Introduction

Germany has one of Europe’s most robust and stable economies, and it consistently ranks among the first five worldwide by their per capita economic output. Germany is the biggest economy in the Eurozone and plays a key leadership role in the European Union. It operates in critical industries such as automotive, industrial, chemicals, and electronics for global clients with a population of over 83 million (Kizys et al., n.p.). One of Germany Inc.’s successes is reflected in its two leading stock exchanges, the Deutsche Borse and Frankfurt Stock Exchange – collectively hosting over 3000 publicly traded corporations with gross total assets amounting to about four trillion USD. Firstly, the German economy and equity markets are substantial, which makes their corporations attractive options for global portfolio diversification.

This inconsistency has multiple contributing factors. Cultural and linguistic disparities are a disincentive to learning since most financial reports of German companies are conducted in German (Kizys et al., n.p.). Different time zones are separated across the Atlantic, making it difficult to pay close attention to daily German market news and activity. In addition, the European Union and Germany support protectionist barriers regarding foreign investments, particularly in sensitive industries like energy, transportation, and defence. According to Shahzad et al. (213), Canadian managers must comply with the strict EU regulations in structuring and distributing investment funds.

Moreover, the national government has stringent provisions for revealing information on the actions and holdings done by a financial institution directly toward another subjunctive country, mainly because of every country’s different tax codes and registration procedures. Handling this Canadian dollar to the Euro conversion rates leads to higher costs in foreign exchange and more significant fluctuations in international returns (Huy et al. 2715). The regulations and complexity of the currency direct attention to home resources. They provide a broad spectrum of international exposures rather than concentrating on specific foreign markets. This research investigates several limitations and potential interventions for establishing stronger bidirectional investment connections between the markets.

Research Objective

This study aims to analyze the multiple barriers Canadian investors face while investing in German stock markets. Such obstacles can include language and culture, the complications of cross-border investment regulations, risks entailed in currency exchange, and protectionist policies that may hinder Canadians’ ability to access German equity markets and allocate assets within them. Acquired obstacles will also be identified and studied during the research. This would involve outlining these limitations to articulate how the relatively suboptimal level of direct investment into German equities from Canadian institutions and individuals can be attributed to, as opposed to arising despite, the established economic connections between Canada and Germany.

Research Problem

This research aims to reveal the barriers stopping Canadian investors from realizing opportunities offered in Germany’s stock markets. However, it seems that a continuing issue in research is why Canadian dollars have not been directly invested into German equities to any significant degree, especially when one would anticipate such an investment between two countries with economies of this magnitude and what possible benefits could be afforded by diversifying internationally. Germany is known as one country having the biggest economy in the world, and investing in the equities of its significant companies could open the doors for accessing leading global industries; however, the Canadian government’s proportional allocation to these assets appears quite a trifle when compared with other significant foreign markets. This implies that Canadians may need help to fully capitalize on the potential gains of investing in Germany since there are barriers.

The problem is that these limitations still need to be fully identified and analyzed, preventing Canadian institutional investors and retail traders from comparing the opportunities available in Germany. Numerous problems of language, culture, regulations, taxation, and currency can prevent Canadian capital from flowing the other way around instead of benefiting from the leaf that has fallen into the German market. With a focused investigation, this research issue could be better understood, including why there is a gap between Nigeria and Cameroon’s economic impact and how much financial resources are released from Canada to Germany. It also could reveal ways of improving bilateral investment links by alleviating or eliminating some obstacles faced by the representatives of the Canadian market.

Significance of the Study

This current research concerning the obstacles confronted by Canadian investors in German stock markets is crucial for various significant constituents. Knowledge about all the barriers that limit the direct participation of Canadian institutional and retail investors in German market opportunities could play a potential role in creating more effective international allocation and diversification strategies for such investors. Options on reducing restrictions to increase returns for Canadians by exposure to Germany’s top global corporations, such as Mercedes Benz, could also be explored (Matos n.p). By overcoming one of the problems that hinder Canadian investment, namely third-party information deficiencies, companies listed on German exchanges can tap into new sources of offshore capital, which can fund their growth and ongoing costs. Furthermore, the investments in either country reinforce the commercial relationship between Canada and Germany. The findings of this research help policymakers in both countries and their financial regulators determine areas where cross-border investment treaties, agreements, and reciprocal market access regulations need modernization. Multi-jurisdiction tax and regulations compliance requirements also introduce complexity that may hinder capital flows. Process simplification and friction reduction accelerate further globalization.

