https://knowledge.wharton.upenn.edu/article/argentina-economy/.

write

write