Bitcoin is a digital currency. Bitcoin, in contrast to other currencies, does not have a central bank and does not keep track of individual transactions as other financial instruments do. When computers solve mathematical problems, they generate new monetary units as a result of their efforts. It was created way back in 2009 and applies the peer-to-peer model of technology in manifestation of its payments which are made instantly. On the flip stock is the term used to describe the money generated by a company or organization via the issuing and subscribing of shares. In finance, a stock return is defined as the change in the price of an asset, investment, or project over the course of time, expressed in either monetary or percentage terms. A positive return indicates a profitable investment, while a negative return indicates a losing investment (Moardi et al, 2020).

The link between bitcoin and stocks may be determined using a vector vector autoregressive model, which is a kind of regression model. Following the model, it seems that the S&P 500 has a slight influence on Bitcoin, while the S&; P 500 has a little impact on Bitcoin. In addition, when the Sliding Window technique is used, the standard deviation of the S&P 500 and the mean of the Dow Jones both have a significant amount of influence on the mean of Bitcoin, and when the technique is used, the standard deviation of the S&P 500 and the mean of the Dow Jones both have a significant amount of influence on the standard deviation of Bitcoin (Wang et al, 2020). A favorable correlation exists between the S&; P 500 and the Dow Jones industrial indexes, which has a beneficial influence on Bitcoin. This paper is purpose to illustrate how bitcoin for the prediction of stock return.

Price assessments of Bitcoin were carried out by Gandal et al. (2018) during the last several years, and the researchers discovered that the cryptocurrency has seen both growth and fall in recent years. As a result of significant Bitcoin investments, the price of bitcoin has plummeted dramatically in recent months. The volatility of Bitcoin is strikingly similar to that of the stock market. Many predictive analytic tools, initially developed by economists to anticipate stock market volatility, have been applied to Bitcoin price volatility, and the results have been overwhelmingly positive. The growth of the Bitcoin economy, as well as increased interest from the financial investment industry, has resulted in the relationship between Bitcoin and the stock market becoming a lucrative research topic, despite the fact that this subject has received little attention from professionals and researchers in the past. Because of the relationship between the stock market and Bitcoin, investors will have an easier time devising their investment plan and identifying market-moving components.

According to the authors, several research have been conducted on the predictability of stock returns (Narayan & Sharma, 2018). The bulk of these studies take into consideration both “individual aspects” (such as economic activity, inflation, currency exchange rate, and interest rates) and “common variables” (such as commodity prices and oil prices). The accuracy of their forecasts is then compared to that of time series models that use historical averages to make their predictions. As an alternative, there are two parts to the conclusion. According to this line of data, the historical average stock return projection surpasses the macroeconomic-based predictive model, for starters. Another line of study, which has emerged more recently, is an effort to account for the intrinsic salient properties of macroeconomic variables, such as endogeneity, persistence, and conditional heteroscedasticity, in order to correct the results reached in the past.

It has been proved that stock return models that include these characteristics beat the historical average. Regardless of the results of the second strand, it is possible that a macroeconomic-based prediction model of stock returns will be updated to account for the effect of the Bitcoin price in the future. According to a recent study, crypto-currencies may provide some advantages in terms of diversity when compared to conventional financial assets such as stock returns. Specifically, this was the first research of its kind to investigate the possibility of using Bitcoin price prediction to estimate stock returns both inside and outside of a sample. The Arbitrage Pricing Theory (APT), which considers a wide range of risk indicators (both systematic and unsystematic) as the primary drivers of stock returns, theoretically supports the inclusion of Bitcoin price in the prediction model of stock returns. The use of Bitcoin, as recently shown by the researchers at Corbet et al., may be a risk factor when it comes to maximizing earnings on traditional financial assets.