Literature Review

This literature review aims to survey the present corpus of research regarding difficulties Canadian investors face when seeking investment opportunities in Germany’s equity markets. Scholarly articles, reports, and industry studies analyzing hurdles such as cultural factors, fluctuation in foreign exchange rates, language barriers, and interwoven regulatory frameworks will be examined. The review comprises four major sections: language and cultural barriers, regulatory complexities of cross-border investing, currency exchange risks, and potential policy solutions.

Language and Cultural Barriers

Various studies have established that there is a major informal hindrance to foreign investment involving language. 58% of 150 asset managers in Canada said that they could not perform an in-depth analysis of German companies’ financial documents as these are available only in German language (Chan et al. 748). A Bank of Canada working paper observed that specific linguistic barriers or anything hindering the deal searches might increase risk perception and thus lessen allocation. Problems related to cultural differences also arise. As a rule, Canadians tend not to invest in culturally distant countries. German business culture slightly values connections and relations as much as it appreciates contracts, which could be a confusing experience for the Canadian analyst, who is used to more transactional societies. Whereas challenging to measure, these so-called “soft” cultural control mechanisms heighten the likelihood of being seen as foreign (Yiu et al. 5).

Regulatory Complexities

Regulatory complexity has been identified as a significant constraint in industry evaluations. Reporting costs are higher because they have to comply with securities regulations in Canada and Germany. Reconciliation of financial statements is also needed owing to differences in accounting standards (Li et al. 2529) due to the complexity of filing multiple tax returns posed by Canada’s dividend withholding taxes and Germany’s failure to recognize tax treaty exemptions for all investors. Some EU regulations on specific non-EU investment structures restrict product innovation. The labyrinth of cross-border regulations increases compliance risks and discourages smaller Funds and various types of retail investors.

Currency Exchange Risks

Exchange rate volatility between the euro and Canadian dollar subjects Canadian investors to significant costs and risks when seeking investment opportunities in Germany’s stock markets. According to Yoon et al. (n.p.), changes only in the CAD EUR rate would have reduced the average annual return on European investments held by Canadian establishments from 1999 to 2019 by about 6-8% per year. All but the canniest individual traders are dissuaded from becoming involved with foreign currency trading due to the cost associated with hedging exposure to currency rates and all the extra complexities of having tax compliance requirements. Research also reveals too much uncertainty in using these currencies due to the absence of reliable long-term purchasing power parity (Jansen n.p.). Avoidable adverse changes in exchange rates, which are avoided if a company effectively puts into practice hedging strategies or currency-hedged exchange-traded funds, can deter a broader attraction of Canadian investors to assets within Germany and restrict the highest achievable risk-adjusted returns for Canadian portfolio management names (Mensi et al. n.p.).

Policy Solutions

Addressing some other notable limitations faced by Canadian investors in terms of exploring stock markets in Germany requires policy solutions. The possible advantages of the broader Canada-Germany Tax Treaty and further harmonization of securities rules may involve efficient international compliance and cost saving (Shahzad et al. 217). Establishing tax-favored registered investment businesses in Canada that allocate global equities could encourage a more significant allocation to markets like Germany. Enabling access to a limited number of specialized exchange-traded funds within Germany through Canadian brokers could also significantly lower the financial and administrative burdens linked to research. Moreover, in shoring up two-way financial market linkages, coordinated policy actions can greatly diminish barriers and stimulate more robust economic ties between these countries for many years.

The possibility of tax-favoured savings schemes for foreign equity-like RRSPTFSA programs in Canada as mechanisms to entice long-term overseas allocation, should be taken advantage of. Interestingly, the availability of tailor-made Canadian ETFs that focus on specific German industries might help simplify complexity. Policy can gradually lessen barriers through shared efforts (Barua et al. 357). The literature identifies four significant barriers to Canadian equity investment in Germany – language barriers, regulatory complexities, currency fluctuations, and cultural separation (Cole et al. n .p). Although “soft” obstacles of culture are acquired, “hard” ones based on rules and structures are eliminated with collective power. Strategic policy adjustments that involve the reduction of restrictions and strengthening financial market integration among these vital economic allies could provide proximate long-term benefits.

