Executive summary

The Chinese and Indian financial systems rely heavily on the country’s banking and money markets. People who do not want to spend all their money and those who would like to spend more than they have can both benefit from their services. Therefore, financial institutions work to mitigate market pressures like fierce rivalry for scarce goods. Banks and money markets, like the heart, pump money into the economy to keep it healthy and thriving (John et al., 1997). There are periods when economies require less money and times when they require more. Banks use various methods to regulate the supply of currency, which vary with the state of the economy and the central bank’s authority. One of the primary tools used by the central banks of China and India to regulate the money supply is the reserve requirement. There exists a widespread practice in these financial markets whereby central banks mandate that depository institutions, such as commercial banks, hold a specific percentage of their clients’ deposits as reserves (John et al., 1997). So, money is constantly saved and never squandered away. Reserve requirements can be as low as 9 percent in India. The theory of absolute cost advantage can be helpful in various contexts, including determining interest rates and inflation in China and India. For instance, if India and China can reduce the amount of money needed to produce a particular good or service, the countries may be in a position to sell that good or service to other countries at a lower price, which could help the countries’ exports and their overall economic growth. In the case of China and India, their success in international markets is due in part to their neoclassical economic policies and focus on increasing productivity and efficiency.

Background of the Chinese and Indian financial markets

The Chinese and Indian financial systems rely heavily on the country’s banking and money markets. People who do not want to spend all their money and those who would like to spend more than they have can both benefit from their services. Therefore, financial institutions work to mitigate market pressures like fierce rivalry for scarce goods. Banks and money markets, like the heart, pump money into the economy to keep it healthy and thriving (John et al., 1997). There are periods when economies require less money and times when they require more. Banks use various methods to regulate the supply of currency, which vary with the state of the economy and the central bank’s authority. For instance, in China, The People’s Bank of China serves as the country’s central bank. It is the primary financial reserve of the People’s Republic of China.

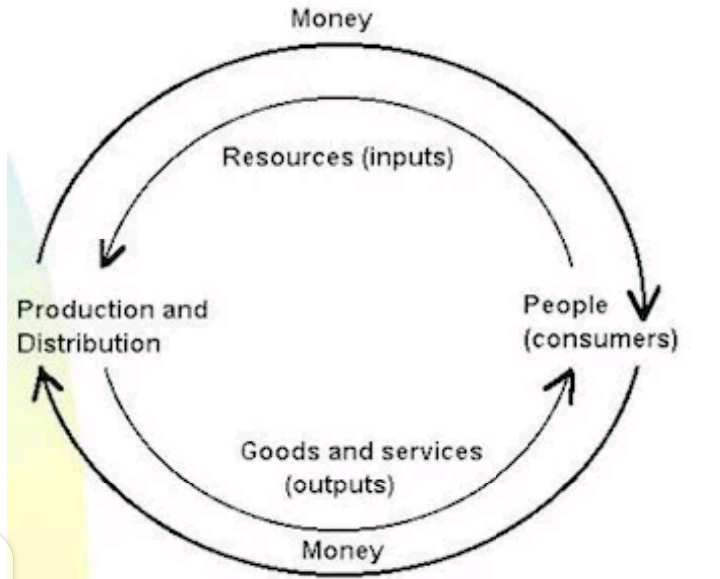

Money circulation influences both micro and macroeconomic activities. Individuals and organizations will spend more of their own money if they have access to a huge sum of money that is effectively free (Abbas, 2022). Borrowing money becomes less of a hassle for individuals (via loans for things like cars and homes) and enterprises (through lines of credit and other forms of funding). A country’s GDP, general growth, interest rates, and unemployment rates are all impacted by the flow of money at the macro level (Abbas, 2022). Routinely, the People’s Bank of China regulates the supply of currency in the economy to achieve economic goals and influence monetary policy.

One of the primary tools used by the central banks of China and India to regulate the money supply is the reserve requirement. There exists a widespread practice in these financial markets whereby central banks mandate that depository institutions, such as commercial banks, hold a specific percentage of their clients’ deposits as reserves (John et al., 1997). So, money is constantly saved and never squandered away. Reserve requirements can be as low as 9 percent in India. Banks with more than $100 million in deposits must have $9 million in reserves. The remaining 91,000,000 USD can be dispersed as needed. This way, sending money to folks who do not need it right now will be less hassle (John et al., 1997). The Reserve Bank of India could encourage excellent economic activity by reducing this requirement. As a result, the bank will be able to extend more loans. People who spend more than they earn will be able to receive aid more efficiently.

