Introduction

Space for Rent is one of the new startups that sprouted up mainly due to the lack of office space in the U.K., focusing on purchasing down buildings and renovating them into professionally furnished spaces (from desks to whole rooms). The present business model responds to the surge in demand for a more flexible and cost-effective working environment. The fact is that such a start-up needs effective decision-making, particularly in the aggressive U.K. market, where many vital decisions could prove crucial to its success or failure (Penque, 2019). Market analysis, accurate data collection, and robust decision-making are necessary to navigate turbulent market situations and exploit available opportunities. The report investigates the decision-making model, data collection methods, and market analysis. Space for Rent becomes a decision based on these factors.

Task 1

1.1 Selection of a Decision-Making Model

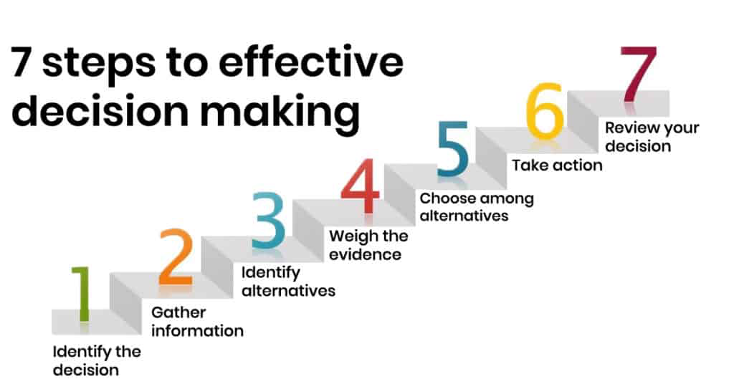

Space for Rent is one company that is entering the U.K. market, which is dynamic and very competitive. However, a company’s policy of buying and refurbishing property for flexible workspace is fraught with difficulties and potential benefits. The 7-Step Decision-making Process is more appropriate for space for Rent.’ The process entails identifying the problem, gathering relevant information, exploring possible solutions, evaluating the alternatives, taking a specific action, implementing the implementation stage, and outcome review and subsequent (Panpatte and Takale, 2019).

Figure 1: 7-Step Decision-making process

Source: (Panpatte and Takale, 2019).

Problem identification: The first step is to identify ‘Space for Rent’s biggest challenges, such as navigating the U.K. market and competing with Foreign Direct Investment. As a smaller player, ‘Space for Rent’ does not need expensive properties. It should focus on finding affordable, strategically located buildings that fit its business model (Kozioł-Nadolna and Beyer, 2021). This crucial first step establishes a market entry strategy.

Data collection: The next step is gathering market data. This step examines U.K. property market trends, demand for adaptable office spaces, and local and international competitors’ strategies. To make informed decisions, this information is essential for ‘Space for Rent’.

Exploring alternatives: Next, ‘Space for Rent’ must assess market entry and growth strategies. This exploration may include focusing on specific market segments like startups, freelancers, or small businesses, using diverse pricing methods, and strategically choosing locations in urban city centres or suburbs (Panpatte and Takale, 2019).

Weighing evidence is essential. Data-driven management must weigh the pros and cons of each option. This may include financial projections, risk assessments, and market potential assessments.

Choosing among alternatives: After assessing the options, the fifth step is to choose. This should match company goals, resources, and market potential. Starting in high-demand urban areas could work.

Taking action: The sixth step is strategy implementation. This means buying, renovating, and marketing properties for ‘Space for Rent.’ Careful planning and execution make this step effective (Panpatte & Takale, 2019).

Reviewing the decision: Finally, reviewing the decision and its consequences ensures that ‘Space for Rent’ can learn and adapt. This involves analysing the outcomes of their market entry strategy and making necessary adjustments.

Justification for 7-Step Decision-Making

Employing the 7-Step decision-making process allows ‘Space for Rent’ to approach its challenges and objectives systematically. Each step is an opportunity to align the company’s actions with its goals while adapting to the market dynamics. This model supports strategic decision-making by ensuring that each choice is data-driven and well-evaluated, thus increasing the likelihood of positive outcomes (Kozioł-Nadolna and Beyer, 2021).

By systematically following this model, management can demonstrate how each decision contributes to achieving the company’s objectives. For instance, choosing the right location for the first property will directly impact the business’s visibility and accessibility, key factors in attracting clients. Similarly, decisions regarding refurbishment and pricing directly affect customer satisfaction and profitability.