Additionally, Bitcoin has been hailed as a one-of-a-kind asset that can be used as both a traditional financial asset and a speculative asset, according to some analysts. Therefore, understanding the out-of-sample prediction powers of the Bitcoin price on stock returns may aid investors and regulators in making better educated decisions. When it comes to Bitcoin, for example, if the price of the cryptocurrency could be predicted with such accuracy, investors and regulators could be able to use this information to make future decisions that reduce the risks and uncertainties connected with financial assets.

To demonstrate that Bitcoin may be used as a reliable gauge for stock performance. To be accurate, a bivariate stock return prediction model must take into account both the bitcoin price and conventional stock return drivers (both “individual variables” and “common factors”). Secondly, evaluations of the individual and combined forecast performance of the Bitcoin-based prediction model in comparison to traditional components are required, both in-sample and out-of-sample, in both the short and long term. The third point to make is that while evaluating data, it is important to consider the specific features of predictors such as persistence, endogeneity, and conditional heteroscedasticity, all of which are present in the vast majority of financial series. In the fourth step, it is crucial to determine whether or not the addition of structural discontinuities improves the performance of the Bitcoin-based stock return model. The fact that stock returns exhibit structural discontinuities in their behavior lends support to this point of view as well (Akanni et al, 2019).

Model, Estimation and Speculation Procedure

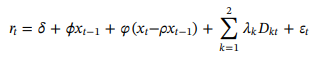

In order to forecast stock returns, an APT (Arbitrage Pricing Theory) model is used, which takes into consideration macroeconomic factors such as inflation, real economic activity (GDP), short and long-term interest rates, the exchange rate, the price of oil, and commodity prices (Devpura et al., 2018). Therefore, recent research on the predictability of stock returns has shown the need of integrating significant predictor traits such as endogeneity, persistence and conditional heteroscedasticity in the study. As a result, the baseline prediction model is as follows.

![]()

r1 signifies a possible predictor for stock returns enumerated as log (pt/ pt-1), Pt denotes the stock price index; xt signify possible speculator towards stock returns and per each of the macroeconomic variables where prices of Bitcoin are independently examined in this respect; ρ; is the autocorrelation coefficient of first order. In most cases, the first term in a predictive model (ϕxt−1) represents the bivariate representation of the data. By including a second term, (Xt –Pxt −1) the predictive model can account for any lingering effects that may be present. When dealing with high frequency predictors, which often display random walk, taking the persistence effect into account may be a good idea. AR (1) coefficient is close to being equal to one (ρ = 1). In order to account for this, it is important to do a pre-test of the series for persistence. The equation for perseverance is as follows:

![]()

Here ![]() . Due to the potential of causal relationships between the predictor (Xt) and an endogenous bias, a statistically significant persistence effect is feasible.in relation to the error of regression (Et.). Salisu & Isah (2018) propose a formula to check for endogeneity.

. Due to the potential of causal relationships between the predictor (Xt) and an endogenous bias, a statistically significant persistence effect is feasible.in relation to the error of regression (Et.). Salisu & Isah (2018) propose a formula to check for endogeneity. ![]() . Here Vt and E t exhibit terms of errors for the second and first formulas respectively. Variable Q record the endogeneity impact, if found to be statistically important, a conclusion is made that there is presence of endogeneity impact.

. Here Vt and E t exhibit terms of errors for the second and first formulas respectively. Variable Q record the endogeneity impact, if found to be statistically important, a conclusion is made that there is presence of endogeneity impact.

The Bitcoin-based stock return model takes structural defects into account when calculating the return on investment. According to Salisu et al. (2019), structural flaws were discovered in a significant number of models that were used to anticipate stock returns in the United States. According to Dastgir et al. (2019), the Bai and Perron test allows for the detection of up to five breaks in the test equation using endogenous determination. In order to identify structural instabilities, the prediction model is tested against the Bitcoin-stock return nexus. Any structural instabilities found are then included into the original model. For this reason, in order to avoid overfitting, we restrict the number of breaks included in the prediction model with dummy variables for breaks to just two of the most important breaks, particularly when the detected number of breaks exceeds two, in order to avoid overfitting.  Here the breaks in structures are recorded by the use of a lifelike model variables where by Dk is equated to one in the event that t is more or equal to date of break and zero. This model is also approximated by the FQGLS estimator. According to Salisu et al (2018) OLS and FQGLS remain to be consistent even in the absence of important attributes of predictors.

