This analysis of the strategic field of business strategies introduces the ways of production and transaction costs, involving Williamson’s theorem of make or buy, affecting the decision on economising. It underlines that the TCE framework proposed by Argyres and Zenger has some weaknesses that can not fully describe the complexity of the corporate strategy. SupportingSupport the Disney-Pixar criticism demonstrates the need for broader instruction, including models of firm boundaries alternative. Integrating crucial insights from fundamental and additional readings proposes embracing a broader perspective on business boundaries and capabilities dynamics, thus emphasising the fact-based nature of strategic management and decision-making.

Production and Transaction Costs and Their Influence on Economising Decisions

Definition and Importance

In strategic management, the differences in production and transaction costs uncover the sectors of efficacy and decision-making processes at different levels of immensity. Production cost is spending incurred during the production of a good or service, and these production costs include the expenditure of materials, labour, and overhead (Dementyev and Kwilinski, 2020). Meanwhile, exchange costs are the costs related to locating, communicating, and fulfilling the terms of the exchanges. These exchange costs include bargaining, enforcing and renewing agreements. The supply chain of many large retailers, including Walmart, illustrates this antagonistic approach. It minimises costs by incorporating advanced economies of scale in production and partnerships with strategic suppliers while managing its transactions using smart logistics and information technology systems (Kian et al., 2021). Thus, minimising both types of costs, which is of utmost importance in enhancing organisational efficiency and formatting strategic decisions, is committed.

‘Make or Buy’ Decision: (by Williamson)

The basis of Oliver Williamson’s strategic decision-making framework, the ‘make or buy’ option, is the problem of choosing between internalising production processes and then reducing transaction costs, thus increasing efficiencies, or outsourcing to lower production costs (Williamson, 1991). This decision acquires more importance as the globalised and technologically driven economy expands, demonstrated by Apple’s case when it entrusted manufacturing to Foxconn. For Apple, relying on Foxconn to handle the manufacturing is an example of how the company’s focus on innovations, design, and software development can be more efficient by bringing Foxconn’s scale and production abilities into play (Naradichiantama, 2021). In addition to decreasing production costs, this strategy provides Apple with substantial agility in monitoring the market dynamics and keeping pace with the latest technologies that guarantee its competitive advantage against the high-tech, challenging environment. Besides, Apple’s strategy consists of efficiency and strategic priorities, such as controlling product quality, supply chain demands, and intellectual property protection (Pathiranage, 2019). It also highlights the importance of strategic partnerships and how the organisation must take a holistic approach between internal resources and opportunities outside the business borders. Apple’s ability to deduce among these alternatives, Williamson’s rules of the game, represents the power that ‘make or buy’ decisions play to augment internal efficiency, thus ensuring organisational longevity.

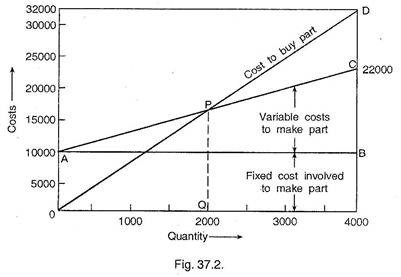

(Fig. 1: Breakeven Analysis for Make or Buy Decision in Spark Plug Production, Business Management Ideas, 2024)

The provided diagram shows a breakeven analysis of the firm’s decision to make or buy spark plugs. Fixed costs represented by line AB do not differ depending on the number of units produced due to a horizontal line. The variable cost curve AC is plotted at zero as no units are produced and then goes to Rs. Rs. 12,000 for 4,000 units, totalling Rs.22,000 combined with fixed costs. The initial cost to buy the parts is given by the OD line, which starts from zero and ends at Rs.32,000 for 4,000 units. The breakeven point, labelled as P, implies that we will be in a more favourable position at this point if we produce more units than 2,000. On the other side of the spectrum, especially for quantities of less than 2,000, buying spark plugs is more cost-effective, which basically confirms the above OQ as the breakeven point of this make-or-buy decision.

Influence on Economising Decisions

The duality of production and transaction costs is a determinant for firms’ strategic planning and decision-making process, which maximises efficiency and minimises costs, thus elucidating the make or buy dilemma that involves not only cost and benefits considerations but also long-term sustainable competitive advantage optimisation (Parker, 2023). An industry like automotive, where mechanism and innovation are key, uses strategies of global component purchasing that allow them to get the advantage of production costs and suppliers’ expertise. At the same time, their internal efforts are focused on core competencies like design and customer experience. The quality and coordination costs are carefully managed so that they may avoid their dependency on external providers (Jensen, 2019). Also, strategic decisions in ‘make versus buy’ are among the main supply chain configuration factors that lead to operational flexibility and market responsiveness. Likewise, although vertical integration gains control of the supply chain and better quality, it needs huge capital and more market adaptability (Special Oliver Williamson Memorial Issue, 2022). On the other hand, outsourcing makes your operations more flexible and reduces capital costs, with supplier reliability being a disadvantage. Hence, companies of any scale and industry, particularly in technology fields, apply hybrid solutions to govern core capabilities while involving external production efficiency, where they strive to make their enterprise capable of timely response towards a dynamic business environment and strategic foresight.

