Introduction

ZXY is a food product company that needs to expand to two new products, in this case, Product A and B, and acquire a second production facility. A $ 7,000,000 is required for equipment investments with a 10-year life. A 12% Return on Investment ( ROI) is required. Therefore, there is a need to evaluate the company’s financial information, as indicated in the Appendix, to recommend whether or not to continue with the investment.

Analysis of the Financial Information

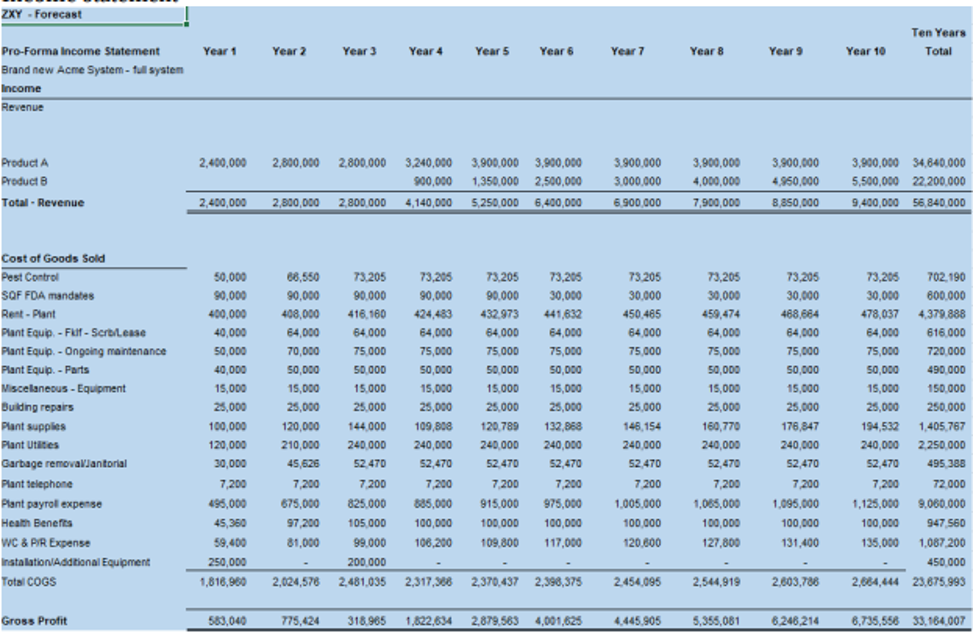

Based on the information in the Appendix, Product A had a projected revenue from year one, while Product B offered revenue in year four. In the first, second, and third years, product A had revenue of 2.4 million and 2.8 in both the second and third years. Unfortunately, product B has no projected revenue till the fourth year. Thus, it indicates that the company had only realized profit after introducing product B. By the end of the 10th year, the projected revenue was $56,840,000.This revenue forecast is critical since it helps strategize how much and how the management intends to grow their company quickly. Thus, based on the projection, product A may begin being more beneficial in terms of profits than product B.

The project expense indicated in the financial statement is that ZXY is projected to have a total expense of $ 29,050,717 by the end of the tenth year. In terms of the Cost of Goods sold, the company is projected to have an increasing cost from the first year to the 10th year. The COGS totals 23,675,993 from the investments, which enabled the company to have a total gross profit of 33,164,007 by the end of the tenth year. In year one, the company is projected to have a profit of 583,040, in the second year 77,424 profit, and in the third year a 318965 profit. Thus, as the year accumulates, the company is projected to have more profits after the investment. Thus, the year night and ten indicates a higher profit of 6 million and above.

Risks linked to the project.

Risk related to food production is associated with different elements, including hazards described as the nature of the adverse effect and the extent and level of exposure to the hazard(Ghosh & Kar, 2018). However, based on ZXY’s financial statements, several risks are linked to the project aimed at including two products and a production facility as their investments. The financial statements show that the company took a long time to recover its $7,000,000 investment capital. Thus, there is a high risk of delay in reaping the capital investment. By the fourth year, the company realized its investment and, after introducing the second product. It meant that the company was operating from a deficit point, a risk condition the company had to wait for to produce its first product. As a result, this makes the project project to be hazardous.