Here the breaks in structures are recorded by the use of a lifelike model variables where by Dk is equated to one in the event that t is more or equal to date of break and zero. This model is also approximated by the FQGLS estimator. According to Salisu et al (2018) OLS and FQGLS remain to be consistent even in the absence of important attributes of predictors.

Prognosticate Assessment

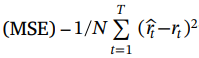

Forecast assessments are carried out both inside and outside of the sample. The normal technique for predicting involves dividing the whole data set in half so that we may examine both within- and without-sample predictions. 2 We utilize 75 percent of the full-sample data for the in-sample forecast evaluation, with the remaining 25 percent being used to evaluate predictions outside of the sampling frame. Furthermore, it is used in the construction of prediction estimates utilizing the recursive window approach, which takes into account time-varying behavior in the predictive models of stock returns (Devpura et al, 2018). Forecast assessment is done in three major phases whereby in the first phase involves utilization of the FQGLS estimator to find out how well important macroeconomic variables and common components, like the price of Bitcoin, predict each other in a given set of data. Following this, one will find out how well the bitcoin-based stock return forecasting model does in the sample and when it is not in the sample, so one can figure out how well it does. There are two different forecast metrics that we will use in this case. A simple way to think about the first measure is to think of it as a single prediction metric because it is so easy. It is based on Mean Squared Error (MSE) –  In the above formula, N represent the prediction numerals utilized in the mean calculation. Secondly the application of the C-T hereafter analysis calculated as

In the above formula, N represent the prediction numerals utilized in the mean calculation. Secondly the application of the C-T hereafter analysis calculated as ![]() here MSE1 and MS2 represent the MSE errors of restricted and unrestricted models sample prognosis. To gauge that the unrestricted model performs better than the restricted model one has to check the C-T statistics it will exhibit a positive value.

here MSE1 and MS2 represent the MSE errors of restricted and unrestricted models sample prognosis. To gauge that the unrestricted model performs better than the restricted model one has to check the C-T statistics it will exhibit a positive value.

Application of Structural breaks In Bitcoin Prices as an Indicator for Prediction of Stock Returns

It is vital to highlight that, out of the several cryptocurrencies available, only Bitcoin plays a strategic role in projecting stock return, as opposed to the others. Bitcoin is the most valuable cryptocurrency in terms of its asset value when compared to all of the other cryptocurrencies. In terms of asset value, Bitcoin is the most valuable, with a confirmed market value of more than one billion dollars. Additionally, Bitcoin is the most actively traded cryptocurrency in the financial markets, out of the thousands of cryptocurrencies accessible on the market (Dyhrberg, 2018). The fact is that Bitcoin, among other cryptocurrencies, possesses one of the largest databases that is also the most secure and well-configured. To demonstrate how Bitcoin may be used as a critical indication to estimate stock returns in this scenario, it is necessary to gather stock prices and Bitcoin data from the well-known Bloomberg terminal, which can be found here. The data under consideration should be representative of a reasonable time period spanning from 2010 in the month of July through 2017 in the month of July.