Integration of Holmström and Rob’s approach, Simon’s theory

The integrated theories of Bengt Holmström, John Roberts, and Herbert Simon offer a more profiled perspective on the firm decision-making and demarcation regarding the TCE approach by depicting the importance of internal organisational factors and market uncertainties. Holmström and Roberts emphasise the importance of aligning incentives and managing information asymmetry within firms to form effective boundaries, which they suggest should be considered in cross-function partnerships and outsourcing regarding the motivation of the employees and the alignment of organisational goals such as the technology sector, which is an innovation-driven (Holmström and Roberts, 1998). On the other hand, Simon’s idea that firms act as devices to deal with market disturbances and uncertain environmental factors demonstrates the critical function of firm limits in the risk management process (Simon, 1991). This approach proves challenging as it diverts TCE’s focus from cost minimisation to cost management within the strategy, incentive alignment, information handling, and uncertainty reduction (Argyres, 2021). These theories assist in comprehending the ‘make or buy’ concept holistically by considering the business’s internal capabilities and the dynamics of market forces that are constantly changing and, as a result, devising these strategies to be adaptive and resilient to these changes. United, Holmström, Roberts, and Simon’s achievements are the foundations for the strategies based on broader factors, thus contributing to a firm’s prospects and shaping its structure, capabilities, and competitive position in the global market.

Critique of TCE and the Role of Alternative Models

Argyres and Zenger’s Critique

Nicholas S. Argyres and Todd R. Zenger, using the Transaction Cost Economics (TCE) of Oliver Williamson as a starting point, precisely identify some crucial gaps in its theory: its deficient attention to the strategic value of firm capabilities and the flexibility of organisational boundaries. The critics emphasise that though TCE is primarily aimed at promulgating the reasons for insourcing and outsourcing, it has overlooked the pivotal role of firm competencies as the main determinants of business outcomes, offering a limited picture with a significant focus on cost minimisation (Rindfleisch, 2020). Such a critique then highlights that a more expanded analytical agenda for analysing a firm’s capabilities in establishing company boundaries and competitive advantage is required. A notable difference between TCE and R-Hex is that TCE defines a firm as primarily a minimiser of transaction costs, and this ignores the crucial role of strategic resources and abilities in building competitiveness (Kristinae et al., 2023). The scholars emphasise creating standards that highlight the unique strengths of an entity and the resources it has in mind while developing a market-dominant strategy; this should be beyond mere transactional considerations to a fully developed model. The model takes the firm as a system of dynamic processes, arguing that decision-making and efficient competition depend on capability development, strategic resource management, and a more sophisticated perceptual model of the organisational strategy and advantage.

The shortcomings of Transaction Cost Economics (TCE) underscore the requirement for other models focused on the internal capabilities and resources of the firm as key elements of setting up the boundaries of an organisation and strategic plans. These models believe in a different approach and focus on utilising different innovations and novel inventions to attain a product-differentiating characteristic. For instance, the resource-based view (RBV) emphasises that a company’s unique resource- the preferred value that is scarce, inimitable, and not to be substituted- plays a crucial role in strategic planning. Amazon’s leveraging of its massive logistics and technological capabilities is an ideal example of how core resources form the frame of the organisation and stipulate market domination (Cuthbertson and Furseth, 2022). Besides that, Dynamic Capabilities Theory contributes to the supplement as it highlights the firm’s ability to adapt and reconfigure its competencies in response to external change, which is what Apple do. Apple is proof of the effectiveness of the dynamic capabilities of strategic planning and has strengthened its strong position in the market (Schoder et al., 2019). By demonstrating the viability of substitute models for strategic management, these approaches explicitly depict the link between dynamic capabilities, strategic resources, and sustained competitive advantage. Moreover, they offer a detailed and actionable point of view to strategic management.

