Introduction

Italy’s monetary system has experienced substantial changes since 2002 when the country adopted the euro as its official currency. This essay examines the evolution of Italy’s monetary system and how it has affected trade, fiscal, and monetary policies. Further, it will outline the main players in Italy’s monetary system, including relevant organizations and financial institutions. Additionally, a comparison between the United States and Italy’s balances of payments will be made, with the latter’s current exchange rate against the dollar stated.

Evolution of Italy’s Monetary System

The introduction of the euro and Italy’s membership in the European Union (EU) have substantially impacted the country’s monetary system’s evolution. Italy had its national currency before joining the EU, the Italian Lira, which was subject to volatility and inflationary pressures. Adopting the euro was meant to promote stability and economic unity within the Eurozone. Thus, Italy used the Italian Lira before adopting the euro.

Impact of Fiscal, Monetary, and Trade Policies

EU directives and rules have positively impacted Italy’s budgetary policy since adopting the euro. For instance, budget deficits have been managed, public debt controlled, and economic growth fortified. The European Central Bank (ECB) is making monetary policy choices affecting interest rates and the money supply. Bilateral agreements and EU trade policy influence Italy’s trade contacts and exports.

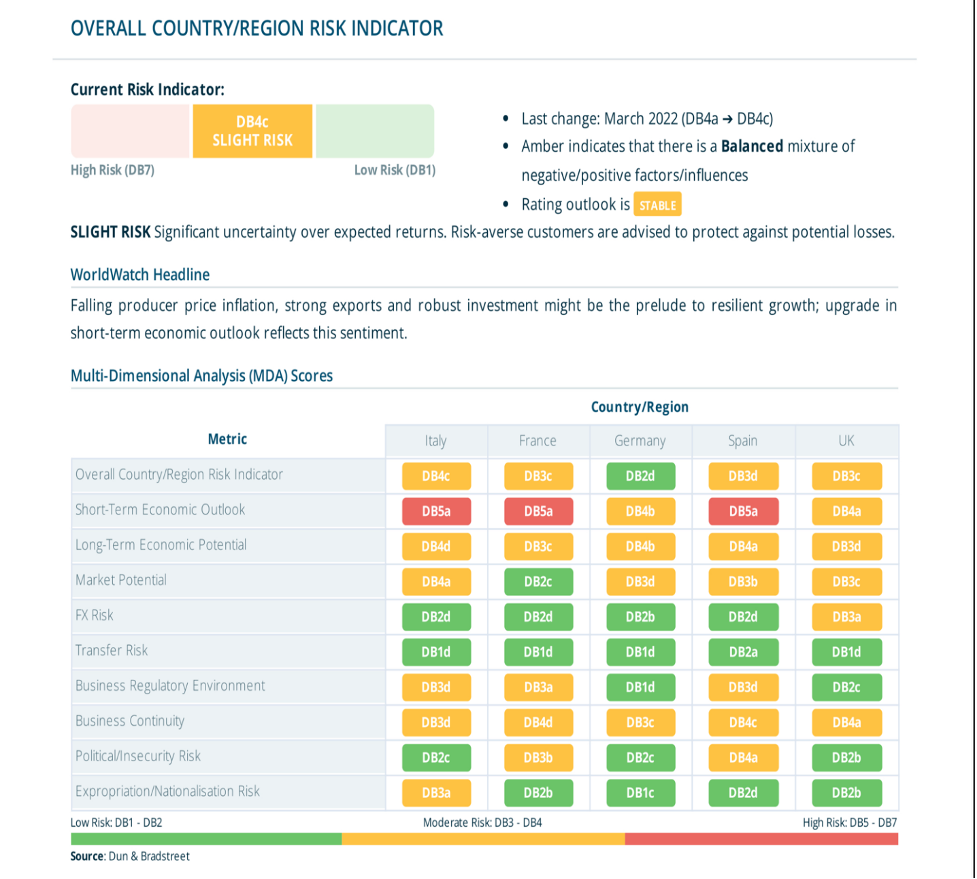

Italy’s Current Risk Indicator

Fig. 1: Italy’s Current Risk Indicator

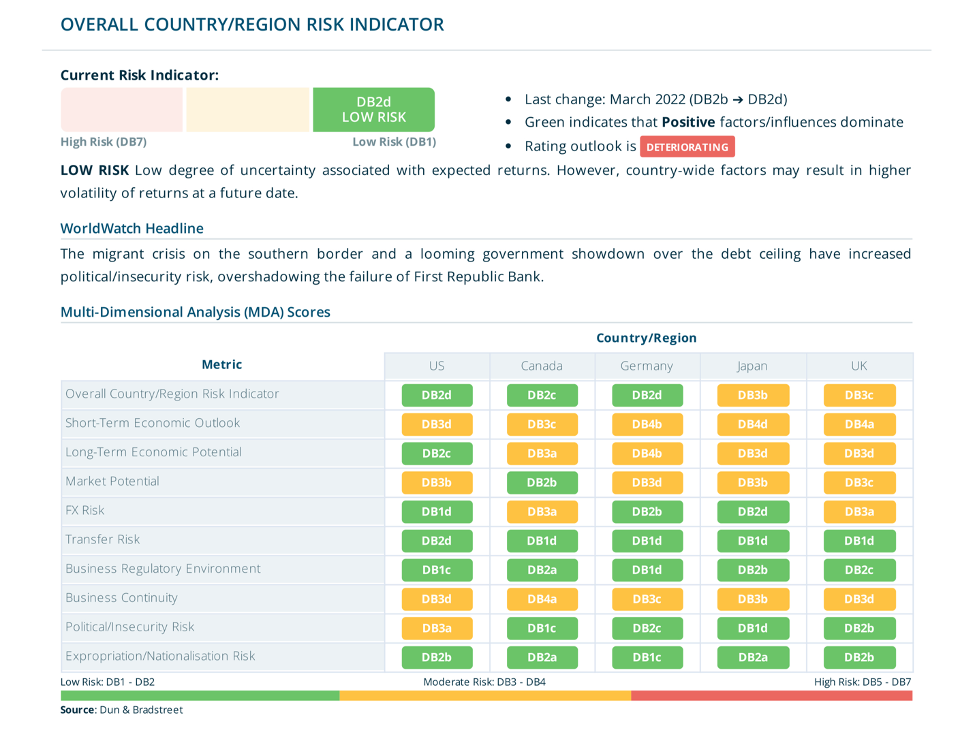

USA Current Risk Indicator

Fig. 1: USA’s Current Risk Indicator

Major Components of Italy’s Monetary System

The ECB, which develops and implements monetary policy for the Eurozone, is one of the key elements of Italy’s monetary system. Italian banks and financial institutions are essential to the country’s ability to offer banking services and facilitate financial transactions.

Balance of Payments Comparison

Italy’s balance of payments depicts its international trade activities. When we examine its financial account, we find deficits in the first three quarters of 2022 (-9026.2, -4576.9, and -10674.8) and a surplus in the fourth quarter of 2022 (8321.3) (“Balance of Payments,” n.d.). In the first quarters of 2022 (1093.6), 2022 (2145.3), 2022 (2234.4), and 2022 (5229.1), the capital account displays surpluses (“Balance of Payments,” n.d.). In contrast, the United States likewise suffered changes in its capital and financial accounts, highlighting the dynamic nature of the global economy.