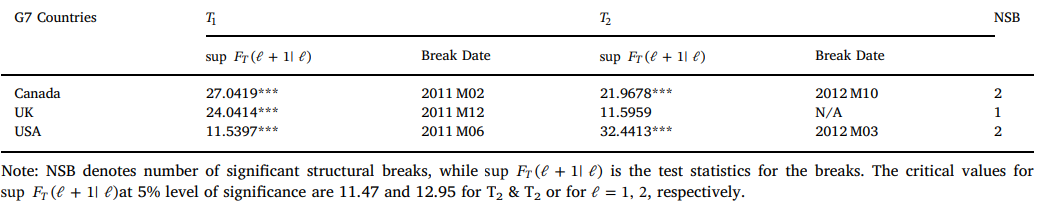

In order to maintain the stability of the bitcoin price, the G7 stock market returns from the world’s seven most economically stable countries, known as the G7, are employed. Each of the nations on the above-described list has a financial interest in at least one of the stocks named. Among other things, it is being explored whether or not accounting for structural break has an effect on the accuracy with which Bitcoin anticipates stock returns (s). Alternative approaches, such as utilizing the Bai and Perron multiple breaks date test on the data instead of making arbitrary assumptions about structural break dates, are better in this situation. Bai and Perron’s break periods will be recorded in our records, and we will keep track of what occurs during those times. Three countries, namely Canada, the United Kingdom, and the United States, each have at least one break, whilst the rest of the world does not have any breaks at all. As a result, the evaluations are confined to countries that are located within this geographical zone. Because of this fundamental shift in the predictability of BTC stock return, it is critical to communicate this shift, particularly in countries where it is obvious.

Multiple Structural Breaks Results

Figure 1.0 Salisu et al (2019).

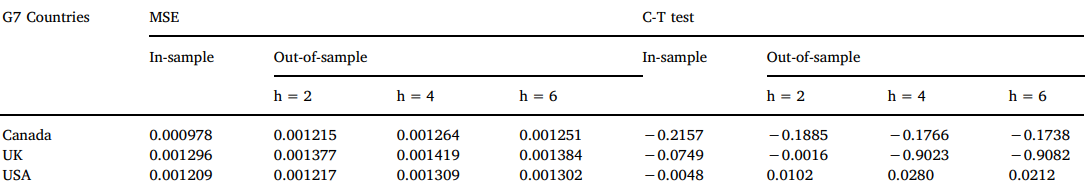

Prognostic Presentation Outcome of Bitcoin predictive Representation with Structural Breaks

Figure 2.0 Salisu et al (2019).

Because we assumed that the BTC prediction model was valid in the absence of structural break(s), we tested the null hypothesis, which was shown to be true. The Bitcoin model does not seem to gain from accounting for structural cracks, with the exception of the United States, where it appears to benefit from accounting for structural cracks. The United States, in addition, take bride in having the largest number of people using bitcoin, bitcoin ATMs, and trading BTC volume in the world. All of these things might be linked together in some way or another. Since it comes to structural change, it is only reasonable to acknowledge it in this context, especially when the Bitcoin in the United States exhibits a significant presence of it. To effectively project a nation’s stock returns, it is also necessary to take into account structural change.

Out of Sample Prognostic Outcome Assessment

For those who do not have adequate data to make an in-sample prediction, BTC’s capacity to forecast out-of-sample stock returns should be considered in contrast to other conventional and popular approaches.