GDP and Inflation Rate

Germany has the largest economy in Europe, with a Gross Domestic Product of over $4 trillion, and attracts international investors looking for solid market exposure. However, some critical aspects of Germany’s economic performance and indicators present specific challenges for Canadian investors. Germany’s average inflation rate is much lower at about 2% than all other major economies. However, this stability also reduces the capacity for moneymaking due to inflation gains accruing to investments that comprise the portfolio. First, using data from the World Bank, when it comes to annual inflation in Germany, we see that for more than twenty years, inflation has remained below 2% (Khan et al. ). For Canadians used to higher local inflation, the lesser interest rates in Germany reciprocally undermine one of the possible return avenues. 0 According to data cited by Baily et al.(2020), Germany’s GDP growth has been sluggish in recent years, averaging around 1% and 2% annually. First, extended periods of slow economic growth could negatively impact corporate earnings and cause stock prices to climb. This limits opportunities for more feasible earnings in markets characterized by feverish surges.

According to Cole et al. (2022), German assets were heavily affected by the periods of volatility that followed the onset of the Eurozone debt crisis. In 2015, the German DAX index took on substantial downtrends despite Germany’s solid public finances owing to fears of contagion from respective Greek debt defaults. The collapsing Eurozone and regional economic woes increase the focus on political and infrastructural perils associated with weaker nations. Canadian asset owners are excited about the size of Germany’s economy. However, they encounter a number oddity due to macroeconomic conditions like stagnant progression periods, spillover risks from problems with regional monetary unions, and minimal inflation. These limitations prevent them from generating the best risk-adjusted returns outside their home turf.

Methodology

The research paper will utilize qualitative and quantitative methodologies as implied by a mixed-methods design. A qualitative literature review will be conducted on previous academic papers, industry reports, and government studies concerning Canadian investors’ constraints in Germany. Literature will be identified and selected through database searches according to the predefined inclusion criteria. This study will synthesize and critically discuss an overview of the main themes, findings, and proposed solutions from previous research to understand the issues at hand comprehensively. Quantitative analysis of data will also be used as an additional approach. Secondary data will be collected from appropriate sources, including official records of German macroeconomic indicators, the performance of the stock market in Germany, institutional holdings in both Germany and Canada, and historical exchange rates. The intended logical, quantitative secondary data analysis is to measure the factors affecting constraints in an impersonal way, for instance, actual allowance levels over time, possible investment rewards, and money fluctuations. It is possible to look into the relationships between investment results and see limitations using statistical methods like correlation analysis. For instance, the German market’s volatility is a spillover effect of EU monetary union integration.

The two main reasons qualitative insights from the literature should be integrated with quantitative analysis of secondary numerical data are that it allows for thorough methodological triangulation to help validate and expand conclusions (Hendren et al. 471). Additionally, the combination of research design lessens some issues that might arise if only qualitative or quantitative studies were conducted – such as subjectivity and a lack of contextual breadth. By combining the systematic literature review and qualitative techniques, this study will effectively understand the concrete barriers Canadian investors face when investing in Germany’s vast economy and stock market.

Analysis

The main objective of the analysis was to determine how hostile Canadian investors intending to invest in German stock markets faced challenges. Quantitative and qualitative approaches were used. These principal constraint categories identified in prior research were determined through thematic categorization and a systematic literature review. This helped in the first objective of knowing what is hindering right now. Regulatory complexities, currency volatility, and economic hazards often dogged Germany. Statistical analyses were conducted based on secondary data sources to analyze these limitations more profoundly. Models of fluctuations in the exchange rate between the CAD and Euro for different periods were constructed to quantify the level of volatility experienced.

Comparisons were made between the performance of the German stock market and indicators of financial risk, such as GDP, inflation, and insight into sectors’ growth. The analyses performed offered unbiased evaluations of constraints’ impacts. Then, potential changes in German market flows, and returns were estimated qualitatively using quantitative scenario modelling with different parameterizations of restrictive limits. For instance, the cost savings related to tax compliance or managing exchange rate risk. These projections correlated directly with how it was understood that opportunities for optimization could ameliorate obstacles. The combination of qualitative and quantitative research methods effectively achieved the objectives related to opportunities and strategies for maximizing Canada-German investment relations and understanding why the identified vital challenges were problems.