1.2 Data Collection Strategy for ‘Space for Rent’

In the competitive field of the U.K. real estate market, the entry of ‘Space for Rent’ demands a strategic approach to decision-making underpinned by robust data collection. The plan for gathering this data, encompassing primary and secondary sources, forms a critical foundation for the company’s strategic moves. While the focus is predominantly on secondary data due to time constraints, a complementary approach incorporating elements of primary data collection can provide a well-rounded perspective.

Primary data collection

While secondary data will form the core of our research strategy due to its efficiency and breadth, incorporating primary data collection can provide invaluable, direct insights from the market. Designing and distributing online surveys targeting potential customers will help gauge preferences, needs, and price sensitivity regarding different types of rental spaces (Ajayi, 2017). Additionally, conducting interviews with industry experts, real estate agents, and potential clients will offer qualitative insights into market trends, customer expectations, and the competitive landscape. Organising focus groups with potential clients is another avenue to explore, as it can yield direct feedback on the business concept and specific customer needs (Ber, 2016).

Secondary data resources

Secondary data, given its accessibility and comprehensive coverage, will be pivotal in the research. Market reports on the U.K. real estate market, particularly those focusing on office and coworking spaces, provide an overview of current trends and future projections (Ajayi, 2017). Industry publications, including journals and articles, offer updated information on market dynamics, competitor strategies, and consumer behaviours. A thorough competitor analysis, achieved through a review of competitors’ websites, press releases, and annual reports, will help understand market positioning and identify best practices and gaps in the market. Academic journals accessed from databases furnish empirical and theoretical insights that can guide strategy formulation (Ber, 2016). Additionally, data from government and industry bodies are vital for understanding the regulatory environment, market size, and growth trends.

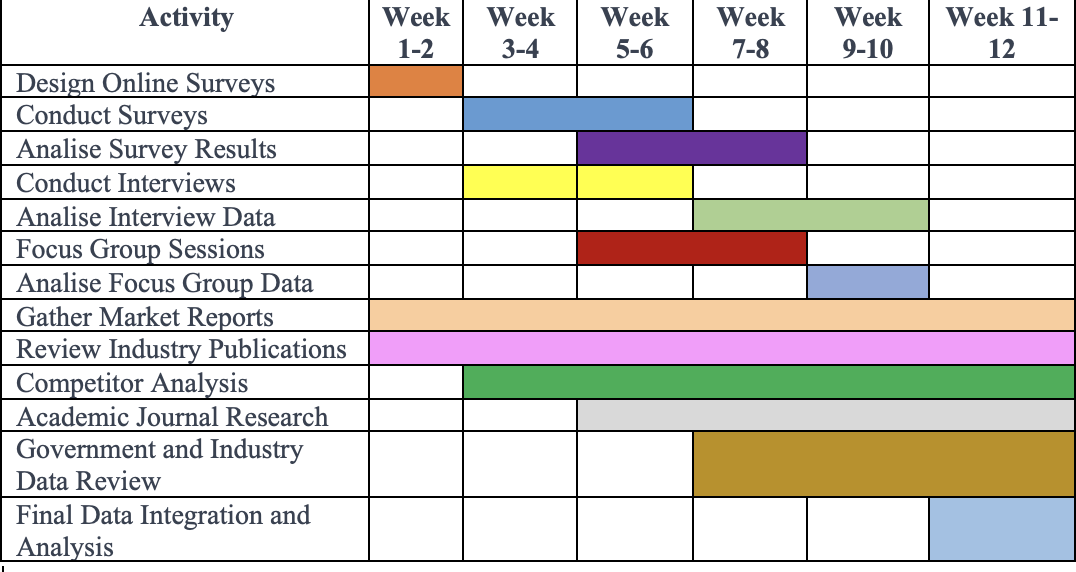

GANTT Chart Representation

A GANTT chart is an indispensable tool to manage this extensive data collection process efficiently (Ramachandran and Karthick, 2019). The initial weeks would focus on designing surveys and preparing for interviews, followed by collecting and analyzing primary data. Simultaneously, the gathering and reviewing secondary data would be an ongoing process throughout the timeline, ensuring a continuous flow of information.

Complexities of business decision-making

Navigating the complexities of business decision-making, especially in a competitive and dynamic market, involves addressing several key challenges. The risk of data overload is significant, with the vast amount of available secondary data necessitating a focus on specific, actionable insights. Time management emerges as a critical skill, balancing data collection, analysis, and decision-making (Ajayi, 2017). Ensuring objectivity, particularly in interpreting qualitative data from interviews and focus groups, is crucial to avoid bias. Secondary data’s relevance, accuracy, and currentness are paramount, as outdated or irrelevant data could lead to misguided decisions. Lastly, effectively integrating insights from both primary and secondary sources is essential to form a cohesive and comprehensive understanding of the market landscape.