Figure 3.0

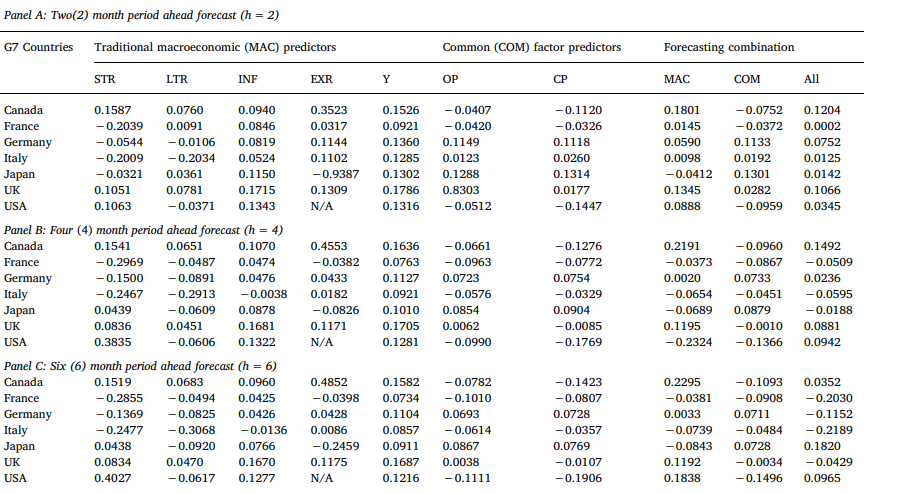

In the figure above It is determined how well the BTC-based predictive model performs out-of-sample when compared to the conventional and regular factors-based prognostic frameworks by employing C-T test paired technique to forecast assessment. In addition, out-of-sample forecast performance statistics from forecast combination predictive regressions are included in the table below. The results of the out-of-sample forecast for the next two (2), four (4), and six (6) months are displayed in Panels A, B, and C of the table, respectively, for the next two (2), four (4), and six (6) months ahead.

The graph above, presents the findings for three alternative prognostic horizons (h): two months, four months, and six months, respectively, to help us better comprehend the recursive window technique. C-T figures and MSE are used in the out-of-sample forecast study, just as they were in the in-sample prediction evaluation.

The out-of-sample findings in Panels B and C, which have broader prediction horizons than Panel A, seem to be mixed among the other participative prognostic blueprint for stock returns and nations in consideration, in contrast to Panel A. It is particularly true that the improved out-put of the BTC-based forecasting framework, in particular, diminishes with time. However, the BTC- framework appear to be better suited for projecting short-term stock returns than other models. It has been shown in one study that short-term investors are more likely to benefit from cryptocurrencies’ ability to diversify their portfolios than long-term investors.

Besides the above-mentioned models and mechanisms applied to predict stock returns by use of Bitcoin, there are also other modes one can use to predict the stock market returns using Bitcoin and Bitcoin prices.

Bitcoin Stock-Market Projection

Projection of Bitcoin can be done based on many techniques depending on what one is specifically subjected to. One may decide to predict Bitcoin in consideration of the price levels, signal intraday levels based on the financial market major memory zones (Yogeshwaran, 2019). Below are some of the mechanisms that can be applied in Bitcoin stock market projection.

Financial Markets Technical Evaluation or Analysis.

According to Ferdiansyah et al (2019) technical evaluation of the financial markets involves the application of trading knowledge based on the bitcoin stock market historical data that are manifested in the financial markets and exhibited via trading platforms. Proper analysis of the financial markets gives a informative approach towards the markets price movements hence enable people who have invested in the stock market make informed investment decisions. Besides applying fundamental evaluation of the financial markets, it is vital to apply the technical evaluation mechanisms.

Time Sequence Data Evaluation.

For short-term price forecasts, Autoregressive integrated moving average (ARIMA) models are a common option. These models function best when the data shows a consistent or stable pattern (constant) across time with the fewest potential outliers. However, in a real-time setting when data fluctuates dramatically and is very volatile, this may not always work (Karasu, 2018).

Technical Indicator

Moving averages are sequences of data points that are generated by applying a formula to the price of a security’s historical data series, according to Huang et al. (2019). Technical indicators are frequently used to filter data points prior to analysis. These indicators are displayed in a graphical format above or below the data points in the form of a price, value, or signal chart, depending on the indicator. Simple Moving Average (SMA) is computed by summing up final prices of the prior few trading periods, which I’ll refer to as X period, and then dividing the total by the number of trading days in the past few weeks. Because of this, a moving average will be created, which will change over time as the market continues to increase its price appreciation.

Strategy Applied in Trading

Maintain a constant Bitcoin position of either +1 Bitcoin, zero Bitcoin, or a negative Bitcoin position. The average price change over a ten-second period, p, is forecasted using Bayesian regression, which is a statistical technique. A Bitcoin will be acquired if the existing bitcoin position is less than zero and the average price movement is more than a particular threshold; else, we shall do nothing at all… The present trend is taken into consideration when choosing time increments for trading, and this is done with great care.