Interest rate changes are another tool for reducing consumer spending and increasing competition for limited resources. In China and India, mortgage, auto, and personal loan interest rates are not actively regulated by their respective central banks (John et al., 1997). Conversely, the central bank has a number of tools at its disposal to increase interest rates to target ranges. A prime illustration of this is the central bank’s role in establishing the policy rate (the rate at which commercial banks can borrow money from the central bank). When banks can borrow funds from the central bank at a reduced interest rate, they can reduce the cost of lending to their consumers. Reduced loan interest rates have increased currency availability (John et al., 1997). This will also encourage more people to participate in the economy by spending money.

It is a common misconception that the government cannot affect free markets in any meaningful way. However, governments intervene to ensure market order, monitor financial dealings, establish the necessary infrastructure, and enforce property rights and contract rules. Governments can implement rescue measures, including bailouts, in the event of a market collapse. For instance, China and India should weigh the benefits and drawbacks of various hedging strategies before settling on one. The theory of absolute cost advantage specifies that the prosperity of a nation cannot be calculated by how much gold and other valuable commodities it has but by its people’s living values. Investments in securities, real estate, currencies, and interest rates are among the most effective ways for businesses to lower their risk exposure. Different industries can benefit from using different hedging contracts to spread risk (Nasir et al., 2018). Derivatives are financial contracts whose value relies on the value of the underlying commodity or assets. Commodities, equities, currencies, and interest rates are only some examples. In contracts, they serve to mitigate potential adverse outcomes. Forwards, futures, options, swaps, equity derivatives, and credit derivatives are all examples of derivatives that can be purchased in the financial markets. A company may use one or more derivatives to cover its various risks. According to Keynesian economics, the role of the government in the economy is crucial (Paul et al., 2018). This is evidenced by the ebb and flow of prosperity seen in free markets.

Critical assessment of the attractiveness of international expansion of China and India

Absolute Cost Advantage Theory

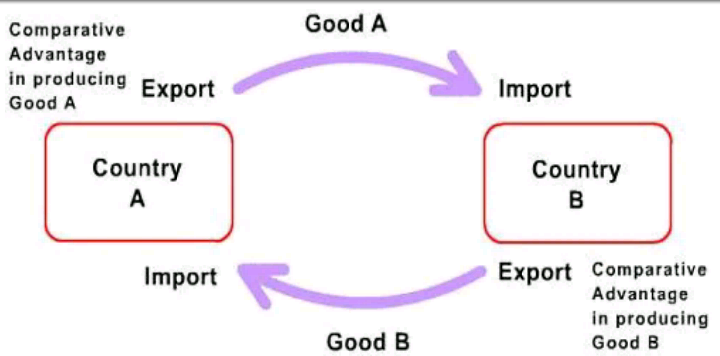

The father of modern economics, Adam Smith, first proposed this concept. This concept was conceived in reaction to protectionist and mercantilist viewpoints on international commerce. According to Adam Smith, free trade is crucial since it is the only way to guarantee trade expansion. He argues that nations should only produce items with a competitive advantage. According to Smith, free trade facilitates the division of labor around the world (Paul et al., 2018). Producers with varying absolute advantages will always be able to outperform producers in more isolated locations thanks to specialization and division of labor. He advocated playing to a country’s strengths to increase output while decreasing costs. A nation should engage in competitive advantage exporting when its production costs for a given product are lower than those of competing nations.

The theory explains how nations can profit from trade by specializing in producing goods and services where their production costs are lower (Paul et al., 2018). This allows the nation to produce more goods and services at a lower cost. According to this theory, the relative costs of production in different nations are different for various reasons, including differences in technology, the cost of labor, and the availability of natural resources. Both China and India try to reduce their cost of production to gain a competitive advantage. However, China has managed to reduce its cost of production hence gaining a competitive advantage.

For this reason, the theory of absolute cost advantage can be helpful in various contexts, including determining interest rates and inflation in China and India. For instance, if India and China can reduce the amount of money needed to produce a particular good or service, the countries may be in a position to sell that good or service to other countries at a lower price, which could help the countries’ exports and their overall economic growth (Fredrick et al., 2012). Interest rates may decline if there is a concurrent increase in the credit demand and the central bank’s efforts to stimulate economic activity.

Similarly, India might be able to lower the prices of the goods and services it offers due to technological developments or other increases in efficiency. This has helped China to maintain low inflation rates. The rate at which prices are increasing is referred to as inflation, and the fact that prices are increasing at a slower rate can help to keep interest rates at a low level (Fredrick et al., 2012).

Neoclassical counterrevolution theory

Neoclassical counterrevolution theory is an economic theory that explains how building up capital, making progress in technology, and increasing productivity all help the economy grow (Paul et al., 2018). This idea says that countries with higher productivity and efficiency can make goods and services for less money, which makes them more competitive on the world market. In the case of China and India, their success in international markets is due in part to their neoclassical economic policies and focus on increasing productivity and efficiency. Both countries’ economies have become more productive and competitive due to market-based reforms and the influx of foreign capital.