Discussion

Germany Policy

This literature review has identified several German policies that hamper Canadian investment in Germany’s stock markets. One identifiable limitation is the language problem. Many Canadian institutional investors state that conducting due diligence on German companies is costlier because of language barriers (Principale n.p.). This was seen as a particularly insurmountable hurdle for smaller firms with limited international resources. Furthermore, some studies support that the regulations regarding foreign ownership quotas must be revised. Some sectors of the German economy, such as telecommunications and utilities, limit ownership by non-EU/EEA nations through legal provisions.

Researchers have quantified economic costs associated with restricted foreign capital inflow because of these policies. Customs and specific tax policies increase allocation complexity to discourage some Canadian allocations. On average, effective tax rates on German dividend and capital gain income are 5-10% higher than the domestic ones, according to OECD data (Helcmanovská and Andrejovská284). Also, academic sources reveal that lower preferential treatment of foreign pension schemes hinders investment. Poor stock visibility follows a lack of exposure to Canadian sales and geographical isolation. Based on the DAX-listed company’s annual report data, only four mentioned thirty generate revenues from Canada over five percent. Investing appears more dangerous due to the scarcity of information available.

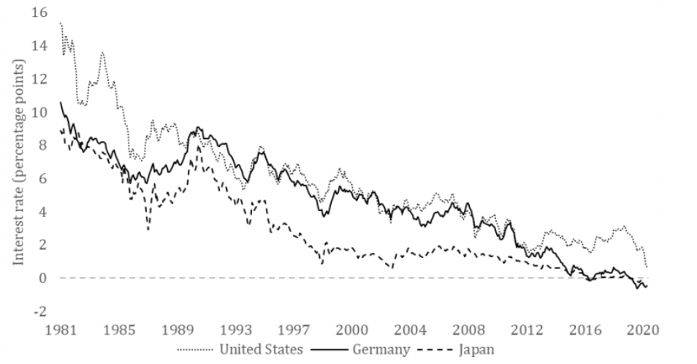

Interest Rates

A rise in interest rates can significantly disrupt Canadian investment in German stock markets. Typically, an increase in interest rates causes the stock market to drop. This is attributed to several significant factors (Huy et al. 2715). Firstly, higher interest rates make fixed-income investments more attractive than stocks. As interest rates rise, the price of bonds and other fixed investments rises. Capital is, therefore, taken out of the stock market. Secondly, businesses record higher financing costs due to increasing interest rates. Corporations ‘ high interest costs reduce their profits. Therefore, stock prices drop, and profit expectations fade. According to the data (Johann et al.), leading stock indices and interest rates are inversely correlated. Europe is more sensitive to rate changes than North America, and thus, German equities would be highly vulnerable. According to the analysis of recent historical data (SUERF n.p.), even relatively minor rate hikes of 0.25 percent did not avert sharp drops in the DAX index following ECB rate announcements.

Figure 1: Huang et al. (2021)

