Introduction

Modern business operations are significantly influenced by corporate governance and corporate social responsibility (CSR), both of which play pivotal roles in determining the sustained viability and prosperity of enterprises. The configuration of corporate governance frameworks is responsible for delineating the organizational direction and control mechanisms, constituting elements that harmonize the interests of diverse stakeholders (Adnan et al., 2018). In this comprehensive framework, the governance of risks assumes a critical position, holding responsibility for the systematic recognition, evaluation, and proficient handling of potential hazards and advantages. Simultaneously, the concept of CSR mandates organizations to transcend profit-seeking objectives, addressing social and environmental concerns. The effective integration of these practices not only ensures sustainable growth but also enhances a company’s reputation, stakeholder trust, and overall success (Loviscek, 2020). This report delves into a comprehensive appraisal of the Coca-Cola’s risk governance and CSR strategies to provide recommendations for improvement.

Part A. Governance of Corporate Risk

Current Risk Framework and Board Committee

The company has developed Business Resilience Framework, that helps in mitigating its risks through value creation and effective planning. The ultimate responsibility for the management of the Group’s risk and internal control systems lies with the Board, which also oversees the assessment of their efficiency. However, the board delegates this responsibility to the Audit & Risk Committee (Coca-Cola, 2022). Comprising independent 5 directors with financial expertise and chaired by David B. Weinberg, the committee plays a crucial role in determining the Group’s tolerance for risk. This is achieved by formulating and periodically evaluating the Company’s risk appetite statement. The Audit & Risk Committee is responsible for overseeing risk exposure, ensuring that the company effectively addresses significant risks in accordance with its goals (Loviscek, 2020).

| Risk | Impact | Probability of Occurrence |

| Changing Economic Conditions | 4 (high) | 3 (moderate) |

| Competitive Threat | 4(high) | 4(high) |

| Foreign Exchange Fluctuations | 3 (moderate) | 4 (moderate) |

| Board Level Strategic | 2 (low) | 2 (low) |

| Corruption | 4 (high) | 2 (low) |

| Cybersecurity Risks | 4 | 3 |

| 7. Staff Turnover | 3 | 3 |

Identification and Evaluation of Risks

Strategic Risks

Changing Economic Conditions

Changing economic conditions present a strategic risk to Coca-Cola. Economic downturns can lead to reduced consumer spending on non-essential products like beverages. Throughout 2022, the company observed rising inflation and interest rates within the markets it operates. These circumstances have the potential to diminish consumer buying ability, thereby affecting the affordability of the company’s products (Coca- Cola, 2023). This scenario becomes especially pertinent when input costs are on the rise, necessitating price hikes to uphold profitability. Contributing factors include governmental and central bank actions such as tax adjustments and interest rate hikes, along with unemployment and underemployment levels. As a result of these conditions, the company could face unfavourable outcomes like decreased volume and revenue, ultimately leading to reduced profitability (Aghion et al., 2018, p.170). The probability of economic conditions changing significantly is moderate, given the cyclic nature of economies. Therefore, the impact is assigned a level 4, while the probability is assigned a level 3.

Competitive Threat

Using Porter’s five forces, competitive threats from both traditional and emerging beverage companies pose a strategic risk to Coca-Cola. The impact of heightened competition could lead to market share erosion and pressure on pricing. Furthermore, its largest competitors, Pepsi, are eating into its valuable market share, thus making this competition a significant risk. This can lead to decreased market share, price erosion, and the need for increased marketing expenditures to maintain brand relevance (Bauer et al., 2022, p.40). This impact directly influences the company’s revenue streams and operational margins, potentially affecting its financial performance and long-term sustainability. The probability is relatively high, as the beverage industry is dynamic and competitive, warranting a level 4.