Developing a robust data collection strategy, encompassing both primary and secondary sources is vital for ‘Space for Rent’ to make informed decisions in the competitive U.K. market. While secondary data provides a broad market overview, primary data offers specific insights, making their integration essential for a holistic market understanding. Using a GANTT chart to manage this process and being aware of the complexities involved in data interpretation will be vital in making strategic decisions that pave the way for the company’s successful market entry and growth.

1.3 Selection and justification of an appropriate decision-making framework

In the context of ‘Space for Rent,’ a company venturing into the competitive U.K. real estate market, selecting an apt decision-making framework is crucial. The framework must facilitate strategic decisions and align with the unique challenges and opportunities the company faces (Hampshire et al., 2022). After careful consideration, the most suitable framework for ‘Space for Rent’ is the Market Opportunity Navigator (MON).

Justification for Choosing the Market Opportunity Navigator

The Market Opportunity Navigator is particularly advantageous for ‘Space for Rent’ for several reasons:

Adaptability and broad perspective: MON offers a flexible methodology that aligns well with the fluid nature of the real estate industry. It aids businesses in methodically exploring various market possibilities, a crucial aspect for ‘Space for Rent’ as it ventures into the intricate and ever-changing realm of workspace rentals (Gruber and Tal, 2023).

Comprehensive market exploration and opportunity spotting: The framework initiates an extensive scan of potential market opportunities, prompting ‘Space for Rent’ to consider a wide array of market segments and business approaches. This is especially useful for delving into sectors within the U.K.’s real estate market, such as startups, freelancers, or small enterprises searching for adaptable office spaces.

Assessment of opportunities’ viability and appeal: A key feature of MON is its focus on gauging the viability and allure of each identified market chance (Gruber and Tal, 2023). This is a pivotal step for ‘Space for Rent,’ enabling it to evaluate the prospects of various locations, pricing models, and renovation plans within the U.K.’s context.

Strategic focus with the ability to pivot: MON helps zero in on the most lucrative opportunities while maintaining the flexibility to adjust strategies. This equilibrium is vital for ‘Space for Rent,’ requiring it to adapt to shifts in market conditions, consumer tastes, and competitor strategies.

Addressing the challenges in decision-making

MON acknowledges business decision-making challenges, especially for a newcomer like ‘Space for Rent’: A significant challenge in new markets is the need for more localised information. The MON framework reduces this risk by emphasising broad market exploration and focused analysis (Arora, 2017).

MON requires a comprehensive market understanding, unlike ‘Space for Rent,’ which relies on secondary data due to time constraints. The vast online resources, industry reports, and academic journals help here. Online industry reports, YouTube videos, market research data, and relevant journals provide a wealth of data for informed decision-making (Gruber and Tal, 2023).

Entry modes: The framework evaluates market entry options like partnerships, collaborations, and direct investment. Strategic positioning requires understanding the pros and cons of each entry mode for ‘Space for Rent,’ which is entering a market with established players (Arora, 2017). ‘Space for Rent’ must establish a competitive edge in a saturated market. The MON framework helps the company find unique value propositions and untapped market segments, giving it a competitive edge.

Finally, the Market Opportunity Navigator is a good decision-making framework for ‘Space for Rent.’ Its comprehensive but flexible approach helps the company understand and adapt to the U.K. market (Gruber and Tal, 2023). Using abundant secondary data and MON insights, ‘Space for Rent’ can make strategic decisions to grow and expand in a new and competitive landscape.

Task 2

2.1 Competitor Analysis and SWOT for ‘Space for Rent’

Identification of competitors

‘Space for Rent’ must conduct a SWOT analysis of its competitors to navigate the U.K.’s flexible workspace market. WeWork, Regus, and local coworking spaces compete with ‘Space for Rent’ in the U.K. (Lee, 2017). The competitive landscape is diverse and challenging due to these competitors’ size, market reach, and services.

SWOT Analysis of ‘Space for Rent’

| Strengths | Weaknesses |

| Innovation and flexibility: ‘Space for Rent’ can leverage its agility and innovative approach to cater to niche markets that larger competitors may overlook.

Cost-Effective Solutions: Given its focus on cost-effectiveness, ‘Space for Rent’ can appeal to startups and small businesses looking for affordable workspace solutions. |

Brand recognition: As a new entrant, ‘Space for Rent’ needs more brand recognition and customer loyalty than established competitors possess (Ifediora et al., 2021).