Conclusionary, from the above models a clear picture of how Bitcoin prices are used to bring about improved predictability of stock returns in the key seven best stock markets in the world. The top seven countries illustrated above have a number of factors considered including, interest rates, oil prices, inflation and prices of commodities. Bitcoin- based model project the stock returns of the group seven nations much better than all the above-mentioned economic parameters. One can hence easily conclude that when attempting to estimate stock returns during a time when the worldwide number of Bitcoin transactions is at its highest, it is possible to take advantage of Bitcoin. Additionally, this article also provides efficient techniques for Bitcoin prediction such as; time sequence data evaluation, trading strategy, and technical indicators that also help people investing in stocks to make investment decisions hence project the stock returns.

References

Baur, D. G., & Dimpfl, T. (2018). Excess volatility as an impediment for a digital currency. Available at SSRN 2949754.

Corbet, S., Meegan, A., Larkin, C., Lucey, B., & Yarovaya, L. (2018). Exploring the dynamic relationships between cryptocurrencies and other financial assets. Economics Letters, 165, 28-34.

Dastgir, S., Demir, E., Downing, G., Gozgor, G., & Lau, C. K. M. (2019). The causal relationship between Bitcoin attention and Bitcoin returns: Evidence from the Copula-based Granger causality test. Finance Research Letters, 28, 160-164.

Devpura, N., Narayan, P. K., & Sharma, S. S. (2018). Is stock return predictability time-varying?. Journal of International Financial Markets, Institutions and Money, 52, 152-172.

Devpura, N., Narayan, P. K., & Sharma, S. S. (2018). Is stock return predictability time-varying?. Journal of International Financial Markets, Institutions and Money, 52, 152-172.

Dyhrberg, A. H., Foley, S., & Svec, J. (2018). How investible is Bitcoin? Analyzing the liquidity and transaction costs of Bitcoin markets. Economics Letters, 171, 140-143.

Ferdiansyah, F., Othman, S. H., Radzi, R. Z. R. M., Stiawan, D., Sazaki, Y., & Ependi, U. (2019, October). A lstm-method for bitcoin price prediction: A case study yahoo finance stock market. In 2019 International Conference on Electrical Engineering and Computer Science (ICECOS) (pp. 206-210). IEEE.

Gandal, N., Hamrick, J. T., Moore, T., & Oberman, T. (2018). Price manipulation in the Bitcoin ecosystem. Journal of Monetary Economics, 95, 86-96.

Huang, J. Z., Huang, W., & Ni, J. (2019). Predicting bitcoin returns using high-dimensional technical indicators. The Journal of Finance and Data Science, 5(3), 140-155.

Karasu, S., Altan, A., Saraç, Z., & Hacioğlu, R. (2018, May). Prediction of Bitcoin prices with machine learning methods using time series data. In 2018 26th signal processing and communications applications conference (SIU) (pp. 1-4). IEEE.

Moardi, M., Salehi, M., Poursasan, S., & Molavi, H. (2020). Relationship between earnings management, CEO compensation, and stock return on Tehran Stock Exchange. International Journal of Organization Theory & Behavior.

Salisu, A. A., & Isah, K. O. (2018). Predicting US inflation: Evidence from a new approach. Economic Modelling, 71, 134-158.

Salisu, A. A., Isah, K., & Akanni, L. O. (2019). Improving the predictability of stock returns with Bitcoin prices. The North American Journal of Economics and Finance, 48, 857-867.

Salisu, A. A., Swaray, R., & Oloko, T. F. (2019). Improving the predictability of the oil–US stock nexus: The role of macroeconomic variables. Economic Modelling, 76, 153-171.

Wang, X., Chen, X., & Zhao, P. (2020). The relationship between Bitcoin and stock market. International Journal of Operations Research and Information Systems (IJORIS), 11(2), 22-35.

Yogeshwaran, S., Kaur, M. J., & Maheshwari, P. (2019, April). Project based learning: predicting bitcoin prices using deep learning. In 2019 IEEE Global Engineering Education Conference (EDUCON) (pp. 1449-1454). IEEE.

write

write