Foreign Exchange Fluctuations

Foreign exchange fluctuations represent a strategic risk due to Coca-Cola’s global operations. Changes in exchange rates can impact the company’s revenues and profitability when translated back to the reporting currency. Throughout the year 2022, the company observed ongoing turbulence in foreign exchange rates and notable fluctuations, notably impacting the Russian rouble, Nigerian naira, and Egyptian pound (Coca-Cola, 2022). These trends are primarily propelled by the broader macroeconomic conditions at play. The national instability within Russia, Nigeria, and Egypt, combined with the ways governments respond to both global and local economic circumstances, contribute to these shifts (Khan et al., 2019). The potential outcomes of these dynamics include financial losses and an elevated cost structure for the company. There is also a risk of asset impairment and restrictions on the repatriation of cash (Yee et al., 2020). The impact is moderate as the company uses hedging strategies to mitigate currency risks, assigned a level 3. The probability is considered moderate, reflecting the inherent volatility of exchange rates and geopolitical factors, given a level 3.

Management-Level Risks

Board Level Strategic failing

The risk of board-level strategic failings, particularly failing to adapt to changing consumer trends, poses management-level challenges. If the board fails to anticipate shifts in consumer preferences, Coca-Cola’s product portfolio might become misaligned with market demand, impacting sales and brand resonance (Thompson et al., 2013). The impact could be substantial due to potential revenue decline and eroded competitive edge. The probability is low, considering the company’s history of adapting to market shifts, allocated a level 2 for both impact and probability

Corruption and Fraud

Corruption and fraud are significant management-level risks that could tarnish Coca-Cola’s reputation and financial standing. Instances of unethical behavior can lead to legal actions, regulatory fines, damaged brand perception, and diminished investor trust (Tricker, 2019). The impact of these risks is considerable, affecting multiple aspects of the company’s operations. The probability is relatively low, considering the company’s emphasis on ethics and compliance, assigned a level 4 for impact and level 2 for probability.

Operational Risk

Cybersecurity Risks

Cybersecurity risks are critical operational concerns that can disrupt business operations, compromise customer data, and damage the company’s reputation. The potential impact of a cybersecurity breach is significant due to potential financial losses, regulatory penalties, and customer distrust (Laville & Taylor, 2017). The probability is moderate, given the evolving nature of cyber threats and the company’s investments in security. The impact is assigned a level 4, and the probability is allocated a level 3.

Staff Turnover

Operational risks related to staff turnover can impact workforce productivity, organizational knowledge, and employee morale. The potential impact of high staff turnover includes increased recruitment and training costs, reduced operational efficiency, and compromised innovation (Whelan & Fink, 2016). The impact can be moderate to significant, assigned while the probability may vary based on industry trends and company-specific factors, allocated a level 3.

III. Risk management techniques

Changing Economic Conditions

The board can best manage this risk by strategy formulation to mitigate the risk posed by changing economic conditions. In 2022, the company executed several proactive measures, including the use of targeted actions to optimize product mix and address cost inflation, careful monitoring and control of operational expenses to maintain cost efficiency, vigilant management of cash outflows to ensure liquidity and financial stability, collaboration with partners like TCCC and stakeholders on aligned promotions and marketing initiatives, and ongoing vigilance of economic conditions to enable timely adjustments to the action plan (Coca cola, 2022). These strategies collectively showcase Coca-Cola’s proactive stance in navigating economic fluctuations, safeguarding profitability, and maintaining operational resilience in the face of uncertainties related to changing economic environments.

Cyber security

To mitigate the significant risks associated with cybersecurity, Coca-Cola implements a multi-pronged strategy that involves board oversight of robust cybersecurity policies. The company’s approach to risk mitigation encompasses various key actions, including continuous strengthening of cloud security programs and the implementation of plant network segmentation to prevent unauthorized access. Additionally, efforts to enhance privileged access management processes and technologies are pursued alongside improvements in the detection of potential cyber threats through vigilant monitoring by the Security Operations Centre. Furthermore, Coca-Cola focuses on improving its response and recovery capabilities in the face of cyber incidents and attacks. These comprehensive measures underline the company’s proactive commitment to safeguarding digital assets, data integrity, and confidential information through meticulous policies and advanced technological interventions.