Disney-Pixar Case Study

Under Pixar’s purchase of Disney, the 2006 merger signifies the most distinguished case of how decision-making matters are affected by capabilities and the notions of modern TCE expositions (Agnihotri and Bhattacharya, 2021). The merger was not just a transaction to reduce costs but a deal of strategic material to build a union of complementary qualities – Disney’s unmatched distribution network and Pixar’s world-class animation technology and creative power. Thus, with a three-way partnership, Disney was back at the top of the animation chart, and more successful films like “Frozen” and “Toy Story 3” just proved how right it was about the strategic importance of the merger. However, the merging was also challenging, especially in merging distinctive organisational cultures and keeping Pixar’s tremendous innovative abilities inside a giant corporation’s framework. In the end, the merger ended positively for Disney despite all the problems, and this fact solely proves that contradictory views in TCE have more to back it, a factor that calls for rethinking traditional strategic frameworks.

Beyond Transaction Costs to Dynamic Capabilities and Strategic Assets

The supplementation to the various theories of TCE is also made available by the proposed readings that collectively reinforce the deficiency of transaction cost alone to adequately capture the industry-specific dimension of firm boundaries and strategies. Richard Nelson’s work on firm-specific differences and their strategic implications emphasises the variety of organisational capabilities and how these differences affect strategic decisions and performance outcomes (Cattani and Malerba, 2021). Nelson states that the inherent differences in firm competencies, knowledge and resources cause discrepancies in the competition’s success (Nelson, 1991). These discrepancies contradict the TCE theory that rationalises transactions solely with their cost. Thus, Nelson’s contribution helps develop the hypothesis that the strategy as a dynamic process should imply a broader analytical approach that combines the firm’s specific capabilities on the one hand and an external market on the other (Nelson, 1991). This approach not only queries the suitability of the TCE model but also corresponds to the criticism of Argyres and Zenger; the theme is that we still need models that can adequately capture the strategic significance of capabilities.

According to Teece (2018) and Shamsie et al. (2009), they greatly help us in strategic management by highlighting the challenge of total focus on transaction costs and showing the need for dynamic capabilities and the business model. A firm is defined and characterised by the singular resources and capabilities that make it competitively superior, contradicting TCE postulates (Shamsie et al., 2009). Analogically, Teece highlights the strategic requirement of dynamic capabilities -the capacity of firms to reconfigure, evolve and adjust rapidly to drastic environments as fundamental for competition maintenance (Teece, 2018). In the partnership of these researchers, the rigidity of the closed system TCE is recognised, and they propose a more versatile and novel strategy for planning an organisation’s operations in the ever-changing reality of today’s market environment.

The use of the readings on the TCE will, therefore, bring the critique one step further with the consideration of the multidimensional character of strategic choice. It follows that the thorough analysis of strategic tools and boundaries in a firm is not limited only to the transaction costs but should extend to the strategic assets and the capabilities that lead to a firm’s competitive edge and robustness (Suddaby et al., 2019). These insights contradict TCE, which opens the door for the Modern Industrial Organisation, which is strategic, dynamic, and focused on capabilities. Still, this broadened standpoint goes beyond Argyres and Zenger’s critiques. However, it lays a decent foundation for future strategic management studies, focusing on making capabilities and dynamic strategies a part of analysing firm boundaries and competitive edge.

Conclusion

This essay elucidates the vital significance of production and transaction costs in corporate strategy. However, by exploring the limitations of transaction cost economics (TCE) concerning strategic capabilities, the article further hints towards the need for strategic adaptation in the face of dynamic market conditions. The combined companies of Disney and Pixar illustrate well that today, dynamic capabilities and innovation are keys to surviving in a fiercely competitive marketplace. These results also urge a migration from a TCE framework, which is primarily task-oriented, to a capability-based approach that is more comprehensive in scope. For strategic management practitioners, the recommendation is evident: for firms to successfully manoeuvre through the complexities and uncertainties of the current business world, there is a need to focus on formulating the firm strategies and boundaries that place a strategic emphasis on core capabilities and adaptability. Adopting a broadened point of view will thus enable companies to foresee and control changes in technologies and markets better.

Recommendations

An appraisal of Transaction Cost Economics (TCE) by its narrow focus on contracting problems would need a shift from a method to a more general strategic management view emphasising dynamic capabilities and strategic assets. This paradigm goes beyond the transaction costs to see how the internal capabilities of firms are moulded by and shaped by the external market dynamics, as Akpinar and Sahin wrote in 2020 (Akpinar and Sahin, 2020). Organisations’ growth dynamic capabilities allow effective dealings with the global business environment, resulting in the avoidance of risk and the capturing of opportunities. It is also worth remembering the point about reconsidering organisational barriers in the light of strategic assets and core competence, which offers one more angle to further grow the competitive advantage and operational effectiveness. Further studies must be based on the experience of these advanced strategic planning across the industries and establish the effect of their impact on the competitive strength or sustainability of firms (Rounaghi et al., 2021). This evolution of strategic footprint accentuates the importance of leadership commitment, clear communication of strategic goals, and allocation of resources for continuous adaptation while permanently preserving the company’s agility and robustness in the face of market changes.