China and India are also good places to make things and do business because they have many people and do not pay much for their labor. Their ability to make goods and services for less money than other countries has helped them grow their international market. The neoclassical counterrevolution thesis is an excellent way to understand how China and India have grown quickly in international markets. The theory demonstrates how their focus on boosting productivity and competitiveness has helped their economy, even though other things like government policies, trade agreements, and the global economy have also played a role.

Evaluation of Chinese and Indian Economies

| Economic evaluation | India | China |

| Patterns of trade | Since the early 1990s, there have been significant shifts in the worldwide economic patterns involving India. A sixteen-fold growth from 1990–1991’s $18 billion to 2017–2018’s nearly $300 billion may be seen in export value. Imports of goods during this same period increased by more than 20 times, from $ 24 billion to more than $ 460 billion. The export market is moving away from traditional staples like textiles and food. Currently, 28 percent of all items are engineering-related. Many vital drugs are exported from India, making it a “pharmacy” for the rest of the globe. Companies in developed economies have been increasingly turning to their Indian partners to handle back-office operations that necessitate a high level of IT and expertise, turning India into a global back office. Although these remittances and remittance revenue support India’s balance of payments, they are not included in statistics on merchandise trade. | To deal with global economic integration and industrial migration, China has established a strategy and policy that prioritizes “active absorption of foreign direct investments and facilitation of international trade development.” Excellent results have been obtained using this technique, but it is increasingly difficult to implement. Resource, energy, and environmental issues are worsening as China’s economy develops rapidly. China’s relationships with other nations have suffered due to the rapid expansion of China’s trade volume throughout the world, which has led to a rise in the number of trade disputes. Given the current environment, recent national changes, and international contacts, China needs to develop a long-term trade policy. |

| Major trade partners | India enjoys a substantial commercial relationship with numerous Middle Eastern nations, such as Saudi Arabia and the United Arab Emirates. China, Singapore, Japan, and many more Asian nations have substantial trading ties with India. Additionally, India has a close trade relationship with the United States. | Many Asian nations, notably Japan, South Korea, and Australia, trade extensively with China. In addition, China has substantial trading ties with several European nations, including Germany, the UK, France, and the United States (Petros, 2012). |

| The competitive advantage of the economy

· Interest rate · Inflation rate · Unemployment rate · Exchange rate · Net FDI · Foreign reserve · Gold reserve · Poverty index |

· The Reserve Bank of India, the nation’s central bank, determines the benchmark interest rate. The benchmark interest rate in India was about 4% as of 2021 (Petros, 2012).

· The inflation rate in India was 4% in the year 2021 · India had an unemployment rate of about 7% in 2021. · Around 73 Indian rupees were for one U.S. dollar when the exchange rate stood. · India’s net FDI was estimated to be $49 billion in 2021. · India’s foreign reserves were approximately $570 billion in 2021. · India’s gold holdings were estimated to be 558.5 million ounces in 2021. · In India, the poverty index was 21% as of 2021. (Petros, 2012). |

· The benchmark interest rate for China is established by the People’s Bank of China, the nation’s central bank. The benchmark interest rate in China was about 3% as of 2021.

· The inflation rate in china was 2% in the year 2021 (Petros, 2012). · China had an unemployment rate of about 5% as of 202. · The exchange rate between the Chinese yuan and the American currency as of 2021 was roughly 6.5 yuan to 1 dollar. · China’s net FDI in 2021 was estimated to be $163 billion. · China’s foreign reserves were over $3.2 trillion as of 2021. · China’s gold holdings were estimated to be 63.5 million ounces as of 2021. · In China, the poverty index was about 1% as of 2021 (Petros, 2012). |

| Trade agreements | Twelve bilateral and multilateral free trade agreements and regional agreements have been signed between India and other nations. These pacts streamline India’s ability to trade with foreign nations. The European Union, Canada, Australia, and Israel are among the several countries in FTA negotiations with India (Petros, 2012). | There are currently 16 FTAs in effect between China and its business and investment partners, while another eight are either in negotiation or implementation. Countries with free trade agreements with China include those in the Association of Southeast Asian Nations (ASEAN). In addition to the FTAs with Australia and South Korea, China has recently signed FTAs with several other countries (Petros, 2012). |

| Membership in international trade organizations | India’s membership in various international organizations is a focal point of the country’s economic and political development. It is common knowledge that the World Trade Organization (WTO) is a government-led organization focused on facilitating commercial transactions between countries (WTO), and India is one of the countries in the organization (Petros, 2012). | China officially joined the World Trade Organization (WTO) on December 11 of that year, following approval by the Ministerial Conference. It took extensive negotiations and substantial economic reforms for China to join the World Trade Organization finally. China’s membership in the WTO has had significant economic and political impacts on other nations, and the WTO itself is not a good fit for China’s economic model (Petros, 2012). |

Critical evaluation of challenges facing India and China

China and India have significantly benefited from industrialization and trade policies, but there have also been significant drawbacks. The following are some of the major difficulties that both nations have encountered as a result of industrialization and trade policies:

Environmental degradation: The growth of businesses has caused air, water, and soil pollution in both China and India, which has led to several environmental issues like climate change, desertification, and biodiversity loss (Nasir et al., 2018).