Employee Retention

In its efforts to mitigate the risks associated with employee retention, Coca-Cola adopts a multi-pronged strategy focused on creating a positive and engaging workplace. The strategy encompasses various key actions, including the utilization of continuous listening to assess culture and engagement, enabling swift identification and resolution of concerns. Additionally, the company concentrates on enhancing people management skills to sustainably energize and engage employees, especially those in remote teams (Whelan & Fink, 2016). The commitment to leadership development and the cultivation of a coaching and mentoring culture further underscores the organization’s dedication to employee growth (Whelan & Fink, 2016). Notably, Coca-Cola’s proactive stance extends to promoting the retention of female employees through targeted action plans, thereby fostering diversity and inclusion while reducing turnover risks and enhancing overall organizational resilience.

Corruption and Fraud

Coca-Cola employs a multifaceted approach to mitigate the risk of corruption and fraud. The company emphasizes a culture of ethics and compliance through rigorous training programs for employees and partners. Robust internal controls are established to detect and prevent fraudulent activities. The company also engages in thorough due diligence while selecting business partners and suppliers. Reporting mechanisms and confidential channels are provided to encourage whistleblowing (The Coca-Cola Company, 2022). Through these measures, Coca-Cola reinforces its commitment to integrity, transparency, and accountability, actively deterring and addressing instances of corruption and fraud within its operations.

Part B. Corporate Social Responsibility at Coca-Cola.

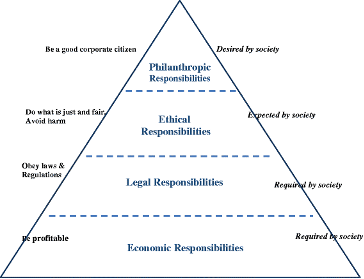

At the heart of Coca-Cola’s corporate philosophy lies a steadfast dedication to responsible corporate citizenship and ethical behavior. Consequently, the company has made substantial investments to safeguard the interests of all stakeholders within its corporate social responsibility initiatives. The company’s CSR initiative can be evaluated using Caroll’s CSR pyramid (Figure 1).

Figure 1. Caroll’s CSR pyramid (Carroll, 2016)

Per this framework, companies have an ethical obligation to take actions that are just and do not harm others (Mihaljević & Tokić, 2015). Furthermore, according to Carroll (2016), companies engage in CSR by operating environmentally, socially, and economically responsible. Thus, Coca- cola has taken positive steps to act responsibly by developing a sustainability governance board.

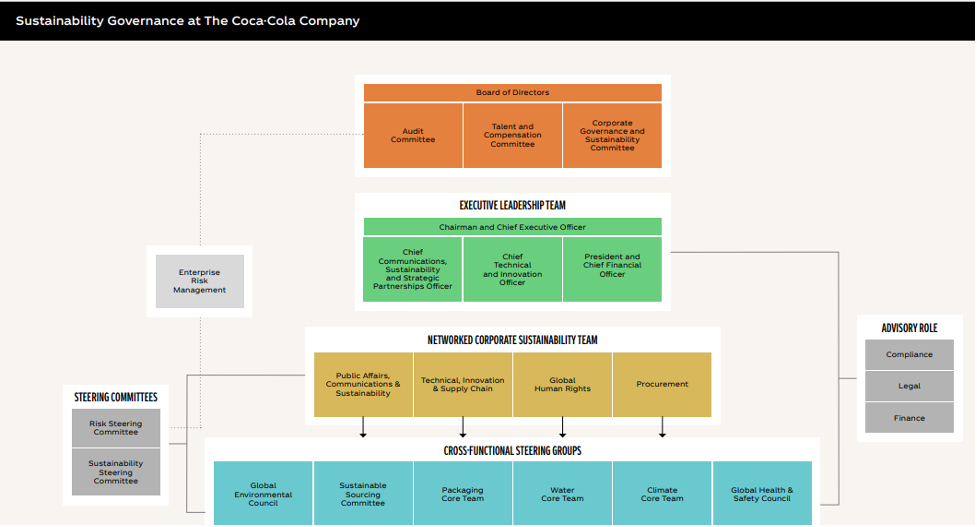

Fig. 2 Coca-Cola sustainability board (Coca-Cola, 2022, p.20).