References

Agnihotri, A. and Bhattacharya, S. (2021). Dynamics of the Disney–Fox Merger. SAGE Publications: SAGE Business Cases Originals.

Akpinar H and Sahin B (2020). “Strategic management approach for port state control: The Black Sea Memorandum of Understanding detention analysis,” Maritime Business Review, 5(3):281–293, doi:10.1108/MABR-10-2019-0043.

Argyres N (2021). “Virtual Special Issue: The Organisational Economics of Organisational Capability Development,” Organisation science (Providence, RI), 32(2):522–525, doi:10.1287/orsc.2021.1439.

Cattani, G. and Malerba, F., 2021. Evolutionary approaches to innovation, the firm, and the dynamics of industries. Strategy Science, 6(4), pp.265-289.

Cuthbertson, R.W. and Furseth, P.I., (2022). Digital services and competitive advantage: Strengthening the links between RBV, KBV, and innovation. Journal of Business Research, 152, pp.168–176.

Dementyev, V.V. and Kwilinski, A., 2020. Institutional component of production costs. Journal of Institutional Studies, 12(1), pp.100-116.

Holmström, B., and Roberts, J. (1998). The Boundaries of the Firm Revisited. Journal of Economic Perspectives, 12, 73–94.

Jensen, M.C., (2019). Eclipse of the public corporation. In Corporate governance (pp. 239–252). Gower.

Kian R, Berk E, Gürler Ü, Rezazadeh H and Yazdani B (2021). “The effect of economies-of-scale on the performance of lot-sizing heuristics in rolling horizon basis,” International Journal of Production Research, 59(8):2294–2308, doi:10.1080/00207543.2020.1730464.

Kristina V, Sambung R, Meitiana M, Mering L, Dwiatmadja C and Tunjang H (2023). “Application of RBV theory in entrepreneurial orientation, dynamic capability and customer relationship management,” Uncertain supply chain management, 11(2):707–712, doi:10.5267/j.uscm.2023.1.010.

Nelson, R. (1991). Why do Firms Differ, and How Does it Matter? Strategic Management Journal, pp. 12, 61–74.

Parker, D.A., (2023). The COVID-19-induced transaction Cost Suggests Considerable Cost Effectiveness Resulting from the Prevalence of Universal Health Care in the United States. In Biopolitics and Shock Economy of COVID-19: Medical Perspectives and Socioeconomic Dynamics (pp. 181-199). Cham: Springer Nature Switzerland.

Pathiranage, J., 2019. Organisational culture and business performance: an empirical study. International Journal of Economics and Management, 24(2), pp.264-278.

Rindfleisch, A., 2020. Transaction cost theory: past, present and future. AMS Review, 10(1-2), pp.85-97.

Rounaghi MM, Jarrar H and Dana L-P (2021). “Implementation of strategic cost management in manufacturing companies: overcoming costs stickiness and increasing corporate sustainability,” Future Business Journal, 7(1):1–8, doi:10.1186/s43093-021-00079-4.

Schoder, D., Schlagwein, D. and Fischbach, K., 2019. Open resource-based view (ORBV): A theory of resource openness.

Shamsie, J., Martin, X., and Miller, D. (2009). In with the old, in with the new: capabilities, strategies, and performance among the Hollywood studios. Strategic Management Journal, p. 30, 1440–1452.

Simon, H. (1991). Organisations and Markets. Journal of Economic Perspectives, p. 5, 25–44.

Special Oliver Williamson memorial issue. Journal of Institutional Economics, 18(2022).

Suddaby, R., Coraiola, D., Harvey, C., and Foster, W. (2019). History and the Micro-Foundations of Dynamic Capabilities. Strategic Management Journal, pp. 41, 530–556.

Teece, D. J. (2018). Business Models and Dynamic Capabilities. Long Range Planning, p. 51, 40–49.

Williamson, Oliver. “Strategising, Economising and Economic Organisation.” Strategic Management Journal 12 (1991): 75–94.

Business Management Ideas. (2024) Fig. 1: Breakeven Analysis for Make or Buy Decision in Spark Plug Production. Available at: https://www.businessmanagementideas.com/production-management/make-or-buy-decision-factors-criteria-and-analysis/7056 (Accessed: 8 March 2024)

Naradichiantama, D. (2021). Why does Apple outsource its manufacturing? Kusucorp. Available at: https://www.kusucorp.com/blog/why-does-apple-outsource-its-manufacturing (Accessed: 8 March 2024).

write

write