Exchange Rate Against the U.S. Dollar

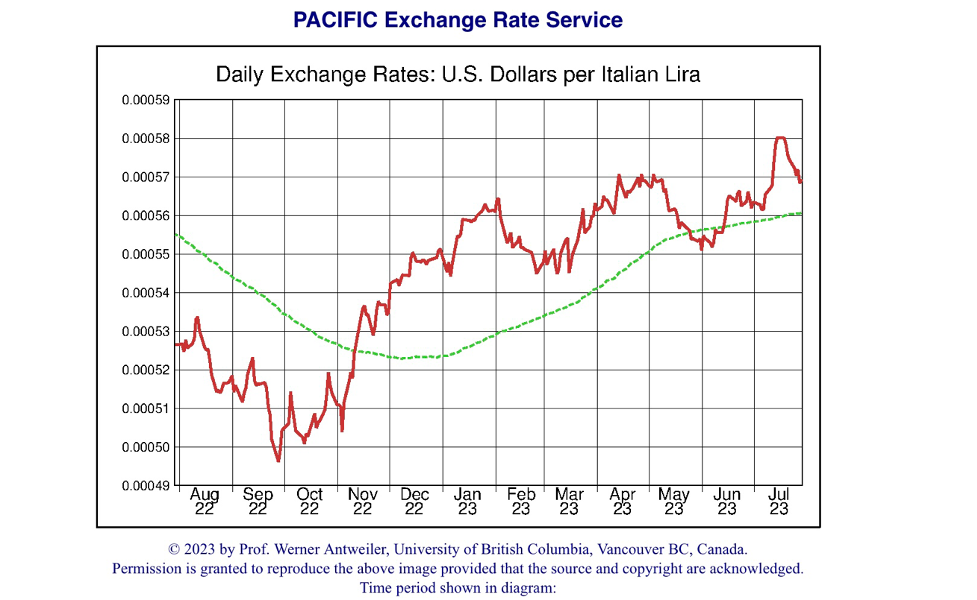

The value of the Italian Lira (ITL) against the U.S. dollar is shown by the exchange rate of 1 ITL to 0.000568874 USD (“1 ITL to USD,” n.d.). Several variables, including interest rates, geopolitical events, and economic indices, influence exchange rates.

Fig. 3: Comparison of U.S. dollar and Italian Lira exchange rates (“FX Charts,” n.d.)

Economic Exposure, Transaction Exposure, and Translation Exposure

International businesses operating in Italy are subject to economic, transactional, and translation vulnerability. Exchange rate changes that affect future cash flows and profitability cause economic vulnerability. While translation exposure entails translating foreign subsidiary financial statements into the reporting currency, transaction exposure deals with possible profits or losses from foreign currency transactions.

Recommendations for Investors

Investors should carefully assess market conditions and risk tolerance before investing in Italy’s currency. Economic indicators, geopolitical risks, and inflation expectations can inform whether to buy or sell futures or options in Italian Lira.

Importance of Diversity, Equity, and Inclusion in International Business

When working with foreign clients and conducting business in Italy, it is essential to comprehend and put Diversity, Equity, and Inclusion concepts into practice. As a result of embracing diversity, relationships and cooperation improve because of increased cultural awareness and empathy. Equity guarantees that all stakeholders receive fair treatment and equal opportunity, establishing an inclusive and sustainable corporate environment. Utilizing many viewpoints is made possible by inclusivity, which produces creative solutions and competitive benefits in the international market.

Conclusion

Italy’s monetary system has changed tremendously, especially since adopting the euro and joining the Eurozone. Regulations from the European Union have an impact on trade, monetary, and fiscal policy. The nation’s current account balance and exchange rate against the dollar reflect a dynamic international economic environment. Investors should carefully evaluate market circumstances when making currency-related investment choices since multinational firms operating in Italy are exposed to various risks. Lastly, it is critical for Italy’s worldwide commercial initiatives to support diversity, equity, and inclusion.

References

Balance of Payments and international investment position statistics (BOP/IIP). (n.d.). International Monetary Fund. https://data.imf.org/?sk=7a51304b-6426-40c0-83dd-ca473ca1fd52&sid=1542635306163

1 ITL to USD – Convert Italian Lire to U.S. Dollars. (n.d.). Xe. https://www.xe.com/currencyconverter/convert/?Amount=1&From=ITL&To=USD

FX charts & plots (v2.16). (n.d.). Pacific Exchange Rate Service. https://fx.sauder.ubc.ca/plot.html

write

write