The board in charge of governance holds the duty to ensure that the company’s partners and supply chain contribute towards achieving its sustainability objectives. To effectively handle sustainability matters, the board has assigned different committees with oversight duties, aiming to make use of their specific expertise and strengths in dealing with the diverse and technical aspects of sustainability (Laville & Taylor, 2017). Notably, the Corporate Governance and Sustainability Committee is in charge of CSR. Moreover, the committee evaluates a range of pertinent issues affecting the company, its shareholders, the larger stakeholder community, and the public. This evaluation involves analysing information connected to social, political, and environmental trends, in addition to supervising the company’s sustainability goals and human rights practices. Furthermore, it also takes charge of supervising the company’s plans and strategies concerning climate-related matters.

Environmental

Coca-Cola has taken significant steps to protect the environment and operate sustainably. According to the Stakeholder’s theory, to be deemed responsible, companies are required to operate in a way that satisfies all stakeholders. And according to George et al. (2019), Coca cola’s operating environment is the primordial stakeholder. This is according to an argument by Hitt et al. (2019) who argue that stakeholders should be considered as various groups affected by a company’s actions.

As a beverage company, the company has taken steps to conserve water and reduce its wastage through its 2030 Water security strategy. The company states that it returns 159% of the water utilized in its final beverages back to nature and local communities. Throughout 2022, the company affirms that it has restored over 100% of the water consumed in its finished beverages annually starting from 2015 (Coca-Cola, 2022, p.8). Moreover, the company is taking steps to reduce its waste problem. The company’s “World Without Waste” vision reflects its dedication to addressing plastic waste. By 2030, Coca-Cola aims to collect and recycle one bottle or can for everyone it sells. This initiative includes investing in sustainable packaging and raising consumer awareness about responsible waste disposal.

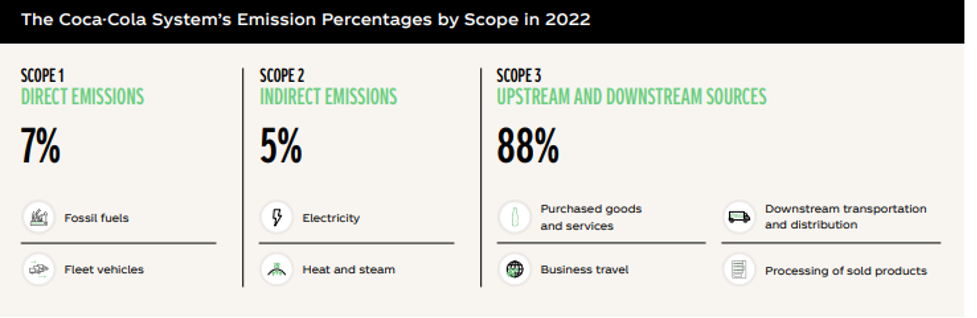

Furthermore, the company is actively engaged in efforts to curtail its carbon footprint. This involves examination and prioritization of greenhouse gas (GHG) emission sources throughout the entire value chain, alongside collaborative endeavors with stakeholders to diminish these emissions. As of 2022, there has been a 7% reduction in emissions encompassing Scopes 1, 2, and 3, signifying progress towards achieving a science-based reduction target of 25% by the year 2030 (Coca-Cola, 2022, p.39). The overarching goal is to attain net zero emissions by 2050. Furthermore, an essential approach employed by the company to lower emissions within its operational framework involves a heightened adoption of renewable energy within its manufacturing procedures. The utilization of renewable electricity escalated from 12% in that year to 21% in 2022 (Coca-Cola, 2022, p.39).

Fig. 3 Coca-Cola Carbin Emissions

Coca-Cola’s environmentally sustainable practices have profound implications. In the short term, these practices enhance the company’s brand reputation and consumer loyalty, fostering positive perceptions among environmentally conscious consumers. This can lead to increased sales and market share, strengthening the company’s financial performance (Laville & Taylor, 2017). In the long term, these sustainability initiatives safeguard the company’s license to operate, ensuring continued access to essential resources

Social

According to the Tripple bottom CSR theory, people and the community at large are stakeholders that should be considered. In this area, Coca cola has stepped up its efforts to become sustainable. The company maintains its dedication to the well-being of individuals throughout its value chain who play a role in its achievements (Carmichael and Moriarty, 2018). This commitment involves upholding human rights within its operations and supply chain, fostering inclusivity by providing equitable opportunities, promoting more environmentally sound agricultural methods, and contributing to communities through philanthropic endeavours. As an example, the social sustainability initiatives undertaken by Coca-Cola centre on water management and active participation within communities. The “Replenish Africa Initiative” (RAIN) serves the purpose of extending access to hygienic water sources and sanitation facilities to a considerable number of individuals within Africa by the year 2030.