From the financial statement, it is found that the company happens to use MACRS depreciation, which is a risky concept for any company. The MACRS depreciation is risky since it complicates the company’s accounting and tax reporting, as there are rules that must be followed(Vasigh & Rowe, 2019). The method also delays when a company realizes profits. From the MACRS depreciation presented in the Appendix, a company only realizes profit in later years after investment, where a vast depreciation is found in the early years. To avoid this risk, there is a need to use a straight-line deduction.

The straight line is a simple depreciation method that aids companies in calculating their depreciation where a simple path is followed(Liebhardt & Pertz,2022). Thus, the rate at which equipment depreciates each year is noted. Furthermore, to find out if the risk is linked to using MACRS depreciation ROI, which in this case is 12%. In every company, using ROI is essential since it aids in evaluating the profitability of investments, hence making informed decisions concerning the area that needs more resource allocation. Regarding the ROI allocated in this case, 12 % would place the company at a high risk where a lower ROI is the best. Therefore, for the risk to be accommodated, there is a need for the company to increase its goal.

Recommendations

Much is learned based on the financial statements and the 12 % ROI, making the project unfavorable. A $ 7,000,000 is required as investments, which is supposed to be obtained as soon as the project is initiated. Thus, to ensure that reaping back the investments in the early years is achieved, the company needs to change the rate of its ROI. In this case, the 12%ROI is very high, deteriorating the company’s operations and making it undesirable. Also, the company is supposed to make product B available simultaneously with product A to maximize the chance of profit. Generally, this would enable the ZXY to regain its initial investment and realize profits as soon as the project starts. Another thing the company needs to do is to change the depreciation method from MACRS depreciation to a straight-line depreciation method. This is key since it would aid the company in having less tax liability, hence being able to raise its cash flow.

Explanation of criteria supporting your recommendation

The first recommendation that ZXY needs to make to ensure the project is achievable is to decrease its ROI by 1 or 2 if it needs to realize its cash flow sooner rather than later. In any company, cash flow is critical since it shows that the company is participating in its activities. Thus, by realizing colossal cash flows, the company can cater to its debts and expenses and conquer possible challenges. Hence, realizing cash flow as soon as the project is initiated will prevent the company from declining its liquid assets(Dirman,2020). Also, having a positive cash flow is crucial since it makes investors want to invest in the company. The other comment was that for the project to be feasible, there is a need to change the depreciation method from MACRS to a Straight line. This is because a straight line is one of the easiest methods used primarily when asset value decreases time after time.

Conclusion

ZXY is a company that deals with food products and where it intends to expand its operation by investing in two products: products A and B. The investment is intended to cost $ 7,000,000. Thus, the purpose of this paper was to analyze the company’s financial information to find whether or not it can invest. Therefore, from the analysis, the project was found to be linked with different risks, and in its first years after the introduction of the first product, there needed to be cash flow. Another risk is the MARCS depreciation method, which should be replaced with a straight line that will give the company more cash. The company can only continue with the investment if the recommended changes are made.

References

Dirman, A. (2020). Financial distress: the impacts of profitability, liquidity, leverage, firm size, and free cash flow. International Journal of Business, Economics and Law, 22(1), 17–25.

Ghosh, A., & Kar, S. K. (2018). Application of analytical hierarchy process (AHP) for flood risk assessment: a case study in Malda district of West Bengal, India. Natural Hazards, pp. 94, 349–368.

Liebhardt, B., & Pertz, J. (2022). Automated cargo delivery in low altitudes: business cases and operating models. Automated Low-Altitude Air Delivery: Towards Autonomous Cargo Transportation with Drones, 73-104.

Vasigh, B., & Rowe, Z. C. (2019). Foundations of airline finance: Methodology and practice. Routledge.

Appendix

Income Statement

write

write