Limited resources: Compared to larger competitors, ‘Space for Rent’ may need more financial and operational resources to scale quickly or invest in premium locations. |

| Opportunities | Threats |

| Growing market for flexible workspaces: The increasing trend towards remote working and the need for flexible office spaces presents a significant opportunity (Nuredini, 2020).

Technological integration: Implementing technology-driven solutions for space management and customer service can differentiate ‘Space for Rent’ from traditional providers. |

Competitive market: The presence of established players and new entrants makes the market highly competitive.

Economic uncertainties: Fluctuations in the real estate market and broader economic uncertainties can impact demand for rental spaces. |

Simon’s Decision-Making Model, which includes intelligence gathering, design, choice, and implementation, can be applied here to enhance decision-making. ‘Space for Rent’ can use the intelligence gathered from the SWOT analysis to design strategies that capitalise on its strengths and opportunities while mitigating weaknesses and threats. The choice phase involves selecting the most viable strategy, followed by its implementation in the market (Ifediora et al., 2021).

The SWOT analysis, enriched with data from various sources, provides ‘Space for Rent’ with a clear understanding of its competitive stance. Aligning this analysis with Simon’s Decision-Making Model enables the company to make strategic decisions that are not only data-driven but also contextually informed, enhancing the likelihood of successful market entry and sustainable growth in the competitive U.K. workspace market.

2.2 Selecting and Justifying a Problem-Solving Technique for ‘Space for Rent’

In addressing ‘Space for Rent’s’ primary business challenge – identifying and strategizing against main market competitors in the flexible workspace sector – the Rational Decision-Making Model is particularly suited (Uzonwanne, 2016). This structured approach aligns well with the nature of the problem, which requires thorough analysis, systematic evaluation of alternatives, and strategic implementation.

Rational decision-making model

The Rational Decision-Making Model involves a straightforward, step-by-step process that aids in making well-informed decisions. Finding feasible ideas, evaluating them, and implementing the best ones are the process’s initial phases. The model’s emphasis on reasoned thinking and evidence-based decision-making is ideal in a dynamic and competitive market.

- Problem identification

The biggest challenge for Space for Rent is determining who its competitors for flexible workspaces are in the U.K. This needs a comprehensive assessment of flexible office trends, traditional office rents, and coworking spaces (Zachary, 2018). Understanding the business strategies, benefits, and drawbacks of various competitors, ranging from well-known chains to regional independent service providers, is critical.

- Development of alternative strategies

Once the fundamental challenge has been recognised, ‘Space for Rent’ should consider various strategic approaches to differentiate itself in the market. One might provide competitive rates, appealing locations, exclusive facilities, or community-focused activities to separate itself from competitors. The company could also tailor its services to underserved market segments like startups, freelancers, and small businesses (Penque, 2019). Strategic partnerships with other companies boost market visibility and resource sharing. Finally, using cutting-edge technology to manage workspaces, optimise booking systems, and improve customer interaction could give ‘Space for Rent’ an edge in the dynamic market.

- Choosing the most suitable strategy

Assessing each option’s practicality, impact, and alignment with the company’s goals and resources is crucial to choosing the best ‘Space for Rent’ strategy. A distinctive strategy focusing on unique selling points could significantly benefit the company if it resonates with the target audience. Simultaneously, specializing in niche markets promises enhanced customer loyalty and reduced competition but requires in-depth market knowledge (Danial et al., 2019). Forming strategic alliances offers rapid market entry and resource benefits, albeit with the trade-off of shared control. Lastly, integrating advanced technology could provide a competitive advantage, though it necessitates substantial investment in innovation. Each strategy, therefore, presents unique opportunities and challenges for ‘Space for Rent.’

- Implement

The chosen solution should then be implemented in a structured manner. For instance, if ‘Space for Rent’ decides on a differentiation strategy, it would involve developing these unique aspects, modifying marketing strategies, and potentially adjusting operational processes.

The Rational Decision-Making Model provides a comprehensive framework for ‘Space for Rent’ to tackle its business problem systematically. By clearly defining the problem, exploring and evaluating various solutions, and implementing the most suitable strategy, ‘Space for Rent’ can effectively navigate the competitive landscape (Zachary, 2018). This structured approach not only aids in addressing the immediate challenge of identifying main competitors but also equips ‘Space for Rent’ with a strategic mindset for future decision-making scenarios.

Recommendation

Based on the comprehensive analysis conducted in this report, the following strategic recommendation is offered for ‘Space for Rent’ as it prepares to enter the U.K. market:

Implement the 7-step decision-making process and the market opportunity navigator framework: These should guide the company’s strategic decisions. The 7-Step Process ensures thorough, data-driven decision-making, while the Market Opportunity Navigator will help identify and focus on the most promising market opportunities (Penque, 2019).