The company engages with local communities to address water scarcity and enhance overall well-being. This initiative not only addresses a critical need but also enhances community health, education, and economic opportunities. The company has partnered with Bonsucro, a prominent international non-governmental organization (NGO), alongside a variety of local and global experts, to address human rights risks that are prevalent within Pakistan’s sugarcane supply chain (Kamasak, 2017, p.257). This ongoing project’s central objective revolves around fostering the adoption of sustainable and ethical labor practices within the sugar production sector in Coca-cola’s supply chain, with a specific focus on addressing the persisting concerns of child labour and forced labor.

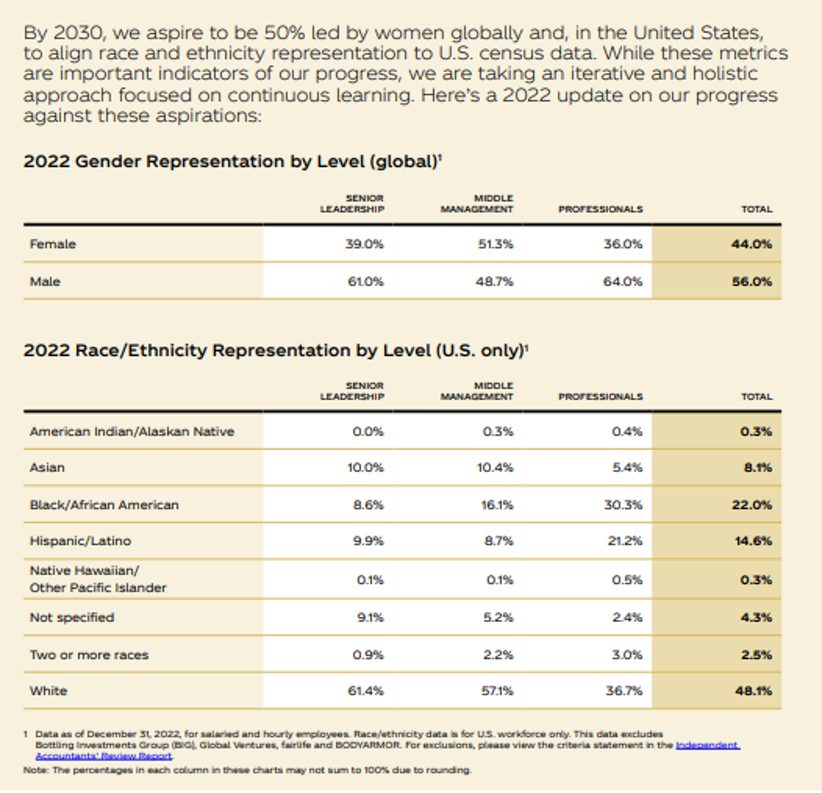

Furthermore, Coca cola is operating sustainably, ensuring diversity and inclusion in its workforce by ensuring equal representation of all gender and ethnic minority as shown on figure 4.

Figure 4. Diversity at Coca-Cola (Coca-Cola, 2022, p.44)