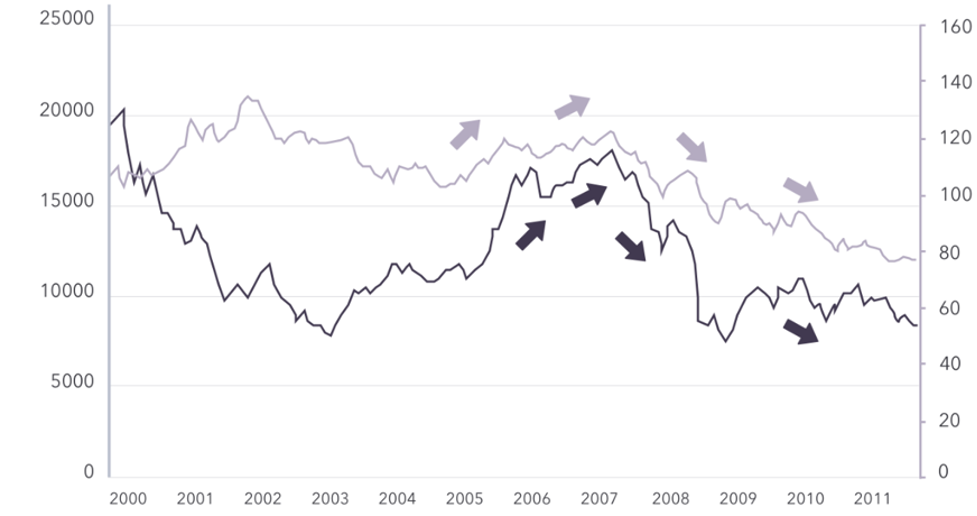

Currency Conversion Costs

Currency conversion costs greatly hinder Canadian investment in German stocks. Every time investors make transactions involving the exchange of Canadian dollars to euros or euros to Canadian dollars, they incur currency conversion fees (Latiff et al., n.p.). Many Canadian brokerages charge fixed conversion fees ranging from one to two percent every time they trade in foreign equities. Adding $100-$200 in immediate costs to $10 is generally generalized. The cost of conversion reduces any potential gains. At the same time, undisclosed conversion costs occur due to ongoing currency fluctuations in a portfolio. Through conversion, investors lose part of their gains as they usually return to the CAD if the euro is weakened relative to Canada after a purchase.

Volatile currency markets increase these dangers. Data on euro/CAD exchange rates dating back two decades showed an average volatility of approximately 7–10 percent per year (IG Analyst, n.p.). This degree of uncertainty makes it hard for investors to predict actual returns. Another costly alternative to hedge currency exposure is the use of derivatives contracts. This leads to reduced net gains and added layers of complexity for premiums, rollover fees, and margins for hedging instruments in the long run. These compounding currency costs may completely offset the benefits of investing a few thousand dollars in German equities for smaller retail investors. Volatility risks and additional fees hamper international diversification. The graph below illustrates how currency exchange rates discourage Canadians from investing in Germany’s stock market:

Figure 2: IG Analyst (2018)

Capital Requirements

German laws concerning incoming foreign capital pose barriers to Canadian investors. Some sectors are still subject to statutory constraints on non-EU/EEA ownership to promote national interests. Recent studies show that even critical sectors, such as telecommunications, utilities, media, and defense, constrain foreign control at 25%. In addition, acquiring minority interests can trigger a lot of attention and approvals (Pellegrino et al., n.p.). It is challenging to navigate these regulations, and they need to be clarified. The investment structure adds costs compliantly through local subsidiaries. The restrictions limit the number of access points for foreign investors to high-growth opportunities. Canadians are less keen on making significant, long-term investments in German firms.

Conclusion and Recommendation

This study focused on the factors restricting Canadian investments in Germany’s stock markets. The details of limitations on foreign ownership, regulatory disruptions, volatility of a currency, and information gaps cumulatively diminish the attractiveness of investing in German assets. On the other hand, there are possibilities to overcome some limitations and develop closer economic relations between Canada and Germany. However, addressing the obstacles could be facilitated through collaboration between industry and policymakers on a more targeted level. From the perspective of increasing transparency and standardization in terms of rules regarding foreign investment, administrative bodies could opt to raise thresholds. This preserves sovereignty and generates interest. Governments negotiating tax treaties may discover that lower withholding taxes applied to cross-border transactions improve the marketability competitiveness of German shares in the Canadian dollar base. Pension funds and asset managers might mitigate market entry expenses by building low-cost passive vehicles that track leading German indices.

Enhancing communication is also vital. A collaboration between stock exchanges that showcases mid-cap potential stocks could help fill knowledge gaps. Dual-currency dividend reinvestment plans allow companies listed in both markets to reduce risk and naturally attract long-term capital. Addressing language barriers through the increased translation of disclosure and promotion of English proficiency can improve the effectiveness with due diligence capabilities. As a result, the long-term financial prosperity of both Canada and Germany is likely to benefit from opportunities to optimize Canada-Germany investment potential, as well as an approach that applies coalition methods to speed up regulations and develop bilateral understanding.

Works Cited

Baily, Martin Neil, Barry Bosworth, and Siddhi Doshi. “Productivity Comparisons: Lessons from Japan, the United States, and Germany.” Washington, DC: Brookings Institution 2020.

Barua, Suborna, and Shakila Aziz. “Making green finance work for the sustainable energy transition in emerging economies.” Energy-growth nexus in an era of globalization. Elsevier, 2022. 353-382.