Develop a differentiation strategy based on unique value propositions: ‘Space for Rent’ should differentiate itself from competitors by offering unique services or experiences. This could include innovative space designs, flexible pricing models, additional services like networking events, or technology-driven solutions for space management. Understanding customer needs and preferences through market research is key to defining these unique aspects.

Strategic use of secondary data for market insights: To gain market insights, ‘Space for Rent’ should prioritise secondary data collection, such as market reports, industry publications, and competitor analyses, due to time constraints. This data should guide business strategy, from location to marketing and operations (Zachary, 2018).

Monitor market and competitors: ‘Space for Rent’ should monitor market trends, consumer behaviour, and competitor moves using SWOT and competitor analysis tools. This ongoing analysis will enable agile strategy and operations adjustments.

Leverage technology for competitive advantage: ‘Space for Rent’ can stand out in a competitive market by implementing advanced workspace management and customer experience technology. This includes virtual tours, user-friendly booking systems, and space-efficient technologies.

Conclusion

‘Space for Rent’ is poised to enter a dynamic and competitive U.K. market. Embracing a systematic decision-making process, emphasizing unique differentiators, and harnessing the power of technology, the company is well-equipped to traverse this complex market terrain. Utilizing secondary data for comprehensive market analysis and ongoing vigilance of market dynamics and competitor activities is vital for crafting well-informed, strategic choices. As ‘Space for Rent’ evolves, its ability to continuously adapt and refine its strategies based on market insights and trends will be crucial in securing its long-term prosperity and stability in the ever-changing world of flexible workspaces.

References

Ajayi, V.O., 2017. Primary sources of data and secondary sources of data. Benue State University, 1(1), pp.1-6.

Arora, S., 2017. Changing dynamics of corporate real estate: The rise of coworking spaces. Corporate Real Estate Journal, 7(2), pp.127-136.

BER, M., 2016. Internet data sources for real estate market statistics (Doctoral dissertation, Poznan University OF Economics).

Danial, S.N., Smith, J., Veitch, B. and Khan, F., 2019. On the realization of the recognition-primed decision model for artificial agents. Human-centric Computing and Information Sciences, 9(1), pp.1-38.

Dobrovolskienė, N., Pozniak, A. and Tvaronavičienė, M., 2021. Assessment of the sustainability of a real estate project using multi-criteria decision making. Sustainability, 13(8), p.4352.

Gruber, M. and Tal, S., 2023. Reflecting on the creation of the Market Opportunity Navigator (4th tool in the Lean Startup). Journal of Business Venturing Design, p.100017.

Hampshire, N., Califano, G. and Spinks, D., 2022. Pirate Metrics. In Mastering Collaboration in a Product Team: 70 Techniques to Help Teams Build Better Products (pp. 60-61). Berkeley, CA: Apress.

Ifediora, C.O., Efobi, D.J. and Nwosu, C.C., 2021. Strengths, Opportunities, Weaknesses and Threats (SWOT) in Real Estate Sector: An Insight for Practitioners in Anambra State for Effective Practice.

Kozioł-Nadolna, K. and Beyer, K., 2021. Determinants of the decision-making process in organizations. Procedia Computer Science, 192, pp.2375-2384.

Lee, S., 2017. Convergence in the U.K. direct real estate market. Journal of Property Investment & Finance, 35(4), pp.382-396.

Nuredini, B., 2020. Impact of the Covid 19 pandemic on the global real estate market. University for Business and Technology: Pristina, Kosovo.

Panpatte, S. and Takale, V.D., 2019. To study the decision making process in an organization for its effectiveness. The International Journal of Business Management and Technology, 3(1), pp.73-78.

PENQUE, M.B., 2019. Flexible workspace in corporate real estate. A swot analysis for investment professionals.

Ramachandran, K.K. and Karthick, K.K., 2019. Gantt chart: An important tool of management. Int. J. Innov. Technol. Explor. Eng, 8(7).

Teoli, D., Sanvictores, T. and An, J., 2019. SWOT analysis.

Uzonwanne, F.C., 2016. Rational model of decision making. Global encyclopedia of public administration, public policy, and governance. Springer International. https:/doi. org/10.1007/978-3-319-31816-5_2474-1.

Zachary, D.A., 2018, September. A Recognition Primed Decision Model for Public Consumption of Government Data. In Proceedings of the Human Factors and Ergonomics Society Annual Meeting (Vol. 62, No. 1, pp. 1712-1716). Sage CA: Los Angeles, CA: SAGE Publications.Top of Form

write

write