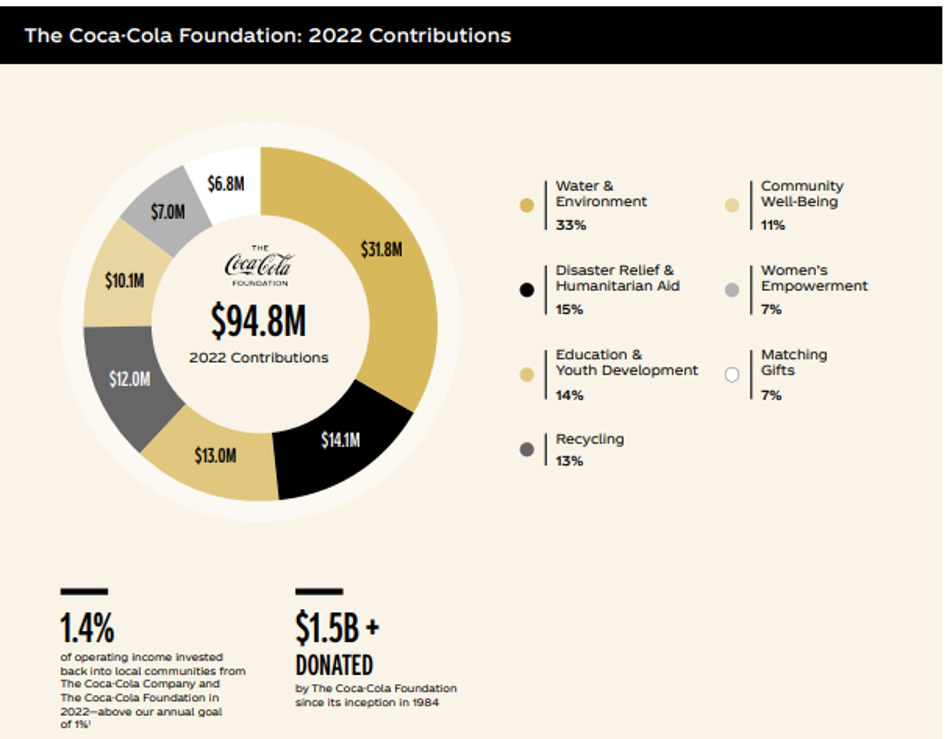

Furthermore, through its Coca cola Foundation, it is has made donations exceeding 94 million to charitable causes.

Figure 5. Coca-Cola Charitable Donations

These social sustainability efforts have had significant impact on Coca cola. In the short term, these initiatives foster positive relationships with local communities, creating a favourable operational environment. Enhanced community engagement and well-being can result in increased consumer trust and loyalty, boosting immediate sales and brand reputation. In the long term, these practices solidify the company’s social license to operate. By promoting access to clean water, education, and economic opportunities, Coca-Cola contributes to the development of future generations, potentially expanding its consumer base. Socially responsible practices also mitigate reputational risks, enhancing the company’s resilience against negative publicity and stakeholder concerns (Kengelbach et al., 2020).

Economic

Coca Cola has a responsibility to become financially successful as highlighted by the Tripple bottom CSR framework, that proposes that CSR should also consider profitability. This duty is also emphasised by Friedman’s shareholder’s theory that emphasizes that the primary responsibility of a business is to maximize shareholder value and profits (Friedman, M 1970). The main concern is to generate financial returns for the company’s owners (shareholders) and fulfil their interests. However, unlike Friedman’s theory the Tripple bottom framework, does not emphasise on the sole focus on profitability, but rather acknowledges it as a necessary duty (Capron, 2013, p.30). Coca-Cola’s economic sustainability practices encompass a range of strategies aimed at promoting financial stability, fostering local economic development, and ensuring long-term business viability. These initiatives align with relevant corporate governance principles and theories, emphasizing responsible business conduct and stakeholder value.

One core economic sustainability practice is the company’s commitment to responsible sourcing and supplier development. By partnering with local farmers and suppliers, Coca-Cola not only supports local economies but also promotes fair labor practices and ethical business conduct. Furthermore, the company also sources from multiple suppliers by reporting that it was planning to spend more than $1 billion in diversifying its supply chain (Wolf and Floyd, 2017). This practice not only strengthens supply chain resilience but also contributes to the economic growth of local communities. Furthermore, it protects Coca cola from supply chain disruption, guaranteeing long-term financial viability. Furthermore, the company’s economic sustainability practices also involve investing in communities where it operates. Initiatives like job creation, skill development programs, and supporting small-scale entrepreneurs contribute to economic growth in these regions. This approach echoes the “Stakeholder Theory,” which considers local communities as essential stakeholders whose interests should be considered in business operations.