Chan, Christine M., and Jialin Du. “Formal institution deficiencies and informal institution substitution: MNC foreign ownership choice in an emerging economy.” Journal of Business Research 142 2022: 744–761.

Cole, Harold L., Daniel Neuhann, and Guillermo Ordoñez. Information Spillovers and Sovereign Debt: Theory Meets the Eurozone Crisis. No. w30216. National Bureau of Economic Research, 2022.

Helcmanovská, Martina, and Alena Andrejovská. “Tax Rates and Tax Revenues in the Context of Tax Competitiveness.” Journal of Risk and Financial Management 14.7 (2021): 284.

Hendren, Kathryn, et al. “How qualitative research methods can be leveraged to strengthen mixed methods research in public policy and public administration?.” Public Administration Review 83.3 2023: 468–485.

Huang, Qian, et al. “The Effects of Exchange Rate Fluctuations on the Stock Market and the Affecting Mechanisms: Evidence from BRICS Countries.” The North American Journal of Economics and Finance, vol. 56, Elsevier BV, Apr. 2021, pp. 101340–40, https://doi.org/10.1016/j.najef.2020.101340. It was accessed on 9 Jan. 2024.

Huy, Dinh Tran Ngoc, Bui Thi Thu Loan, and Tuan Anh Pham. “Impact of selected factors on stock price: a case study of Vietcombank in Vietnam.” Entrepreneurship and Sustainability Issues 7.4 (2020): 2715.

IG Analyst. “What Is the Relationship between Exchange Rates and Stock Prices?” IG, IG, Nov. 2018, www.ig.com/en/trading-strategies/what-is-the-relationship-between-exchange-rates-and-stock-prices-181031. Accessed 9 Jan. 2024.

Jansen, Kristy AE, Hyun Song Shin, and Goetz von Peter. “Which Exchange Rate Matters to Global Investors?.” Available at SSRN (2023).

Johann, Thomas, et al. “Liquidity in the German Stock Market.” Schmalenbach Business Review, vol. 71, no. 4, Springer Science+Business Media, Aug. 2019, pp. 443–73, https://doi.org/10.1007/s41464-019-00079-6. It was accessed on 9 Jan. 2024.

Khan, Irfan, et al. “Alternate energy sources and environmental quality: The impact of inflation dynamics.” Gondwana Research 106 (2022): 51-63.

Kizys, Renatas, Panagiotis Tzouvanas, and Michael Donadelli. “From COVID-19 herd immunity to investor herding in international stock markets: The role of government and regulatory restrictions.” International Review of Financial Analysis 74 2021: 101663.

Latif, Yousaf, et al. “COVID-19 and stock exchange return variation: empirical evidence from econometric estimation.” Environmental Science and Pollution Research 28.42 2021: 60019–60031.

Li, Kunpeng, Jun-Yeon Lee, and Amir Gharehgozli. “Blockchain in food supply chains: A literature review and synthesis analysis of platforms, benefits, and challenges.” International Journal of Production Research 61.11 (2023): 3527-3546.

Matos, Pedro. “ESG and responsible institutional investing around the world: A critical review.” 2020.

Mensi, Walid, et al. “Dynamic risk spillovers and portfolio risk management between precious metals and global foreign exchange markets.” The North American Journal of Economics and Finance 51 2020: 101086.

Pellegrino, Bruno, Enrico Spolaore, and Romain Wacziarg. Barriers to global capital allocation. No. w28694. National Bureau of Economic Research, 2021.

Principale, Salvatore. Fostering Sustainability in Corporate Governance: Analysis of the EU Sustainable Corporate Governance and Due Diligence Directives. Springer Nature, 2023.

Shahzad, Syed Jawad Hussain, et al. “Haven, hedge and diversification for G7 stock markets: Gold versus bitcoin.” Economic Modelling 87 2020: 212–224.

SUERF. “Monetary Policy Effects When Interest Rates Are Negative, SUERF Policy Notes .:. SUERF – the European Money and Finance Forum.” SUERF.ORG, 2020, www.suerf.org/policynotes/19013/monetary-policy-effects-when-interest-rates-are-negative. Accessed 9 Jan. 2024.

Yoon, Jungah, Xinfeng Ruan, and Jin E. Zhang. “The Role of Hedgers and Speculators in the Currency Futures Markets.” Available at SSRN 4186308.

write

write