Social inequality: Trade and industrialization policies frequently favored some sections of the population more than others, resulting in social inequality and an increasing wealth disparity.

Labor issues: Industrialization has increased the labor force in China and India, but it has also brought about several labor-related problems, such as low salaries, unfavorable working conditions, and worker exploitation (Nasir et al., 2018).

Export dependence: China and India are both strongly dependent on exports for economic growth, which leaves them open to changes in the global economy and shifts in consumer demand for their goods. While trade policies and industrialization have benefited China and India greatly, they have also generated several problems that both nations have had to resolve (Nasir et al., 2018).

Several governmental takeovers have stymied industrialization efforts in China and India (Enderwick, 2022). Many worry that politically influential groups would exploit industrial policy for their own ends rather than alter the economic system. There is substantial evidence that the Chinese president’s financial holdings in many industries, including banking, telecommunications, and transportation, have helped shield some Chinese enterprises from competition both within China and outside, like the development policy of China (Enderwick, 2022). As a result of price increases brought on by monopolistic power being granted to specific sectors, China’s exporting sector is now less competitive than before. Since this is a worldwide issue, it is crucial to consider how to prevent the policy from being usurped by other nations before implementing an industrial plan. By raising awareness of the correlation between cronyism and job losses, citizens can pressure politicians to fulfill their campaign pledges, decreasing the likelihood of political capture.

According to India’s 2020 WTO Trade Policy Review, India’s trade policy mainly comprises tariffs, export restrictions, export taxes, anti-dumping fines, and import licenses. According to economist Arvind Panagariya, these technologies wreak havoc on the international trade system by sowing doubt and confusion (Enderwick, 2022). Most of the policy changes implemented through circulars and notifications counter India’s trade policy goals outlined in the country’s five-year FTP plan. New import limits, tariffs, and regulations have made India’s trade policy the most stringent it has ever been. Schedule 1 of India’s import regulation lists “restricted” commodities, and this year, 101 types of military hardware are expressly prohibited.

Conclusion and Recommendations

International trade transactions have become more complex due to the globalization of trade through digitalization. A comprehensive strategy is now more crucial than ever, and policymakers from China and India must put aside their limited vision and concentrate on coordinating, simplifying, and integrating the FTP goals with other strategic initiatives while guaranteeing their adherence, suitability, and cohesion with the international trading system. Therefore, significant adjustments are required to make the new FTP suitable for Export activities and at the legislative level. Tax reductions and rebates should be implemented in the Chinese and Indian economies. Tax reductions and tax credits aim to place more income in taxpayers’ wallets. The ideal scenario is for these customers to spend some of that cash at various firms, raising their revenues, profits, and cash flows (Cheng & Birth, 2018). More cash gives businesses the means to raise finance, advance technologies, expand, and grow. All of these activities boost productivity, which boosts economic growth. Tax discounts and repayments allow customers to lift the economy by spending more money. For these reasons, the techniques will enable investors to conduct profitable business while the economy grows. The Chinese and Indian financial systems rely heavily on the country’s banking and money markets. People who do not want to spend all their money and those who would like to spend more than they have can both benefit from their services.

References

Abbas, S., 2022. International Trade Finance and Investment. 1st ed. London: Pearson Education. Print ISBN: 978-1-800-06664-9

Chen, K. Z., Joshi, P. K., Cheng, E., & Birthal, P. S. (2019). Innovations in the financing of agri-food value chains in China and India: Lessons and policies for inclusive financing. China Agricultural Economic Review.

Enderwick, P. (2022). Understanding emerging markets: China and India. Routledge.

Nasir, M. A., & Du, M. (2018). Integration of financial markets in post-global financial crises and implications for British financial sector: Analysis based on a panel VAR model. Journal of Quantitative Economics, 16(2), 363-388.

Paul R. Krugman, Maurice Obstfeld, Marc J. Melitz (2018) International economics: theory and policy, 11th edition Pearson Education.

Frederic S. Mishkin, Stanley G. Eakins, (2012) Financial markets and institutions, 7th edition, Pearson Education. Print ISBN: 0273754440, 9780273754442

Petros Mavroidis, (2012) Trade in goods: the GATT and the other WTO agreements regulating trade in goods, Oxford. Print ISBN: 9780199657483, 0199657483

John P. Lewis, Devesh Kapur, Richard Webb (1997) The World Bank: its first half-century, Brookings Institution. Print ISBN: 081575230X, 0815752342

write

write