Furthermore, Coca Cola is very financially viable, with the company generated high income. In the last quarter of 2022, the company experienced robust net revenue growth, reaching $10.1 billion, which was a 7% increase (Coca-Cola, 2022, p.44). Over the entire year, net revenues expanded by 11%, reaching $43.0 billion, while organic revenues grew by 16%. Thus, these reports indicate the company has healthy finances and the board is actively working to ensuring it is financially viable.

Recommendations

To effectively mitigate structural, operational, and management-level risks, Coca-Cola’s board should consider comprehensive recommendations. Enhance board oversight through dedicated committees focusing on specific risk domains. In the case of risks falling within the high impact/high likelihood quadrant, the board should carefully consider implementing suitable policies. For instance, they should provide comprehensive staff training to reduce turnover (Tricker, 2019). This is also the domain where leveraging financial instruments or external insurance coverage can play a pivotal role. The board should emphasize the establishment of robust information systems to monitor cyber security risks and guarantee that the company is equipped to swiftly address the occurrence. Also, Coca-Cola should conduct holistic risk assessments to identify interdependencies and develop crisis management protocols for swift responses to emerging risks. Implement scenario planning to anticipate potential disruptions and bolster cybersecurity measures to safeguard sensitive data. The board should also implement real-time monitoring mechanisms to track risk indicators, ensuring agile responses.

Furthermore, the board should also embrace several recommendations to improve its CSR initiatives. The board should consider enhancing transparency and reporting mechanisms as this foster’s stakeholder trust and accountability. Additionally, the board should advocate for a more ambitious approach to sustainable packaging. and eliminate its plastic use completely. The board should prioritize supporting the local communities by engaging and supporting them, thus enhancing social sustainability and adhering to the stakeholder theory (Hasan and Chyi 2017). Furthermore, the board should emphasize the integration of sustainability into core business strategies. Ensuring that CSR initiatives are woven into the company’s long-term plans would embed responsible practices and align with theories like the Triple Bottom Line. Lastly, the board should oversee the establishment of comprehensive metrics to measure the impact of CSR initiatives. This would enable the performance function to evaluate the effectiveness of programs and provide data-driven insights for continuous improvement.

Conclusion

This comprehensive appraisal report has delved into the intricate fabric of Coca-Cola’s corporate governance, risk management, and corporate social responsibility practices. The analysis revealed a robust governance structure underpinned by a diligent board and risk committees, shaping strategies to mitigate a spectrum of risks across strategic, management, and operational levels. The company’s commitment to sustainability shone brightly through its multi-pronged CSR initiatives, spanning environmental, social, and economic spheres. By aligning these practices with relevant corporate governance principles and theories, Coca-Cola has showcased its dedication to responsible business conduct. The risk governance evaluation underscored the company’s proactive approach to risk identification and management, while risk mitigation techniques highlighted a readiness to address the complexities of a dynamic business landscape. Additionally, the report’s recommendations provide a strategic compass for the board to navigate future challenges, from risk resilience to CSR advancement.

References

Adnan, M., Abdulhamid, T. and Sohail, B., 2018. Predicting firm performance through resource-based framework. European Journal of Business & Management, 10(1), pp.31-36.

Aghion, P., Bechtold, S., Cassar, L. and Herz, H., 2018. The causal effects of competition on innovation: Experimental evidence. The Journal of Law, Economics, and Organization, 34(2), pp.162-195.

Bauer, F., Friesl, M. and Dao, M.A., 2022. Run or hide: changes in acquisition behaviour during the COVID-19 pandemic. Journal of Strategy and Management, 15(1), pp.38-53.

Capron, L., 2013. Cisco’s corporate development portfolio: a blend of building, borrowing and buying. Strategy & Leadership, 41(2), pp.27-30. https://doi.org/10.1108/10878571311318213

Carmichael, B and Moriarty, B. (2018) How Coca-Cola came to terms with its own water crisis. The Washington Post. https://www.washingtonpost.com/news/business/wp/2018/05/31/how-coca-cola-came-to-terms-with-its-own-water-crisis/

Carroll, A. B. (2016). Carroll’s pyramid of CSR: taking another look. International journal of corporate social responsibility, 1(1), 1-8. https://jcsr.springeropen.com/articles/10.1186/s40991-016-0004-6/

Coca-Cola. (2022). Business & Sustainability Report. https://www.coca-colacompany.com/content/dam/company/us/en/reports/coca-cola-business-sustainability-report-2022.pdf

Coca-Cola. (2022). Risk Management. https://www.coca-colahellenic.com/en/about-us/corporate-governance/risk-management

Coca-Cola. (2023). Replenish Africa Initiative (Rain). https://www.coca-colacompany.com/sustainability/water-stewardship/replenish-africa-initiative

Friedman, M 1970, ‘A Friedman doctrine: The social responsibility of business is to increase its profits’, The New York Times, vol. 13, pp. 32-33, 24 November 2022, https://www.nytimes.com/1970/09/13/archives/a-friedman-doctrine-the-social-responsibility-of-business-is-to.html

George, B., Walker, R.M. and Monster, J., 2019. Does strategic planning improve organizational performance? A meta‐analysis. Public Administration Review, 79(6), pp.810-819.

Hasan, R.U. and Chyi, T.M., 2017. Practical application of Balanced Scorecard-A literature review. Journal of Strategy and Performance Management, 5(3), p.87.

Hitt, M.A., Ireland, R.D. and Hoskisson, R.E., 2019. Strategic management: Concepts and cases: Competitiveness and globalization. Cengage Learning.

Kamasak, R., 2017. The contribution of tangible and intangible resources, and capabilities to a firm’s profitability and market performance. European Journal of Management and Business Economics, 26(2), pp.252-275.

Kengelbach, J., Gell, J., Keienburg, G., Degen, D. and Kim, D., 2020. COVID-19’s impact on global M&A. Retrieved from Boston Consulting Group: https://www. bcg. com/publications/2020/covid-impact-global-mergers-andacquisitions.

Khan, S.Z., Yang, Q. and Waheed, A., 2019. Investment in intangible resources and capabilities spurs sustainable competitive advantage and firm performance. Corporate Social Responsibility and Environmental Management, 26(2), pp.285-295.

Laville, S., & Taylor, M. (2017). A million bottles a minute: world’s plastic binge ‘as dangerous as climate change’. The Guardian, 28(6), 2017. https://www.academia.edu/download/59291834/A_million_bottles_a_minute__worlds_plastic_binge_as_dangerous_as_climate_change___Environment___The_Guardian20190517-80604-4wdf05.pdf

Loviscek, V. (2020). Triple bottom line toward a holistic framework for sustainability: A systematic review. Revista de Administração Contemporânea, 25, e200017. https://www.scielo.br/j/rac/a/dQWB6Px4YpFjX9yRvvRJZsh/

The Coca-Cola Company 2022, Anti-Bribery Policy, viewed 24 November 2022, https://www.coca-colacompany.com/policies-and-practices/anti-bribery-policy.

Thompson, A., Janes, A., Peteraf, M., Sutton, C., Gamble, J. and Strickland, A., 2013. EBOOK: Crafting and executing strategy: The quest for competitive advantage: Concepts and cases. McGraw hill.

Tricker, R. I. (2019). Corporate governance: Principles, policies, and practices. Oxford University Press, USA.

Whelan, T., & Fink, C. (2016). The comprehensive business case for sustainability. Harvard Business Review, 21(2016). https://everestenergy.nl/new/wp-content/uploads/HBR-Article-The-comprehensive-business-case-for-sustainability.pdf

Wolf, C. and Floyd, S.W., 2017. Strategic planning research: Toward a theory-driven agenda. Journal of management, 43(6), pp.1754-1788. https://worldsmostethicalcompanies.com/honorees/pepsico-inc

Yee, F. Y., Kee, D. M. H., Jye, L. M., Jingyi, L., Wen, L. J., & Almutairi, S. (2020). Save environment by Replace plastic, the case of PepsiCola. International Journal of Applied Business and International Management (IJABIM), 5(1), 51-59. http://www.ejournal.aibpmjournals.com/index.php/IJABIM/article/view/767

write

write